RWA Weekly Report | Hong Kong Stablecoin Ordinance Receives 77 Intended Applications in First Month; Zhou Xiaochuan: Central Bank Concerned about Over-Issuance of Stablecoins and High Leverage (August 27-September 2)

- 核心观点:RWA市场加速扩张,结构分层明显。

- 关键要素:

- RWA链上总价值周涨5.47%。

- 机构另类基金单周激增70%。

- 稳定币规模增至2731.8亿美元。

- 市场影响:推动资产代币化与机构资金流入。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3)

RWA Sector Market Performance

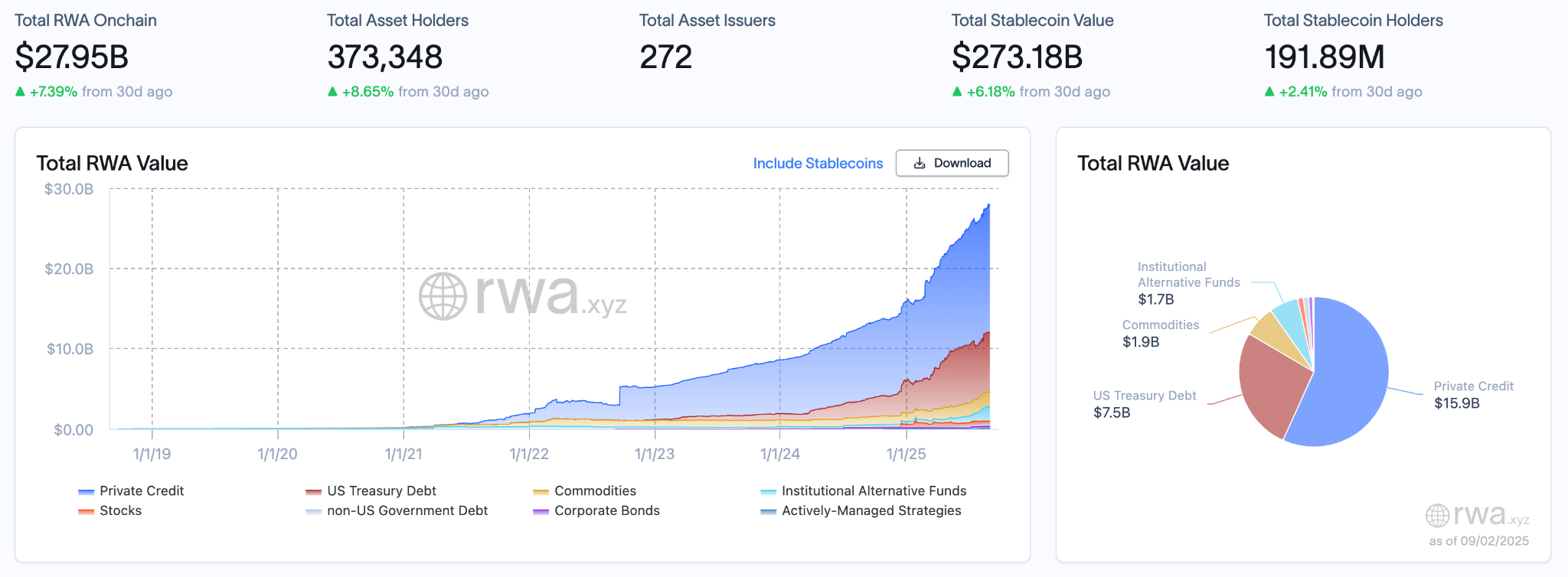

As of September 2, 2025, the total value of RWA on-chain reached $27.95 billion, an increase of $1.45 billion from $26.50 billion on August 26, a weekly increase of 5.47%, the largest weekly increase in nearly a month. The number of on-chain asset holders increased from 367,619 to 373,348, a weekly increase of 5,729 or 1.56%. The number of asset issuers increased slightly from 271 to 272, maintaining steady growth. Regarding stablecoins, the total value rose from $268.43 billion to $273.18 billion, an increase of $4.75 billion or 1.77% weekly. The number of holders increased from 190.09 million to 191.89 million, an increase of 1.8 million or 0.95%.

Looking at asset structure, private credit rose from $15.5 billion to $15.9 billion, a weekly increase of 2.58%, maintaining its position as a core asset. U.S. Treasuries rose slightly from $7.4 billion to $7.5 billion, a 1.35% increase, maintaining positive growth for three consecutive weeks. Commodity assets increased by $100 million to $1.9 billion, showing stable performance. Institutional alternative funds surged from $1 billion to $1.7 billion, a 70% weekly increase , becoming the most prominent highlight of the market structure this week, indicating a significant increase in institutional allocations to non-standard assets.

What are the trends (compared to last week )?

As of early September, the RWA market demonstrated a trend of accelerated expansion and structural stratification. Total market capitalization and stablecoin size increased simultaneously, with users and issuers continuing to grow, and the ecosystem's resilience and activity continued to increase. From an asset perspective, credit and US Treasuries remained core supporters, but the sharp growth of institutional alternative funds was a major highlight this week, reflecting the dual signals of a rebound in market risk appetite and accelerated fund rotation. In the short term, the RWA market is expected to continue expanding within a high range, with private credit and US Treasuries providing a solid foundation, while alternative funds are likely to become the key variable driving further market capitalization.

Review of key events

Hong Kong's Stablecoin Regulation received 77 applications in its first month of implementation

The Stablecoin Ordinance came into effect on August 1st. The Hong Kong Monetary Authority (HKMA) previously encouraged institutions interested in applying for Hong Kong stablecoin issuer licenses to contact the authority by August 31st. An HKMA spokesperson announced on September 1st that they had received 77 applications in August, including from banks, technology companies, securities/asset management/investment firms, e-commerce companies, payment institutions, startups, and web 3 companies. The HKMA spokesperson reiterated that only a few stablecoin licenses would be granted during the initial phase of the ordinance's implementation.

Cobo, a digital asset custody and wallet infrastructure provider, announced that its next-generation RWA tokenization, custody and settlement infrastructure project, supported by JD Technology, has been successfully selected for the Hong Kong Cyberport "Blockchain and Digital Asset Pilot Funding Program."

The project focuses on income-generating assets and aims to build an integrated infrastructure covering token issuance, compliant custody and fund settlement, serving institutional scenarios with actual business needs to improve asset liquidity, transparency and operational efficiency, and assist Hong Kong institutions in carrying out RWA pilots and commercialization.

The Blockchain and Digital Asset Pilot Funding Program aims to promote the development and testing of high-impact blockchain and Web 3 applications, encouraging companies to explore innovative commercialization paths through pilot projects. Approved projects will receive two phases of funding, one to initiate and one to complete pilot testing.

During a fireside chat at BNB Day in Tokyo, CZ stated that BNB Chain is primarily community-driven. He doesn't do much himself, primarily posting tweets and encouraging people to build. He also revealed that he holds a significant amount of BNB, with a significant portion of his wealth tied up in it.

If he were 20 years younger, CZ said he would develop an AI trading agent and a privacy-focused perpetual DEX. DEX trading volume will surpass CEX in the future, and DeFi is the future. He believes that RWA is still in its early stages but has great potential. He hopes to see a dedicated BNB Chain team in Japan. Japan is very suitable for technological development and has a good business culture. He hopes to see more AI and robotics projects appear on BNB Chain.

CZ believes that digital asset treasuries (DATs) make cryptocurrency investing more accessible through public markets and, if properly managed, sustainable. Single-asset treasuries are the simplest, while basket strategies are highly management-dependent. The next major breakthrough in the crypto space may come from AI, RWAs, and stablecoins within blockchain.

At the CF40 biweekly closed-door seminar on "Opportunities and Prospects for RMB Internationalization," former People's Bank of China Governor Zhou Xiaochuan pointed out that central banks currently have at least two concerns about stablecoins. First, there's the issue of "excessive money issuance," whereby issuers issue stablecoins without 100% true reserves, effectively overissuing them. Second, there's the issue of high leverage, whereby the post-issuance operation generates a multiplier effect of monetary derivatives. To date, centralized account systems have demonstrated good suitability. The argument for replacing account-based payment systems with full tokenization is weak. Under the current, improved institutional framework, whether it's the US Genius Act, relevant regulations in Hong Kong, or regulatory requirements in Singapore, these issues remain unreliable.

While many believe stablecoins will reshape the payment system, objectively speaking, the current payment system, especially in the retail payment sector, has little room for cost reduction. Judging from current micro-behavior, we must be wary of the risk of stablecoins being overused for asset speculation. A deviation in this direction could lead to fraud and financial instability. Just because a stablecoin issuer has obtained the relevant licenses and paid reserves does not necessarily mean they have issued the stablecoin. Without sufficient demand, stablecoins may not enter effective circulation, meaning they may receive an issuance license but remain unissued. Whether a stablecoin is used as a temporary payment medium for transactions or as a store of value for a limited period of time will affect its remaining market share after issuance.

PetroChina: Exploring the possibility of cross-border settlement with stablecoins

Wang Hua, CFO of PetroChina (00857), said at the half-year results conference that the company is closely following the Hong Kong Monetary Authority's intention to issue licenses to stablecoin issuers and is studying the possibility of cross-border settlement and payment through stablecoins.

Stablecoin startup M0 completes $40 million financing, led by Polychain and Ribbit Capital

Stablecoin infrastructure development startup M0 has completed $40 million in financing, led by Polychain and Ribbit Capital, with participation from Endeavor Catalyst Fund, Pantera, and Bain Capital Crypto. M0 co-founder and CEO Luca Prosperi declined to disclose the valuation of his startup, but revealed that the company's total financing to date has reached $100 million.

New Town Development agrees to issue shares to raise approximately HK$50 million for the RWA sector

New Town Group announced on the Hong Kong Stock Exchange that the company agreed to issue approximately 19 million shares to Blockchain Metaverse Academy at a price of HK$2.5845 per share.

The subscribed shares represent approximately 0.27% of the enlarged issued share capital; the subscription price represents a premium of approximately 4.2% to the closing price of HK$2.48; and the gross proceeds are approximately HK$50 million. The funds raised will be used for strategic deployment in the Real World Asset (RWA) application sector.

Hot Project Dynamics

Bedrock (BR)

One sentence introduction:

Bedrock is a multi-asset liquidity re-staking protocol powered by a non-custodial solution designed in partnership with RockX. Bedrock leverages its universal standards to unlock the liquidity and maximum value of PoS tokens like ETH and IOTX, as well as existing liquid staking tokens called uniETH and uniIOTX.

Recent Updates:

On August 27, Bedrock officially announced on the X platform that BR is now available on Solana. Users can use InterportFi to cross-chain BR from BSC to Solana, and the cross-chain is secured by Chainlink CCIP.

On September 1, Bedrock announced that the incentives for the uniBTC token liquidity pool on @rootstock_io (Rootstock) have been updated, offering up to 29% APR and $2,150 in daily rewards through Woodswap and Uniswap.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading Reliable Warrants (RWAs) such as US stocks on-chain. Through a partnership with Fidelity, the platform offers 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD 1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with highly liquid, low-barrier-to-entry on-chain investment in US stocks, and building the "NASDAQ of the crypto world."

Latest News:

On August 27, the 24-hour trading volume of the MyStonks platform was US$209.11 million.

On September 2nd, data from MyStonks' official website showed that the platform's total RWA trading volume exceeded $1 billion, reaching approximately $1.14 billion at the time of publication. Last week's trading volume increased by $641 million, a month-over-month increase of over 125%, setting a new weekly record since its inception. MyStonks provides users with 100% US stock asset custody support and 1:1 on-chain RWA issuance and trading. Currently, 182 RWA tokens are available, covering US stocks and ETFs such as AAPL, AMZN, DIS, GOOGL, META, MSFT, NFLX, and NVDA.

Related links

Sort out the latest insights and market data for the RWA sector.

The popularity of stablecoins has finally reached the medical sector

When medical assets are digitalized with blockchain technology, how should companies keep up with this trend?

This article attempts to use simple and easy-to-understand language and writing to break through the language "fog" and remove professional "barriers", summarize the ten questions related to RWA that the legal team's clients often ask, and give everyone a preliminary understanding of RWA, a financial innovation.