Delphi Digital: How will interest rate cuts impact Bitcoin's short-term performance, based on historical data?

- 核心观点:比特币9月走势取决于降息前价格表现。

- 关键要素:

- 历史显示降息前涨、落地后跌。

- 2024年因结构性买盘打破模式。

- 当前ETF流入放缓、企业买盘减弱。

- 市场影响:降息或成条件性行情触发点。

- 时效性标注:短期影响。

Original author: that 1618 guy , market researcher at Delphi Digital

Original translation: Yuliya, PANews

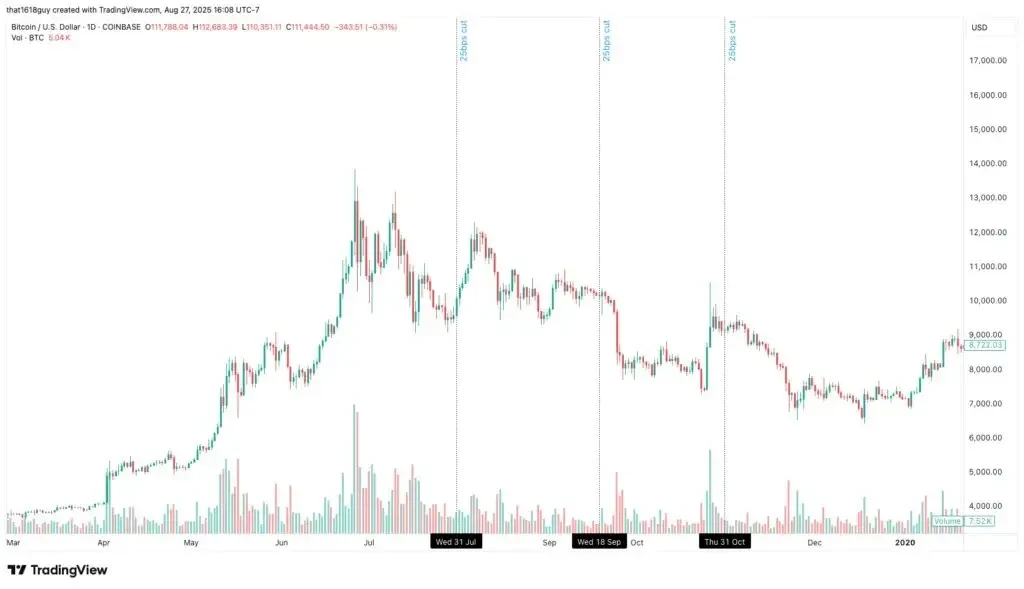

The market generally expects the Federal Reserve to cut interest rates for the first time this cycle in September. Historically, Bitcoin has tended to rise before easing policies are implemented, but retreat after rate cuts are implemented. However, this pattern doesn't always hold true. This article will review the performance in 2019, 2020, and 2024 to predict possible trends in September 2025.

2019: Expected rise, then realized fall

In 2019, Bitcoin rebounded from $3,000 at the end of 2018 to $13,000 in June. The Federal Reserve announced interest rate cuts on July 31, September 18, and October 30, respectively.

Each rate cut decision signals the near exhaustion of Bitcoin's upward momentum. BTC surged before the meeting, but was subsequently sold off as the reality of weak economic growth resurfaced. This suggests the market had already priced in the positive impact of the rate cut, leaving the reality of slowing economic growth to dominate subsequent price movements.

2020: An exception to the emergency rate cut

March 2020, when the Federal Reserve slashed interest rates to zero in response to the panic caused by the coronavirus pandemic, was not a typical cycle.

During this liquidity crisis, BTC plummeted along with stocks, but subsequently rebounded strongly thanks to massive fiscal and monetary policy support. Therefore, this was a unique case driven by the crisis and cannot be used as a template for predicting trends in 2025.

2024: Narratives trump liquidity

The trend changed in 2024. BTC did not fall back after the rate cut, but continued its upward momentum.

The reasons are:

- Trump's campaign turned cryptocurrency into an election issue.

- Spot ETFs are attracting record inflows.

- MicroStrategy continues to see strong buying demand at the balance sheet level.

In this context, the importance of liquidity has declined, with structural buying and political factors overriding traditional economic cycle influences.

September 2025: Conditional market launch

The current market backdrop is different from the runaway rallies of past cycles. Bitcoin has been consolidating since late August, ETF inflows have slowed significantly, and corporate balance sheet buying, once a persistent tailwind, has begun to wane.

This makes the September rate cut a conditional market trigger rather than an immediate catalyst.

- If Bitcoin rises sharply before the interest rate meeting, the risk of history repeating itself will increase - that is, traders "sell the fact" after the easing policy is implemented, resulting in a "rise followed by a fall" situation.

- But if prices remain stable or move slightly lower before the decision, much of the excess positioning may have been eliminated, making the rate cut more of a stabilizing force in the market rather than an end to the upward momentum.

Core Viewpoint

The current trend of Bitcoin may be affected by the Federal Reserve’s September interest rate meeting and related liquidity changes. Overall, Bitcoin may see a wave of increases before the FOMC meeting, but the increase may be difficult to break through new highs.

- If prices rise sharply before the meeting, then a "sell the news" pullback is likely;

- However, if prices consolidate or fall between early September and the meeting, there is a possibility of an unexpected rise due to interest rate adjustments.

However, even if a rebound occurs, the market still needs to remain cautious. The next leg up may form a lower high (around $118,000 to $120,000).

Assuming this lower high occurs, it could set the stage for the latter half of Q4, when liquidity conditions are expected to stabilize and demand could pick up again, pushing Bitcoin towards new highs.