WLFI MVP Battle: Trump Family Accepts $5 Billion, Chain Whales Enjoy "Rice Reaping Moment"

- 核心观点:WLFI上线后特朗普家族成最大赢家。

- 关键要素:

- 特朗普家族持币25%,账面财富50亿美元。

- 公募投资者获超30倍回报,巨鲸大量抛售。

- Falcon Finance支持WLFI抵押铸造稳定币。

- 市场影响:大户获得退出渠道,价格获支撑。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Golem ( @web3_golem )

Yesterday, the market's attention was all focused on WLFI TGE, which was around 20:00 Beijing time. Some people were waiting for the currency to be unlocked, some were playing the long-short game, and the rest were rushing to buy cheats to grab red envelopes from group friends. It was a scene of bustling prosperity.

A minor incident occurred before the launch of WLFI. The market originally estimated the initial circulating supply of WLFI to be 5 billion or even lower. However, after some debate, the makeshift WLFI team finally determined the actual initial circulating supply to be approximately 24,669,070,265 tokens. The unexpected 19 billion circulating tokens caused a setback in WLFI's pre-market trading, with the price plummeting from $0.35 to below $0.30.

However, the hype didn't last long. WLFI's on-chain price reached $0.45812 at 8:00 PM after its launch. It peaked at $1.10 after opening on Gate. An hour later, it opened at $0.478 on Binance, a price not much different from other CEX exchanges that opened earlier. Based on pre-sale costs, the first and second rounds of public offerings generated returns of over 30x and 9x, respectively.

So, who is the MVP of this game? Let's do a simple "post-battle settlement".

Trump family receives $5 billion in paper wealth

If the Trump family claims to earn little, no one dares to claim to earn much. The Wall Street Journal estimates that the Trump family has amassed a paper fortune of $5 billion since the launch of WLFI, potentially its greatest financial success since taking office . Currently, the Trump family holds approximately a quarter of all WLFI tokens. Previously, the White House disclosed in its 2025 financial filing that Trump personally holds 15.75 billion WLFI tokens in his crypto wallet, representing 15.75% of the total supply.

Even at the current WLFI market price, Trump's personal holdings of WLFI tokens are worth over $3.62 billion. While World Liberty Financial claims the tokens held by the founders and team members are locked up, it's hard to believe they haven't liquidated their holdings through other means, such as through Alt 5 Sigma. (Odaily Note: Alt 5 previously announced it would issue 200 million new shares, half of which will be used directly for token swaps with the WLFI project.)

The Trump family is undoubtedly the MVP of this game. A previous Financial Times analysis estimated that the Trump family made at least $350 million in profits from the sale and market making of TRUMP. This time, with the launch of WLFI, the Trump family directly received about $5 billion. WLFI may have become the Trump family's most valuable asset, surpassing the real estate portfolio they have operated for decades.

Justin Sun unlocks 600 million WLFI tokens, not selling any

Justin Sun was once considered one of the largest individual holders of WLFI. According to public information, he holds a total of 3 billion WLFI, representing 3% of the total supply. According to Arkham monitoring, Sun claimed 600 million WLFI yesterday, currently valued at $138 million. However, Sun stated in a statement that he will not sell WLFI in the short term and will work to increase the total circulating supply of USD1 on TRON to 200 million.

Justin Sun's decision not to sell is not surprising, as his purchase of WLFI was primarily a political donation, intended to maintain close ties with the Trump family, safeguard his own security, and pave the way for future expansion of TRON or Huobi into the US market. Therefore, his profits likely stem not directly from the cash returns from his WLFI investment, but rather from the complex resource allocation behind it.

The "Rice Reaping Moment" of On-Chain Whales

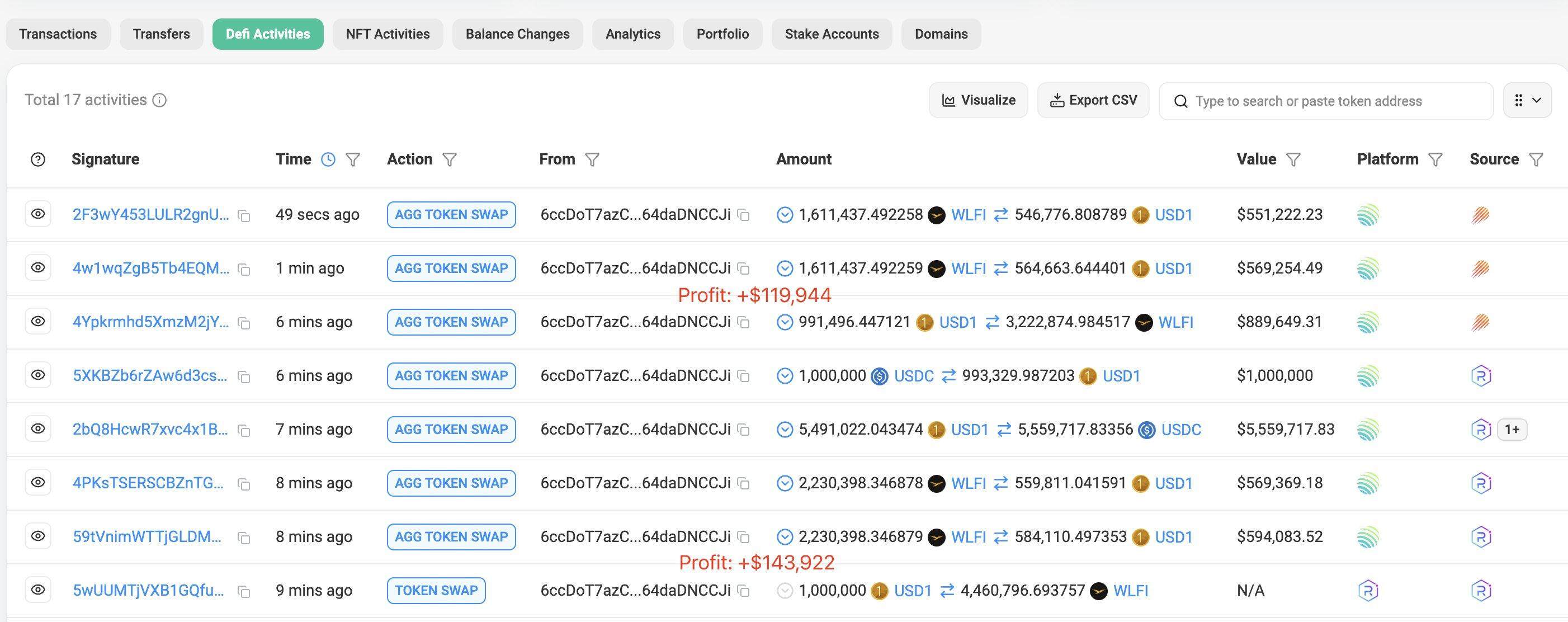

Compared to "strategic players" like the Trump family and Justin Sun, on-chain whales are playing the role of "jungle players" in this game. Some rely on trading, while others choose to sell their coins directly, all of which have reaped significant profits. A smart money address starting with 6ccDoT earned $263,866 in profits through trading within 10 minutes of WLFI's launch.

Faced with a return on investment exceeding 30 times, many whales who participated in the public offering sold WLFI, even at the high on-chain gas costs (Ethereum gas fees once soared to 129.327 Gwei). According to Lookonchain monitoring , when Binance opened WLFI deposits, three WLFI pre-sale participants had already transferred a total of 160 million tokens to Binance.

Meanwhile, WLFI investor moonmanifest , after claiming 200 million unlocked WLFI last night (he subscribed to 1 billion WLFI at $0.015 in the first round of the public offering with 15 million USDC), sold 10 million WLFI this morning, recovering his initial $2.1 million investment. Perhaps the investor remains bullish on WLFI's future performance. This morning, official news announced the launch of a new WLFI governance proposal, which plans to use all fees earned from the protocol's liquidity (POL) to repurchase and burn WLFI, thereby reducing the circulating supply. If approved, this token buyback could boost WLFI prices.

But other whales haven't been as patient as moonmanifest. According to on-chain analyst Ai Yi, four of the top 10 WLFI holders (6th, 7th, 8th, and 10th) sold some or all of their holdings half an hour after the TGE. This morning, 80% of holders have taken some or all of their profits, leaving only the top 2 and 5 holders who haven't transferred or sold any tokens. The top 6 holder, convexcuck.eth, sold $3.8 million worth of WLFI to 36 buyers through the over-the-counter (OTC) platform Whales Market.

Does the stablecoin protocol Falcon Finance provide an exit channel for large investors?

However, large investors may not need to worry too much about exit liquidity. Last night, DWF Labs partner Andrei Grachev announced that its stablecoin protocol, Falcon Finance, will support WLFI as collateral. Within the protocol, users can use WLFI as collateral to mint USDF. Using the classic minting model, 100 million WLFI (valued at approximately $27.9 million) can be minted into 19.81 million USDF.

This can almost be regarded as a guaranteed exit channel for large investors, because if WLFI continues to fall, the minter can choose to take away 19.81 million USDf, and if the WLFI price is maintained, he can continue to maintain the mortgage position.

"One billion WLFI may be salable in the market, but 200 million stablecoins can be minted directly here, which means you can run away with all of them for $0.2. This is a disguised liquidity exit channel," my colleague Azuma , a senior DeFi player at Odaily, pointed out incisively.