B² Launches U2 Stablecoin System: Transforming Bitcoin from "Digital Gold" to "Global Payment Unit"

- 核心观点:U2稳定币释放比特币流动性。

- 关键要素:

- 超额抵押BTC铸造美元锚定稳定币。

- AI驱动风控与自适应清算机制。

- 支持多场景支付与收益策略。

- 市场影响:提升比特币金融应用效率。

- 时效性标注:中期影响。

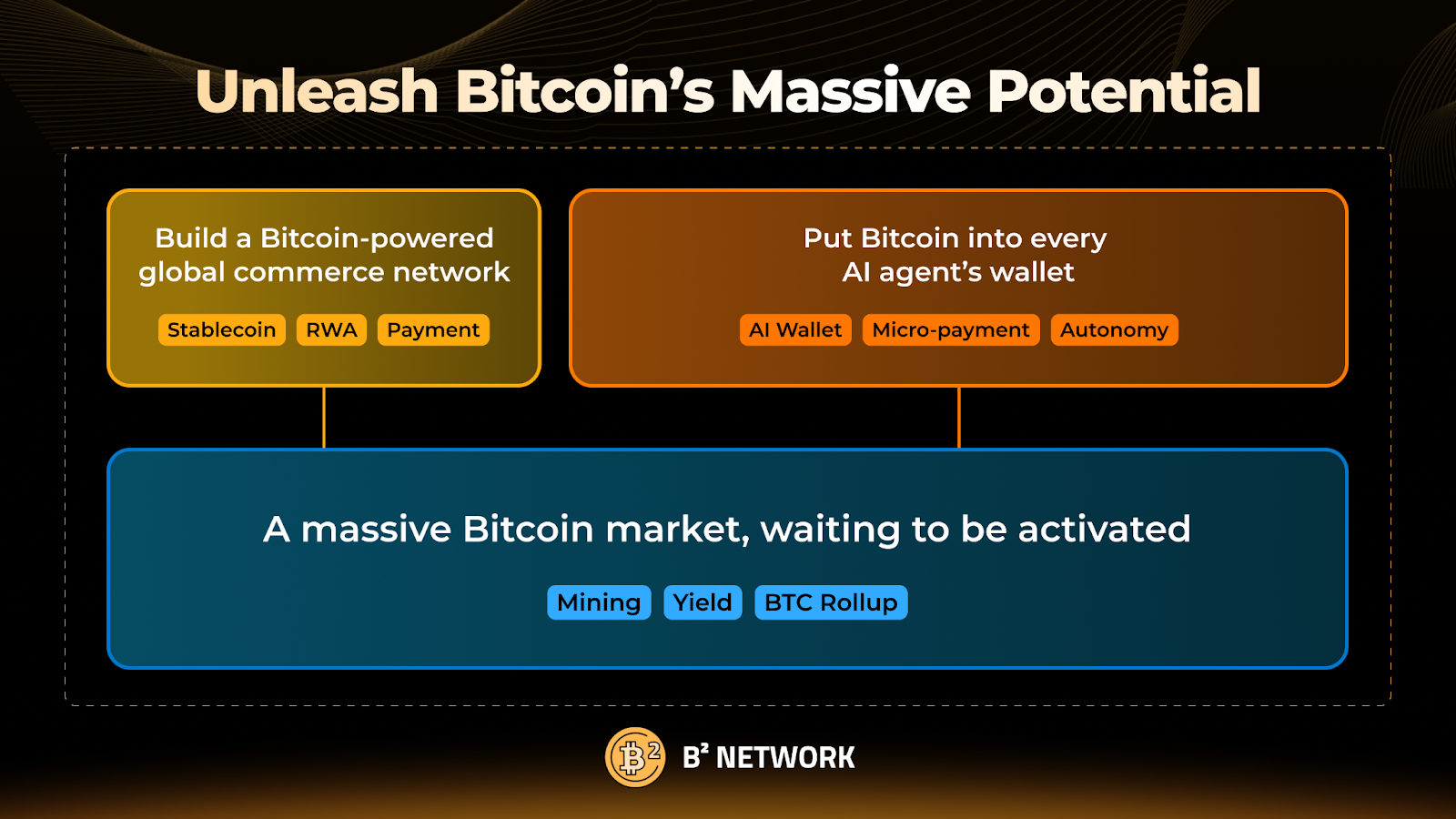

Unleashing a New Path for Bitcoin: From Dormant Asset to Financial Engine

For the past decade, Bitcoin has remained the most resolute anchor of value in the crypto world. It defies authority, cannot be issued inflated, boasts absolute scarcity, and is permissionless, defining "digital gold" in the simplest and most elegant way. However, the on-chain utilization of this "gold" remains inefficient, leaving a significant amount of BTC dormant and unable to participate in on-chain interactions and financial flows.

Over the past year, B² Network has been dedicated to awakening this dormant value. We built a high-performance Rollup and data availability layer, deeply integrating smart contracts and security with the Bitcoin mainnet. We launched the BTCFi aggregator Buzz and the innovative mining pool Mining Squared, creating sustainable and composable income channels for Bitcoin holders and miners. We have attracted over 5,000 BTC inflows, served over 500,000 Bitcoin holders and miners, and connected a multi-chain ecosystem.

We have taken a decisive step on this path to unleashing the usability of Bitcoin.

But as more and more BTC is mobilized to participate in lending, liquidity, staking, and even cross-chain collaboration, a deeper problem is gradually exposed: we still lack a stable and native standard unit of value that allows BTC to flow freely and be flexibly settled between these applications.

The high volatility of native BTC makes it unsuitable as a payment unit or price reference. While current mainstream stablecoins are widely circulated, most are detached from the BTC system, lack on-chain transparency, and are even unable to circumvent centralization risks in terms of their mechanisms. Meanwhile, a new generation of on-chain users, including AI, large models, and agents, urgently need an "economic fuel" that can complete payment settlements within milliseconds and is sufficiently secure and transparent.

Therefore, in the face of more complex and high-frequency financial interactions in the future, Bitcoin needs a stablecoin that truly belongs to it. This is exactly why we launched U2.

U2: A Bitcoin-powered stablecoin system that creates real liquidity units for BTC

U2 is a Bitcoin-powered, USD-pegged stablecoin, running on the B² Network's high-performance execution layer and secure custodian architecture. It serves as an amplifier of Bitcoin's liquidity and a key interface connecting BTC with the on-chain economy and AI agents, making it a true "Bitcoin-native stablecoin."

Users can use BTC (or corresponding cross-chain assets) as collateral to mint U2 under the protection of leading custodian institutions and enjoy an efficient, secure, and transparent minting process. Its features are as follows:

- Stable anchoring: U2 can be exchanged for mainstream stablecoins at a 1:1 ratio, ensuring anchoring stability;

- Secure Collateralization: Utilizing an over-collateralization mechanism, the collateralization process is fully transparent and combined with an AI-driven "adaptive liquidation engine" to ensure that the anchor can be safely maintained amidst BTC fluctuations and dynamically manage risks.

- Asset custody: Connect with leading custodians, support regular audits and compliance supervision, and ensure the stable operation of the system;

What makes U2 unique is its ability to amplify Bitcoin's value. Unlike traditional stablecoins, the BTC behind U2 remains "idle" but can continue to participate in mining, yield strategies, and on-chain activities, unlocking the dual value of "minting and earning interest." U2 has designed a comprehensive financial system centered around revenue and governance, further enhancing its usability and supporting the value of $B2:

- B2 Governance and Incentives: $B2 holders have governance rights and can vote to adjust risk control parameters (such as collateralization rate caps and interest rate thresholds). They can also stake $B2 to obtain higher borrowing limits or fee discounts. The protocol will also regularly distribute B2 rewards and retain a certain percentage as a risk reserve pool to enhance system robustness.

- B2 Value Enhancement: A portion of all protocol surplus generated through U2 lending and revenue will be used to repurchase $B2 and inject it into the ecosystem. Additionally, a portion of the platform's interest expenses can be paid directly with $B2, further increasing its usage and market demand.

- Interest Rate and Yield Mechanism: U2 will adopt an innovative yield model in the future. With the support of B²'s rich on-chain yield products, users will have the opportunity to enjoy a variety of on-chain compound interest. Stay tuned.

This mechanism offers a clear user perspective: Imagine you're a long-term BTC holder. By pledging your BTC to mint U2, you can use this stablecoin to participate in on-chain yield strategies and earn additional income. You can also stake some of your $B2 to receive higher limits and discounts, and even use the earned U2 to compound interest. While you hold your BTC, your earnings continue to accrue—truly achieving "efficient asset management."

B² completed all of this in just a few steps, opening up the interface and giving “BTC HODL” a new and dynamic paradigm.

What can U2 do? 7 capabilities fully activate BTC's on-chain usability

U2 is Bitcoin's bridge to modern on-chain finance, AI-powered commerce, and global payment networks. By integrating with diverse scenarios, it opens up unprecedented avenues of use. From miner financing and on-chain payments to agent micropayments and global consumption, U2 is gradually building a globally applicable, composable stablecoin capability matrix based on BTC endorsement:

1) Minting generates interest, keeping BTC working: While pledging BTC to mint U2, the underlying assets can be deployed in multiple income strategies, including access to the B² Buzz platform for native on-chain returns, participation in quantitative arbitrage strategies like Delta-Neutral, and investment in mining equipment/computing power financing for lending returns. Meanwhile, U2 itself provides holders with a stable annualized return, establishing a sustainable stablecoin model with bilateral interest generation, achieving a dual-income structure of "continued BTC interest generation and U2 holding interest generation."

2) Providing financing channels for miners, allowing them to monetize future profits: U2 integrates with B²'s innovative mining pool product, Mining Squared, allowing miners to pledge not only their existing BTC but also their hashrate (RWA) representing future profits and physical mining rigs, obtaining U2 stablecoins as liquidity in advance. Miners can also repay their loans with subsequent BTC or other profits earned from mining. This means miners no longer need to sell BTC to operate their mining rigs, preserving growth potential while improving cash efficiency.

3) Payment and Settlement: U2 is the "usable dollar" on the Bitcoin chain. Thanks to the B² Network's high-throughput and low-cost execution environment, U2 can be widely used in various scenarios, including daily consumption, protocol interaction, and cross-border payments. B² will integrate with Web2 applications with tens of millions of users, such as ShareX. U2 can be directly used for encrypted payments, driving consumer adoption within the BTC ecosystem.

4) Gas Fee Support: Use U2 to Operate the Entire B² Network: U2 can be used directly as the gas token for the B² Network, allowing users to complete all on-chain operations, including contract interactions, transfers, and transactions, without the need for additional tokens. As the ecosystem continues to grow, the frequency and demand for U2 will continue to expand.

5) Multi-chain account system, allowing U2 to be quickly transferred across multiple chains without cross-chain transactions: B² Network natively supports a multi-chain account system, allowing U2 to be seamlessly transferred between multiple blockchain ecosystems without the need for traditional bridging. This not only lowers the barrier to entry but also significantly improves interoperability across different chains, making U2 a more flexible universal unit of value on-chain.

6) Adaptive Liquidation Engine, AI-Powered, Dynamically Resilience: The risk control engine behind U2 incorporates an AI-driven, real-time dynamic collateralization adjustment mechanism. This model integrates data from multiple sources, including Chainlink and Bitstamp, and on-chain market depth to assess risk every 10 seconds and predict extreme tail events within the hour, enabling proactive adjustments to minting conditions and triggering alerts. This enables the system to proactively respond to extreme market conditions, avoiding forced liquidations and systemic risks.

7) Millisecond-level AI micropayment standards connect agent-to-agent business models: Every future AI microservice will require a stable and globally accessible micropayment method. AI can pay U2 to obtain API access, data fragments, or computing resources, forming a new settlement layer for on-chain AI-to-Agent commerce. U2 is emerging as a candidate for the "AI native dollar."

One stablecoin, seven capabilities, and full-scenario penetration. As a "unified value interface," U2 opens up new ways to use Bitcoin for long-time BTC users, miners operating small and medium-sized mining farms, developers building on-chain payment channels, and technicians running AI agent systems.

Conclusion: Scaling BTC, starting with stablecoins

As part of the ongoing BTC Scaling strategy, U2 enables B² Network to continuously promote Bitcoin's evolution from "hard currency" to "efficient liquid asset" along three main lines: infrastructure, financial capabilities, and smart ecology.

Stablecoins are the first step to succeed BTC, the key to unlocking asset efficiency, and the entrance to the era of intelligent economy.

We believe that a scalable, transparent, and efficient Bitcoin financial network is emerging, one that truly serves holders, developers, and future intelligent systems. The next story will be written by each of you who builds the future with BTC.