BitMart Weekly Market Report (August 25-31)

- 核心观点:加密市场小幅回调,资金持续流入ETF。

- 关键要素:

- 加密货币总市值下降4.35%。

- BTC和ETH ETF净流入15.2亿美元。

- Solana等热门币种涨幅超10%。

- 市场影响:短期波动,长期资金面支撑强劲。

- 时效性标注:短期影响。

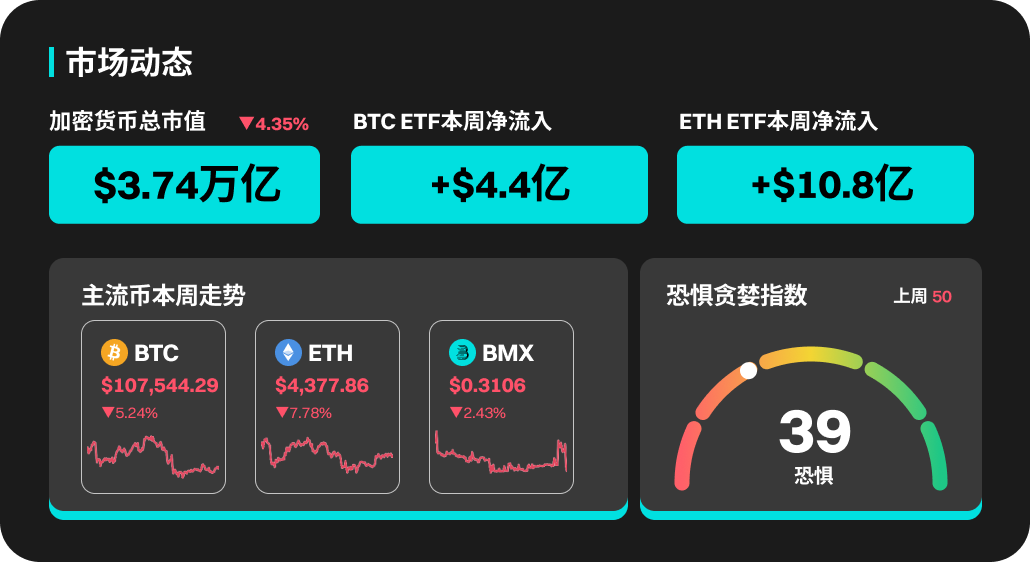

According to BitMart's market report on September 1, the total market value of cryptocurrencies in the past week was 3.74 trillion, down 4.35% from the previous week.

Crypto market dynamics this week

Last week (August 25th to September 1st), BTC ETFs saw net inflows of $440 million. Throughout the week, BTC remained in a narrow range between $107,000 and $113,000. BTC's current market share is currently at 57.3%, roughly the same as last week. BTC's 13% retracement from its all-time high in August is considered a normal decline after a period of rapid growth.

Last week, ETH ETFs saw a net inflow of $1.08 billion, marking another significant inflow. Amidst this strong inflow, ETH outperformed BTC during this period. ETH's market share is currently reported at 14.2%, and the ETH/BTC exchange rate is currently at 0.041, remaining largely unchanged from last week. ETH is currently down 11% from its all-time high in August, and the market awaits further confirmation.

This week's popular currencies

Among popular cryptocurrencies, PYTH, CRO, MITO, TA, and M all performed well. PYTH saw a 42.81% price increase this week, with a 24-hour trading volume of 1.17 B. CRO saw a 76.23% price increase, reaching a high of 0.3792 USDT. TA and M saw increases of 140.49% and 47.04%, respectively.

U.S. market and hot news

Last week, the US stock market saw a slight adjustment overall, mainly due to inflation data, a pullback in AI technology stocks, and pre-holiday selling sentiment: the S&P 500 fell about 0.1%, the Dow Jones Industrial Average fell about 0.2%, and the Nasdaq also fell about 0.2%, while the Russell 2000 rose slightly by 0.2%. Overall performance this month remains strong: the S&P 500 rose 1.9%, the Dow Jones Industrial Average rose about 3.2%, and the Nasdaq rose about 1.6%, marking four consecutive months of gains.

At 21:00 (UTC+8) on September 3, 2025 FOMC voting member and President of the Federal Reserve Bank of St. Louis, Moussallem, delivered a speech on the US economy and monetary policy.

The Federal Reserve will release the Beige Book on economic conditions at 2:00 am on September 4 (UTC+8)

At 20:30 on September 4 (UTC+8), the United States will release the number of initial jobless claims for the week ending August 30, and the U.S. trade balance for July.

At 20:30 on September 5 (UTC+8), the United States announced the August unemployment rate, August seasonally adjusted non-farm payrolls, and the average hourly wage annual and monthly rates.

Unlock popular sections and projects

Solana

Solana performed exceptionally well, gaining approximately 12.9% for the week, the best performance among major L1 public chains, outperforming Ethereum (+11.0%) and Avalanche (+6.9%). SOL remains within an upward trending channel, with strong buying and positive technical indicators. A breakout above the $209–$211 resistance range could lead to further price challenges. Overall, Solana demonstrates strong growth potential and market interest amidst the resurgence of capital inflows and a rebound in market risk appetite.

Sui (SUI) will unlock approximately 44 million tokens at 8:00 am Beijing time on September 1st, accounting for 1.25% of the current circulation and worth approximately US$145 million.

Ethena (ENA) will unlock approximately 40.63 million tokens at 3:00 PM Beijing time on September 2, accounting for 0.64% of the current circulating supply and worth approximately $27.1 million.

Immutable (IMX) will unlock approximately 24.52 million tokens at 8:00 AM Beijing time on September 5th, accounting for 1.27% of the current circulating supply and worth approximately $12.8 million.

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve substantial risk of loss. Past, hypothetical, or simulated performance is not necessarily indicative of future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.