Ethereum DAT Treasury Strategy Company: When will ETH be sold?

- 核心观点:机构持有加密资产存在多种终局可能。

- 关键要素:

- 盈利套现或税务优化出货。

- 资金压力或止损被迫抛售。

- mNAV低于1引发减持。

- 市场影响:大规模机构行为影响市场流动性。

- 时效性标注:长期影响。

Original author: 0xTodd

Good Ending 1-Pocket

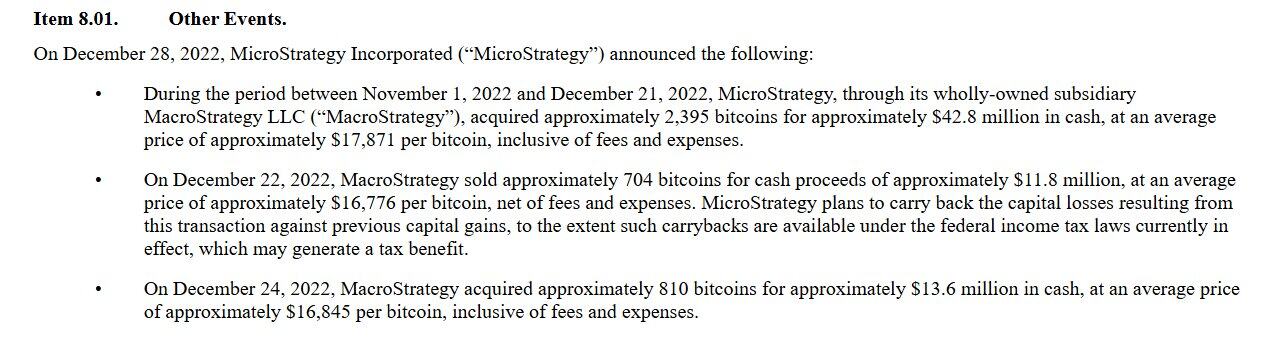

When the price of crypto assets is significantly higher than their investment cost, they cash out under shareholder/tax requirements, although the transfer address will slightly affect the floating profit.

WeStrategy had previously transferred some coins to "optimize taxes," but it did not cause any settlement or market crash.

But for their capital scale, it doesn’t matter. 3000, average cost 6000 to sell, big capital is already very happy.

Good Ending 2-Love Changes

If they make enough money, human nature is to replicate their own success. Someone who started out with Ethereum DAT might try to invest in other altcoins in the future, and at that point, they might switch gears.

Normal Ending 1 - Hedge Shipment

If they think their holdings are nearing their ceiling, they will stop buying and even prepare to sell.

Even if their on-chain addresses are transparent, it does not prevent them from hedging in a low-key manner through contracts and options, thus retaining a little bit of the fruits of victory.

Normal Ending 2 - No One Cares

If mNAV is lower than 1 for a long time, the company will think that it is a loss to continue issuing additional shares, so it may sell some coins at this time to appropriately pull back mNAV.

According to my experience, of all the anchors in the world, only the "two-way anchor" is effective. No project can be anchored by "psychological anchor" alone.

Bad Ending 1-Funding Pressure

For example, Tesla was forced to sell three-quarters of its Bitcoin holdings in 2022 due to financial pressure. These institutions may face similar financial pressures at some point in the future.

Bad Ending 2-Stop Loss

If you do the opposite, the cost of building a position will be much higher than the current price, and the whole game cannot continue. One day you can only stop the loss and try to get it back through a lower bottom.

Of course, these are just long-term endgame predictions and do not imply a near-term bearish or negative outlook on DAT. While the drums continue to beat, we should keep playing and dancing.

As for when the drumbeat stops? That’s a topic for the next post, focusing on three key indicators: cost of establishing a position, CEO/CFO/Board of Directors turnover, and mNAV remaining below 1 for a prolonged period.