Fidelity Ethereum Report: Three Future Destinies

- 核心观点:以太坊面临模块化扩容与竞争风险。

- 关键要素:

- 二层扩容牺牲一层价值捕获。

- Solana等竞品性能优势明显。

- 年升级机制引入技术风险。

- 市场影响:可能影响ETH长期价值与市场份额。

- 时效性标注:长期影响。

Original author: Fidelity Digital Assets

Original translation: Aki Wu talks about blockchain

This article does not constitute any investment advice. Readers are advised to strictly abide by local laws and regulations and not participate in illegal financial activities.

Fidelity's latest Ethereum report provides a detailed analysis of Ethereum's current status, strengths, weaknesses, technical roadmap, governance structure, fundamentals, and market competition. Based on this analysis, it also deduces the competitive risks Ethereum faces under different scenarios. The report points out that Ethereum, as a pioneering decentralized smart contract platform, possesses significant network effects and reliability. Its smart contracts and decentralized nature provide high transparency and censorship resistance. However, Ethereum's modular scaling path and proof-of-stake mechanism sacrifice some value capture at Layer 1 and present technical, regulatory, and governance risks. Investors should continue to monitor Ethereum's technological upgrades and market trends to assess its long-term value.

1. Key points of Ethereum

1. Current Facts

As a decentralized platform, Ethereum was the first to support the innovation of "smart contracts" (code that executes automatically on the blockchain).

Ether (ETH) is the native token of the Ethereum network and is used to pay transaction fees (Gas).

Ethereum has an ongoing technology roadmap, and network upgrades are basically implemented on an annual basis.

2. Advantages

With the first-mover advantage of the smart contract platform, Ethereum has formed a significant network effect.

Ethereum prioritizes security and decentralization, and has stronger reliability, censorship resistance, and transparency than other existing smart contract platforms.

Ethereum generates "free cash flow" through a transaction fee mechanism and reduces the total supply of ETH by burning transaction fees, which is functionally similar to "automated share repurchases."

Ethereum is fundamentally different from Bitcoin at the functional level and can be seen as a potential diversification asset for investment portfolios.

3. Disadvantages

Ethereum adopts a "modular expansion" path (mainly based on the second layer), which sacrifices a certain amount of value capture on the first layer while introducing more users.

Its degree of decentralization is between Bitcoin and Solana, making it more vulnerable to challenges in terms of "monetary asset" competitiveness and overall performance.

Ethereum typically undergoes a major upgrade once a year. Every change to the network carries potential risks, and investors should evaluate them carefully.

2. What is Ethereum? What is its core value proposition?

Ethereum was proposed by Vitalik Buterin in 2013 and launched in 2015. In the Ethereum white paper, Buterin stated: "The Ethereum protocol offers a platform with unique potential; it is not a closed, single-purpose protocol designed for a specific use case. Ethereum is open by design, and we believe it is well-suited to serve as the foundational layer for a wide range of financial and non-financial protocols for many years to come."

The Ethereum protocol can be considered a digital "blank canvas" for developers: applications can be written and secured by a global network of computers. These applications, powered by smart contracts, are at the core of Ethereum's value proposition. The decentralized nature of the Ethereum protocol is a key differentiator from its competitors. Its open design enables widespread and creative application. This combination of practicality and decentralization has made Ethereum's native currency, Ether (ETH), the second-largest digital asset by market capitalization, approaching $300 billion.

Ether (ETH) is the essential asset for transactions on the Ethereum network. Every transaction includes a "gas fee" (paid in ETH) to complete its execution. Whether developers create and launch new applications or users interact with applications, all transactions require ETH to pay for these fees.

3. Ethereum Investment Thesis

Ether (ETH), a necessity for using the Ethereum network, is central to its investment thesis. In theory, if demand for various applications on Ethereum grows over time, demand for the token should also increase accordingly.

Just as Bitcoin represents a non-sovereign store of value and payment method, Ethereum represents a globally neutral, open-source application network. Therefore, this report argues that networks like Ethereum are likely to expand along the typical adoption curve (S-curve) observed by other disruptive technologies.

Currently, decentralized finance (DeFi) and stablecoins account for a significant portion of Ethereum network activity. While Ethereum's underlying nature is inherently financial, applications built on it cover a wide range of computational scenarios, resulting in a vast addressable market (TAM).

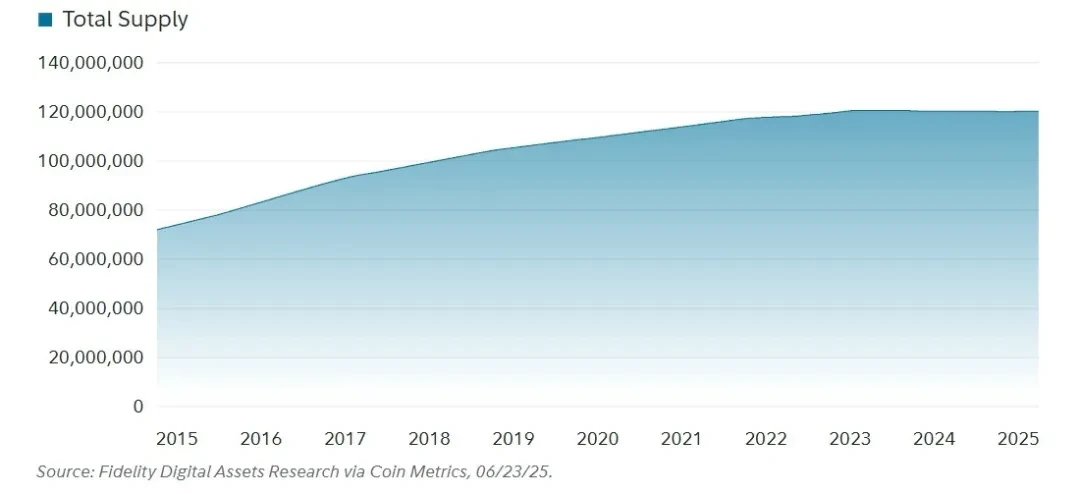

On the supply side, new ETH supply primarily comes from Proof-of-Stake (PoS) issuance, making it more stable than other cryptocurrencies. Its mechanism is designed to prevent hyperinflation, capping the annualized net inflation rate at approximately 1.5% in extreme cases. In practice, according to the current design, ETH supply typically fluctuates within a small range of -1% to 1%.

Combining the inherent demand generated by network adoption with a relatively stable supply means that this investment thesis depends heavily on the actual trajectory of the adoption curve over the next few decades. Investors can then assess the range of potential adoption outcomes and, accordingly, determine whether this demand trend warrants allocation/investment. However, given that Ethereum's roadmap is still evolving, investors should continue to monitor progress and adjust their thesis accordingly.

IV. History and Future

1. Initial Token Distribution

The current Ethereum ecosystem is vastly different from when the mainnet launched in 2015. Ethereum initially launched as a Proof-of-Work (PoW) blockchain—a mechanism where miners solve computational puzzles to verify transactions and secure the network—and simultaneously launched a "genesis sale" (early crowdfunding) to raise funds for the Ethereum Foundation.

Source: CoinMarketCap, July 15, 2025

Source: CoinMarketCap, July 15, 2025

Note: In theory, there is no cap on the total amount of Ether, but the protocol parameters are designed to ensure that the annualized inflation rate does not exceed 1.5%.

Interestingly, the difference between Ethereum's initial supply at genesis and its current supply can be primarily attributed to issuance and distribution during its Proof-of-Work (PoW) phase. Compared to other Proof-of-Stake (PoS) networks, this mechanism enabled ETH to achieve widespread distribution and decentralized ownership similar to Bitcoin in its early days. Given that a significant portion of the supply was allocated to Ethereum miners during the PoW phase, this widespread distribution provided a solid foundation for the network's transition to PoS.

2. Merge into Proof of Stake

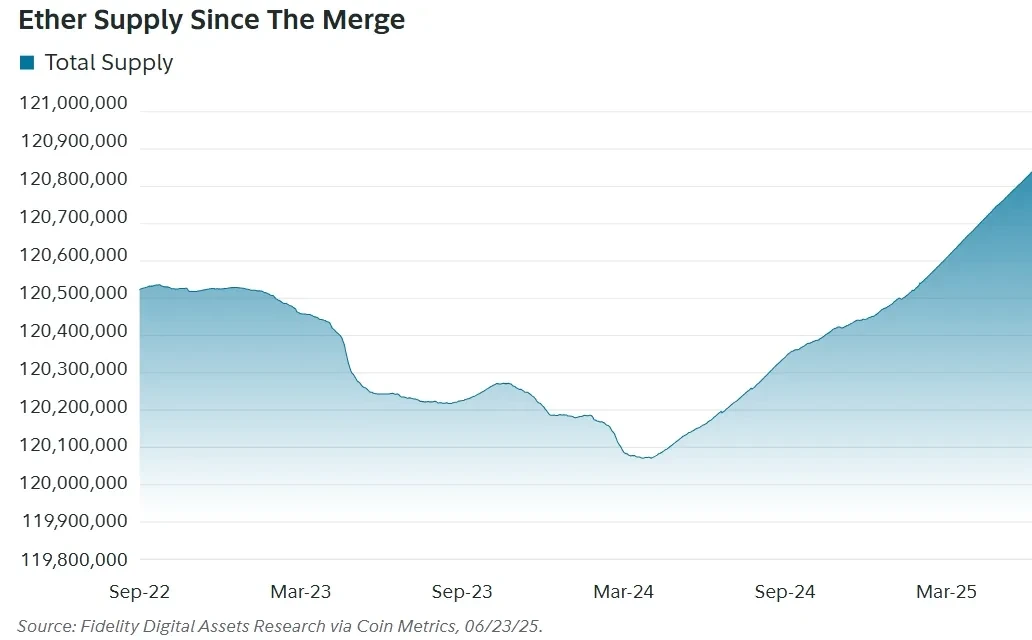

Ethereum's "merger" marks a pivotal transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This process begins with the launch of the Beacon Chain in 2020 and concludes in 2022, integrating the Beacon Chain with the Ethereum Mainnet. This move significantly reduces Ethereum's energy consumption by approximately 99.95% and reduces Ether issuance by approximately 89%, thereby stabilizing its supply.

The significant reduction in issuance since the merger has further solidified the stable nature of Ether (ETH) supply. Under the PoS mechanism, constraints on ETH issuance ensure that network security can continue to improve without excessively increasing maintenance costs.

3. Modular expansion path

3. Modular expansion path

In 2021, due to strong demand, Ethereum faced significant scaling challenges, leading to high transaction costs. "Modular scaling" involves separating different on-chain functions into separate layers, thereby improving the efficiency of transaction processing and data management. Ethereum's core position within this approach remains as a secure, decentralized data availability layer (DA), facilitating transaction execution.

4. Roadmap

Given the impact each upgrade has on the network, it’s crucial to understand Ethereum’s overall roadmap and potential changes. Ethereum is a continuously evolving network — investors should plan and adjust accordingly.

Strategic Initiatives:

Expanding L1: Increase the capacity of Layer 1 and provide sufficient block space to accommodate asset issuance, governance, DeFi, and settlement activities of Layer 2.

Scaling Blobs: Expanding the scale and capabilities of Blobs—temporary data packages introduced to improve data availability and reduce costs—to provide the most compelling data availability service in the digital asset space.

Improved User Experience (UX): Achieve a unified, seamless, and secure user experience across the entire Ethereum ecosystem.

5. Ethereum Governance Structure

1. Ethereum Foundation

The Ethereum Foundation (EF) is a nonprofit organization supporting the entire Ethereum ecosystem. Its responsibilities include funding protocol-layer development, fostering ecosystem growth, and promoting Ethereum advocacy and evangelism. The Foundation's Executive Board consists of three members, including Vitalik Buterin.

Since its founding in 2015, the Foundation has embraced two core principles: long-termism and subtraction. The Foundation believes its work should be measured over the long term—spanning decades and even centuries, not just quarters and fiscal years. Furthermore, the principle of subtraction means proactively reducing its own power whenever possible and resisting the natural tendency of organizations to expand and accumulate power. The Foundation's overarching goal is to enable the network to thrive with the support of the broad community, rather than relying solely on the Foundation and its board.

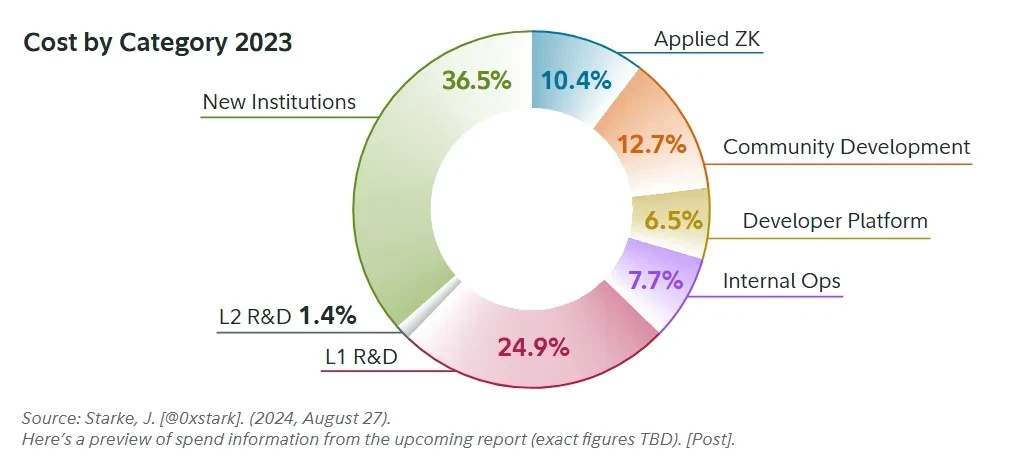

The most obvious role of the Foundation within the ecosystem is financial support. At the time of the initial token offering (ICO), the Foundation was allocated 3.5 million ETH and has a budget of approximately $100 million per year to fund various aspects of R&D.

The following is a schematic breakdown of the funding allocation for 2023:

Grant amounts and their allocation details are continually adjusted based on the community's priorities. While the Ethereum Foundation doesn't directly determine the specific work the community undertakes, it does have some influence in directing funding to areas of its focus. Overall, the Ethereum Foundation plays a key role in the Ethereum ecosystem, primarily through research and grants; however, the organization is committed to reducing its role over time.

Grant amounts and their allocation details are continually adjusted based on the community's priorities. While the Ethereum Foundation doesn't directly determine the specific work the community undertakes, it does have some influence in directing funding to areas of its focus. Overall, the Ethereum Foundation plays a key role in the Ethereum ecosystem, primarily through research and grants; however, the organization is committed to reducing its role over time.

2. Ethereum Improvement Proposals and Upgrades

Ethereum governance utilizes a structured process called Ethereum Improvement Proposals (EIPs) to advance protocol changes. Proposals are discussed in All Core Devs (ACD) meetings, where core developers collaborate to determine the content of the upgrade. This process begins with the drafting of an EIP, followed by community review and discussion. Once a proposal garners broad (or even overwhelming) community support, it undergoes rigorous testing and security audits.

It's important to emphasize that governance decisions about how to improve Ethereum occur off-chain. These decisions are made in public forums, and changes are driven by community consensus rather than top-down mandates. Once an EIP has been thoroughly reviewed, it's incorporated into a network upgrade to ensure the changes are implemented safely and stably. Compared to the early days of the network, upgrades are significantly less frequent today. Developers generally expect that, going forward, several proposals will be packaged and implemented as a single upgrade on an annual basis.

3. Token Issuance

Ethereum's token issuance mechanism aims to achieve Minimum Viable Issuance (MVI), issuing only the minimum amount of Ether (ETH) necessary to maintain network security. While the issuance curve has undergone several adjustments over time, the core objective of minimizing issuance without compromising security has remained consistent. This approach strikes a balance between security requirements and inflation suppression, leading to a perennial debate over the optimal security threshold.

6. Ethereum Technical Structure

1. Smart Contracts

Smart contracts are at the heart of Ethereum's uniqueness. The simplest way to think of them is as programmable logic—much like apps on your phone. The fundamental difference lies in where they are deployed and how they run.

Smart contracts deployed on Ethereum benefit from the auditability and high availability of the blockchain: any user can view the application's operational logic and publicly verify its correctness and effectiveness. Furthermore, Ethereum has not experienced a single network-wide outage since its launch, ensuring extremely high availability and accessibility for the applications it hosts.

This is different from most Internet applications today: the core business logic of the latter is usually not open to the public, and users need to trust the application provider to a greater extent to properly handle data and execute correct operating procedures; at the same time, Internet-based applications often rely on smaller server clusters to operate normally, which increases the probability of downtime.

Therefore, while smart contracts have the full functionality of other mainstream applications, they can also benefit from the higher transparency, censorship resistance and reliability provided by Ethereum.

Ethereum initially used a Proof-of-Work (PoW) consensus mechanism, but its roadmap has always included an eventual transition to Proof-of-Stake (PoS). This shift to PoS has had significant implications for both the network's economics and the investment characteristics of Ether (ETH).

The issuance contraction achieved by "The Merge", coupled with the destruction mechanism (EIP-1559) launched in 2021, has made Ethereum gradually show the attributes of a "productive asset": its "net cash flow" flows back to investors in the form of token destruction.

It is important to emphasize that Ethereum’s net cash flow is dynamic and will change with the continued evolution of network demand and protocols.

2. Issuance and Destruction

Ethereum initially adopted a Proof-of-Work (PoW) consensus mechanism; however, its roadmap from the outset included an eventual transition to Proof-of-Stake (PoS). This shift to PoS has had a significant impact on the network's economics and the investment characteristics of Ether. The issuance reduction brought about by "mergers," coupled with the implementation of a burn mechanism in 2021, has gradually transformed Ethereum into a "productive asset": its "net cash flow" flows back to investors in the form of token burns. It's important to emphasize that Ethereum's net cash flow is dynamic and will change with the ongoing evolution of network demand and the protocol.

Ether (ETH) supply since the merger:

3. How does staking work?

3. How does staking work?

Ethereum's transition to Proof-of-Stake (PoS), also known as "The Merge," introduces a new method of "credibility enhancement" to prove that validators are contributing value to the network. To participate in consensus, validators must stake at least 32 ETH to the smart contract and enter the activation queue. Upon activation, a block proposer for the current "slot " is randomly selected from the validators using a process similar to a lottery to produce the next block.

Ethereum generates a slot every 12 seconds; 32 slots constitute an epoch (an epoch is used to group slots/blocks within the blockchain system for processing and consensus). Each slot also randomly selects a group of validators to form a "committee" to attest to the validity of the proposed block and vote on it. The purpose of the committee is to distribute network load and ensure that all active validators participate as planned during each epoch.

Newly issued ETH is generated at the consensus layer. The amount of rewards received by individual validators fluctuates with the total number of participating validators. As of June 23, 2025, the average daily issuance of ETH is approximately 2,602, corresponding to 1,078,281 participating validators. The same entity can run multiple validator instances. Additionally, approximately 0.33% of validators can exit the consensus layer daily.

4. Ethereum’s destruction mechanism

In recent years, Ethereum has implemented a burn mechanism as part of the London upgrade (a 2021 network upgrade that adjusted the fee structure and introduced a mechanism to burn a portion of transaction fees, thereby reducing the supply over time). Unlike Bitcoin, Ethereum has no cap on total supply. One of the goals of introducing a burn mechanism is to generate value back to Ether holders through trading activity, rather than relying solely on staking; this value return is directly reflected in the form of "burns"/"token buybacks" at the Ether holder level.

Executing a transaction on the Ethereum chain requires a base fee. This base fee fluctuates between blocks based on transaction activity. During the PoW era, the base fee was awarded to miners. However, since the London upgrade (and subsequent Merge), this base fee has been burned, reducing the total supply of ETH. Since the burn mechanism was implemented in August 2021, approximately 4.6 million ETH has been destroyed. As of June 23, 2025, this amount, at market prices, is approximately $13 billion, a value that would have otherwise accrued to miners or validators.

5. Layer 2

Ethereum also has a second layer (Layer 2, L2) designed to handle more transactions. This layer consists of multiple performance-optimized second-layer blockchains. Transactions on these chains are completed in larger batches and at lower fees. These transactions are then aggregated and published to Layer 1 (the base layer). Transaction fees are not calculated on a per-transaction basis as on the base layer, but are instead aggregated and charged per batch. Each transaction only bears a small portion of the total fee, improving efficiency and reducing user costs.

Publishing and storing Layer 2 transaction data on Ethereum not only improves efficiency through batching but also provides additional security for Layer 2 users. Publishing transaction batches on Ethereum allows any interested party to independently verify the validity of transactions originating from other chains. This allows Layer 2 blockchains to focus on performance optimization while anchoring some security on Ethereum.

As of June 2025, the most recent network upgrade was the Prague–Electra upgrade, implemented in May 2025. This upgrade doubled the capacity of blobs (temporary data packages used to improve data availability and reduce costs), further improving transaction efficiency. This resulted in lower Layer 2 Rollup fees and a reduction in ETH burns. This scaling upgrade also highlighted the divergence in interests between ETH investors and users: higher fees benefit investors due to the burn mechanism, while lower fees translate into lower transaction costs for users.

Since the Prague–Electra upgrade, ETH supply has increased, suggesting that the efficiency gains from the upgrade have not yet been fully offset by on-chain transaction activity (i.e., the amount of destruction is not yet sufficient to cover the amount of issuance). However, the net effect is lower inflation and lower fees, which can be considered a trade-off. It's still early days, and subsequent upgrades may continue to alter Ethereum's network dynamics. Regardless, it remains valuable to continuously track the inflationary/deflationary trends in ETH supply.

7. Fundamental Analysis of Ethereum

1. Trading

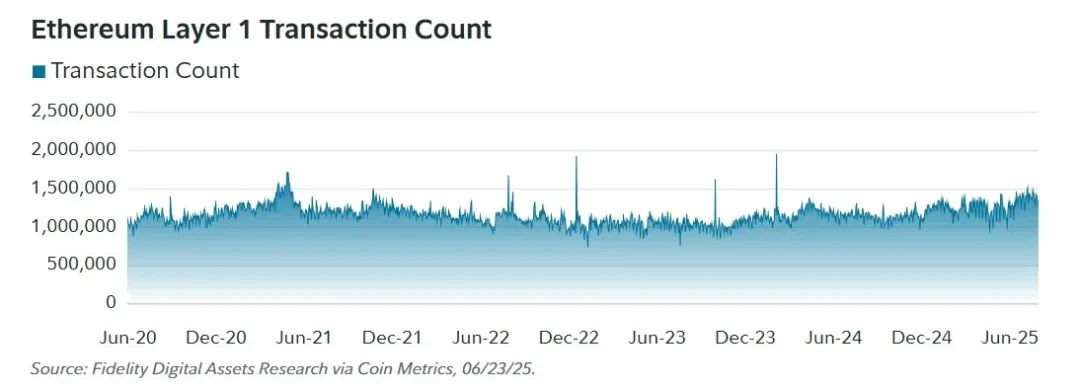

Over the past four years, the average daily transaction volume of Ethereum’s base layer (Layer 1, L1) has been approximately 1.14 million.

Number of Ethereum Layer 1 (L1) transactions from June 2020 to June 2025:

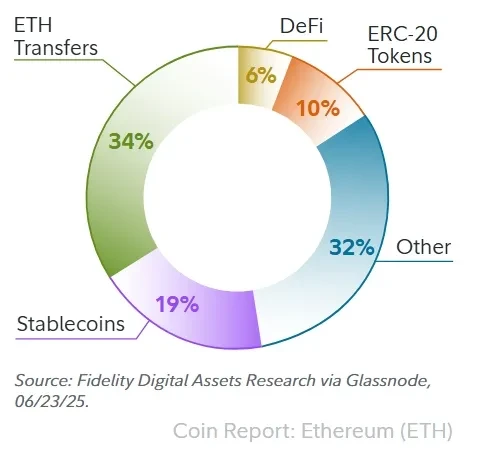

The most common transaction uses on the Ethereum network are:

The most common transaction uses on the Ethereum network are:

● Ether (ETH) transfer

● Stablecoins

● ERC-20 tokens

Decentralized Finance (DeFi)

By 2025, these four categories will account for 69% of all Ethereum transactions, or approximately 873,000 transactions per day. Below is a complete breakdown of each transaction type.

Ethereum transaction type composition

Ethereum transaction type composition

The Ethereum ecosystem supports both Ether (ETH) and a variety of non-native tokens. This stands in stark contrast to Bitcoin, which only supports its native token. The two most common types of non-native tokens are ERC-20 tokens, of which stablecoins are a subcategory. As the chart to the right shows, support for non-native tokens is clearly essential: ERC-20 tokens and stablecoins together account for 29% of daily trading volume.

2. Smart Contract Functionality

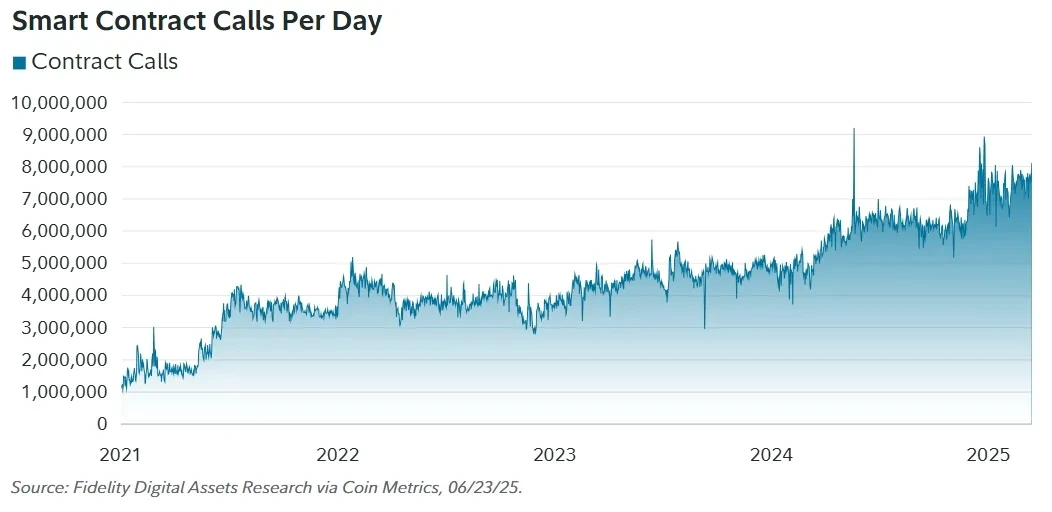

Smart contract calls serve as a proxy for Ethereum's overall functionality; therefore, more calls generally indicate more complex transactions taking place and/or greater usability for users. Since Ethereum's launch, the number of smart contract calls initiated daily has steadily increased. As of June 23, 2025, the network averaged over 7 million smart contract calls per day throughout 2025.

Given the inherent nature of smart contracts as programmable logic, the above metrics can be used to approximate the overall functionality and user usability of the network. The continued growth of smart contract calls on Ethereum indicates that users are able to perform more complex on-chain operations than before, thereby benefiting from the increased utility of applications on the network. It's important to note that this data includes both successful and failed contract calls, but it still clearly points to continued growth in network usability.

Daily smart contract calls:

3. Layer 2 Analysis

3. Layer 2 Analysis

Ethereum relies on Layer 2 (L2) to process the majority of transactions at a lower cost; this Layer 2 leverages the security and censorship resistance provided by Ethereum. Currently, the most popular Layer 2 types are Zero-Knowledge (ZK) and Optimistic (OP). While both share the goal of carrying and processing transactions, they inherit security from Ethereum through different mechanisms. The differences in security guarantees between these two solutions are particularly important for their users; investors should understand that while both can scale Ethereum, they differ in their security mechanisms.

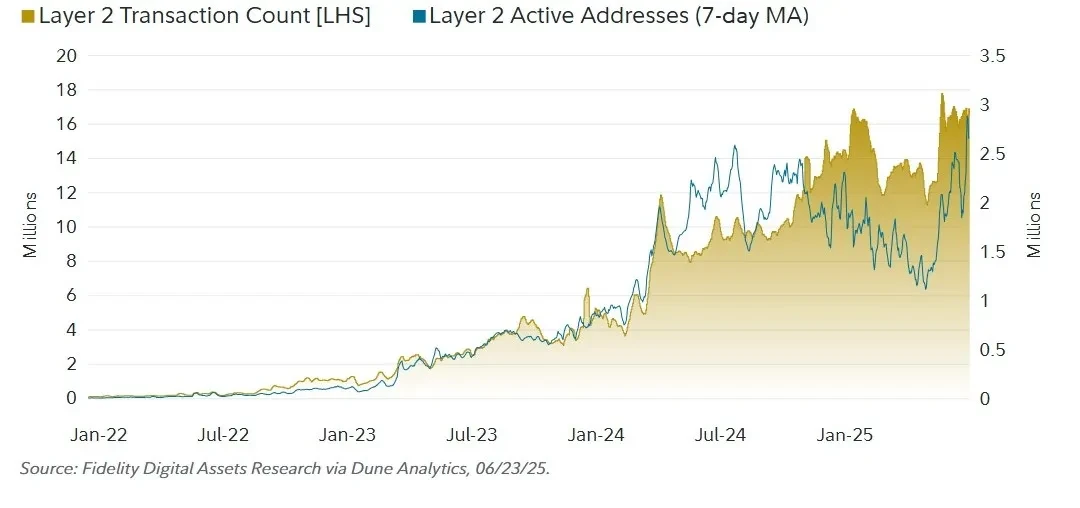

To measure the on-chain activity of these Rollups, this article will focus on two indicators: the number of daily transactions and the number of daily active addresses.

Layer 2 transactions and active addresses:

As of June 24, 2025, approximately 3 million active users initiated 16 million transactions daily on both Optimistic and Zero-Knowledge Rollups. The significant growth in users and activity on these platforms over the past year demonstrates Ethereum's ability to sustainably expand thanks to its modular scaling approach. From the perspective of Metcalfe's Law, this "modularity thesis" has driven the significant increase in Ethereum's network value in recent years.

As of June 24, 2025, approximately 3 million active users initiated 16 million transactions daily on both Optimistic and Zero-Knowledge Rollups. The significant growth in users and activity on these platforms over the past year demonstrates Ethereum's ability to sustainably expand thanks to its modular scaling approach. From the perspective of Metcalfe's Law, this "modularity thesis" has driven the significant increase in Ethereum's network value in recent years.

However, this path presents a trade-off in terms of value repatriation and value capture. Compared to transactions occurring on Layer 1, transactions on Layer 2 (L2) return significantly less value to ETH in the form of "cash flow." From a value capture and financial perspective, this trade-off is clear: before the introduction of Blobs (dedicated block space for Layer 2 data), Layer 2 platforms accounted for approximately 20% of Ethereum's total revenue (primarily transaction fees). After the upgrade, due to the reduction in fees generated by Layer 2, Layer 2 now only accounts for approximately 1% of total fees.

It can be said that through Blob expansion, Ethereum sacrificed some revenue and value capture from Layer 2 platforms in exchange for lower user fees and increased network capacity. This "leverage" essentially oscillates between Metcalfe-style network scale effects and value capture. In the long term, if Layer 2 activity achieves substantial and sustained growth, Ethereum revenue could still rise, but this remains to be seen. Therefore, Ethereum's long-term value repatriation prospects largely depend on a significant increase in Layer 2 demand to offset the ceded revenue space.

8. Competitor Analysis

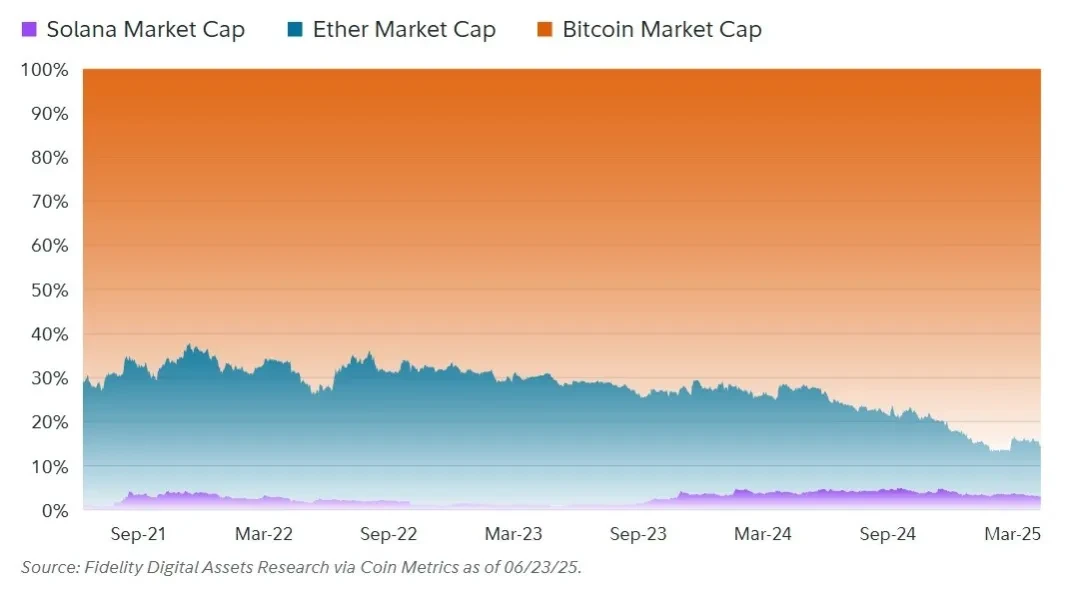

1. Market share/dominance

As the leading smart contract platform, Ethereum always faces the risk of being surpassed by newcomers—a trend already demonstrated to some extent by its largest competitor, Solana. On April 20, 2025, Solana's price reached a record high in Ether (ETH): 1 Sol was exchangeable for 0.087 ETH.

Market share trends:

Solana is a prime example of the competitive risks facing Ethereum. Its strategy of providing a low-cost, layer-one blockchain—partially trading decentralization for convenience and efficiency—has proven to be advantageous. In contrast, within the Ethereum ecosystem, investors typically need to bridge or migrate their tokens to a layer-two system to achieve similar high performance and low fees as Solana's layer-one environment.

Solana is a prime example of the competitive risks facing Ethereum. Its strategy of providing a low-cost, layer-one blockchain—partially trading decentralization for convenience and efficiency—has proven to be advantageous. In contrast, within the Ethereum ecosystem, investors typically need to bridge or migrate their tokens to a layer-two system to achieve similar high performance and low fees as Solana's layer-one environment.

This highlights a potential pain point for Ethereum developers when faced with the blockchain trilemma: the higher the performance of the chain, the more transactions it can process, and therefore the more value it can directly capture.

However, higher performance requirements for blockchain often also mean greater centralization and weaker security guarantees.

The "Blockchain Trilemma" was coined by Ethereum founder Vitalik Buterin in 2017. This view posits that decentralized databases/distributed ledgers like Ethereum can only fully meet two of the three key requirements of decentralization, security, and scalability, and struggle to achieve optimal performance across all three simultaneously. Ethereum chooses to maintain higher decentralization, while Solana pursues maximum performance. Ethereum maintains decentralization by offloading transaction execution to Layer 2 platforms, but this sacrifices some of the direct value capture of Layer 1. In contrast, Solana's native high performance enables it to process millions of transactions daily, which more directly captures value for Solana holders.

Whether investors, developers, and users will embrace Ethereum's "decentralization-first" approach remains to be seen. However, in the short term, Solana has made substantial gains in market share by adopting a more centralized approach. Bitcoin, on the other hand, has succeeded on extreme decentralization and simplicity, rather than performance. This demonstrates that there is no single correct path: Bitcoin and Solana have achieved growth through completely different strategies (and use cases). Furthermore, there may be room for multiple public chains with varying degrees of decentralization to coexist. For investors, the key question is: which two of the "trilemma" will the market prioritize?

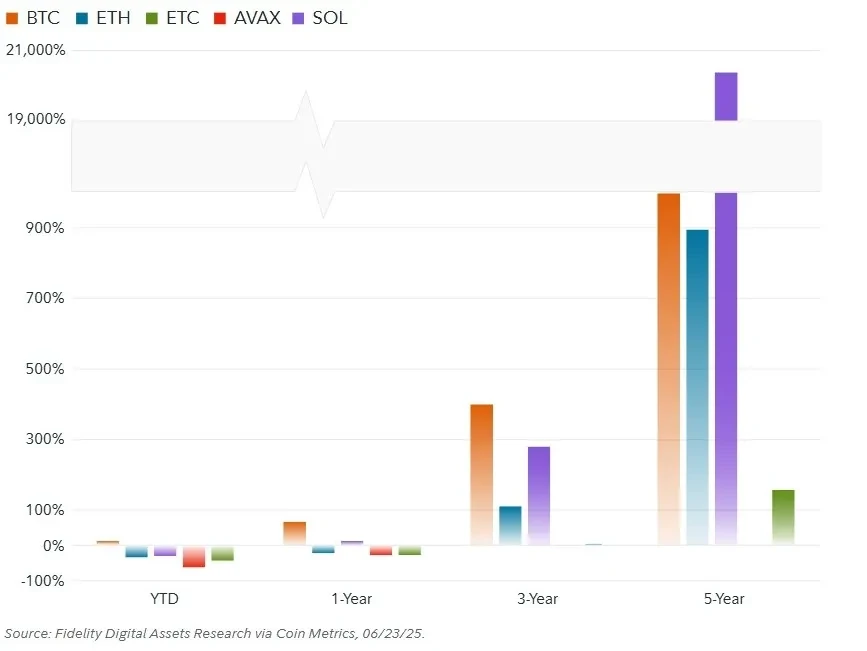

2. Price performance

BTC and SOL outperformed ETH across all periods, demonstrating the unprecedented intensity of competition facing Ethereum. While Ether has demonstrated solid performance over the longer term, investors should carefully assess the risks posed by competition to Ethereum's future prospects. Recent price performance may be due to Ether's period of "overextension" in 2021, requiring a repricing relative to its competitors; it may also reflect a shift in overall market sentiment.

Notably, Ethereum Classic (ETC), an early hard fork of Ethereum, has consistently underperformed Ether (ETH) throughout its lifecycle. This can be seen as a sign that developer activity and community support play a significant role in the valuation of smart contract platforms. Despite their similar early histories, Ethereum, through its ongoing development, has better served market demand.

Notably, Ethereum Classic (ETC), an early hard fork of Ethereum, has consistently underperformed Ether (ETH) throughout its lifecycle. This can be seen as a sign that developer activity and community support play a significant role in the valuation of smart contract platforms. Despite their similar early histories, Ethereum, through its ongoing development, has better served market demand.

Fundamentals of each token (average value in 2025):

Looking at fundamentals in 2025, while Solana holds a clear performance advantage, the value locked in smart contracts (TVL) or in stablecoins remains primarily concentrated on Ethereum, demonstrating the power of network effects. Furthermore, when compared to Solana, Ethereum's "users/transactions" ratio shows that Solana's average per-user transaction frequency is significantly higher than Ethereum's.

Looking at fundamentals in 2025, while Solana holds a clear performance advantage, the value locked in smart contracts (TVL) or in stablecoins remains primarily concentrated on Ethereum, demonstrating the power of network effects. Furthermore, when compared to Solana, Ethereum's "users/transactions" ratio shows that Solana's average per-user transaction frequency is significantly higher than Ethereum's.

Financial Valuation (2025):

Due to its aggressive scaling push, Ethereum has recently fallen behind Solana in terms of total transaction fees and token holder revenue. While this continues to drive strong user demand into the Ethereum ecosystem, actual usage hasn't yet fully matched the scaling success. It's important to note that each public chain has different issuance and fee mechanisms, which impact where value is captured and how it's distributed within the network.

Due to its aggressive scaling push, Ethereum has recently fallen behind Solana in terms of total transaction fees and token holder revenue. While this continues to drive strong user demand into the Ethereum ecosystem, actual usage hasn't yet fully matched the scaling success. It's important to note that each public chain has different issuance and fee mechanisms, which impact where value is captured and how it's distributed within the network.

In Bitcoin, for example, all transaction fees go to miners; at the same time, new issuance dilutes Bitcoin holders at a corresponding rate. For other networks that burn a portion of their fees, the "fees minus issuance" metric can be used to measure the dilution offset by transaction fees.

Importantly, Proof-of-Work (PoW) network security is a continuously competitive market, typically requiring miners to sell a significant portion of their issuance to cover costs. In contrast, Proof-of-Stake (PoS) networks typically do not require the same level of ongoing costs to maintain security. Therefore, the negative impact of inflation on prices in PoS systems is generally not as significant as in PoW.

3. Scenario Analysis

(1) Optimistic scenario

Smart contract platforms are reshaping many areas of society by enhancing global collaboration and trust. Ethereum maintains its leading position as a smart contract platform through continuous technological innovation. Numerous users and businesses favor Ethereum for its decentralization, security, transparency, and reliability, all without sacrificing user experience. On Layer 2 networks, transaction frequency is high enough to keep transaction costs low; this cumulative effect generates significant value return/income for ETH holders.

(2) Baseline scenario

Smart contract platforms have improved specific sectors of the financial and non-financial markets, acting as a counterweight to the traditional system (primarily dominated by governments and large corporations). A large number of users and businesses benefit from decentralized smart contract networks. However, due to Ethereum's inherent financial nature, its growth has lagged behind the typical technology adoption curve. While Ethereum is still growing and ultimately capturing a certain share of its addressable market (TAM), its integration into all aspects of society is slower than technologies such as mobile phones or the internet. Ethereum remains the dominant smart contract platform, offering reasonable value capture prospects for investors. However, specialized competitors have limited Ethereum's market share, forcing it to focus more on use cases requiring the highest security and trust.

(3) Pessimistic scenario

Smart contract platforms have experienced periodic fluctuations but have failed to produce widely-demanded products. Centralized systems continue to iterate faster and provide greater user utility than distributed systems. Most digital interactions do not prioritize decentralization, censorship resistance, or transparency. Ethereum's slow and unstable network growth has made it difficult to attract a critical mass of users, hindering value capture for ETH holders. Furthermore, in the few use cases that do merit smart contract platforms, competitors could erode Ethereum's market share with superior user experiences.

IX. Risks and Uncertainties

Like other digital assets, Ether (ETH) faces risks associated with its investment properties, the most commonly cited of which is its high volatility. ETH, like other digital assets, often experiences significant periodic drawdowns, so investors should pay particular attention to the appropriateness of their investment horizon and position/weighting when making allocations.

Furthermore, compared to traditional financial markets, digital assets operate in a less regulated environment, meaning investments may lack investor protection and transparency. These risks can manifest as fraud or market manipulation; should they occur, investors often lack adequate legal remedies. For example, there is often no deposit insurance or ongoing oversight of exchanges, leaving investors more exposed.

Regulators, including the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission), are increasingly focusing on the digital asset market to address these issues. However, the regulatory landscape is still evolving, which presents both risks and opportunities. Investors should continue to monitor regulatory developments and fully assess potential risks when trading and investing in various digital assets.

The remainder of this section will focus on risks that are unique/inherent to Ether (ETH) and may not apply to other digital assets.

1. Competition Risk

Ethereum faces competition from multiple blockchains. This risk can arise from both existing public chains and newly emerging ones, as demonstrated by the rise of Solana in 2020. As blockchain technology gradually moves toward mainstream adoption, competition will intensify, raising the risk of marginalization or elimination.

2. Technical risks

The Ethereum community typically attempts to implement protocol upgrades on an annual basis. These upgrades bundle multiple EIPs and implement them all at once. Each upgrade modifies the code that Ethereum runs on, introducing new technical risks that investors should be aware of. Because many investors cannot independently verify the correctness of these changes, these risks persist for a period of time and gradually decrease over time—consistent with the experience of the Lindy Effect (i.e., the longer a technology or institution survives, the longer its expected remaining lifespan).

3. Regulatory risks

Ethereum passed a key regulatory threshold in 2024 with the approval of an Ether spot exchange-traded product (ETP). This approval demonstrates that Ether (ETH) as an asset meets relevant regulatory standards to a certain extent; however, it should be emphasized that future regulatory enforcement may still have a significant impact on the development of the Ethereum ecosystem. It should be noted that the Ethereum application ecosystem as a whole still faces room for further regulatory clarification, and banks and other financial institutions that provide fiat currency access to the ecosystem also need to clarify applicable rules and compliance boundaries.

4. Governance Risks

Ethereum governance has the most direct impact on the network by deciding which parts need to change. Its community-driven governance process presents two commonly cited challenges.

First, any change to Ethereum typically affects different stakeholders in multiple ways, making consensus difficult, or sometimes impossible, on certain topics. This structure has led, and is likely to continue to lead, to a slower pace of development on Ethereum compared to other networks with top-down governance structures that allow for faster progress.

Secondly, one of the risks associated with Ethereum governance is known as "soft impact." This type of risk is difficult to quantify and difficult for investors to accurately assess. It refers to the gradual shift in community values over time, potentially favoring some stakeholders while detrimental to others. These soft impacts typically manifest gradually over an extended period of time and are inherent to any human-centered governance structure.

We should also be aware of potential "key figure risk." Ethereum co-founder Vitalik Buterin remains actively involved in network research and is viewed by many as a key opinion leader. This potentially gives him an outsized influence on the community's direction and consensus.

Investors must understand that people determine the direction of the network and continually make decisions that influence its course. While it's generally accepted that community-led governance is more likely to deliver the best possible outcomes for the majority, it's unlikely that all stakeholders will benefit equally and receive equal priority.