BTC is poised for further decline! Six major macroeconomic obstacles loom large.

- 核心观点:宏观因素引发风险资产抛售潮。

- 关键要素:

- 经济增长恐慌致市场重定价。

- 美元走强推高全球融资成本。

- 美联储鹰派转向抑制降息预期。

- 市场影响:高风险资产承压,资金转向防御。

- 时效性标注:短期影响

Original title: 6 reasons why risk assets are selling off

Original author: Tomas ( @TomasOnMarkets )

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Asher ( @Asher_0210 )

Over the past few weeks, risk assets have fallen almost in unison, with the S&P 500 down 5%, the Nasdaq down 8%, and Bitcoin also correcting by about 30%. The market is filled with various concerns: Has the bubble burst? Is a new bear market forming? Is a larger-scale crash imminent?

So what exactly happened? The following will analyze six reasons for the recent sell-off of Bitcoin from a macro perspective.

I. Economic Growth Panic

The so-called growth scare is not actually a significant economic slowdown or an impending recession, but rather a sudden investor concern that economic growth will decline faster than expected, causing a rapid escalation of "fear of weakening growth." This sentiment is often amplified when some leading indicators show signs of weakening, leading the market to repric and triggering price adjustments in risk assets such as Bitcoin.

Currently, several growth-related indicators in the United States have shown signs of turning downwards. Looking at the trends over the past four months, whether it is the "U.S. Potential Growth Rate" which measures real-time growth, the "Citi Economic Surprise Index (CESI)" which reflects whether economic data is higher than expected, or the "1-year U.S. Inflation Swap" which reflects market expectations for inflation over the next year, all have started to decline since the beginning of September, especially accelerating significantly in November. This trend is highly similar to the characteristics of previous rounds of growth panics (such as early 2025 and summer 2024).

Historically, growth panics are quite common, occurring roughly once or twice a year. When economic indicators capture changes in economic growth and market participants begin to reallocate assets, a short-term decline in risk appetite often triggers a "regular" correction. Typically, during a typical growth panic, the S&P 500 corrects by about 5% to 10%, and the Nasdaq usually falls by 5% to 15%, which closely matches the current market performance.

Of course, the fear of growth could escalate into a more prolonged and severe economic slowdown or even a recession. However, given the current economic environment, this situation is more likely a "normal fluctuation" than a harbinger of a recession. Although the market has been adjusting in the short term due to sentiment, it has not shown signs of a systemic downturn.

II. The US dollar strengthens

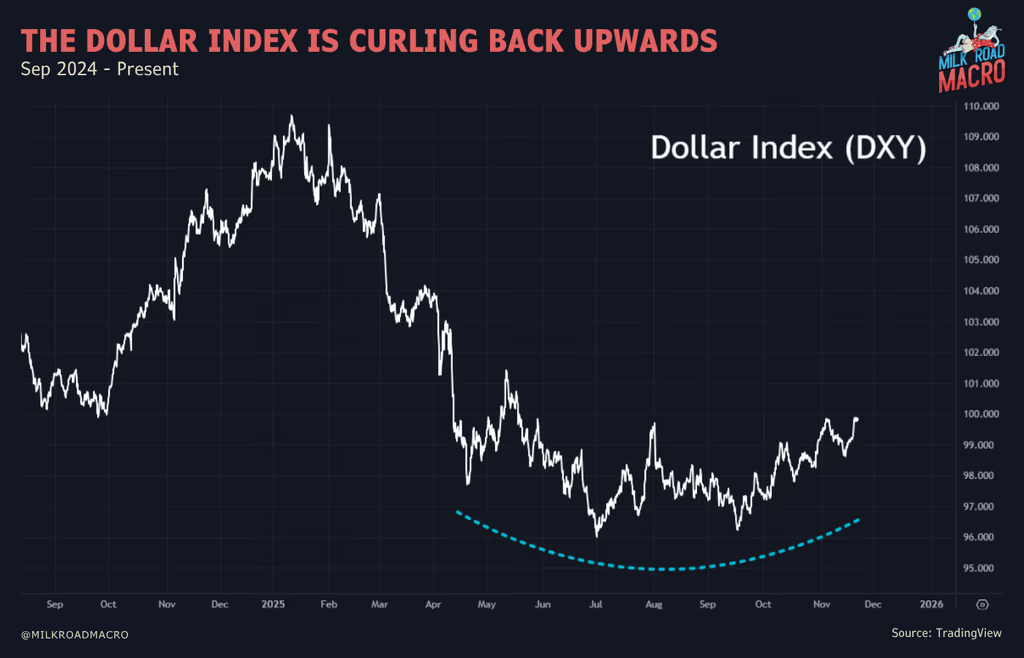

The US dollar index (DXY) has shown a clear strengthening trend in recent weeks, a move that is hardly a good sign for risk assets. The dollar's weakening in the first half of 2025 provided a strong boost to global risk assets; however, since mid-September, the dollar has strengthened again, subtly altering market sentiment.

As the world's reserve currency, the strength or weakness of the US dollar has a direct impact on the global economy. Currently, over 70% of global trade is denominated in US dollars, and over 70% of global debt is pegged to the dollar. When the dollar continues to strengthen, it's equivalent to a simultaneous increase in global financing costs, forcing the real economy into a period of austerity, and overall liquidity becomes tight. Historical experience shows that a stronger dollar often precedes adjustments in risk assets, making it a leading indicator—the stronger the dollar, the less likely risk assets are to maintain a sustained upward trend.

Comparing the three-month changes in the US dollar index with the three-month performance of the S&P 500 reveals that a rise in the dollar often corresponds to a correction in US stocks. The same pattern appears with Bitcoin, where the three-month changes in the dollar and Bitcoin's price movement are almost mirror images (the chart below shows the dollar index inverted and moved three months ahead). This means that upward pressure on the dollar is typically reflected in risk asset prices over the following weeks to months.

At this stage, what market bulls most want to see is a renewed weakening of the US dollar index. As long as the dollar continues to rise, the market will remain under pressure – which may also be one of the driving forces behind the recent simultaneous weakening of BTC and US stocks.

III. The Federal Reserve's stance is becoming more hawkish.

The Federal Reserve's stance has shifted significantly towards hawkishness in recent weeks. According to CME FedWatch data, the market's probability of a December rate cut has plummeted from over 95% to 33% (it surged again to over 70% yesterday, currently standing at 67.3%). Previously, the market almost unanimously expected a December rate cut, but at the latest FOMC meeting at the end of October, Chairman Powell explicitly stated that a December rate cut was "not a certainty," marking a turning point in policy expectations and causing market confidence in a rate cut to decline rapidly.

Despite the Federal Reserve's expected more hawkish policy stance in December, the market remains convinced that the central bank is still in an "easing cycle," a fact supported by market expectations regarding the "final interest rate." The final interest rate is the level at which the market anticipates the Fed will eventually lower interest rates during this easing cycle.

Currently, the market expects the terminal interest rate to remain at around 3%, while the current federal funds rate is 4%. This means that the market still expects about four more rate cuts of 25 basis points each in the future. Therefore, the market remains confident in the overall policy direction of the Federal Reserve, only that the pace has been adjusted in the short term.

IV. Concerns about an AI bubble

Concerns about a so-called "AI bubble" continue to rise in the market, with investors increasingly worried about excessive speculation and overvaluation risks in AI-related stocks. According to Bank of America's latest global fund manager survey, approximately 45% of the surveyed fund managers believe that an "AI bubble" is the biggest tail risk at present, while in another survey, more than half of the fund managers believe that AI stocks already show signs of a bubble.

This concern about a "bubble" has driven recent market rotation of funds away from AI and AI-related sectors. Investors have been withdrawing from overvalued AI stocks and shifting to more stable or defensive assets, leading to a certain degree of pullback in AI-themed stocks and some major market indices. This adjustment not only affects the stock market but also indirectly impacts technology-related crypto assets and high-beta risk assets.

However, the market may be poised for a turnaround. Nvidia, a leading AI company, recently released earnings that not only significantly exceeded expectations but also raised its future growth forecasts. Nvidia not only has a large market capitalization in the S&P 500 and Nasdaq but can also be seen as a bellwether for the AI hype. The earnings report shows that "computing demand continues to accelerate and grow exponentially in training and inference, and AI is rapidly expanding across various fields." This strong performance is expected to support a return to AI trading, alleviating short-term panic and potentially boosting market bulls. The rotation of funds in the AI sector may also see a halt and recovery.

V. Withdrawing investment from speculative assets

Recently, the financial markets have not only seen a rotation of funds towards AI stocks, but also a greater outflow of funds from speculative assets, with investors turning to relatively stable, low-volatility defensive assets. While the declines in major indices such as the S&P 500 and Nasdaq have been relatively mild, losses in other high-risk sectors have been quite significant, with many speculative stocks often falling by more than 20%, and the declines resembling a tidal wave.

This rotation of funds also impacted the Bitcoin and crypto markets. Since crypto assets are generally viewed as "high-beta risk assets," they often face greater pressure during downturns. In other words, when market risk appetite declines, high-risk assets are usually the first to be affected, and their corrections are more severe.

The current intensity of capital rotation in the market is very similar to that during the sharp correction from February to April this year—this indicates that the current market adjustment is not only a short-term reaction to a certain sector, but also reflects a systematic reallocation of funds between high-risk and defensive assets.

VI. Systemic Deleveraging Strategy

Systematic strategies refer to quantitative funds that automatically buy and sell stocks according to predetermined rules (usually related to trends and volatility). These strategies typically manage very large sums of money. Between May and September of this year, due to low market volatility and clear trends, systematic strategies bought heavily into stocks, accumulating positions worth hundreds of billions of dollars. However, these strategies have recently completely "turned to selling," which could exacerbate downward pressure on the stock market. In that case, BTC, considered a "high-beta risk asset," would face even greater pressure and a more significant decline.

Such deleveraging can sometimes create a "cascading effect," where systematic selling triggers more systematic selling. A similar situation occurred earlier this year, from late March to early April, and this chain reaction could lead to a rapid market correction or even amplify volatility.

Therefore, the market urgently needs a strong catalyst to stop the spread of systemic selling. Perhaps Nvidia's strong Q3 earnings report could act as this catalyst, providing support for the stock and crypto markets and alleviating short-term market panic.