A Conversation with Pantera: The Logic Behind Spending $1.25 Billion on Solana Tokens

- 核心观点:数字资产金库公司是新兴金融结构。

- 关键要素:

- Pantera拟募12.5亿投Solana公司。

- ETH/SOL因质押收益更适合DAT模式。

- 赛道将整合,每链剩2-3家赢家。

- 市场影响:加速传统资本进入加密市场。

- 时效性标注:中期影响。

Original author: Peggy

Since 2024, Digital Asset Treasuries (DATs) have gradually become popular in the crypto market, and more and more companies have joined the "crypto treasury" game.

On August 26th, the market was rocked again. According to The Information, Pantera, a cryptocurrency fund, is planning to raise up to $1.25 billion to transform a publicly traded company into a Solana investment firm. Meanwhile, Galaxy Digital, Multicoin Capital, and Jump Crypto are also in talks for a $1 billion acquisition of Solana.

Notably, Pantera not only participates deeply in the capital market but also directly participates in corporate governance by appointing its partner, Marco Santori, to the board of directors. This move signals that the crypto fund is stepping out from behind the scenes and beginning to personally shape the future strategic direction of DAT companies.

This “treasury race” around Solana may become the largest centralized allocation of funds dedicated to the digital token to date.

Pantera partner Cosmo Jiang believes the rise of crypto treasury companies isn't hype, but the birth of a new financial organizational structure. Before joining Pantera, he worked in traditional investing on Wall Street, from mergers and acquisitions at Evercore to private equity at Apollo and long-short hedge funds at Hitchwood. He has long led fundamental research in the retail and internet industries, covering companies like Walmart, Costco, Facebook, Google, and Spotify.

“You have to admit that even the companies that seem the craziest to us are creating real business value. And that’s something that deserves serious study.”

Pantera General Partner Cosmo Jiang | Source: Pantera Capital official website

During the two-hour interview, Cosmo systematically reviewed the underlying logic of the DAT model, investment screening criteria, exit paths, and the evolving industry landscape. He believes that the current period remains a "window of opportunity" for DATs, but time is running out for new players.

"You witnessed the birth of a new industry. And an industry will never be born twice."

This interview was conducted by BlockBeats in mid-June. Here is the conversation:

TL;DR

- Why would someone choose to hold a digital asset vault company instead of buying spot assets directly? The only reason is: you believe that this "half Bitcoin" will be worth more than a whole Bitcoin in the future. As long as the market occasionally overvalues certain assets and there is sufficient volatility, you can activate the ATM (at-market-price issuance) mechanism and the convertible bond (Convertible Debt) engine.

- The DAT sector is essentially a "quasi-commodity business" and will eventually form an oligopoly. This is because the competition in this industry is about cost efficiency—who can produce at the lowest cost?

- Compared to Bitcoin, assets like Ethereum and Solana are actually more suitable for the DAT model. The reason is simple: BTC itself doesn't generate returns, so DAT companies rely on structure to maximize exposure. However, smart contract assets like ETH and SOL can be staked and integrated into DeFi, possessing inherent profitability.

- This sector will undoubtedly undergo consolidation over the next three to five years, especially among major assets like Bitcoin, Ethereum, and Solana. Ultimately, only two or three DAT companies will truly emerge on each chain.

- We're still in a window of opportunity, but it will become increasingly difficult for new entrants. There's still a three-to-six-month "new product launch period," but if we extend that to one or two years, or even two or three years, the number of new entrants will decrease.

From Wall Street to cryptocurrency, why do fundamentalists favor treasury companies?

BlockBeats: You didn’t come from a crypto background initially. Could you please tell us how you got into this industry?

Cosmo Jiang: I began my career in traditional finance. I graduated from Harvard with a degree in mathematics and then followed a typical New York finance path. I first worked in Evercore's M&A team, then spent a few years in private equity at Apollo, and then joined Hitchwood Capital, a multi-billion dollar long-short hedge fund. During that time, I covered companies like Walmart, Costco, Facebook, and Google.

Cryptocurrency wasn't my initial focus. It wasn't until 2020 and 2021 that I noticed all these companies starting to talk about crypto, from Facebook to Spotify, Universal Music, Nike, and LVMH. As an analyst, if I wanted to be the lead analyst for these companies, I had to quickly learn about crypto.

I started out just to keep up with research needs, but ended up discovering that real business models were being built in this field.

I realize that in the future there will be a group of companies that will never go public, and their incentives will rely entirely on tokens: the incentives of the team, employees, holders, and users will all be integrated. This kind of innovation makes me very excited.

I originally planned to start my own fund, continuing the traditional stock style. However, in New York, there are many such funds, but there are very few people who truly understand financial modeling and crypto.

So I founded Nova River, and soon after several large funds including Pantera also found me.

I ultimately joined Pantera because of their strong VC experience and platform capabilities. I incorporated my own capital and began overseeing investments related to Liquid Markets.

Today, I am a general partner at Pantera, responsible for overseeing the firm's investment strategy while continuing to lead our investments in the public markets, particularly hybrid opportunities between secondary markets and private placements—like the Digital Asset Treasuries (DATs) we're talking about today.

BlockBeats: Why did you set up a new fund instead of using the existing Liquid Fund to cover such investment opportunities?

Cosmo Jiang: When we first started developing this strategy, it was essentially a non-consensus bet. We received many pitches for similar projects, but we didn't fully understand their significance until we met Defi Dev Corp (DFDV), a team attempting to replicate Solana's MicroStrategy in the US.

Their vision was clear: the team was based in the US, with direct access to the US capital market; the primary treasury position was Solana, and we were extremely optimistic about Solana's prospects. This combination seemed very attractive at the time.

So we chose to invest in DFDV. It was a very cutting-edge project, with few other institutions entering the market. We were one of the earliest and few investors willing to make a significant bet. Although it seemed unpopular at the time, we were willing to shoulder the uncertainty and be the first to take the plunge. We invested alongside several other investors, but we were the lead investor and the primary investor.

We even thought at the time that this might be the only one, and that this might be the only digital asset vault company in the United States.

BlockBeats: And then you met the second one soon after?

Cosmo Jiang: Yes, far more than that. We eventually received about 90 pitches and invested in multiple projects. So back to your question: I had no idea this track would grow so quickly and so massively.

Initially, we used venture capital funds and liquid token funds to invest in these projects, which served as a certain anchor. However, as the sector exploded, the concentration limits of the original funds began to emerge. We had already invested a lot of money, but there were still many outstanding entrepreneurs worth supporting.

Therefore, establishing a dedicated vehicle became necessary. This would allow us to obtain more dry powder and no longer be constrained by allocation ratios. Our existing foundation continued to participate in some projects, but its allocation was generally close to the upper limit.

That's why we've launched this dedicated fund to address what we believe is a truly emerging category of companies. As investors, opportunities like this come along very rarely in our careers, and we feel fortunate to be a part of it.

DAT's "special fund" is the original venture capital of listed companies.

Background: In July 2025, Pantera, a long-established crypto investment firm, established the DAT Fund (Digital Asset Treasuries Fund), focusing on investing in publicly listed companies that use crypto assets as strategic reserves. The fund's core strategy is to increase its crypto holdings through equity premium financing, thereby increasing the number of coins per share. Pantera sees this model as a new narrative for "gaining crypto exposure through the public market," aiming to bridge the gap between traditional finance and crypto assets.

Since its inception, the DAT Fund has rapidly deployed capital, investing in multiple projects, including Solana's DFDV and Ethereum's Bitmine, and frequently acting as an investor in Anchor. As market enthusiasm soars, Pantera has also launched fundraising for its second DAT Fund, further increasing its investment in this emerging sector.

BlockBeats: In your DAT Fund memorandum, you called this a "timely investment opportunity." Will this affect the DAT Fund's cycle and exit plan?

Cosmo Jiang: Yes, I think this type of investment is a form between "venture capital" and "liquid assets".

All of our funds are designed with a long-term investment objective in mind—we are long-term believers in this industry and participate from the perspective of long-term investors, not short-term traders. For example, our venture capital fund is a closed-end fund with a 10-year lifecycle and an 8-year lock-up period. It's truly designed to support the growth cycle of early-stage projects, requiring a long holding period.

On the other hand, we also have a product that focuses on liquidity—our Liquid Token Hedge Fund. While it provides quarterly liquidity, we certainly hope that investors will take a multi-year perspective with us so they can truly benefit from our research and investment process. However, we also provide a certain level of liquidity.

The DAT (Digital Asset Treasury) fund sits squarely between these two approaches. Because we're helping these companies launch from scratch, we impose certain lock-up periods and liquidity restrictions. At the same time, we believe the success of these projects can be determined relatively quickly. Therefore, the holding period for this fund is shorter than that of traditional venture capital funds.

Furthermore, since we invest in publicly traded companies, we also hope that investors will hold on to what we believe to be long-term winners. Therefore, we will also adopt an in-kind distribution approach for exits. This means that we will directly distribute these shares to investors, allowing them to choose whether to continue holding, rather than requiring them to sell. This approach allows us to execute our long-term investment strategy while also providing investors with greater freedom.

BlockBeats: The emergence of the DAT (Digital Asset Treasury) trend has truly exceeded everyone's expectations, and some are beginning to believe this may be a "toppish signal." Do you think it's still a good time to invest?

Cosmo Jiang: The core of my daily work is closely tracking the public markets. As someone who has been investing for 15 years, I'm no longer obsessed with fixed beliefs. I now firmly believe that when reality changes, our perceptions should also change, and our actions should adjust accordingly.

Going back to your question, I do think that because these investments are liquid, we evaluate them every day.

While my initial investment intention is to hold these assets for the long term, the reality is that sometimes management teams fail to execute as expected, and sometimes industry consolidation occurs faster than expected. When this happens, we react promptly and make decisions that are best for our LPs. Ultimately, our core goal is to provide LPs with the best risk-adjusted returns.

So regarding the market cycle, I do believe there is a 3 to 6 month window of opportunity for new projects worth participating in. However, if this judgment changes, we will face it honestly and adjust our strategy quickly.

Of course, I also believe that eventually, two or three winners will emerge from each mainstream token, and we will hold these winners for the long term. But the general principle is: as facts change, we will also adjust to respond to market changes.

BlockBeats: How much more has the overall cost of investing in these companies increased now compared to before?

Cosmo Jiang: Overall, the valuation multiples of these DAT (Debt Asset Tokenization) projects generally range from 1.5x to 8x. Therefore, the current premium is still quite high. It's important to note that many projects have very low initial circulation, so valuations may be high during initial trading. However, once shares are unlocked and circulated, there is usually a certain correction.

Some projects currently trade at high premiums, but they face liquidity constraints. Therefore, we may see valuation corrections for these projects in the future. However, even after full circulation, many projects will still trade between 1.5 and 8 times their initial public offering price, which is still a fairly healthy premium overall.

BlockBeats: What is the average amount Pantera invests in these projects?

Cosmo Jiang: The range actually varies quite a bit, but our check sizes generally range from $5 million to $29 million, which is our typical investment range. Of course, we've invested in some larger projects, several times larger than this, but we've never made an investment smaller than this. So if we're going to participate in a project, it has to meet this standard at least.

BlockBeats: So investing in these DAT projects isn't necessarily cheaper than investing in early-stage crypto projects, like seed or Series A rounds?

Cosmo Jiang: I think the two are just different types of investments, and their risk-return structures are also very different. For example, when you invest in an early-stage startup, you are essentially buying a small portion of its equity at a certain valuation that you estimate.

In these (DAT) companies, what you buy is more like "Bitcoin in a box." That is, if you spend $1, you can get a share of Bitcoin worth $1. The total amount of this investment is actually not that important, because you get back the corresponding assets at an almost 1:1 ratio, which is a form of "asset share mapping."

BlockBeats: So in the past month (June), how many DAT projects did Pantera review? And how much did it invest in?

Cosmo Jiang: We have looked at nearly 100 projects in the past three months. It has been very intensive since this trend started.

BlockBeats: Can you explain in a little more detail how the investment process of these DAT companies works?

Cosmo Jiang: Well, I think the process is actually very diverse. We will try to intervene as early as possible at the appropriate time.

Sometimes we proactively reach out to foundations or major shareholders to understand their plans and why this approach might be helpful. Often, because of our strong reputation in this field, foundations will proactively seek our advice, as will major sponsors who aren't affiliated with foundations. Typically, this process involves them approaching us directly, or they may first approach an investment bank to set up the deal, and then the bank will approach us.

It could be either way. We try to get involved early and offer as much help as we can, knowing we've seen more deals of this nature than any other team in the market. We take this responsibility very seriously and hope that our involvement will help them understand and build what we believe is the best product.

BlockBeats: So you would say that in these projects, crypto VC is not the main source of funding, but more family offices or traditional funds?

Cosmo Jiang: The participant structure is now very diverse. Initially, it was primarily crypto insiders, as the projects were relatively new. But now, many projects are large-scale, and crypto-native funds don't have as much capital reserves. As a result, we're seeing more and more traditional funds, even some well-known large blue-chip funds, joining in. While we can't disclose their names, they are indeed making these trades. Many hedge funds are also entering the market.

BlockBeats: What is the barrier to entry for projects like BitMine or SharpLink Gaming? If a Crypto VC only has a fund of a few million dollars, is it still possible to participate?

Cosmo Jiang: It depends on the project structure, but we're very focused on the quality of the investor base. If a project is raising $500 million, we're very concerned that the funds come from long-term investors, not just a bunch of quick-money speculators. We're now more proactive, directly helping project owners screen funds, eliminating those we deem to be short-term speculators and retaining only those we deem to be truly long-term investors. This is what we're doing.

BlockBeats: Do you think small Crypto VCs still have a chance to participate in this track?

Cosmo Jiang: We do have some advantages, such as experience, reputation, and access to information. But there will always be deals, and there are still opportunities. Some projects do seek funding broadly, but those are generally lower quality—we generally don't participate. Truly high-quality projects, like BitMine, raised $20 million before going public. They were built by a small group of trusted funds. The higher the quality of the project, the more closed it is.

DAT, a testing ground for US stock finance

BlockBeats: You mentioned earlier that the "Digital Asset Treasury" (DAT) model wasn't universally accepted from the start. How did you determine whether it would work?

Cosmo Jiang: I think the key is to first understand the business model of a "digital asset vault company." Honestly, it took me some time to overcome my initial biases. It was only after MetaPlanet's success that I began to seriously research these companies. At that time, we also saw Sole Strategies in Canada beginning similar attempts, and we spent a lot of time trying to understand their underlying logic.

For me, this was quite challenging, as I come from a traditional fundamental value investing background. Imagine a company like MicroStrategy trading at 2 times its net asset value (NAV) for a long period of time. This was completely unacceptable to my investment philosophy. It went against everything I had done before, right?

BlockBeats: But you later changed your mind about it?

Cosmo Jiang: Yes, because as an investor, you must continue to challenge your own prejudices, especially when contrary evidence emerges in reality.

The reality is that MicroStrategy has been trading at a premium for almost the entire past five years. Even after the introduction of ETFs, its advantage hasn't been "ended"—and at the time, the mainstream market view was that once ETFs were launched, MicroStrategy's valuation premium would collapse.

Moreover, among its top shareholders are some long-term value investors whom I greatly respect, such as Capital Group (the largest mutual fund company in the United States) and Norges (Norway's sovereign wealth fund). These are all long-term investors who focus on fundamentals and are definitely not short-term speculators.

So I really forced myself to think about this from a different perspective, and finally I realized - wow, it turns out this is really a "sustainable" financial engine?

BlockBeats: Why?

Cosmo Jiang: From the perspective of first principles, there are actually two key points:

First, do you believe that the market can sometimes get overly excited and push the valuation of something above its intrinsic value? My answer is: yes, of course, it does happen.

Second, do you believe that the market is sometimes volatile? Because it is volatility that gives you the opportunity to sell convertible bonds for arbitrage. My answer is: Yes, it is obvious that the market is sometimes volatile.

So as long as the market sometimes overvalues certain assets and there is enough volatility, you can start the ATM (at-market issuance) mechanism and operate the convertible bond (Convertible Debt) engine.

From this perspective, the premium can actually be maintained in the long term.

BlockBeats: So in your opinion, what are the fundamentals of these "digital asset vault companies"?

Cosmo Jiang: I think the question is: Why would someone choose to hold a "digital asset treasury company" instead of buying spot directly?

Take MicroStrategy, for example. Its stock price often trades at twice its net asset value (2 x NAV). Sounds crazy, right? Why would you spend the same amount of money to buy "half a Bitcoin" instead of buying a full Bitcoin? The only reason is: you believe that this "half Bitcoin" will be worth more than a full Bitcoin in the future.

So how do they achieve this? The key lies in increasing the number of tokens per share. MicroStrategy raises funds through methods such as issuing shares at a premium and convertible bonds, and then uses this proceeds to increase its Bitcoin holdings. These instruments are essentially selling volatility, or selling call options on its own stock.

The company thus earns income that can be used to increase its holdings of Bitcoin, and it does so in an accretive manner.

Let’s take a simple example:

Suppose a company can increase the number of bitcoins per share by 50% per year for two consecutive years.

So if someone initially holds a half Bitcoin exposure, after two consecutive years of 50% growth, they will own about 1.1 Bitcoins. In this way, after a few years, their holdings will be more than if they had directly bought one Bitcoin.

From this perspective, buying into these companies is a reasonable choice. As long as you believe they have the ability to continuously increase the number of tokens per share through various means, investing in them is reasonable.

By 2024, MicroStrategy's Bitcoin per share had increased by nearly 75%. So far this year, it's also increased by over 25%. So in just a year and a half, their Bitcoin per share has more than doubled. So if you bought in 2023 or 2024, you'd have far better returns now than someone who bought a single Bitcoin directly back then.

Therefore, this model has been verified in practice.

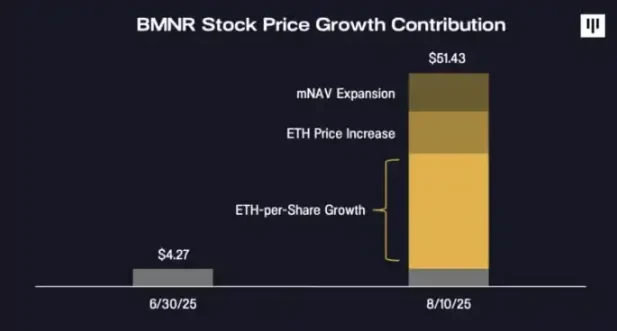

Three major drivers of BMNR's stock price increase | Source: Pantera official website

BlockBeats: So how do these companies do this? What tools do they use to continuously increase their Bitcoin exposure per share?

Cosmo Jiang: I think it can be viewed from two levels.

First, it is to increase awareness and user adoption.

Many people assume that the crypto industry's story is well-told, but that's not the case. I've spoken with friends at Tiger, Coatue, Viking, and Lone Pine, all of whom are now fund partners, but crypto isn't their daily focus. For them, it's still a new field.

Therefore, the first thing that companies like MicroStrategy or these digital asset treasury companies (DATs) need to do is to tell the story of crypto assets to the traditional financial world and penetrate the mainstream market that has not yet truly understood crypto.

This market is enormous. Currently, there are tens of millions of active crypto users, while the number of traditional finance users is likely 100 times that. This disparity in understanding presents an opportunity for DATs.

Therefore, "raising awareness" is a crucial strategy. Whether someone can truly tell this story clearly—both the underlying token story and the company story itself—is one of the key factors to success. This is the first point: raising awareness.

BlockBeats: What about the second level?

Cosmo Jiang: The second point is overall marketing capabilities among retail investors. I believe that in the early stages, it is not just about impressing retail investors in the crypto community, but also about winning over "main street retail investors" in the early stages. This is crucial to the long-term success of these companies.

To open up financial leverage tools, such as convertible bonds and preferred stocks, the prerequisite is that the company's market value must be increased first, generally reaching the level of US$1 to US$2 billion.

However, there won't be many institutional investors buying into the platform in the early stages. The real key is to be able to tell your story to a wider range of ordinary investors so that they are willing to come in. Therefore, "building trust and belief" is a key part of this, and of course, it also includes promoting institutional awareness.

The ultimate goal of all this is to enable you to obtain a "premium trading" in the market—thus liquidating your shares and achieving growth in a more valuable way. Once you reach a market capitalization of $1 billion to $2 billion, you can start issuing convertible bonds and preferred stock, which is when you truly open the "other door" to institutional capital.

Therefore, the above steps are based on your belief that they will be realized before the entire model can be established. Ultimately, it’s all about marketing.

BlockBeats: Once a company gains market trust, how can it further expand its asset exposure?

Cosmo Jiang: This brings us to the second stage: leveraging various financial tools to further increase your exposure per share of Bitcoin or other tokens. Specifically, this involves converting your early market knowledge into financing capabilities, such as through ATMs and convertible bond issuance, to continue raising funds, which can then be used to purchase more crypto assets.

BlockBeats: Does this also mean that different types of underlying assets have different support for this model?

Cosmo Jiang: Yes, we've recently observed an interesting phenomenon: compared to Bitcoin, assets like Ethereum and Solana are actually more suitable for the DAT model. The reason is simple: BTC itself doesn't generate returns, so DAT companies rely on structure to maximize exposure. However, smart contract assets like ETH and SOL can participate in staking and DeFi, and have inherent profitability.

In other words, even without financial engineering, they can still increase the token per share through on-chain income, interest rate products, etc.

BlockBeats: Is this why the market is willing to give these DAT companies a valuation premium?

Cosmo Jiang: You can understand it this way. When you think about why an asset commands a valuation premium, the core issue is whether it has a structure that can consistently generate returns. Data Access (DAT) companies are one such structure; they look more like financial services companies or banks.

At their core, banks are a pool of capital that generates returns through lending and other means. Data-as-a-service (DAT) companies are similar. They are a pool of capital used to generate returns. Therefore, as long as these returns are consistent and stable, they deserve a valuation above book value, just like banks.

Why Ethereum?

BlockBeats: Back to Bitmine, originally a Bitcoin mining company, which has now transitioned to an Ethereum treasury. This seems like a very smart market entry strategy. As you mentioned earlier about the importance of marketing, was this one of the main reasons why you and Tommy chose Bitmine as the Ethereum treasury?

Cosmo Jiang: I think there are many factors to consider when we're moving forward with these types of transactions. First, you're usually working with an existing management team, so choosing the right one is crucial. In a public company, team continuity is crucial.

Therefore, we believe it is crucial to find a team with a strong alignment of ideas. In particular, they must understand the importance of building a digital asset treasury company, a fact we place great importance on. Bitmine meets these requirements.

I think their openness to switching from Bitcoin to Ethereum is also key, and while not every company would do that, their flexibility is valuable to us.

So those were all important factors that we looked at. And we significantly accelerated that process by bringing in Tom Lee and his reputation. His influence has been a catalyst for the company's growth.

Tom Lee is being interviewed

BlockBeats: Defi Dev Corp is the first non-Bitcoin crypto treasury company in the United States. Why did Solana Treasury appear first, but now Ethereum Treasury is more successful?

Cosmo Jiang: I think this kind of thing only makes sense in retrospect. The reality is, the world is full of randomness, and often, it's just chance events that become catalysts for market fluctuations.

We initially backed Defi Dev Corp in part because it was the first well-prepared and clearly articulated fundraising proposal we saw at the time. Of course, it also helped that we're already a strong supporter and investor in Solana, having already invested there. We've always been bullish on Solana, but that doesn't mean we have any bias against Ethereum.

In fact, Ethereum itself has long been one of our key investment targets. It was just that the DFDV team came on board first, and they clearly stated their intention to focus on Solana, as Solana undoubtedly had greater market momentum and popularity at the time. That's why we supported DFDV first.

You're absolutely right—in April and May of this year, the Ethereum ecosystem was actually quite quiet and sluggish, so few people had the confidence to launch Ethereum-related projects at that time.

It wasn't until later on—and I really admire Joe Lubin and the ConsenSys team—that they were the ones who said, "Why can't we do this?" And I agreed: Why not them? That's why we worked together to help them finalize who would be the investment banker and who would be the advisor.

We were actually quite deeply involved throughout the entire process. We felt that since the Solana treasury already existed, it was time for an Ethereum treasury as well. It wasn't a question of favoritism on our part; it was simply that the market clearly favored Ethereum. This is because Ethereum is significantly more well-known than Solana among mainstream users and traditional financial institutions.

Coupled with the news of Circle's IPO, I believe it significantly accelerated the entire process. This is because, in most people's minds, the correlation between Ethereum and stablecoins is far stronger than Solana. Circle's success in the public market was also seen as a clear signal, which is the real reason why the Ethereum treasury craze started faster and more intensely than Solana's.

And then the outbreak came naturally.

BlockBeats: But you also mentioned in a previous interview that institutions and LPs are actually more interested in Solana than Ethereum.

Cosmo Jiang: I think so. The market itself is very dynamic, and the recent "stablecoin moment" has indeed quickly shifted the discussion about the "top ten assets." So, indeed, a year or two ago, the most common questions we received from institutional investors were about Solana.

But if we look at the situation today, the reality is that even in the stock market, most participants are individuals, not institutions. And the majority of wealth is also in the hands of individuals.

Ethereum is undoubtedly much more well-known among the mainstream public than Solana, so I think that's why we're seeing Ethereum treasury companies having more success in the public markets right now.

From a broader perspective, this is a crucial time for the US stock market's exposure to crypto assets. Consequently, companies with any exposure to crypto assets have performed very well recently. And these "digital asset treasury companies" are just one component of this landscape.

Look at the surge in share prices for companies like Coinbase and Robinhood this year, largely due to their exposure to crypto assets. If you look at Circle's IPO, Etoro's IPO, and even the success of many other IPOs this year, they were essentially due to their exposure to crypto-related assets.

I think the real big catalyst was Coinbase being included in the S&P 500 index.

I think many people don't really realize how significant this is—its impact is vastly underestimated. The S&P 500 is the benchmark for all fund managers globally, and before Coinbase joined, it had absolutely no crypto-related components. But after its inclusion, everyone working in finance globally had to factor crypto into their portfolios for the first time in their careers.

This means that almost everyone, including professional investors, must start considering whether they are overweight, underweight, or equal weighted in crypto assets. This question was truly "legitimized" by Coinbase's inclusion in the S&P 500 in April of this year.

This is a key driving factor why everyone has suddenly started paying attention to this track recently.

A short window of opportunity

BlockBeats: We noticed that your first investment was BitMine. Pantera had previously invested in SharpLink, another Ethereum vault company, and the two appear to be direct competitors. Why did you invest in BitMine again? What was the rationale behind this?

Cosmo Jiang: We do believe there's competition between the two companies. Ultimately, this is one of the reasons we're bullish on this sector. My prediction is that this sector will undergo consolidation over the next three to five years. This is especially true for large assets like Bitcoin, Ethereum, and Solana. Ultimately, only two or three DATs will truly succeed.

BlockBeats: Why?

Cosmo Jiang: This sector is essentially a quasi-commodity business. Its biggest moat is capital, but capital isn't actually a moat. The typical development trend of this type of industry is that, in quasi-commodity industries, they don't typically form monopolies, but rather oligopolies. This is because the competition in these industries is about cost efficiency—who can produce at the lowest cost?

So I think there will be a process of integration in the future, and in the end there will only be two or three real winners left.

BlockBeats: So in your opinion, now is not the time for winner to take all?

Cosmo Jiang: Far from it. We are now at the starting point of this "big bang", the early stage of the birth of a new type of company.

It's still completely uncertain who will ultimately emerge victorious. There are so many excellent and interesting teams and talented individuals pursuing this direction, each with their own distinct paths. So, at this early stage, we're betting early on teams we believe have high quality and potential, and that they could become one of the "two or three" companies of the future.

BlockBeats: What about the survival rate? For example, out of ten DAT companies, how many survived?

Cosmo Jiang: I think the ones that will ultimately survive are most likely those with large market capitalizations. Let's get back to the core issue: if a company wants to succeed in the DAT (digital asset treasury) space, the key is scale.

You need to achieve at least a billion, or even $2 billion, in market capitalization to truly achieve basic sustainability. Furthermore, once you reach this scale, you must continue to generate market attention and excitement. Only then will your "flywheel effect" continue.

But the reality is that the number of tokens capable of supporting a billion-dollar public company is extremely limited. A quick look at CoinMarketCap reveals only about 15 tokens with a circulating market capitalization exceeding $5 billion. If your token's market capitalization falls below this threshold, becoming a billion-dollar public company will be extremely difficult—not impossible, but certainly challenging.

Especially for long-tail assets, not even one DAT may survive. We believe that the DATs that truly survive will ultimately be concentrated in the major assets of Bitcoin, Ethereum, and Solana, with perhaps only two or three companies on each chain.

In my past professional experience, whether it is the commodities industry or other less transparent industries, it will eventually form a pattern of "two or three leading companies + a little bit of long tail".

I believe the future of the DAT sector will likely follow this logic. Over the past three months, I've reviewed 90 to 100 projects, but it's unlikely all 100 will survive. We've only invested in a tiny fraction of them because we want to set the bar high enough to only invest in projects with the greatest potential to become future winners. This is likely the overall trend of this sector going forward.

BlockBeats: You and Tom Lee have both mentioned that during market downturns, there will be some consolidation, prompting more mergers and acquisitions between DATs. But you seem to disagree on this point. Do you disagree with this "M&A" approach?

Cosmo Jiang: Let me clarify. We completely agree with Tom's statement. This is an idea I've discussed repeatedly with many of our digital asset treasury team members, and it's something I've been pondering. Coming from traditional finance, I'm very familiar with the financial instruments available. Therefore, I believe that mergers and acquisitions make perfect sense in this field.

What I'm really saying is that if a company's stock price is below its net asset value (1x NAV), I think the right thing for such a company is to either buy back shares or seek an acquisition, rather than just staying below net asset value, collecting management salaries, and still thinking about "empire expansion," right?

Therefore, as long as the valuation falls below net asset value, I expect these companies to become "willing sellers." Of course, how this actually develops remains to be seen, but this is my judgment.

Therefore, I do believe that once a downturn begins, as I mentioned earlier, this is a relatively homogeneous market, where only scale can win. Therefore, small companies that cannot expand and achieve economies of scale will likely see their stock prices underperform in a market correction.

At this time, it would be very accretive for larger, more mature companies that can still trade at a premium to acquire other companies at 1x or less than 1x net assets. This is much more cost-effective than buying assets directly on the open market, right?

So I think that makes perfect sense, and I totally expected that to happen.

BlockBeats: So what kind of DAT companies can survive?

Cosmo Jiang: Yes, in the final analysis, it all depends on "execution".

You see, the US equity capital market is inherently very deep and vast, right? So, as long as the company is high-quality, there's plenty of trading volume to go around. Therefore, I wouldn't be surprised if many crypto treasury companies (DATs) achieve very high trading volumes. As you just mentioned, this is crucial for increasing valuation premiums and enhancing financing capabilities.

Of course, this comes with volatility—but clearly, the key is execution. This is why you see significant disparity in trading volume between different DAT companies. Ultimately, it comes down to their ability to execute—both in terms of marketing and capital operations.

BlockBeats: During the due diligence phase, what key points does Pantera consider when evaluating a team's investability?

Cosmo Jiang: We mainly look at several core dimensions:

First, what kind of token is the underlying asset? Do we really have a deep understanding and confidence in it?

The fundamental reason why we bet on these projects is not to treat them as short-term transactions, but to make real long-term investments.

Therefore, we will only invest in a DAT (crypto treasury company) if its underlying token is one we are truly optimistic about. We will spend a lot of energy researching these tokens, which is also the core of our work.

Second, are the project's opportunities or arbitrage potential clear? Are there any special tax arbitrage opportunities?

For example, MetaPlanet has a very clear tax arbitrage logic in the Japanese market. So, are there also some kind of "entry arbitrage" opportunities in the US? For example, in projects like Hyperliquid, where US investors are unable to repurchase shares, there is a possibility of arbitrage.

So we ask ourselves: Does this project have some interesting mechanics that make it unique and therefore create excess demand?

Third, what is the competitive landscape of this project in the market?

We have a very large comps table that lists all currently issued crypto treasury companies, including their tokens, issuance methods, market capitalization, etc.

So, we have a very clear understanding of the competitive landscape of the entire market. So, where does this new team fit into this landscape? What is the differentiated message they intend to convey to the market?

Of course, there is also the management team itself, which is equally critical.

Do they have enough credibility and expressive ability to tell this narrative and convince people?

Especially when it comes to financial structure design, it's not just about having the relevant capabilities. More importantly, do you truly understand how to execute it? Do you have a complete and actionable implementation plan?

A lot of teams come to us and say, “We want to raise $200 million.” I ask, “Great, what’s next? What’s your second step?” They often say, “We haven’t figured it out yet.”

This is completely unacceptable to us because the key to getting these projects off the ground is not the first round of financing, which is usually easy, but whether you can complete the second and third rounds of financing.

Therefore, we hope that the other party has already planned the second, third, and fourth steps.

Also crucial is the transaction structure design, including how they are listed, liquidity arrangements and pricing mechanisms.

BlockBeats: What you provide to the team is not just funding, but more like systematic guidance.

Cosmo Jiang: You could say that. We're very lucky that many teams do seek our advice. We're often the first people they contact.

Therefore, I will try my best to share with them all the experience I have accumulated during this period: because I have seen too many teams rise and fall, I know which steps are correct and which consultants are reliable, so as to really help them get started and stay stable.

BlockBeats: You mentioned earlier that this industry is still in its early stages, and consolidation hasn't begun yet. So, when do you think consolidation will begin? Is there a rough estimate, perhaps within the next two to three years?

Cosmo Jiang: You know, if we go back to April of this year, when we did the DFDV (Defi Dev Corp) deal, I thought "one deal was enough." Then when we did the second deal, I thought "two deals would be enough." But now it seems that this has evolved into a larger trend.

This also illustrates the depth of the U.S. capital market and the huge market demand for exposure to crypto assets - this is exactly what I want to emphasize today.

I'm someone who lives in the secondary market, essentially assessing the situation on a day-to-day basis. I'm well aware that public markets always have "windows": sometimes opportunities are open, sometimes they're closed, and you have to adapt at all times. Right now, this window is very wide open, and I believe it will last for at least a few months.

But I think launching a new digital asset treasury company is going to get increasingly difficult—especially if it's your 100th or 110th. So, from now on, it's only going to get harder. However, there are some promising teams emerging. We estimate there's a three-to-six-month "launch period," during which some excellent new projects will emerge. And what about after that? We'll have to wait and see.

Maybe in three or six months, I'll still say, "There's still a three to six month window," just like I said three months ago (laughs). So we'll just wait and see. But if we extend the timeline to one or two years, or even two or three years, I think there will be fewer and fewer new companies entering the market.

Because this is a very rare window period, you can witness the birth of a new industry. And an industry will not be "born twice."