Seeing Through the "Hidden Logic" of the Prediction Market: 11 Arbitrage Strategies Explained

- 核心观点:预测市场存在结构性套利机会。

- 关键要素:

- 跨市场赔率差异套利。

- 利用市场信息滞后获利。

- 反身性操作影响结果。

- 市场影响:提升市场效率,吸引专业交易者。

- 时效性标注:中期影响。

Original author: Pix

Original translation: Saoirse, Foresight News

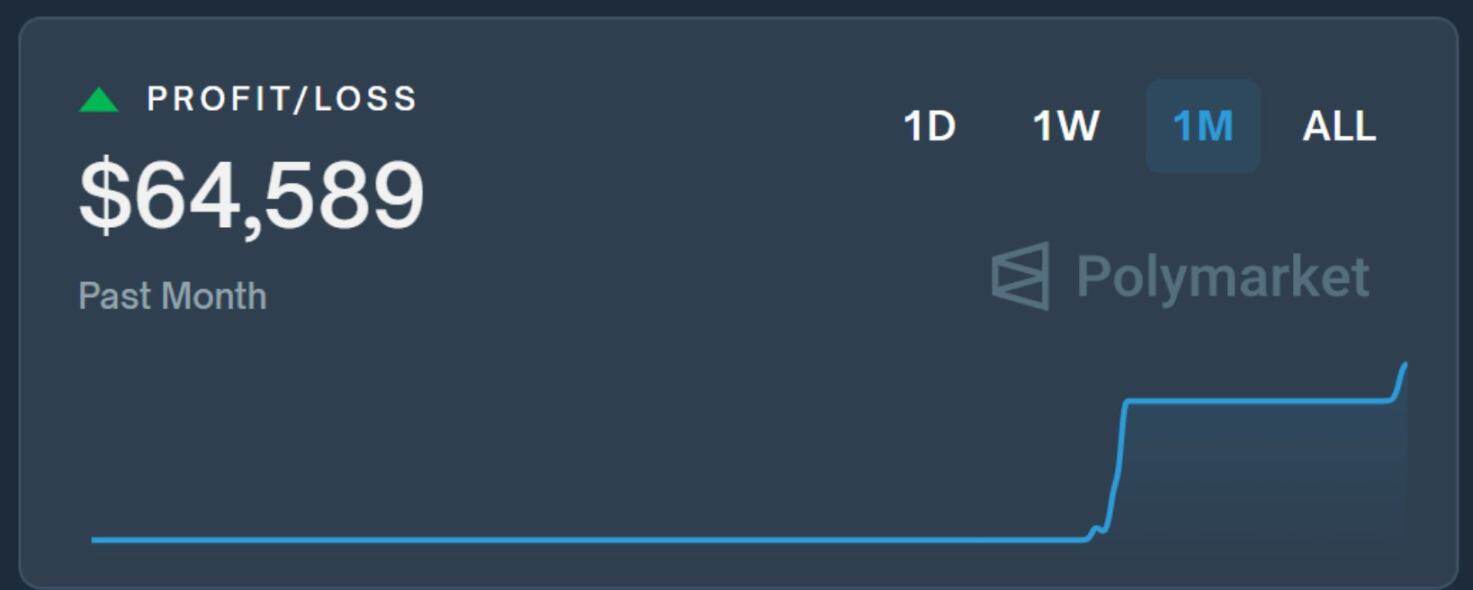

Translator's Note: While people often perceive prediction markets as mere "event betting," this article, with its $64,000 monthly real-world returns, reveals its underlying logic—it's not a casino, but a profitable system that hides structural opportunities like pricing bias and market lags. Eleven strategies, ranging from cross-market arbitrage to reflexive trading, are presented, hoping to offer readers new perspectives and insights, offering insights for both traders and market observers.

Most people think of prediction markets as being for betting, but that’s just the surface.

To the expert eye, they reveal even more:

- Unreasonably priced odds

- A delayed market

- Herd behavior

- Reflexive cycles that can be influenced

If you understand how these systems work, you're not limited to just betting on outcomes, but can profit directly from market structures.

Here are 11 methods I’ve implemented:

Arbitrage strategies

1. Cross-market arbitrage

The odds for the same event can vary across different platforms. For example, the odds of Trump winning might be 55% on Polymarket, but 48% on Kalshi.

By buying low and selling high at this time, you can earn risk-free expected returns.

This can be done manually or automatically via the API. Using the Kelly Criterion to control transaction size is even more effective. (For more details, see the FN article " KOL: How I Made $100,000 Through Prediction Market Arbitrage .")

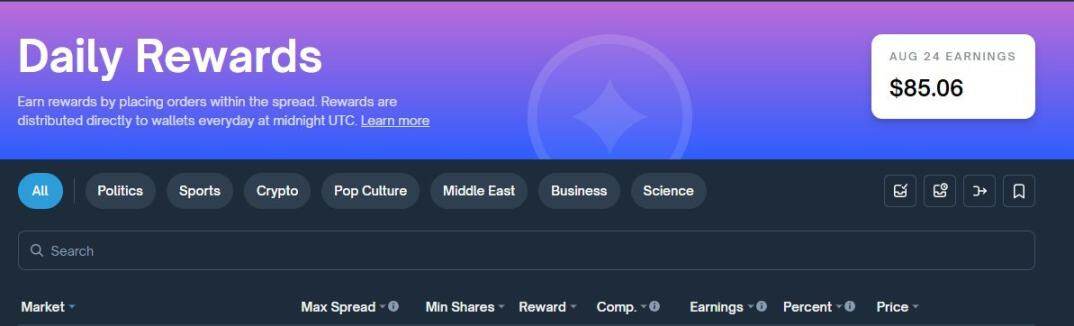

2. Provide liquidity for the market pool

If there is an automated market maker (AMM) behind the market, you can become a liquidity provider (LP).

This is similar to a straddle option strategy, which allows you to maintain delta neutrality (risk hedging) while earning fees from trading activities.

This approach can be particularly profitable in volatile, high-profile markets.

3. Bayesian Updating vs. Market Lag

(Bayesian Updating refers to the process of continuously adjusting the probability of an event based on new information, thereby gradually approaching a more accurate conclusion.)

Market reactions are often slow, especially in decentralized markets.

For example, if a candidate withdraws from the election, most bettors will not adjust their positions immediately.

But if you have a model that updates the odds in real time based on new information, you can get ahead of them.

This time difference is your profit margin.

Meta-reflexivity and incentive vulnerability exploitation

(Meta-Reflexivity describes the deep interactive relationship between market participants, where the behavior of market participants is not only affected by market conditions but also shapes the market itself and even changes the outcomes of events predicted by the market.)

4. Transaction Oracle

Some markets rely on a single news source for their outcomes.

If the rules of a bet are "will X event happen (and be reported by CNN) before Y date", then you are not actually betting on the event itself, but on whether CNN will report on it .

Understanding the biases and reporting tendencies of these “oracles” (information sources) is a huge advantage.

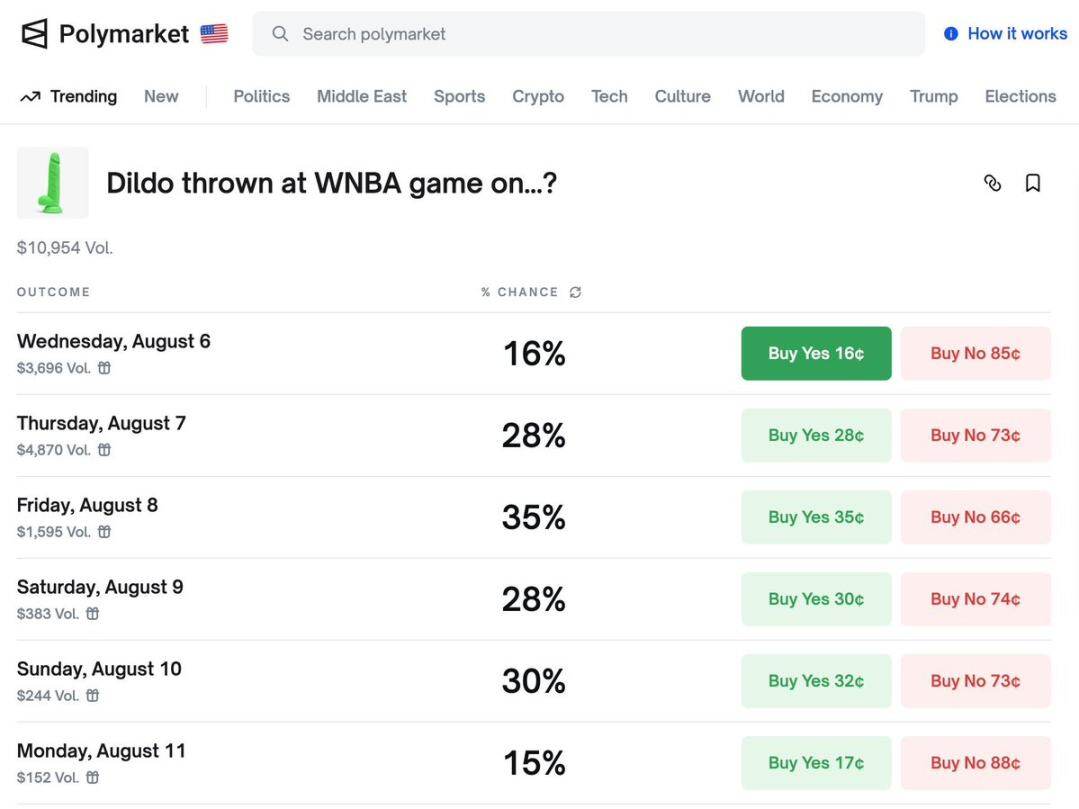

5. Reflexive Arbitrage

Some markets can in turn bring about the outcomes they predict.

For example, if there is a bet on "Will Project X be launched before the third quarter?", if you buy "yes", you will have the motivation to make this happen.

Post tweets to build momentum, contact the project team, and drive community attention...

Prediction markets can be actively guided.

Remember that incident with rubber products appearing on WNBA courts? If you think about it, you can always find a way to profit. Those who understand will understand...

Use prediction markets as intelligence sources

6. Using odds to guide perpetual contract trading

Platforms like Polymarket often respond to probabilities faster than the media.

If the odds of an Ethereum ETF being approved suddenly spike to 90%, you could potentially take a long position in Ethereum before the news even breaks.

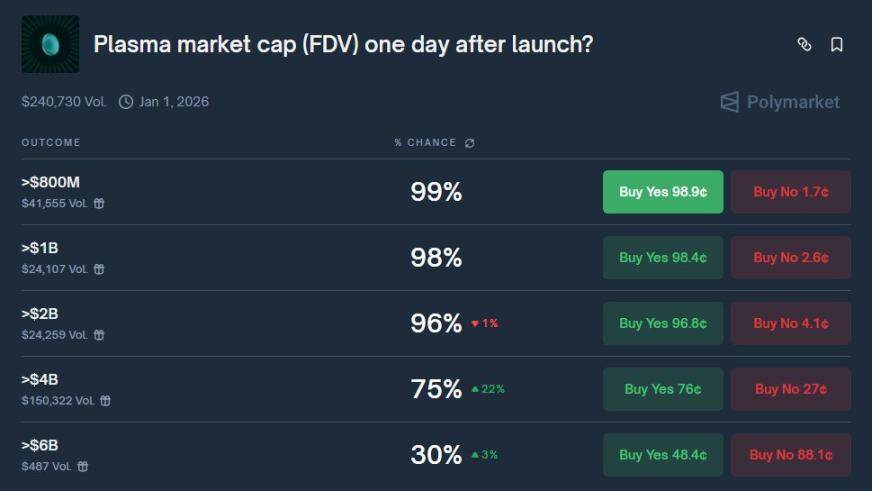

7. Preemptive layout of token trading

Some markets can predict the popularity of a project.

When Polymarket adds a new bet related to a certain token, it often indicates that the token is about to usher in high trading volume.

You don't have to bet on the outcome of the game, just follow the trend or be prepared to provide liquidity when it goes online.

Structural Operations

8. Think of prediction markets as synthetic options

A binary outcome bet is similar to a capped option.

For example, if the "YES" option has a 3-day expiration date and a current price of 0.09, and the actual probability of occurrence is 20%, it is a volatility pricing error.

Analyze it as an option and model and calculate delta (price sensitivity to probability) , theta (time decay) and gamma (rate of change of sensitivity) .

9. Build custom combination bets

Parlay betting involves combining two or more separate bets into a single bet. The entire parlay wins only if all bets on the combined bets hit. If any of the individual bets fail, the entire parlay loses.

By overlaying multiple markets, you can create synthetic portfolio strategies.

For example, Trump's odds of winning the Republican primary are 70%, and his odds of winning the general election are 40%. If the former comes true as you expected, the odds of the latter will definitely skyrocket, and you can make a profit by buying the latter at this time.

10. Tax planning

In some jurisdictions, losses from prediction markets can be claimed as gambling losses.

If you have gains on your cryptocurrency holdings, creating some losses through structuring may reduce your tax bill.

But be sure to consult a professional.

Token exposure operations

11. Trading Infrastructure Tokens

Some platforms have native tokens (such as Zeitgeist, Truemarkets, etc.).

When platform trading volume surges, the prices of these prediction market tokens tend to rise with a lag (not investment advice).

To be honest, I’m not very good at evaluating these tokens, but “when the big trend comes, all boats will float.”

I don’t hold any positions at the moment, but may provide some liquidity in the future.

Conclusion

Prediction markets are often misunderstood as simple gambling tools.

But in fact, it contains rich data, behavioral patterns and time-lag opportunities.

If you think of it as a set of operating logic rather than a casino, you will find asymmetric profit opportunities everywhere.