From Bitcoin Miner to World's Largest Corporate ETH Holder: A Complete Analysis of BitMine's Ethereum Treasury Strategy

- 核心观点:BitMine转型以太坊财库策略获巨大成功。

- 关键要素:

- 2.5亿美元私募启动ETH储备战略。

- 120万ETH持有量成全球最大企业持有者。

- 股价30天内上涨605.07%。

- 市场影响:推动传统金融机构加速布局加密资产。

- 时效性标注:中期影响。

Article author: Lesley

On June 30, 2025, BitMine Immersion Technologies (NYSE: BMNR) announced the launch of a $250 million private placement, officially transitioning to an Ethereum ($ETH) treasury strategy. Simultaneously, Thomas Lee, founder and chief investment officer of renowned investment firm Fundstrat, became chairman of the company's board and personally participated in the investment. Shortly thereafter, Wall Street heavyweights such as former PayPal CEO Peter Thiel and ARK Investment Management CEO Cathie Wood followed suit, providing strong capital support for this strategic shift.

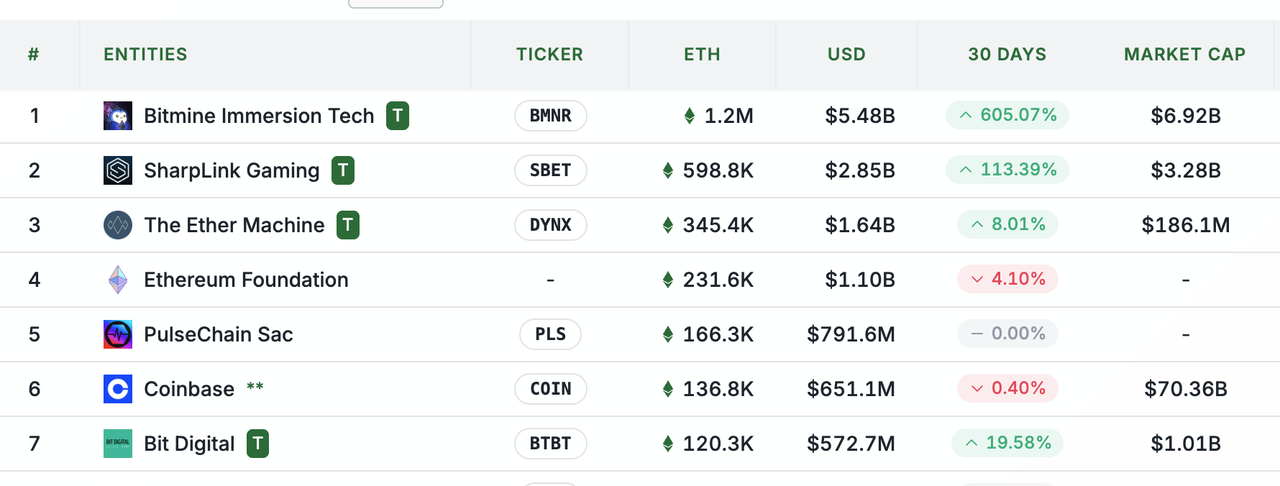

ETH Strategic Reserve Ranking (Source: strategythreserve.xyz)

Over forty days later, the market responded clearly. This Bitcoin mining company has become a focal point of the capital markets. As of August 14th, BitMine had accumulated approximately 1.2 million ETH, valued at approximately $5.48 billion, making it the world's largest corporate holder of Ethereum.

The stock price trend more directly reflects market sentiment: it rose 605.07% in 30 days and 1214.38% in three months. From any perspective, this is a textbook capital market operation.

Behind these numbers lies a reallocation of capital. BitMine's shift from the traditional "Bitcoin mining for cash" model to a "long-term Ethereum holding" treasury strategy is essentially a shift from industrial capital to financial capital. The success of this model not only demonstrates the viability of digital assets as corporate reserve assets, but more importantly, it may be opening up a new path for traditional financial institutions to participate in the crypto economy.

In this article, we'll delve deeper into how BitMine, a Bitcoin mining company, has become the world's largest corporate holder of ETH in just two months.

BitMine Treasury Strategy Implementation and In-Depth Analysis

From launching a $250 million private placement on June 30 to becoming the world's largest corporate holder of ETH, BitMine has demonstrated the power of the Digital Asset Treasury (DAT) model with a textbook-level capital operation.

BitMine's Ethereum Treasury Strategy Timeline

BitMine’s ETH accumulation trajectory shows a textbook capital allocation rhythm, with each step carefully designed:

June 30, 2025: BitMine announces the launch of a $250 million private placement program to implement its Ethereum treasury strategy. Thomas Lee officially becomes Chairman of the Board and will lead the company's new strategy.

On July 9, 2025, BitMine announced the completion of its $250 million private placement plan, further advancing the implementation of its asset-light treasury strategy.

July 14, 2025: The company announced it holds over $500 million worth of ETH.

July 17, 2025: The company announced it holds over $1 billion worth of ETH.

July 24, 2025: Holds over $2 billion worth of ETH, establishing its leadership in the Ethereum treasury.

August 4, 2025: Holding more than 833,000 ETH tokens, worth more than US$2.9 billion, becoming the world's largest ETH treasury.

August 11, 2025: Over 1.15 million ETH tokens are held, valued at over $4.96 billion, representing another $2 billion increase in a week.

August 12, 2025: Bitmine Immersion filed documents with U.S. federal regulators to increase its fundraising target for purchasing ETH by another $20 billion to $24.5 billion, in an effort to consolidate its position as the world's largest ETH treasury.

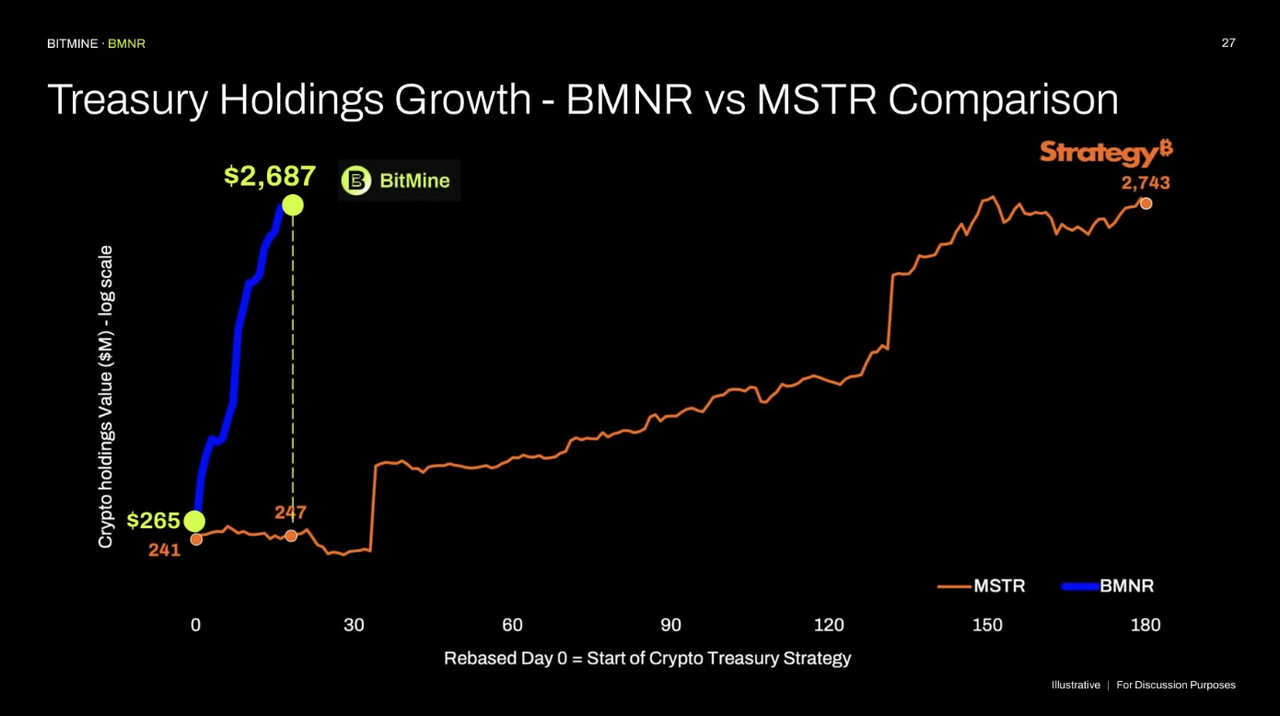

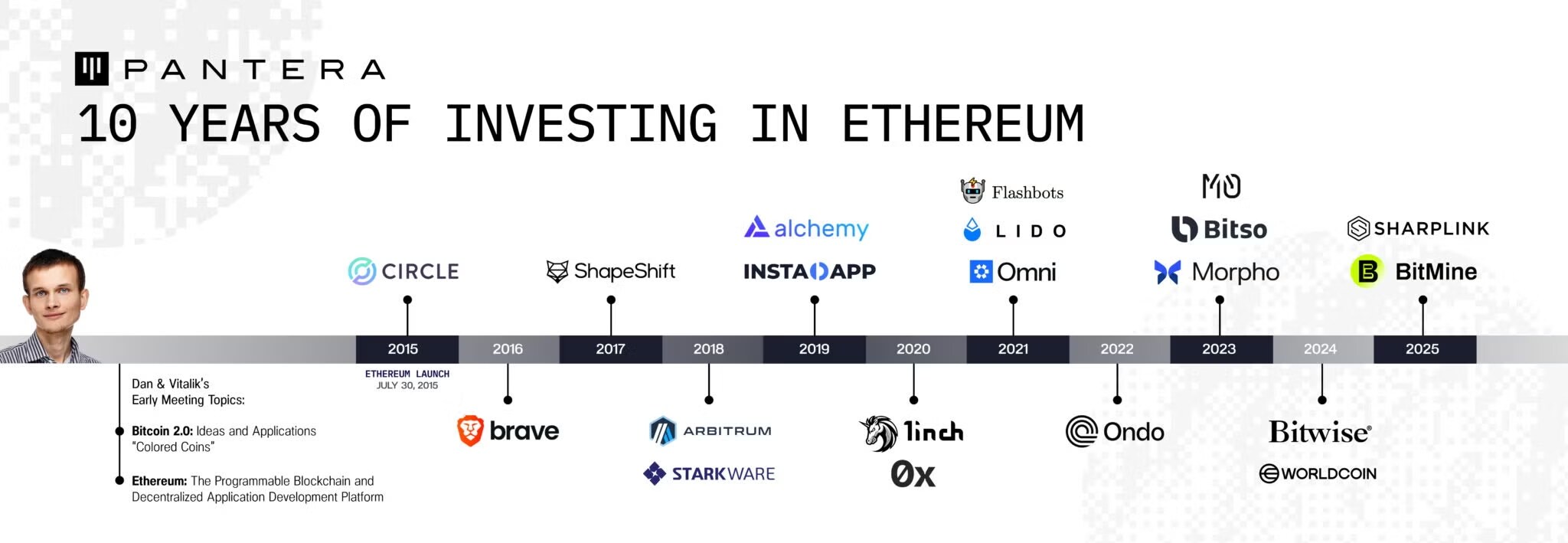

Source: Pantera official website

This accumulation speed is rare in the capital market - the growth rate of ETH per share in the first month of BitMine's launch of the Ethereum treasury strategy has surpassed the cumulative growth of Strategy (formerly MicroStrategy) in the first six months.

In-depth Analysis of BitMine Ethereum Treasury Strategy

Why choose a digital asset treasury strategy?

DAT (Digital Asset Treasury) refers to an emerging model in which companies incorporate cryptocurrencies like Bitcoin and Ethereum into their balance sheets as strategic reserve assets. Bitcoin treasury strategies, represented by Strategy, have long been a proven path for companies to participate in the crypto economy. In June 2025, Bitmine launched its Ethereum Digital Treasury strategy, igniting the current ETH rally.

The core of the DAT model lies in redefining how businesses create value. According to Pantera Capital's analysis, the most important factor in DAT success lies in the long-term investment value of its underlying tokens. While traditional businesses rely on cash flow from operating activities to create value, DAT companies rely on the appreciation of digital assets. The advantages of this model are:

• Capital Allocation Efficiency : Compared to traditional asset-heavy operations, the DAT model allows for more efficient capital allocation. BitMine’s shift from Bitcoin mining to an Ethereum treasury was essentially a shift from an asset-heavy model that relied on electricity, hardware, and operations to a flexible capital allocation model.

• Valuation Reconstruction and Asset Management : The valuation of DAT companies no longer relies on the traditional price-to-earnings ratio (P/E ratio), but is more based on the net asset value (NAV) of their holdings. When investors purchase DAT company shares, they are actually purchasing a professionally managed digital asset portfolio.

• Exploiting a stock price premium : A DAT's stock price can be broken down into the product of three key factors: (1) the number of tokens per share; (2) the underlying token price; and (3) the multiple of Net Asset Value (mNAV). When the stock price is trading at a premium relative to NAV (i.e., mNAV > 1 x), the company can raise funds exceeding its net asset value through stock issuance, which can be used to increase the number of tokens held per share, thereby increasing value. The core of this strategy is to leverage the valuation premium given by the market to increase the number of tokens held per share, thereby amplifying shareholder returns when the underlying token price rises.

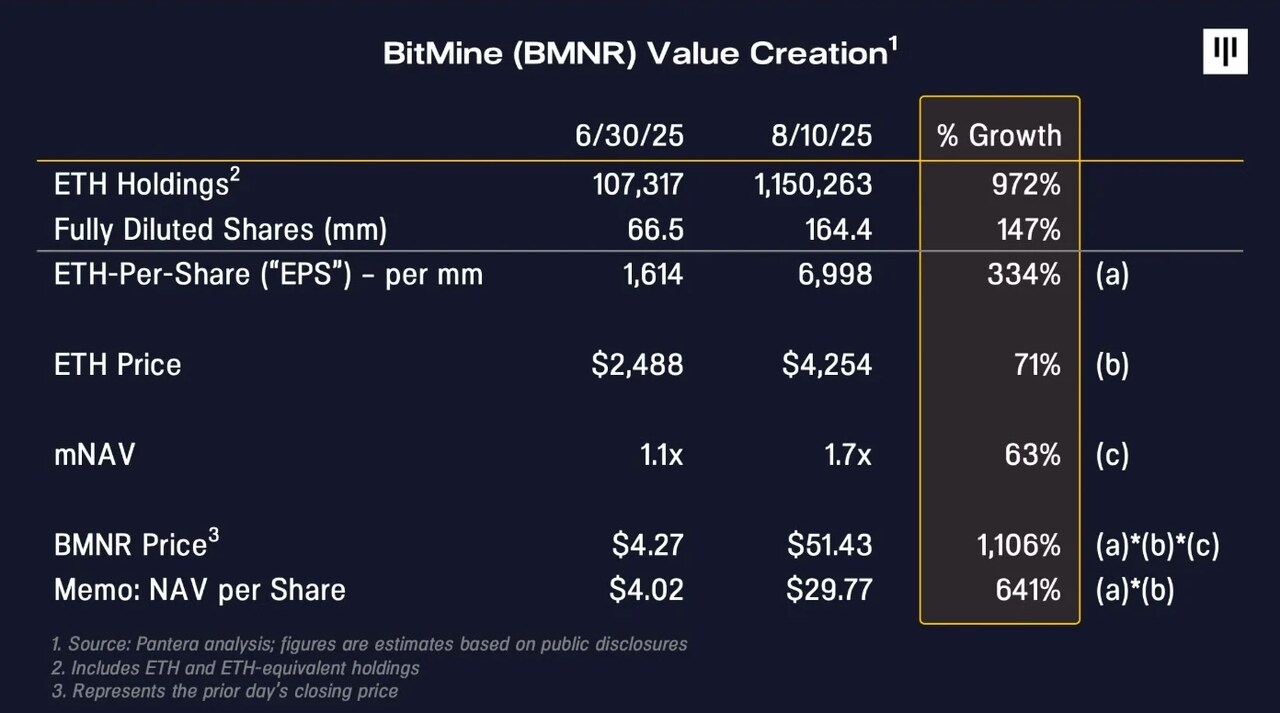

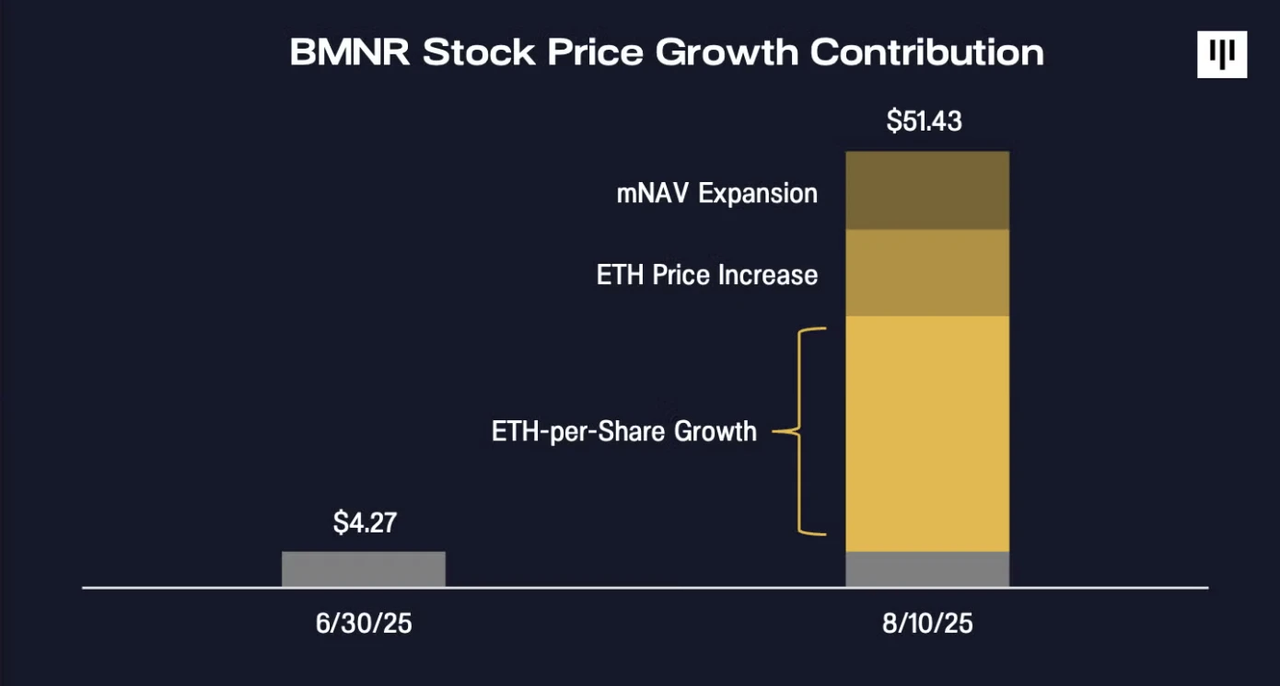

Source: Pantera official website

According to Pantera analysis, BMNR's astonishing stock price surge, for example, has a clear value-driven logic. Within a month of launching its treasury strategy at the end of June, BMNR's ETH holdings per share surged 334%, contributing approximately 60% of the stock price increase. The ETH price rose from $2,500 to $4,300, contributing approximately 20%; and its mNAV expanded from 1.1x to 1.7x, also contributing approximately 20%.

This earnings breakdown highlights the core competitive advantage of the DAT model: the dominant factor behind share price growth isn't passive digital asset price fluctuations, but rather the appreciation in per-token value achieved through management's active capital allocation. In other words, investors receive not only the market returns of ETH price increases (i.e., returns that align with market fluctuations), but more importantly, the active returns generated by management (i.e., returns that don't align with market fluctuations). This "management-controlled value creation mechanism" is the core differentiating value proposition of DAT companies compared to directly holding spot assets, and it also explains why institutional investors are willing to pay a premium for DAT shares.

Why choose Ethereum?

Source: Pantera official website

BitMine's unwavering commitment to Ethereum reflects its deep understanding of the future direction of blockchain infrastructure. Tom Lee stated on the Bankless podcast that Ethereum will become the infrastructure for the financial and AI eras, while its current market price far underperforms its true potential. With Wall Street moving on-chain, Ethereum will become one of the most significant macro trends of the next decade.

• Network Effect Advantage : Ethereum has become the core infrastructure of digital finance. It powers the vast majority of DeFi applications, NFT transactions, and enterprise-level blockchain applications. As traditional financial institutions accelerate their on-chain migration, Ethereum’s network value will continue to grow.

• Diversified Income : Compared to Bitcoin, Ethereum offers more diverse revenue streams. Ethereum's Proof of Stake (PoS) mechanism allows businesses to earn stable returns through staking. As Tom Lee explains, "This essentially gives these companies a stable revenue stream, similar to that of infrastructure operators." Furthermore, staking derivatives and on-chain yield strategies within the DeFi ecosystem offer more innovative financial tools and revenue opportunities than Bitcoin.

• Institutional adoption trend : Tom Lee mentioned on the podcast: "For many US institutions, ETH ETFs may not meet the fund investment parameters, and Digital Asset Treasury provides a compliant and efficient alternative." This shows that as institutional investors become more interested in Ethereum, Digital Asset Treasury provides them with more investment options.

BitMine's core business model: maximizing ETH holdings per share

BitMine's core business model is to maximize ETH per share (EPS). Because in a bull market for digital assets, the density of holdings determines the multiplier of shareholder returns, and this metric has replaced traditional EPS as a key performance indicator. BitMine takes this logic to its extreme, continuously increasing ETH per share through a diversified capital allocation strategy, thereby achieving superlinear stock price growth as ETH prices rise.

There are several main ways to increase the number of tokens held per share:

• Premium Issuance Strategy : Building on the theoretical framework of the aforementioned DAT model, BitMine has translated the strategy of "exploiting share price premiums" into a specific operational approach. New shares are issued when the share price is at a premium to ETH's NAV. This is the logic behind BitMine's latest plan to raise $20 billion to purchase ETH. Assuming the NAV per share is $100 but the share price is $120, the company can issue shares to receive $120 in cash to purchase the equivalent amount of ETH. This would increase the value of each ETH share from $100 to approximately $110, significantly increasing its value.

• Innovation in derivatives : Issuing equity-linked securities such as convertible bonds to generate additional capital by monetizing the dual volatility of stocks and ETH. Pantera predicts that BitMine will soon expand into this area, raising funds through bond financing and other methods to purchase more ETH without diluting existing shareholders.

• Reinvestment of staking income : Ethereum's PoS mechanism provides BitMine with an additional revenue stream not available to Bitcoin DAT companies. The annualized income earned from staking ETH can be automatically reinvested to purchase more ETH, creating a compound growth effect. This is a unique advantage of smart contract token DATs like ETH over Bitcoin DATs.

• M&A Integration : As more companies turn to Ethereum treasury strategies, BitMine can achieve scale by acquiring other DAT companies trading at or below NAV.

The synergy of these four growth mechanisms enables BitMine to amplify its profits when ETH prices rise and maintain its competitive advantage through an active capital allocation strategy when ETH prices fall.

At its core, BitMine's treasury strategy is a meticulously crafted financial engineering exercise, whose success hinges on management's precise market timing, skillful application of capital market tools, and accurate assessment of the long-term value of the Ethereum ecosystem. The sustainability and replicability of this model will largely determine the future trajectory of DATs as an emerging asset class.

Summary: Future Outlook

With clear strategic planning and strong execution, BitMine is driving profound changes in the crypto asset management sector. BitMine Chairman Tom Lee has outlined the company's long-term goal of acquiring 5% of the total Ethereum supply, a goal he has dubbed the "5% Alchemy."

Ethereum Treasury Strategies is replicating the success of companies like Strategy in the Bitcoin space, attracting follow-up investment from companies like Bit Digital and SharpLink Gaming. Meanwhile, Pantera Capital's $300 million investment in the DAT sector demonstrates the investment of institutional capital in this emerging field.

Pioneers like BitMine are transforming theoretical concepts into replicable commercial realities through their successful implementation of Ethereum treasury reserves. As more and more listed companies recognize the unique value of digital assets, the strategic layout and execution experience of these pioneers will become a crucial catalyst for driving corporate digital transformation and accelerating the deep integration of traditional finance and the blockchain economy.

Reference Information:

Bitmine Immersion Technologies, Inc. official disclosure (PR Newswire release): https://www.prnewswire.com/news/bitmine-immersion-technologies%2C-inc./

Pantera’s research on digital asset treasury investment strategies: https://panteracapital.com/blockchain-letter/dat-value-creation/

LongHash VC’s analysis of DAT as a new asset class: https://www.longhash.vc/post/digital-asset-treasury-companies-passing-fad-or-a-new-asset-class