Originally Posted by Tanay Ved

Original translation: Saoirse, Foresight News

Key Takeaways:

- Bitcoin's market capitalization has exceeded $1 trillion. This data reflects that as the total market capitalization of cryptocurrencies approaches $4 trillion, long-term holders are investing more funds and their convictions are stronger.

- The continued inflow of funds into spot ETFs, coupled with the continuous increase in corporate cash reserves, has caused the demand for BTC and ETH to exceed the new issuance.

- The market dominance is gradually expanding, ETH is relatively strong, and altcoins such as SOL and XRP are also increasing their participation thanks to the growth of spot trading volume.

- The GENIUS Act establishes the first federal regulatory framework for fiat-backed stablecoins in the United States, bringing regulatory clarity to the stablecoin market, which is over $250 billion in size, and laying the foundation for increasing industry participation and competitiveness.

Introduction

The digital asset market has approached the $4 trillion mark for the first time, a significant milestone in the industry's development. This latest surge is driven by a combination of structural and cyclical factors, including continued growth in inflows into Bitcoin and Ethereum spot ETFs, accelerated increases in digital asset fund managers, and significant regulatory breakthroughs such as the passage of the GENIUS Act. Momentum behind cryptocurrencies appears to be growing.

In this article, we will analyze the key market forces and on-chain capital flows driving this expansion phase.

Bitcoin has achieved a market capitalization of $1 trillion, and market activity has expanded

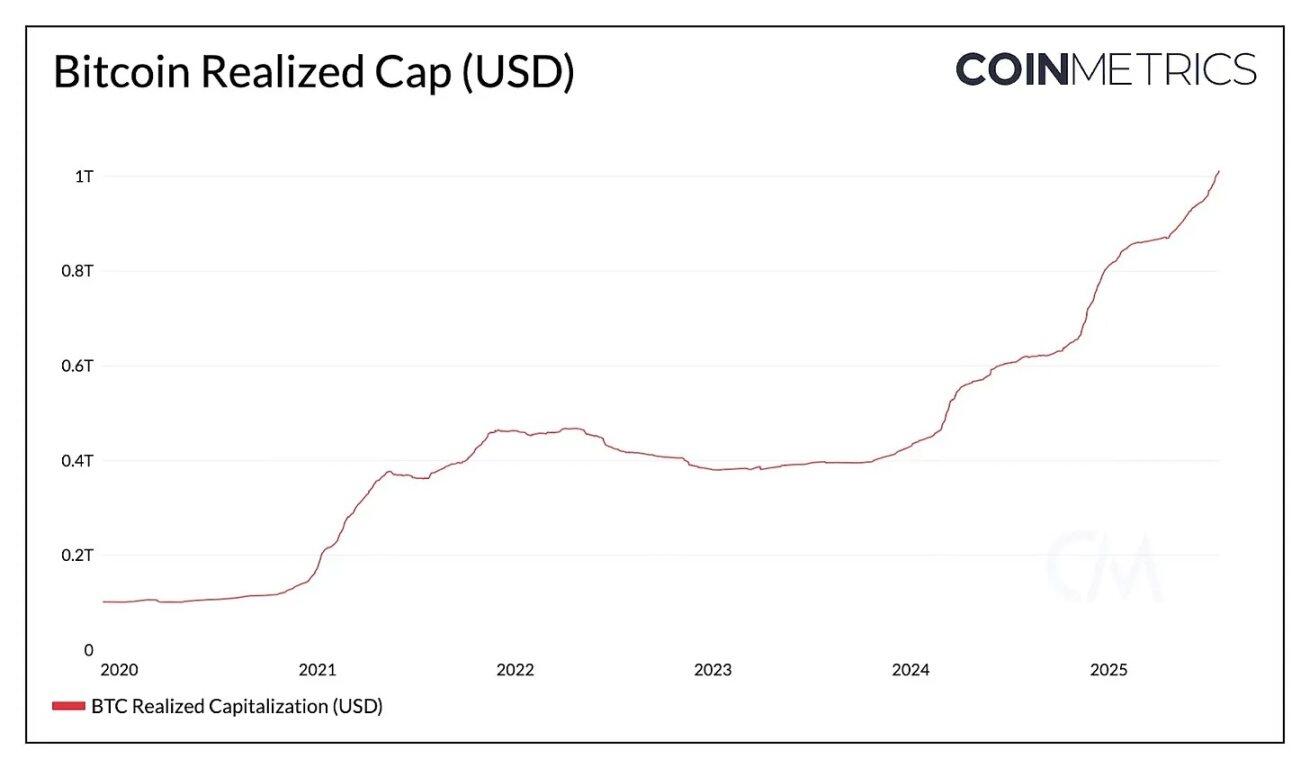

Bitcoin hit a record high of $123,000, pushing its market capitalization to $2.38 trillion and its realized market capitalization exceeding $1 trillion. This data reflects deeper investment during high prices and underscores Bitcoin's growing recognition as a global asset amidst continued strong demand for ETFs and increased institutional attention.

(Note: Realized market capitalization is the total value of each token calculated based on the price at which it last moved on-chain. This metric more accurately reflects the actual capital investment and asset accumulation of market participants. Compared to ordinary market capitalization (calculated at current prices), it better reflects the confidence of long-term holders and the true market valuation level.)

Source: Coin Metrics Network Data Pro

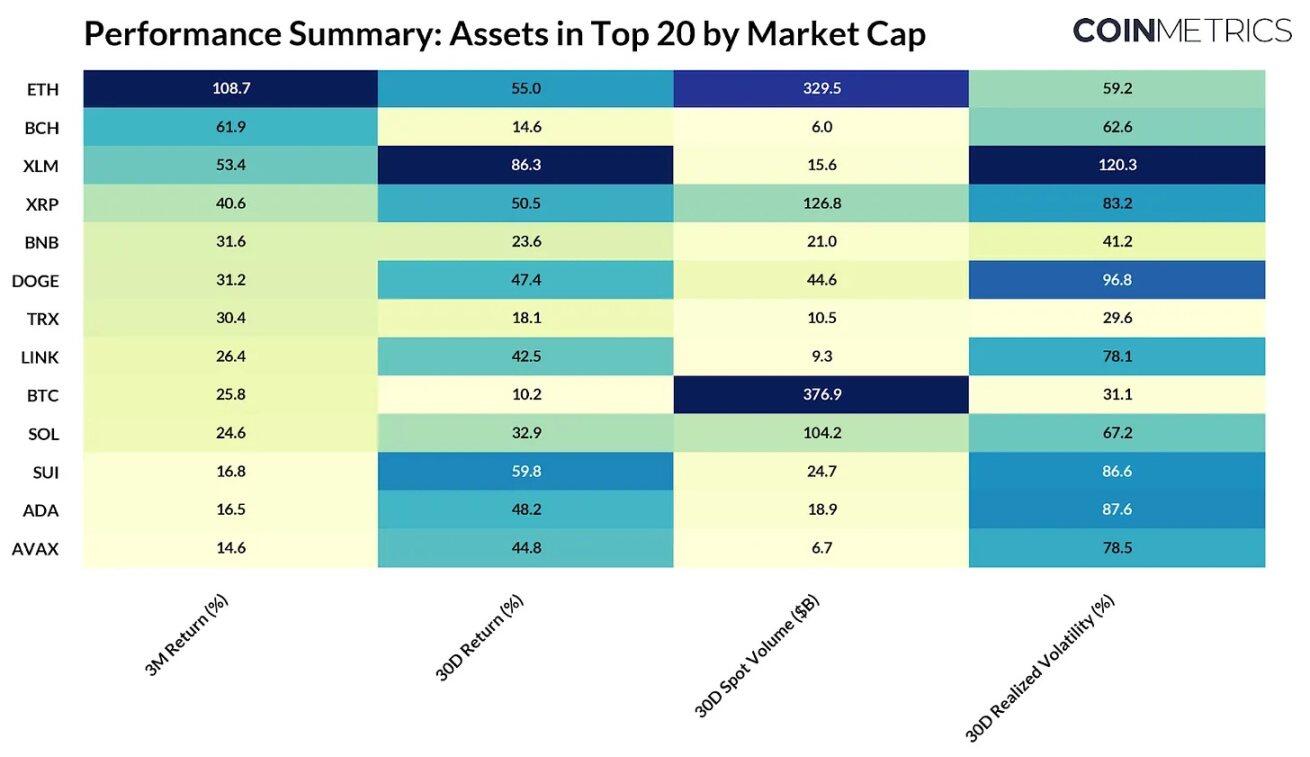

Recent market dynamics suggest we may be in the early stages of a broader market dominance. Ethereum has begun to demonstrate relative strength, with the ETH/BTC exchange rate rebounding 73% since May, pushing ETH prices above $3,900. This momentum is driven by record ETF inflows, increased adoption by corporate treasury reserves, and Ethereum's continued dominance in the stablecoin space, making it a beneficiary of the GENIUS Act.

Source: Coin Metrics Market Data Pro

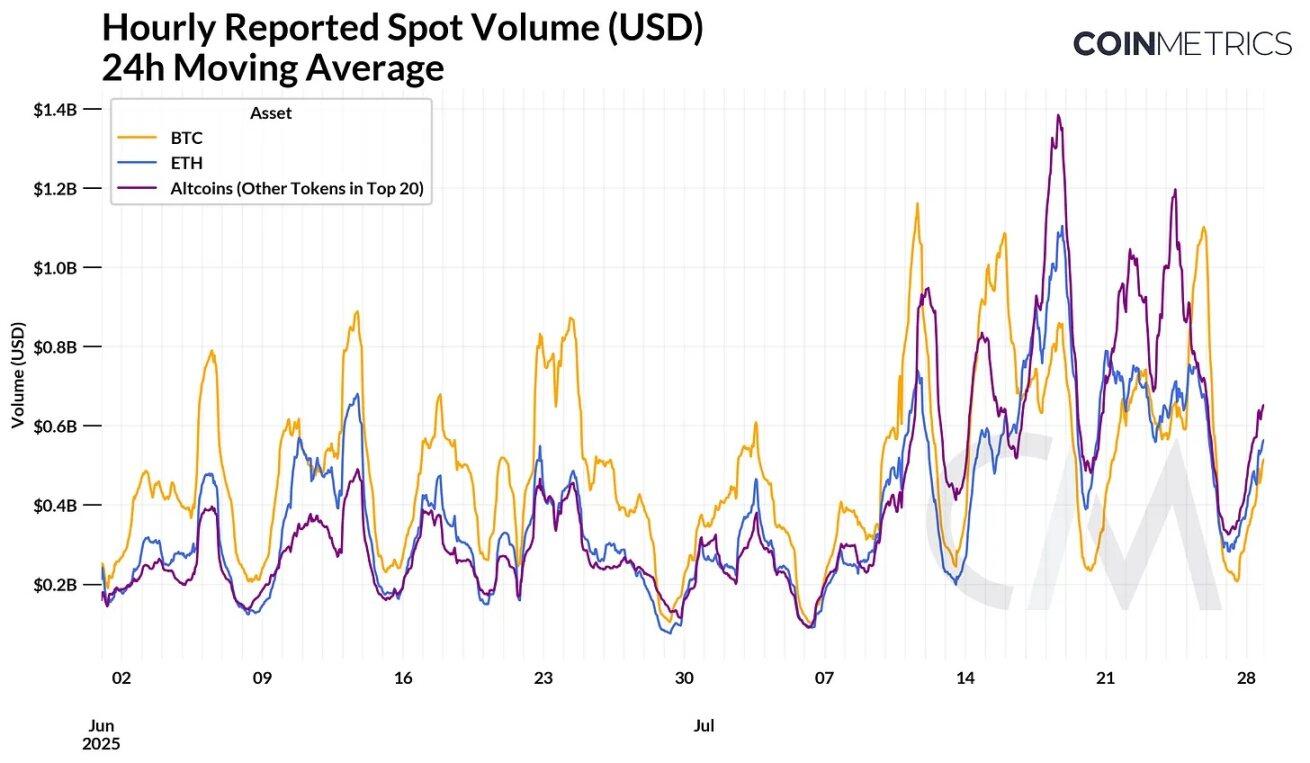

This broadening landscape is also reflected in spot trading volumes, with a resurgence in activity for ETH and large-cap altcoins like SOL and XRP. While Bitcoin trading volume remains strong, ETH and altcoin trading has seen significant growth in recent weeks. As the total altcoin market capitalization approaches $1.6 trillion, Bitcoin's market dominance has fallen to 59%. While early signs of a broadening landscape are emerging, whether this signals a lasting market shift remains to be seen.

The following table summarizes market data for the top 20 tokens by market capitalization (excluding stablecoins and other on-chain derivatives):

Source: Coin Metrics Reference Rates & Market Data Pro

ETFs and corporate cash reserves drive accelerated demand growth

A significant source of demand for Bitcoin and Ethereum is spot ETFs. After slowing in March and April, Bitcoin ETF flows regained momentum in May, bringing total holdings of US spot ETFs to over 1.27 million BTC (6.4% of the total supply). BlackRock's iShares Bitcoin Trust (IBIT) remains the largest issuer, holding 735,000 BTC (valued at $87 billion).

Ethereum is currently experiencing a similar surge in demand. Over the past few weeks, Ethereum spot ETFs have seen consistent net inflows, at times even exceeding those of Bitcoin ETFs. Although Ethereum ETFs have been around for over a year, they have seen significant growth in recent months, with ETF holdings currently reaching 5.8 million ETH, representing 4.8% of the total supply.

The growing number of Ethereum-focused corporate treasuries is also supporting demand, causing ETH accumulation to outpace new issuance. Unlike Bitcoin treasuries, which primarily hold BTC as a passive asset, ETH treasuries actively generate native yield through staking and DeFi, a model that has now extended to other large-cap token ecosystems, including Solana (SOL), TRON (TRX), and Ethena (ENA).

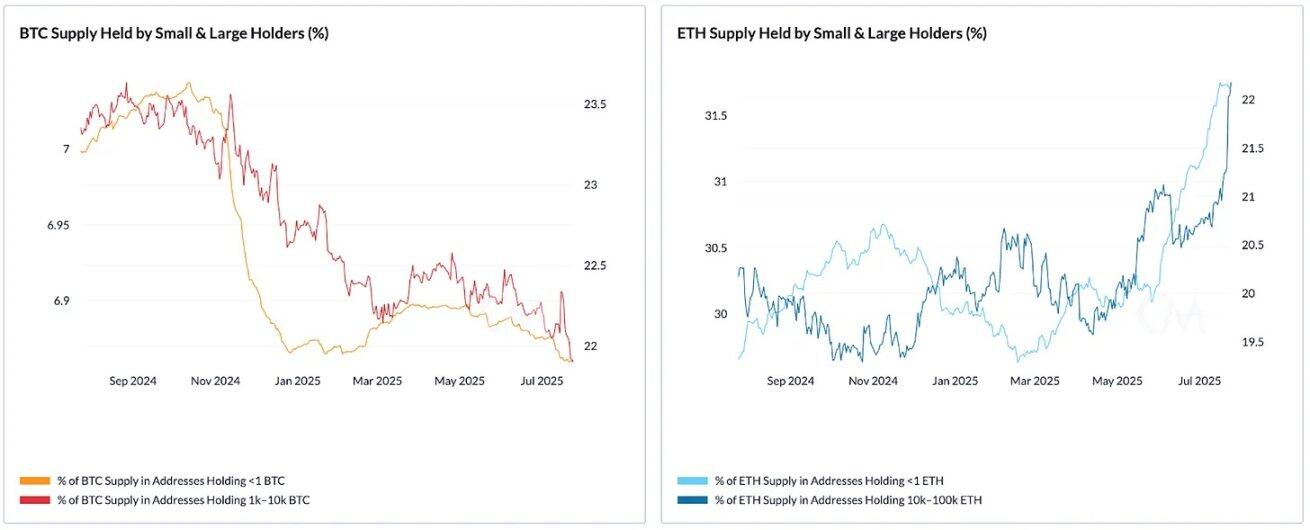

On-chain holdings by address balance

Source: Coin Metrics Network Data Pro (BTC supply and ETH supply by address balance)

As shown in the above chart, the holdings of both small (<1 BTC) and large (1k–10k BTC) Bitcoin holders have gradually declined over the past year, suggesting a period of dispersion at high prices. In contrast, Ethereum is showing signs of renewed accumulation, particularly among large holders (10k–100k ETH), whose share of holdings has recently climbed to over 22%. The holdings of small ETH holders (<1 ETH) have also increased, continuing a steady upward trend that began in 2021.

The GENIUS Act and the New Era of Stablecoins

On July 18th, the GENIUS Act was officially signed into law, establishing the first federal framework for fiat-backed stablecoins in the United States. This framework creates a level playing field for stablecoin issuers, requiring them to maintain full reserves consisting of low-risk, short-term U.S. Treasury bonds and cash, undergo regular audits, and obtain a license to issue. Similar to the approval of Bitcoin spot ETFs, the GENIUS Act is expected to bring clarity and legitimacy to the stablecoin sector, which is dominated by dollar-pegged stablecoins.

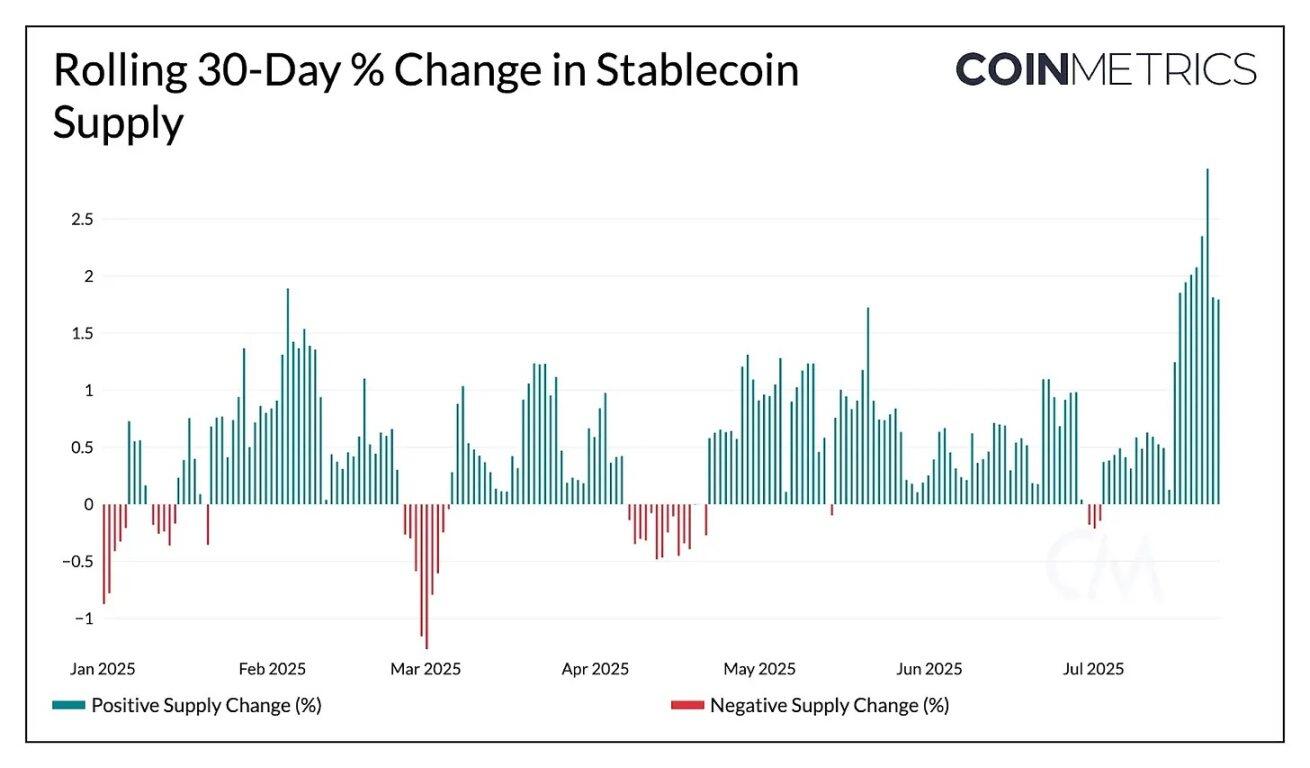

Judging from the 30-day rolling supply changes, the growth of stablecoin supply has accelerated in recent weeks, and the total supply has now exceeded US$255 billion.

Source:Coin Metrics Network Data Pro

This framework is expected to strengthen market trust in fiat-backed stablecoins, lower barriers to entry for new entrants, and create conditions for increased competition in the payments sector. From existing issuers like Tether and Circle to potential entrants like regulated banks and fintech companies, competition could not only reduce costs for consumers and businesses but also increase demand for the US dollar.

Source: Coin Metrics Network Data Pro

Among existing issuers, Circle and Paxos appear well-positioned to meet the requirements of the GENIUS Act. Their USDC and PayPal USD (PYUSD) tokens are fully reserve-backed and regularly verified. Circle is actively applying for a federal trust bank charter from the Office of the Comptroller of the Currency (OCC) to fully comply with the GENIUS Act and provide custody services to institutional clients. Other major issuers are also adjusting their structures to adapt to the new regulations. Anchorage Digital, a federally chartered crypto bank, has partnered with Ethena Labs to launch USDtb through its stablecoin issuance platform, making Ethena's USDtb one of the first stablecoins to fully comply with the GENIUS Act, with Anchorage responsible for federal regulation and reserve management. This model provides a "one-stop" solution for other projects looking to operate in the US market.

Tether (USDT), which controls approximately 68% of the stablecoin supply, faces a more complex regulatory compliance journey. USDT has historically operated outside of direct US regulation, and its reserves have included non-compliant assets such as Bitcoin and precious metals. In response, Tether plans to launch an independent, US-compliant stablecoin focused on institutional payments and interbank settlements. The new product will adhere to the GENIUS Act standards, while the existing $162 billion in USDT will continue to operate in offshore markets, primarily serving emerging markets.

Stablecoin issuers have three years to comply with the GENIUS Act. After that, only stablecoins that comply with the Act will be supported by exchanges and custodians, giving issuers time to adapt to the new framework.

in conclusion

The market's recent surge toward a $4 trillion market capitalization reflects growing investor confidence in the asset class. Demand from ETFs and corporate reserves continues to outpace new issuance, creating favorable supply dynamics for Bitcoin and Ethereum. Valuation metrics such as Bitcoin's market capitalization to realized value (MVRV) ratio suggest the market has not yet entered an overheated phase. While Bitcoin maintains its central position thanks to strong ETF inflows and long-term holders, the market's dominant position is showing signs of broadening.

Furthermore, the passage of the GENIUS Act marks a critical turning point in US cryptocurrency regulation, bringing clarity to the stablecoin sector and paving the way for enhanced industry competitiveness and deeper integration with traditional finance. Despite potential short-term volatility, strong structural demand, an improving regulatory environment, and growing participation suggest the market is poised for continued strength.

- 核心观点:加密货币市场逼近4万亿美元,结构性与周期性因素推动增长。

- 关键要素:

- 比特币已实现市值突破1万亿美元,长期持有者信心增强。

- 现货ETF和企业资金储备推动BTC和ETH需求超过供应。

- 《GENIUS法案》为稳定币市场带来监管清晰度。

- 市场影响:增强市场信心,推动行业与传统金融融合。

- 时效性标注:中期影响。