Original author: BitpushNews

On July 30th, Eastern Time, the crypto industry will release a highly anticipated document: the White House's first digital asset policy report. This report is not only the first systematic articulation of the Trump administration's stance on cryptocurrency regulation, but is also considered a potential roadmap for the industry's development in the coming years.

This report, which is about to be released, stands out among multiple legislative developments and regulatory games, and its impact may far exceed the regulation itself.

The "Top-Level Design" Inspired by Executive Orders: Starting with Order No. 14178

In January of this year, US President Trump signed Executive Order 14178, formally establishing the Presidential Task Force on Digital Assets, led by the Secretary of the Treasury. This task force, which includes several key regulators, including the Chairman of the SEC and the Secretary of Commerce, is tasked with comprehensively assessing the development of digital assets and proposing targeted policy recommendations.

Now, after 180 days of preparation, this blockbuster report is finally about to be released. Bo Hines, the White House's executive director for crypto affairs, has confirmed on social media that the report will be officially released on July 30th, stating that "the United States is leading the global trend in digital asset policy."

The timing of the report's release is also quite delicate - key legislation such as the GENIUS Act and the CLARITY Act are making substantial breakthroughs. The dual advancement of executive orders and legislation sends a strong policy signal: the United States is no longer on the sidelines in digital asset governance, but is fully involved.

The core of industry concern: the arrival of the "clear text era" of supervision

After years of regulatory ambiguity and multi-party game, the industry's most urgent expectations for this report focus on "clarity" and "sense of boundaries."

Cody Carbone, CEO of the U.S. Digital Commerce Council, said bluntly: This will be "a programmatic document for all relevant regulations and guidelines for the next three and a half years."

Based on the available information, the report is expected to focus on the following four areas:

1. Stablecoin Regulatory Framework

The report may propose institutional designs such as the issuance threshold, reserve mechanism and audit transparency of dollar-pegged stablecoins, laying the foundation for the stablecoin ecosystem with an ever-expanding market size.

2. Bank access and cooperation mechanism

Focusing on the "legal identity" of crypto companies in terms of bank accounts, payment channels, etc., the report is expected to propose policy ideas for integration with traditional finance while strengthening risk isolation.

3. National security perspective

In response to potential issues with digital assets in cross-border transactions, sanctions evasion, and money laundering risks, the report will emphasize the development of "compliance technology" and promote the connection between technical means and regulatory needs.

4. Technological neutrality and regulatory boundary demarcation

"Regulation based on function rather than technology" may become the main theme of the report, clarifying the functional boundaries of various regulatory agencies and solving the "multiple management" and "regulatory gaps" that have plagued the industry for many years.

Cody Carbone pointed out that if the bottom line of "what can and cannot be done" can be clearly defined, it will greatly enhance industry confidence.

Holdings mystery: How much BTC does the US government actually hold?

In addition to the regulatory blueprint, another highly anticipated part of the report is the first official disclosure of the U.S. government's crypto asset holdings.

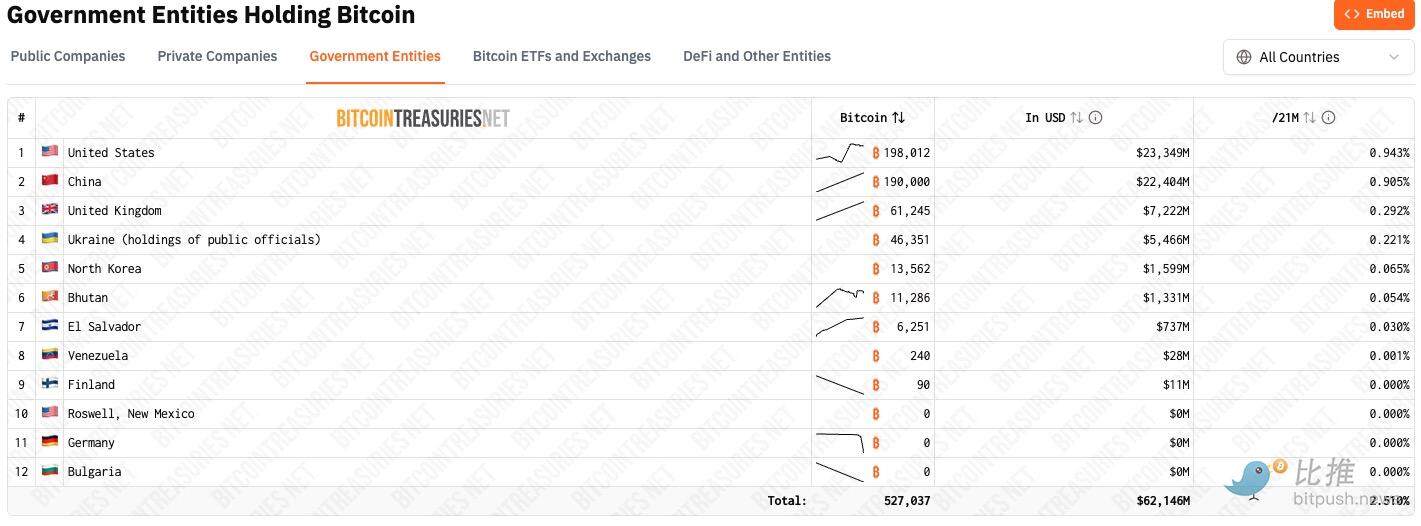

For years, the claim that the US government holds the largest amount of Bitcoin in the world has been widely circulated online. According to estimates by the BitcoinTreasuries platform, the US government holds approximately 198,000 BTC, far exceeding any other country.

However, independent journalist L 0 la L 33 tz recently requested Bitcoin holdings data from the Department of Justice through the Freedom of Information Act (FOIA), and the results showed that the Department of Justice only holds 28,988 Bitcoins. This figure is far lower than market expectations, raising the question of "How could nearly 170,000 Bitcoins have been sold?"

A more neutral explanation comes from community user Shifu Dumo. He argues that the FOIA data only reflects the currently liquid assets of the U.S. Marshals Service (USMS), a subsidiary of the Department of Justice. Some assets may have been frozen, used to compensate victims, or held by other institutions, and are not included in the DOJ's report.

However, this also means that the number of Bitcoins that actually belong to the U.S. federal government and can be used for the "national strategic reserve" may be far lower than the outside world imagines.

Crypto commentator “The ₿itcoin Therapist” directly asked Bo Hines, the executive director of crypto affairs at the White House, on social media: “How much Bitcoin does the US government hold? Isn’t it important to reveal it?” This sentence fully expresses the community’s desire for transparency.

This upcoming White House report is expected to reveal the true situation of the US government's Bitcoin holdings and provide an official explanation for these "disappearing" Bitcoins, thus answering long-standing questions in the market.

Industry Response: Signals of Entering the "Adoption Phase"

The industry has generally responded positively to the upcoming report. Summer Mersinger, CEO of the Blockchain Association, believes it marks the beginning of the implementation phase of the crypto executive order.

Ron Hammond, policy director at Wintermute, viewed the report as "an important step for Trump to deliver on his promises to the crypto industry."

In the view of Jordi Visser, Managing Director of 22 V Research, we are at an inflection point in the crypto industry, moving from "experimentation" to "acceptance and adoption." He likens the current stage to "the ChatGPT moment of the crypto world."

With regulatory expectations becoming clearer and institutional investors entering the market at an accelerated pace, Bitcoin prices have recently rebounded strongly, briefly breaking through the $120,000 mark. As of press time, it remains stable above $117,000, with a total market capitalization of $3.85 trillion.

This report not only presents a comprehensive overview of the Trump administration's crypto policy but also marks a significant moment for the global crypto market. How will it strike a balance between encouraging innovation and mitigating risks? And will it address the trust gap surrounding the US's strategic position? The answers will soon be revealed.

- 核心观点:白宫首份数字资产报告将定义美国加密监管框架。

- 关键要素:

- 明确稳定币、银行准入等四大监管领域。

- 首次披露美国政府比特币持仓数据。

- 行业视为加密“采纳期”关键转折点。

- 市场影响:推动监管透明化与机构加速入场。

- 时效性标注:中期影响。