15% - This seems to be the "new baseline" tariff line for all future US trade agreements. According to the latest announcements from the United States, Japan and the European Union last weekend, the European Union has now agreed to accept a general tariff rate of 15% like Japan, but there are still some unsettled details in terms of energy procurement and VAT arrangements. Overall, the agreement is expected to bring about $90 billion to $100 billion in additional tariff revenue to the United States and attract about $600 billion in new investment from continental Europe. If everything is implemented, it will be a pretty good report card for the authorities.

At the same time, the United States also announced that it would extend the grace period for tariffs on China by 90 days. However, the market is still waiting to see whether the United States and China can achieve a substantial breakthrough, especially in the context of the relatively stringent tariff conditions faced by Asia (excluding Japan). This issue is still under development.

On the other hand, the stock market continued to rise strongly, reaching new highs. This was mainly due to corporate earnings performance that was "just on target" compared to expectations (led by Alphabet), and the significant easing of relations between President Trump and Federal Reserve Chairman Powell. After a media-filled visit to the Federal Reserve headquarters, Trump said:

"Firing Powell is unnecessary, the Fed will take the right action"

“Powell tells me the economy is good.”

“Powell is a very good person.”

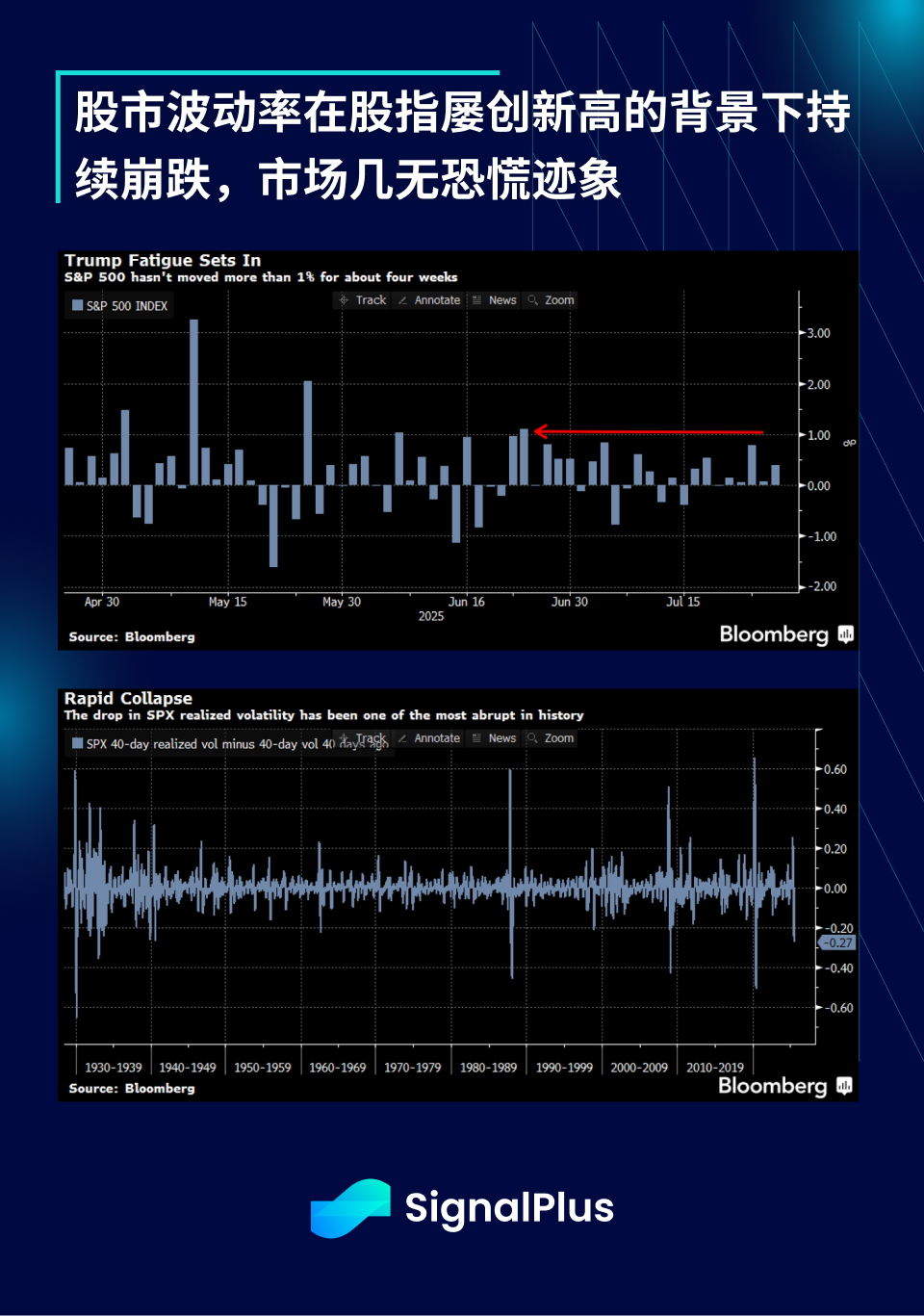

The dollar rebounded as one of the most influential political uncertainties eased, the yield curve flattened last week, European and Japanese stock indices rose on the prospect of an "acceptable" trade deal with the United States, and stock market volatility continued to fall, presenting one of the most persistent downward trends in history.

Even more unfavorable for bears, momentum indicators are breaking out across the board, the market is showing good breadth, and the benchmark index and the equal-weighted SPX index hit new highs last week. The 13-week and 26-week moving averages have formed a golden cross, and bond traders have also significantly lowered their expectations for rate cuts amid high risk sentiment.

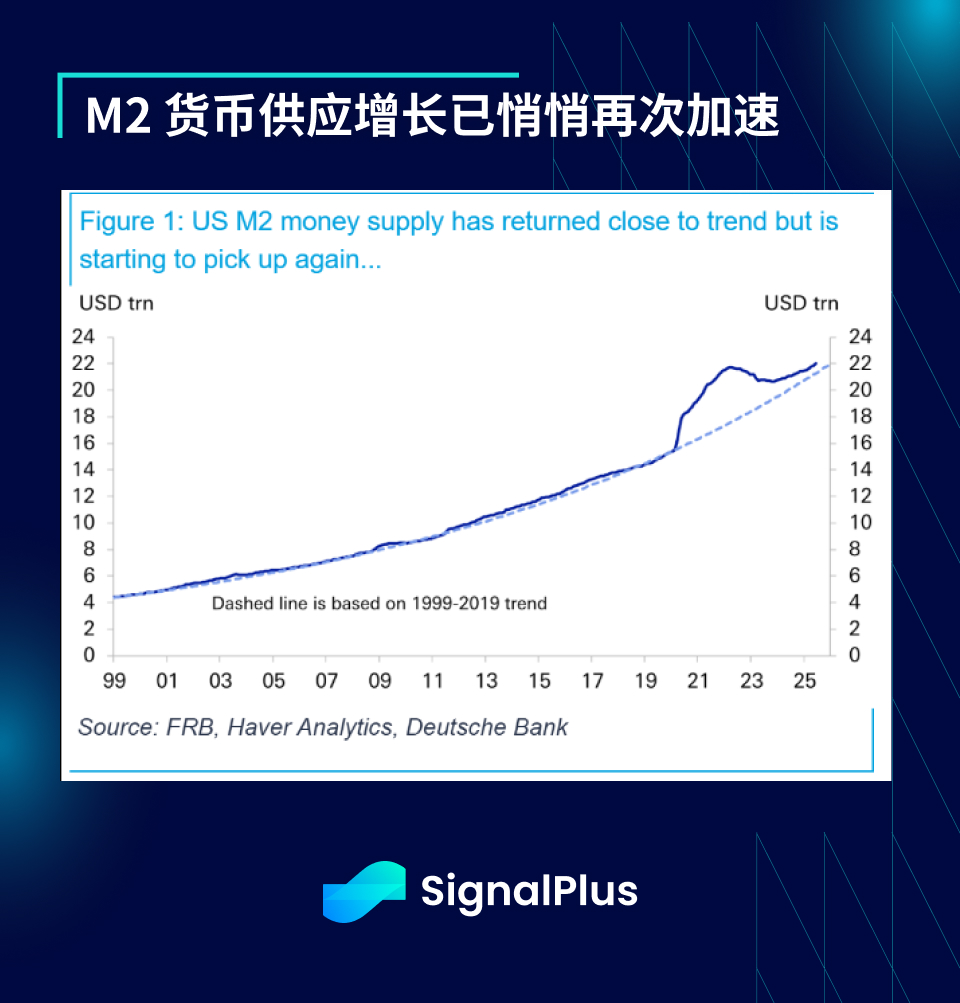

The macro and financial situation also remains favorable. With the recent dovish turn of global central banks and the weakening of the US dollar, the growth of M2 money supply has quietly picked up, which provides positive support for financial assets and fixed assets (including commodities and cryptocurrency assets).

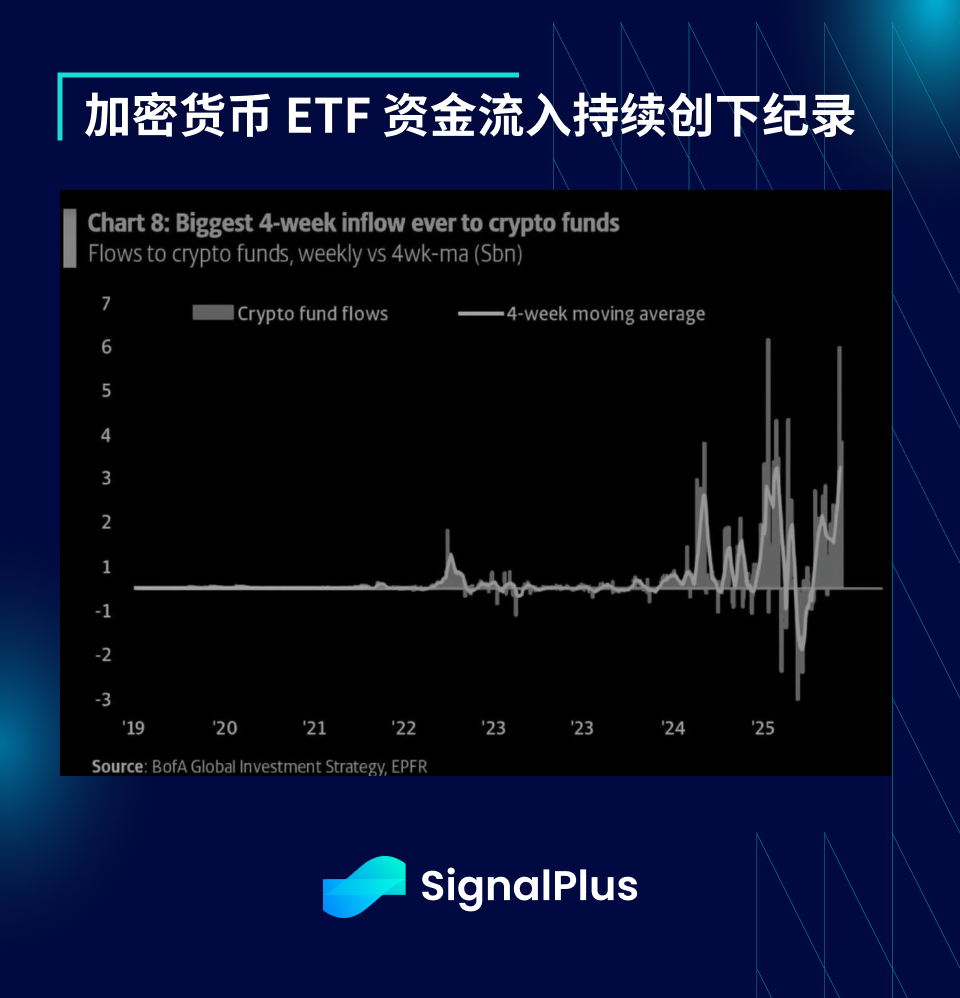

Back to cryptocurrencies, despite Galaxy Digital reporting that a “Satoshi-era” investor took $9 billion in profits, the market was barely affected, with BTC holding steady near $120,000 and ETH returning to the $4,000 mark. This wave of OG selling pressure was offset by record-breaking spot ETF inflows, with crypto assets seeing net inflows for 14 consecutive weeks, with cumulative net inflows of $27 billion year-to-date and nearly $4.4 billion in weekly net inflows.

ETF spot trading volume also continued to hit new highs, with weekly trading volume approaching $40 billion. Among them, ETH performed the best, with inflows reaching $2.1 billion, almost double the previous record, and cumulative inflows since the beginning of the year have reached $6.2 billion. In the past three and a half months, the total assets of ETH ETFs have risen by nearly 25%.

ETF inflows are still almost dominated by the United States, accounting for more than 97% of the total weekly inflows. The narrative adopted by mainstream institutions is still hot. Goldman Sachs and Bank of New York Mellon announced a partnership to use Goldman Sachs' "GS DAP" platform to handle some tokenized BNY funds. Although this move is a positive development for the industry as a whole, what is more noteworthy is a sentence in the official statement:

BNY will continue to "maintain the fund's official books, records and settlements in accordance with currently approved guidelines." - Bloomberg

In other words, the final legal and operational decision-making power is still in the hands of the existing "paper system", which is not entirely consistent with the future imagined by DeFi/chain-native users, but this is probably the price that must be paid for mainstreaming.

Looking ahead, the market does look hot (but what asset class isn't?), and Bloomberg points out that an increasing part of the current BTC rally comes from expectations of "monetary policy", that is, a dovish liquidity outlook. We don't have a particularly strong opinion on this breakdown, but it can be noted that the recent gold price appears to be more fragile after several failed attempts to attack. If it falls back to the $3,000-$3,200 range in the short term, it may have a certain drag on BTC.

Having said that, it is still the best to follow the trend (please study DYOR on your own), and we still recommend avoiding going against the trend. Until you receive new signals, please continue to keep your faith and enjoy this summer. I wish you all good luck and happy trading!

You can use the SignalPlus trading indicator function for free at t. signalplus. com/crypto-news/all. Through AI integration of market information, market sentiment is clear at a glance.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between the English and the number: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

- 核心观点:加密货币市场持续走强,ETF资金流入创新高。

- 关键要素:

- 加密货币ETF周流入44亿美元,累计270亿美元。

- ETH ETF流入21亿美元,创纪录增长。

- 机构合作推进代币化,但传统系统仍主导。

- 市场影响:加密货币市场信心增强,机构参与度提升。

- 时效性标注:中期影响。