ETH vs SOL: Crypto War in 2025, Trillion Capital Bet on the New and Old Order

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

“2021 is the year of Layer 1’s dominance, and 2024 is the year of Meme’s carnival. So, where will the main market trend go in 2025?”

The answer to this hotly debated question on the X platform is being clearly revealed by mainstream capital: With the successful legislation of the GENIUS Act and the formal inclusion of stablecoins in the U.S. sovereign regulatory framework, a new multi-dimensional financial narrative integrating "stablecoin × RWA × ETF × DeFi" is rising strongly.

In this profound evolution of cross-chain finance, the core focus is no longer Bitcoin or Meme coin, but the battle between Ethereum and Solana over the old and new order. The two public chains have essential differences in technical architecture, compliance strategy, expansion path, ecological construction model and even value foundation.

At present, this competition that will determine the future has entered a critical stage where capital is making fierce bets with real money.

Capital betting preference: from "BTC belief" to "ETH/SOL two choices"

Unlike the previous crypto bull market driven by macro-currency and with general ups and downs, the market in 2025 shows obvious structural differentiation. The top projects are no longer rising synchronously, and funds are concentrating on betting on selected battlefields, and the trend of survival of the fittest is emerging.

The most intuitive signal comes from changes in institutional buying strategies:

On the ETH side: A number of US listed companies have begun to build Ethereum asset vaults on a large scale .

On July 22, GameSquare announced that it would increase its digital asset treasury authorization to $250 million and hold an additional 8,351 ETH, with the clear goal of "allocating high-quality Ethereum ecological assets and achieving stablecoin returns";

SharpLink Gaming has accumulated 19,084 ETH this month, with a total holding of 340,000 ETH and a market value of over $1.2 billion.

A new wallet address bought more than 106,000 ETH through FalconX in the past 4 days, worth nearly $400 million;

The Ether Machine announced that it will complete its backdoor listing plan with 400,000 ETH, and has received more than $1.5 billion in financing support from top institutions including Consensys, Pantera, and Kraken, aiming to become the "largest public ETH output company." (Also recommended article: "400,000 ETH whale is born! Countdown to the approval of The Ether Machine, the first Ethereum asset management platform in the US stock market" )

On the SOL side: the buying scale is equally astonishing, and has a more explosive speculative temperament.

DeFi Development Corp, a listed company, announced that it had increased its holdings by 141,383 SOLs, bringing its total holdings close to 1 million.

SOL treasury company Upexi announced that it bought 100,000 SOLs for $17.7 million, with a total holding of 1.82 million SOLs and a floating profit of more than $58 million.

According to CoinGecko data, PENGU has a market value of US$2.785 billion, surpassing BONK (US$2.701 billion) to become the Solana ecosystem Meme coin with the largest market value.

These phenomena indicate that ETH and SOL have become the preferred underlying assets for institutional multi-asset allocation. However, the investment logic of the two is significantly different: ETH is used as " on-chain treasury bonds + high-quality asset underlying + spot ETF access institutional target "; SOL is being built into " high-performance consumer application chain + the main battlefield of the new Meme economy ".

The two betting methods represent the expectations for the two main lines of the future of the crypto market: ETH is a financial engine taken over by the system, and SOL is a speculative track for capital offensive bets.

ETH: The misunderstood institutional axis is fulfilling the mission of financial assets

Over the past two years, the Ethereum narrative has been questioned as “idle”. From the lack of significant improvement in staking income after the merger, to the fragmentation of the Layer 2 ecosystem and high gas fees, to the voluntary relocation of projects such as dYdX and Celestia, the market’s expectations for ETH have fallen to a low point.

But the reality is: ETH has never left the market, but has become the core asset most closely tied to the institutional narrative. Its underlying support lies in the deep institutional synergy in three dimensions:

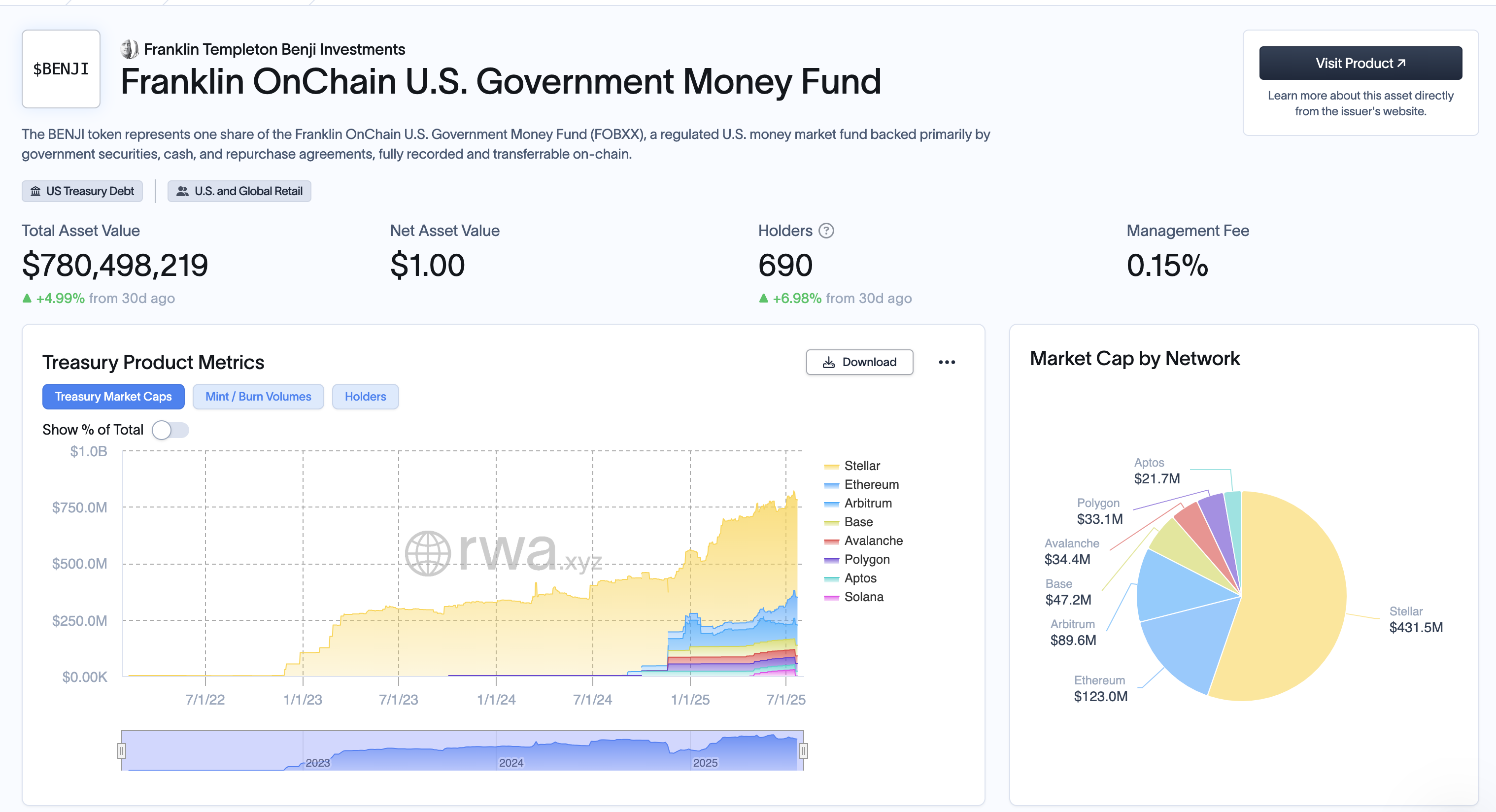

RWA's core hub status is established

The total amount of RWA issued on the chain currently exceeds 4 billion US dollars, of which more than 70% occurs on the Ethereum mainnet and its L2 network. Core products including BlackRock's BUIDL, Franklin Templeton's BENJI, Ondo's USDY, Maple's cash fund, etc. all use ETH as the key hook layer or liquidity medium (such as WETH). The larger the scale of RWA, the more indispensable ETH is.

Spot ETF and Stablecoin Policy Anchor Assets

After the passage of the GENIUS Act, stablecoin issuers such as Circle and Paxos clearly set "on-chain reserve transparency" and "short-term U.S. debt pledge structure" as core demands. In Circle's latest asset allocation, WETH has risen to 6.7%. At the same time, Grayscale, VanEck and other institutions are accelerating the preparation of Ethereum spot ETF products. After BTC, ETH is likely to become the next ETF focus.

On-chain lock-up and developer ecology still have absolute advantages

As of July 22, the total TVL of Ethereum mainnet and L2 network reached 110 billion US dollars, accounting for 61% of the global crypto TVL. The monthly active developers of ETH are stable at more than 50,000, which is 4 times that of Solana and more than 8 times that of other L1. This means that no matter how the market narrative changes, ETH, as the "main financial layer" for on-chain asset governance, value precipitation and liquidity distribution, its institutional foundation and ecological stickiness will be difficult to shake in the short term.

In terms of price, ETH has approached the $4,000 mark. With BTC breaking through and stabilizing above $120,000, the process of ETH rekindling market expectations is not the creation of a new story, but the rediscovery of old values.

SOL: Native consumption power on the chain, the capital logic behind the explosive power

Compared with Ethereum's "financial hub" positioning, Solana is more like a consumer infrastructure in high-frequency scenarios. Its narrative has successfully transformed from "the chain with the best technical parameters" to "the native blockbuster manufacturing machine on the chain", and will usher in a structural breakthrough in 2024-2025.

MemeCoin’s native market, not a secondary transfer:

In this round of "crypto consumer goods" craze, the number and liquidity of MemeCoins emerging on the Solana chain hit a record high. Market data shows that as of July 22, BONK, the Meme project with the highest market value on Solana, reached US$2.67 billion, followed by PENGU (US$2.32 billion) and TRUMP (US$2.2 billion). The total market value of the three has surpassed Dogecoin. With Solana's extremely low gas fee and high TPS, these projects have formed a fast closed loop of "low-cost experiment → community-driven FOMO → high-frequency trading stimulation". On Solana, Meme has become the native consumption behavior of users on the chain.

Capital is betting on "on-chain activity" rather than technical routes:

The huge increase in holdings by listed companies such as DeFi Development Corp and Upexi shows that mainstream capital is viewing SOL as a trinity of "tradable assets + user growth indicators + narrative carriers", with its focus on ecological activity, transaction depth and the consumer attributes of "on-chain stories" rather than technical details.

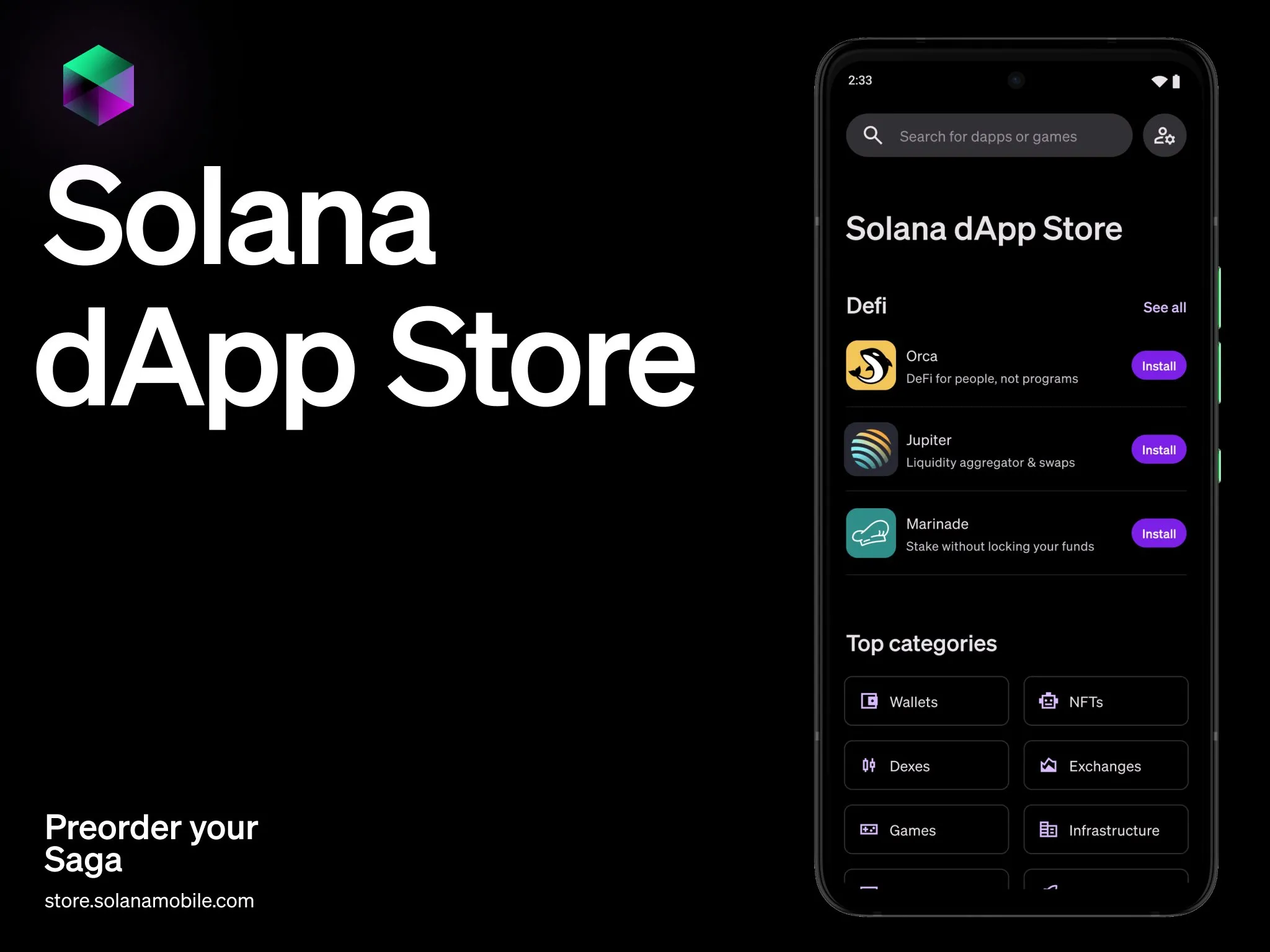

Ecological products are moving from hot products to the "basic consumption layer":

From Jupiter's DEX experience, Backpack mobile wallet, to Solana mobile phone and the upcoming Solana App Store, the entire ecosystem is trying to build a closed loop that is closer to the habits of Web2 users. On-chain native consumption (including Meme, DePIN, mini-games, community points, social media) has become Solana's "local life", creating a natural consumption scenario for SOL. Although its TVL is only 12% of Ethereum, the transaction frequency, per capita interaction and total Gas consumption on the Solana chain have significantly exceeded traditional L1s such as Polygon and BNB Chain. It is more like a "daily active entry" for crypto natives rather than a pure financial "pricing anchor".

Price signal: Break through $200 and enter the high volatility main rising wave:

As BTC stabilizes at $120,000 and ETH sprints to $4,000, SOL has also recently returned to above $200. High volatility accompanied by high popularity is itself a precursor to the brewing of new narratives and the main players' position changes. What we see is not speculative frenzy, but an increasingly shorter feedback loop between "on-chain behavior-price response".

This is a model where transaction expectations are driven by consumption data. ETH cannot do this, so SOL has become the paradigm.

Giant whale game and policy catalysis: Who can take over the bullets of the main force's position change?

Technological applications determine the "narrative potential" of the public chain, while funds and policies determine its "transaction carrying capacity" - especially when BTC breaks through $120,000 and the market enters the main uptrend, it is crucial to identify the next stage of the "fund convergence area".

On-chain data shows that since Q2 2025, the three major institutions have shown completely different strategies for "on-chain position building": Grayscale continued to increase its holdings of ETH from May to July (a total of 172,000 pieces, approximately US$640 million), which was explicitly used to build its spot ETH ETF base position; Jump Trading has frequently adjusted its positions on the Solana chain since June, focusing on BONK, PENGU and Jupiter, and has accumulated nearly 280,000 SOL through multiple addresses; DeFi Development Corp and Upexi, two listed companies, continued to announce increases in SOL holdings, and both have formed positions of more than one million (with a total market value of nearly US$500 million) and achieved considerable floating profits.

This is not a simple “win or lose” bet, but a market stratification: ETH is a “structural asset allocation” and SOL is a “short-term volatility tool”.

Differentiation of policy directions boosts "double-line growth". On July 19, US President Trump officially signed the "GENIUS Act", the first federal regulatory framework for stablecoins in the United States. Coinbase and BlackRock submitted S-1 spot ETH ETF documents, and the path of "ETH inclusion in the compliance framework" is becoming increasingly clear. At the same time, the Solana team cooperated with exchanges such as OKX and Bybit to promote the "compliant issuance of consumer assets" experiment. For example, OKX launched the Solana on-chain asset-exclusive Launchpad in July and introduced a light KYC mechanism for the Meme coin issuance process.

This "two-way compliance" means that policy dividends are being distributed differently according to application scenarios, capital attributes and risk preferences: ETH continues to absorb traditional capital, and SOL becomes a compliance test field for young users and consumption scenarios.

Short-term policy expectations: ETH benefits more obviously, SOL is less restricted. Although ETH is at the forefront of policy dividends in terms of ETF and RWA, it also faces multiple thresholds from the SEC in terms of securities attribute identification and pledge classification. Since the SOL ecosystem is less involved in centralized issuance and complex pledge channels, its tokens and applications are more likely to enter the regulatory "gray safety zone". This results in ETH's rising path being more stable but with a longer cycle, and SOL's rising path being steeper and more volatile.

Who defines the future? Hedging, not choosing between two options

Judging from the market path of BTC after breaking through $120,000, the difference between ETH and SOL is no longer a linear question of "who replaces whom", but a distributed answer of "who defines the future in what cycle".

ETH is the protagonist of the medium- and long-term narrative under structural support

With the support of the GENIUS Act, the path for ETH to be included in the financial compliance system is clear. Whether it is the promotion of spot ETFs or its positioning as the "clearing and settlement layer" in the RWA model, it has become the "core asset" for Wall Street to configure blockchain assets.

Judging from the position building logic of institutions such as BlackRock and Fidelity, ETH is evolving from a "Gas Token" to a "basic financial platform", and its valuation anchor has also shifted from on-chain activity to the Treasury bond yield model and Staking interest rate. ETH's way to win is not an explosion, but a precipitation.

SOL is a short-term burster in structural cracks

Compared with the stability of ETH, SOL has become the main battlefield for capital games in terms of high-frequency trading, Meme coin narratives, terminal applications, and native consumer products (such as Saga mobile phones). From BONK to PENGU, and then to the governance experiment of JUP, the Solana chain has built a highly liquid and highly permeable "native narrative market".

Combined with the actual performance on the chain: SOL's TPS, cost, and terminal response speed continue to lead; and the independence of the SVM ecosystem also allows it to get rid of the dilemma of EVM ecosystem involution and duplicate construction.

More importantly, SOL is one of the few narrative depressions that is "capable of taking on funds and willing to experience high volatility". After BTC starts its main upward trend, it becomes a core short-term option for capturing "quick response to fund rotation".

Therefore, this is not a "multiple choice question" but a "periodic game question":

For medium- and long-term funds that are optimistic about institutional change and bet on the structured entry of traditional capital, ETH is the first choice. For short-term participants who want to capture opportunities for capital rotation and narrative explosion, SOL provides more tense Beta exposure.

Between narrative and system, volatility and sedimentation, ETH and SOL may no longer be opposing options, but constitute the optimal combination in a mismatch of an era.

Who defines the future? At present, the answer may not be a single project, but the continuous fine-tuning process of this "combination weight".