The bill of "Crypto Week" was stuck, but ETH soared 12% to break through $3,400

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

This should have been a week to boost industry confidence, but now it has added an extra layer of "uncertainty" due to repeated legislative changes.

On July 16, Beijing time, Trump announced on social media that he had met with 11 key congressmen and obtained their support, pushing the GENIUS Act into a formal vote.

In the early morning of July 17, the U.S. House of Representatives passed a procedural vote with a vote of 217: 212 , formally establishing the proceedings of three crypto bills, including "GENIUS", "CLARITY" and "Anti-CBDC". Although this vote is not the final passage of the bill, it means that the legislation has entered the final stage, and the stablecoin bill will enter the final vote as early as this Thursday.

This "Crypto Week" is moving closer to reality from anxious waiting, while the market is quietly strengthening on the other end.

OKX real-time quotes show that ETH broke through the $3,400 mark this morning, reaching a high of $3,428, with a 24-hour maximum increase of 11.91%. As of press time, it has fallen back to 3,380 USDT; BTC is relatively calm, with its highest point fluctuating around $120,000. The maximum 24-hour increase is only 3.14%, and the current price is 118,740 USDT.

Other altcoins also saw a general rise this morning. BONK's 24-hour maximum increase was 21.2%, currently trading at 0.000037854 USDT; CRV's 24-hour maximum increase was 13.31%, currently trading at 0.9226 USDT; JUP's 24-hour maximum increase was 9.56%, currently trading at 0.53 USDT; BOME's 24-hour maximum increase was 18.43%, currently trading at 0.002113 USDT; SOL's 24-hour maximum increase was 6.55%, currently trading at 170.81 USDT.

As the U.S. House of Representatives passed a procedural vote on cryptocurrency-related bills, cryptocurrency concept stocks generally rose, including: Coinbase (COIN) rose 4.21% to $404.26; Circle (CRCL) rose more than 22% to $238.58; Strategy (MSTR) rose 2.29% to $452.42%; Mara Holdings (MARA) rose 5.17% to $19.73.

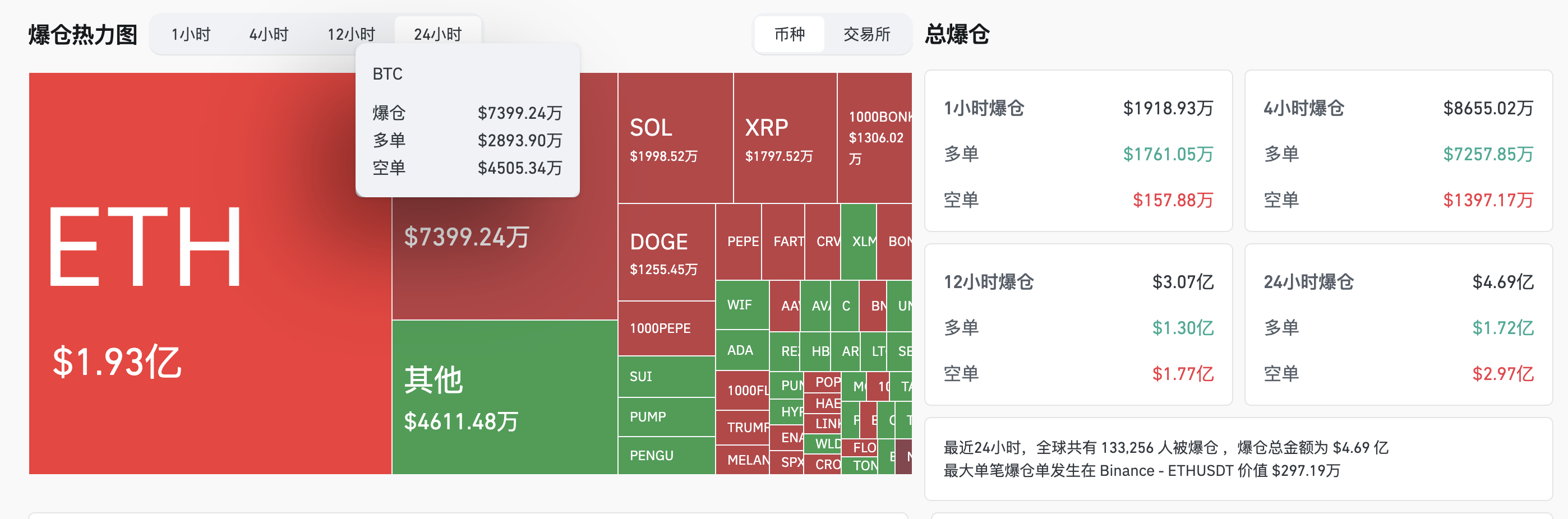

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has a liquidation of US$469 million, of which long orders have a liquidation of US$172 million and short orders have a liquidation of US$297 million. In terms of currencies, BTC has a liquidation of US$73.9924 million and ETH has a liquidation of US$193 million.

The rise of ETH is not a single point outbreak, but the result of structural funds. On-chain data shows that in the past 48 hours, many institutions and large addresses have completed the "silent accumulation" of ETH.

Profit-taking and bottom-fishing are intertwined, and the main players on the chain split and started fighting

Trend Research's substantial reduction in holdings has undoubtedly become the focus of market attention.

According to Lookonchain data , it has sold a total of 69,946 ETH in the past 24 hours, with a cash amount of up to $218.3 million. In just one transaction last night, it sold 21,000 ETH, worth about $67 million. Despite this, the institution still holds more than 115,000 ETH, with a book value of nearly $380 million.

But other forces are quietly taking over.

SharpLink Gaming purchased 10,614 ETH through its strategic account today, worth about $35.62 million. Its total holdings have reached 296,508, with a value close to $1 billion, making it one of the most aggressive ETH financial allocators on the chain.

Buyers and sellers are not opposites, but two ends of the game. The main forces are in disagreement, and the market is pricing. The increase in ETH is not a castle in the air, but a revaluation after a "chip rotation".

The bill is stuck, why did ETH rise sharply?

On the surface, the delay of the bill should be a negative factor. However, the market did not fall as a result, but instead showed signs of rebounding and rising.

Oppenheimer analyst Owen Lau pointed out in an interview with CNBC that the passage of bills such as GENIUS is a matter of “when” rather than “whether”. The passage of the procedural vote has cleared the institutional obstacles for formal legislation.

But what really drives ETH’s strong rise is the increasingly clear asset narrative behind it.

On the one hand, in May 2024, the SEC approved the listing applications of several Ethereum spot ETFs, and officially started trading in July, marking that ETH officially entered the mainstream investment market in the United States after Bitcoin. The current focus of the market has shifted to the subsequent capital inflow, whether the pledge function is supported, and whether the launch of related option products is allowed.

On the other hand, since the Ethereum Foundation started the structural reform at the beginning of the year, the traditional financial market has been increasingly accepting of ETH. Following the MicroStrategy effect, US-listed companies such as SharpLink Gaming have also begun to include ETH in their balance sheets for long-term reserves.

In addition, ETH's core position in on-chain finance also makes it naturally possess the attributes of a "digital sovereign asset" that can fight against liquidity tightening and dollar fluctuations. In short, ETH is no longer a "cryptocurrency platform currency" but is slowly becoming a "on-chain version of national debt."

Market outlook: The triple game of legislation, interest rate cuts and “copycat season”

ETH’s breakthrough may just be the beginning of this new cycle.

The FOMC meetings on July 22 and July 30 are seen as key windows for this round of macroeconomic game. Once the Fed releases a signal of rate cuts, the crypto market will usher in a second layer of liquidity drive.

In terms of legislation, the U.S. House of Representatives has advanced three key crypto bills, GENIUS, CLARITY and Anti-CBDC, into the final voting stage today. The stablecoin bill is expected to be voted on as early as Thursday, and if passed, it will be sent to the president for signature. Even if the final number of votes is uncertain, the mere entry into the voting process has boosted market risk appetite.

More importantly, ETH’s strength is also reigniting expectations for a “altcoin season.”

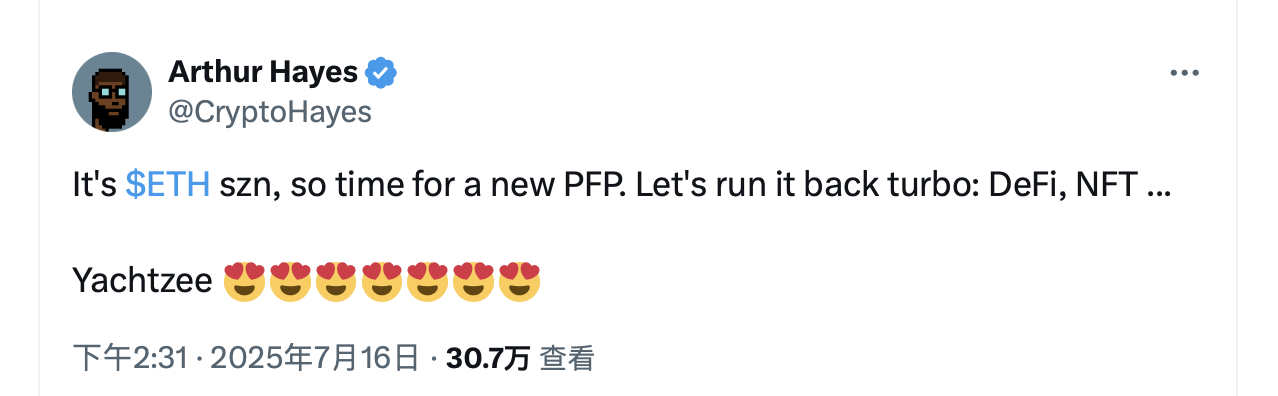

On-chain data shows that emerging public chain tokens such as SUI and HBAR have risen by more than 12% in 24 hours, and mainstream altcoins such as SOL, AVAX, LTC, and DOGE have also turned red. BitMEX co-founder Arthur Hayes wrote yesterday: "The Ethereum season has arrived," and predicted that ETH will outperform BTC, and the DeFi and NFT sectors will also pick up. He even changed his social platform avatar to CryptoPunk to show his confidence.

Conclusion: FOMO sentiment has not really spread yet

From Trump personally pressuring the bill, to ETH's strong breakthrough of 3,400, to on-chain institutions steadily building positions, the script of this "Crypto Week" seems to be being rewritten.

But the market is not fully resonating at the moment, BTC is sideways, altcoins are diverging, and FOMO sentiment has not really spread. Perhaps, this is the time for calm people to enter the market. When you hear the audience shouting "altcoins take off" next time, ETH may have already flown ahead.