Staking TON for a UAE Golden Visa? The announcement was reversed 20 hours later

Original | Odaily Planet Daily ( @OdailyChina )

Author: jk

Over the weekend, the TON Foundation announced a plan to obtain a 10-year "golden visa" in the UAE by staking Toncoin , which sparked heated discussions in the market and caused the price of Toncoin to soar. However, the relevant UAE government departments subsequently issued a statement denying the existence of any such official project , and the price of Toncoin immediately gave up the gains. Why did the TON Foundation promote such a visa project on such a large scale? Will there be a reversal in the future? Odaily Planet Daily will take you to explore the cause and effect.

TON Foundation Launches Golden Visa Staking Program

On July 6, Max Crown, CEO of the TON Foundation, announced a "groundbreaking plan" on the social platform X, claiming that Toncoin holders have an "exclusive opportunity" to obtain long-term residency in the UAE by staking cryptocurrencies. The plan requires applicants to stake $100,000 worth of Toncoin for three years and pay a one-time $35,000 processing fee to apply for a 10-year UAE golden visa.

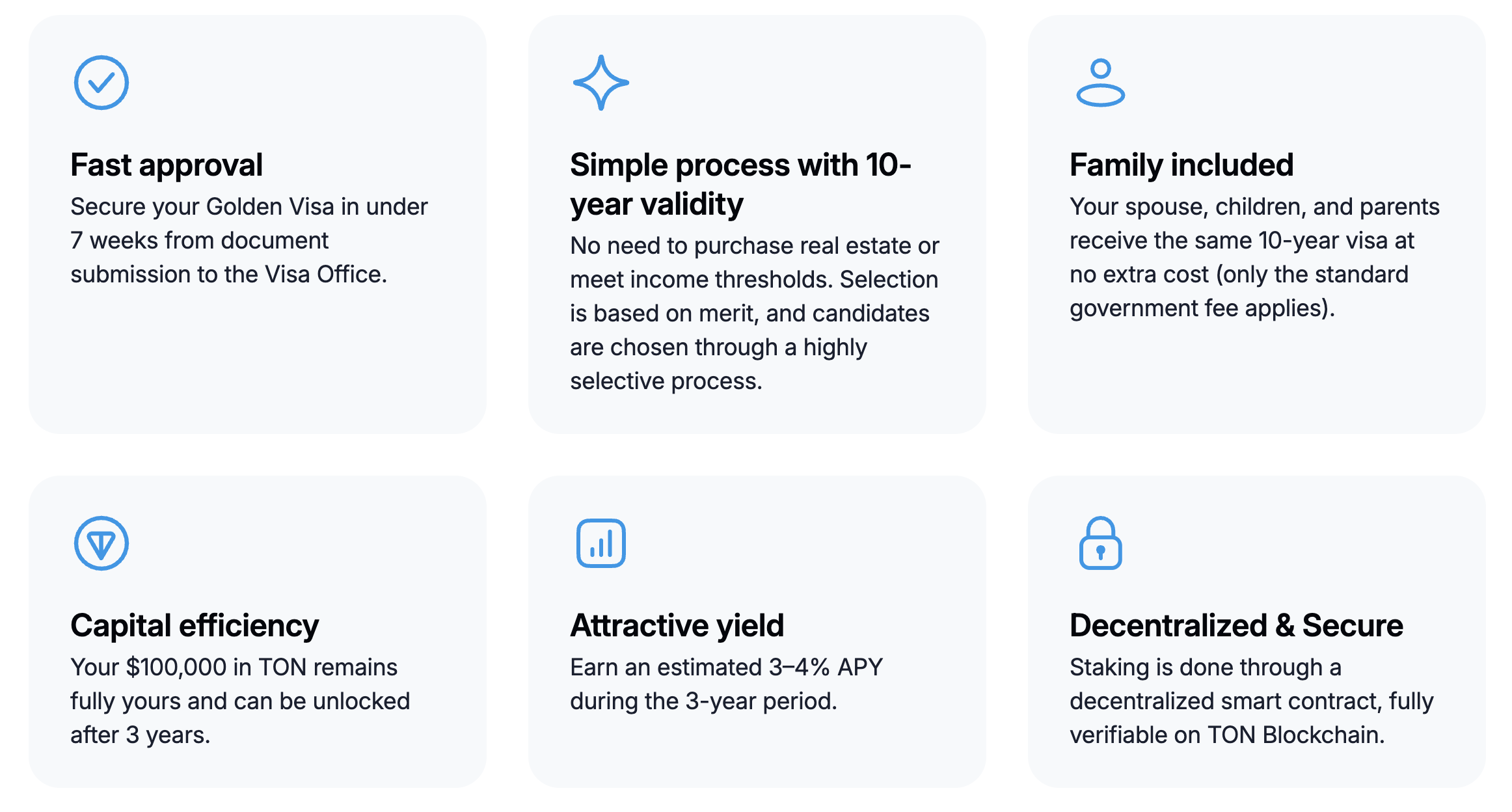

The TON Foundation's official website highlights several advantages of this program, including fast approval within about seven weeks from the submission of materials, a simple process without the need to purchase real estate or meet income thresholds, and the ability to include family members such as spouses, children and parents in visa applications at no additional cost . This project is promoted as a more cost-effective alternative to traditional routes - traditional applications for golden visas usually require at least about US$540,000 (RMB 4 million) in high-value and low-liquidity assets such as real estate or deposits. The founder of Telegram also forwarded the relevant news on social media, attracting wider attention.

At the same time, the pledged assets can also obtain a return rate of 3-4% per year.

After the announcement, the price of Toncoin surged. According to public data, on July 6, Toncoin quickly climbed from about $2.75 to a high of about $3.06, with a short-term increase of more than 12%. By the close of the day, the price of Toncoin fell back to $2.89, still up about 5% on the day, and the 24-hour trading volume surged by more than 250% compared with the 30-day average.

The UAE officials denied and clarified

However, UAE officials quickly clarified the rumor.

On July 7, the UAE Federal Authority for Identity, Citizenship, Customs and Port Security, the Securities and Commodities Authority and the Dubai Virtual Assets Regulatory Authority issued a joint statement through the Emirates News Agency, denying the existence of an official program of "pledging digital currency in exchange for golden visas." The statement clearly stated that the issuance of UAE golden visas has a clear and officially approved framework and standards, which does not include the category of digital currency investors . The regulator emphasized that digital asset investments are subject to specific regulations and have nothing to do with golden visa eligibility. The Dubai Virtual Assets Regulatory Authority also added that the TON project has not been licensed or endorsed by regulators in Dubai. The relevant departments called on investors to obtain information from reliable official channels to avoid being misled or defrauded.

Affected by the official clarification, the crypto market's enthusiasm for Toncoin quickly reversed. Toncoin prices quickly fell from their previous highs after the news came out, from about $3.03 to around $2.84, a drop of about 6%, basically giving up the gains previously gained due to rumors.

Comparison between TON channel and official Golden Visa threshold

Why did the UAE government immediately come out to clarify the relevant issues? Putting aside the attitude towards virtual assets, it is because the channels promoted by TON are much cheaper than the official channels.

The UAE Golden Visa is a long-term residence program launched by the country since 2019, aimed at attracting outstanding talents and major investments. The visa period is 5 to 10 years, allowing foreigners to live, work and study in the UAE without a local sponsor. Strict conditions must be met to apply for a Golden Visa, including categories such as special skills (such as doctors, scientists), public investment and venture capital. Among them, investment applicants must have an investment of at least 2 million dirhams (about 544,000 US dollars, 4 million RMB) in the UAE to qualify for a Golden Visa, and buying a house also requires the property market value to reach the same threshold amount.

This official threshold is much higher than the amount of the pledge plan proposed by the TON Foundation: the TON plan requires staking $100,000 worth of Toncoin (about 367,000 dirhams) and paying a handling fee of $35,000, totaling about $135,000 (about 500,000 dirhams), less than a quarter of the official investment-type golden visa funding requirements. The TON Foundation claims that its crypto pledge plan provides a faster, lower-cost and digital immigration path, and that residency can be obtained without buying a house or making a large deposit, which is promoted as an innovative measure that fits the UAE's image as a crypto-friendly country. However, as the UAE official later announced, the golden visa review has a fixed framework and currently does not take cryptocurrency holdings into consideration.

Analysis: Was the TON Foundation scammed by an intermediary?

According to Coindesk, this is actually a method used by a third-party legal service agency to assist in applying for the UAE "entrepreneur visa" with the help of Toncoin tokens, rather than a government-exclusive crypto visa channel. To put it bluntly, the TON Foundation was "cheated by the intermediary" and mistakenly believed that the channel was effective, and then was slapped in the face by the official agency.

Some comments also pointed out that the TON Foundation may have been misled by some intermediaries when launching the plan. However, such unverified information was promoted on a large scale, lacking basic due diligence, which greatly reduced people's impression of the TON Foundation. Odaily reminded investors that this incident reminded readers to be cautious about such "tokens for visas" claims - in the high-risk and volatile crypto field, all claims involving major rights such as immigration need to be strictly verified to avoid believing in unofficial propaganda.

It is worth noting that, as of press time, the relevant pages on the TON Foundation's official website about "Staking Toncoin in exchange for UAE Golden Visa" are still visible and have not been removed; the promotional tweets posted by the TON Foundation CEO on the social platform X have not been deleted. This attitude has triggered new speculation: After the UAE officials clearly denied the legitimacy of the plan, why did TON delay in withdrawing the relevant content? Is it because the mistrust of the intermediary information has not been clarified, or is there another cooperation path behind it that has not been made public? Will there be a reversal in the incident? Odaily will continue to follow up on the report.