10x Research: Why no one mentions the signal behind Metaplanet's extremely overvalued stock price

This article comes from "Metaplanet Is Trading at $ 596, 154 per Bitcoin—Time to Short?"

Compiled by: Odaily Planet Daily jk

Bitcoin has risen by $15,000 in a matter of weeks — but not for the reasons the market generally believes. The share price of a “little-known” Japanese listed company Metaplanet reflects an implied value of $596,154 in Bitcoin, more than five times the actual market price. Meanwhile, a dangerous net asset value (NAV) distortion is brewing beneath the surface of the market as Asian trading hours quietly dominate the market narrative.

Volatility continues to decline, retail flows are changing, and the signals we are observing are highly similar to key turning points in history. From Japan's bond market to currency flows to cryptocurrency holding tools such as Metaplanet, something unusual is happening - but it has not yet appeared in mainstream news. If you are looking for the starting point of the next big move, this report is worth reading.

Bitcoin vs. MicroStrategy vs. Metaplanet — Which is Most Likely to be Overvalued?

Core ideas:

Bitcoin is undoubtedly one of the most disruptive innovations of the 21st century, but many misunderstandings surrounding it are still widespread. One of the most basic principles - "Not your keys, not your coins" - is rarely taken seriously. Today's market has moved away from Satoshi Nakamoto's original vision of a "peer-to-peer electronic cash system."

Billions of dollars of retail money are trying to gain exposure to Bitcoin through various financial instruments, but many of these instruments often require high premiums . In some cases, investors even inadvertently bought Bitcoin at $596,154, when the actual market price was only $109,000, a premium of 447%.

Although some of our market views have caused controversy, they have been repeatedly verified by the market as being extremely forward-looking. It is worth mentioning that in December 2022, we pointed out that Grayscale's GBTC was at a 47% discount to NAV (then the price of Bitcoin was $18,000) and listed it as a key investment recommendation for 2023 (the same recommendation also included Solana, which was priced at $13.70 at the time). At that time, market sentiment was extremely pessimistic and there were general concerns about an economic recession.

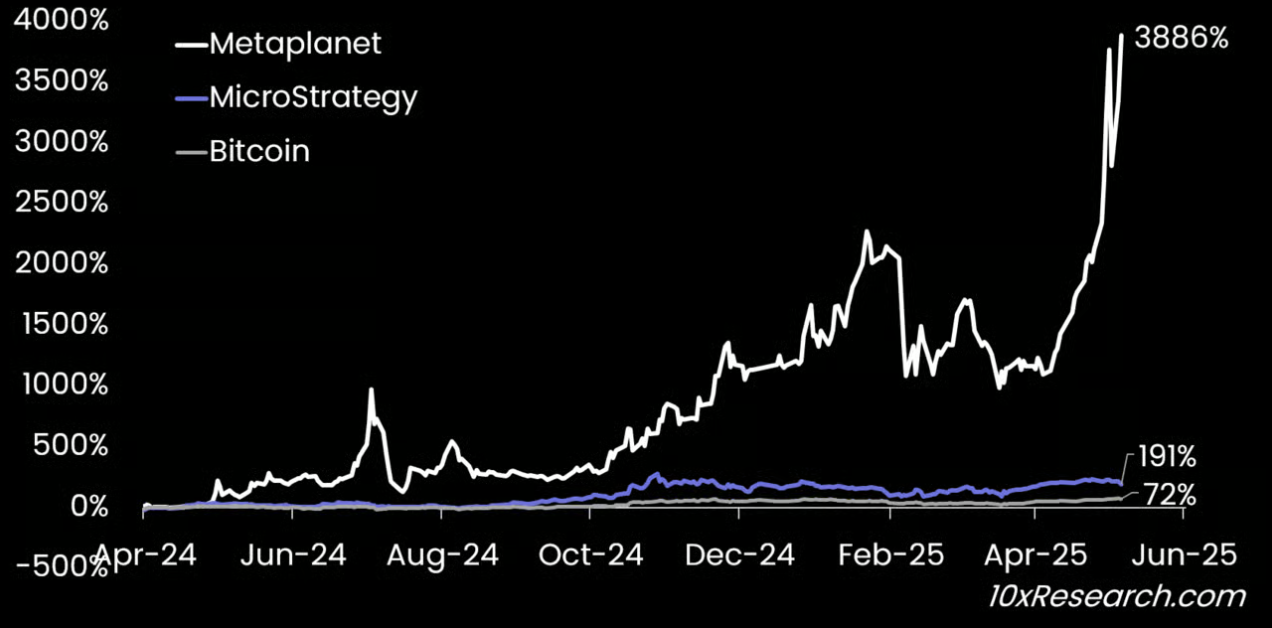

On January 29, 2024, we published the view that "MicroStrategy may be more valuable than the Bitcoin ETF", when the company's stock price was 7% discount to the value of its Bitcoin holdings, effectively capturing the starting point of its subsequent market value revaluation. We also pointed out that MicroStrategy is expected to break out on October 7, 2024, when its stock price was $177 (now it has risen to $380).

text

Most people have no idea what net asset value (NAV) is , let alone that they may be paying an extremely high premium to gain exposure to Bitcoin.

Some investors believe they are getting some kind of upside leverage, similar to the logic Wall Street uses when selling gold mining stocks to retail investors: these stocks are packaged as leveraged bets on rising gold prices, especially when institutions need to sell stocks to retail investors.

MicroStrategy's current share price implies a Bitcoin price of $174,100, which is not an extreme premium, but still significant. After all, who would be willing to pay such a high price when there is already a Bitcoin ETF on the market that provides exposure at the actual market price (about $109,000)? The answer often lies in information asymmetry, lack of understanding of NAV, or effective marketing rhetoric.

Every time MicroStrategy issues new shares to retail investors, the Bitcoin value behind these shares is only a small part of its stock price, and the company earns the difference and packages it as so-called "Bitcoin income." Existing shareholders applaud this because new investors are essentially buying Bitcoin indirectly at a price of $174,100 per coin, and the company uses this capital to buy BTC at the market price. In the long run, this will dilute the net asset value (NAV) per share, and this part of the cost is borne entirely by new shareholders.

Although the crypto media called this operation a "masterpiece of financial engineering", the fundamental reason why this model is established is that most retail investors no longer directly purchase full Bitcoins, and the price of one BTC is now higher than that of a new car (over $45,000). Since the price of Bitcoin broke through this psychological threshold, MicroStrategy's NAV has risen rapidly, thus supporting its so-called "Bitcoin income" strategy - but from another perspective, this is actually " squeezing retail investors to finance its Bitcoin empire ."

As we’ve noted before: As volatility declines and MicroStrategy’s NAV is diluted, the company’s ability to purchase Bitcoin through additional shares is becoming increasingly limited. However, the company still managed to purchase $4 billion worth of Bitcoin in the past month, a move that few others have matched. In contrast, Japan’s Metaplanet, despite its soaring share price, only purchased $283 million of Bitcoin in the same period, and currently holds 7,800 BTC (about $845 million on paper), with a market value of $4.7 billion, corresponding to an implied price of $596,154 per Bitcoin.

Given that the average purchase cost is $91,343 per coin, Metaplanet's book profit will evaporate if the price of Bitcoin drops by 15%. It should be noted that the company was only a traditional hotel company with a market value of $40 million a year ago. With the appreciation of the yen (the exchange rate of the US dollar against the yen is falling), capital repatriation is intensifying, and the Japanese economy is entering a new stage, the reduction in foreign tourists may directly impact its core business - hotels.

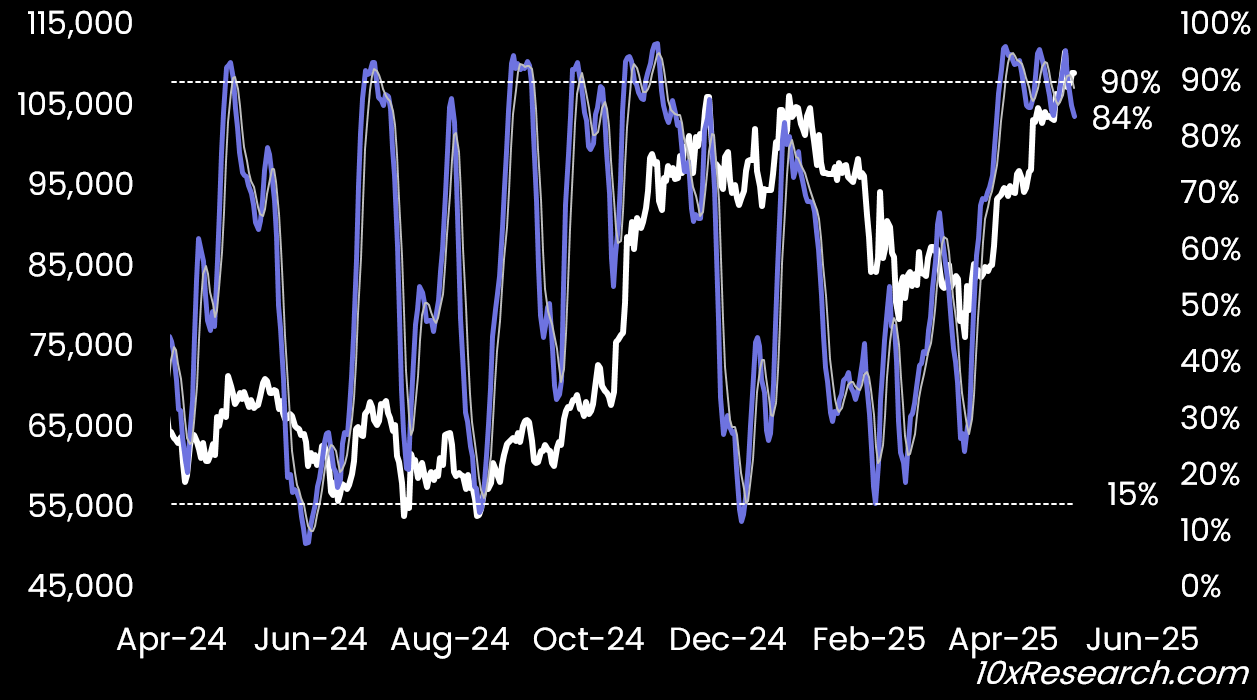

More notably, the recent rise in Bitcoin to $15,000 occurred mainly after the Bank of Japan’s policy meeting, where officials drastically cut their economic growth forecasts, while Japanese government bond yields soared and demand for government bond auctions was weak. At the same time, multiple Asian currencies (such as the Taiwan dollar) appreciated sharply, although officials denied any negotiations with the Trump administration on currency appreciation.

There is growing evidence that Bitcoin's recent price action is driven primarily by the Asian trading session , perhaps driven by Michael Saylor's suggestive tweets about Bitcoin buying, or a surge in retail activity in Japan. Bitcoin has gained 16% overall over the past 30 days, but the Asian trading session has seen gains of up to 25%. In contrast, the U.S. market session made little contribution (prices were flat), while the European session recorded an 8% drop. This further suggests that Asia is currently the dominant force in Bitcoin pricing. If Asian capital flows begin to weaken, Bitcoin may enter a period of consolidation.

It is worth mentioning that Google Trends shows that there is no widespread retail Bitcoin craze in Japan, which means that the parabolic rise in Metaplanet's stock price may be driven by a small number of speculative funds rather than the enthusiasm of the whole people.

At its current market cap, the stock trades at 5.47x its NAV, or a 447% premium , providing an attractive carry trade opportunity. A hedge fund could express a market view in a pairing trade: buy 5 Bitcoins while shorting $550,000 worth of Metaplanet stock (roughly 70,000 shares at 1,116 yen per share at USDJPY 142). The appeal of such trades is growing, especially with Japan expected to approve a Bitcoin ETF within the next 12 months, by which time Metaplanet's NAV premium could be significantly compressed and valuations rationalized.

Although we accurately predicted the Bitcoin rally that began on April 12, we believe that current prices are a reasonable time to take profits. If Bitcoin price breaks above $105,000, traders should consider reducing their long positions.

The options market has already sent out warning signs: Bitcoin's implied volatility skew - the difference between the implied volatility of call options and put options - has fallen to nearly -10%, indicating that the market is pricing calls much higher than puts. In other words, traders are actively chasing the upside rather than hedging against downside risks. In our experience, such extreme skew levels often reflect extremely optimistic market sentiment at the top, a classic contrarian signal.

Our multiple technical reversal indicators (such as the RSI and Stochastics) are now overbought and have begun to reverse downwards, forming a divergence with the Bitcoin price. The gap between the current Bitcoin price and our trend signal has reached $20,000, and the gap is narrowing, indicating that the market momentum is weakening. We have maintained a bullish view since mid-April (which was a contrarian view at the time), but now believe that it is wiser to reduce risk exposure and wait for a more favorable re-entry time.

Chart caption: Bitcoin (left axis) vs. Stochastic (right axis) – Divergence is widening

The gains over the past six weeks are certainly amazing, but the core of trading is risk-adjusted return management, not blindly chasing trends. At the current overvalued level, the last Japanese retail investors who bought Metaplanet may pay a heavy price.

in conclusion:

Now is the time to lock in some profits. We recommended buying MicroStrategy put spreads last Friday, and the stock has fallen 7.5% so far, and the strategy has achieved a 66% gain. Next, Metaplanet looks like it could be the next target for a valuation correction in the coming months. A short position hedged against Bitcoin is an effective way to express this call.

From a broader market perspective, as June approaches and the traditionally quiet summer trading period arrives, we believe that Bitcoin itself may also enter a period of volatility and consolidation. At this stage, more attention should be paid to profit realization and risk control rather than blindly chasing highs.