RWA Weekly Report | US Senators plan to amend the GENIUS Act; Tether's US debt holdings surpass Germany (5.21-5.27)

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA Sector Market Performance

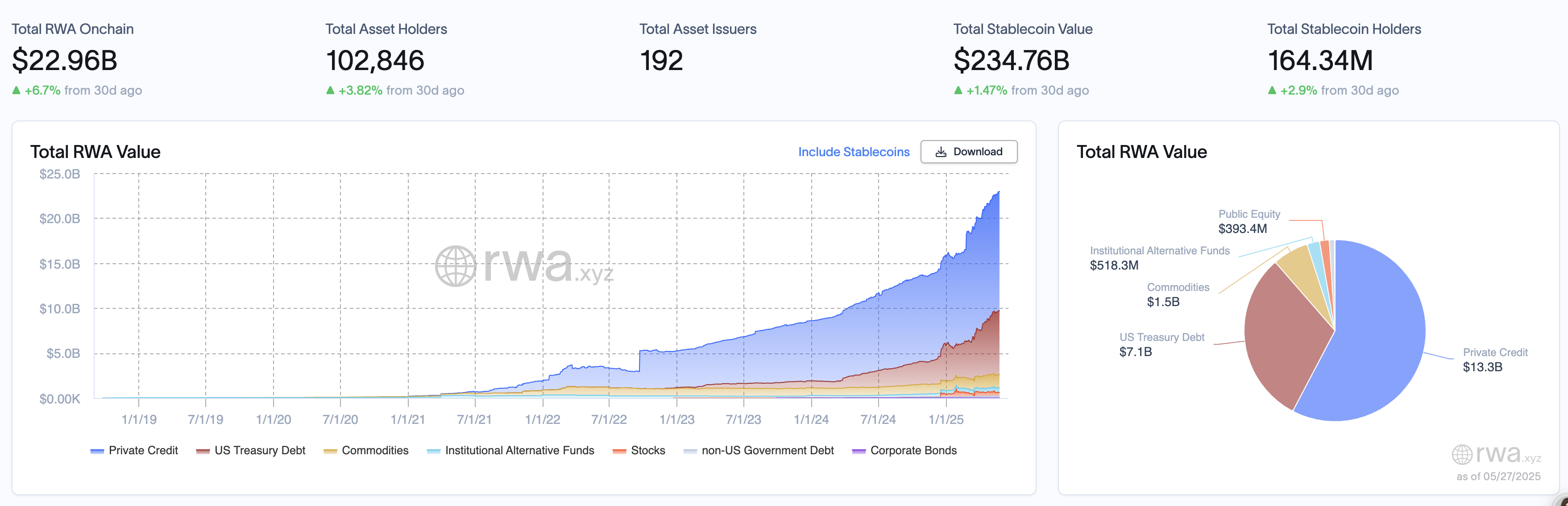

According to RWA.xyz data, as of May 27, 2025, the total value of RWA on the chain reached US$22.96 billion, an increase of 1.59% from US$22.6 billion on May 20. The total number of on-chain asset holders increased from 101,854 to 102,846, an increase of 0.97%; the number of asset issuances increased from 191 to 192. The total value of stablecoins increased from US$232.17 billion to US$234.76 billion, an increase of 1.11%; the number of stablecoin holders increased from 163.02 million to 164.34 million, an increase of 0.81%.

In terms of asset categories, private credit increased from US$13.1 billion to US$13.3 billion, and its proportion decreased slightly from 57.96% to 57.92%, and its dominant position in total assets was slightly diluted; US Treasury bonds increased from US$7 billion to US$7.1 billion, and its proportion decreased from 30.97% to 30.92%. Although the amount increased, the proportion fell slightly, reflecting that the market still maintains its allocation but has not significantly increased its holdings.

It is worth noting that commodity assets increased from $1.4 billion to $1.5 billion, and the proportion increased from 6.19% to 6.53%, showing a certain recovery in allocation enthusiasm, which may be driven by macro inflation or bulk market. Institutional alternative funds increased from $511.8 million to $518.3 million, and the proportion remained unchanged at 2.26%, showing that it still exists as a small-scale and stable supplement. Categories such as stocks, non-US government debt and corporate bonds still account for a small proportion and have not expanded significantly.

Compared with last week's data , the changes in asset category distribution this week are relatively small, but there are some trends worth noting:

Although private credit continued to grow, the growth rate slowed down and its share declined slightly, reflecting that the market's marginal preference for this type of asset may enter a period of adjustment; U.S. Treasuries are still favored by stable funds, and although the allocation ratio has slightly decreased, the total value continues to rise; the growth of commodity assets is more obvious, which may indicate that the market is beginning to increase its attention to inflation hedging assets; and niche assets such as alternative funds remain stable, showing that they still have stable allocation value in institutional investment portfolios.

Overall, RWA on-chain assets are still dominated by high-yield and low-volatility assets . Investors are advised to continue to seize private credit opportunities while paying attention to potential opportunities in commodity assets and moderately increase the allocation of low-risk assets such as government bonds to optimize the risk-return ratio of the overall portfolio. At the same time, stocks and corporate bonds are still under-allocated, and investment strategies can be adjusted dynamically according to the market environment.

Review of key events

Some Democratic senators plan to propose amendments to the ongoing GENIUS Act to address potential conflicts of interest between former President Trump and his family and cryptocurrency platforms. According to Axios, Senate Minority Leader Chuck Schumer and Senators Elizabeth Warren and Jeff Merkley will propose a ban on the US president from making profits through stablecoins.

Previously, the Trump family was involved in the crypto platform World Liberty Financial and launched the USD 1 stablecoin in March. An Abu Dhabi investment institution announced that it would use USD 1 to complete a $2 billion Binance investment, sparking concerns among Democrats about potential interest transfers.

In addition, Merkley and Warren also criticized Trump for hosting a private dinner on May 22 to entertain a large number of people who bought his personal "Meme Coin", calling it "one of the worst corruptions." The incident has now triggered protests from progressive organizations, and Democratic lawmakers have demanded the release of the dinner guest list.

Circle denies rumored sale to Coinbase or Ripple

Stablecoin issuer Circle has denied rumors of a sale to San Francisco crypto firm Ripple Labs or Coinbase. A Circle spokesperson refuted the claims in a recent statement to PYMNTS following reports that Circle was in informal discussions to sell the company at a valuation of $5 billion, which is consistent with its target valuation for an initial public offering (IPO). Despite the reports, a Circle spokesperson emphatically denied plans to sell to any entity, including Coinbase and Ripple, and said Circle is committed to its long-term goals.

Robinhood proposes to the SEC to create a federal framework for tokenized RWAs

Robinhood has submitted a 42-page proposal to the U.S. Securities and Exchange Commission to create a federal framework for tokenized real-world assets to modernize the U.S. securities market. It is reported that the plan may include tokenizing traditional assets such as bonds and stocks to achieve greater liquidity and transparency. This move is seen as an important step in promoting the on-chainization of Wall Street assets, which may have a profound impact on traditional finance and the crypto market.

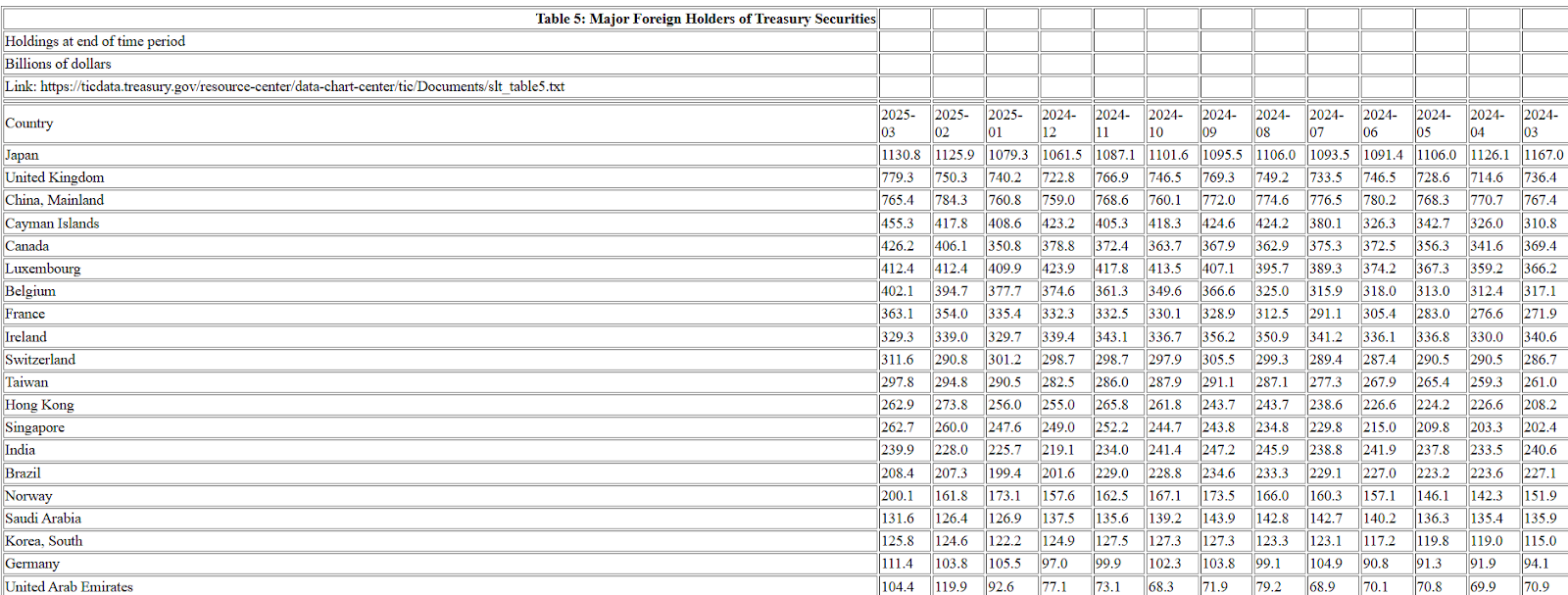

Tether's U.S. Treasury holdings surpass Germany's, reaching $120 billion

According to data from the U.S. Treasury Department, the size of U.S. Treasuries held by stablecoin issuer Tether has exceeded Germany's $111.4 billion, reaching $120 billion, ranking among the world's major holders.

As a stablecoin issuing giant with a market value of over $151 billion, Tether has demonstrated stronger stability in dealing with crypto market fluctuations by relying on a diversified reserve strategy centered on U.S. Treasuries. This breakthrough also highlights the increasing scale of its asset allocation in the global financial system.

The Hong Kong SAR Legislative Council passed the Stablecoin Bill

On the evening of May 21, the Stablecoin Bill submitted by the Hong Kong Special Administrative Region Government at the end of 2024 was passed by the Hong Kong Legislative Council in its third reading. This move means that the Hong Kong Special Administrative Region has begun to establish a licensing system for issuers of legal currency stablecoins, and it is also an important step towards improving the local regulatory framework for virtual asset activities. By the end of this year, compliant Hong Kong stablecoins are expected to be officially launched.

Hot Project Dynamics

Ondo Finance (ONDO)

Official website: https://ondo.finance/

Introduction: Ondo Finance is a decentralized financial protocol that focuses on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products such as tokenized U.S. Treasuries or other financial instruments through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application scope in the DeFi ecosystem.

Recent developments: On May 21, Ondo announced that the TVL of on-chain tokenized U.S. Treasuries exceeded $7 billion for the first time, with Ondo’s USDY and OUSG as the main drivers. Ondo also said that it took five years for stablecoins to reach this scale, while tokenized treasuries took less than three years, which is enough to show that RWA’s growth rate is far faster than expected; On May 23, Ondo announced the launch of the "Ondo Global Markets" platform, which will support on-chain trading of public securities (including stocks) on the Solana blockchain.

Plume Network

Official website: https://plumenetwork.xyz/

Introduction: Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering the investment threshold and improving asset liquidity. Plume provides a customizable framework that supports developers to build RWA-related decentralized applications (dApps) and integrate DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, and is committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Latest developments: On May 21, Plume partnered with Espresso Systems to launch Composables NFT ( cross-chain Web3 avatar NFT ); On May 22, Plume announced that the originally scheduled Plume Room live broadcast (with @Cultured_RWA , @truflation and @stevenmai_ ) was postponed to May 26 at 14:00 UTC. The live broadcast will discuss RWAfi and yield strategies; On May 23, Plume partnered with Skate Chain to unlock cross-chain RWA liquidity, allowing users to seamlessly access Plume's real yield assets in different blockchain ecosystems.

Related articles

RWA Weekly Report Last Week: Sorting out the latest industry insights and market data.

《 Interactive Tutorial|Zero-efficiency high-performance RWA public chain Pharos 》

On May 16, the popular RWA public chain Pharos announced the launch of the public testnet, which attracted widespread attention from the market. Pharos also launched a series of testnet tasks, and users were very enthusiastic about participating. According to official data , more than 110,000 real users flocked to the testnet in just 24 hours after its release. This article will teach users how to interact with the Pharos testnet without any effort.

" After the US GENIUS, what are the new highlights of the stable currency bill passed by Hong Kong? "

Based on the original text of the Hong Kong Stablecoin Act (Gazette No. C 3116-C 3684), the author of this article deconstructs its core content, compares it with the US Stablecoin Act "GENIUS Act", and gathers industry perspectives to explore the similarities, differences and impacts of the two major regulatory frameworks.

" Dollar Hegemony 2.0: How does the GENIUS Act reshape the global landscape of stablecoins? "

The article brings together the main views of all parties as the GENIUS Act, a bill regarded as a milestone in US stablecoin regulation, enters the revision stage and sentiment in the crypto industry heats up.

" Inventory of seven RWA newcomers on the chain: KTA has a market value of over US$900 million "

This article lists the seven new on-chain forces that have been active under the RWA narrative recently, covering Base, BNB Chain and Solana ecosystems. Most projects have evolved comprehensively in multiple dimensions such as application implementation, compliance practices and ecological linkage, taking into account both narrative imagination and practical implementation.

Tokenization of Real World Assets (RWA): Market Dynamics, Global Practices and Chinese Explorations

Written by The Web3 Dao, this is an in-depth report covering multiple angles on the current development of RWA.