The flow of ETF funds may indicate the future scenario. Is ETH finally going to take over BTC?

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

On December 29, Eugene Ng Ah Sio, a highly influential trader in the cryptocurrency community, released his outlook and expectations for the first quarter of 2025 on X, predicting that ETH will become the best performing mainstream token in the next quarter.

Eugene first mentioned three reasons for being bullish on ETH: technical trends; Trump’s favor (especially WLF’s massive purchase of the Ethereum ecosystem); and the development of the Base ecosystem. He then wrote another article emphasizing that since Trump’s election, the inflow of funds into the Ethereum spot ETF has undergone a 180-degree turn.

ETF fund movements: Is Ethereum more favored?

Eugene is not exaggerating. SoSoValue data shows that since Trump's victory on November 6, the inflow of funds to the spot Ethereum ETF has increased significantly, and the growth trend during the same period has even exceeded that of the Bitcoin spot ETF.

Entering late December, this trend has become more obvious.

SoSoValue data shows that the Ethereum spot ETF had a net inflow of US$349 million last week (December 23 to December 27, Eastern Time); while the Bitcoin spot ETF had a net outflow of US$388 million during the same period - this obvious difference in capital movements may indicate better expectations for ETH in the future.

As of the time of writing, the official ETF inflow/outflow data for this Monday has not yet been fully released, but according to Lookonchain's on-chain monitoring, the ten US Bitcoin ETFs had a net outflow of 3,000 BTC (US$275.59 million) yesterday; the nine Ethereum ETFs had a net inflow of 16,359 ETH (US$54.33 million), and the trend seems to remain unchanged.

Trump concept family bucket

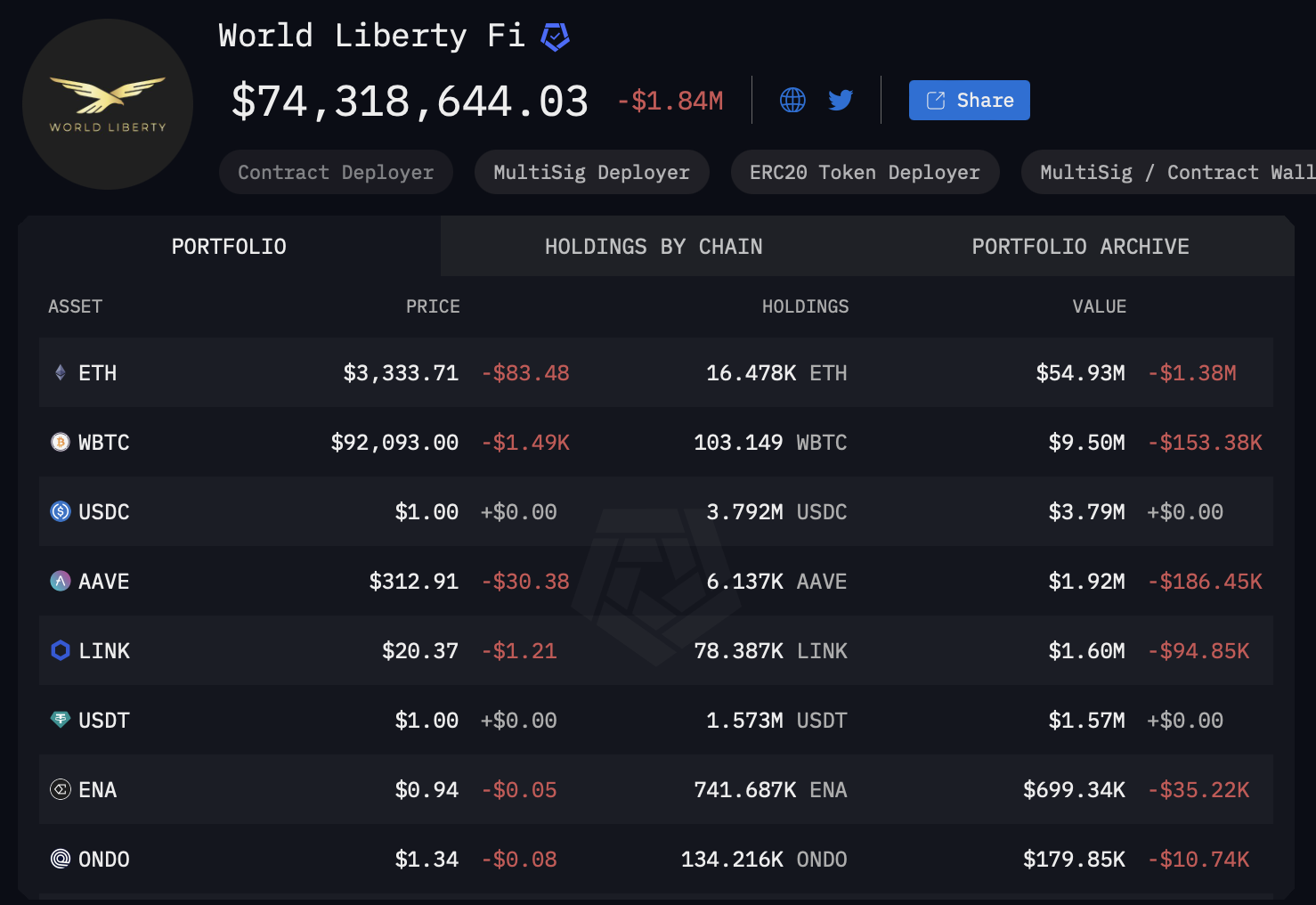

In addition to the ETF's liquidity data, another reason supporting ETH's expectations is the continued building of positions in the Trump family project WLFI.

In the past period of time, WLFI has successively purchased multiple Ethereum ecological tokens such as AAVE, LINK, ENA, ONDO, etc., but the project's largest holding is still ETH.

Although this is somewhat related to the fact that WIFI itself is deployed in the Ethereum ecosystem, the phrase "The president is already in the car, what are you still hesitating about" still has a strong FOMO effect.

Looking back at historical data, will the script repeat itself?

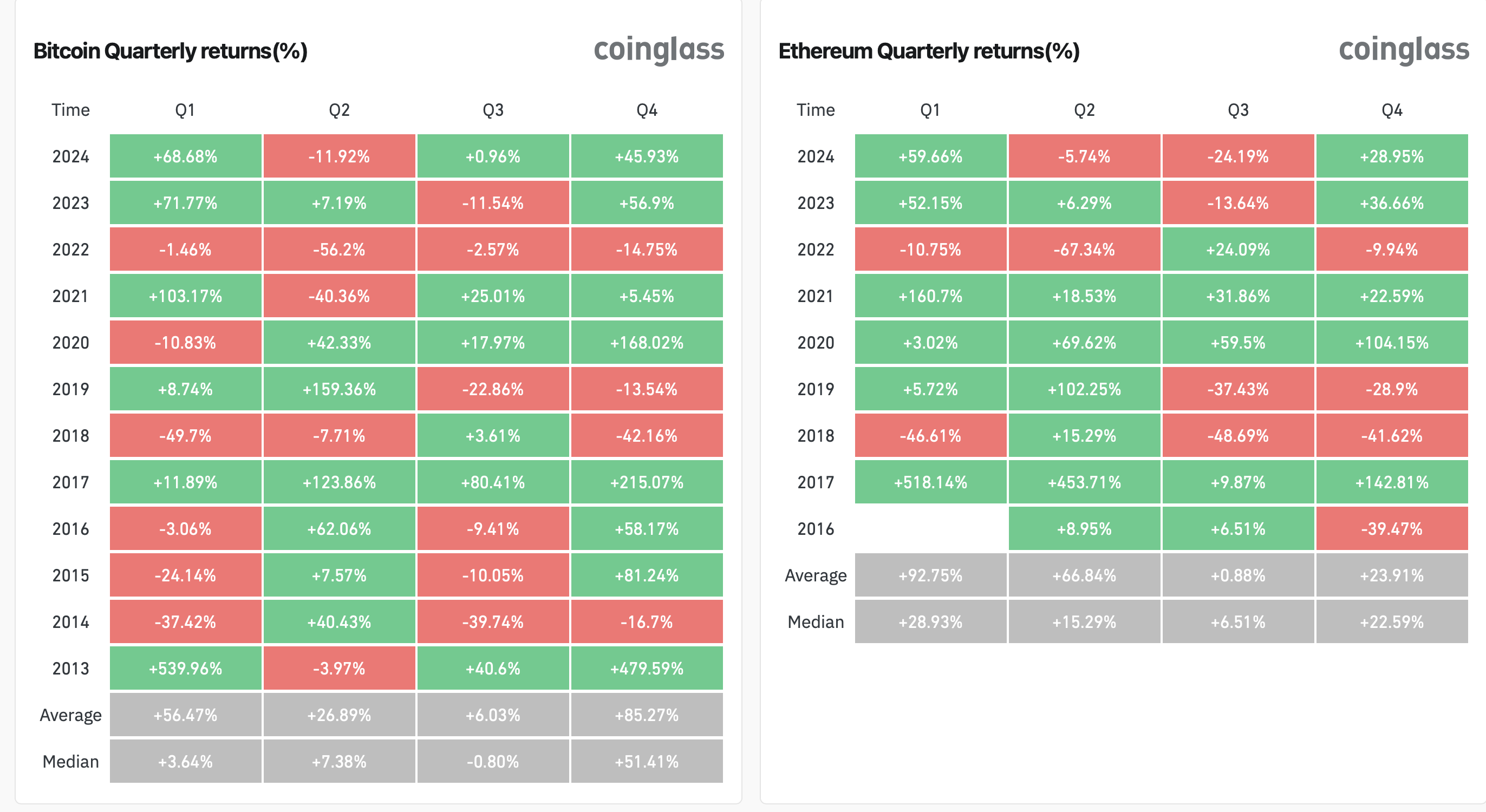

Coinglass data shows that ETH performed best in the first quarter of the new year after the historical US election and Bitcoin halving cycle, especially in the first quarter of 2017 and the first quarter of 2021, when ETH rose by 518% and 161% respectively, even exceeding BTC's returns in these two quarters (11.9% and 103.2%).

If history repeats itself, ETH may see a significant rise in Q1 next year.

Potential Beta Selection

If ETH can really rise as expected, some Ethereum ecosystem tokens may become Beta options with higher risk/return, such as:

Trump concept coin portfolio: AAVE, LINK, ENA, ONDO;

Grayscale Top 20 selections: LINK, UNI, AAVE, ENA, OP, LDO;

ETF pledge is expected to have potential benefits: LDO, EIGEN, RPL, SSV;

Ethereum ecosystem’s top AI concepts: VIRTUAL, GAME, AIXBT;

Odaily Note: The above tokens are only a list of specific sectors and concepts and do not constitute investment advice.

Counterpoint

Although many well-known investors/traders including Eugene have clearly been bullish on ETH, there are also voices that are pessimistic about ETH's future performance.

Markus Thielen, founder of 10x Research, painted a more pessimistic scenario, predicting that ETH will continue to underperform and fail to hit new all-time highs in a "hawkish" macro environment in 2025: "We expect a more conservative outlook for ETH in 2025. Unlike previous years, the initial hawkish policy may be tested by a weakening liquidity tailwind.

At this time when the market is volatile, the forecasts given by all parties are merely "one-sided conclusions" based on the conditions and indicators they are concerned about. No one can predict the future, so remember to DYOR before you take action.