A-shares rose above 3,300 points and stood up. Cryptocurrency VS stock market 2024 annual correlation node review

Original|Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser2010 )

“It’s reached its daily limit again!”

“It’s already up over 130 points!”

"Qidian.com writer went all-in on A-shares, made over 3 million, and then simply stopped writing!"

“A new stock starting with CL has risen more than 17 times today. Isn’t this scarier than the Meme coin on SOL?”

"Someone made 520,000 RMB in one morning. According to statistics, A-share investors made an average of 47,000 RMB in four days!"

As the Federal Reserve took the lead in cutting interest rates, the global market has long since started a "flooding tide". A-shares have also started a new round of "recovering lost ground" under the stimulation of a number of favorable policies of the central bank. It is understood that on September 30, the turnover of the two A-share markets exceeded 250 trillion yuan, setting a new record; it took only 35 minutes before the turnover exceeded one trillion, setting a new "fastest trillion record in history". The crazy market is attracting more and more investors to join, and many cryptocurrency practitioners have claimed that "large amounts of money have been withdrawn, and the goal is to hit the daily limit of A-shares". On the other hand, the relationship between cryptocurrencies and U.S. stocks is also increasing. According to IntoTheBlock data , last week the correlation between BTC and the U.S. stock market reached its highest level since Q2 2022. After the Bitcoin spot ETF and Ethereum spot ETF were passed one after another, the above situation is also a side epitome of the further deepening of the coupling between the traditional financial market and the cryptocurrency industry.

In this article, Odaily Planet Daily will retrospectively sort out the key nodes of Bitcoin prices since this year, and take a glimpse into the correlation between Bitcoin, as a "barometer" of cryptocurrency, and the corresponding performance of US stocks and A shares in different periods.

Back to 2024: BTC price key nodes VS US stocks and A-share performance

At the beginning of the year, the milestone event of "Bitcoin spot ETF approved by the US SEC" became the best annotation for the acceleration of the mainstreaming process of the cryptocurrency industry. Looking back at the performance of BTC since January this year, although it has experienced several months of volatility and multiple price drops after breaking through the new high, compared with other investment targets in the same period, it still belongs to the ranks of "high-quality assets and safe-haven assets". The following is a summary of the key points of BTC and the corresponding performance of US stocks and A shares from January to September this year:

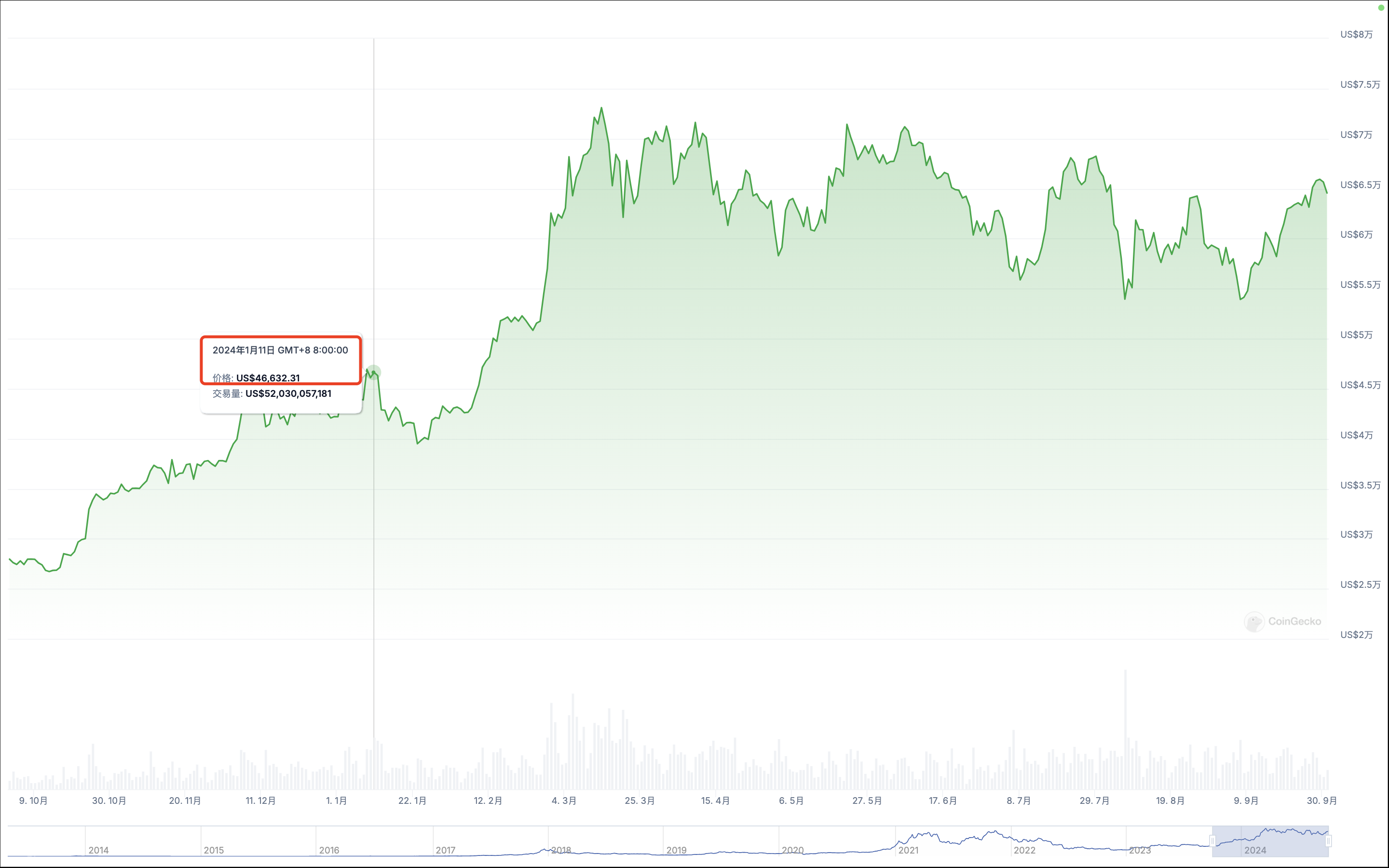

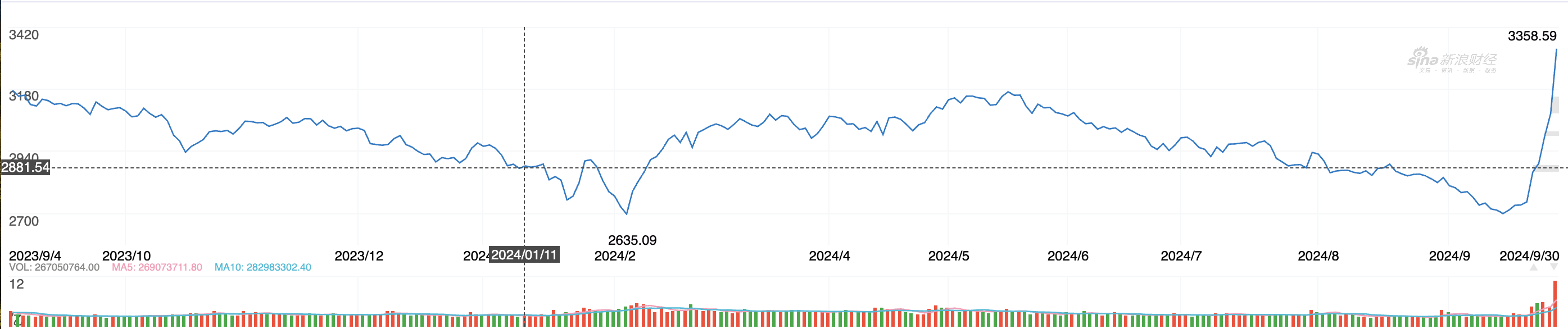

January 11th - Bitcoin spot ETF officially approved

On January 11, 2024, local time, the US SEC officially approved several Bitcoin spot ETF funds, thus unveiling a new process of "mainstreaming cryptocurrency". Although the matter was "exposed in advance" two days ago due to the theft of the official account of the US SEC X platform, the Bitcoin price reacted relatively coldly after the previous slight increase, but compared with the past, it still showed a "stable and improving" situation, and also laid a solid foundation for the subsequent breakthrough of the historical high. For more information, please see "Historic Moment: Bitcoin Spot ETF Finally Approved, Will the Opening of Cryptocurrency Be a New Starting Point for Long Bull Market?" .

At that time,

The BTC price is around $46,632;

The A-share Shanghai Composite Index is around 2,881 points;

The Dow Jones Industrial Average was around 37,584 points.

BTC Price

Shanghai Composite Index

Dow Jones

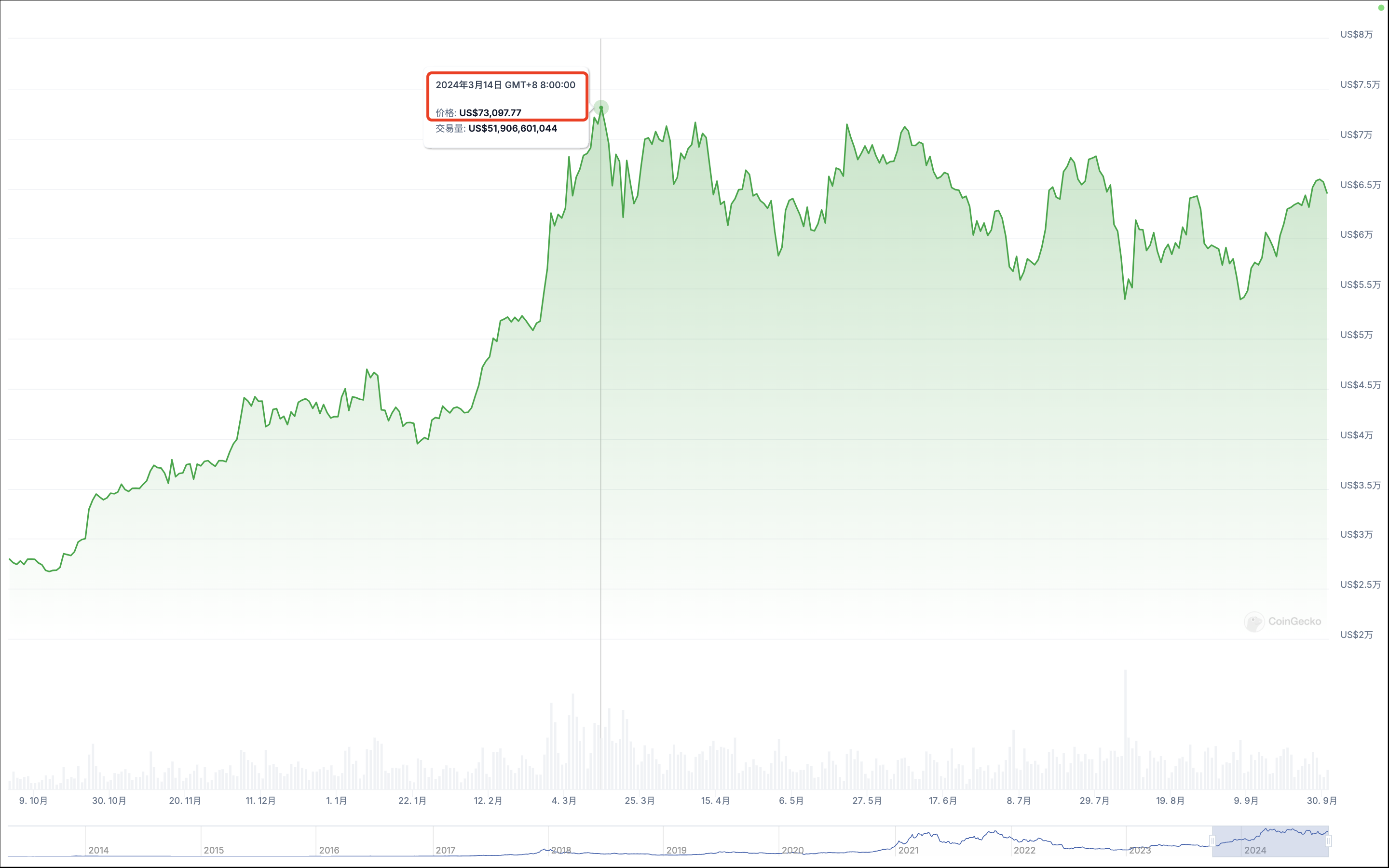

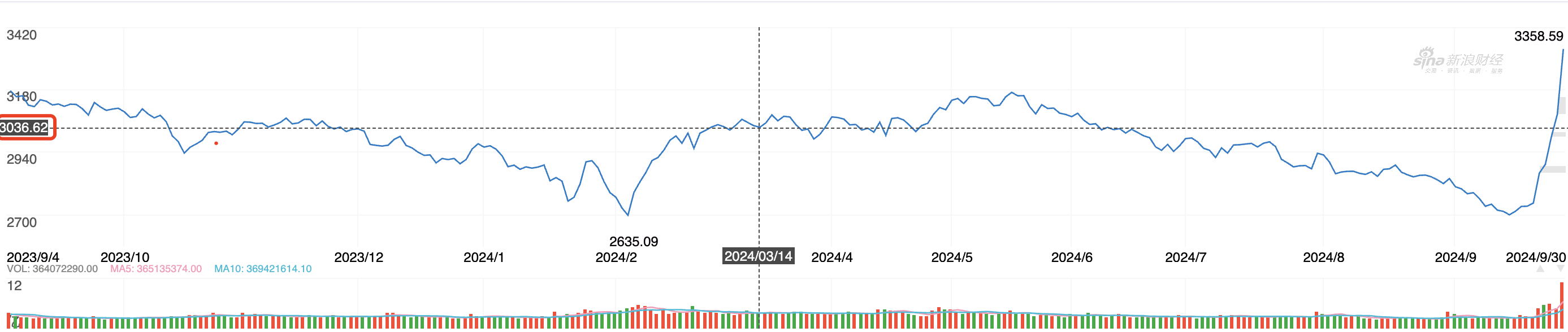

March 14th - BTC hits new high, "no longer owes anyone"

On March 14, as funds continued to flow into Bitcoin spot ETFs, U.S. stock investors' enthusiasm for investing in Bitcoin continued to grow. The cryptocurrency industry was also immersed in the optimistic atmosphere of the "crypto bull market". The Solana Meme coin craze also began to emerge. Many star projects that had previously received tens of millions or even hundreds of millions of dollars were also gearing up and preparing for TGE and listing on top exchanges. Amid the positive trend, the price of Bitcoin broke through previous highs one after another, eventually surpassing the previous historical high of around US$69,000 on the 14th, and rose all the way to more than US$73,000.

At that time,

The BTC price is around $73,097;

The A-share Shanghai Composite Index is around 3,036 points;

The Dow Jones Industrial Average is around 38,888 points.

BTC Price

Shanghai Composite Index

Dow Jones

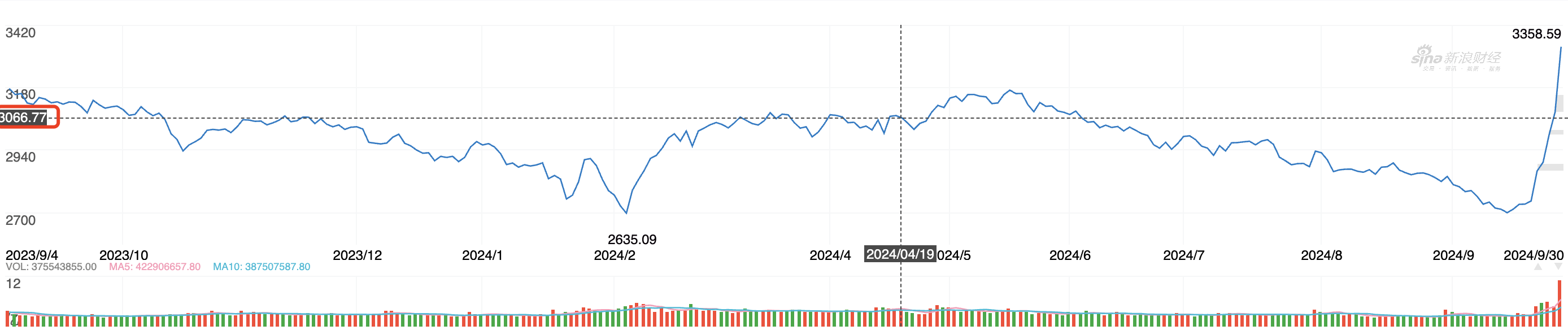

April 20 — The halving comes, with unexpected results

On April 20, Bitcoin successfully completed its fourth halving. Before the halving, people had different opinions on the price of Bitcoin. Some people believed that the halving would promote a rapid rise in the price of Bitcoin in the short term; others believed that the halving would lead to a decrease in the income of Bitcoin mining and a sharp drop in miners' income. We all know the story that followed: the price of Bitcoin did not rise rapidly, and even fell below $60,000 at one point; the income of miners did not drop sharply, but instead, thanks to the growth of Bitcoin ecological projects such as Runes, the daily income once broke through the historical high. For more information, see "BTC Completes the Fourth Halving in History, How Do Various Institutions Predict the Future Market?" and "BTC Network is Congested After Halving, the Gas Fee for Runes is Thousands of Dollars" .

At that time,

The BTC price is around $63,988;

The A-share Shanghai Composite Index is around 3,066 points;

The Dow Jones Industrial Average was around 37,918 points.

BTC Price

Shanghai Composite Index

Dow Jones

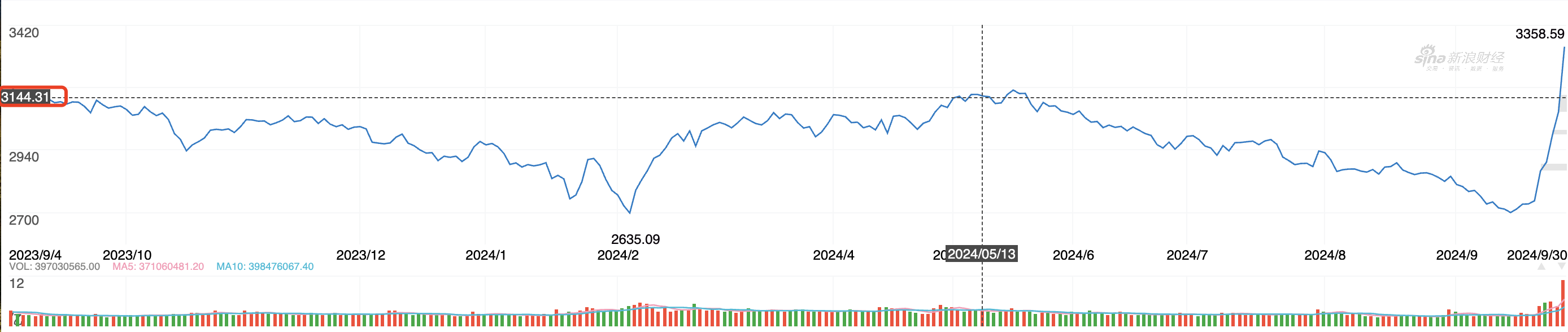

May 12-BTC crashed first and then rose, and the impact of regional political situation gradually increased

In early May, after experiencing a flash crash on the 1st and 2nd of the month, the price of Bitcoin gradually climbed steadily to around $60,000. However, at the same time, the increasing friction in the Middle East and the political situation brought about by the US presidential election cast a shadow on the development of traditional financial markets, including the cryptocurrency market and US stocks. However, compared with the "disappointment and even despair in the volatile market" in July and August, many crypto investment institutions and major industry professionals were still optimistic about the market at that time. For more information, please see "3-minute quick view of Bitcoin's future market view: moving towards... in the volatility?"

At that time,

The BTC price is around $60,776;

The A-share Shanghai Composite Index is around 3,144 points;

The Dow Jones Industrial Average was around 39,422 points.

BTC Price

Shanghai Composite Index

Dow Jones

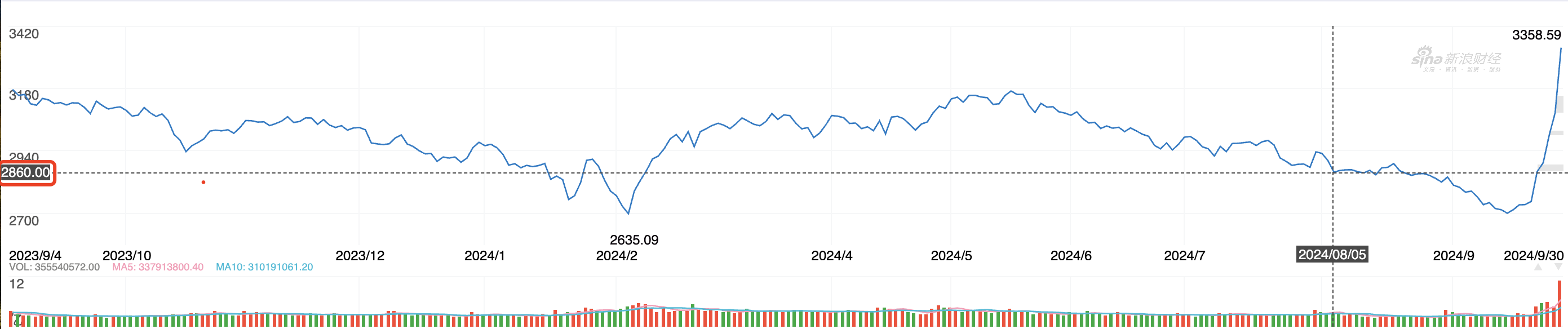

August 5th-BTC fell by $15,000 in 4 days, and the market was in panic

August 5th may be a day that many cryptocurrency industry practitioners still feel cold sweat when they think about it. At about 14:00 on that day, according to the OKX market, the price of Bitcoin once fell to $48,934.8, a 24-hour drop of 15%. The price fell by $15,000 in 4 days, the largest drop of the year up to that time, and the cryptocurrency market fell into extreme panic. Looking back, the panic at that time was undoubtedly under the huge pressure of the global macroeconomic downturn. The U.S. stock market fell by nearly $3 trillion in market value overnight, equivalent to 2.5 cryptocurrency markets. This incident also once again verified that the cryptocurrency market is increasingly closely connected with the global economic market, and the market performance of the two is closely related. As the old saying goes: no egg is intact under the overturned nest, and it is difficult for the cryptocurrency market to remain unscathed. For more information, see "BTC fell by $15,000 for four consecutive days, and the global financial market fell into panic and plunged" .

At that time,

The BTC price is around $53,956;

The A-share Shanghai Composite Index is around 2,860 points;

The Dow Jones Industrial Average is around 38,687 points.

BTC Price

Shanghai Composite Index

Dow Jones

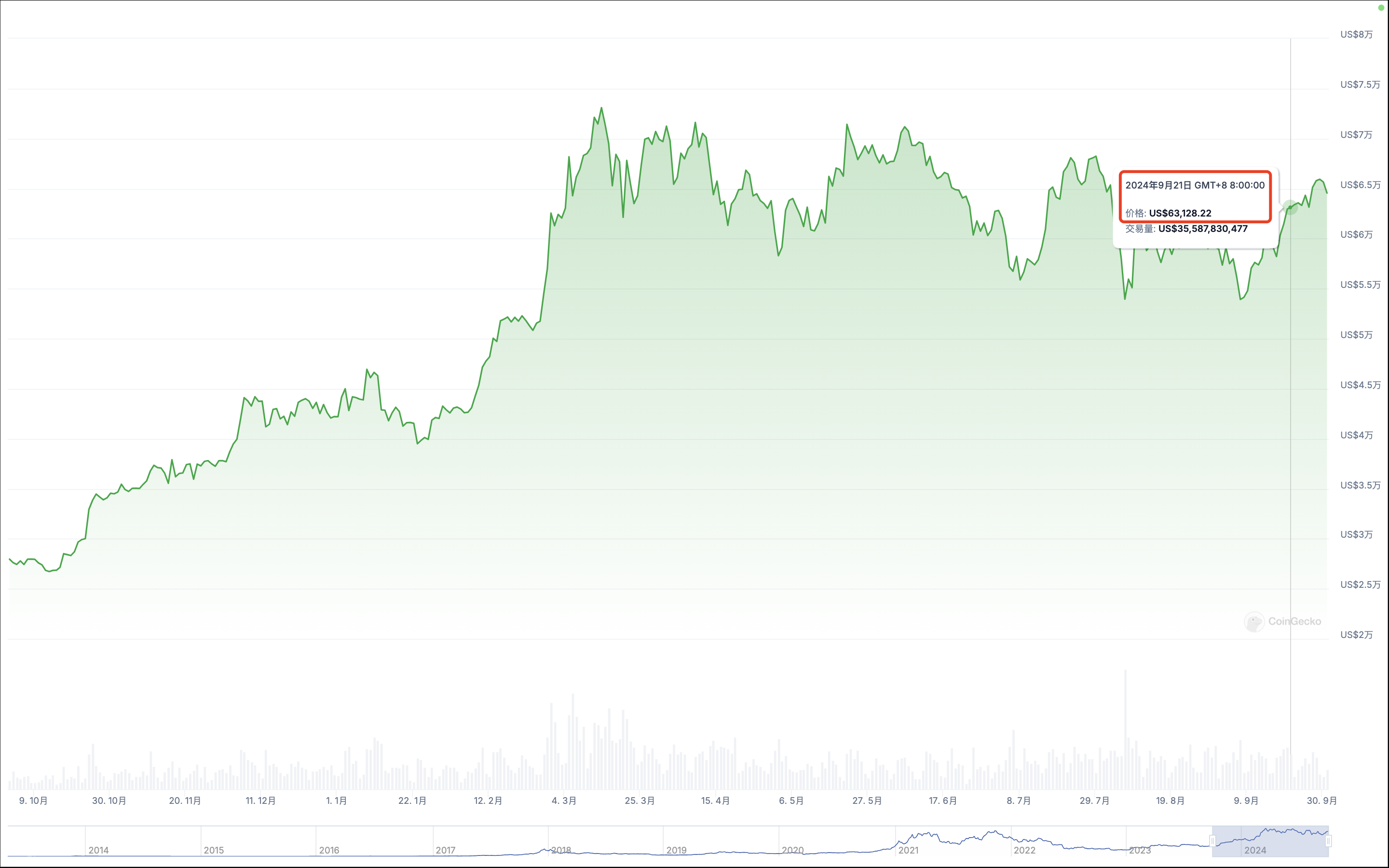

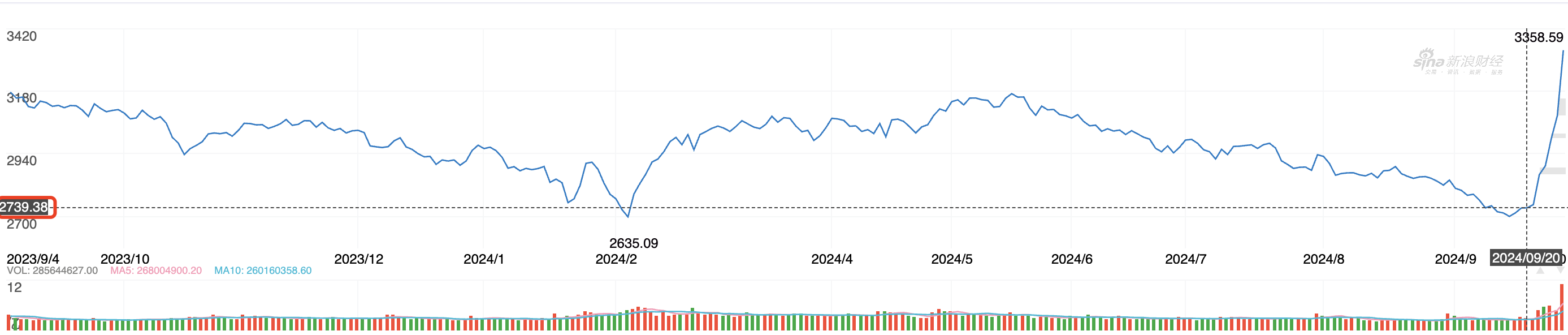

September 20-The Federal Reserve cut interest rates by 50 basis points, ushering in a global "flooding"

At 2 a.m. on September 19, the Federal Reserve announced the start of a rate cut cycle, lowering the federal funds rate by 50 basis points to 4.75%-5.00%, the first rate cut since March 2020. Subsequently, global markets rose in response, and China also introduced a series of favorable policies, including interest rate cuts, reserve requirement ratio cuts, and a package of policies to stimulate the investment market. The "national team" spent hundreds of billions of dollars to boost confidence in the capital market. The continued rise of A shares in recent days is the best illustration, and the "exponential rise K line" of the Shanghai Composite Index now looks extremely steep, which is very consistent with the "To Da Moon" curve that the cryptocurrency industry has always advocated.

At that time,

The BTC price is around $63,128;

The A-share Shanghai Composite Index is around 2739 points;

The Dow Jones Industrial Average was around 42,063 points.

BTC Price

Shanghai Composite Index

Dow Jones

Conclusion: The correlation between the cryptocurrency market and the traditional financial market is gradually increasing

Looking back at the BTC price trend, A-share index trend and US Dow Jones trend this year, we can clearly draw the following conclusions:

After the Bitcoin spot ETF was approved, Bitcoin's safe-haven asset attributes were weakened to a certain extent compared to gold;

After the Bitcoin spot ETF is approved, the price trend of Bitcoin will be more affected by the Dow Jones Industrial Average rather than the other way around.

Bitcoin spot is more responsive to macroeconomic conditions and geopolitical factors due to its 24/7 trading flexibility, and its volatility is much greater than that of the U.S. and A-share markets.

The A-share market represented by the Shanghai Composite Index has long maintained a fluctuation range of around 2,800-3,100 points. In comparison, the Dow Jones Industrial Average has risen more significantly, from 37,000 points at the beginning of the year to around 42,600 points recently, an increase of about 15%; the price of Bitcoin has risen from US$42,000 at the beginning of the year to around US$64,000 now, an increase of about 52%, which can be called "the annual high-quality investment target";

In the long run, although the current size of the cryptocurrency market (according to Coingecko data , the current total volume is 2.36 trillion US dollars) is far less than the trillions or even trillions of trading volumes of A-shares and US stocks, there may still be a possibility of "two-way bloodsucking" to a certain extent. Channels such as Hong Kong virtual currency ETF funds and US ETF funds have opened the entrance for capital inflows into traditional financial markets, but at the same time may also lead to further reflux of the already scarce liquidity of cryptocurrencies.

For the cryptocurrency industry, how to introduce more real-world assets and massive liquidity in traditional financial markets through ecosystem construction, narrative, application, market, consumption and other aspects is the next "industry-level problem" that practitioners cannot avoid. Mass Adoption may not be urgent, but attracting more capital flows is a top priority.

Information sources:

BTC price data: Coingecko website

Shanghai Composite Index data: Sina Finance

Dow Jones data: Sina Finance-US stock market