SignalPlus Macro Analysis (20240909): On the Precipice?

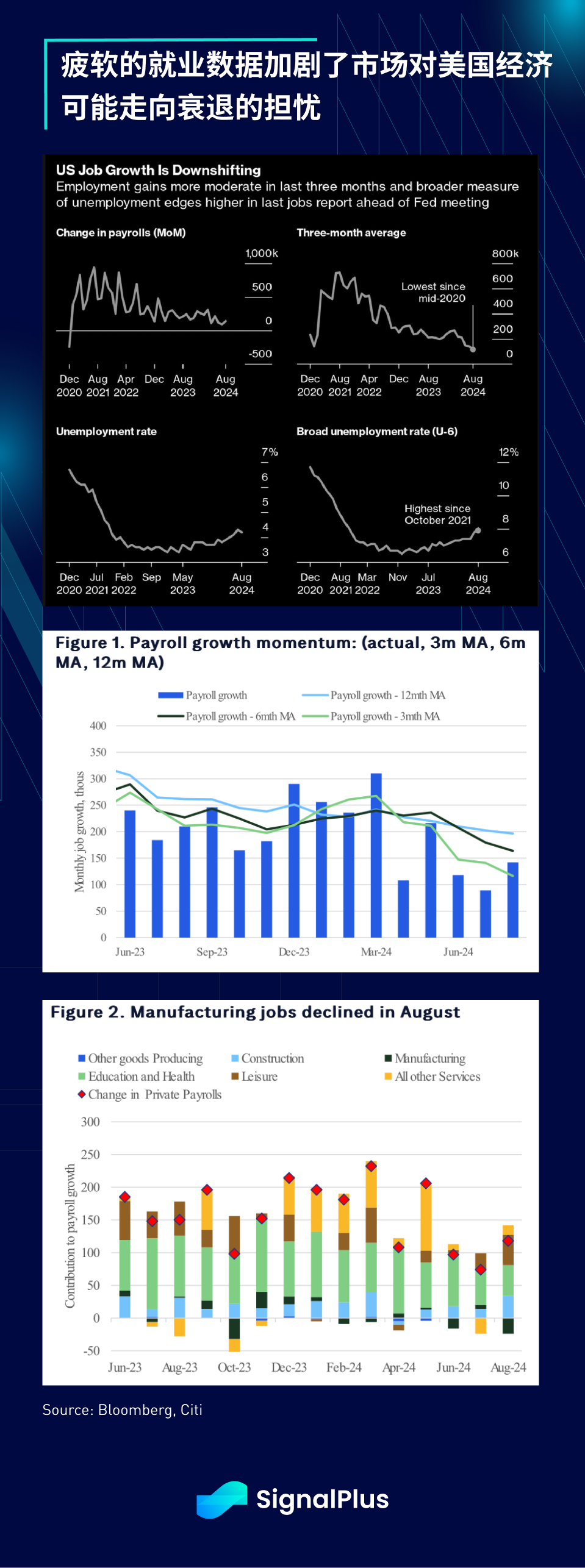

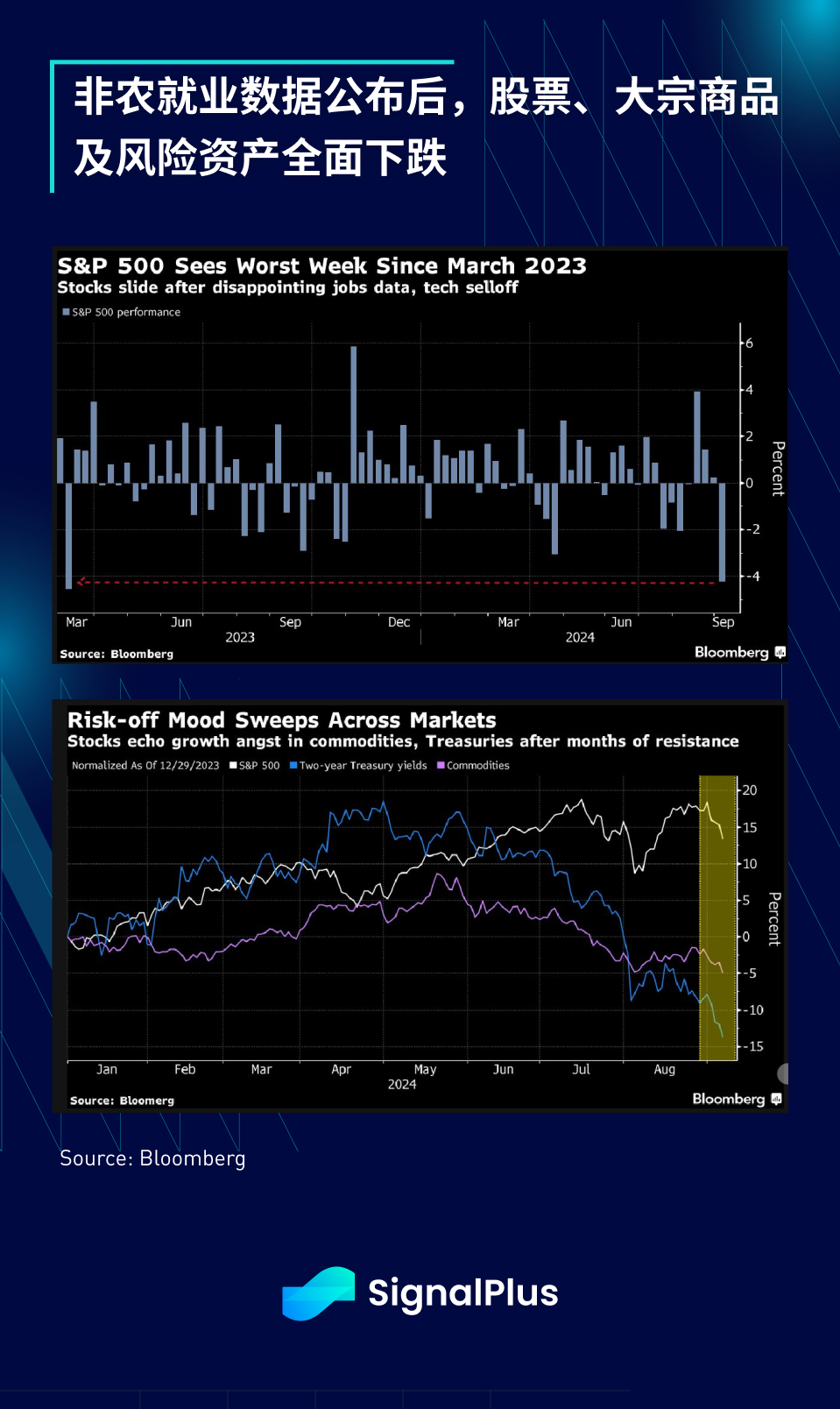

Last week's disappointing nonfarm payrolls data reignited market concerns about an impending recession and the market increasingly believes that the Federal Reserve is lagging behind the yield curve, causing U.S. stocks to suffer their worst single-week performance since March 2023, while yields closed near their lowest levels this year.

Nonfarm payrolls increased by just 142k (160k expected), with the previous reading revised down by 89k, while the unemployment rate remained at around 4.22%. The weak data brought the three-month average of new jobs down to below 100k, the weakest quarterly trend since 2012. Suddenly, private sector growth is falling to its lowest point in more than a decade, and a recession seems more imminent than ever.

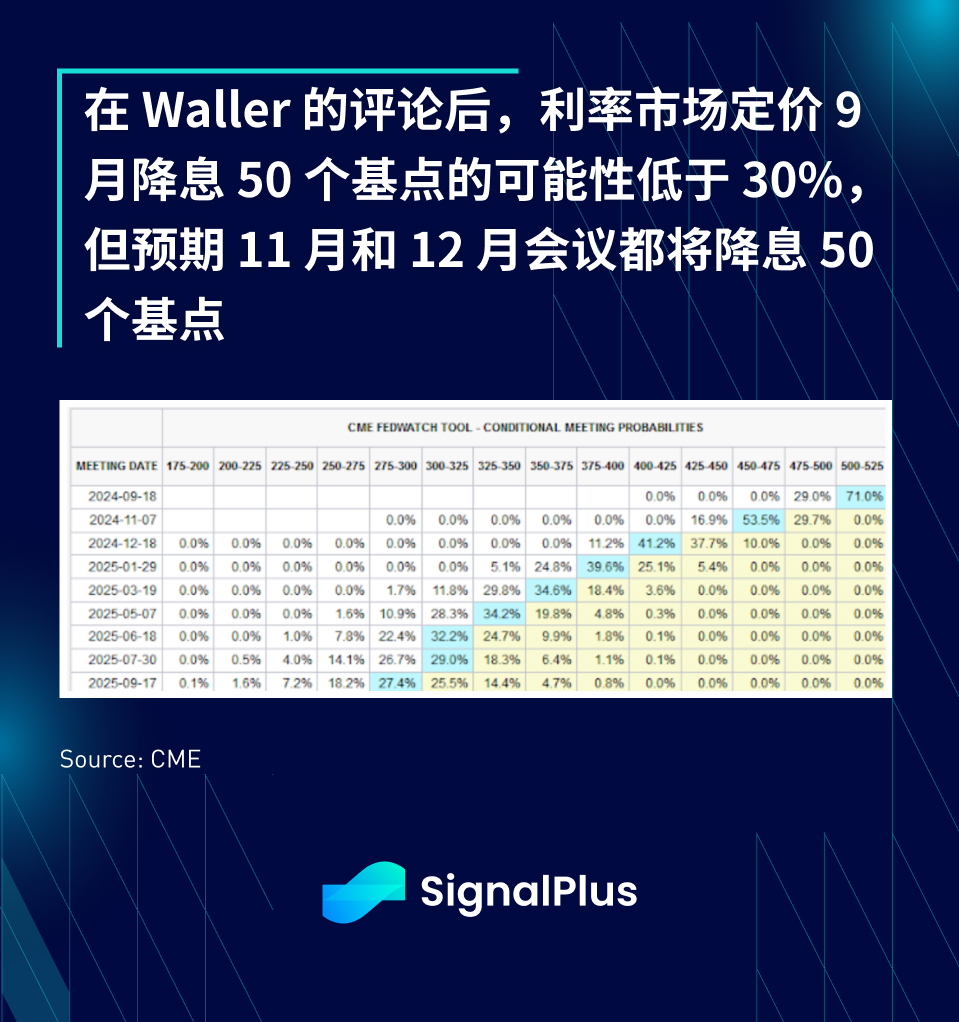

Asset prices reacted as expected, with US Treasuries showing a steep bull trend, with the 2-year yield falling 12 basis points at one point, and the 2/10s curve steepening 6 basis points, finally reversing to positive territory. However, the position expressed by Fed Governor Waller was unexpectedly "balanced", with no clear statement on a 25 or 50 basis point rate cut in September, which caused the fixed income market to give up some of its gains.

*WALLER: If appropriate, would support an early rate cut

*FED'S WALLER: Current batch of data "requires action"

*WALLER: It's important to start cutting rates at the next Fed meeting

Faced with weak data, experienced macro observers would certainly advise against inciting panic or overreacting. If officials intervene excessively at this stage, any liquidity benefits from rate cuts will quickly be offset by concerns about a severe economic recession. Therefore, after Waller made a cautious response after the non-farm payrolls report, Treasury Secretary Yellen immediately made a statement, making it clear that the US economy remains "robust" and is moving towards a "soft landing."

"We're seeing a cooling off in terms of hiring and job openings, but we're not seeing significant layoffs," Yellen said at the Texas Tribune Festival in Austin. "We remain mindful of downside risks to the job market, but I think what we're seeing and hopefully will continue to see is a good, solid economy."

The bond market is very forward-looking, and after Waller and Yellen's speeches, interest rate futures quickly lowered expectations for a rate cut at the September FOMC meeting to 25 basis points, but as the US economy slows faster, prices reflect an 80% chance of a 50 basis point rate cut at both the November and December meetings.

As expected, this is bad news for stocks and risk assets. The Nasdaq fell 3% and the SPX fell 2%, posting its worst weekly performance since 2023, while the VIX has rebounded to 25 as macro assets fell across the board.

Amid the current stock market decline, U.S. stock holdings by both retail investors and professional fund managers are at high levels. The Wall Street Journal reported that U.S. households have now allocated more than 40% of their wealth to financial assets, a record high, while long-term asset management companies remain firmly long the SPX index even after the August pullback.

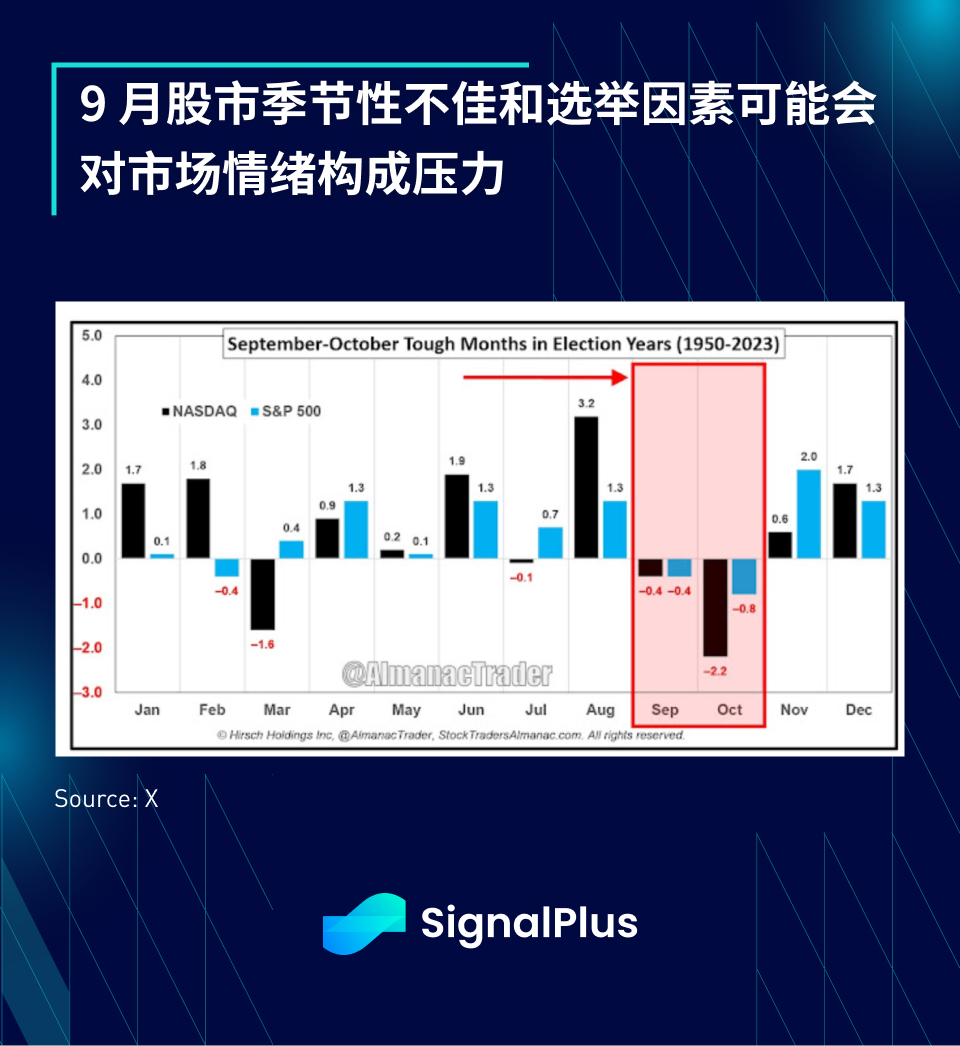

The combination of a slowing economy, record long positions, and September’s typically weaker stock market seasonality has us taking a cautious view of how the market will perform in the near term.

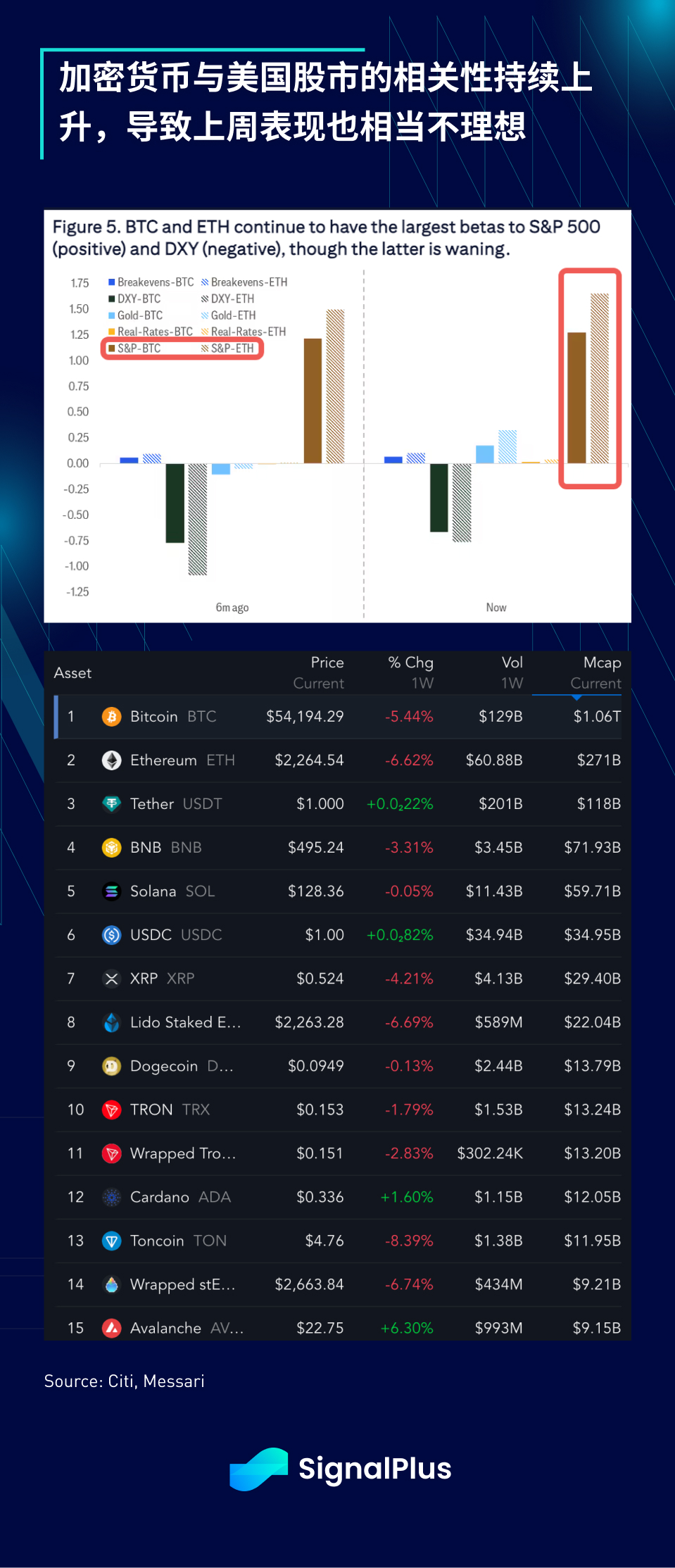

As we mentioned earlier, for the cryptocurrency market, the results of the non-farm payroll data must be almost perfect in order to drive the market up. However, the final result was quite bad. The shift in risk sentiment dragged BTC down to around $54K and ETH down to $2.2K, falling again by about 6% last week, continuing its recent poor performance.

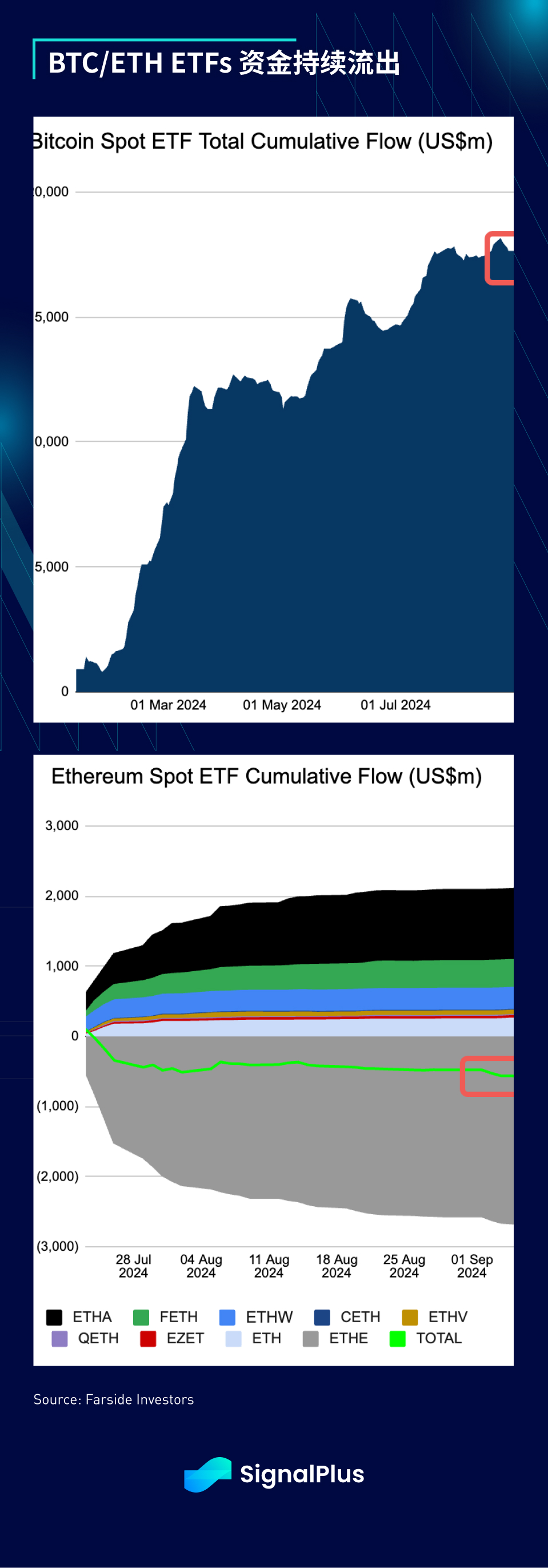

ETF fund flows remain disappointing, with the BTC ETF seeing outflows of $170 million last Friday, marking eight consecutive days of outflows, and the ETH ETF also seeing outflows of $6 million on the same day. Since its launch in July, the cumulative flow has been declining sharply, and there is currently no clear sign of improvement.

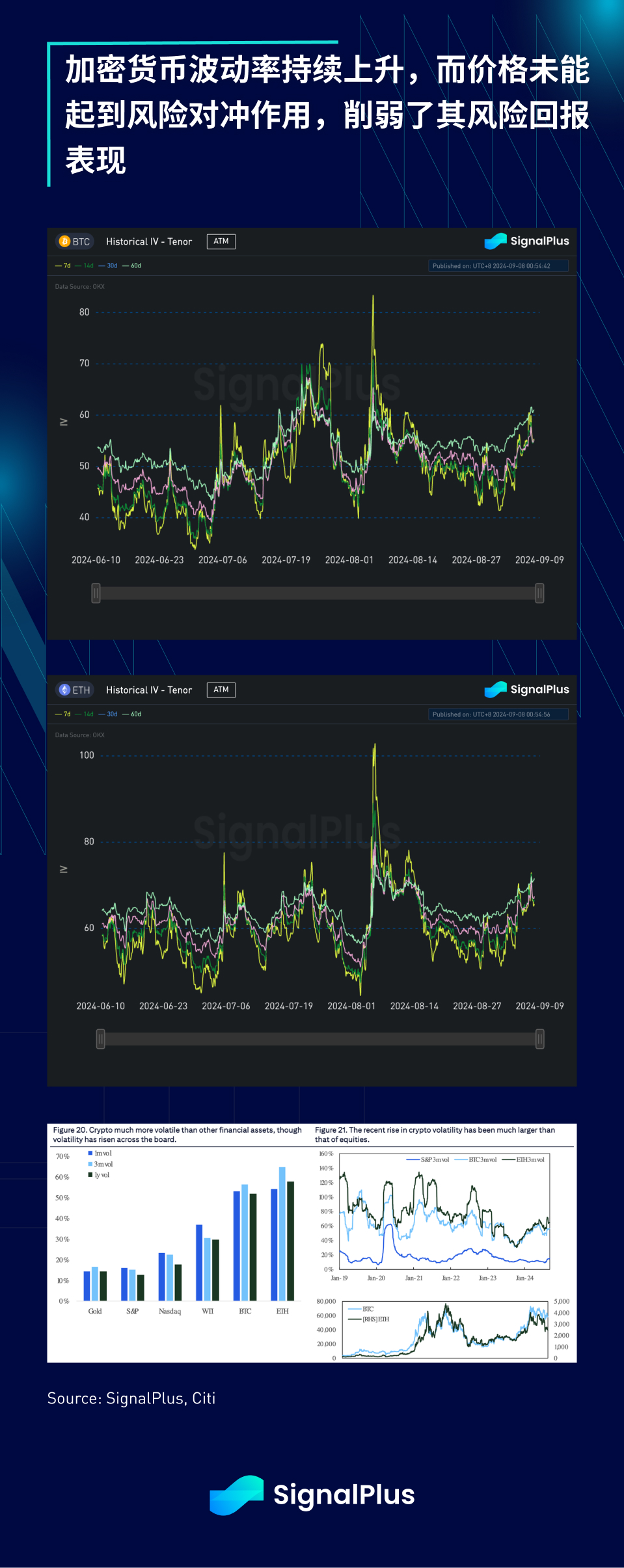

In addition, the rise in implied and realized volatility has weakened the current risk-reward performance of cryptocurrencies, and their lack of risk diversification characteristics (high correlation with SPX) makes it difficult to drive capital inflows.

Glassnode’s on-chain analysis paints a similar picture, with downward pressure increasing and unrealized losses accumulating. As expected, hedge funds are building short positions in BTC and ETH relative to asset managers’ long positions, and it is expected that as BTC approaches $50,000, cryptocurrency market sentiment will continue to be challenged and liquidation pressure will rise significantly.

Given the lack of positive catalysts ahead, we expect risk exposure to be further reduced in the coming week. The focus this week will be the US election debate on Tuesday, as well as intensive inflation data (including US and China) and global central bank talks (ECB resolution, RBA and BOJ talks). We are cautious about risk exposure and expect that the stock market may remain weak this week and continue until the FOMC meeting.

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com