Looking for bull market catalysts: Taking over Meme, these consumer applications are worth paying attention to

Original author: IGNAS | DEFI RESEARCH

Original translation: TechFlow

I’m tired of seeing yet another L2 project launch at $5B fully diluted valuation (FDV). Even more bored of yet another Uniswap, Aave, or Liquity fork on a new L2.

I am also not interested in buying another infrastructure protocol (data availability, oracle, blockchain as a service, etc.) with a high valuation and no value added to the token. I am hungry for innovation! Where is the innovation?

Finding internal catalysts for a bull market

In my last blog, I mentioned the boring state of the market and shared the external catalysts that could drive the market higher. ETH ETF and the change in the US government’s attitude towards cryptocurrencies can play a role, but more external catalysts like rate cuts will drive the bull run later.

I really like the positioning of the 2020-21 bull run. Due to the pandemic, governments have to print money (external catalyst), and people are bored at home and start speculating in NFTs, participating in 1000% DeFi yield farms, exploring the metaverse, and "working" in Axie Infinity or other P2E games. Our multiple innovations in the crypto space keep us interested.

But so far, this bull run has seemed a bit boring.

I believe that for this bull market to turn into a super cycle, we need strong internal innovation (in addition to the macro environment) to attract retail investors and continue to keep their interest and participation while allowing everyone to see paper earnings grow.

If we cannot activate the cryptocurrency market, even loyal users of the crypto market will choose to simply hold BTC, ETH, SOL because the risk/reward ratio of trading in the PvP market is not cost-effective.

At the moment, we are just earning points or speculating on memes. Memes are fun, and there are signs that some new retail traders have joined the market. But if you don’t have a special edge, the chances of making money on memes are slim. Influencers, market makers, and pump-and-dump groups are all making a killing on naive traders.

Points are a fading airdrop trend where the rich get richer, as rewards are usually based on 1) deposited funds and 2) trading volume. You can at least earn more airdrops by creating multiple wallets and performing manual trades. But most airdrops are linear right now, and LayerZero's anti-Sybill efforts may be changing the game.

So, what innovations in this cycle can bring back retail investor enthusiasm?

You know, I am bullish on the re-staking narrative as a playground for printing new tokens, which will increase yields and demand for ETH. But re-staking is not an attractive story for retail investors. Few people will actually understand or care to read what a “general purpose subjective work token” is.

Restaking is a game for big players. Although the innovative AVS (Active Verification Service) may be more attractive to tech-savvy retail investors.

(Reshaping Restaking: Eigenlayer Active Verification Service Guide)

BTCFi with Ordinals and Runes is my second favorite innovation/narrative in this cycle. I explained why in my previous article:

(Leading to the Rune Protocol launch: Beyond the initial hype)

But due to technical complexity and lack of clear value proposition, even tech-savvy Ethereum and Solana players are not very interested. Despite some hilarious videos of Chinese grandmas trading BRC 20.

We need something that can reignite our enthusiasm for investing, attract a large number of new retail users, and actually bring them returns (unlike most memes).

It’s hard to predict what will happen to NFTs or P2E in this current cycle, but I tend to believe in a new generation of consumer applications. There are already signs that this trend is happening.

Top Consumer Applications

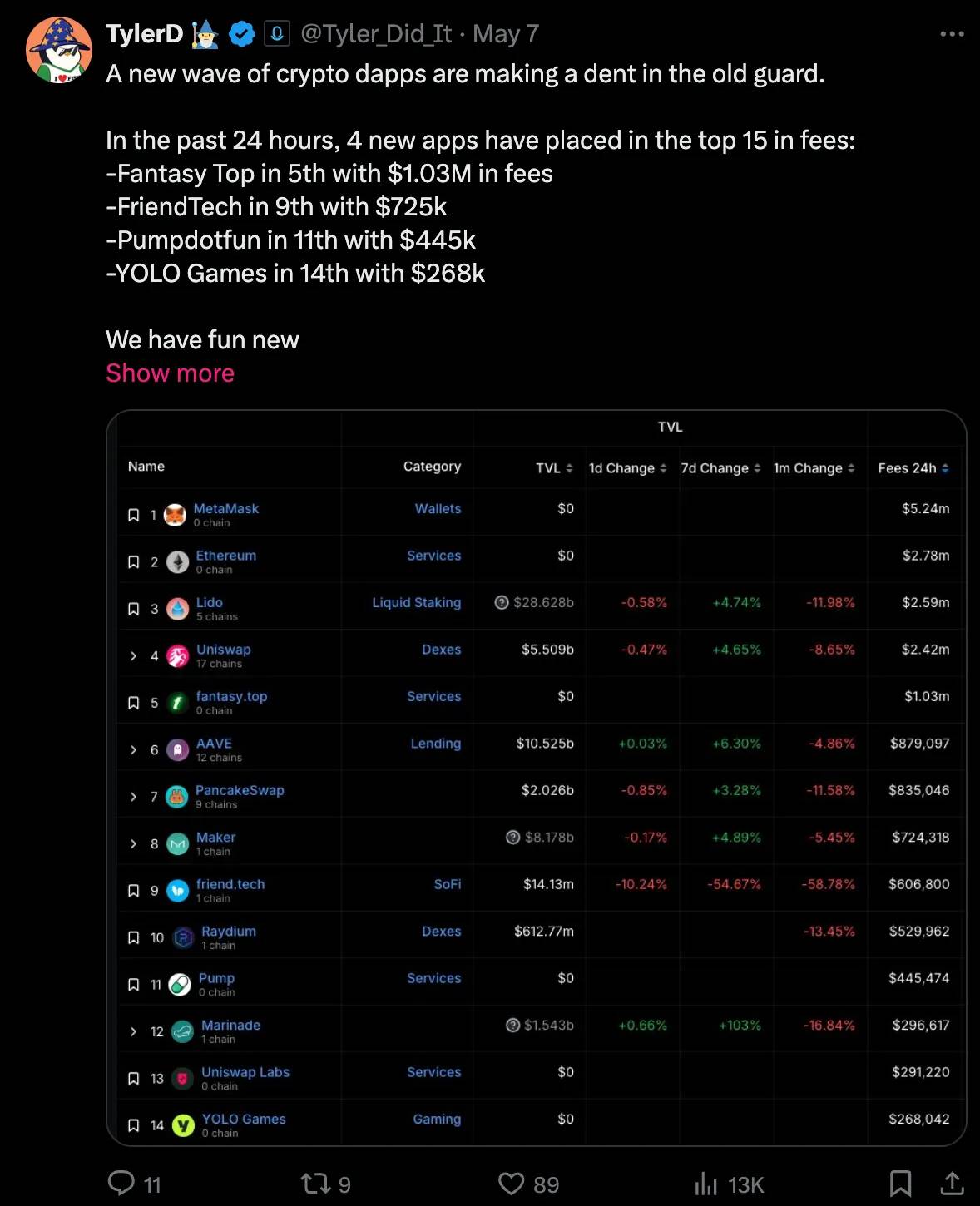

On May 7, four new social applications briefly entered the top 15 protocols by fee generation.

Fantasy Top

Friend Tech

Pumpdotfun

YOLO Games

“User numbers remain small (none have more than ~20,000 DAUs), but from a monetization perspective their success represents a shift in crypto-native business models toward building proprietary distributions.” - Consumer Ecosystem Report from Our Network newsletter.

Honestly, I am very skeptical about Blast L2 (powered by Paradigm) because it is just another L2 that lets you farm points. And there is no intention to deposit any ETH to farm points.

But Fantasy Top got me into Blast. Turns out, I don't really care about another L2. I care about the apps on that L2.

Fantasy Top allows speculating on the engagement of Twitter influencers. You can earn Blast Gold + FAN Points, or trade your hero cards.

It’s a niche protocol that combines speculation with Crypto Twitter. But just as Facebook started as a platform for Harvard students to connect and later expanded to other Ivy League universities, Fantasy Top has the potential to expand its reach to include famous Twitter or Instagram influencers.

Elon Musk’s card will be popular.

This kind of growth beyond crypto is my hope for this cycle. Which app is most likely to achieve this?

Friend Tech did it briefly: it attracted the girls from Only Fan, but they didn’t stay. Friend Tech is currently at a crossroads of reinventing itself through a points program with another local L2.

Pumpdotfun is a great platform. Yes, I don’t like speculating on memes, but Pumpdotfun as a platform has found a good market fit at this stage of the market.

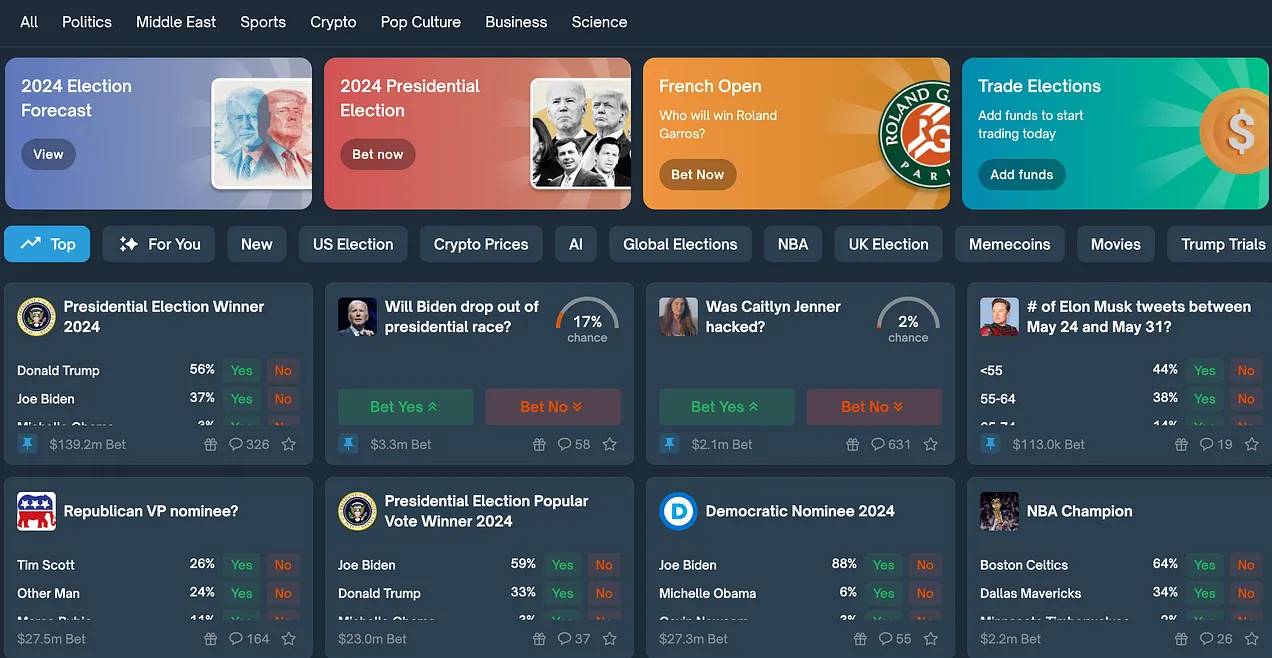

The YOLO game is also largely based on speculation, but there is one consumer app that blends speculation and social elements better than the others: Polymarket.

Polymarket Prediction Market

Polymarket is a prediction market that allows trading of event-driven binary options that will settle at either $1 or $0 at expiration.

You can choose to exit your position before expiration.

For example, you can bet on who will win the US presidential election, or whether ETH will surpass BTC by 2025.

I like it because it uses the collective wisdom of the crowd for real-time sentiment analysis. It helps in understanding world events more clearly.

Vitalik has praised Polymarket on multiple occasions:

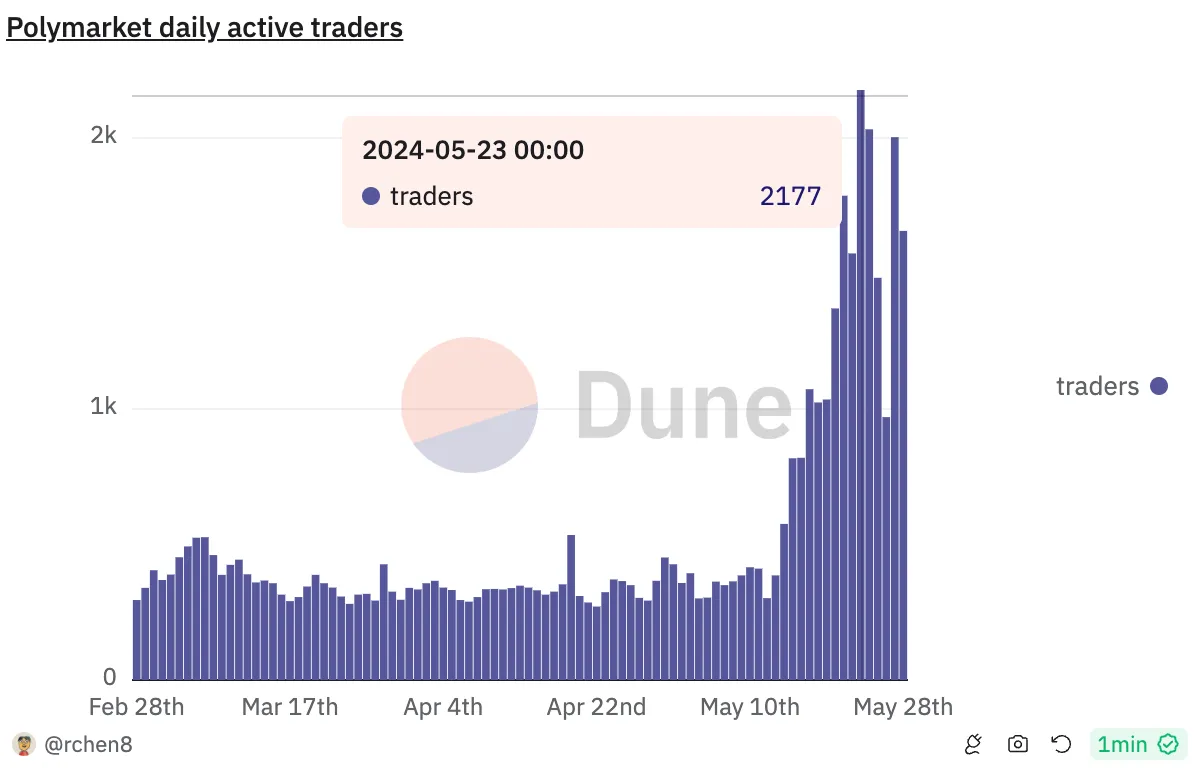

During the speculative frenzy surrounding the ETH ETF approval, Polymarket had around 2,000 daily active users. Still too few, but with great potential for growth.

Polymarket just raised $70 million from Vitalik Buterin and Founders Fund (Peter Thiel’s VC firm). I wouldn’t be surprised if they launch an airdrop soon.

There is another consumer application that I am more optimistic about: Farcaster

Farcaster - Decentralized Twitter

Farcaster raised $150 million at a reported $1 billion valuation !

Compared to other fundraisings in 2024, Eigenlayer raised $100 million, Optimism raised $89 million, and Berachain raised $69 million.

Farcaster is the 0 to 1 innovation of this cycle, combining the best features of social media (Twitter) and crypto. It could become a super crypto app, combining social interactions with financial transactions such as payments and trading.

It’s good enough so that if X suddenly disappeared, all Crypto Twitter users could move to Farcaster in a short time.

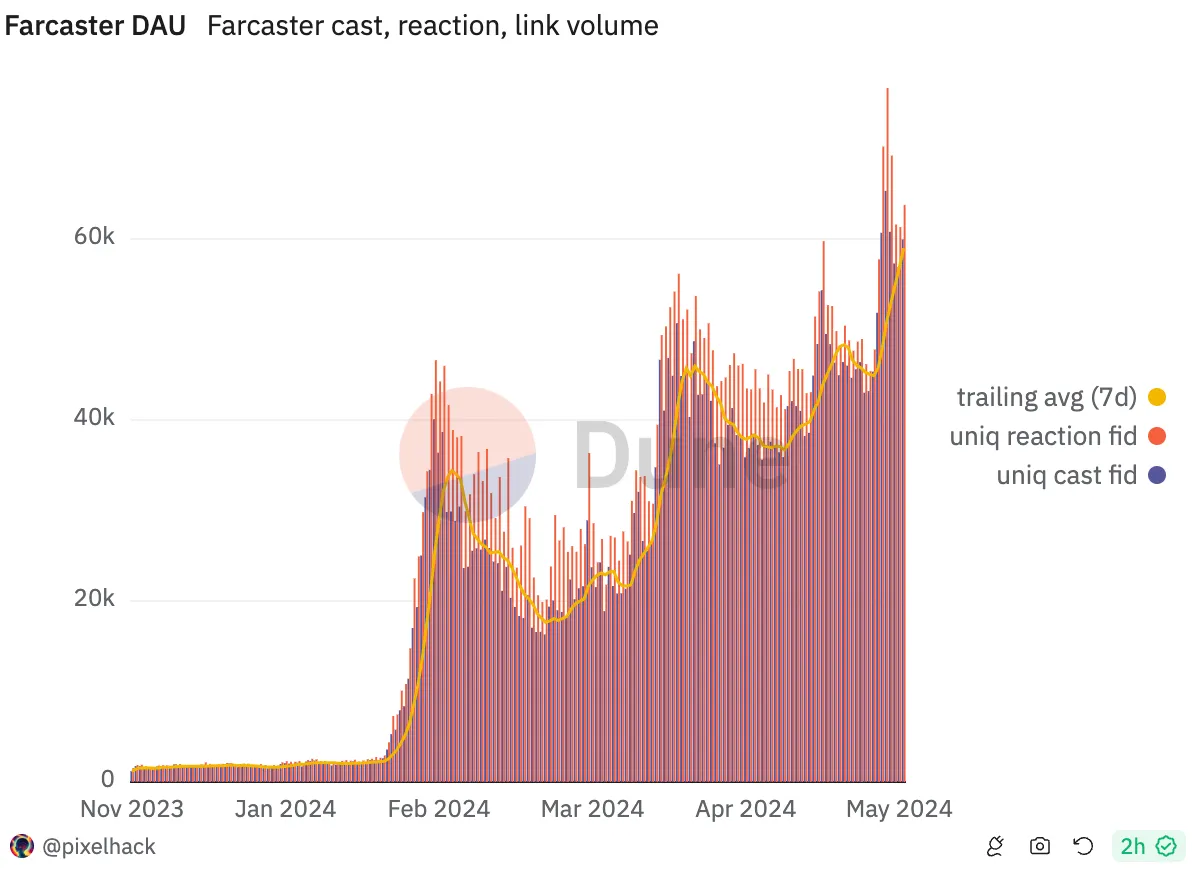

Farcaster saw a huge increase in users in February when $DEGEN community tokens were airdropped to early users. Amazingly, daily active users continue to grow, reaching 59,000.

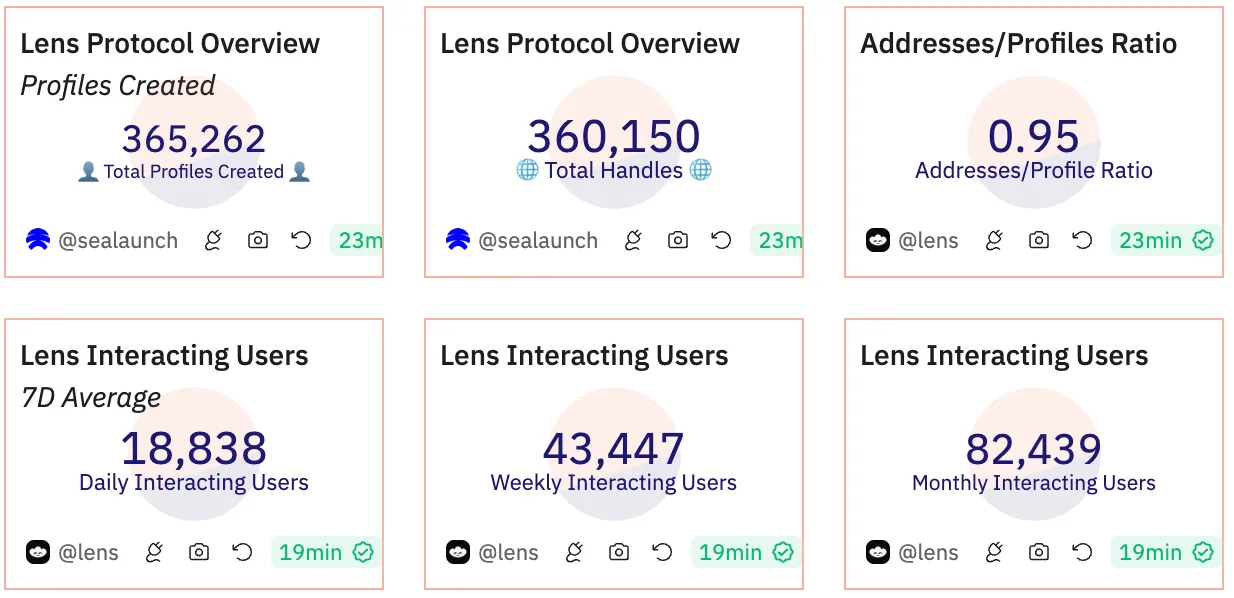

Lens Protocol is another decentralized social media layer with 19,000 daily active users.

Despite having fewer users, Lens is actually the only network that stores user content and identities on-chain. Farcaster’s posts and interactions are off-chain (while user profiles are on-chain).

In a surprise move, Lens announced its migration from Polygon PoS to zkSync, a ZK Stack superchain. A big win for zkSync and a loss for Polygon.

What consumer applications are you bullish on? I asked this question on X and received a lot of interesting comments.

A new way to make money

I am bullish on consumer applications because they innovate in user reward mechanisms and token economics, providing a way out of the current low float, high fully diluted valuation problem.

The problem is: there are too few popular consumer apps!

Furthermore, speculating on the growth of Farcaster or Lens may seem complicated at the moment, but one thing I know for sure about cryptocurrency is that it always finds unique ways to reward early users.

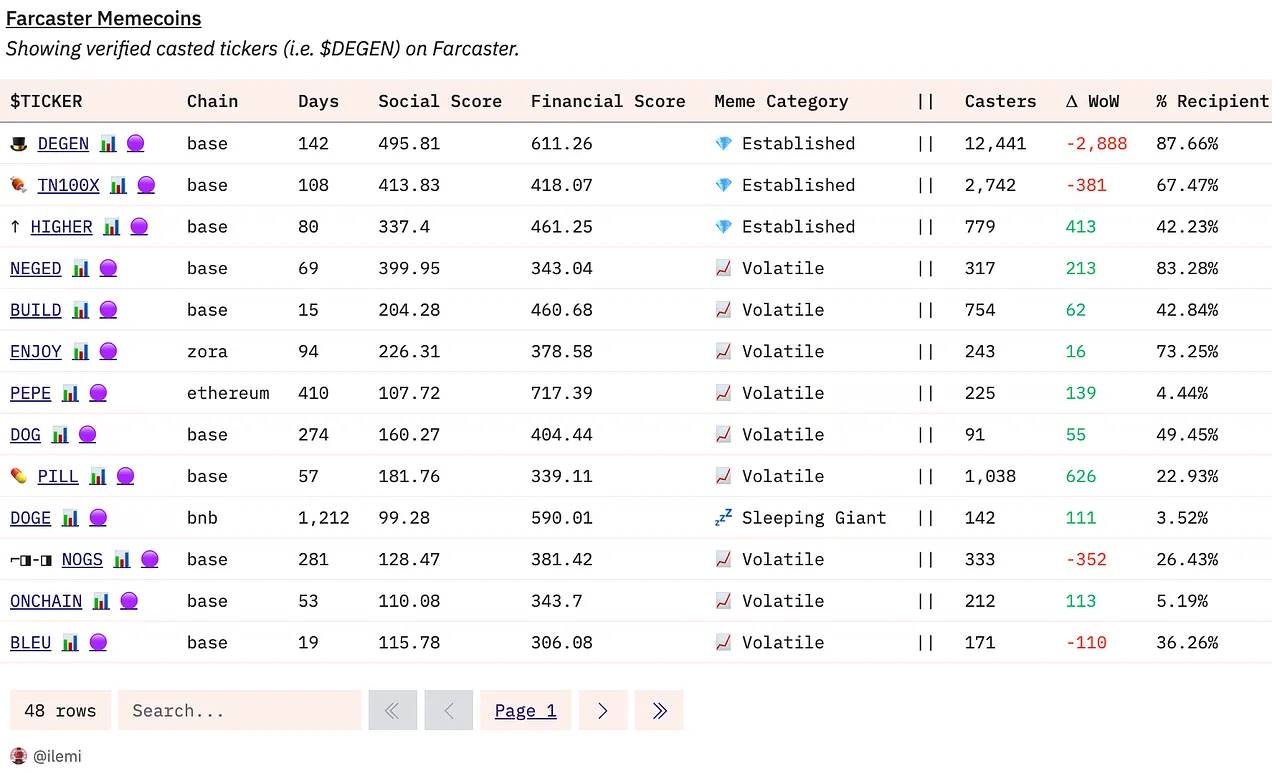

I received several thousand dollars of DEGEN airdrops as an early Farcaster user. In fact, Farcaster also has 47 "scene coins" you have never heard of - social memes.

Lens has its own meme, but I’m pretty confident that Lens will launch a $LENS airdrop at some point in the future. I’m not so sure about Farcaster.

Your airdrop will depend on your engagement, so posting once or twice won’t earn you much, however, these platforms offer a way out of the current “the rich get richer” points meta model, where your airdrop depends on the depth of your pockets.

Even on Fantasy Top or Polymarket, the rewards are more based on ability: if you are smart enough, you can get huge gains.

These consumer apps may have different token economics and may escape the low circulation, high FDV trap. Friend tech is 100% airdropped to the community. I hope other consumer apps will follow FT's footsteps.

A fair and generous Polymarket will shake up the market, potentially attracting more VC funding and user attention from infrastructure products to consumer applications.

Seriously, we really need more successful consumer applications this cycle! For our industry. I like Picolas’ point that we need something to lift cryptocurrencies out of their current state of depravity.

There are other areas that have the potential to attract a large number of new users. Telegram’s integration with TON and new crypto games.

You can read my bullish thesis on the TON ecosystem and dApps here .

Another area is Gamefi.

I worked with our Pink Brains researcher Skipper on the latest top GameFi games and their innovative token economics and incentives.

GameFi: 3 top Web3 games that are "most worthwhile" for early adopters to play

Let's face it. Most previous GameFi projects have been missing the "play" element.

Furthermore, the “earning” element is often achieved by paying users with utility tokens that accrue no value due to the lack of appeal of these unplayable games.

This changes in 2024. For the first time, we see player-centric Web3 games that are able to attract mainstream attention.

Here are 3 top Web3 games worth investing your time in as an early adopter:

Nyan Heroes is a lot like Overwatch, if you added cats that fight in giant mechs. This Solana-based FPS game hooks players by incorporating dynamic moves like wall climbing.

Nyan Heroes is in the top 5 wishlists on the Epic Games Store - after just two pre-release seasons.

The F2P game just launched its $NYAN token on May 21st, which currently has a market cap of $25 million, but is already listed on Bybit, Gate.io, HTX, MEXC, and Backpack Exchange - which bodes well for future price action as long as the team keeps delivering.

9 Lives Interactive, the studio behind the game, raised $3 million in a funding round in early March.

Bullish Catalysts for Nyan Heroes :

One of the top 30 games on the Epic Games Store.

It received over 200,000 downloads within two weeks of its pre-release.

The full version of the game with integrated NFTs will be released in early 2025.

Ways to get rewards as an early player:

Wait for the announcement of the next pre-release season.

Play the game's third season.

Earn CATNIP points by improving your MMR ranking.

Metalcore is like Battlefield meets Star Wars, all powered by a Web3 open economy with a potential earning element.

Metalcore is one of the few Web3 games that can truly compete with mainstream titles in terms of graphics and overall aesthetic, thanks to Unreal Engine 5 — and the game is still in closed beta.

This first-person/third-person territory war shooter combines PvP and PvE elements.

Bullish Catalysts for Metalcore:

The highest quality graphics in Web3 games thanks to UE 5.

Won the Best Blockchain Game Award 2024 at the Global Blockchain Awards.

Metalcore has raised a total of $20 million and is backed by Delphi Digital, Arrington, and Spartan Group.

Ways to get rewards as an early player:

Start playing Metalcore when it’s open access.

Focus on quality cooperative play, not just scores.

Players will earn $MCG tokens through strategic gameplay and tactical decisions.

Shrapnel

Shrapnel is a first-person extraction shooter with earning elements, built on Unreal Engine 5.

The Avalanche-powered FPS is still in early development, but a $100,000+ play-and-airdrop campaign has generated a ton of interest among Web3 creators and is starting to attract Web2 attention.

Bullish Catalysts for Shrapnel:

“Play and Airdrop” event with a prize pool of $100,000.

Join the Emmy-winning team behind Halo, Call of Duty, and Westworld.

Shrapnel has one of the largest communities of creators in Web3 gaming.

Ways to get rewards as an early player:

Purchase the Shrapnel Extraction Pack NFT to play the game.

Participate in the next Play and Play Airdrop event (to be announced).

The top 1000 players on the leaderboard share the prize pool.

Don’t be sucked in by excessive bullishness

Consumer applications need to attract mainstream users beyond the crypto community.

But Brave teaches us a lesson: the success of a protocol does not necessarily mean that the token will perform well.

Despite Brave being one of the most successful consumer apps, its BAT token is still trading at 2017 prices.

In the long run, it will be difficult for any dApp mentioned in this blog to outperform BAT.

Therefore, it is important to research when to take profits.