The battle between memes and governance tokens: Everything is a meme

Originally Posted by Yash Agarwal

Original translation: TechFlow

Ramblings and insights on how and why Meme offers a fairer launch compared to VC-backed governance tokens and TradFi — lessons for crypto founders.

A16z’s chief technology officer recently argued that Meme Coin is “unattractive to builders” and “may even be net negative if external influences are taken into account.”

"A series of false promises covering up the casino"

“Changed the way the public, regulators and entrepreneurs think about cryptocurrencies”

“Technologically unattractive”

etc.

Meanwhile, Chris Dixon published a more sobering article highlighting the systemic absurdity of the US securities legal system — highlighting how the best projects are mired in regulatory limbo, while Meme Coin is able to stand out because they don’t “pretend that Meme Coin investors are dependent on anyone’s management efforts.” This indirectly acknowledges the pretense of the rest of crypto — the management efforts of various teams over protocols, which we call governance tokens.

Our goal is neither to defend nor to diminish the importance of Meme Coin (or governance tokens), our purpose is simply to advocate for fairer token issuance.

Governance Tokens Are Memes With Extra Steps

I believe that all governance tokens are essentially memes, and their value depends on the meme origin of the protocol. In other words, governance tokens are memes in suits. Why do you say that?

Typically, governance tokens don’t provide any revenue distribution (due to securities laws), and they don’t perform very well as a framework for community-oriented decision-making (holdings tend to be concentrated, participation is low, or DAOs are generally dysfunctional), which makes them act like memes, just with a few extra steps. Whether it’s ARB (Arbitrum’s governance token) or WLD (Worldcoin’s token), they are essentially meme coins attached to these projects.

This is not to say that governance tokens don’t have their uses. Ultimately, their existence is a constant reminder of why laws need to be updated. That being said, governance tokens can cause as much harm as memes in many cases:

For builders: Many high-profile VC-backed governance tokens launched before product was released, creating significant disillusionment. This directly undermines the credibility of founders who have worked for years to gain adoption. For example, Zeus Network launched with a $1B FDV before even launching a product, while many founders struggle to reach such valuations even after making significant progress.

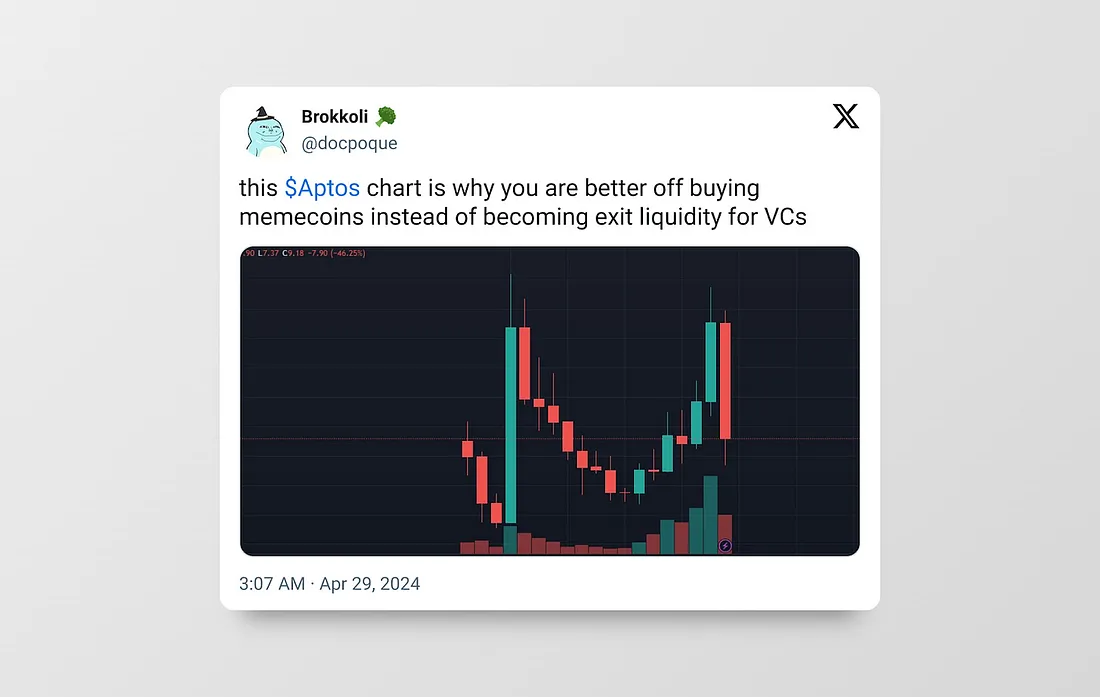

For the community: Most governance tokens are venture-backed, launched at high valuations and gradually transferred to retail investors.

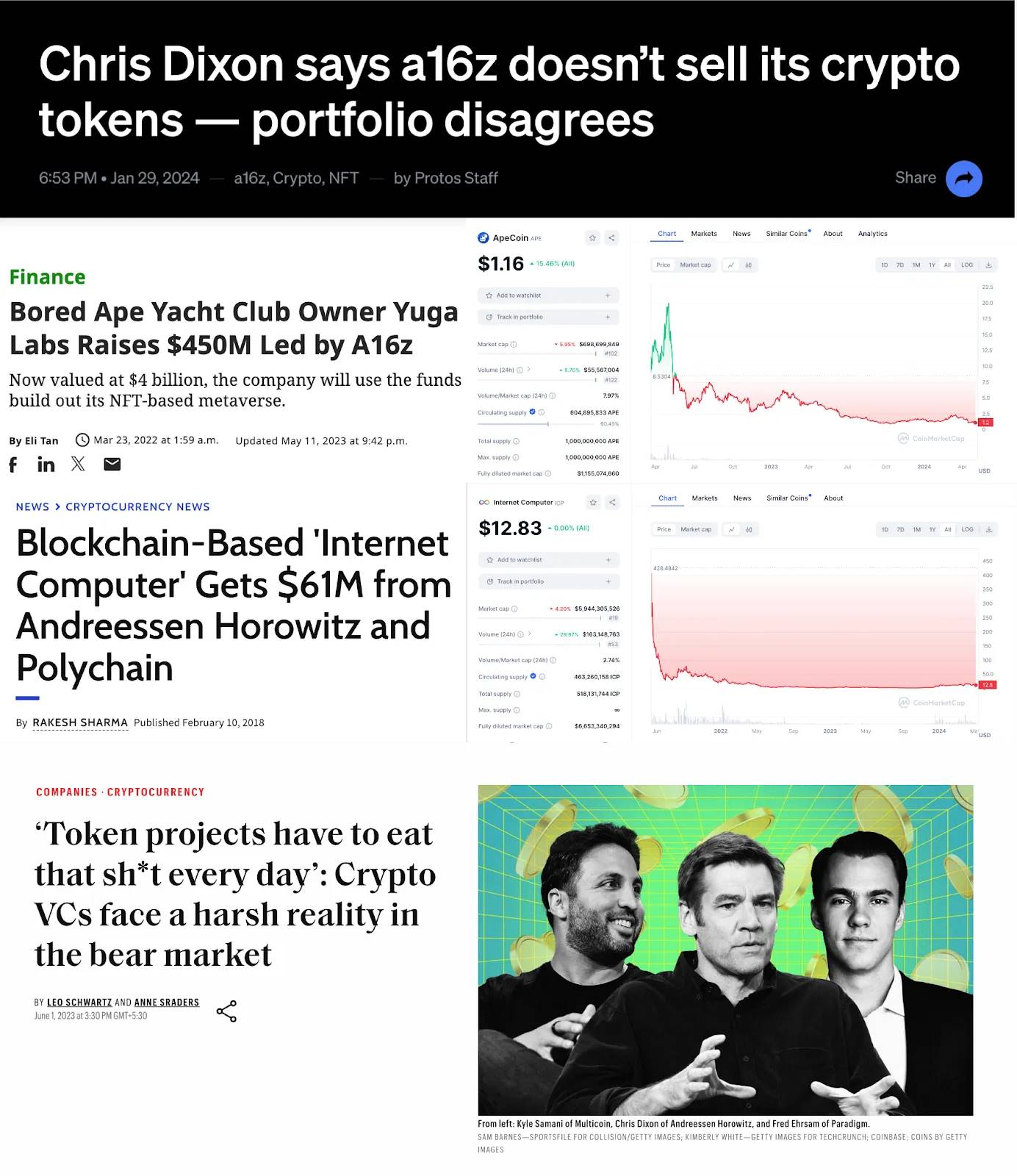

Research ICP, XCH, Apecoin, DFINITY , etc. Even the ICOs from 2017 are better than the current VC-backed low-circulation tokens because most of their supply was unlocked at launch.

Take the a16z case, but look at any large VC with more than $300 million in funds.

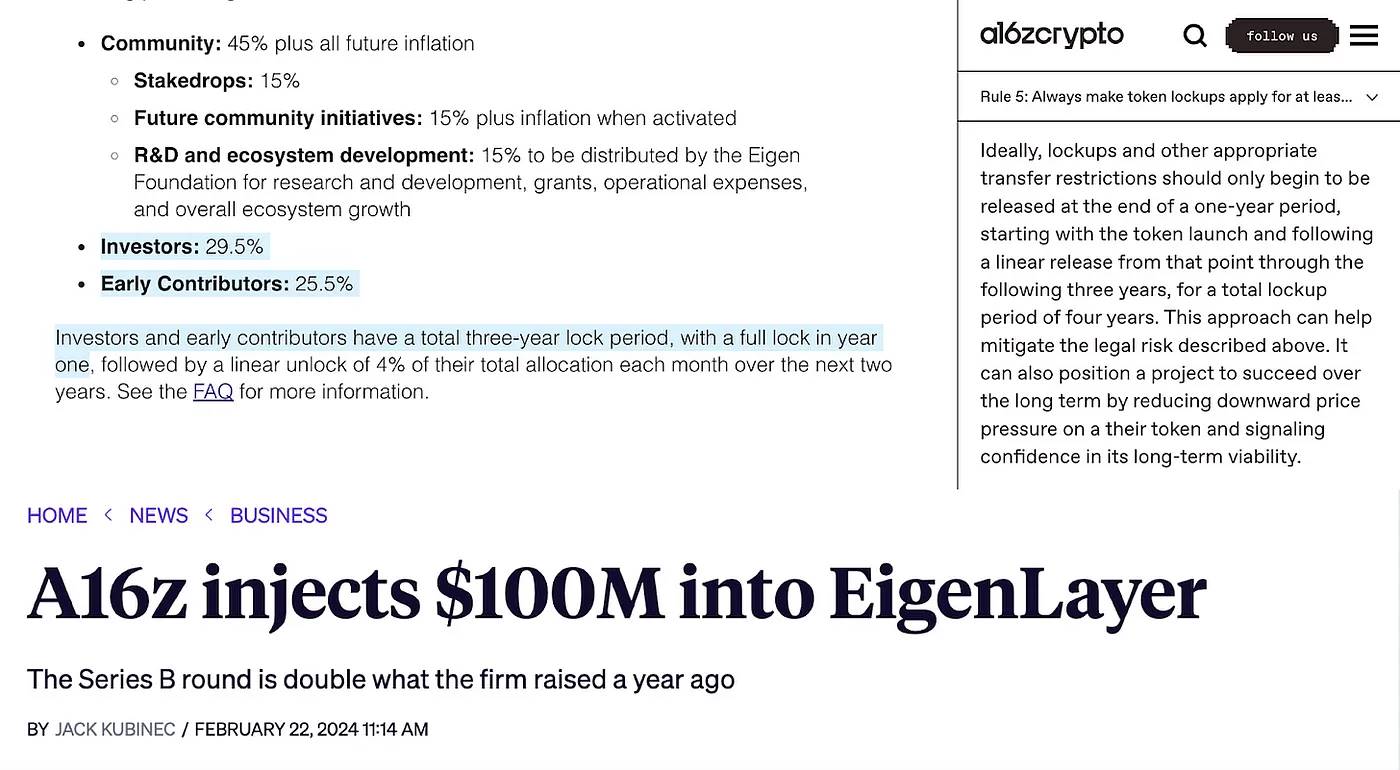

Let's take a look at the case of EigenLayer:

EigenLayer, arguably the largest Ethereum protocol in this cycle, is a classic example. Insiders (VCs and team) hold a sizable portion, 55%, while the initial community airdrop was only 5%. This is a classic low circulation, high FDV play, backed by VCs with 29.5% of the shares. Last cycle, we blamed FTX/Alameda, but this cycle we are not much better.

EIGENDAO, governed by EIGEN, is now like any Web2 governance committee, as insiders control the majority of the supply (initially community supply was only 5%). Don’t forget, the whole concept of EigenLayer is re-hypothecation (leveraged yield farming), making financial engineering as much a Ponzi scheme as a Meme.

If a group of insiders holds more than half of the supply (55% in this case), we will severely hinder the redistributive effect of the cryptocurrency, making a small number of insiders extremely wealthy through low float, high FDV issuances. If insiders truly believe that they would be better off reducing their distributions given the astronomical valuations of the token issuances, then the tokens will be issued at a lower price.

Please let the real conspiracy group stand up

Given the absurdity of the capital formation process — we’ll end up with VCs blaming memes, and meme makers blaming VCs for the regulatory chaos and reputational crisis in the space.

But why is VC so harmful to tokens?

There are structural reasons why VCs drive up FDVs. For example, if a large VC fund invests $4 million for a 20% stake at a $20 million valuation, they logically must raise the FDV to at least $400 million at the TGE (token launch event) to generate profits for LPs. Protocols are pushed to go public at the highest possible FDV to boost returns for seed/pre-seed investors.

In the process, they continually encourage projects to raise funds at ever-higher valuations. The larger the fund, the more likely it is to give the project an absurdly high private valuation, build a strong narrative, and eventually go public at an even higher public valuation, forcing a sell-off on retail investors when the token is issued.

Starting with a high FDV only leads to a downward spiral and zero attention. See Starkware’s case.

Starting with a low FDV allows retail investors to profit from repricing and helps form community and mindshare. See Celestia for example.

Retail investors are more sensitive to unlocks than ever before. In May alone, $1.25 billion worth of Pyth will be unlocked, plus hundreds of millions from Avalanche, Aptos, Arbitrum, etc.

Some unlock data

Memes are the product of a broken financial system

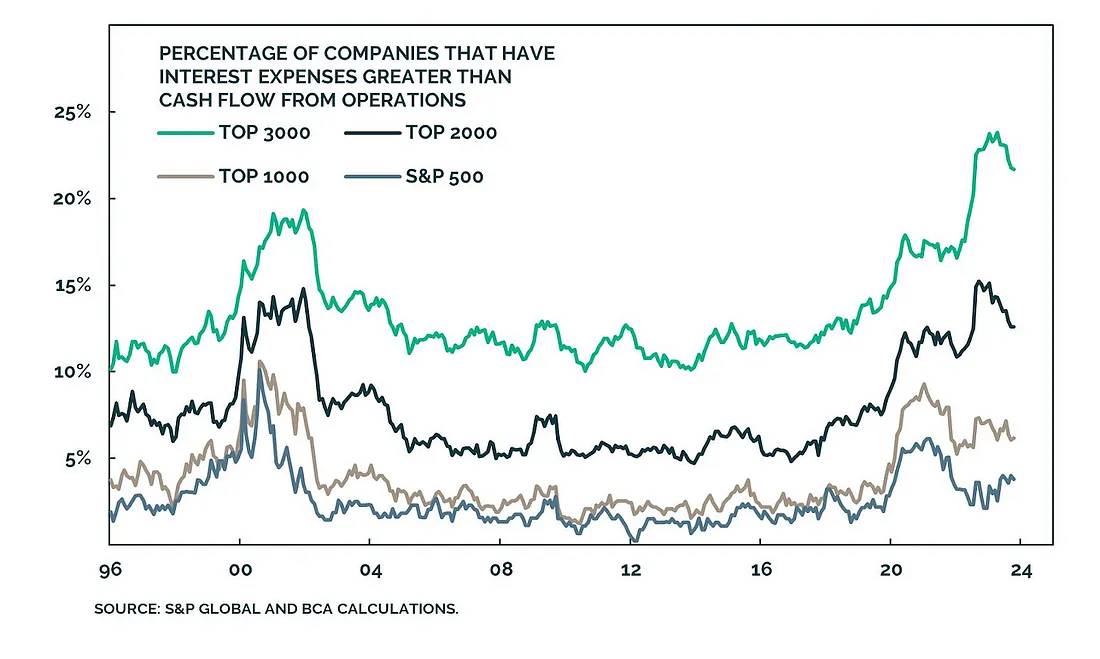

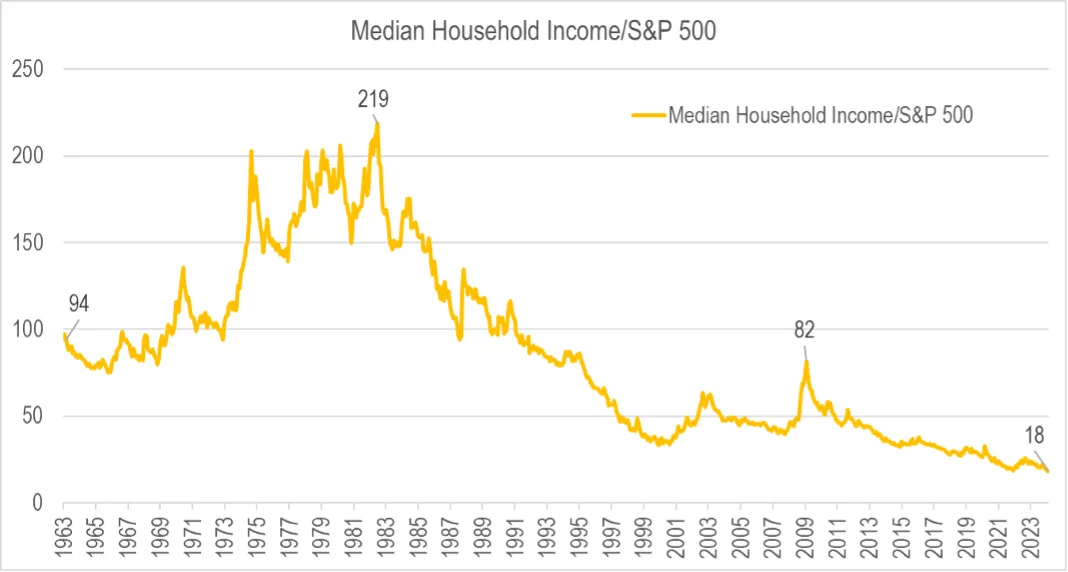

Bitcoin is arguably the largest and oldest meme coin, born after the financial crisis of 2008. Negative/zero real interest rates (interest rate minus inflation) forced every saver to speculate on a new shiny asset class (e.g., meme coins). The zero interest rate environment created a market environment filled with desperadoes who were sustained by cheap capital. Even top indexes like the S&P 500 have about 5% zombie companies, and their condition is about to get worse as interest rates rise, making them no different from memes. What's worse is that they are promoted by fund managers and retail investors continue to buy them every month.

There is a reason why speculation never dies, and in this cycle they are memes.

FRED via Kana and Katana

On this basis, the term ‘financial nihilism’ has been getting a lot of attention lately. It encapsulates the idea that the cost of living is killing most Americans, that opportunities for upward mobility are increasingly out of reach, that the American Dream is largely a thing of the past, and that the median housing price-to-income ratio has reached completely unsustainable levels. The underlying drivers of financial nihilism are the same as those of populism, which is an approach to politics that appeals to ordinary people who are fed up with the establishment elites – ‘this system isn’t working for me, so I want to try something very different’ (e.g., buy BODEN instead of voting for Biden).

Meme is testing infrastructure

Meme is not only a great cryptocurrency onboarding tool, but also a great way to test infrastructure. Contrary to A16z’s position, we believe that Meme has a net positive impact on any ecosystem. Without Meme coins, chains like Solana would not face network congestion and all network/economic vulnerabilities would not surface. Meme coins on Solana have a net positive impact:

Not only did all DEXs process the highest volume ever, they also outperformed their Ethereum counterparts.

Money markets integrate Meme to increase TVL.

Consumer apps integrate memes to gain attention or for marketing purposes.

Validators can earn huge fees thanks to priority fees and MEV.

The network effects in DeFi are more potent due to increased liquidity and activity.

There’s a reason why Solana’s wallet, Phantom, has 7 million monthly active devices, as it’s powered by memecoins and allows regular people to get onboard, which is probably one of the most used applications in cryptocurrency right now.

For true RWAs to trade on-chain requires infrastructure with sufficient liquidity (look at the top memes, they have the deepest liquidity outside of L1 tokens/stablecoins), stress-tested DEXs, and DeFi more broadly. Memes are not a distraction; they are just another asset class that lives on a shared ledger.

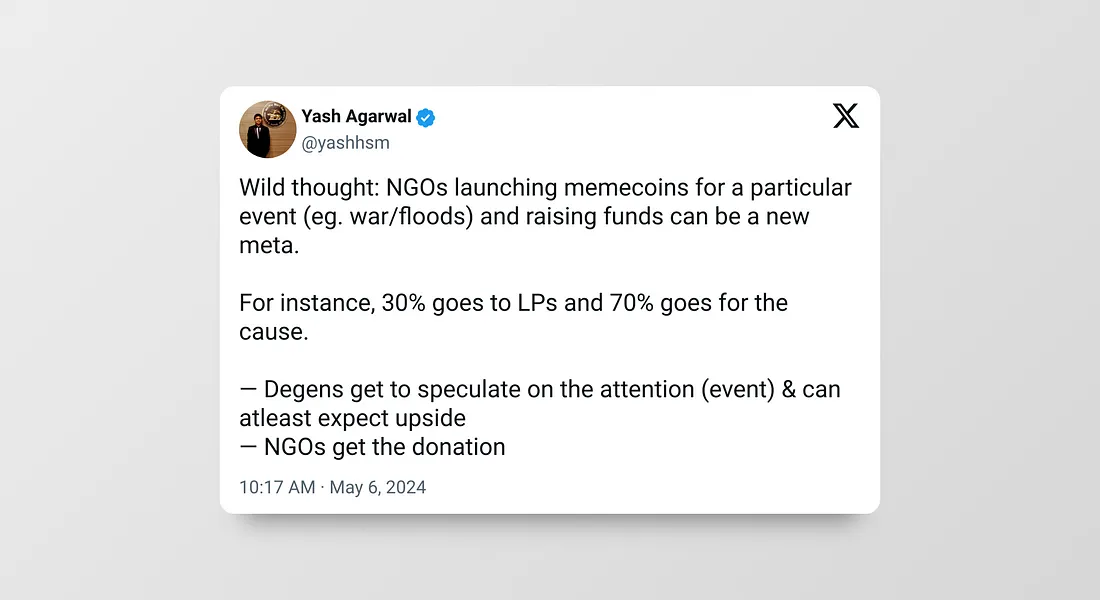

Memes as a Fundraising Mechanism

Memes have now proven to be an effective means of capital coordination. Research Pump.fun, which has facilitated the issuance of close to millions of memes and created billions of value for memes. Why? Because for the first time in human history, anyone can create a financial asset for less than $2 and in less than 2 minutes!

Memes can serve as an excellent fundraising mechanism and go-to-market strategy. Traditionally, projects raise large amounts of money by allocating 15-20% to VCs, developing products, and then issuing tokens while building communities through memes and marketing. However, this often results in communities ultimately being abandoned by VCs.

In the meme era, people could raise funds by launching their own meme (no roadmap, just for fun) and forming a tribal community early on. They could then continue to build applications/infrastructure, continually adding utility to the meme without making false promises or providing a roadmap. This approach leverages the tribalism of the meme community (e.g. holder bias), ensuring high engagement from community members who become your BD/marketers. It also ensures a fairer token distribution, countering the pump and dump strategy of low circulation and high FDV adopted by VCs.

This is already happening

BONKBot , a Telegram bot (with a daily transaction volume of up to $250 million), originated from the BONK Meme and uses 10% of transaction fees to buy and burn BONK. It has cumulatively destroyed about $7 million of BONK through fees, thus aligning its economy with holders.

Degen , a meme in the Farcaster ecosystem, enables contributors to reward/tip others with DEGEN for quality content. In addition, they have built an L3 chain for degen. Similarly, Shibatoken, one of the most popular memes in the last cycle, is now building an L2.

This trend will eventually lead to the convergence of memes and governance tokens. It is important to note that not all memes are created equal; scams are common, but they are easier to uncover than scams that VCs carry out quietly.

Looking ahead

Everyone wants to get in on the next big thing, and memes are one of the few areas where retail investors can get in earlier than most institutions. With limited access to private VC deals, memes offer Sandlake Capital a better potential market fit. While memes do make crypto look like casinos, it does put the power back in the hands of the community.

So, what is the solution?

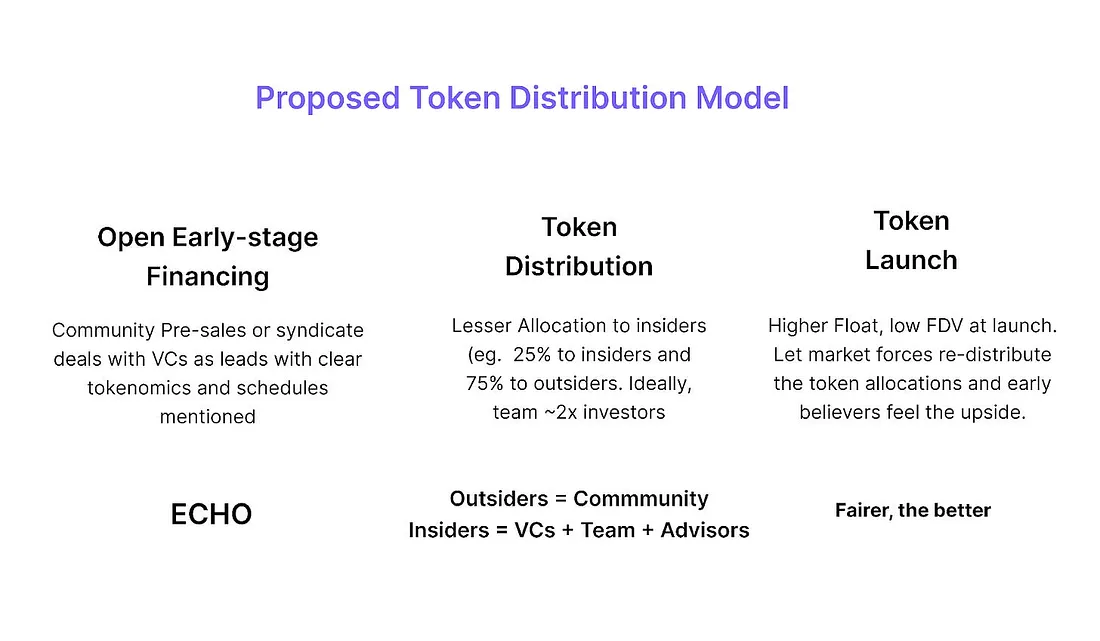

VCs like a16z should syndicate their deals so anyone can participate. Platforms like Echo are a great fit for this.

For VCs, put your deals on Echo, engage the community in syndicating deals, and witness the meme-like magic of early-stage communities rallying around projects.

To be clear, we are not against VC/private funding, we advocate for fairer distribution and a level playing field where everyone has the opportunity to achieve financial sovereignty. VCs should be rewarded for their early risk taking. Crypto is not only about open and permissionless technology, it is also about openness in early stage financing, which is currently as opaque as traditional startups.

all in all:

Everything is a meme.

Studying memes as fundraising and community building mechanisms.

Projects should lean towards more equitable launches.

It’s time to make early-stage financing more open.