SocialFi data comparison: Friend.tech VS Farcaster, who is the social king?

Original|Odaily Planet Daily

Author: Wenser

As the hottest L2 network in 2024, the Base ecosystem has successively launched two major social protocols, Friend.tech and Farcaster. The former fell into silence after the popularity in August last year, but recently with the launch of the FRIEND token and the V2 version, the Club gameplay has once again attracted many attentions in the market; the latter was initially built on the OP ecosystem, and after relying on the Base ecosystem, it launched the Frame application in January 2024, and relied on the Meme coin craze including DEGEN, and gradually embarked on a "social forum road" of its own.

Today, Odaily Planet Daily will lead everyone to look at the performance of the two hot products in the SocialFi track - Friend.tech and Warpcast (the underlying protocol is Farcaster) from a data perspective.

1. Basic data: number of users + contract income

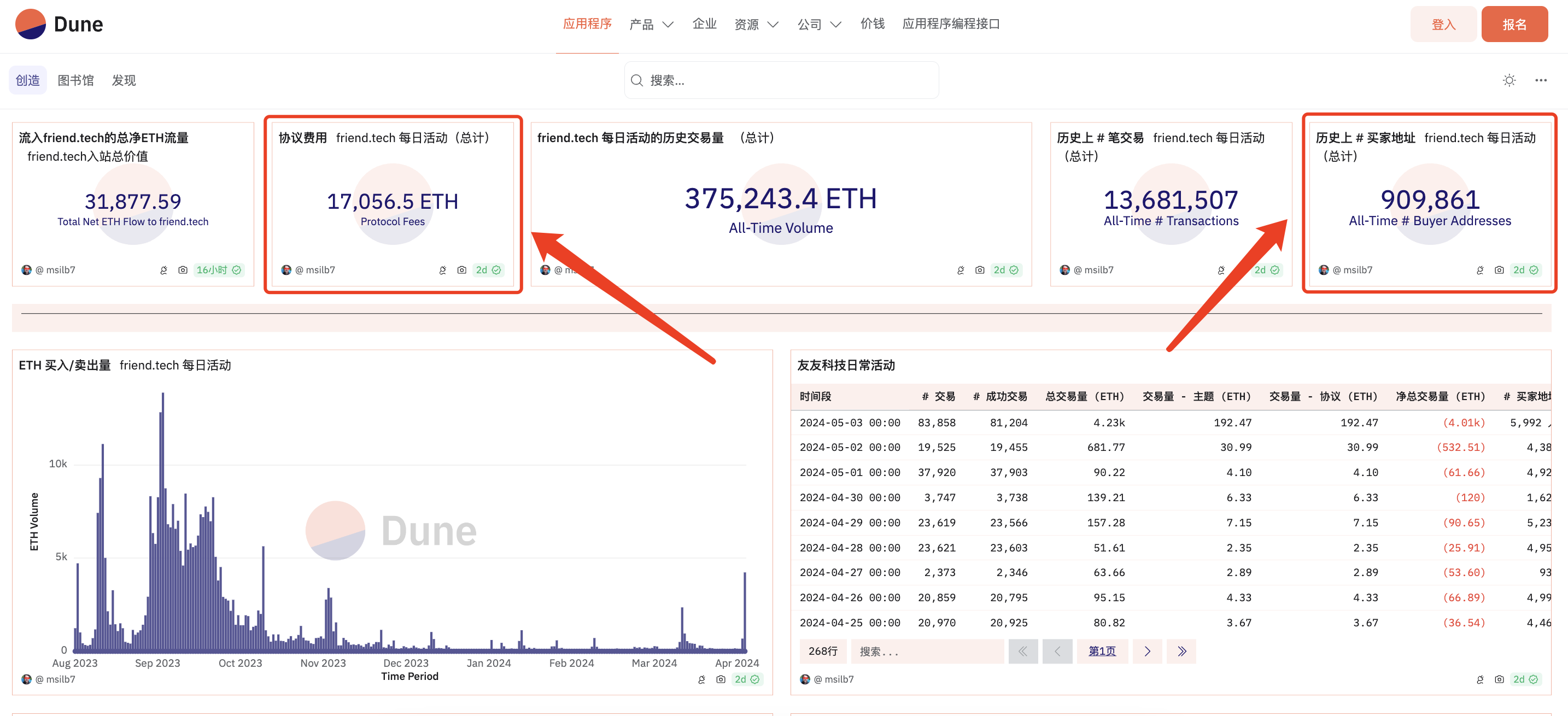

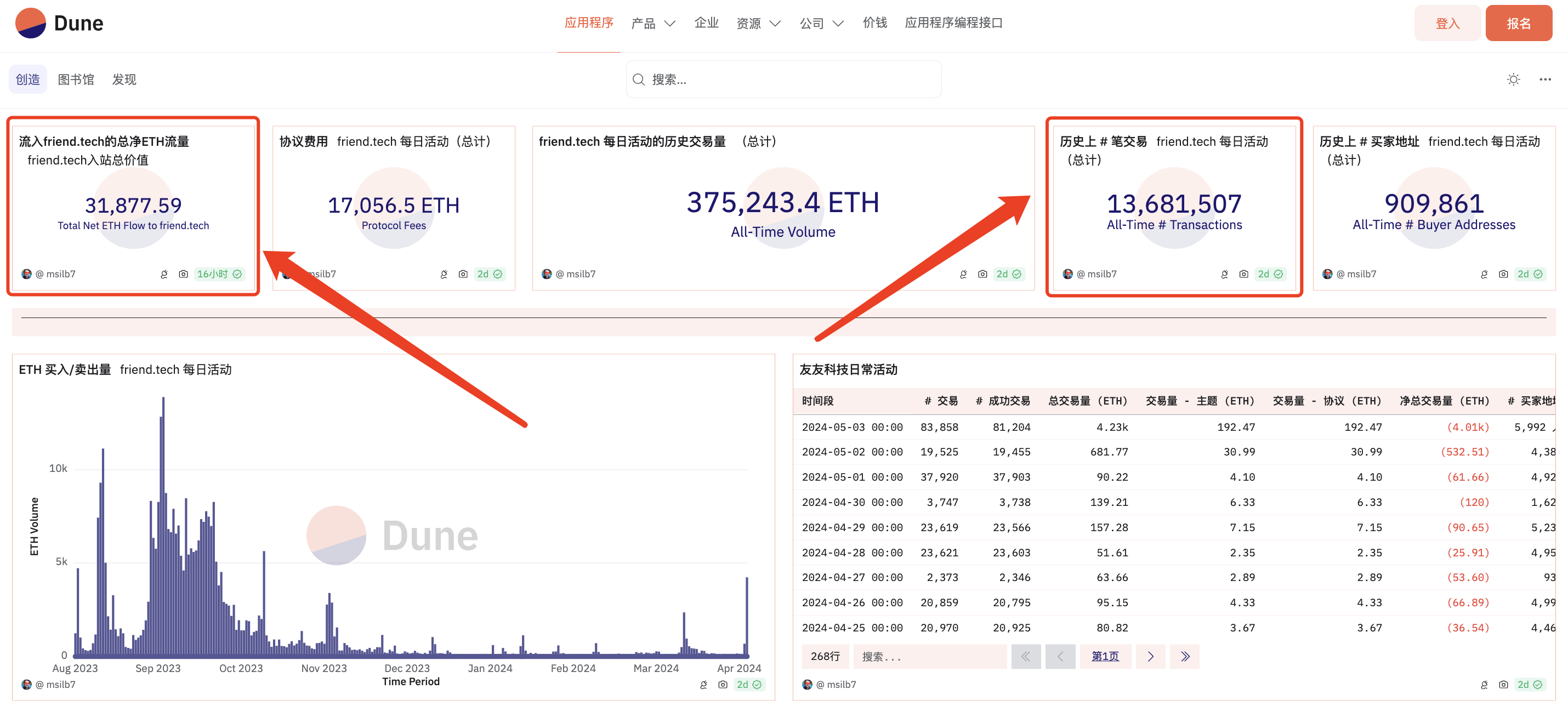

According to Dune data , the total number of Friend.tech users is currently 909,861 independent addresses, and the protocol revenue is 17,056.5 ETH (approximately US$54.647 million). Of course, this is data from August 2023 to early May 2024, and the overall duration is about 9 months.

https://dune.com/msilb7/friendtech-on-base-activity

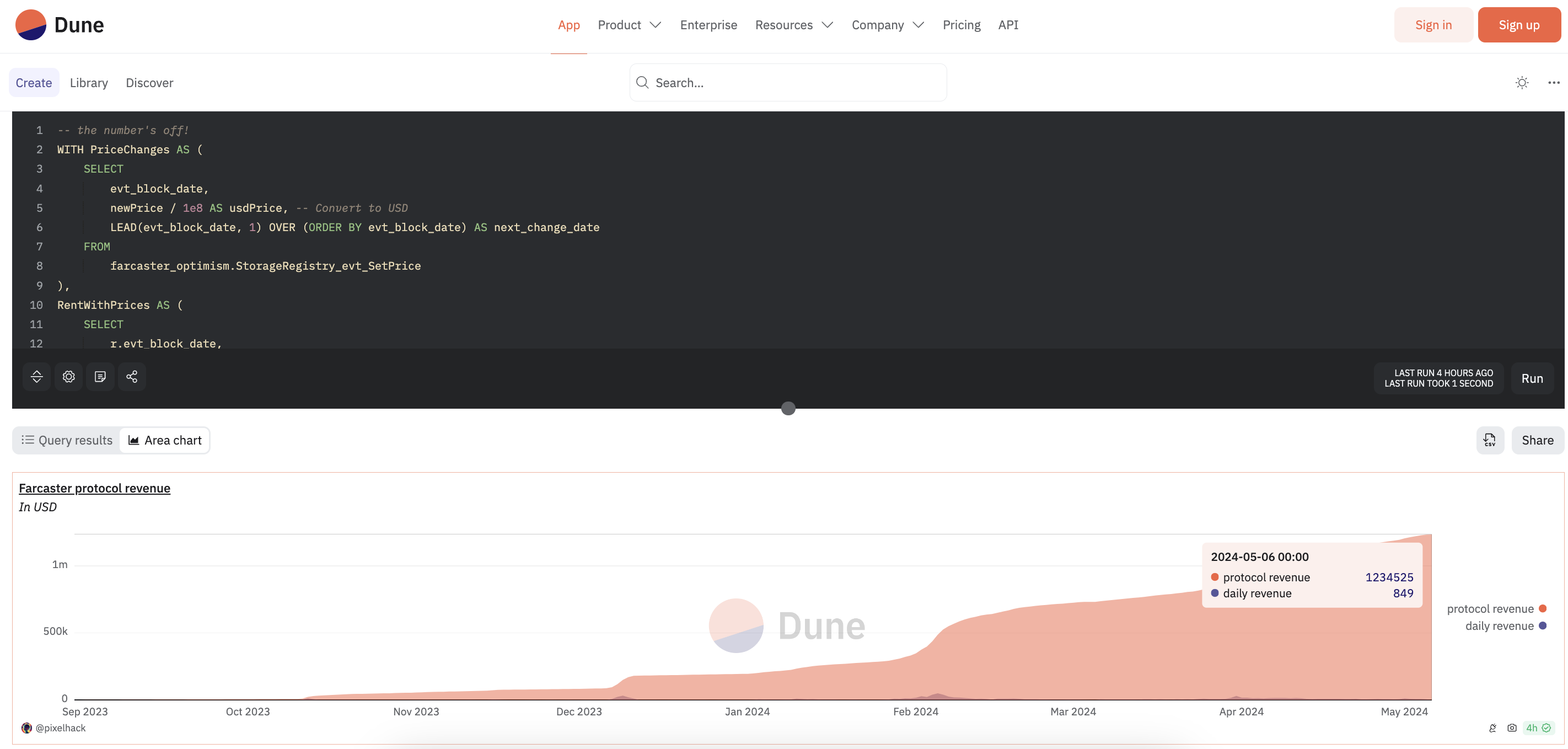

According to Dune data , Farcaster currently has a total of 344,474 independent users, with protocol revenue of US$1.234 million. It is worth noting that Farcaster's protocol revenue data began in early October 2023. Compared to Friend.tech, which became popular on the entire network as soon as it went online and received a lot of transaction fees, Farcaster's protocol revenue was only a few thousand dollars in the early stage. It can be said that the gap is huge.

https://dune.com/queries/3397864/5702593

2. Advanced data: inflow assets + transaction data

After understanding the fundamentals of the two social products, we can further compare their inflow asset data and transaction volume data.

According to Dune data , Friend.tech's total inflow of assets was 31,877.59 ETH (about 102 million US dollars) and the overall transaction volume was 13,681,507 times.

https://dune.com/msilb7/friendtech-on-base-activity

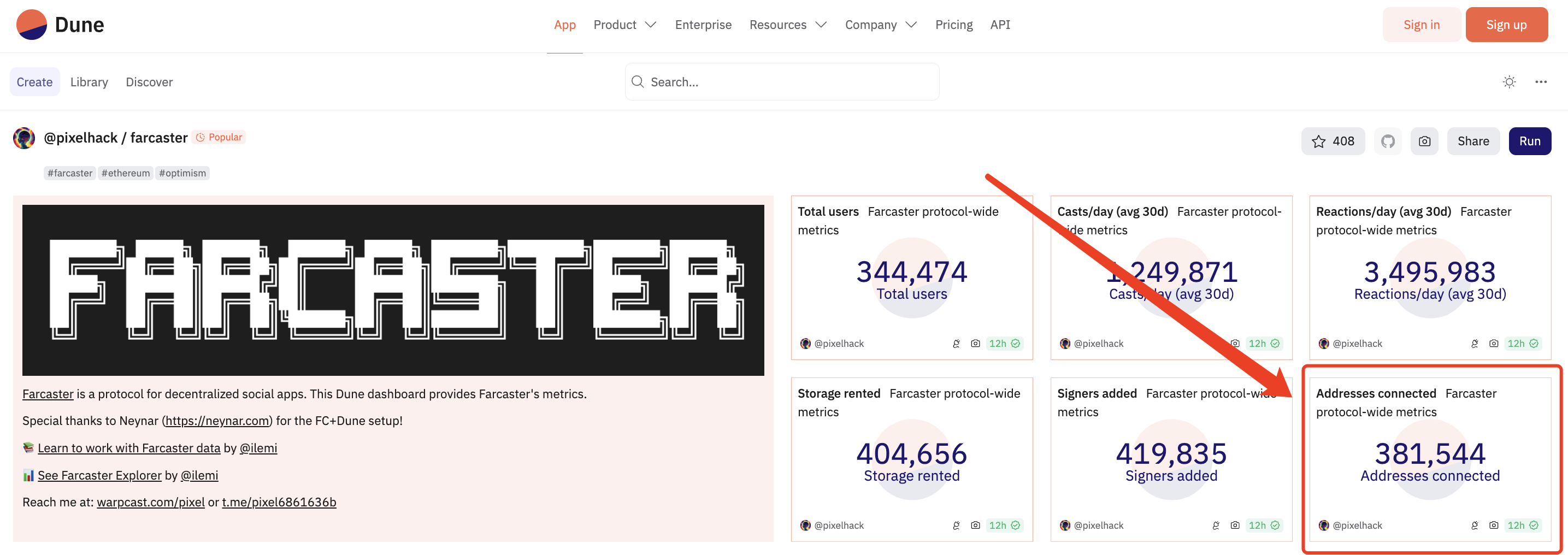

It is difficult to count Farcaster's asset inflow data. Currently, data analysis platforms such as Dune do not have corresponding panels and accurate data. However, if each Warpcast registered user wants to join some paid channels, he needs to buy $25 of Warp as an in-app token, and the exchange rate is about 1:100. According to 381,544 independent addresses , the total inflow of assets can be roughly counted as $9.538 million. Since the Farcaster protocol supports client applications including Warpcast, including on-chain and off-chain operations, and according to relevant data , the number of Farcaster ecological posts is about 1.26 million, so we will not expand too much on Farcaster-related transaction volume data here.

https://dune.com/pixelhack/farcaster

3. High-level data: token data + daily active users

Based on the above data comparison, the most important data comparison may be the difference between the two token data and daily active user data. The former represents the current market attention and the number of deep participants; the latter represents the long-term development direction of the project and product and the number of loyal fans.

According to Coingecko data , the current price of Friend.tech token FRIEND is $2.67, the total circulation is 90.91 million, and the overall market value is $242 million.

Screenshot of Coingecko website

The Farcaster protocol has not issued a corresponding token, so we use the DEGEN token, which has a wide range of applications in the Farcaster ecosystem, as a comparison object.

According to Coingecko data , the current price of DEGEN is $0.02138, the total circulation is 36.96 billion, and the overall market value is $266 million.

Screenshot of Coingecko website

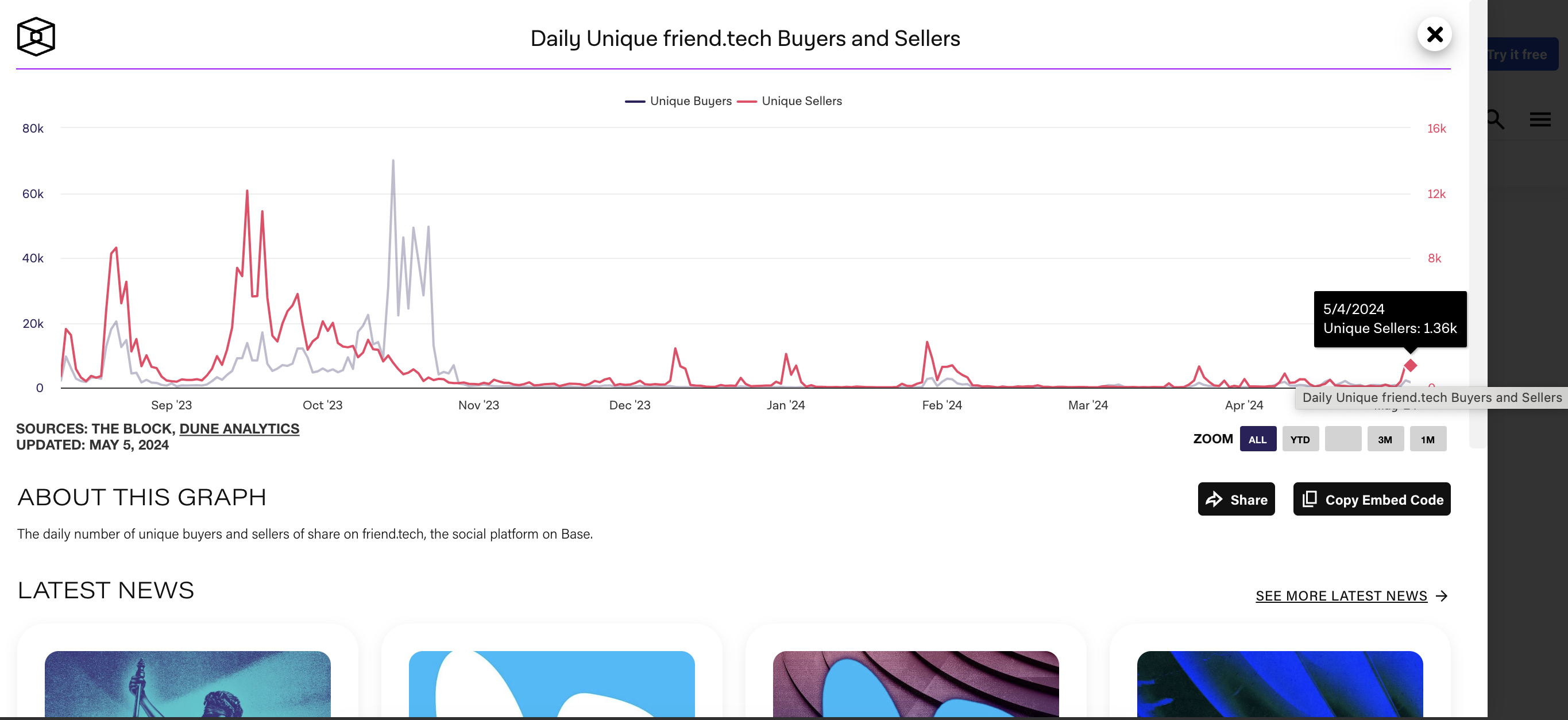

In terms of daily active users, according to statistics from TheBlock website , Friend.tech's average daily active users have dropped from nearly 80,000 users in mid-October last year to around 3,000 at present (1,360 independent sellers and 1,640 independent buyers).

TheBlock statistics interface

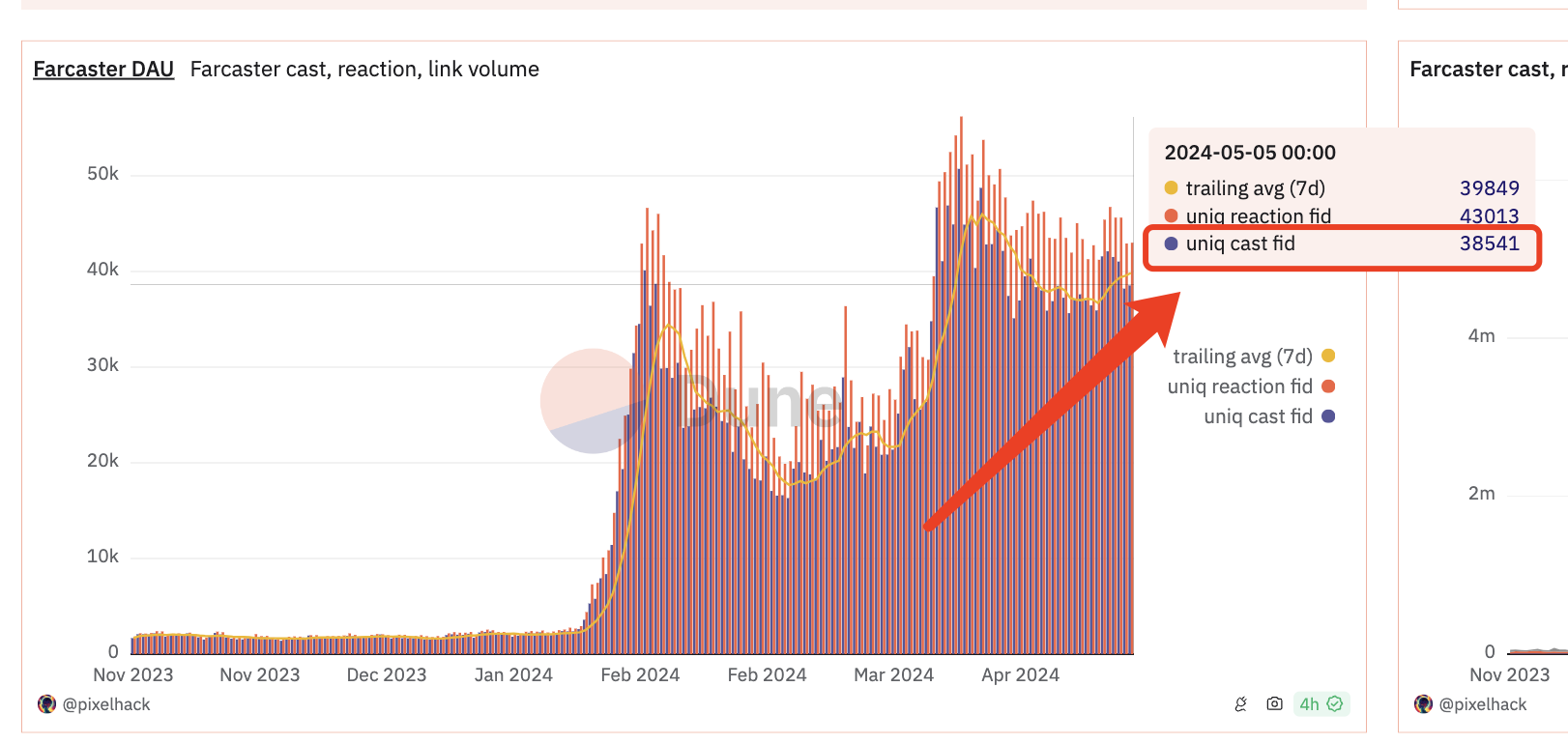

Farcaster's average daily active users are showing a steady growth trend. According to Dune data , there are currently about 38,500 original creators in the Farcaster ecosystem, and the overall number of active users is around 43,000.

Farcaster daily active user data interface

It is worth noting that Farcaster founder Dan Romero posted on the X platform that Farcaster's daily active users hit a record high of 85,000 in April, and in the first month, it achieved data records such as "daily active users exceeded 70,000" and "monthly active users exceeded 200,000".

Summary: Friend.tech is more profitable, Farcaster has more loyal fans

After comparing the above data, we can draw the following conclusions in stages:

In terms of profitability, Friend.tech achieved a higher profit ratio through higher Key and Club transaction taxes, thereby obtaining more protocol revenue;

In terms of product cycle, although Farcaster launched its ecosystem earlier than Friend.tech, Farcaster entered the Base ecosystem later than Friend.tech. In other words, Friend.tech has a certain first-mover advantage, and its product has entered the V2 version hyped by Club, while Farcaster mainly relies on the construction of different applications and channels within the ecosystem, so its product cycle development is relatively slow.

In terms of loyal fans, the number of loyal fans of Farcaster ecosystem is much greater than that of Friend.tech. This is due to the relatively higher entry threshold of Friend.tech and also to a certain extent influenced by the product functions of both.

In terms of product positioning, the Farcaster ecosystem is more like Internet forums such as Reddit and Tieba, while Friend.tech is similar to the paid version of Web3 Knowledge Planet, text-based Clubhouse and other products. The former is aimed at group communication, while the latter is more of a one-to-many club-style communication.

In addition, although both have endowed content (Cast) or Key, Club with a certain degree of hype and speculative value, relatively speaking, Friend.tech products have stronger speculative attributes and more direct positive feedback, while Farcaster ecosystem products are more inclined to empower community incentives and member exchanges. Therefore, in the long run, Farcaster ecosystem has relatively stronger potential and stronger user stickiness.

Therefore, who will be the "King of Social Media"? Perhaps we still need to observe for a longer period of time before we can come up with a relatively clear answer.