SignalPlus Volatility Column (20240422): Duds

In the United States, the 2024 rate cut that Fed Chairman Powell had been promising since the beginning of the year gradually disappeared last week, and he clearly conveyed to the market that interest rates will remain high for a longer period of time. And he is not the only one in the Fed who has made a change of attitude. Fed dove Goolsbee not only believes that "it makes sense to wait (before cutting interest rates)", but also said tactfully when asked about the possibility of potential rate hikes, "If necessary, nothing is off the table." U.S. Treasury yields hovered at their recent highest point, and the two-year yield, which is more sensitive to interest rate policies, remained near the 5% mark, now at 4.993%. Looking at the macro this week, the Fed's favorite PCE indicator will be released on Friday, but unfortunately, Powell will not be able to comment on it this Friday, because the Fed has entered a silent period on the eve of the next FOMC meeting.

Source: SignalPlus, Economic Calendar, the Fed’s favorite PCE indicator will be released this week

Source: Investing, the two-year yield, which is more sensitive to interest rate policy, remains near the 5% mark

In terms of digital currencies, the BTC halving was successfully completed without causing any ripples in the market, and most trading opinions were fully priced in before the event. After the volatility reflected in the hourly chart gradually weakened, the price of the currency successfully broke through during the Asian session, challenging the resistance level of $66,000.

Source: TradingView

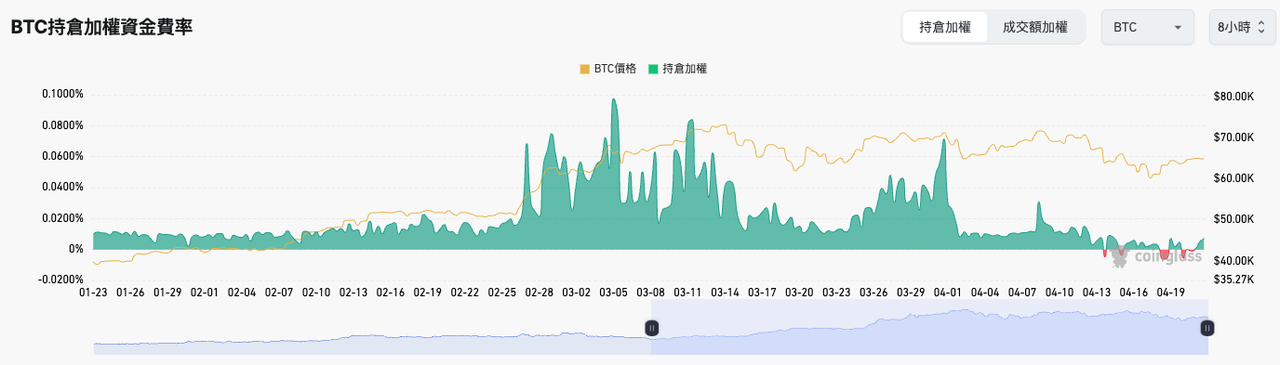

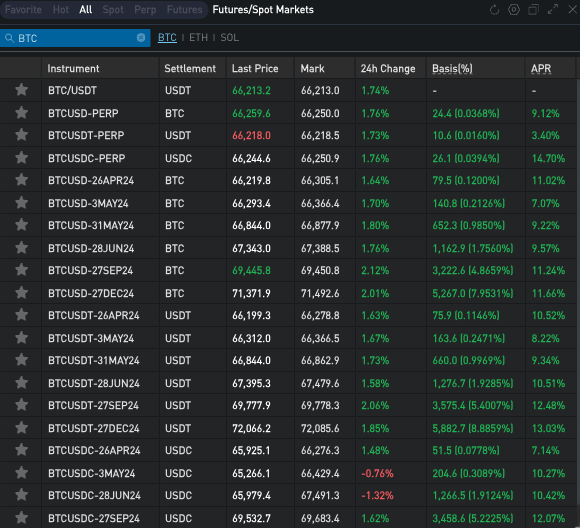

In terms of futures, leveraged funds have not yet entered the market, and the funding rate levels weighted by positions of major exchanges fluctuate around the 0 axis. The futures premium on several important delivery days on OKX is maintained at around 10 to 12% (approximately equivalent to 1 bp of perpetual contract fundingRate).

Source: Coinglass

Source: SignalPlus, OKX Futures

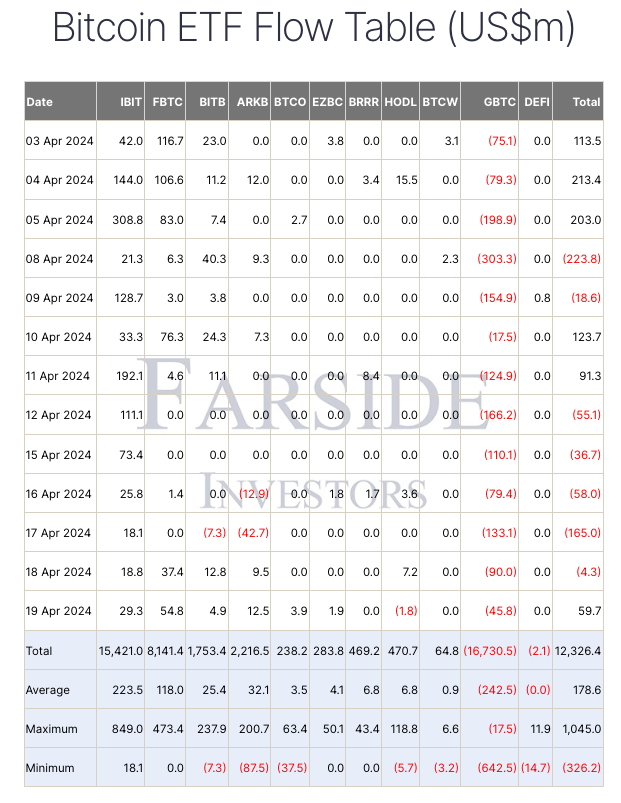

In terms of ETFs, the Bitcoin ETF finally ended five consecutive days of net outflows. The top few ETFs all received capital injections on the 19th. At the same time, the outflow of GBTC also showed a gradual downward trend.

Source: Farside Investors

Source: Deribit (as of 22 APR 16:00 UTC+8)

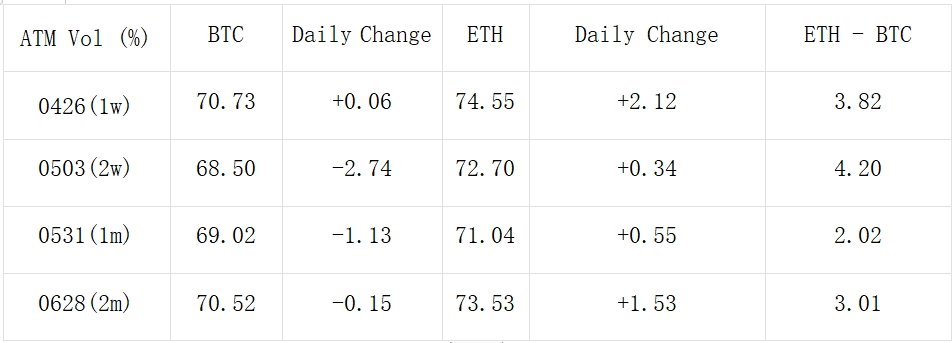

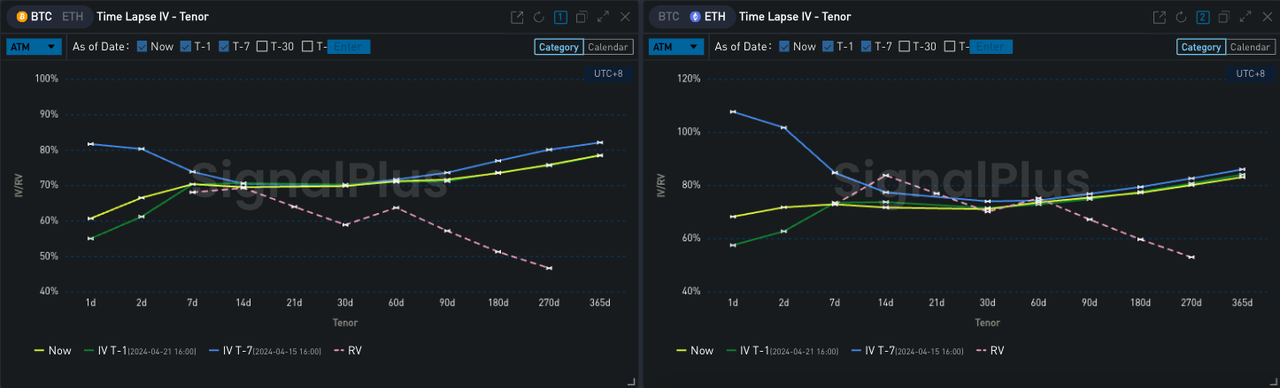

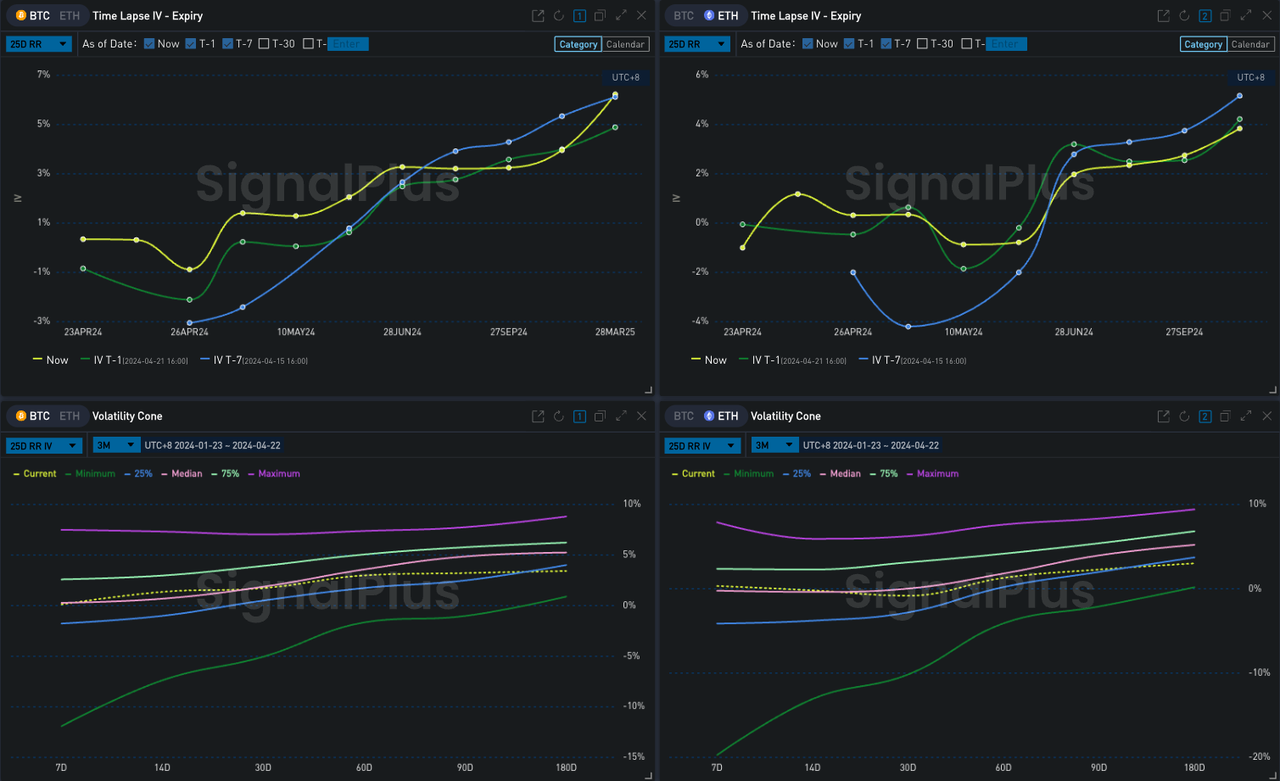

In terms of options, on the one hand, we see that the current volatility curve has broken the previous inverted pattern, but the overall slope is still relatively flat; at the same time, the front-end Vol Skew has also returned to a relatively horizontal position from the previous low, and 25 dRR is near the median of the past three months.

Source: SignalPlus

Source: SignalPlus, Vol skew regression level

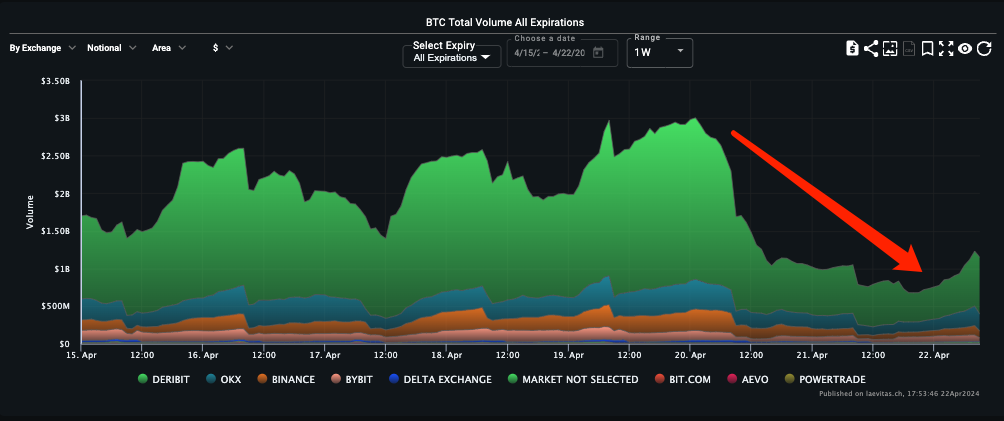

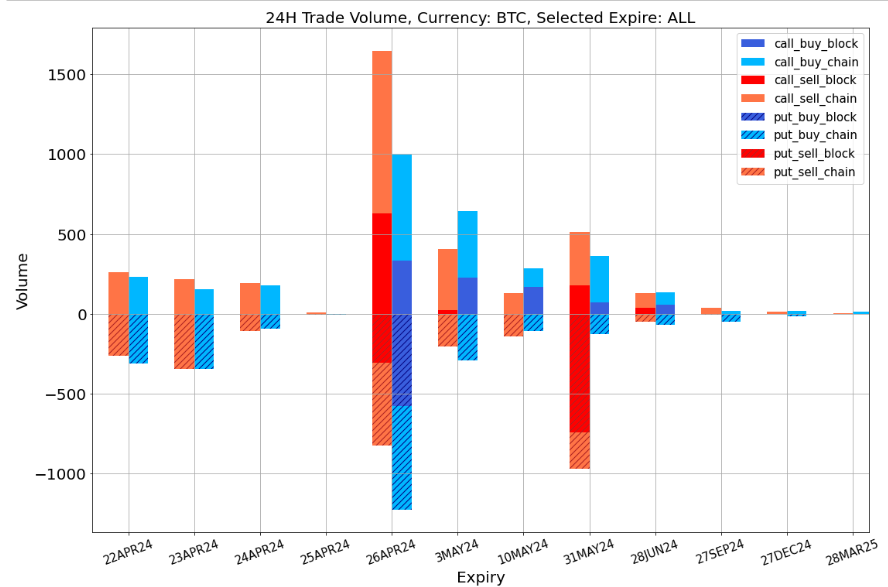

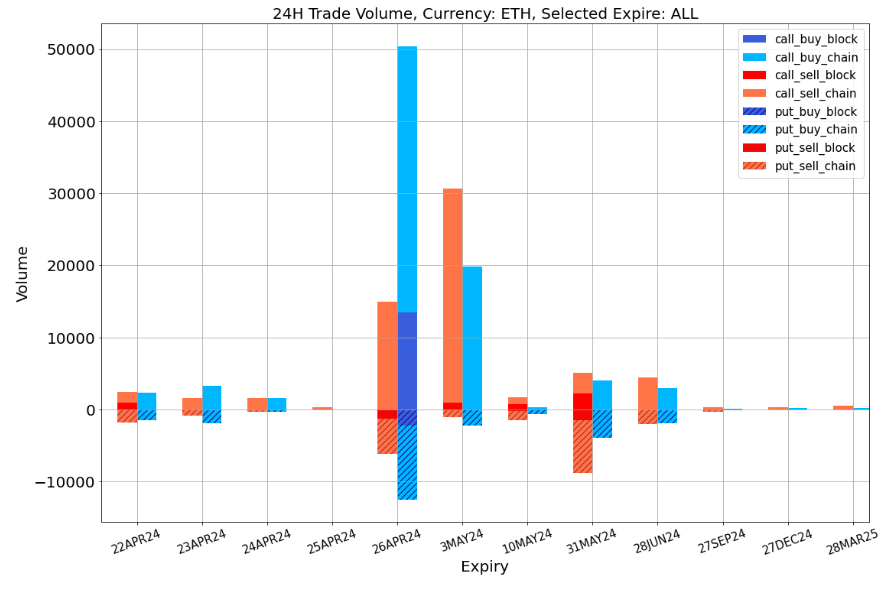

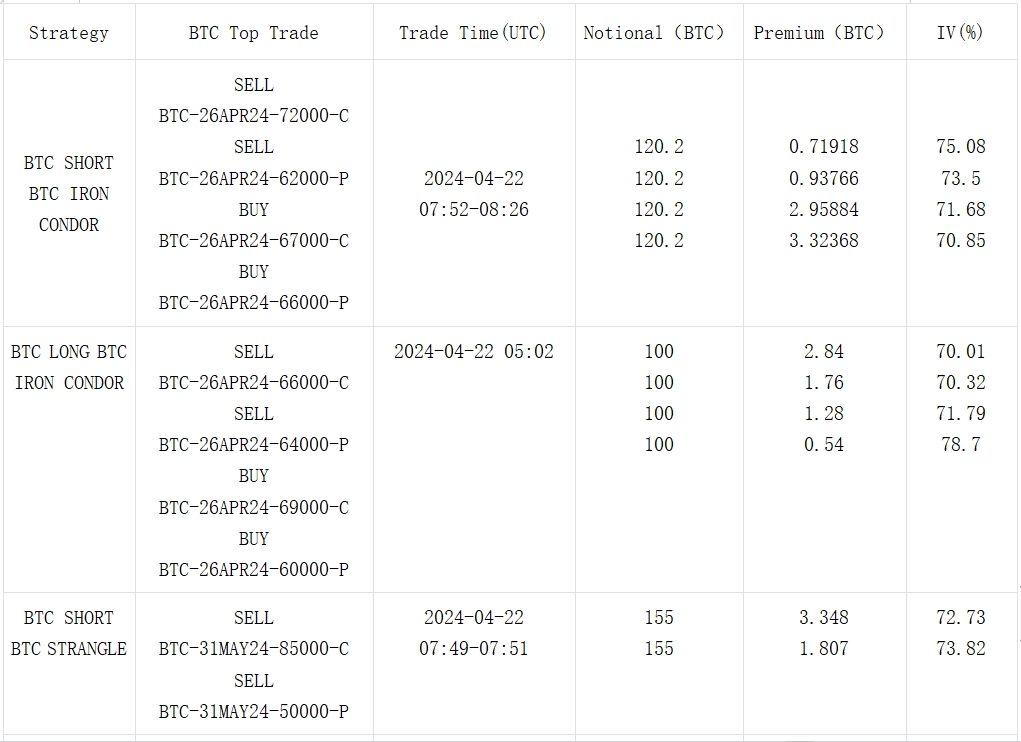

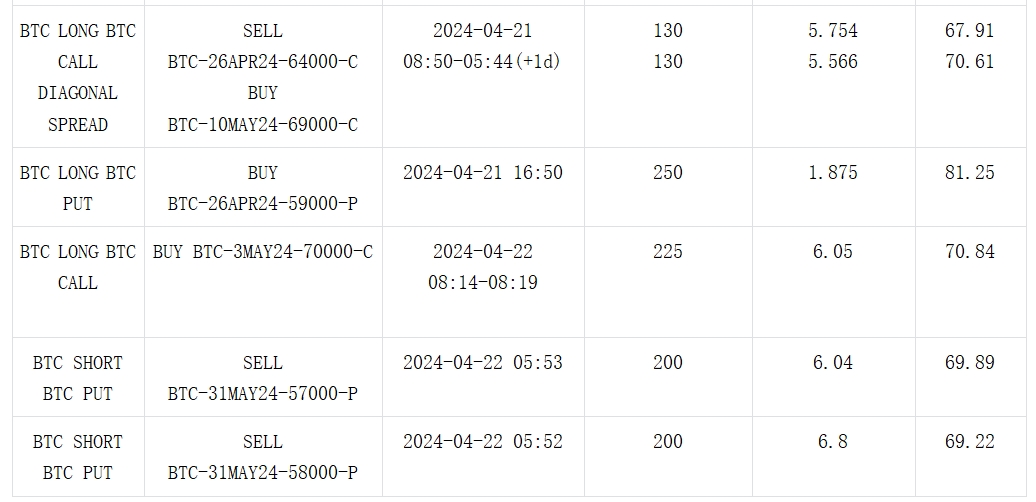

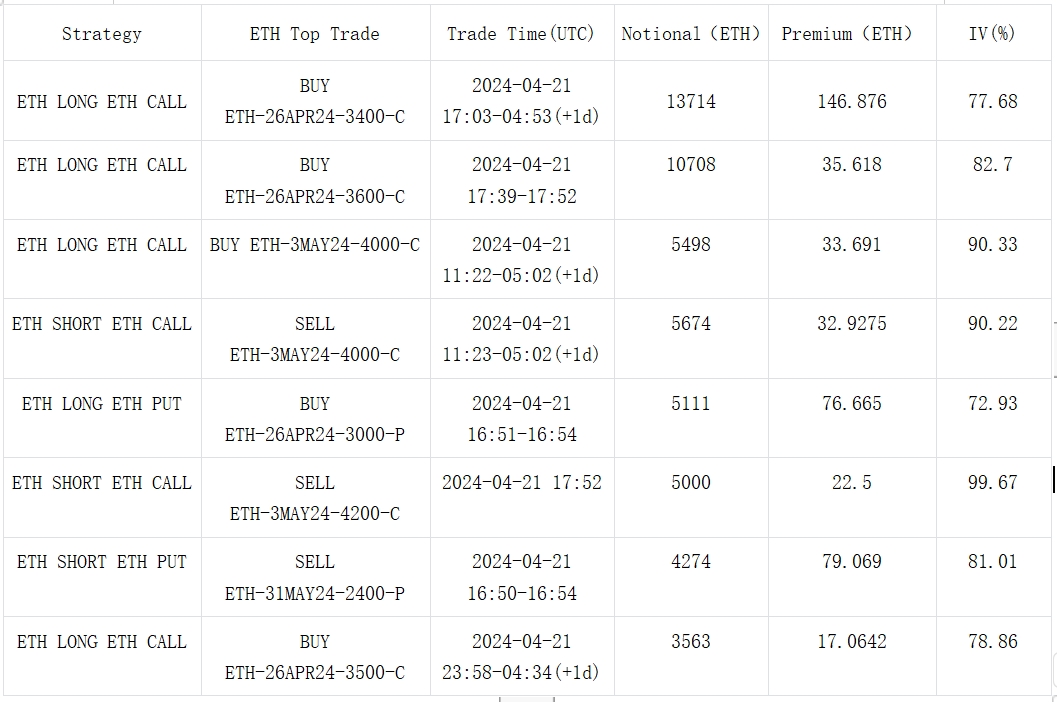

Options trading volume has been at a relatively low level since the halving, of course, this also includes the impact of generally low liquidity on weekends. In the ETH block, tens of thousands of K=3550~3700 call option purchases in April were all identified as positions being reduced, which may be to close profits on Theta and Vega, or it may be a deleveraging behavior made under the current geopolitical macroeconomics and the price trend of the currency after the halving. For BTC, there were put option purchases at the $59,000 support level at the end of April, and a large number of put option sales at the support level (57,000/58,000) at the end of May.

Source: Laevitas

Data Source: Deribit, BTC & ETH transaction distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com