SignalPlus Macro Analysis (20240416): US stocks face short-term downside risk

OK, the market is finally paying attention.

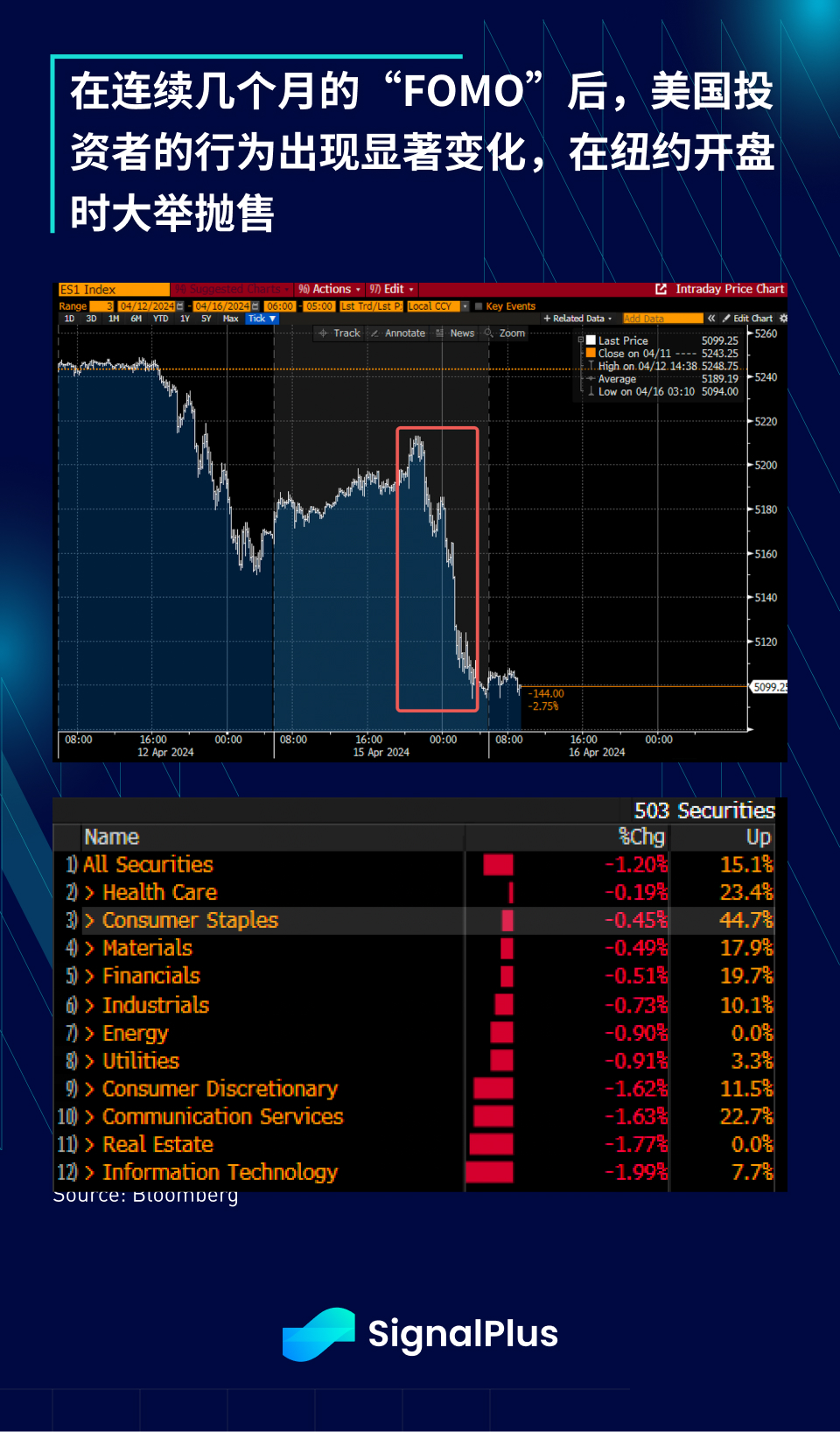

After a long period of complacency in the markets, ignoring all macro concerns and event risks due to AI craze/dovish Fed/low probability of recession etc, we are finally seeing a notable change in US investor behavior, with a massive sell-off at the NY open after a sharp recovery during Asian overnight trading.

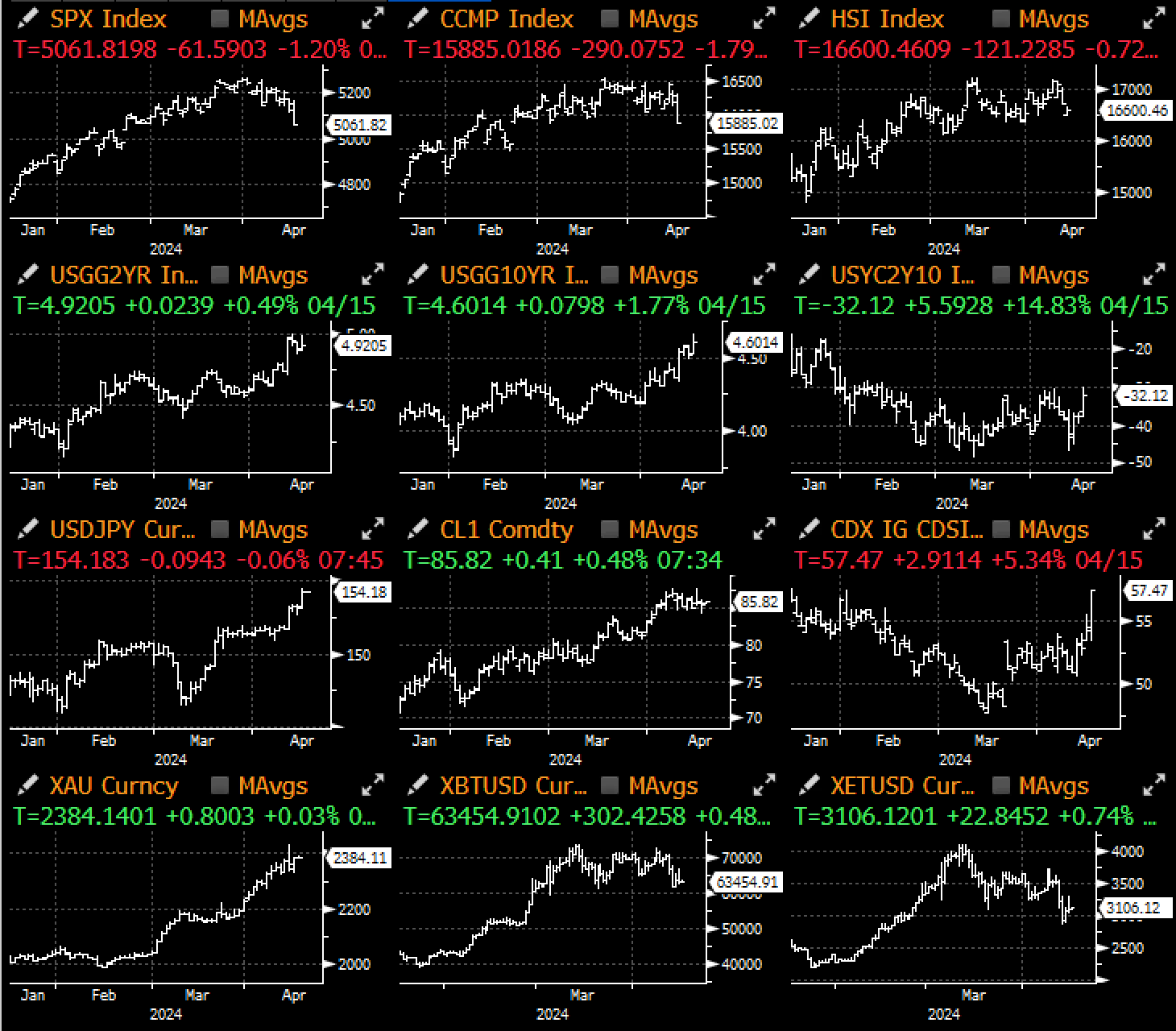

We have long been accustomed to buying the dips in the US market, and after several months of continuous gains, stock market shorts have almost disappeared. Is the recent rise in yields (2-year ~4.9%) starting to affect overall sentiment and lead to changes in stock investor behavior? Are the losses in fixed income and cryptocurrency markets enough to prompt the market to shift to a defensive stance? Although it is too early to tell, we are definitely feeling the early vibrations, and it is definitely worth continuing to monitor as the earnings season will be in full swing in the next 2-3 weeks.

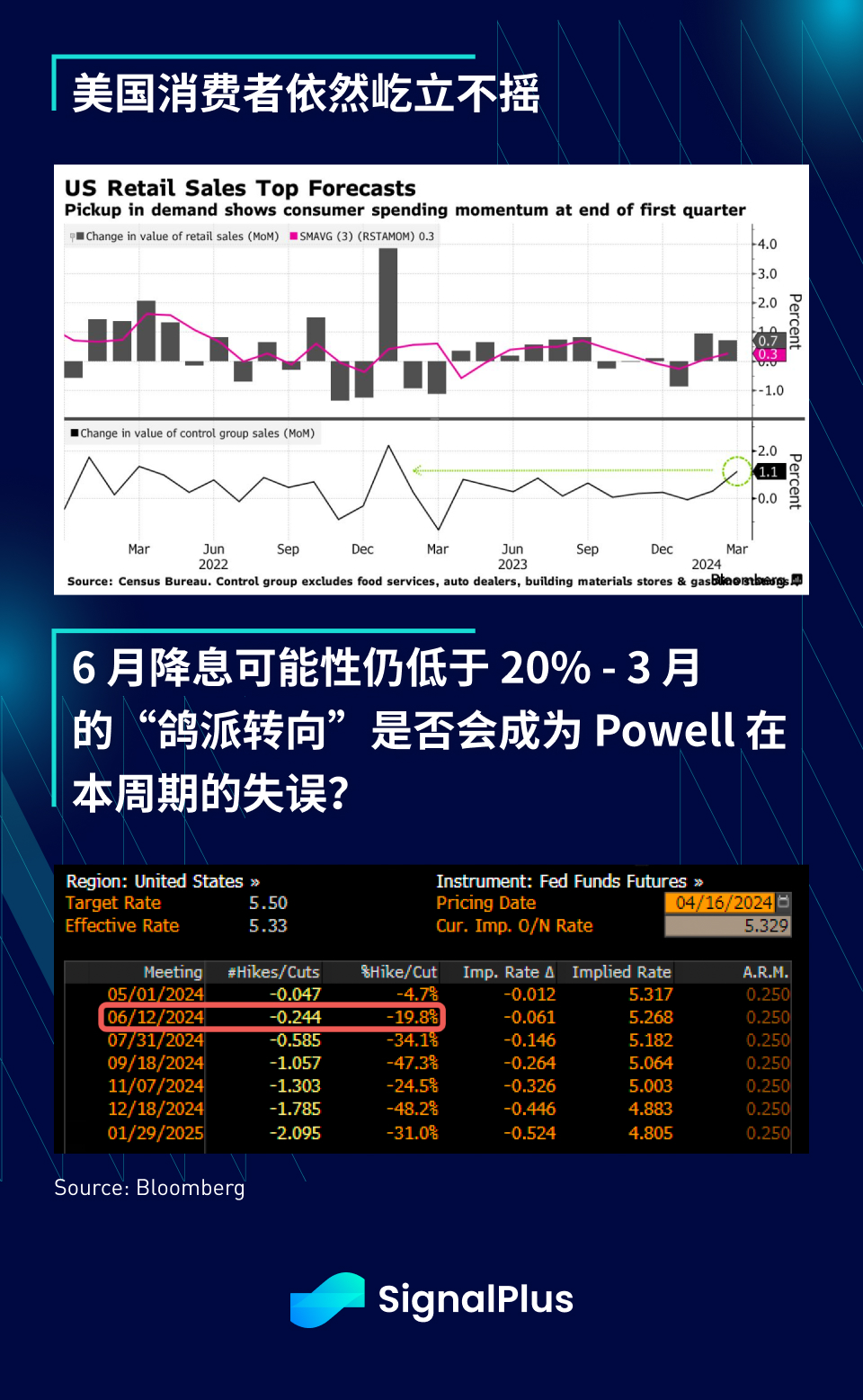

In terms of economic data, the outstanding performance of the US consumer continues, with retail sales increasing significantly in March, with an overall month-on-month increase of 0.7%, and data excluding automobiles increasing by 1.1% month-on-month, both significantly exceeding expectations, with core spending, control groups and physical goods all performing strongly. The continued resilience of consumers will help improve GDP forecasts and put pressure on the possibility of a rate cut, which has fallen to below 20% in June.

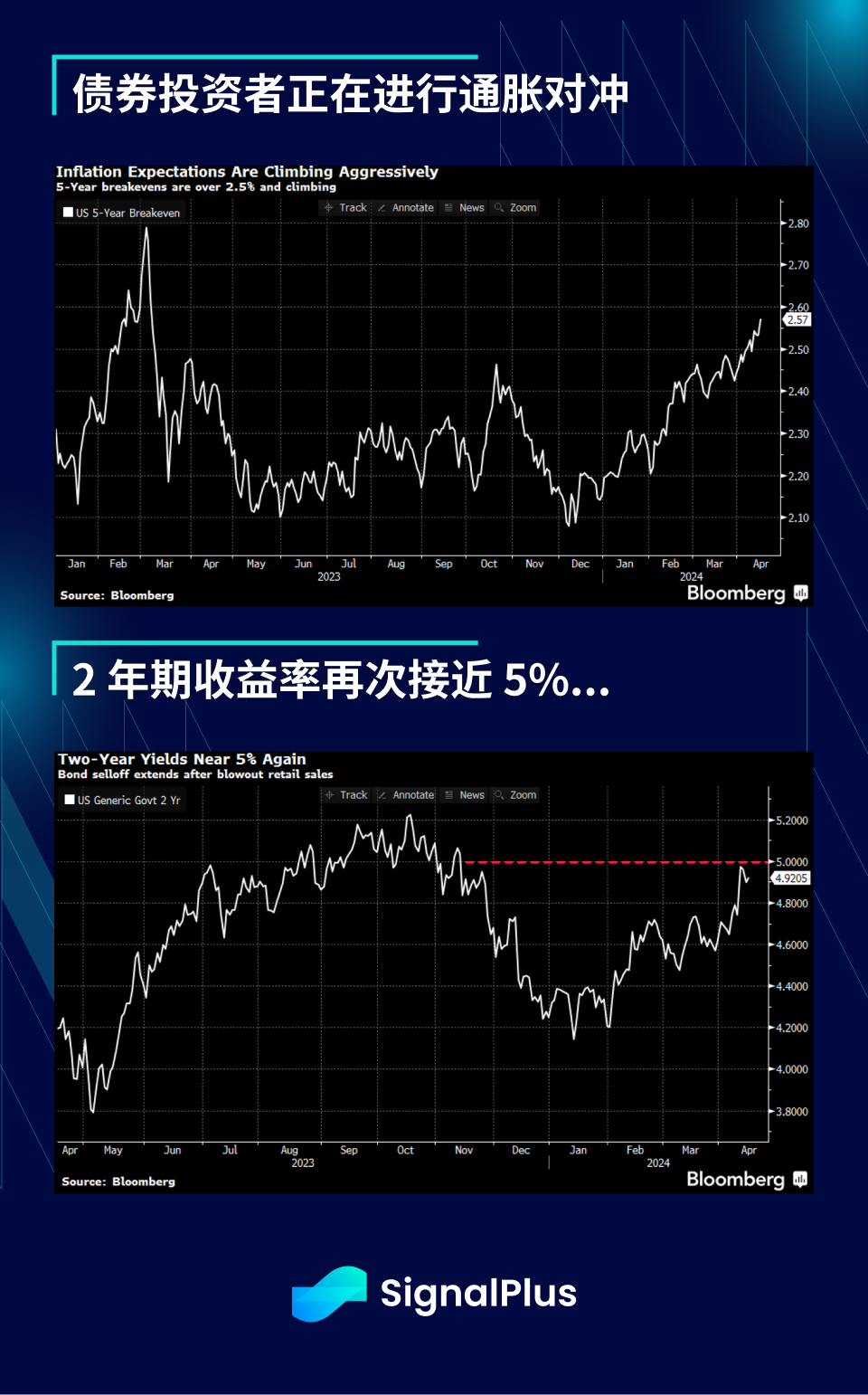

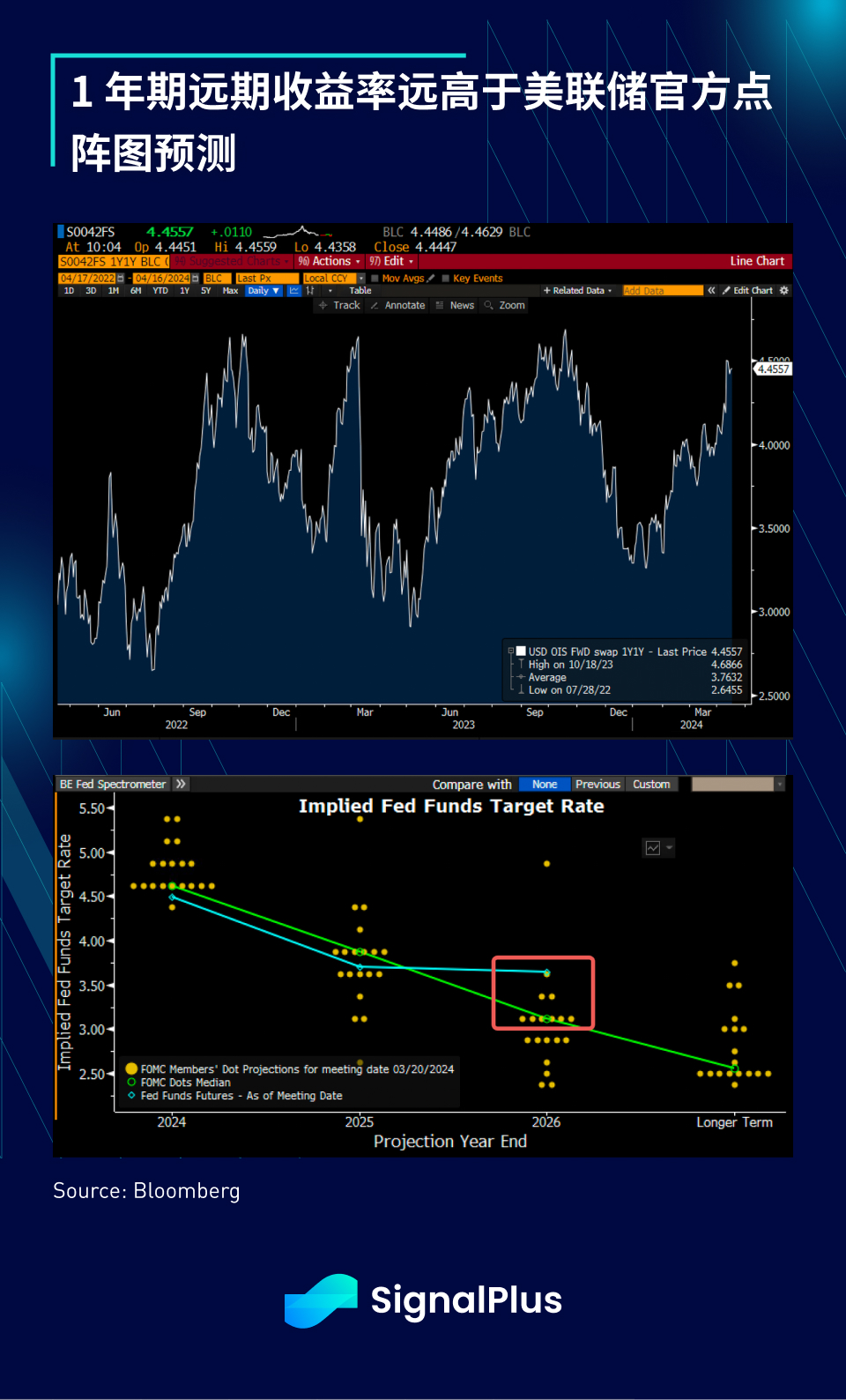

While the Fed continues to find creative narratives to back up its dovish narrative (New York Fed Williams: "Still expect to start cutting rates this year"), inflation expectations have risen sharply, and the interest rate market is self-adjusting, with the 5-year equilibrium inflation rate back above 2.5%, the highest level in more than a year, and the CPI trajectory at that time was completely different from now. The 2-year Treasury yield is close to 5%, which means that the trajectory of the 1-year forward yield is much higher than the Fed's own dot plot forecast.

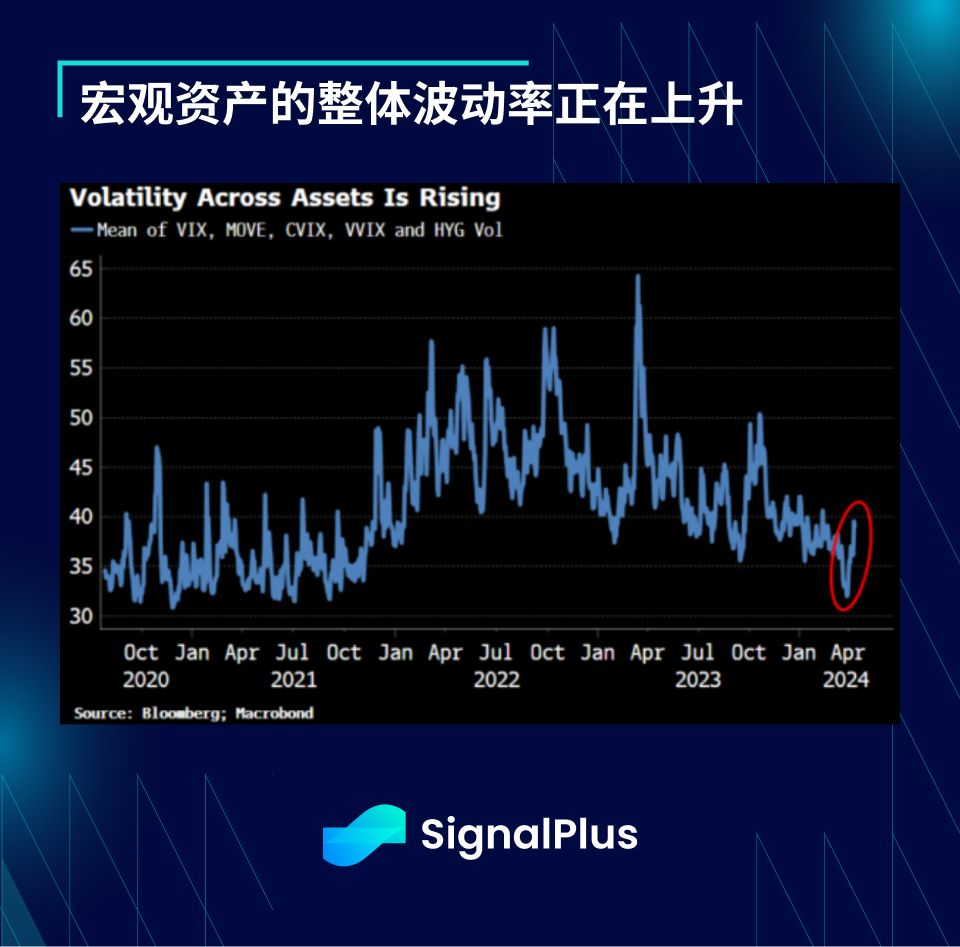

The sharp rise in fixed income implied volatility, as represented by the MOVE index, highlights the market's unease with the Fed's dovish rhetoric. Fed officials used carefully crafted talks in the first quarter to dampen bond volatility, but as the dovish guidance became increasingly inconsistent with the strength of the economy and inflationary pressures, the market rebelled to some extent.

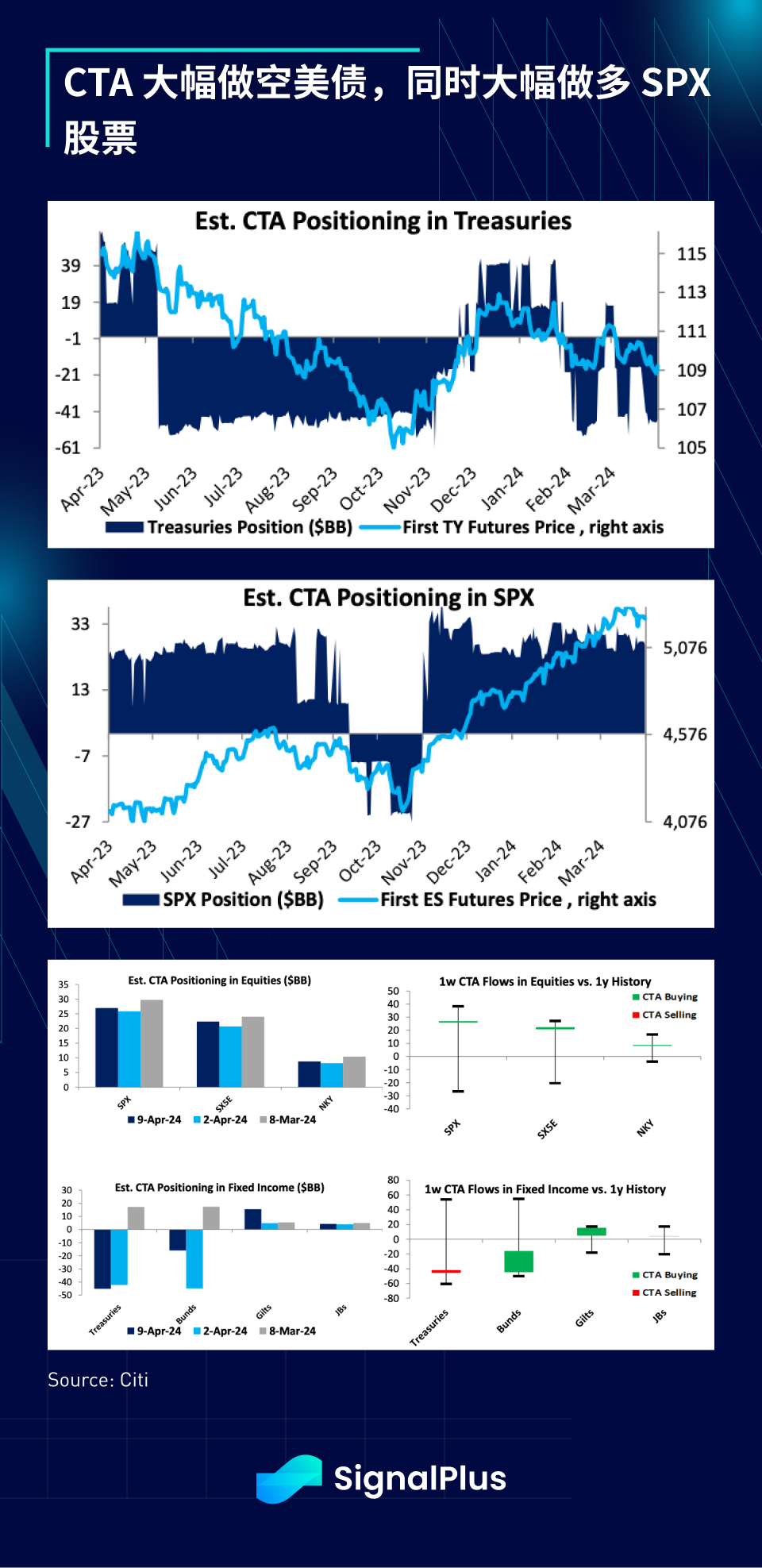

In fact, in addition to interest rates, the overall volatility of macro assets including stocks and high-yield bonds is rising, and the leverage positions of bonds and stocks are also in relatively extreme situations. CTAs are shorting bonds in large quantities (yields are rising) while going extremely long on stocks.

This extreme positioning could lead to more volatile price action in the coming weeks, especially given the high geopolitical tensions and extremely high earnings expectations for this quarter. If the SPX closes below its 200-day moving average this week, it could force CTAs to change their long positions. The last time this happened was in the summer of 2023, followed by a further price drop of about 5%.

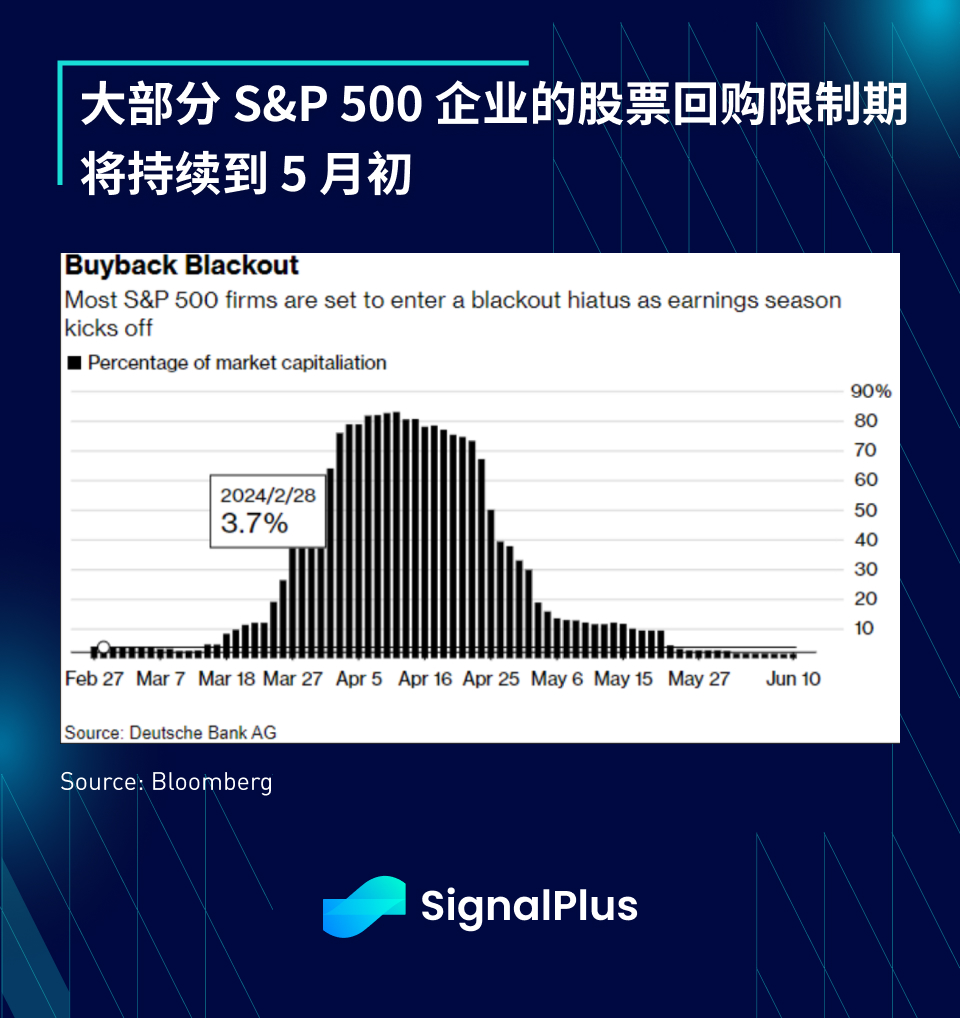

Finally, the restriction on stock buybacks will last until the first week of May, exposing the stock market to further downside risk in the short term, so be careful not to buy the dip too early.

Cryptocurrencies are also struggling with overall bearish sentiment, with traders facing very real losses and liquidations as BTC/ETH prices have fallen 10% this week, while other major altcoins have fallen about 20% during this period. Given the extent and speed of the decline, we believe profit and loss management will be the primary driver going forward, rather than the halving narrative or other mainstream narratives, and will prompt investors to significantly reduce leverage in the coming weeks.

It will still take some time for the macro to reach a new consensus and get clearer guidance and more certainty from the Fed, while fundamental investors will need corporate earnings to support their firm belief in US stocks at their current high valuations. Good luck to everyone.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina