SignalPlus Macro Analysis (20240402): US inflation pressure rises again

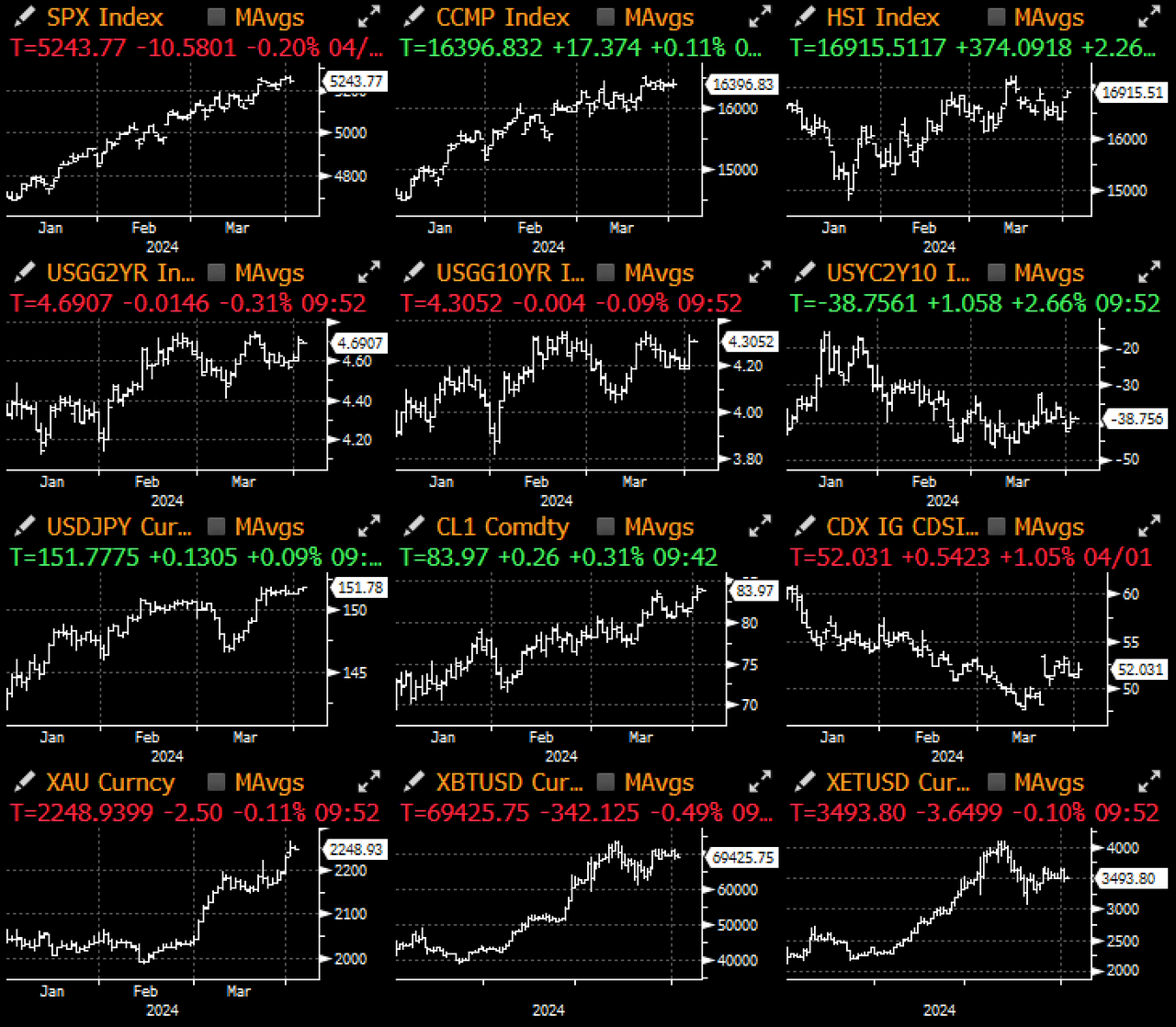

As the market returns from the long weekend, many asset classes are experiencing a sudden risk aversion, and Chairman Powells message on Friday was also confusing. Just a week ago, he was clearly dovish. However, this time he But it said the economy was resilient enough to cope with current interest rate levels. Powells talk came after the PCE data was released, with comments such as We dont need to rush and Given that the U.S. economy is growing at such a solid pace, the job market remains very strong, giving us an opportunity to be cautious before taking the important step of cutting interest rates. We are more confident about the decline in inflation, and other comments. The chairman doesnt sound eager to cut interest rates. Is it because the dovish performance at the last FOMC meeting encountered a lot of internal resistance (such as Waller, etc.)? Or is the election-year conversation influenced by political pressure? Or was he shocked by the markets dovish reaction to his previous remarks? We dont have an answer either.

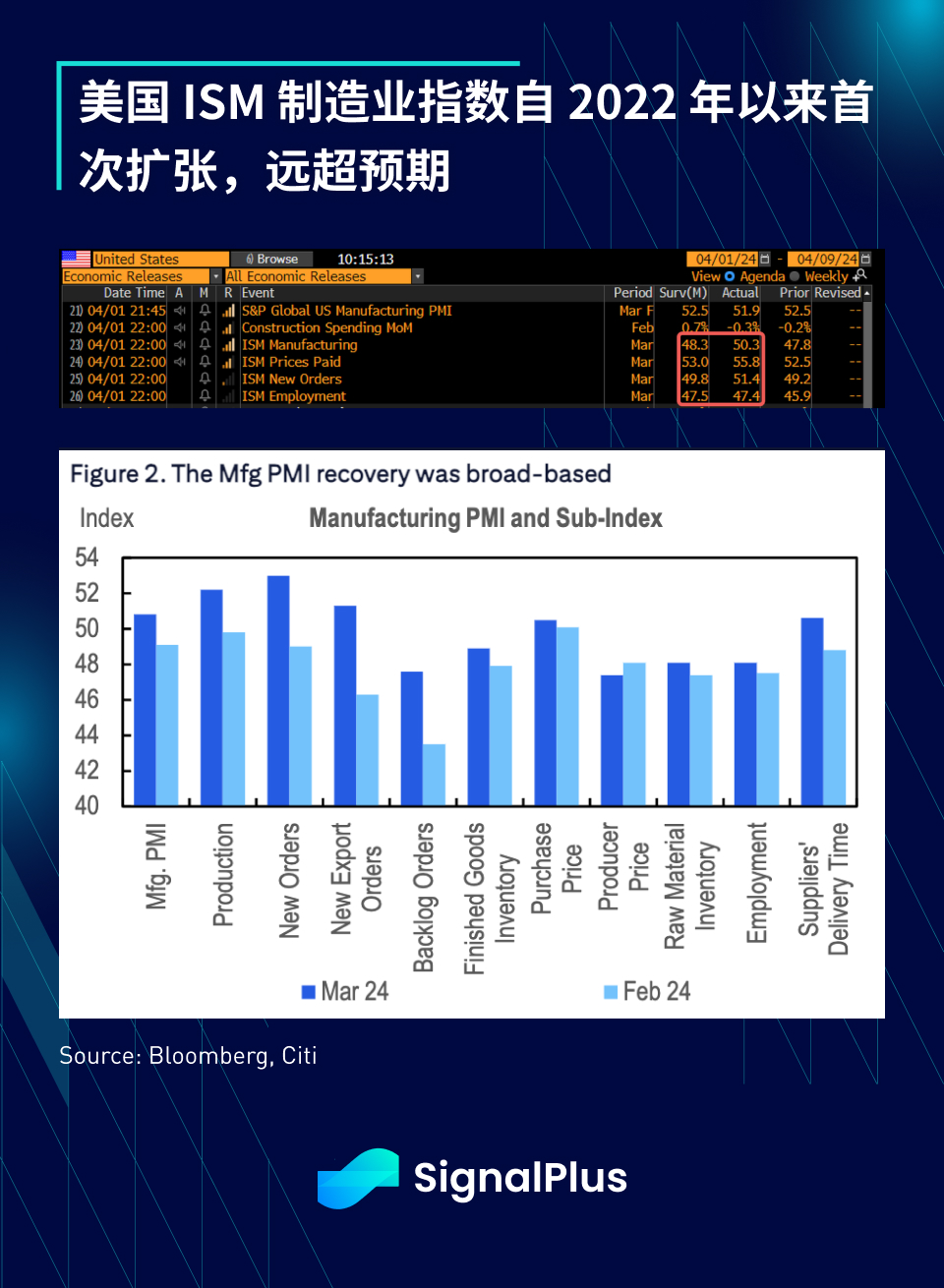

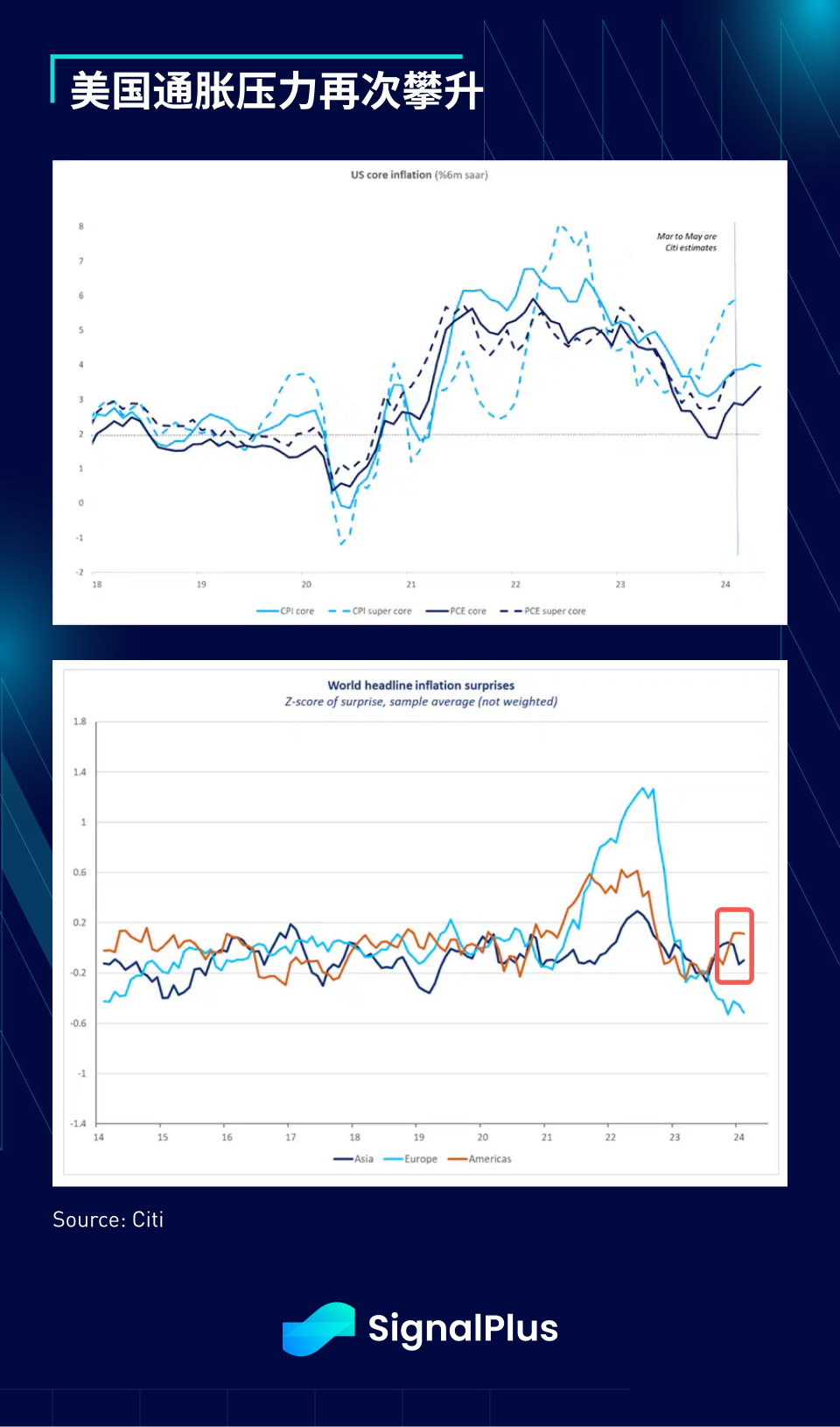

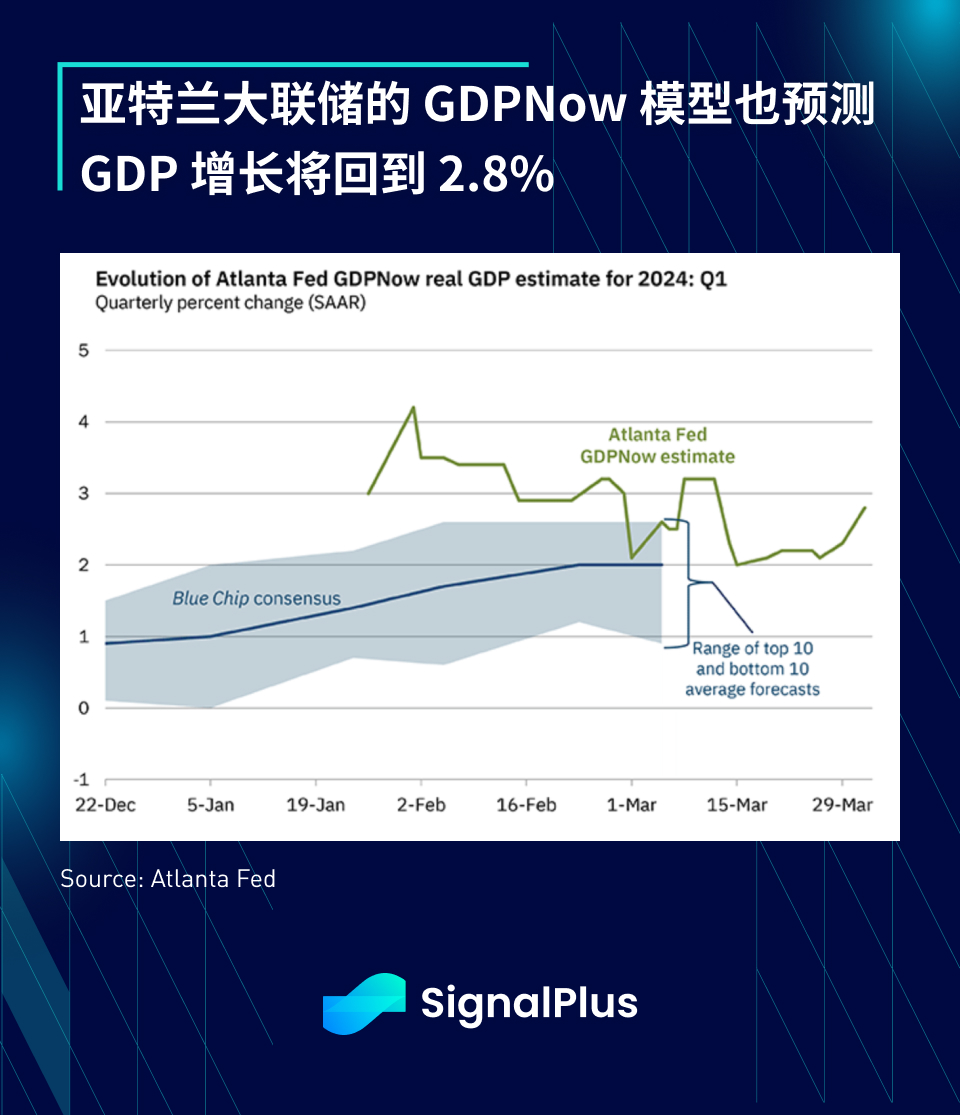

Economic data over the past few days also does not support the rate cut narrative, with the ISM manufacturing index expanding for the first time since 2022, especially in the employment, prices paid and new export orders components that were significantly better than expected. Recent inflation data also show that U.S. core inflation remains at a high level, with the six-month rolling super core CPI approaching 6%, and even the core PCE has rebounded to above 3%, far exceeding the Feds target. Additionally, a statement accompanying the SP Global PMI index said, “The average selling price charged by producers rose at the fastest pace in 11 months, with inflation well above pre-pandemic levels as factories passed on higher costs to customers. average, which doesnt sound like a slowdown in inflation.

Despite quite friendly risk sentiment and Powells supportive stance, the 10-year Treasury yield has been rising steadily this year. In February, the market believed that an interest rate cut in June was a certainty, but now the probability of an interest rate cut reflected in pricing has fallen back to about 55%. However, due to the Feds recent dot-plot guidance, the futures market is still stubbornly predicting three interest rate cuts in 2024. However, if economic data continues to develop on the current trajectory, the dovish narrative may face increasing challenges.

Non-farm employment data will be released this Friday. The market generally expects that the employment population will slow down to 200,000, while the unemployment rate will remain stable at 3.8%, and hourly wages will remain at 0.3% month-on-month. If the data results are like the market Expectations should be positive for risk sentiment, with daily moves reflected in the SPX options straddle of about 0.8%, consistent with previous non-farm payrolls releases.

April tends to be a more challenging month for stocks in terms of seasonality, especially in the middle of the month, which ranks as one of the worst 5 weeks of the year. Except for this Fridays non-farm payrolls data and the CPI data on the 10th, economic data this month is relatively light, so if the CPI data is not friendly, there will be a chance of triggering a risk-off trend at the end of this month.

On the cryptocurrency side, meme-coins are still prevalent, and BTC prices have basically hovered around 70,000 over the past month, but there have been quite a few long liquidations. As positions are lopsided and long funding rates remain high, price action tends to be more negative during the Asian session (e.g. falling below $66,000 this morning), while during the New York session it was supported by ETF inflows (+183 million yesterday). Price action is more positive. Are we just witnessing a long-term redistribution trade, where native users accumulate long-term positions and slowly sell them to mainstream investors through ETFs, but without much significant recent results? As momentum in cryptocurrency prices appears to be beginning to wane, be aware of a possible slide in risk sentiment.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com