A comprehensive analysis of Stacks: a decade of hard work

Original author: @Jane @wenchuan

Original editor: @Lexi @createpjf

Original source: BuilderDAO

The author says

Stacks is the smart contract layer on Bitcoin. Its official construction began in 2017, and the initial version will be online in 2021. The initiators were a group of computer scientists from Princeton. Historically, Stacks has faced a lot of hostility, with both BTC Maxis and Ethereum believers viewing it as an outlier. With the rise of BTC L2 narratives and the cultural shift in BTC brought about by Ordinals and others, various L2s are emerging in endlessly. At this time, Stacks seems to have become an outlier again - it has been continuously building in this direction for nearly ten years, and with the development of BTC L1, it is by no means a common quicksand project in crypto.

Stacks is committed to becoming the most useful Bitcoin layer, and around this goal, the Stacks community has always been built with a long-term mentality. Continuous accumulation has also earned Stacks a unique status: its ecology has begun to improve, with TVL exceeding $140 m; the upcoming Nakomoto upgrade in Q2 will produce faster blocks, further improve security, and is expected to be significantly improved DeFi experience, attracting more liquidity; backed by long-term top capital support. When hundreds of rivals compete for power, a unique position means more resources and the ability to grab attention, which may allow the strong to attract more liquidity.

During the Spring Festival, the price of Stacks increased, and the current MC is 3.6 billion US dollars. We believe that Stacks has stable and upward fundamentals, a team that continues to build through cycles, and combined with strong catalysts such as the Nakomoto upgrade, it is a presence that cannot be ignored in Bitcoin L2. If you are optimistic about the overall development of L2 and believe that Bitcoin will have more uses besides being a SOV (becoming a productive asset), you can use $STX as a beta configuration of the Bitcoin ecosystem at a suitable price. At the end of the article, we discuss its valuation possibilities.

Stacks design ideas: balance, trade-offs and iteration

The impossible triangle of trade-offs

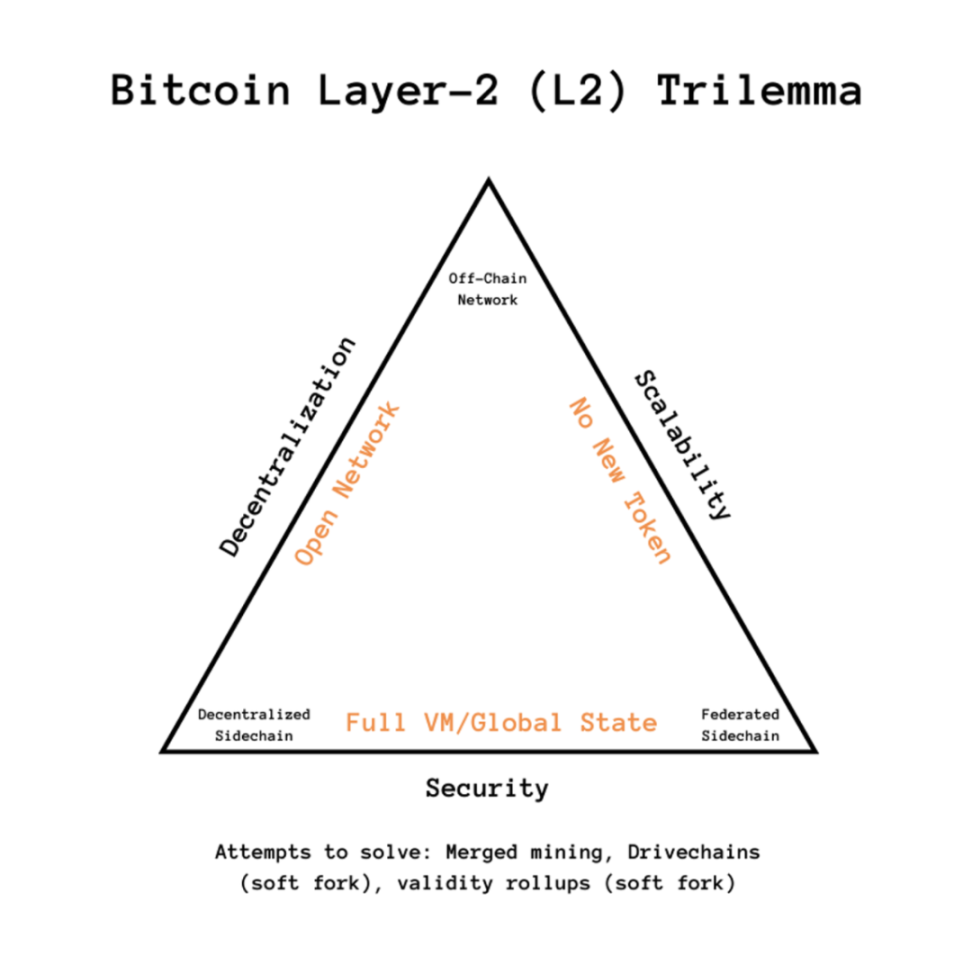

Let’s look at the design ideas of Stacks based on the Bitcoin Impossible Triangle shared by Muneeb on Twitter:

Source:@kyleellicott

Without changing the current L1, there are three optimal options: a) open network, b) no independent token, c) global virtual machine (VM):

Open network means that anyone can participate in consensus, which corresponds to federalism, where only selected entities can participate in mining;

The lack of independent tokens is in line with BTC Maxiss expectations, and there are no new assets to compete with Bitcoin; but tokens can provide incentives to miners, better achieve incentive compatibility, and also help the network cold start;

The opposite of global VM is that data is stored off-chain. There is no universal global ledger and the accessibility of data is weakened. However, it may bring better scalability and privacy, which is very effective in some scenarios.

Stacks chose a) and c), and compromised on b) by issuing an independent token $STX. Part of the rationale behind this trade-off is from a user experience and developer perspective. In the global VM, developers have more room to play and achieve better smart contract interactions, just like their experience in Ethereum and Solana. In most scenarios, the global VM experience will be better.

In addition, the focus of construction on Stacks is DeFi, hoping to make BTC not just an SOV, but a productive asset. And if you want to attract a large amount of funds, being able to safely move BTC between L1 and L2 is the top priority. This is where $STX comes in, as an incentive to miners and validators, enabling an open, trustless, decentralized network. From the perspective of increasing the probability of business success, reasonable incentives are undoubtedly indispensable. Although the price is that Stacks is called Affinity Scammer by some BTC Maxis, in the long run, feasibility and rationality will overcome peoples irrational emotions.

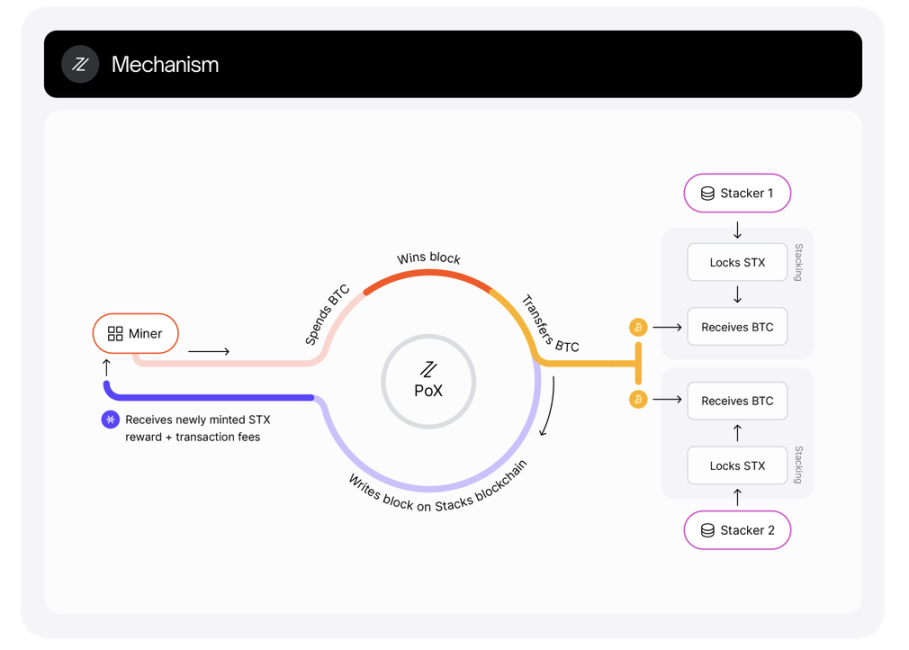

This process is centered on the Proof of Transfer (POX) consensus. POX can be seen as the reuse of POW without consuming additional excessive energy. The current mechanism is specifically shown in the figure below:

Miners transfer BTC to Stackers to obtain potential block rewards. The probability of winning (becoming a leader) is proportional to the amount of BTC transferred. The leader obtains the right to write blocks in Stacks and receives STX and transaction fees. Rewards included.

Source: @godfred_xcuz

On the other side, Stackers obtain BTC rewards by locking STX (this behavior is called stacking), and the reward amount is proportional to the locked STX.

Regarding the specific stacking method, if users choose to stack by themselves, the cycle lasts for two weeks and has a minimum STX locking amount requirement (~ 100,000), so the experience is relatively average. After the liquid stacking protocol StackingDAO (compared to Lido) is launched, users who deposit STX can obtain stSTX as a tokenized voucher, and can trade back to STX at any time in DEX. There is no longer a stacking quantity requirement, and the flexibility is greatly enhanced. However, A 5% commission on earnings is required. In addition to StackingDAO, OKX, Xverse, etc. also provide different pool stacking solutions. The current stacking income of StackingDAO and Xverse is about 6%.

Stackers are motivated by their participation in the two-way decentralized Peg mechanism, and the asset linked to Bitcoin is called sBTC.

Peg in: When a user locks BTC on L1 (deposits into Peg wallet), the corresponding sBTC can be generated on Stack. Its value corresponds to BTC 1:1, and there is no need to pay wrapping fees.

Peg out: Stackers perform threshold signatures. After reaching 70% of the requirements, sBTC will be destroyed, and the same amount of BTC will be released on L1 and sent to a certain BTC address from Peg wallet; because Stackers hope to get BTC rewards, and their locked assets are greater than For the BTC in the Peg wallet, if you lose faith, you will lose more than you gain, so it has the motivation to always make the right choice to achieve peg, that is, incentive compatibility. BTC peg-out requests are also broadcast as BTC transactions. Since Stacker can participate voluntarily, it is completely decentralized.

Nakomoto upgrade elements

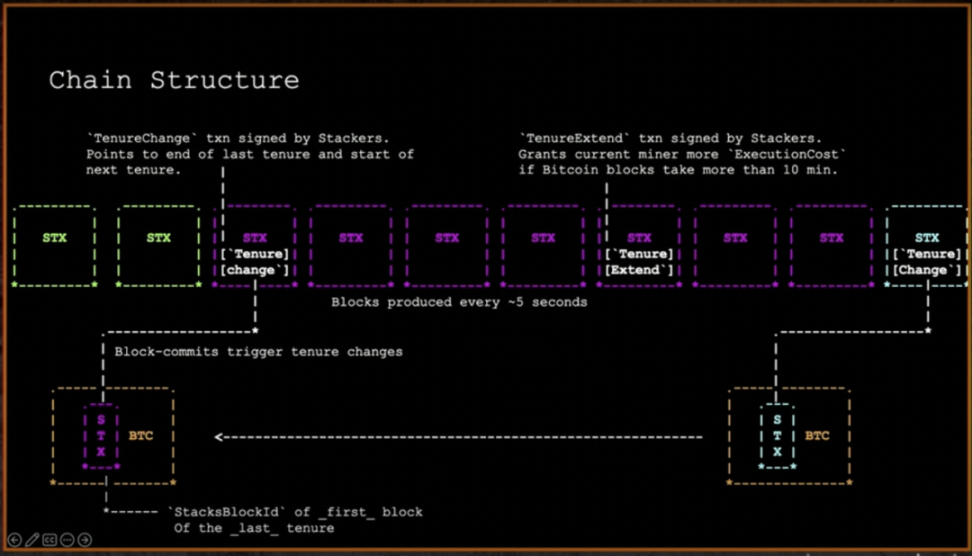

The highlight of Nakomotos upgrade is efficiency. The speed of producing blocks will be increased to 5 seconds (currently tens of minutes). It is conceivable that the implementation of fast blocks can greatly improve the DeFi experience and make many meaningful use cases possible. The core of the realization of fast blocks comes from the introduction of a Tenure-based block production mechanism - the selected miners are responsible for producing all Stacks blocks within the term, and produce them at an intensive rhythm, about 5 seconds/block . The block time of L2 is decoupled from Bitcoin L1 and is no longer anchored 1:1.

Second, improvements in safety mechanisms. Currently Stacks has an independent security budget that depends on the amount of BTC spent by miners. After the upgrade, after more than 2 Bitcoin blocks, the security can reach 100% Bitcoin finality. Finality means that transactions are irreversible, which means that the difficulty of attacking Stacks is equivalent to attacking Bitcoin. The reason behind this is that in addition to submitting the hash of the Stacks block to L1, subsequent miners also need to submit the index block hash of the first block produced during the previous miners term, so that the history of the Stacks chain can be combined with the L1 layer Aligned to the term range of the last miner, it has Bitcoin finality. In the white paper, the original design was to have Bitcoin finality after more than 150 blocks, which was reduced from 150 to 2, which is a huge improvement.

https://www.youtube.com/watch?v=zIXY_49xbIY&t=188s

The security budget of the latest 2 blocks will also be increased. In addition to the miner expenses, Stackers stacking funds are added. Considering that the funds locked by Stacks have reached the level of one billion US dollars, based on the 70% threshold and the current STX price, at least US$780 million is needed to launch an attack. A sufficient security budget is one of the deepest barriers and is also the foundation of long-term construction. If other L2s also plan to adopt similar means to achieve higher instant security, they will need to have higher locked assets, which is not easy.

In addition to continuing to contribute to the economic security of the network, Stacker is also required to verify and approve the blocks produced by miners. In view of the accelerated speed of block production, the efficiency of validators must also keep up, and the cooperation between different roles in the ecosystem will be closer. In addition, Stackers will first internally agree on the chain tip and supervise the miners to produce behind the latest Stacks block. Otherwise, they will refuse to sign and there will be no more Fork.

There has been a lot of controversy on Crypto Twitter about whether Stacks is L2. Since Stacks uses Bitcoin for termination and leader election also occurs on L1, it essentially cannot exist independently of L1 and cannot be counted as L1. In addition, given that Stacks no longer has a separate security budget after the upgrade, there is beginning to be resistance to Bitcoin-like restructuring, and this perspective will be closer to the traditional L2 concept. But in another dimension, we don’t need to be bound by definitions. We can also start from the starting point of better using BTC, pay attention to user scenarios and developer experience, and work backwards to figure out what kind of smart contract layer we need. As for specifically L1, L1.5, L2, what about:)

The third is stop leakage - an improvement of MEV. In the past design, Bitcoin miners were responsible for censorship and could mine Stacks blocks at a lower cost than other Stacks miners during their production of Bitcoin blocks. Big miners like F 2 Pool can acquire Stacks blocks worth over $1,000 for just a few dollars. This reduces Stackers normal BTC rewards and may break the incentive compatibility situation. In view of the central role of Stacking in the entire system, MEV triggered heated discussions in the forum.

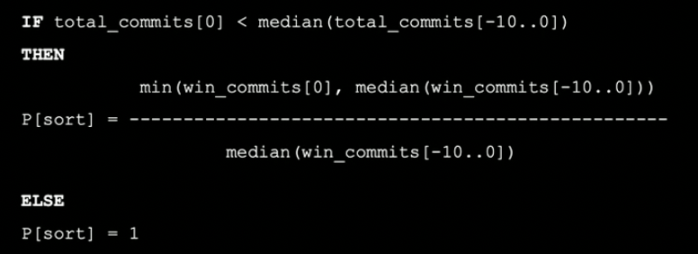

Based on these discussions, the Nakomoto upgrade introduced some improvements to the sorting mechanism (Sortition) to make mining fairer and try to build a more loyal and stable miner team, such as:

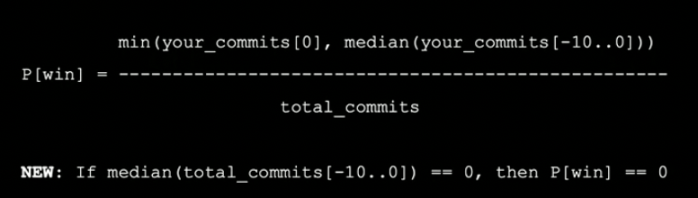

Miners need to participate in at least the past 10 blocks;

The winning probability is calculated by considering the median of the BTC bids in the past 10 blocks: if the median of the bids in the past 10 blocks is zero, the current winning probability is also zero, and the system does not encourage abnormal bidding behavior;

Introduce absolute bid totals to consider miners bid levels and loyalty to the network over a longer period

It can be seen that the new regulations pay more attention to the continued activeness and reliable participation of miners, and ideally hope to achieve synergy between the interests of miners and the stability of the entire network.

In addition, Stacks has its own Clarity language, which improves on Solidity and hopes to achieve safer and more predictable coding. A key focus after the Nakomoto upgrade is to further introduce Clarity Wasm to further improve the running speed of smart contracts.

In summary, Nakomoto and its related upgrades focus on the two main lines of safety and efficiency. This will create a more reliable and efficient trading environment for sBTC and create a solid foundation for the potential large-scale adoption of sBTC. The DeFi ecology has a good growth soil, and the ecological vitality may be fully opened. And the security being linked to BTC is also a good confidence boost and enhances the appeal to big funds. These are the strategic significance of this upgrade that cannot be ignored.

x reasons why we are bullish on Stacks: (Fundamentals * Team) ^ Catalysts

Stable and upward fundamentals

a. The DeFi ecosystem is ready to take off.

DeFi first is a common path, and the Stacks ecosystem is no exception. With the recent increase in the price of $STX, TVL exceeded 140 million US dollars:

Among them, ALEX is the absolute leading protocol, contributing 60% of TVL. ALEX has developed a set of DeFi related components, including AMM, Orderbook, Oracle, Bridge, etc., in addition to the Launchpad business. ALEX launched aBTC in December last year. Compared with sBTC, aBTC sacrifices a certain degree of decentralization and provides faster transaction speeds. It hopes to complement sBTC and demonstrates its ambition to become the financial layer on Bitcoin.

Other new protocols have also begun to emerge. Take the newly released Bitflow (the first DEX designed to solve the liquidity of the fragmented Bitcoin ecosystem) as an example. Its TVL and StackingDAO (February TVL nearly doubled compared to January, reaching $ 62 m) cooperated to launch the stSTX-STX pool to provide liquidity for stSTX and have a points reward system. One month after the launch, the TVL exceeded $30 M, and the growth rate was rapid.

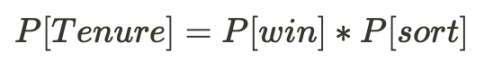

b. Sudden increase in transaction volume

The monthly transaction volume of Stacks is in the hundreds of thousands. In the past two months, benefiting from the vigorous development of STX 20, the transaction volume has shown an obvious upward trend. In January, it exceeded the 1M mark, accounting for close to 10% of the overall Bitcoin transactions, which is a strong signal. illustrates the good progress in its ecological adoption.

Source: Ortege, The Block

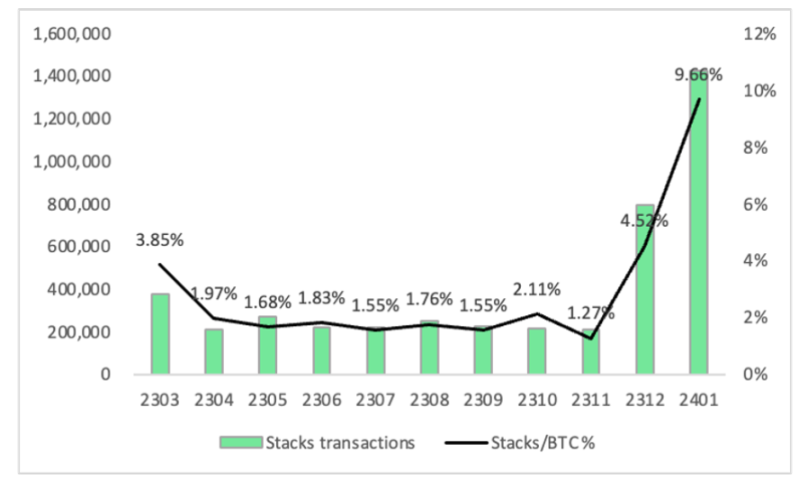

This has also driven the overall monthly transaction fee to increase to hundreds of thousands of STX, with the average single transaction fee ranging from 0.25-0.75 STX, which corresponds to approximately $0.75 based on the January $STX price (~$1.5). Previously, when on-chain transaction activity was inactive and STX prices were lower, individual transactions were cheaper. Low transaction costs are one of the necessary conditions for ecological prosperity.

Source: Ortege

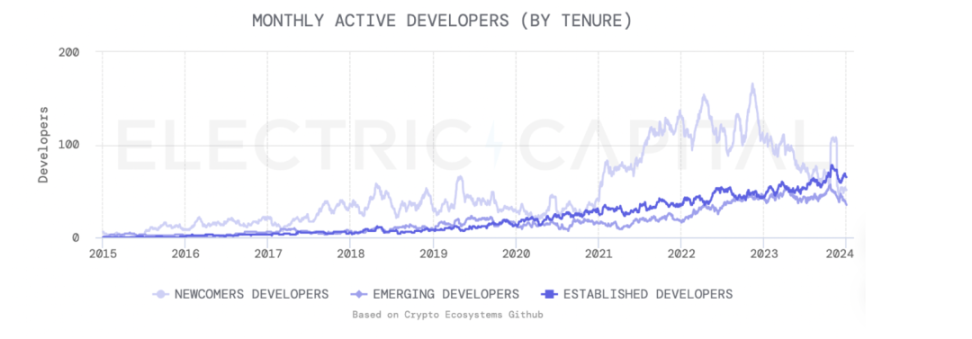

c. Robust developer ecosystem

We can also observe the ecological popularity of Stacks from the changes in the number of developers:

https://www.developerreport.com/ecosystems/stacks

Interestingly, although the number of new developers fluctuates (more related to macro trends), the number of mature developers (with 2 years+ work experience in crypto) continues to rise steadily, with an annual growth rate of +51%. Mature developers are the backbone of the industry, and their continued and steady growth can to a certain extent indicate their optimism for Stacks, which is also consistent with the long-term concept of Stacks.

The catalyst for the combination of virtual and real

Satoshi Nakamoto upgrade brings substantial improvement

The April Satoshi upgrade is a highly anticipated update by the Stacks community and is expected to be completed before the Bitcoin halving. From this perspective, we can basically ignore the recent fluctuations in TVL. After all, until the upgrade brings qualitative changes to the DeFi experience, the current fluctuations may be just a splash. The key is how much BTC and other funds it can absorb into Stacks after the upgrade, and whether its efficiency and experience are improved as expected, thereby creating more transaction volume. For large funds, their core concern is whether they can obtain certain returns while ensuring safety. The influx of more funds will also stimulate the construction of more dAPPs, thereby bringing a better experience to the C-side, and the overall ecology will enter a positive cycle.

The cultural significance behind the inscription and L2 narrative

Although there are mixed reviews about Ordinal, its emergence has profound implications for the Bitcoin ecosystem. In addition to miners getting more handling fees, the more important thing is that Inscription has almost made something earth-shattering within the framework of Bitcoin. Even BTC Maxis is helpless because it cannot prohibit this attempt through any centralized force. Centralization is what BTC Maxis respects. After Inscription set this precedent, peoples psychological boundaries were also opened. Building things on BTC is allowed and should even be fully explored. The potential for spiritual and creative liberation from this cultural turn is endless. Combined with the description of the possible wealth effect brought about by the influx of large amounts of money, more and more developers are beginning to build on the BTC ecosystem, and Stacks, as the current leader, will naturally benefit from this wave of popularity.

The coincidence and promotion of various factors will truly bring about ecological prosperity. Considering the asset size of Bitcoin, this may unlock a market worth hundreds of billions.

Consistently Alpha

So far, we havent mentioned Stacks team and its co-creator Muneeb Ali. The reason why he is a co-creator rather than a founder is that Stacks is essentially an open source project. This may exceed many people’s expectations. There is no centralized decision-making entity behind billions of dollars of tokens. In the Stacks forum, you can see that there are many active contributors, and one of the core figures is Muneeb. Muneeb has a PhD in computer science from Stanford University. He has been working in the BTC ecosystem and has gone through several cycles. He is currently involved in the construction of Stacks as the CEO of Trust Machines.

Munee is impressive in a few ways. The first is its original intention and tenacity. The Bitcoin ecosystem has gone through hot and cold periods, and developers have come and gone. Munee is one of the few OGs who has always focused on deeply cultivating the BTC ecosystem. He once mentioned that the way to survive is to choose a big, fundamental problem and dive in to solve it, and he is obsessed with unlocking hundreds of billions of BTC into the app by building a decentralized two-way hook.

The second is its responsibility. Stacks has historically faced dual hostility from BTC Maxis and Ethereum believers. Munee, as the most vocal person on Stacks, is at the forefront. He has accepted many interviews to promote Stacks ideas, and actively expresses his views on Twitter, politely debating with people who have different opinions. The importance of a core person who can effectively convey ideas to the outside world for any protocol/product is self-evident.

The third is to be pragmatic. Stacks was defined as a side chain in the past. Recently, it has more defined itself as preferring L2, which is considered by some to be a deceptive behavior. But from another dimension, being able to explain and disseminate it at a level that the market can better understand is also a more efficient marketing method, which is understandable from the perspective of gaining adoption. At the same time, we can also see that Muneeb has always sincerely explained its design ideas, iteration ideas, current ecological pain points, why there is L2 narrative, etc., and consistently responded to external doubts and challenges. Continuous construction and voicing, not changing its ambitions due to external fluctuations, but adjusting the communication method according to the migration of narrative hot spots, can be described as very pragmatic idealism. Qiao Wang of Alliance DAO commented after an interview that Muneeb is humble and intellectually honest, which is very pertinent.

Other members of the core team are also hiding dragons and crouching tigers, such as:

Jude Nelson (@JudeCNelson) is a Research scientist at the Stacks Foundation. He is a CS PhD in distributed systems from Princeton and a distributed expert. He is currently the chairman of the SIP Technical Steering Committee.

Rena Shah (@renapshah) is currently the product VP of Trust Machines. She once served as the exchange director of Binance US. She also has various experiences in crypto fund strategy and management consulting. In her spare time, she also runs a renewable energy cryptocurrency mining pool.

Aaron Blankstein: CS PhD from Princeton. His research interests include application performance improvement, memory security, information privacy, etc. He is also an expert in the distributed field.

Trevor Owens (@TO): Host of @TheOrdinalShow, founded @btcfrontierfund, supports Bitcoin ecological projects, and often speaks out for Stacks

In addition, @herogamer 21 btc, a community governance resident from the Stacks Foundation, compiled a complete list of Stacks ecosystem worthy of attention.

If a community can gather enough smart people to build together, put forward good suggestions, and have a way to reach consensus, then the vitality and long-term development momentum of the community will most likely be upward. This is the Alpha that continues to travel through the cycle.

A New Decade of Stacks: Dancing in Shackles

Changes to Bitcoin L1 require a long process of reaching consensus, and this is one of the important reasons why Bitcoin is admired - it cannot be transferred due to any individuals will. Stacks has been building on Bitcoin for so long, and has gradually found the pace of adaptation. What can and should be done when L1 does not move, and how to adjust the design ideas when L1 finally changes, so as to always Can resonate at the same frequency as L1. This is the long-term approach to doing things. Don’t complain, don’t give up, and keep moving forward. This will remain the case in the next ten years.

On the other hand, even if there are no major changes to L1, if BitVM is feasible, L1<>The way in which trust is minimized between L2s may also be greatly improved. This means that the peg design of sBTC can be rethought. Even if sBTC is a relatively optimal solution under current constraints, as new technical solutions are proposed, new boundaries of possibility will open. To be a leader, you must consider these feasibility ahead of time, be prepared, and find a clearer path.

In addition, although the specific development path is not yet clear, there are still many basic skills that can be done to unlock the potentially huge Bitcoin DeFi market. For example, developing better-use infra products, whether it is wallets or other tools, upgrading the programming language level, and trying to find more scenarios and ways to use Bitcoin cleverly. The faster blocks brought about by the Nakomoto upgrade are just the beginning. Good infra and scenes promote each other, and finally it is possible to explore a large PMF.

Since Stacks has its own Clairty language, it must also put extra effort into developer promotion and set up incentives and revenue mechanisms. It has launched the N 21 plan to help developers and teams build within its ecosystem, providing them with technical guidance, marketing and financing support and other assistance. In addition, there are various Grant programs within the ecosystem, such as technology and researcher resident programs and multiple community-driven programs (such as DeGrants, Chapters, etc.).

However, if enough BTC funds can be attracted within the ecosystem and market opportunities emerge in endlessly, developers can naturally be attracted to voluntarily make efforts to join. It is also a common idea to use demand to promote supply in reverse. For example, it can currently take full advantage of the wave of BTC L2 narrative and the influx of funds to attract more developers. And as more and more diverse people stay in the Stacks ecosystem, it will become increasingly resilient.

Discussion on Token Economics and Valuation

There are 1320 M STX in the genesis block of Stacks. The specific allocation is as follows. You can see that its destinations include token sale, allocation to equity investors, founders, teams, independent entities related to the Stacks ecosystem, foundations, and universities, etc.:

By 2050, the overall STX supply will reach 1,818 M. Muneeb and another co-creator Ryan Shea each hold 89M (about 4.9%), while the proportions of other investors or independent entities are also in single digits.

The current circulation (2402) is about 1443M, and the unlocking is about 80%+. Among them, the stacked STX is at 447 M.

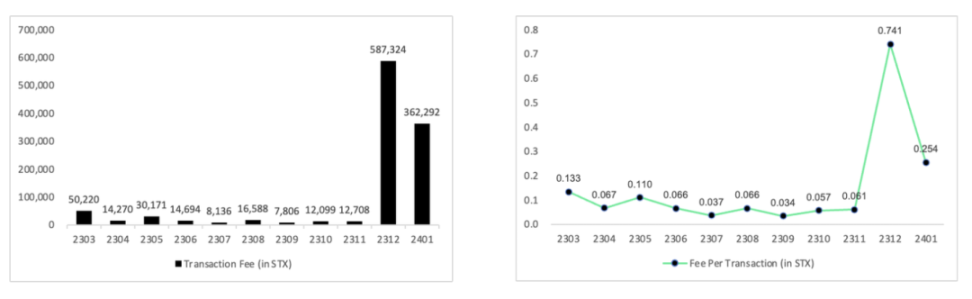

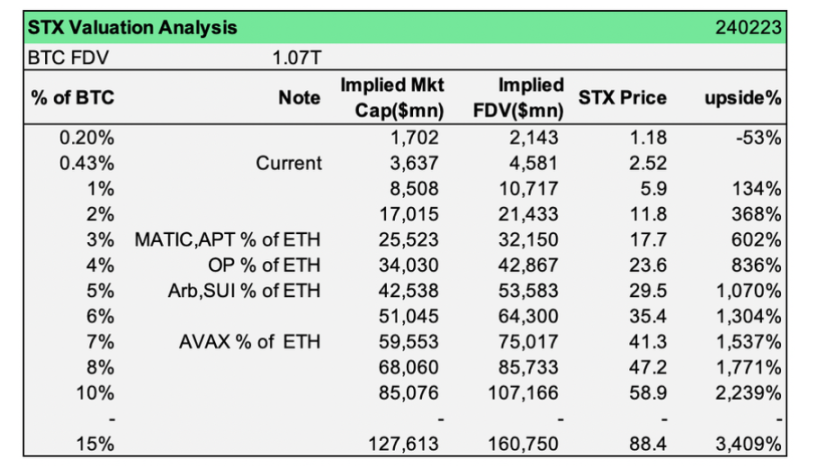

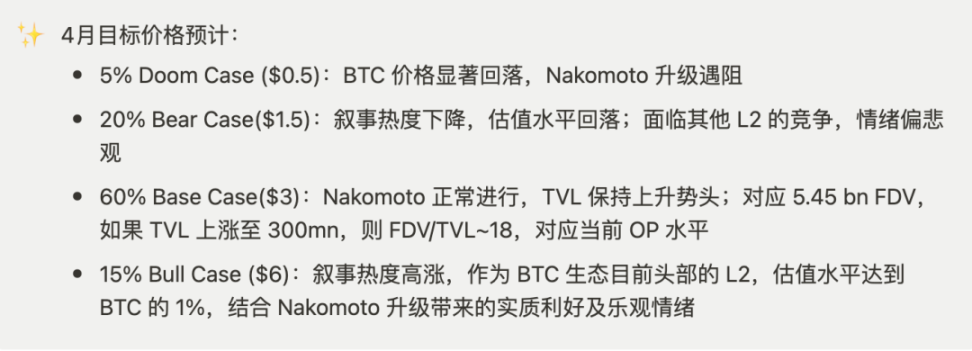

At the valuation level, $STX currently has a market capitalization of US$3.658 billion (240,223). Let’s look at the possibility of Stacks against the market capitalization of ETH L2 compared to ETH:

Source:CoinMarketCap

As can be seen from the above table, the current $STX is only 0.43% compared to BTC FDV, while the magnitude of ETH L2/ETH ranges from 2% to 8%, which means there is still nearly 4-20 times the room. If STX can reach 1% of BTC, its corresponding price will be about 5.9, which is +134% on the current basis; if it can approach the level of ARB/ETH (5%) in the future, its price will correspond to ~$30.

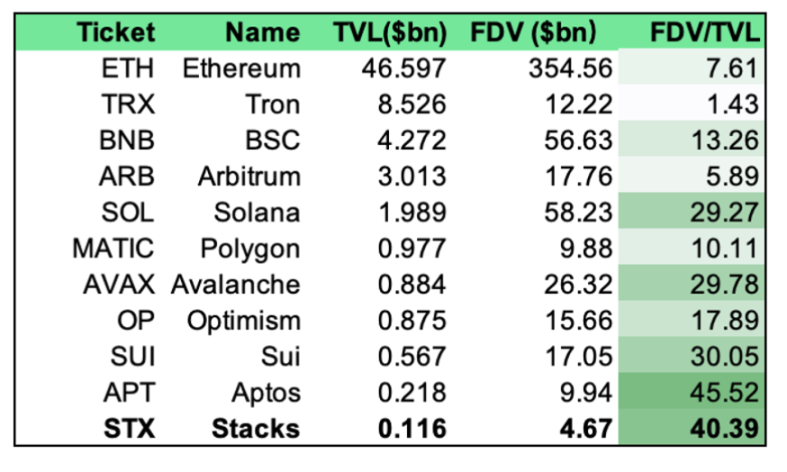

From another dimension, we look at the valuation levels of each chain from TVL:

Source:CoinMarketCap, Defillama

It can be seen that STXs current FDV/TVL is 40, which is equivalent to APT and is at a high level. On the one hand, the price of STX has increased significantly with the rise of BTC recently. On the other hand, investors may expect that the BTC L2 narrative and Nakomoto upgrade and other favorable factors will be superimposed, and its TVL can have a larger increase, which is on the order of FDV/Forward TVL. Probably relatively low. Based on this indicator, the core is observing the development Momentum of Stacks ecological DeFi after Nakomoto’s upgrade.

summary

Bitcoins current market value has returned to one trillion, making it one of the top ten assets in the world. Many new innovations and explorations are emerging. Stacks has been building in the ecosystem for 10 years around bringing utility to Bitcoin. When we are determined to solve a really important big problem, we see top funds, universities, developers, and other smart people in the blockchain being attracted to this community to contribute together. This is the unparalleled centripetal force brought by good vision and pure original intention.

At the same time, although this community is decentralized, it always has a direction: security, efficiency improvement, and exploration around the scene. And after 10 years of honest and continuous exploration in one direction, the accumulated understanding of L1, the experience of leveraging community wisdom and reaching consensus, and the balanced selection of key iteration elements are all profound for entry level three. . This is the core competitiveness it has accumulated and the engine that will drive its development in the next decade.

The hot topic of BTC L2 narrative has brought more funds and attention, giving a big boost to the years of construction. The Nakomoto upgrade will make different roles in the ecosystem more consistent with the overall interests of the ecosystem, and will generate faster blocks. The prosperity of the DeFi ecosystem and the large-scale adoption of sBTC are beginning to be very feasible. Even though L2 competition is fierce and the squandering is becoming more and more attractive, the core is probably still whether it creates valuable and large-scale commercially viable products for end users. In this competition, Stacks has its own unique position and a team that transcends cycles, is long-term and pragmatic, and is worth looking forward to.

Its current price is not cheap, and it may have partially factored in the positive factors of the upgrade based on the rise in BTC. However, considering its long-term potential high development ceiling, it can be used as a Beta configuration of BTC L2 at a certain price. The focus can be to observe the progress of its DeFi ecosystem after the upgrade and the subsequent adoption of sBTC.

Reference:

https://stacks.org/halving-on-horizon-nakamoto?ref=stacksroadmap