AEVO airdrop was criticized by the community for explicitly telling users to cheat but then punishing them

Original - Odaily

Author - Asher

Editor - Qin Xiaofeng

AEVO announced by Binance Launchpool last week has attracted market attention. However, after AEVO opened the token airdrop application at 17:00 this afternoon, it received unanimous negative reviews from the community, and the resentment of the participants spread on social media:

“One account has almost 8,000 US dollars in wear and tear, and has a transaction volume of 60 million US dollars, but only 2,000 AEVOs (currently worth about 6,000 USDT) were given. It’s really annoying to have this kind of market situation reversed.”

Has the real trading volume exceeded 100,000 US dollars and been judged as a witch?

After 300,000 US dollars was worn out, more than 90,000 coins were finally given. I didnt expect that institutional accounts would also be hit back.

“There are several accounts that did not participate in Snapshot 2 transactions, but they had deposited aeUSD and opened orders before Snapshot 1, and none of them were given.”

……

(The airdrop screenshot posted by a user basically only has 0.1 AEVO tokens)

Why did Aevo, which became so popular on social media, get cursed after applying for the token airdrop?Starting from the Farm Boost program, Odaily sorted out the entire process of users participation in Aevo product experience during this period, and showed us how users grievances accumulated and exploded step by step.

Apply for airdrop from Farm Boost to AEVO

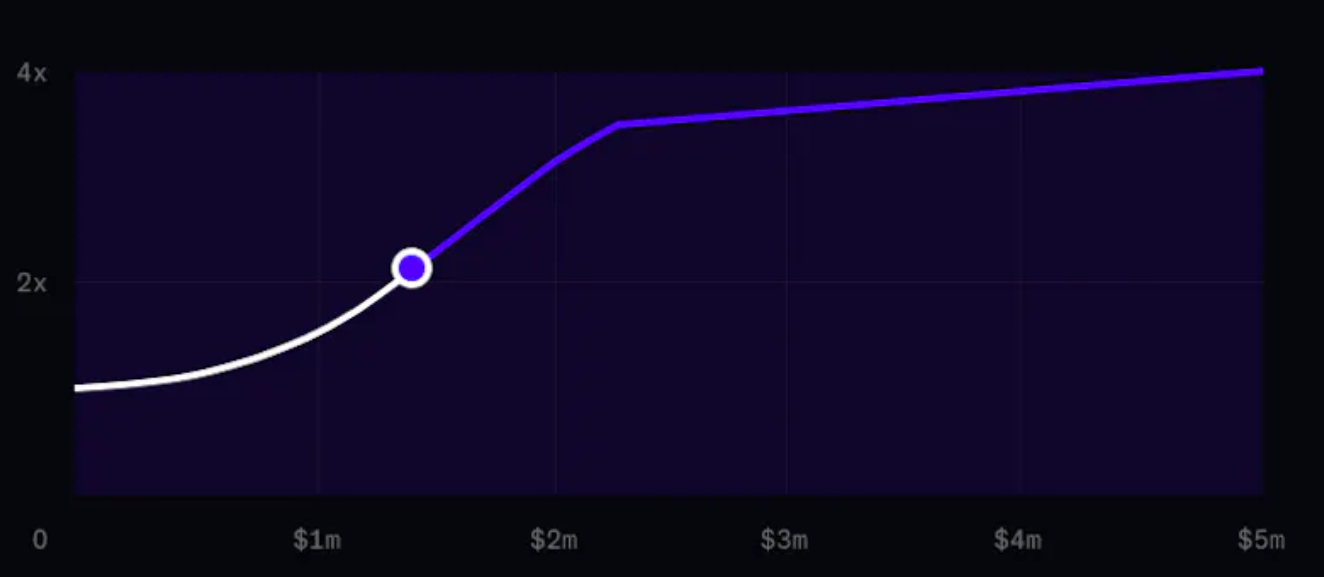

On February 14, 2024, the official announced the Aevo X Pandora: Farm Boost event in the Mirror document.The event highlights that when trading on the platform, the trading volume will affect the token airdrop share. The more you trade, the faster the base for future transactions will increase.

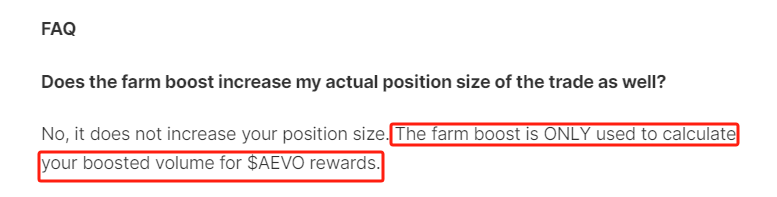

At the same time, the FAQ at the bottom of this document once again explains that the users increased transaction volume in Farm Boost will affect the number of future AEVO token airdrops.

Image source:Official Mirror documentation

This event officially stated that the airdrop of AEVO tokens will be based on transaction volume, so users began to frantically increase the transaction volume on the platform.Part of it is that institutions, studios, etc. use scripts to carry out large-scale transactions, and the other part is that retail investors manually conduct relatively frequent buying and selling transactions. For a time, various major communities were discussing issues such as how to generate greater transaction volume with lower wear and tear, and the project became extremely popular.

The AEVO airdrop application officially started at 5 pm today. When users were looking forward to seeing the rewards of their hard work in these days of trading volume, they found that it was just a basket of water. The vast majority of users have been repulsed, and the total value of the airdrop tokens received cannot cover their transaction wear and tear costs.Users previously contributed liquidity and traffic to the platform, helping the project obtain eye-catching data when it was listed on Binance, but now they have become abandoned.

Unacceptable official explanation

Aevo officially updated the relevant details of this AEVO airdrop in its official Mirror document. The reference standards for this token airdrop are divided into the following points:

Transaction volume before the Farm Boost event;

Transaction volume during the Farm Boost campaign;

aeUSD balance in the account;

The first transaction made on Aevo;

Actively use Aevo;

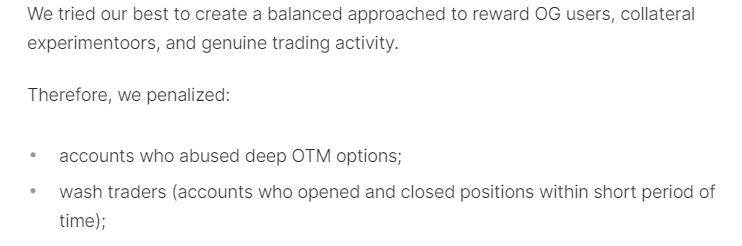

At the same time, what is more worthy of users’ attention is that the official announced that in order to reward real trading users, airdrop penalties will be imposed on two types of accounts. These two types of accounts are accounts that abuse deep OTM options; wash traders (open and close positions in a short period of time) warehouse account).

Image source:Official Mirror documentation

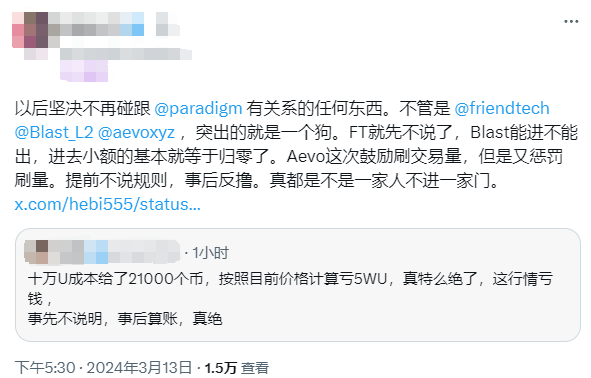

As soon as the content about punishing users for brushing up came out, the communitys resentment spread quickly.The official launch of the Farm Boost activity is to encourage activities that increase transaction volume, but it punishes users who increase transaction volume, which makes a large number of users, studios, and institutions very dissatisfied.This resentment even spread to other projects invested by Paradigm - all projects away from PUAdigm.

Dissatisfaction with the AEVO airdrop

This evening, both Binance and OKX opened AEVO trading. It is currently quoted at 2.9 USDT, with a circulating market value of US$330 million and FDV of US$3.076 billion. AEVO, which has been criticized wildly by the community, will you buy it at this price?