Maker urgently adjusts fees and starts the “DAI defense war”?

Original author: ImperiumPaper

Original compilation: Frank, Foresight News

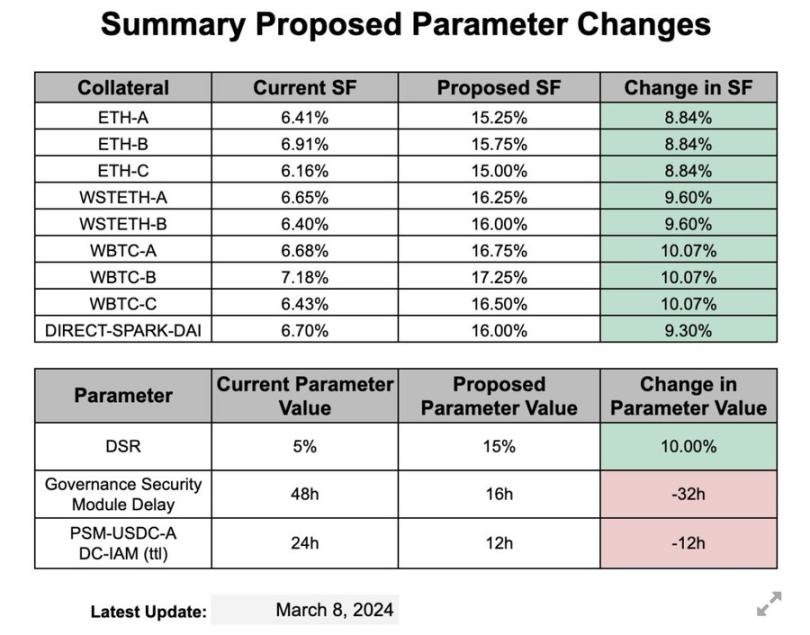

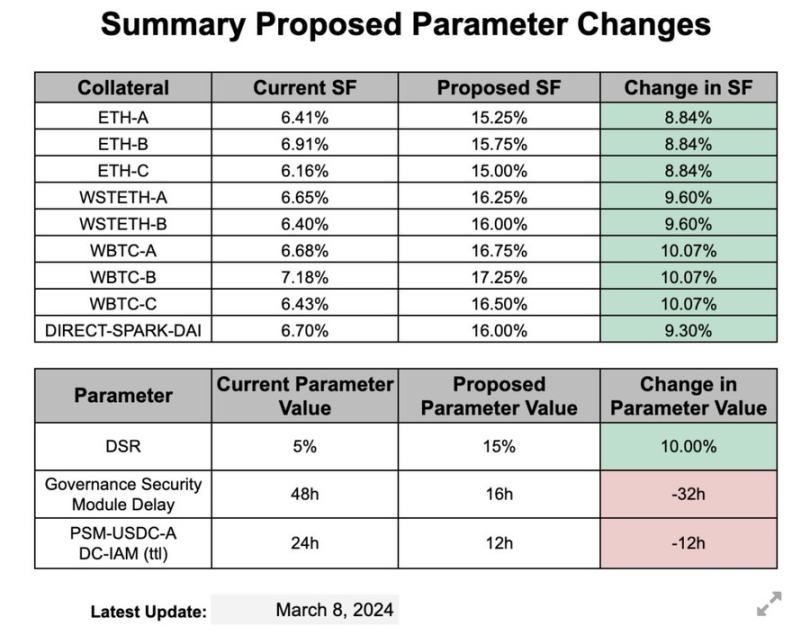

Editors note: On March 11, MakerDAO made a series of adjustments to the stable rates of DAI savings rates, ETH, WBTC and other core vaults. This article aims to briefly analyze the reasons behind these and the possible impacts.

To get straight to the point, the MakerDAO anchored stable module (PSM) experienced a large outflow of DAI funds last week. Although the current outflow is still at a reasonable level, Maker was forced to respond by liquidating tbills and withdrawing USDC stored in the Coinbase Custody cold wallet. , so far more than 900 million US dollars have been injected into PSM.

It should be noted that although MakerDAO did not mention this specifically, it has hinted that Treasury Reserves (tbills) have been slowly being reduced over the past 3 months.

The “Exchange Rate Stability” Dilemma Faced by Maker

Roughly speaking, the reason for the DAI outflow is that MakerDAO and Spark have lower borrowing and lending rates than their peers.

What needs to be made clear is that although the Atlas protocol sets the interest rate in the Maker money market based on different formulas, these formulas are ultimately linked to the interest rate of 3-month U.S. Treasury bonds (T-bill) (Foresight News Note, the Atlas protocol is The basic set of rules that govern MakerDAO).

In short, MakerDAOs system interest rate ultimately depends on the 3-month U.S. Treasury bond interest rate. If you want to know more details, you can search for Yield Collateral Benchmark.

This further means that as the overall DeFi market interest rate rises relative to traditional finance (TradFi), MakerDAOs DAI interest rate does not reflect the increase in borrowing costs in a timely manner (Foresight News notes that the interest rate of DAI failed to increase in time).

In the case of floating exchange rates, this misalignment can lead to inflation. However, for a currency that maintains a fixed exchange rate (that is, DAI), in order to maintain a 1:1 anchor with the US dollar, the system needs to use foreign exchange reserves (USDC) to intervene in the market to ensure that the exchange rate is pegged.

But the problem is that Makers hands are tied - as mentioned above, it cant adjust flexibly because the interest rate is determined by the U.S. Treasury bill rate. For those who are not familiar with the operation of MakerDAO, Makers end game is to strictly follow the Atlas protocol and hold weekly meetings to study the meaning of Atlas. Therefore, even minor rule changes are very difficult, causing it to be inconsistent with the DeFi market. Pressure on interest rates continues to build.

Until last week, the situation took a turn for the worse - PSMs USDC reserves were only 26 minutes away from being exhausted. At this time, Richard Heart sold a large amount of more than 300 million DAI to purchase a large amount of ETH. Although MakerDAO still holds US$1 billion in U.S. Treasury debt reserves, the failure to receive wire transfers in time on weekends makes the situation unpredictable and puts MakerDAO under tremendous pressure.

Against this background, the BA Labs team proposed an emergency rate adjustment, and I think they will also admit that this approach is quite extreme (Foresight News note, BA Labs submitted a comprehensive proposal on March 9 to increase the related rates).

But please note that from a political perspective, there is no feasible path to raising interest rates all the way.

What do you think about the measures taken by Maker?

Okay, now that the reason analysis has been completed, let’s look at the logic behind it:

Increase interest rates to encourage repayment of DAI - preferably by exchanging USDC for DAI;

Increase the DSR (DAI Savings Rate) to encourage holding of DAI - it is also best to let users operate in PSM;

The above measures are relatively straightforward.

We can also analyze the potential consequences. Note that the following content is speculative:

Raising lending rates is a traditional and correct move. However, the implementation of such a large one-time adjustment to interest rates is questionable. At least I think this move may cause market volatility, but of course it may not.

Regarding the DSR interest rate, I have reservations because I feel that this adjustment is a bit hasty. I think we should wait until both borrowers and lenders adapt to the new interest rate and evaluate the actual benefits before making more careful adjustments.

Combined with features such as CHAI/sDAI as collateral and Blast integration, I think there is no need to set the DSR so high (i.e. 15%), that is, the interest rate adjustment of the DSR is too aggressive.

Ive probably been in the crypto space longer than most players, and historically many currencies that have maintained fixed exchange rates have suffered badly because they didnt follow market rates, so while MakerDAO is correct in raising borrowing and lending rates, rates were corrected, but I think they may have made the same mistake again with the DSR rates.

The overall feeling is a bit like Thailand/Indonesia/Philippines in 1997, or Mexico in 1994, that is, MakerDAOs DSR interest rate increase feels like an expansionary monetary policy, but it is different from the Federal Reserve - because DSR can easily Land is repeatedly mortgaged, lowering borrowing costs.