The rise of modular blockchain narratives, settlement layer projects may have higher value

Original author: IMAJINL

Original compilation: Deep Chao TechFlow

Modular blockchains have been getting a lot of attention, but one aspect that’s often overlooked is that they fragment value. In a world where we have a single, massive blockchain, all value accumulates into this blockchain’s ecosystem – but this is not the case in a modular blockchain.

This is due to the inherent design of these modular blockchains. Modularity is related to the core blockchain components (data availability and consensus, execution and settlement), modularity is the specialization of different layers (doing what they do best), and the layer that is best suited for data availability and consensus, settlement and execution Being integrated into a blockchain, when presented to the end user, allows them to get a better product at a lower price.

Elaborating further, the main benefit of the modular stack is that users can access block space at a lower cost while getting better block space and better security guarantees, as this specialization allows the total block space to expand exponentially , the proliferation of more blockchains will unlock applications we haven’t even thought of yet, just like broadband networks unlocked social media for us. Application developers also dont need to worry too much about what the ideal stack is for them, they can just plug in and then deploy their applications. So, when the functions of all these core components are performed by different blockchains, where does the value accumulate?

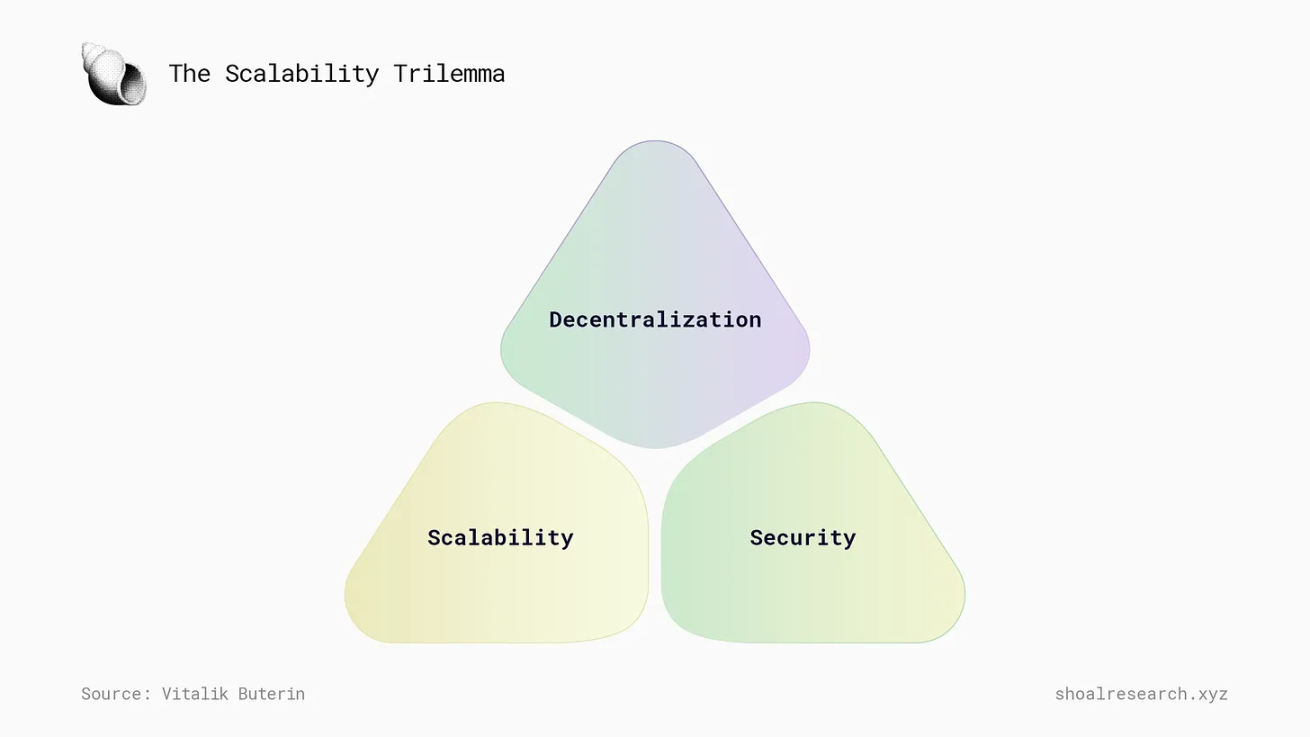

But before answering that question, let’s take a deeper look at modular blockchains. The modular blockchain narrative will contribute to the paradigm shift of blockchain technology and Web 3.0 by allowing us to scale bandwidth without compromising blockchains i.e. their censorship resistance, validity and trusted neutrality sex.

Modular blockchain scalability

Essentially, with modular blockchains, we can try to make the best trade-offs on the blockchain trilemma (pictured above) by layering scaling. Take Ethereum as an example. With a modular blockchain, Ethereum can be used as a settlement layer because it has the largest number of validators and the most geographically distributed set of validators (as well as many individual stakers and less cloud concentration overall, see here ), and Ethereum is objectively the best cryptocurrency after Bitcoin. But in reality, Ethereum is very well suited as a settlement layer, which would make it a place to have canonical bridging, as well as the ability to have dispute resolution (like fraud/proof-of-failure).

Now, in terms of scalability, were doing it on layers built on top of Ethereum, just like we do in traditional finance, where products like Stripe or something like PayPal are built on top of a lot of financial layers. Generally, banks use Fedwire (the Federal Reserve Settlement System) for settlement approximately every other week. It’s worth noting that TradFi has an advantage because TradFi uses a centralized database to record transfers, etc., while blockchain is a distributed ledger that requires the cooperation of thousands of nodes to add and verify. This takes the form of rollup (and other scaling solutions, rollup is the main one), which focuses exclusively on execution (execution is basically just running code in an execution environment, this takes the form of EVM for Ethereum and Ethereum rollup) , so some trade-offs can be made between decentralization and security. Rollup also requires data availability and by extension, consensus to function, and while these can be done by Ethereum, it can also be outsourced to a blockchain like Celestia that specializes in this kind of work.

An example of a project embracing modularity is Eclipse, which uses Ethereum as the settlement layer and Celestia as the DA+ consensus layer, and executes itself using SVM (Solana Virtual Machine) as its execution environment. SVM is currently getting a lot of attention for being the only multi-threaded virtual machine that allows for parallelization (basically processing transactions in parallel at the same time), unlike the single-threaded Ethereum Virtual Machine, where sequential transactions are the norm and cannot be implemented Parallelization.

Modular or integrated?

What I want to clarify here is that Ethereum itself is not a modular blockchain, in the sense that it can do everything on its own (data availability, consensus, execution and settlement), but it can be used by other blocks The layers of the chain and modular stack (such as execution layers like rollup) are used for functions such as settlement, which makes Ethereum an integral part of another project’s modular stack. Jon Charb has written some great articles about the Ethereum roadmap and the Ethereum rollup layer, which is where this meme from Jon Charb comes from. This meme can be understood as follows: everything is either a modular blockchain or an all-in-one blockchain (performing all functions on a base layer, like Solana), depending on how you look at it. If I build a rollup on Solana, is Solana itself a monolithic blockchain or a modular blockchain? Likewise for Ethereum. Even Celestia can perform and settle, but if it is only used for data availability and consensus, then it is a modular blockchain.

By adopting a modular blockchain, you can have different blockchains that are specifically dedicated to meeting the requirements of an optimized blockchain, as I laid out above.

But this begs the question, which of these layers (data availability, consensus, settlement, execution) will capture the most value (have the most value accumulation)?

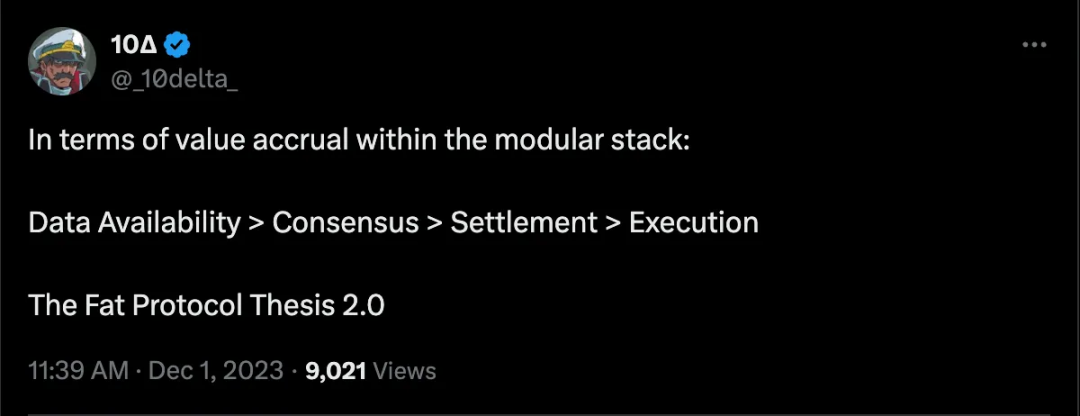

This article was written after discovering the tweet, and here are the conclusions and framework I drew from it (spoiler: I disagree with the content of the tweet).

To state my thoughts more succinctly:

1) For the DA layer to work, you need some kind of ordering on the layer (so the DA layer has its own consensus, the ordering protocol), so in this modular stack, consensus and DA are not two independent things. Imagine using available data on one chain to create a proof, but that data (because its on the blockchain) is ordered in another way by another chain, its a mess.

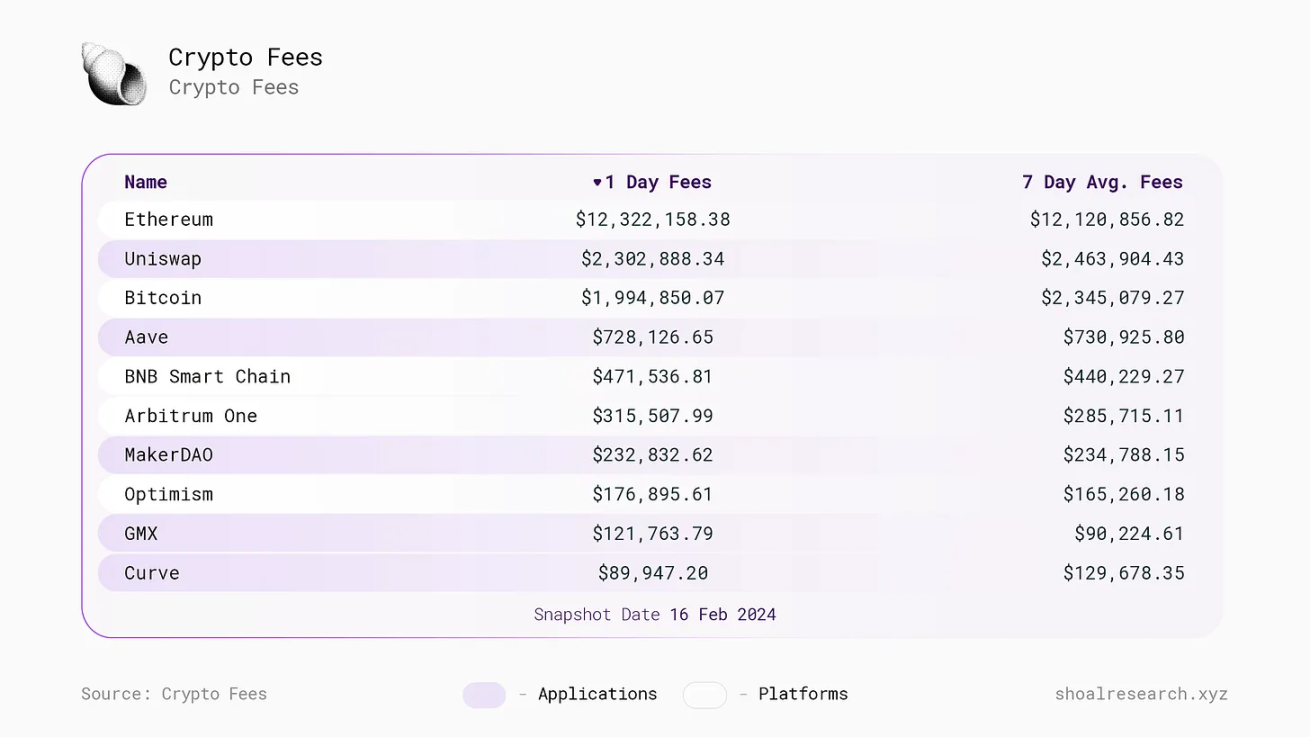

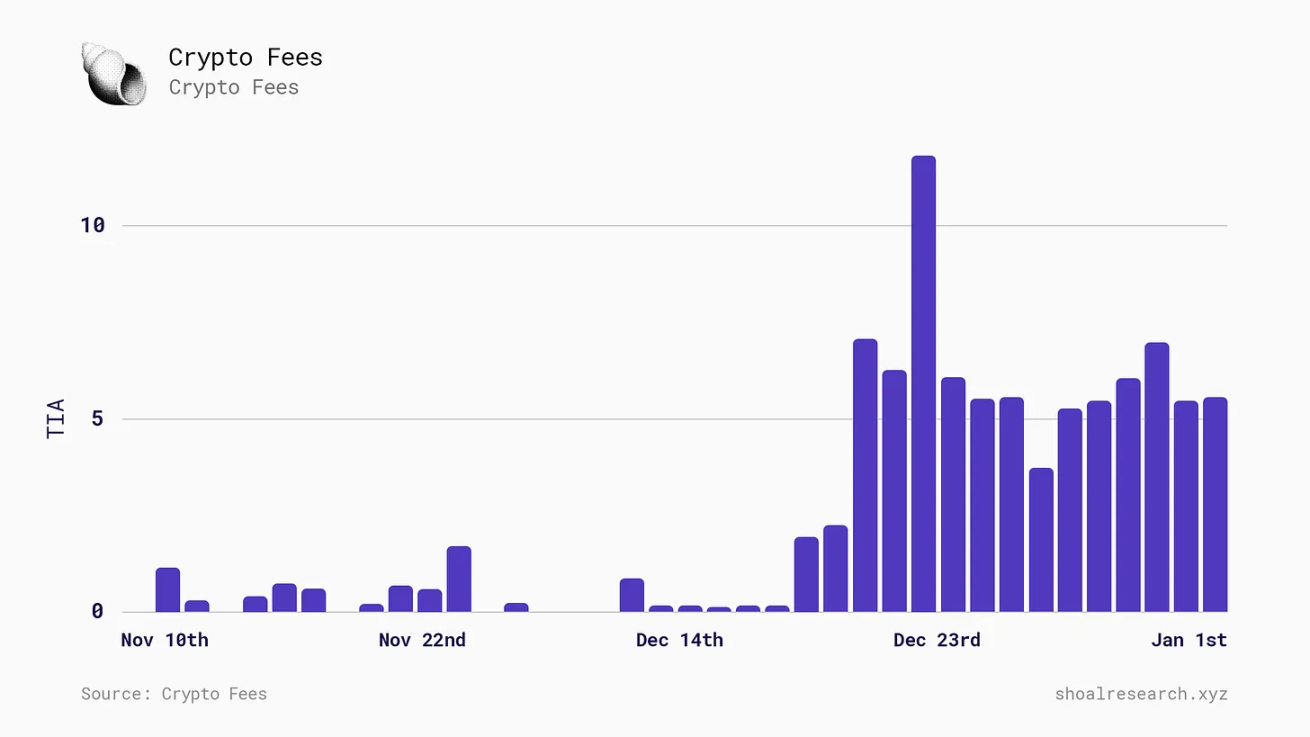

2) Executive layers like Arbitrum have pricing (discrimination) power, while DA layers like Celestia do not. This is because Celestia provides a homogeneous service (data availability), while Arbitrum (and other rollups like Optimism) provides an execution environment for some of the best cryptographic applications found elsewhere, which in itself is what Arbitrum earns Thats a lot of revenue (hundreds of thousands of dollars a day), while Celestia costs much less (less than $100 a day), as you can see in the image below. Arbitrum is also closer to end users due to having a sorting monopoly (the foundation runs the only sorter), and although this may change in the future (e.g. with shared sorting), the Arbitrum protocol (sorters, builders, searchers) will still is the only protocol that charges user fees, and most importantly, part of MEVs fees will be propagated to the DA layer through the rollup and execution environment, because the rollup and execution environment are still writing data to Celestia! Remember, if the DA layer captures most of the value, todays rollups and protocols will charge users less than the cost of publishing/writing data to the DA layer.

Anatoly Yakovenko, founder of Solana, explains this phenomenon in depth on the Lightspeed Podcast.

3) The settlement layer is more valuable than the DA+ consensus layer (and in my opinion the execution layer), and the reason is that the settlement layer will be secured by the most funds/currency-like crypto assets, just like Ethereum, the most trusted neutral settlement layer today, Backed by $ETH. The DA+ consensus layer will inevitably have more activity/traffic going through it than the settlement layer, but the settlement layers assets will still be more valuable, even though the settlement layer does less. Just look at the comparison between $TRX and $ETH. The former blockchain has more transaction volume and burned native tokens than Ethereum, but its value is lower than ETH. This is Why? Precisely the currency premium.

Simply put, a money premium is the multiple that an asset trades relative to its fundamentals because of its money attributes. Gold is a good example, its not really used much in the economy for production processes, sure, gold looks pretty, but most of its value comes from its hard currency properties. Polynya expresses this better than I can below.

So whats the conclusion?

In my opinion: the most valuable part of the stack is settlement, then execution, then DA+ consensus, for the reasons stated above (which is why I dont differentiate between DA and consensus).

My point can be summarized as follows: the settlement layer is the most valuable because of the monetary premium, while the execution layer is more valuable than the DA+ consensus layer because the latter provides a homogeneous service with high competition, cost (as well as the DA+ consensus layer ) will approach 0, while the execution layer can build network effects faster and consolidate them with massive liquidity! They are also closer to users and do not compete on cost.

Let me explain this a little more. Now, rollup protocols like Optimism and Arbitrum pay over 90% of the cost (actually paid by users) for DA costs and want to minimize this fee. So they will probably move to Celestia for DA (and thus consensus), thus significantly reducing costs (and therefore their revenue) Right now, rollup data on Celestia costs pennies; if Arbitrum will do as much as it does today Write the data to Ethereum and then write it to Celestia, then you only need to pay a few thousand dollars. Dan Smith has done a good study on this. But users dont care about the small fee increase between rollups. The user does not care if he paid $0.01 for the exchange of A rollup, when the user could have paid $0.007 for the exchange of B rollup, simply because the user does not exchange many times, and the bridging asset poses a security risk! However, for rollup, which is a business of publishing gigabytes of data to the DA layer, these incremental costs are very important because they are cumulative. Fundamentally, rollup is price elastic. But this is largely not the case for rollup users.

at last

From fat protocols to fat applications, establishing a value accumulation model in the blockchain field is not a new endeavor. The emergence of modularity introduces new components to the public blockchain space, thereby also bringing new economic and value dynamics. Modular blockchains represent a paradigm shift in the blockchain stack: from building a powerful, fully integrated network that can provide all 4 blockchain capabilities on a base layer, to building using dedicated layers to achieve the best possible implementation these functional networks.

To reiterate, I believe the settlement layer is the most valuable component of the stack, based on the currency premium relative to the underlying asset. The executive layer follows. In contrast, the DA+ consensus layer, despite providing basic functionality, faces increasing competition and diminishing revenue possibilities due to its similarity to commodities.

In short, the order of value accumulation in the modular stack: Settlement > Execution > DA + Consensus.