比特币触及6.4万美元,这些OG如何看待后市走向?

Original - Odaily

Author - Asher

Starting yesterday afternoon, the price of BTC experienced a sharp rise.

According to the OKX market, the price of BTC continued to surge yesterday afternoon, returning to the US$60,000 mark after 829 days, and then hit a high of US$64,085.2 within a few hours. As of the time of publication, it was temporarily reported at 62,757.4 USDT, with a 24-hour increase of 2.89%; ETH After breaking through 3,500 USDT, it fell back slightly, temporarily trading at 3,464.28 USDT, with a 24-hour increase of 3.51%.

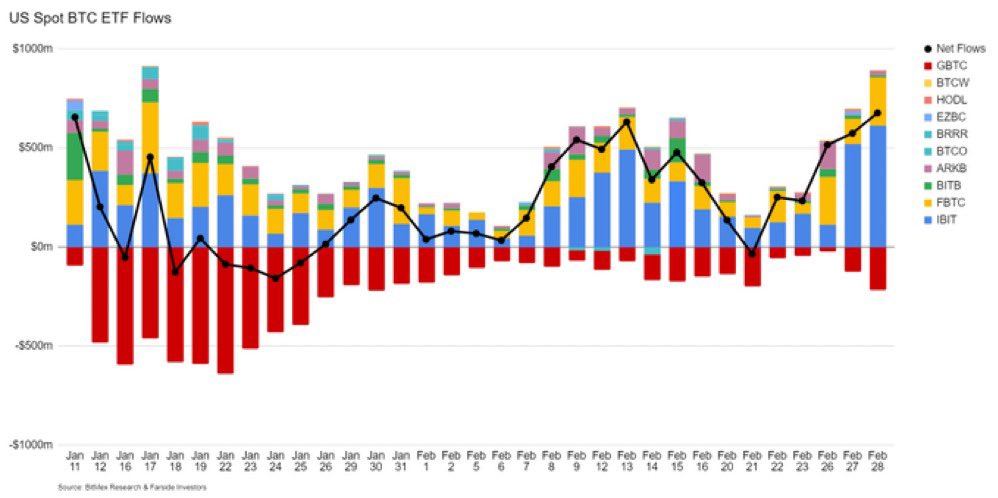

According to monitoring by Farside Investors, in addition to HODL, the Bitcoin spot ETF had a net inflow of US$676.8 million yesterday (February 28). The Bitcoin spot ETF has accumulated a net inflow of US$7.4069 billion since its launch (excluding HODLs inflow/outflow yesterday), as shown below. At the same time, yesterday’s Bitcoin spot ETF trading volume reached US$7.69 billion, hitting a record high.

Image source:Farside Investors

So, what is the future of the plot? Odaily has compiled the opinions of encryption practitioners and KOLs for everyone, and uses the insights of others to look at the future possibilities.

MicroStrategy CEO Michael Saylor:

Dont sell your BTC too early, keep the momentum going and the price of BTC will rise again.

Founder of HexRichard Heart:

Even as BTC continues to rise, “Crypto Twitter” remains relatively silent as the cryptocurrency has been bought up by “Bankers.” The fact that the BTC ETF is trading so heavily right now means that the cryptocurrency is seeing an influx of new Wall Street money, and unless institutions stop buying the ETF, BTC remains very bullish.

Founder of ElementWang Feng:

Seeing that Bitcoin has gained huge buying momentum due to the success of ETFs, the bullish trend has been established. Ignoring the short-selling hedging in anticipation of the halving, the market may go straight to $100,000.

ResearchNothing Partner0x Todd:

The U.S. stock market funds look at Bitcoin, which is different from the K-line we look at. Let’s look at Bitcoin. It opened at about $0. If the current price is $61,000, it has nearly quadrupled the gain from the previous bottom of $16,000. They look at Bitcoin IBIT (taking BlackRocks ETF as an example). It opened at $26 and the current price is only $34. It has risen from the bottom of $22, which is just 50%, so there is still a lot of room for BTC to rise.

Dragonfly PartnerHaseeb Qureshi:

At present, it is impossible for BTC not to achieve ATH within a month.

Electric Capital PartnerKen Deeter:

Keep in mind that the CPI-adjusted BTC/USD ATH is approximately 76,500.

HashKey Capital Investment ManagerRui:

This year, because of the U.S. election year, it is unlikely that there will be major negative macroeconomic policies. On the one hand, both parties need popular votes (especially young people). On the other hand, with the spot ETF (main inflow channel problem solved), Binance Settlement ( Exchange problems are solved), Uni starts dividends (DeFi problems are solved), and the wave of the strongest supervision in the Crypto market is over.

Co-founder of Delphi DigitalTommy:

When everyone decides not to sell crypto for infinitely devaluing fiat currency, the cryptocurrency cycle becomes more permanent.

Co-founder of MatrixportDaniel Yan:

The current market sentiment has reached a level that it believes should be treated with caution. By the end of April, we should see a healthy downward adjustment of about 15%. The specific adjustment may appear in March, because from a macroeconomic perspective, March is already the A tricky month (Fed meeting and BTFP). With the Dencun mainnet upgrade coming to an end and the Bitcoin halving approaching, the market in March may be weak. It is still unknown where the adjustment will start (the historical high and the adjustment may not come first), but long-term holders need not worry.

Deribit Asia Pacific Business LeaderLin:

BTCs DVOL index has exceeded 70 again, exceeding 98.9% of the time in the past year. The consensus of the market is that there should be a big move; but I don’t know whether to go up or down first.

Bitget Research:

There are still more than 50 days until the Bitcoin halving, coupled with the expectation of a mid-year interest rate cut by the Federal Reserve, the Bitcoin price has a support level of $50,000, and may fluctuate to a record high in March.

James Butterfill, Head of Research at CoinShares:

While 900 Bitcoins are produced daily, the newly issued U.S. Spot Bitcoin ETF has seen daily demand of 2,800 Bitcoins, more than three times the output, leading to a decrease in exchange holdings since 2020 increased by 28%, indicating that the market is experiencing a significant demand shock.

Crypto KOLBitcoin Archive :

Continued inflows into Bitcoin spot ETFs make this month more bullish for BTC than any month during the last bull run... BTC is likely to break out to new all-time highs before the halving.

Crypto KOLMags:

From a technical perspective, BTC is inside a massive widening wedge pattern, with overhead resistance at $91,000 if BTC prices sustain above $61,000.

To sum up, as the price of BTC continues to soar, most cryptocurrency KOLs or VC investors are in high spirits and are optimistic about the market outlook - a few people believe that the price will correct to a certain extent and then surge again, while most people It is believed that BTC will break through all-time highs in a very short time.