牛市狂欢:模因币的溢价

Article Author: MATTI

Article Translation: Block unicorn

Meme coins, especially Dogecoin, have become a true type of cryptocurrency in the past bull market. But it's not just meme coins that are influenced by meme premiums, every successful token is influenced by it. I would even go so far as to say that every branded product carries a meme premium.

A meme premium is a phenomenon where people attribute higher monetary value to an idea for the following reasons:

1. Seeing others also value an idea

2. Expecting more people to value the idea

Meme premiums are an ongoing simulation of Keynesian beauty contest. It is a form of speculation that existed long before humans understood what financial speculation meant, as Plato told us through Durandt:

"Men are quickly tired of what they own and long for what they don't have; they rarely long for anything unless it belongs to someone else."

In a world dominated by social media, speculation has become a novel form of consumption. Serious matters have turned into entertainment, and entertainment has become serious. We are turning war or inflation into performances with politicized entertainment, and cryptocurrencies are assimilating into this cultural shift.

In the previous cycle, things depicted as dark and marginalized in the world of cryptocurrency became mainstream. JPEG (NFT images), meme coins, and yield Ponzi schemes became the objects of entertainment. Even the collapse of Three Arrows, Do Kwon, SBF, and the search for scapegoats were widely disseminated and enjoyed.

Meanwhile, while the most "serious" cryptocurrency investors are talking about cryptocurrency infrastructure SaaS (Software as a Service), the marginalization of cryptocurrencies has grown. I believe we are preparing for the most spectacular marginalization ever seen in the cryptocurrency field. We are going twice as crazy, whether it's meme coins, social finance, game finance, or repledging.

In the previous cycle, the subconscious of memes carrying more premiums had formed, and in this cycle, it will become more explicit. Cryptocurrencies will become more marginalized than ever before, which means you don't have to buy Dogecoin to participate in memes. You can buy any cryptocurrency because the secret is out - every coin is a meme coin.

Anatomy (3, 3)

I have previously elaborated on the Coca-Cola stock, there is nothing fundamental about it except for its brand and accompanying customer demand. I propose that speculating on tokens is a form of consumption, much like drinking sugary water, and the value of Coca-Cola is just a sticky lollipop (Charlie Munger's metaphor).

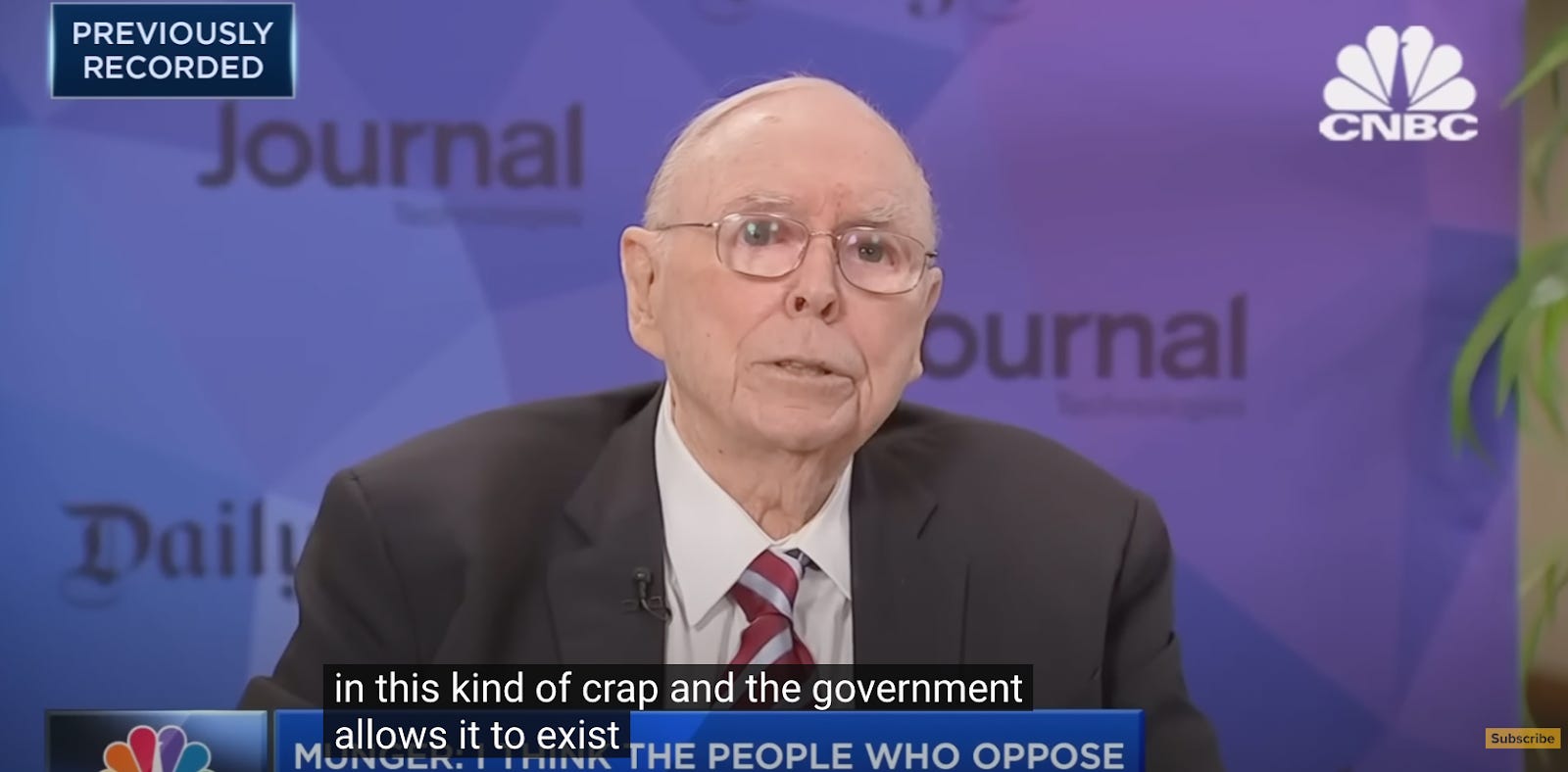

Block unicorn Note: Lola Palusa is a concept proposed by Charlie Munger to describe a complex phenomenon caused by multiple factors working together. This concept suggests that sometimes an event is not caused by a single reason, but rather the result of multiple different factors interacting with each other.

Munger is not a fan of cryptocurrencies, having referred to them as "cryptographic garbage" and "cryptographic waste". Although his infinite wisdom will be deeply missed, his outdated ideas about what can be bought and sold are not as important. Nonetheless, I believe that if Munger were younger, his "Poor Charlie's Almanack" would include a chapter on meme premium.

I simply suggest using these experimental ideas worth trillions of dollars today to update some of our outdated wisdom. They may be small in scale and individually fragile in terms of success, but they are growing. Instead of normatively rejecting them, pessimists should try to better understand them. After all, technology is the foundation of social development, not the other way around.

Let's strive to see cryptocurrencies as consumer products, rather than normatively opposing their mode of consumption. Capitalism is driven by the market, and the market is driven by consumption.

Speculation is also a form of consumption, and every brand in the world relies on meme premiums. The narrative that dominated OlympusDAO in 2021 (3,3) explicitly expresses the meme premium.

Tom Ford's revival of Gucci in the 90s once again made (3,3) shine.

This is where we stand on the curve of cryptocurrency adoption: from memes for the sake of memes to practical memes (also known as social finance). I hope we can agree on the point that to a large extent, all of our coins rely on meme premiums - which is not wrong.

In this cycle, memes (meme coins) will become directly monetizable without the need to bet on meme coins. Memes as coordinating tools and pricing them is a social game. I wouldn't be surprised to see the value of stupid meme coins shifting towards smaller coordinating experiments with "infinite" potential.

Our DeFi summer equivalent might be a meme summer wrapped in social finance narratives (the current Blast season seems to be a Shillin point). People might participate in various mini-games with certain purposes, rather than just buying into an overhyped single meme coin (like Dogecoin) and a bunch of imitations.

After all, money is a coordination game, and prices are signals. OlympusDAO's (3, 3) is a demonstration of a meme that shows it all: game finance, social finance, and a serious attempt at utility. This coin is a true meme coin, even more so compared to Dogecoin. Because if you look at a meme coin as just a meme coin, the crowd's enthusiasm is likely just fleeting magic.

3, 3 Mechanism

Learning how to price memes has always been the alchemy of finance, memes in the era of market wizards are different from now. Finance is evolving from the invention of derivatives to meme coins as the market pours into the infinite world of digital.

Harnessing the power of cryptocurrencies means understanding reflexivity, not just things going up or down, but the fundamental reasons for price changes. The world changes with the market's mood, and meme premiums are potential energies that can be transformed into momentum.

The late 2020s and the 2030s might be the golden age of meme-value-oriented crypto hedge funds, embracing the inherent reflexivity of digital assets. Cryptocurrencies might have spent some time denying themselves, but only when we embrace their true nature can we maximize the value they offer.