比特币涨近10%,突破5.7万美元,牛市启动还是短期高点?

Original | Odaily

Author | Azuma

After more than a week of consolidation, the cryptocurrency market once again ushered in a turning point.

Last night and this morning, the market saw a significant rise. According to OKX market data from Euroequity, BTC broke through 57000 USDT in the short term, reaching as high as 57500 USDT, a new high since November 2021. At the time of writing, it is temporarily reported at 56395.8 USDT, with a 24-hour increase of 9.54%; ETH also broke through 3200 USDT, temporarily reported at 3233.56 USDT, with a 24-hour increase of 4.29%.

In addition to BTC and ETH, some mainstream coins that have undergone long periods of consolidation have also rebounded. As of the time of writing, SOL is temporarily reported at 110.85 USDT, with a 24-hour increase of 7.5%; BNB is temporarily reported at 401.09 USDT, with a 24-hour increase of 4.8%; MATIC is temporarily reported at 1.07 USDT, with a 24-hour increase of 7.8%; ADA is temporarily reported at 0.6274 USDT, with a 24-hour increase of 7.7%.

However, the bullish trend has not spread to all sectors. Layer 2 and DeFi sectors, due to significant market changes in the previous period, have not kept up with the rising trend of the overall market.

Driven by the overall market trend, the total market value of cryptocurrencies has also grown rapidly. According to CoinGecko data, the current total market value of cryptocurrencies has exceeded 2.24 trillion US dollars, with a 24-hour increase of 7%. Data from Alternative shows that the enthusiasm of cryptocurrency users for trading has also increased significantly. The fear and greed index has reached 79 today, with the level changing from "greed" to "extreme greed".

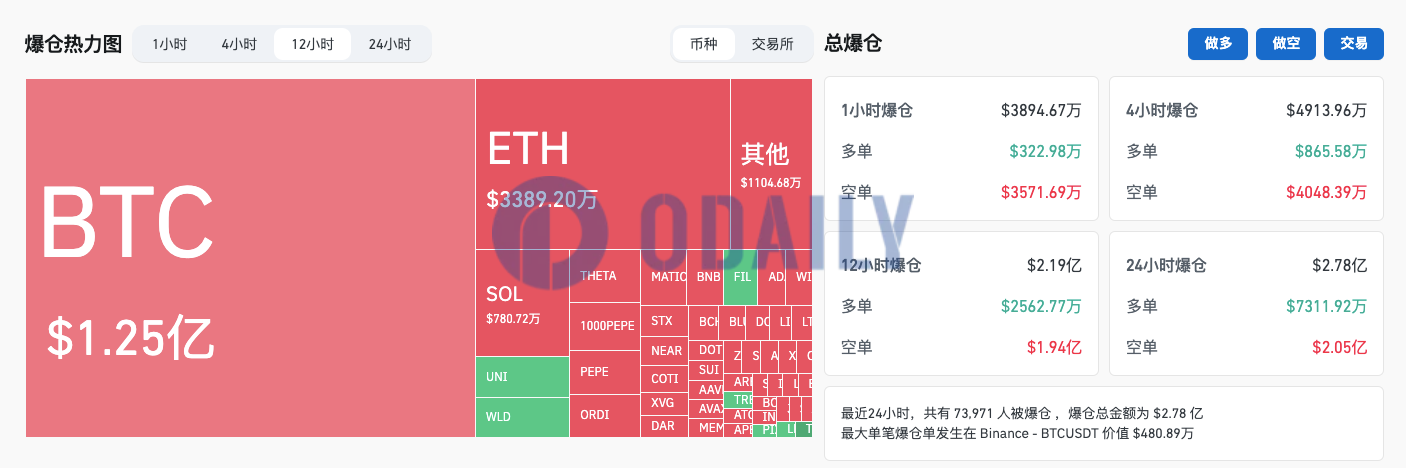

In terms of derivatives trading, Coinglass data shows that there have been liquidations totaling 219 million US dollars in the past 12 hours, with long positions liquidated at 25.6277 million US dollars and short positions liquidated at 194 million US dollars. There have been liquidations of 125 million US dollars in BTC and 33.892 million US dollars in ETH.

Accumulate and breakthrough? Buying pressure from ETFs gradually showing

Looking at the news, aside from the approaching halving in the longer term, this round of volatility seems to not correspond to any dynamic news. In general, the rise in last night's market seems more like a breakthrough after a proper adjustment.

According to the market outlook released by Greeks.live yesterday (link), Bitcoin is currently in a state of "spot bull market driving derivative bull market." The so-called "spot bull market" has actually shown signs of strong buying pressure in the market.

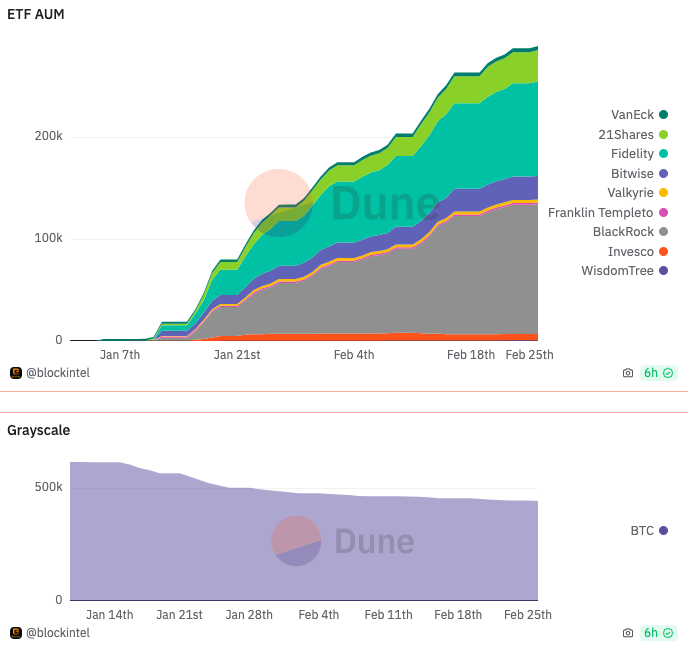

Dune data shows that as of the time of writing, the total BTC holdings of 10 spot Bitcoin ETFs (including GBTC) have reached 732,694 coins, with the total assets under management growing to 39.24 billion US dollars. After the outflow of GBTC slowed down, the other 9 major ETFs have been experiencing continuous inflows.

What does holding 732,694 BTC mean?

Based on the calculation of the real-time circulating supply of 19.64 million coins (of which a large number of tokens are no longer in circulation due to loss and other issues), this means a circulation ratio of 3.73%.

From the reserves of major exchanges, Binance's February reserve fund statement shows that as of February 1st, Binance had a net balance of 594,688 BTC from users and a net balance of 609,477 BTC for the platform; OKX's 16th reserve fund statement shows that in February, OKX had a net balance of 135,969 BTC from users and a balance of 140,086 BTC for the platform. By comparison, it can be seen that the recently approved ETF's BTC holdings are close to the combined total of Binance and OKX, the two major exchanges.

In addition to the buying pressure from the ETF, there are also some institutions/whales that are increasing their purchasing power, whether openly or secretly.

Data disclosed by Tree News shows that from February 15th to February 25th, MicroStrategy and its subsidiaries again purchased approximately 3000 BTC for about $155.4 million.

HODL15Capital also noticed the buying activity of a mysterious whale. Previously, the mysterious address Mr.100, which had made multiple purchases of around 100 BTC in a single day, increased its holdings by 405 BTC on February 24th, currently holding a total of about 46,370 BTC, equivalent to about $2.37 billion. HODL15Capital emphasized that this is not an ETF address, as this address had already held about 40,000 BTC before the ETF was approved.

While buying pressure is increasing, selling pressure from miners is decreasing. A report recently published by CryptoQuant shows that in the past few weeks, miners have been selling less than 100 BTC per day, which is in stark contrast to the situation in November to December 2022 (where sales of 1000 BTC or more per day were common).

Thriving Bitcoin ecosystem

In addition to macro-level supply and demand changes, the Bitcoin ecosystem has recently experienced accelerated growth.

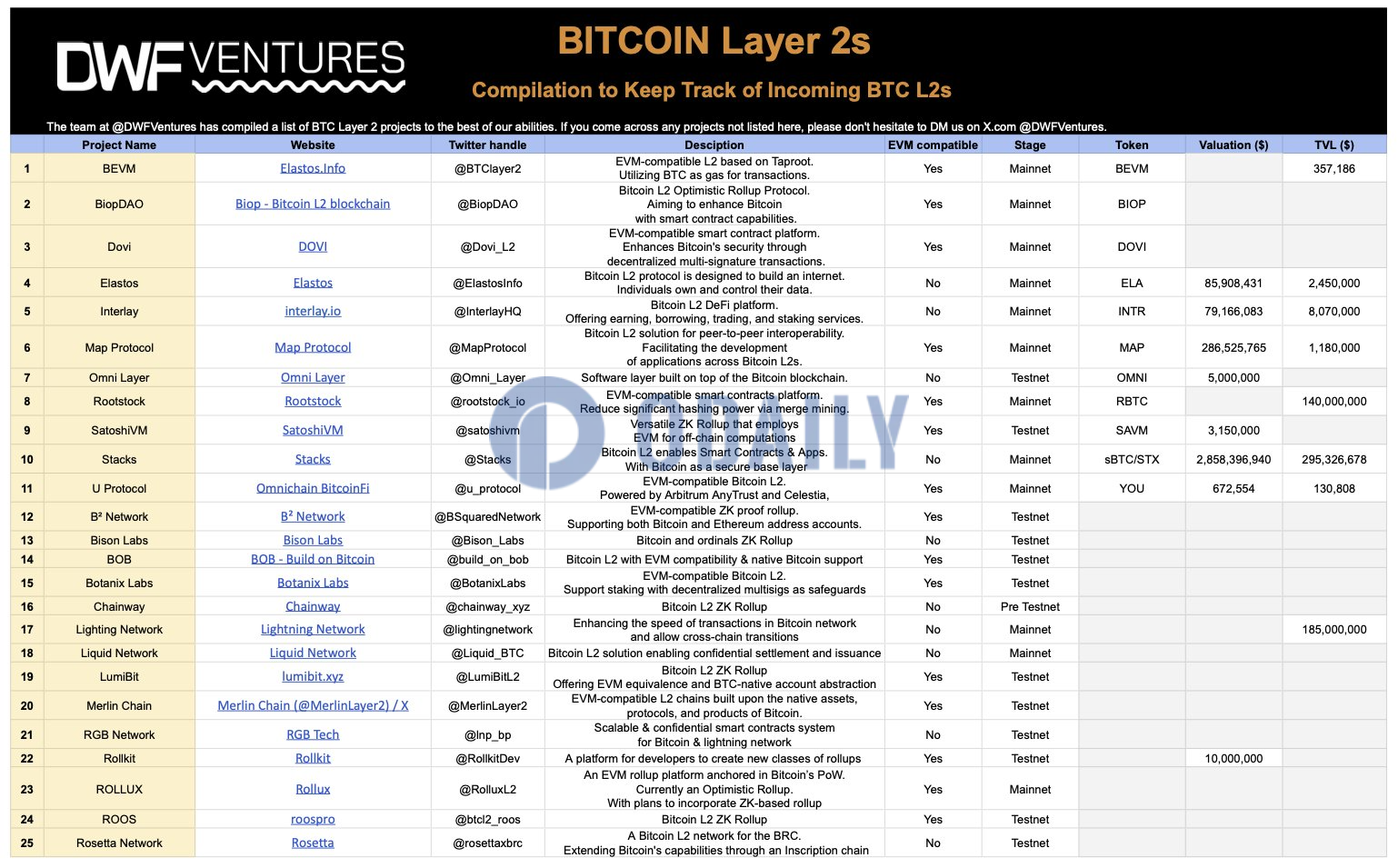

Bitcoin Layer 2 networks or compatible networks, including Merlin Chain, BounceBit, and B² Network, have grown to 25 in number (according to DWF Ventures' statistics this month), with some projects securing considerable funding and others accumulating significant TVL amounts.

Although it is currently of limited direct stimulation to the BTC price for major Bitcoin ecosystem projects, as a new attempt to expand BTC usage, the further development of such projects in the long term will also benefit the price performance of BTC.

When is 60000?

As BTC breaks above $57,000, the most pressing question for investors is undoubtedly whether BTC can hold this key level and continue the upward trend. Some institutions and industry experts have remained optimistic in their recent predictions.

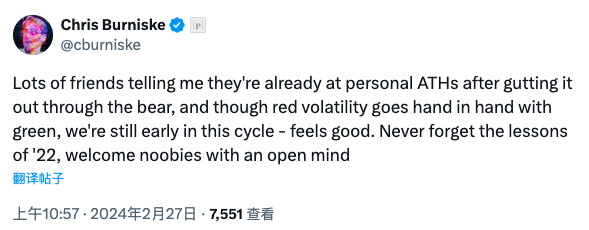

Chris Burniske, a partner at Placeholder and former cryptocurrency lead at ARK Invest, who accurately predicted that the launch of ETF trading would mark the short-term price high, commented today, "Many investors may have already achieved their individual ATH... But we are still in the early stages of this cycle."

Matrixport, which also accurately predicted the "rise before fall" trend of BTC, has released its latest market trend forecast. In the report, Matrixport states that based on historical data of the impact of ETF buying, Bitcoin halving, interest rate expectations, US elections, and other events on the BTC price, it is expected that the price of BTC will rise to $63,000 in March 2024.

March is approaching, let's wait and see if BTC can cross the final few thousand dollars.