Pantera合伙人:重新审视比特币的可编程性

Original author: Franklin Bi, Partner at Pantera Capital

Original compilation: Luffy, Foresight News

Bitcoin is the most overlooked asset in the world. What if I told you there was an asset with the following properties:

Market capitalization of US$900 billion (60% higher than Visa)

Daily trading volume reaches $26 billion (250% more than Apple)

50% annualized volatility (20% lower than Tesla)

There are more than 220 million holders worldwide (there are only 6 countries with a population of more than 220 million)

Yet this asset has been ignored and ostracized by the worlds leading financial institutions for ten years? With such an asset, can an ETF satisfy you?

No. Relative to its size, Bitcoin remains one of the most underserved and least financialized assets in the world.

Bitcoin is one of the most unique assets in the crypto ecosystem. Its market capitalization and trading volume are approximately 2.5 times that of Ethereum. The Bitcoin network serves as a digital Fort Knox. Bitcoin is a fortress with 500 times the computing power of the worlds fastest supercomputer. Bitcoin has more than 200 million holders worldwide, while Ethereum, the second largest, has only 14 million holders. And Bitcoin remains a unique presence in a sea of regulatory gray, being recognized, classified and treated as a digital commodity.

If Wall Street’s financial system isn’t built for Bitcoin, then Bitcoin must build a financial system for itself.

If blockchain technology can help the unbanked gain access to banking services, the most obvious route is through Bitcoin’s global distribution in regions such as Latin America, Africa, and Asia. This already covers millions of people. If we expect trillions of value to eventually flow on the blockchain, no network is more secure or resilient than the Bitcoin network. As Bitcoin spreads to a billion or more users, they want to do more than just store and move their assets. Capital and technology rarely stand still, and this time will be no exception.

Bitcoin is a technology

Just as Bitcoin is overlooked as an asset, it may be even more overlooked as a technology. Bitcoin lags behind blockchain networks like Ethereum in terms of scalability, programmability, and developer interest. My first attempt at building an application on Bitcoin was in 2015, during the early stages of cryptocurrency development at JP Morgan. Theres not much to explore other than colored coins and sidechains, the early ancestors of NFTs and Layer 2 Rollups that are emerging today.

The conclusion at the time was: it was just too hard to build on Bitcoin. Just ask David Marcus, former president of PayPal and co-founder of Meta’s stablecoin project Diem, who is now creating Lightspark, a Bitcoin payment company. David recently tweeted: Building on Bitcoin is at least 5 times harder than building on other protocols.

As a currency and a technology, Bitcoin’s blessing is also its curse:

Resistance to change: This reflects both Bitcoin’s robustness and its slowness. Bitcoin upgrades are difficult to get approved and can take 3-5 years to deploy.

Simple design: This makes Bitcoin less exploitable, but also less flexible. The Bitcoin blockchains UTXO model is ideally suited to serving a simple payment transaction ledger. But because of this, it is incompatible with the complex logic or loops required by most more advanced financial applications.

10-minute block times: The Bitcoin network has maintained 100% uptime since 2013 (a rare achievement) thanks to its 10-minute block times, but this has prevented it from gaining a large number of consumers .

Im seeing signs today that Bitcoins downturn is a temporary, non-structural condition. A decentralized finance (DeFi) system based on Bitcoin may finally emerge. Its potential is similar or greater than DeFi on Ethereum today, although they follow different evolutionary paths.

Why now?

In the past few years, Bitcoin has embarked on a new development trajectory:

Taproot upgrade (November 2021): This upgrade expands the amount of data and logic that Bitcoin transactions can store.

Ordinal inscriptions (January 2023): A Taproot-enabled protocol for writing rich data into a single satoshi (2.1 quadrillion total), opening up metadata for non-fungible tokens (NFTs) layer.

BRC-20 Token (March 2023): An Ordinals inscription that enables deployment, minting and transfer functions.

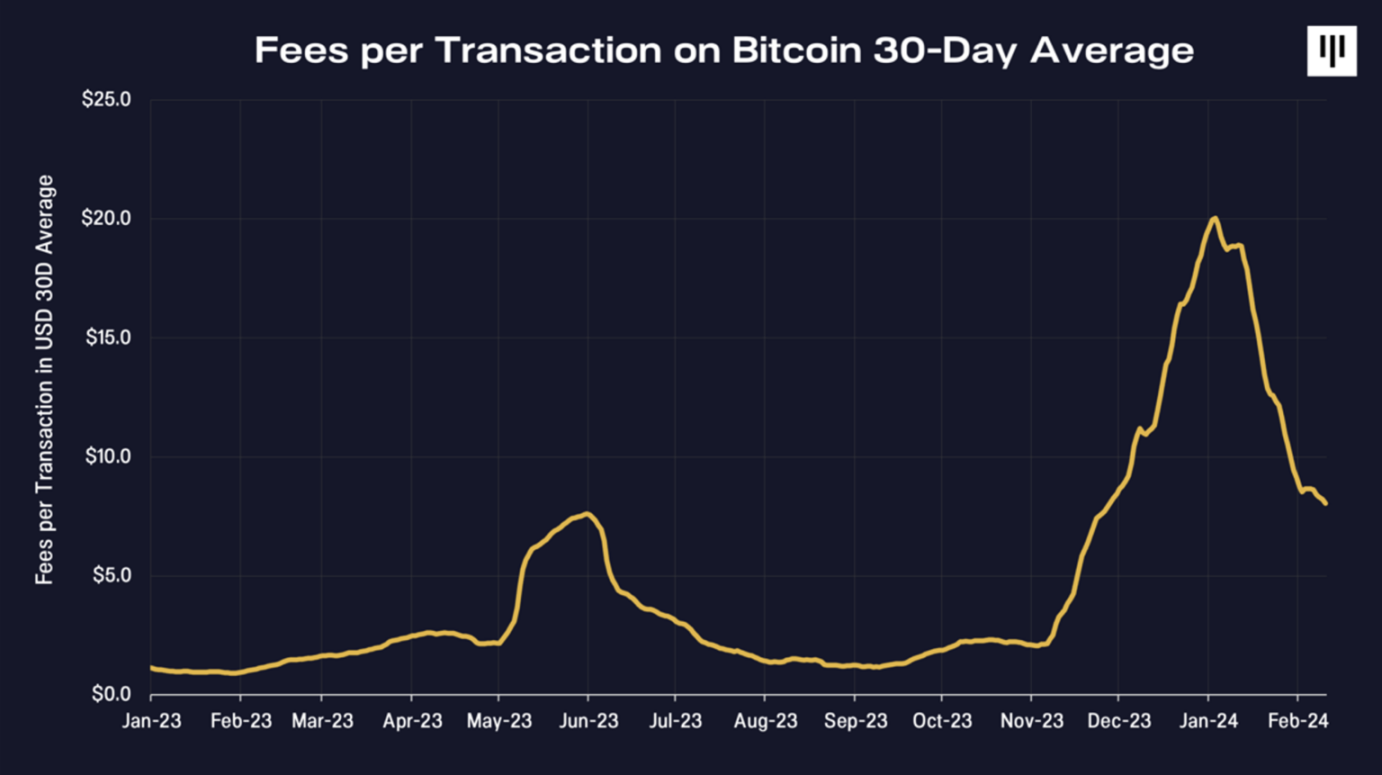

The release of fungible and non-fungible assets kicked off the first wave of DeFi and NFT on Ethereum in 2016-2017. The Bitcoin ecosystem is showing early signs of the same growth. Driven by Ordinal, the average fee per Bitcoin transaction rose 20x in 2023.

Bitcoin is bound to follow its own path, but it’s clear that a new design space has opened up for Bitcoin builders.

Larger macro trends triggered a psychological shift in the Bitcoin community and reignited Bitcoin investor interest in Bitcoin decentralized finance:

Layer 2 Adoption: Layer 2 networks like Arbitrum dominated new DeFi activity on Ethereum in 2023. This shows that it is possible to expand blockchain capacity and programmability without changing the base layer.

Traditional Institutional Acceptance: Bitcoin has broken through major regulatory hurdles with ETF approval, bringing capital flows and entrepreneurial thinking back into its ecosystem. BlackRock and Fidelity are revving up Wall Streets slow but powerful engine. Trading firms are scrambling to find every marginal source of Bitcoin liquidity. This may soon attract them to DeFi, especially new institutional DeFi gateways like Fordefi.

The Failure of Crypto-Native Institutions: When rivals like FTX, BlockFi, Celsius, and Genesis collapsed, it was a crypto-native financial crisis. An entire generation of investors no longer trust trusting centralized financial services with their Bitcoins.

In hindsight, it is clear: technological unlocking and macro trends are converging, and Bitcoin DeFi may be about to usher in a breakthrough moment. Now is the time to seize the moment.

$500 billion opportunity

The benefits of implementing DeFi on Bitcoin are enticing. Social and economic importance aside, every early-stage builder and investor should ask: What if it succeeds? How much is DeFi on Bitcoin worth?

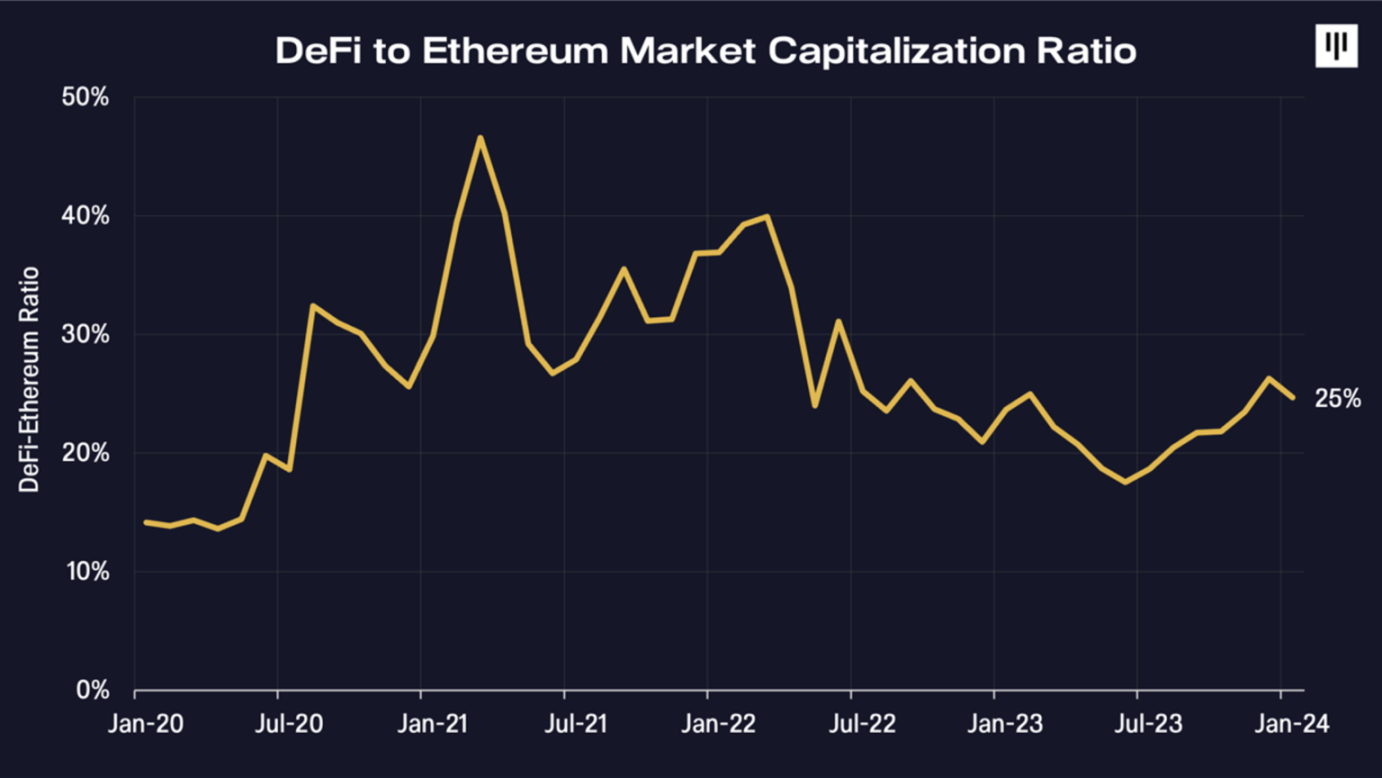

Ethereum, worth approximately $300 billion, hosts the majority of DeFi activity today. Historically, DeFi applications built on Ethereum have accounted for between 8% and 50% of Ethereums market capitalization. Currently this proportion is about 25%. Uniswap is the largest DeFi application on Ethereum, worth $6.7 billion, accounting for approximately 9% of all DeFi applications on Ethereum.

If DeFi reaches the same proportion on Bitcoin as it does on Ethereum, we expect the total value of DeFi applications on Bitcoin to reach $225 billion (25% of Bitcoin’s market capitalization). Over time, its size could fluctuate between $72 billion and $450 billion (8% and 50%). This assumption is based on Bitcoin’s current market capitalization not changing.

The leading DeFi application on Bitcoin may eventually reach a valuation of US$20 billion (2.2% of Bitcoin’s market capitalization), ranging from US$6.5 billion to US$40 billion. This would place it among the top 10 most valuable assets in the crypto ecosystem. Bitcoin has become a trillion-dollar asset again. However, it still has the potential to grow 5x (to reach a market capitalization of $5 trillion).

Looking to the future

Over the past three years, a wave of advancements in Bitcoin programmability has been brewing. Examples include: Stacks, Lightning Network, Optimistic Rollups, ZK Rollups, Sovereign rollups, Discreet Log Contracts, etc. Recent proposals include Drivechains, Spiderchain and BitVM.

But the winning solution won’t achieve breakthroughs based solely on its technical merits. A successful approach to enabling DeFi on Bitcoin requires the following:

Economic alignment with Bitcoin: Any programmable Bitcoin scaling layer should be directly tied to Bitcoin’s economic value and security. Otherwise, users may view it as hostile to or parasitic on Bitcoin. Consistency can take the form of bridging BTC as L2 collateral and Gas payments. It may also involve using the Bitcoin network for settlement and data availability.

Feasibility without base layer changes: Some proposed solutions require a hard or soft fork of Bitcoin. This means a system-wide upgrade. Given the rarity of these upgrades, theyre unlikely to be early contenders. However, some solutions are worth pursuing over the long term.

Modular architecture: Winning solutions need to be scalable enough to incorporate new technological advancements. We are already seeing changes in state-of-the-art technologies for on-chain hosting, consensus design, virtual machine execution, and zero-knowledge applications. Semi-closed systems with proprietary stacks wont be able to keep up.

Trustless cross-chain bridge: It is very difficult to bridge assets from one chain to another. Done right, it can be just as challenging as interstellar transport, given the potential for mishaps, from latency mismatches to destructive exploits. Few decentralized cross-chain bridges have been tried and proven. tBTC is an example of this, which continues to evolve its design and decentralization.

A relentless fighting game: Bitcoin’s two audiences are crucial to its growth. 1) Current Bitcoin holders and 2) Future Bitcoin builders. Both spread in peculiar ways. Exchanges hold approximately 10-20% of the total Bitcoin supply. Approximately $10 billion of Bitcoin exists on Ethereum in various tokenized forms. Developers’ attention is spread across multiple chains and multiple layers of stacks. Engaging both groups requires a meet them where they are mentality.

Bitcoin’s days of neglect may finally be over. In the post-ETF era, Wall Street is finally realizing the obviousness of Bitcoin as an asset. The next era will be one of Bitcoin as technology and the renewed enthusiasm for building Bitcoin.