每周编辑精选 Weekly Editor's Picks(0203-0209)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

airdrop

Interactive Guide: Taking Stock of Potential Solana Ecosystem Airdrop Projects in 2024

The article introduces the airdrop participation strategies of Marinade, Marginfi, Meteora, Kamino, Tensor, and Parcl.

A look at the 9 unissued projects in the Avalanche ecosystem

Struct Finance、Hubble Exchange、Hyperspace、Gunzilla Games、BloodLoop、Spellborne、DeltaPrime、The Arena、LEVR.bet。

Interactive Guide: How to qualify for Jupiter’s next three rounds of bye-investment?

Transaction aggregator Jupiter is currently the largest protocol built on Solana. The JUP airdrop is the largest airdrop event in 2024 so far. We cannot underestimate the potential of airdrops in the last three rounds.

The recommended interaction steps are: Swap on the platform, place a limit order, use DCA (fixed investment), use the bridging function, and use perpetual contracts (be careful when using leverage). A simple summary is to use the native functions of each platform.

Confirm the airdrop and take a look at the interaction strategy of the privacy public chain Aleo

Aleo will be airdropped in the first quarter of this year. The article introduces Aleo interaction strategies: Leo Wallet (privacy protection wallet on Aleo blockchain), adding wallet to green list, Faucet, New faucet, bridging, AleoSwap Faucet, AleoSwap, creating NFT, Aleo Domain, Aleo Discord.

An article reviewing the Dymension staking process and potential airdrop opportunities

Speculate potential airdrop opportunities from two directions, namely Dymensions unissued currency partners and RollApps that have been deployed on the Dymension test network. Wormhole, Avail, and ValiDAO can be interacted with as appropriate.

Also recommended Interactive Guide: Magic Eden is about to be airdropped, how to get more ME diamonds?》。

Bitcoin Ecology

Recommended reading: Delphi Bitcoin Report 2023: Key Trends and Areas to Shine》。

Ethereum and Scaling

Cancun upgrade is coming, taking stock of the favorable tracks and 20 representative events

Optimistic Rollup is a series of 7 major networks:

TVL on Arbitrum chain exceeds 10 billion US dollars, vertical expansion through Orbit L3 stack,

Optimism uses OP Stack development components to create L2 super chains horizontally.

Base backed by the big tree of CoinBase,

Manta launches Layer 2 network Manta Pacific,

L2 rising star Blast,

Decentralized sorter Metis,

Modular L2 network Mantle Network;

ZK Rollup is a series of 5 major Layer 2 networks: ZkSync, Starknet, Polygon zkEVM, ConsenSys’ Ethereum L2 solution Linea, and Scroll;

DA layer: Celestia, Avail, EigenDA, NearDA;

Data storage track: Ethereum L2 data storage project ETHStorage, decentralized data infrastructure Covalent;

LSD and heavy pledge track: EigenLayer;

RAAS service provider: Conduit, Caldera, ZK series RaaS solution Lumoz focusing on Optimism ecology.

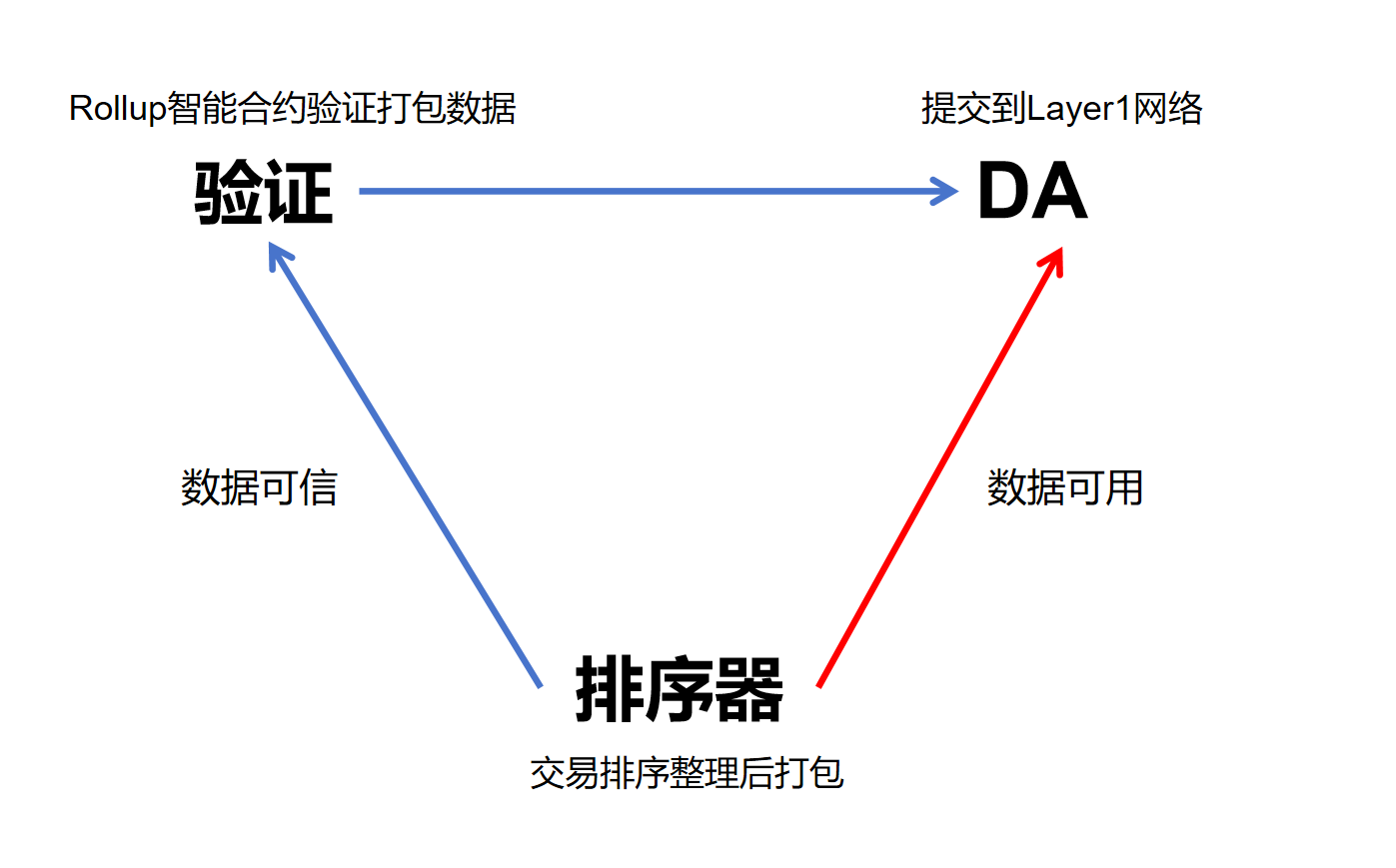

Metis is a Layer 2 based on the Ethereum chain. It is the earliest fork project of Optimism. Its working principle is the same as other Layer 2. The biggest highlight is that it is the first Optimistic Rollup to successfully realize the decentralization of the sorter. Metis transforms a single point sorter into a sorter pool and achieves decentralization through the node staking mechanism and rotation mechanism, so that the decentralized sorter can reach consensus and complete signatures. While this may ultimately make the network cost not much lower than Layer 1, it can achieve MEV resistance and solve the single point of failure problem, while distributing benefits to node stakers.

The biggest competitive point between Metis and other Layer 2 is its decentralized sorter and decentralized economic model. The overall market value displayed by TVL is more in line with market users feedback on Metis confidence. Metis is different from other Layer 2 companies in the way they hold on to financial power. Instead, they distribute more revenue to users.

If Inscription is a tester of public chain performance, then MEME is a touchstone of market recognition to a certain extent.

Multiple ecology and cross-chain

An article discusses how to solve the problem of L2 liquidity fragmentation

Our goal is to make the entire Ethereum ecosystem feel like one network. Let’s see how unified liquidity combined with wallet upgrades abstracts cross-chain and makes the cross-chain L2 experience just like using a single chain. There are 3 main approaches to unifying liquidity in L2 networks, which have different trade-offs but complement each other:

Shared Ecosystem Cross-Chain Bridge: Achieve seamless aggregation of liquidity across the entire chain ecosystem.

Mint/Burn Tokens: Can be transferred between any supported chains without limit.

A native cross-chain bridge of mutual trust: Achieving aggregated liquidity across ecosystems.

There is one flaw that significantly slows down transfers: waiting for finalization. Through financial incentives, we can create soft finality where the economic value of a transaction is higher than its actual value.

Blockchain Killer: The “Impossible Triangle” that plagues transaction quality

Once transaction fees drop significantly below $0.01, the chain and its infrastructure become vulnerable to spam, DDoS, and micro-MEV attacks. Spam attack chains will bring about two major problems: sustainability and cost.

The author believes that Immutable X and Sorare are the best solutions for this. They offer free transactions but use a Web2 style approach to spam mitigation. The key is to provide an alternative censorship-resistant path through state isolation and spam mitigation, which comes at a cost.

DeFi

Taking stock of seven high-potential DeFi products worth paying attention to

Pendle’s restaking pool, Rabby Wallet, Whales Market, RocketX, Picasso, Orca, Avocado Wallet.

re-pledge

Interpretation of EigenLayer points income: How much are the points that everyone is rolling worth?

Based on current assumptions, each EigenLayer point is worth $0.12. On Whales Market, people are trading points for $0.15. Also recommended is EigenLayer by Thor HartvigsenAirdrop Calculator。

Comprehensive comparison of various LRTs: project features and seven major strategies

Features of the Big Six:

Eigenpie: The best benefits, the highest income certainty and ceiling;

Puffer: has the best background and the highest expectations for listing on Binance;

EtherFi: The largest scale, the best liquidity, and already supports unstake;

KelpDAO: second in scale, launched by LST team Stader;

Renzo: Supported by Chinese capital such as OKX and SevenX, Native LST;

Swell: LST+LRT, which can be combined with Eigenpie to form triple points mining.

Seven distinctive strategies:

One fish, three eats: swETH+Eigenpie, swell+Eigenpie+Eigenlayer triple points;

With Binance: Puffer has received double investment from Binance Labs and Eigenlayer, the community generally believes that the expectations for listing on Binance are high;

Surprisingly conservative: mETH+Eigenpie, mETH 7.2% APR is more than twice that of other LSTs, the basic income is high, Eigenpie has many benefits, and the ceiling is also high;

Leave an exit route: EtherFi supports unstake, and large amounts of funds can be exited smoothly with low loss;

Lock in income: Pendle buys PT, gives up points and enjoys fixed high income;

Small stakes gaming: Pendle buying YT is equivalent to gaining more than ten times leverage gaming points;

Bold operation: buy and lock vlPNP/vlEQB and vote to earn points as bribes.

The Eigenlayer project is the matryoshka doll project of the Ethereum ecosystem. Assuming that according to this safe sharing logic, infinite matryoshka dolls can be theoretically created. It has a highly similar structure to the root cause of the 2008 subprime mortgage crisis. Excessive leveraging of the consensus itself may trigger the collapse of the consensus itself. The biggest potential risk to the Eigenlayer project stems from the logistical difficulties of the concept of secure sharing itself. Whether it can achieve stable profitability in the future is also uncertain.

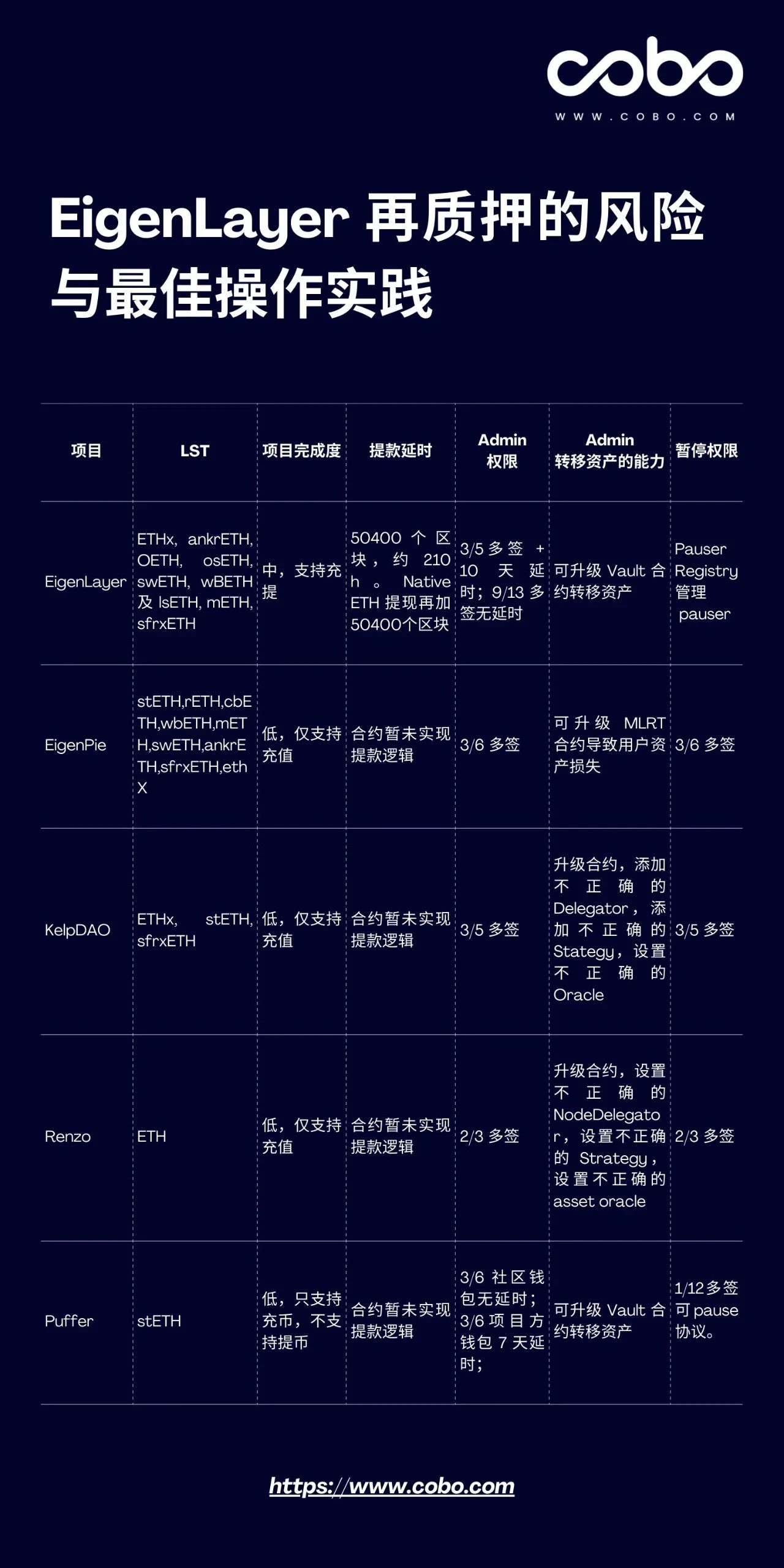

Risks and best operating practices of EigenLayer re-staking

Participating in Restaking will face contract risks, LST risks, and launch risks.

A safer interaction path is to directly participate in EigenLayers Native ETH restaking, appropriately allocate funds to other projects, and configure corresponding contract monitoring to monitor related contract upgrades and the execution of sensitive operations of the project side.

NFT, GameFi and the Metaverse

Redefining NFT, what opportunities does the ERC 404 ecosystem have?

Pandora is the first token built based on the ERC 404 token standard. ERC 404 is an open source experimental token standard for creators and developers. It is a hybrid ERC 20 / ERC 721 implementation and has the characteristics of native liquidity and fragmentation. ERC 404 attempts to fuse some features of the ERC-20 standard and the ERC-721 standard, increasing the liquidity of ERC-721 standard NFTs by combining the token divisibility of the ERC-20 standard. Currently, ERC 404 has not been audited and is an experimental test.

However, the ERC 404 standard document also points out that the ERC 721 implementation here is slightly non-standard. The tokens will be repeatedly destroyed and minted based on the transfer of the underlying/fragmentation. The purpose is to create a native fragmentation, liquidity and encourage Trade to cultivate NFTs with unique feature sets. That is, if you sell the NFT, you no longer own the tokens, and if you sell the tokens, you no longer own the NFT.

The ERC 404 standard can achieve the effect of fragmented NFT ownership. It can not only solve the pain point of low liquidity of NFT, but also further unlock the liquidity of NFT through financial methods such as lending and derivatives. It is worthy of our further observation.

There are also ANON, Vector Reserve, Palette, Wasabi Protocol, and Froggy Friends in the ERC 404 ecosystem.

ERC 404 (Experimental) enables the number of ERC 20 tokens and the unique ID of ERC 721 tokens to use the same data structure in contract storage through a lossy encoding scheme, while maintaining their distinction and independence. This solution is not yet mature, but it also represents a lot of room for innovation and improvement.

Every innovation around asset issuance will have a narrative fermentation effect for a long time. Whether it is the inscription of the Bitcoin ecosystem or the hybrid standard token or programmable token of the Ethereum ecosystem, it will continue to generate a variety of innovations and How to play.

Coin Symbiosis, what is ERC 404 behind Pandoras surge?

ERC-404 directly creates a symbiotic relationship between graphics and currency and can be traded on CEX, which is also a subversion of existing NFTfi products. As long as oracles are introduced, native NFT leverage based on ERC-404 will be easy (directly open long and short on ERC-20 Token), and direct borrowing will also be easy, and it is no longer a matter of saving small pictures to a specified address. , can be operated directly based on ERC-20 Token. It subverts the issuance and even operating logic of an NFT series.

SevenX Ventures: The story behind Matr1x becoming the world’s largest gaming NFT by market value

The Matr1x team reflects its ultra-fast learning ability, decentralization spirit, professional ability, and the huge business opportunities it has discovered with its deep understanding of the shooting game circuit.

The reason why CSGO is so successful in commercialization is that all weapon skins (accessories) are obtained through unboxing and can be traded for real gold on the secondary market. CSGO’s main income also comes from the sale of unboxing keys. and transaction taxation. When players think that they truly own these virtual items, they will regard the accessories in CSGO as assets rather than consumer goods. Since they are assets, users will naturally be willing to spend more money to purchase them.

The Matr1x team gave away all the creation NFT YATC to contributors for free, and firmly replied that the purpose of issuing NFT is not to make money from users, but to reward these early users who were willing to support them. There are currently approximately 1,000 Matr1x NFT series holders, and the founder of the Matr1x team knows almost every NFT holder. Because the founder does a lot of AMAs and offline Matr1x Fire competitions, and carefully listens to the suggestions and feedback from each user. And every NFT holder will be treated as a shareholder of the company, sharing with them the development of the project and strategic thinking about the future.

Exploring the game ecology on the Base chain: Which projects are worth paying attention to?

FrenPet、Words 3、Drawtech、LandTorn、Cambria、Basepaint、Dot、Land, Labor, Capital (LLC)。

Also recommended: Full-chain game track research report: the past, present and future of full-chain games》。

SocialFi

IOSG Ventures: Detailed explanation of Frames, what is the charm of small programs in Farcaster?

Warpcast is a client developed by the official team based on Farcaster. It supports desktop/Android/ios. It is a social application similar to Twitter/X. User registration and login do not require a cryptocurrency wallet, and annual fees are paid through Google Pay or Apple Pay. Warps points used for tipping can be purchased with legal currency at a price of 0.01 u/warps. In addition to purchases, users can get warps rewards by registering, inviting friends, and winning big rewards.

Frames are a newly developed feature similar to inline applets that allow developers to embed interactive experiences within Farcaster posts (casts). These interactive experiences can range from voting, minting NFTs to building games, and even integrating instant transaction checkout links directly into social media feeds, eliminating the need to switch platforms. For popular Frames, there is a dedicated information flow on the Warpast homepage to view.

Nearly a week since the product launched, more than four hundred applications have released nearly a thousand Frames. By creating Frames, user-unfriendly operations such as wallet signing are hidden in the background, and seamless handling of money and digital ownership makes it possible to have a true and pervasive picture of user behavior across consumer applications, which is even possible Something that Web2 also failed to achieve in its heyday.

Hot Topics of the Week

In the past week,Year of the Dragon concept meme coins record high gains,Multicoin Capital is discussing selling its roughly $100 million FTX bankruptcy claim,South Korea arrests three Haru Invest executives and accuses them of misappropriating $826 million in user funds;

In addition, in terms of policy and macro markets, Powell:Rate cuts coming, but confidence in March unlikely,U.S. SEC votes to adopt rules to impose stricter regulations on traders in cryptocurrency and DeFi fields,South Korea:Illegal virtual asset trading will be banned from July, with violators facing up to life imprisonment, Hong Kong Securities and Futures Commission:If a virtual asset trading platform fails to submit a license application before February 29, it must end its business in Hong Kong by May 31;

In terms of opinions and voices, U.S. Treasury Secretary Yellen:Welcomes Congressional efforts to create a regulatory framework to address the risks of stablecoins to the financial system,DecenTrader:BTC may have a month of sideways fluctuations before the market reacts to the “halving event”,Vitalik and Ethereum Foundation researchers propose 5 designs to reduce Ethereum’s maximum block size, founder of Uniswap:UI forks help decentralization, while brand forks harm the interests of users and brands., cosine:ERC 404 is not yet a mature standard, and its mechanism may bring new security risks.,Pandora:First audit completed by PeckShield; Etherscan expected to have full support for ERC 404 contracts in the coming weeks;

In terms of institutions, large companies and leading projects,The U.S. SEC announced that the BitFufu SPAC merger document is valid and plans to list on Nasdaq under the stock code FUFU, Binance issued an insider trading policy reminder:The employees involved will be permanently blacklisted,StarkWare releases STRK inflation model proposal, which will affect STRK’s total token limit,Dymension resumes block production and launches mainnet,Solana network suspends block production for 5 hours,Farcaster DAU activity exceeds 35,000, hitting record high, Wormhole releases token economics:The total supply of W tokens is 10 billion, 31% is allocated to ecology and incubation,Frax Finance announces the launch of modular L2 blockchain Fraxtal,Shardeum will be airdropped in three phases. In the first phase, more than 3.66 million SHM will be distributed to early contributors., Pixels token economics and roadmap revealed:34% of PIXEL tokens will be used for ecological rewards and BERRY will be phased out...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

Odaily would like to wish all readers a Happy New Year! Happy family! See you next time~