一文探讨如何解决L2流动性割裂问题

ผู้เขียนต้นฉบับ: ทิม โรบินสัน

ต้นฉบับเรียบเรียง: ลูฟี่, Foresight News

เหตุใดการเคลื่อนย้ายที่ราบรื่นจึงจำเป็น?

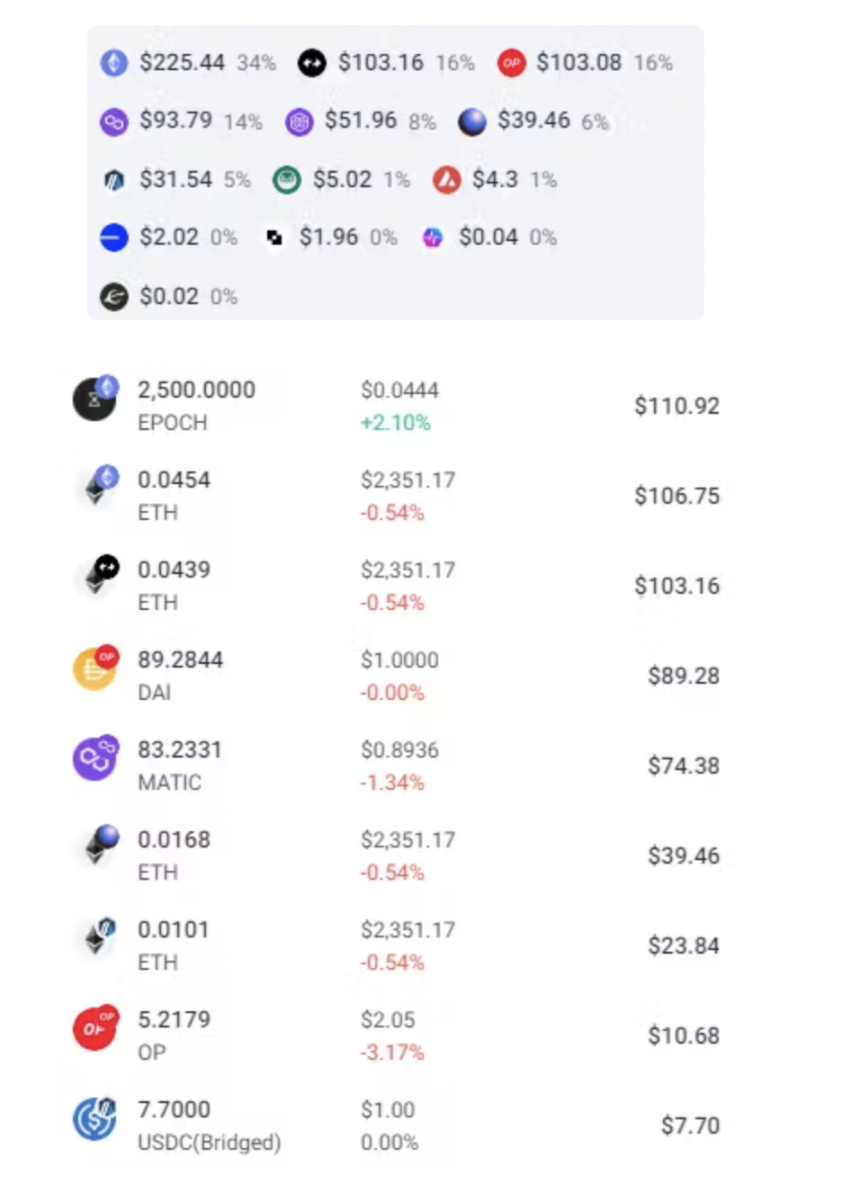

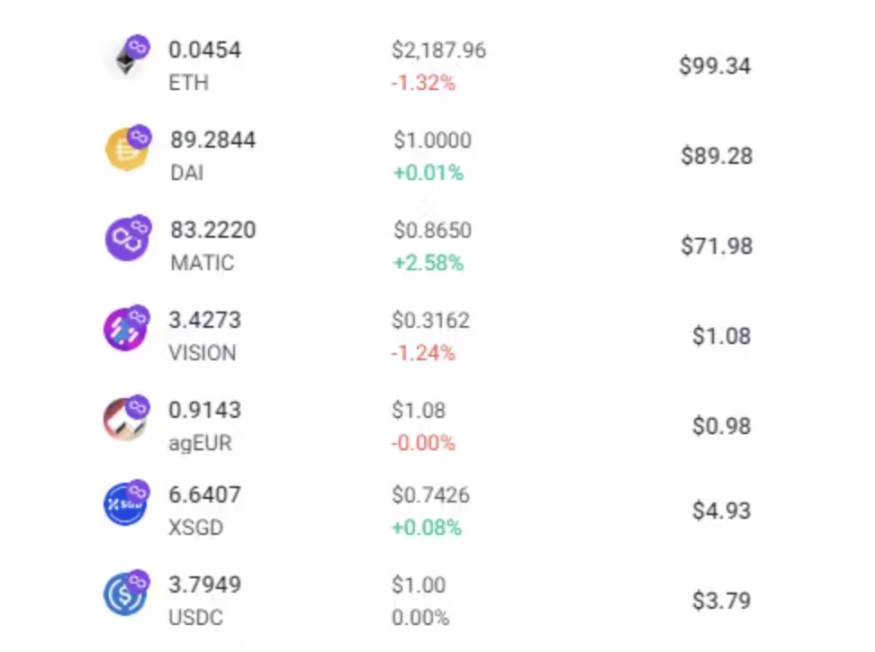

สุดสัปดาห์ที่ผ่านมา เพื่อน Farcaster ของฉันกำลังพูดถึงเหรียญใหม่ที่กำลังมาแรงบน Base: $DEGEN ตามแบบ FOMO ฉันตรวจสอบกระเป๋าเงิน Rabby ของฉันเพื่อดูว่าฉันสามารถลงทุนได้เท่าไร:

ฉันสามารถใส่ $500 ลงในโทเค็นนี้ได้ และเพียงแค่ต้องขายสินทรัพย์อื่นๆ บางส่วน พอร์ตการลงทุนของฉันมีลักษณะอย่างไร?

น่าเสียดาย เกือบทุกโทเค็นอยู่บน L2 ที่แตกต่างกัน เพื่อที่จะรับ $DEGEN ฉันต้องทำธุรกรรมแบบ cross-chain และธุรกรรมหลายรายการ แม้ว่าจะมีค่าธรรมเนียมต่ำ แต่เวลาที่ใช้ในการข้ามเครือข่ายและการแลกเปลี่ยนก็ยังคงน่าหงุดหงิดอยู่

เราต้องแก้ไขปัญหานี้และเป้าหมายของเราคือการทำให้ระบบนิเวศ Ethereum ทั้งหมดรู้สึกเหมือนเป็นเครือข่ายเดียว มาดูกันว่าสภาพคล่องที่เป็นหนึ่งเดียวเมื่อรวมกับการอัพเกรดกระเป๋าสตางค์จะทำให้เกิด cross-chain และทำให้ประสบการณ์ cross-chain L2 เหมือนกับการใช้ chain เดียวได้อย่างไร

ไม่จำเป็นต้องข้ามสายโซ่

เหตุใดสะพานข้ามสายโซ่จึงไม่ดีในปัจจุบัน มีข้อบกพร่องหลายประการ:

คุณต้องไปที่เว็บไซต์อื่น เชื่อมต่อกระเป๋าเงิน อนุมัติ โอน อธิษฐานให้มันไปถึงอีกฝั่งหนึ่ง...

โดยปกติแล้ว Cross-chain จะใช้เวลา 5 - 30 นาทีจึงจะเสร็จสมบูรณ์ ซึ่งช้าเกินไป ซึ่งถ้าจะให้ดีควรน้อยกว่า 10 วินาที

สะพานข้ามสายโซ่ส่วนใหญ่ต้องการสภาพคล่องในการล็อคบนทั้งสองเครือข่าย ยิ่งเรามี L2 มากเท่าไร สภาพคล่องก็จะยิ่งกระจายมากขึ้นเท่านั้น สภาพคล่องต่ำทำให้ยากต่อการเคลื่อนย้ายเงินจำนวนมากระหว่างเครือข่าย และส่งผลให้ราคาแย่ลง

มีเพียงโทเค็นเหลวบางตัวเท่านั้นที่สามารถเชื่อมโยงข้ามเครือข่ายได้ และสำหรับเครือข่ายส่วนใหญ่ โทเค็นเหล่านี้คือ ETH และเหรียญเสถียร

มีโทเค็นที่ห่อไว้บางส่วนที่ไม่ต้องการสภาพคล่องที่ถูกล็อคและสามารถรองรับโทเค็นใดๆ ได้ อย่างไรก็ตาม หลังจาก cross-chain คุณจะได้รับโทเค็นเวอร์ชันที่ไม่ใช่เจ้าของภาษาที่คุณต้องการ และต้องแลกเปลี่ยนเป็นโทเค็นจริงเพื่อใช้ใน DApp ใดๆ บนเครือข่ายใหม่ ซึ่งต้องใช้สภาพคล่อง ดังนั้นเราจึงจบลงที่ กับดักสถานการณ์เดียวกัน

ประเด็นสำคัญคือ หากไม่จำเป็นต้องทำ Cross-Chaining ทำไมเราถึงต้องเสียเวลาหลายล้านชั่วโมงในการทำมัน?

กระเป๋าเงินและแอปพลิเคชันควรจัดการ cross-chain โดยอัตโนมัติ

เมื่อคุณใช้ DEX หรือโปรโตคอลการให้ยืม มันควรติดตามโทเค็นของคุณในทุกเชน เมื่อคุณฝากโทเค็นจากเครือข่ายอื่น มันควรเชื่อมโยงโทเค็นเหล่านั้นไปยังห่วงโซ่ที่ถูกต้องในเบื้องหลังโดยอัตโนมัติ ดังนั้นประสบการณ์ผู้ใช้ของกระบวนการนี้ควรจะเหมือนกันทุกประการกับบน Ethereum mainnet เพียงอย่างเดียว

แอปพลิเคชันและกระเป๋าสตางค์ต้องการให้สิ่งนี้เกิดขึ้น แต่โครงสร้างพื้นฐานพื้นฐานยังไม่ดีพอ หากใช้เวลา 10 นาทีในการทำ cross-link และคุณสูญเสียโทเค็น 1% ในกระบวนการ ผู้ใช้ส่วนใหญ่จะไม่พอใจ

มาเจาะลึกลงไปในชั้นโครงสร้างพื้นฐานและดูวิธีแก้ปัญหานี้กัน

ทำอย่างไรจึงจะมีสภาพคล่องไหลอย่างราบรื่น

มี 3 แนวทางหลักในการรวมระบบเคลื่อนที่ในเครือข่าย L2 ซึ่งมีข้อดีข้อเสียที่แตกต่างกันแต่เสริมซึ่งกันและกัน

สะพานข้ามห่วงโซ่ระบบนิเวศที่ใช้ร่วมกัน: บรรลุการรวมสภาพคล่องอย่างราบรื่นทั่วทั้งระบบนิเวศห่วงโซ่ทั้งหมด

Mint/Burn Tokens: สามารถถ่ายโอนระหว่างเครือข่ายที่รองรับได้ไม่จำกัด

สะพานข้ามสายโซ่ดั้งเดิมของความไว้วางใจซึ่งกันและกัน: บรรลุสภาพคล่องโดยรวมทั่วทั้งระบบนิเวศ

เลเยอร์การทำงานร่วมกันที่ใช้ร่วมกัน

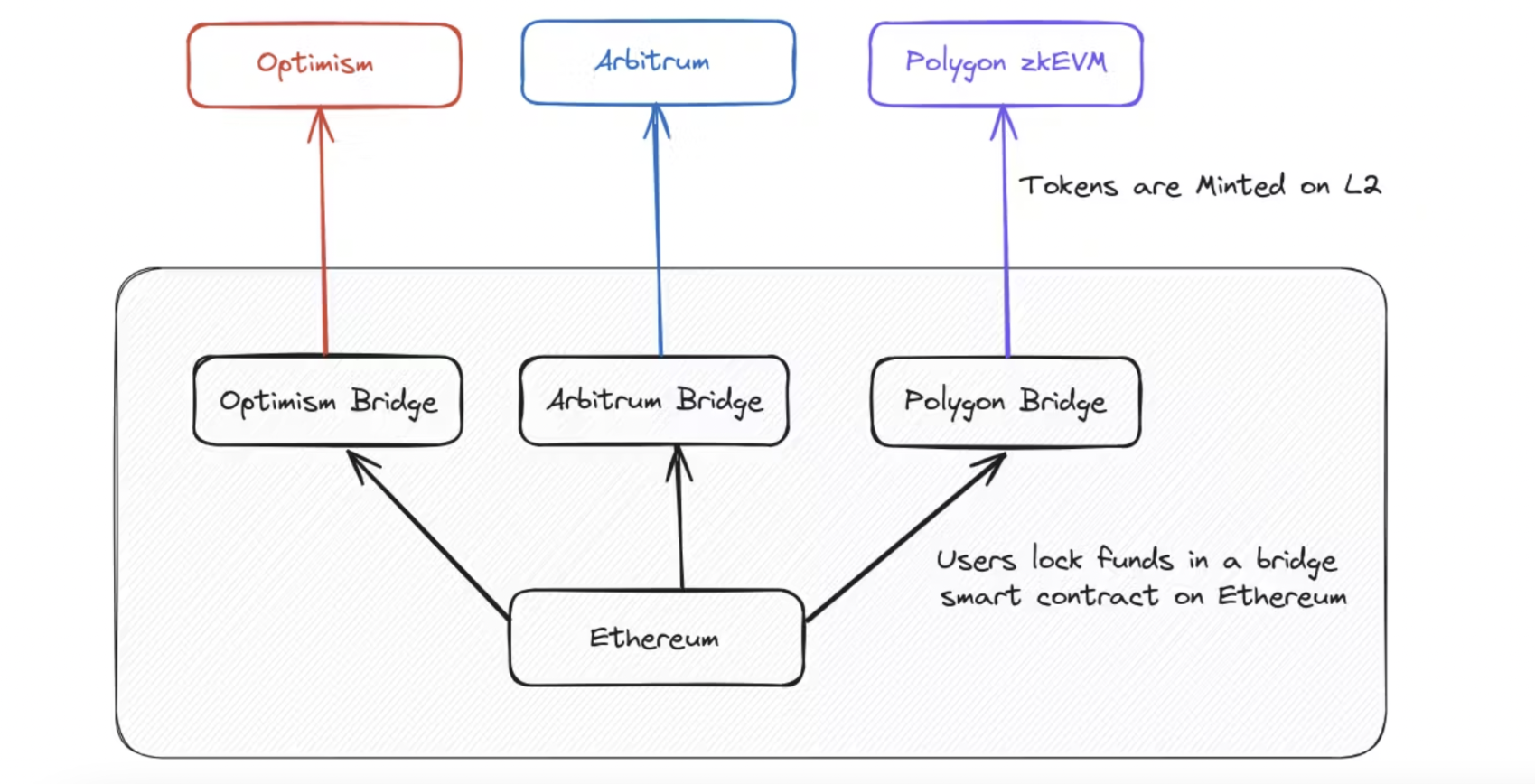

เมื่อคุณเชื่อมต่อข้ามเครือข่ายจาก Ethereum mainnet ไปยัง L2 ใดๆ กระบวนการจะมีลักษณะดังนี้:

สะพานข้ามสายโซ่ทำงานอย่างไรในปัจจุบัน

สะพานข้ามโซ่แต่ละอันเป็นสัญญาที่ชาญฉลาดบน Ethereum ซึ่งเราเรียกว่า สะพานดั้งเดิม เมื่อคุณ cross-chain ไปที่ L2 ทรัพย์สินของคุณจะถูกล็อคที่ L1 และสำเนาจะถูกสร้างบน L2 เครือข่ายเหล่านี้มีความสามารถในการสร้างสินทรัพย์ใดๆ ที่รองรับโดยเนทีฟบริดจ์ได้ไม่จำกัดจำนวน

แม้จะมีชื่อเดียวกันและไม่ได้เรียกว่าสินทรัพย์แบบ wrapper แต่สินทรัพย์ที่ข้ามสายโซ่จาก Ethereum ไปยัง L2 ใดๆ ผ่านทางเนทีฟบริดจ์ของ chain จริงๆ แล้วเป็นสินทรัพย์แบบ wrapper เนื่องจากที่อยู่สัญญาต่างกัน ที่อยู่สัญญาของ USDC บน Ethereum เริ่มต้นด้วย 0x a 0 b 8 บน Arbitrum เริ่มต้นด้วย 0x af 88 บน Optimism เริ่มต้นด้วย 0x 0 b2c และบน Polygon zkEVM เริ่มต้นด้วย 0x a 8 ce

สินทรัพย์ทั้งหมดมีลักษณะเหมือนกันเนื่องจากกระเป๋าเงินและแอปมีรายการสินทรัพย์อย่างเป็นทางการและแสดงไอคอนอย่างเป็นทางการ ดังนั้นผู้ใช้จะไม่ทราบถึงความแตกต่าง

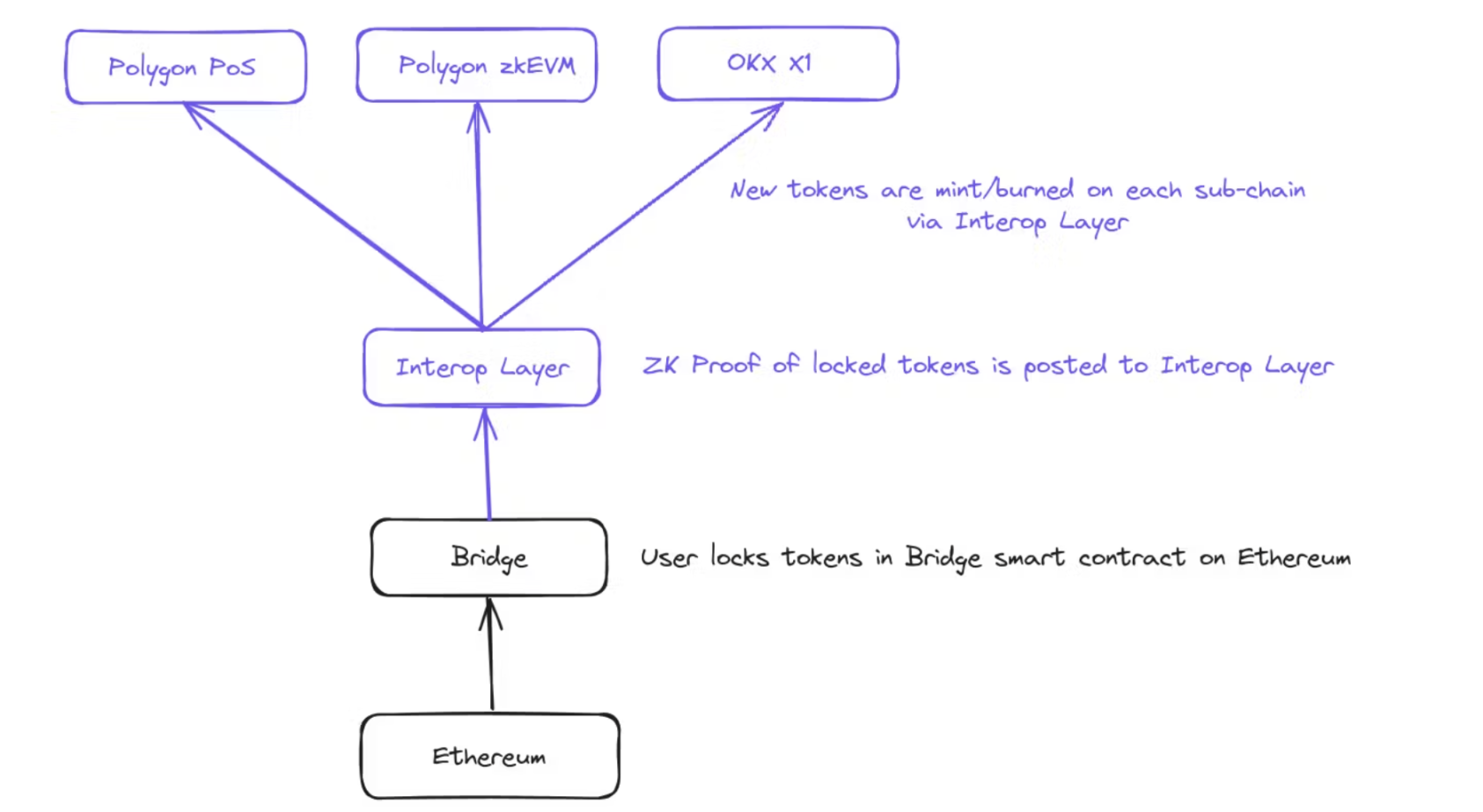

จะเกิดอะไรขึ้นถ้าแทนที่จะให้ L2 แต่ละตัวมีสะพานข้ามโซ่ของตัวเอง พวกเขาทั้งหมดใช้สะพานเดียวกันแทน? สินทรัพย์สามารถถูกสร้างบนห่วงโซ่ที่ใช้ร่วมกันที่เรียกว่าเลเยอร์การทำงานร่วมกัน จากนั้นจึงสร้างบนปลายทาง L2

สะพาน Blockchain แบบรวมทำงานอย่างไร

รูปหลายเหลี่ยมเรียกการออกแบบใหม่นี้ว่าบล็อคเชนแบบหลอมรวม

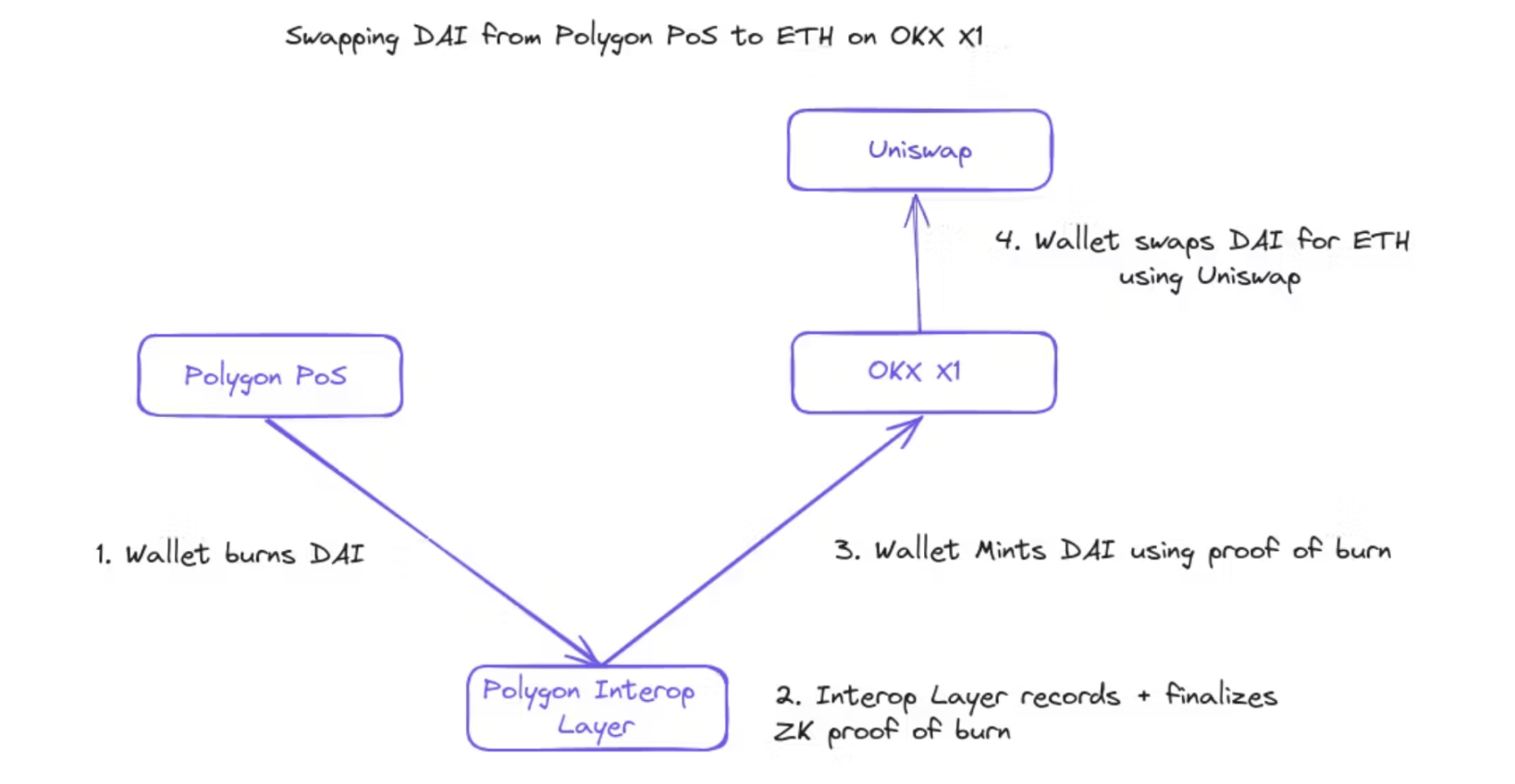

การออกแบบนี้มีประโยชน์อย่างไร? เมื่อสินทรัพย์ถูกย้ายจากห่วงโซ่หนึ่งในระบบนิเวศนี้ไปยังอีกห่วงโซ่หนึ่ง เช่น จาก Polygon zkEVM ไปยัง OKX X 1 ไม่จำเป็นต้องผ่านสะพานข้ามห่วงโซ่แบบเดิมกลับไปที่ Ethereum ก่อน แต่คุณสามารถทำลายสินทรัพย์และให้เลเยอร์ interop สร้างปริมาณสินทรัพย์บนห่วงโซ่เป้าหมายเท่ากันทุกประการ

โอนเงินบนบล็อคเชนแบบรวม

ตอนนี้ สินทรัพย์ที่ข้ามเครือข่ายผ่านชั้นการทำงานร่วมกันที่กล่าวมาข้างต้นจะเหมือนกันทุกประการในทุกห่วงโซ่ในระบบนิเวศ สมมติว่าเลเยอร์ interop ใช้งานได้ฟรีและรวดเร็ว (Polygon กล่าวว่าเวลาเสร็จสิ้นขั้นสุดท้ายคือน้อยกว่า 20 วินาที) คุณจะสามารถเชื่อมโยงสินทรัพย์ทุกขนาดระหว่าง L2 ใดๆ ในระบบนิเวศได้ในไม่กี่วินาทีฟรี

ทั้ง Polygon และ zkSync กำลังพัฒนาเลเยอร์การทำงานร่วมกันประเภทนี้สำหรับระบบนิเวศของตน และเมื่อพิจารณาจากเอกสารการออกแบบของ Optimism ซึ่งรวมถึงสะพานข้ามสายโซ่ที่ใช้ร่วมกัน ดูเหมือนว่าพวกเขากำลังสำรวจพื้นที่นี้ด้วย

ข้อเสียของ Interoperability Layer ก็คือสามารถทำงานได้ภายในระบบนิเวศเดียวเท่านั้น และต้องการให้ Chain ทั้งหมดใช้ Cross-chain Bridge ซึ่งเพิ่มความเสี่ยงแต่ข้อดีของการปล่อยให้สภาพคล่องไหลได้อย่างราบรื่นระหว่าง Chain ทั้งหมดในระบบนิเวศ มากเกินพอ เพื่อชดเชยมัน

เนื่องจากโทเค็นทั้งหมดสามารถทดแทนได้ทั่วทั้งระบบนิเวศ กระเป๋าเงินของคุณไม่จำเป็นต้องแสดงเชนที่มีสินทรัพย์อยู่หรือจัดเรียงโทเค็นตามเชน กระเป๋าเงินของคุณอาจมีลักษณะดังนี้:

เมื่อทำธุรกรรมข้ามเครือข่ายหลายเครือข่าย กระเป๋าเงินของคุณสามารถแสดงได้ว่าคุณกำลังใช้เครือข่าย โพลีกอน และดำเนินการข้ามเครือข่ายทั้งหมดโดยอัตโนมัติในเบื้องหลัง

การออกแบบนี้ยอดเยี่ยมมาก ทำไมไม่สร้างเสร็จเร็วกว่านี้ล่ะ? ZK Proofs เพิ่งจะเร็วและราคาถูกพอที่จะทำให้สิ่งนี้เกิดขึ้นได้ เลเยอร์การทำงานร่วมกันใช้ ZK Proofs สำหรับการหล่อ/การเบิร์นทั้งหมด ดังนั้นจึงสามารถทำให้เสร็จภายในไม่กี่วินาทีโดยไม่มีช่วงเวลาท้าทายใดๆ

ข้อได้เปรียบ

วิธีที่รวดเร็ว ง่ายดาย และเป็นมาตรฐานในการถ่ายโอนโทเค็นระหว่างเครือข่าย

สามารถเชื่อมโยงโทเค็นจำนวนเท่าใดก็ได้โดยไม่มีการเลื่อนหลุด

อาจใช้งานได้ฟรีโดยสมบูรณ์

ข้อบกพร่อง

มีอยู่ในระบบนิเวศเดียวเท่านั้น

สะพานข้ามสายโซ่เป็นจุดเดียวของความล้มเหลวสำหรับระบบนิเวศทั้งหมด

ต้องได้รับการออกแบบตั้งแต่เริ่มต้นและไม่สามารถเพิ่มลงในระบบนิเวศที่มีอยู่ได้หากไม่มีการเปลี่ยนแปลงที่สำคัญ

โทเค็นข้ามสายโซ่

Chains สามารถส่งต่อ cross-chaining ไปยัง token ได้ด้วยตัวเอง แทนที่จะอาศัยสะพาน cross-chain ของระบบนิเวศที่ใช้ร่วมกัน โทเค็นจำเป็นต้องใช้ฟังก์ชันมินต์/ทำลาย และอนุญาตให้ผู้ใช้สามารถทำลายโทเค็นได้ตลอดเวลาเพื่อสร้างโทเค็นเหล่านั้นไปยังเครือข่ายอื่น

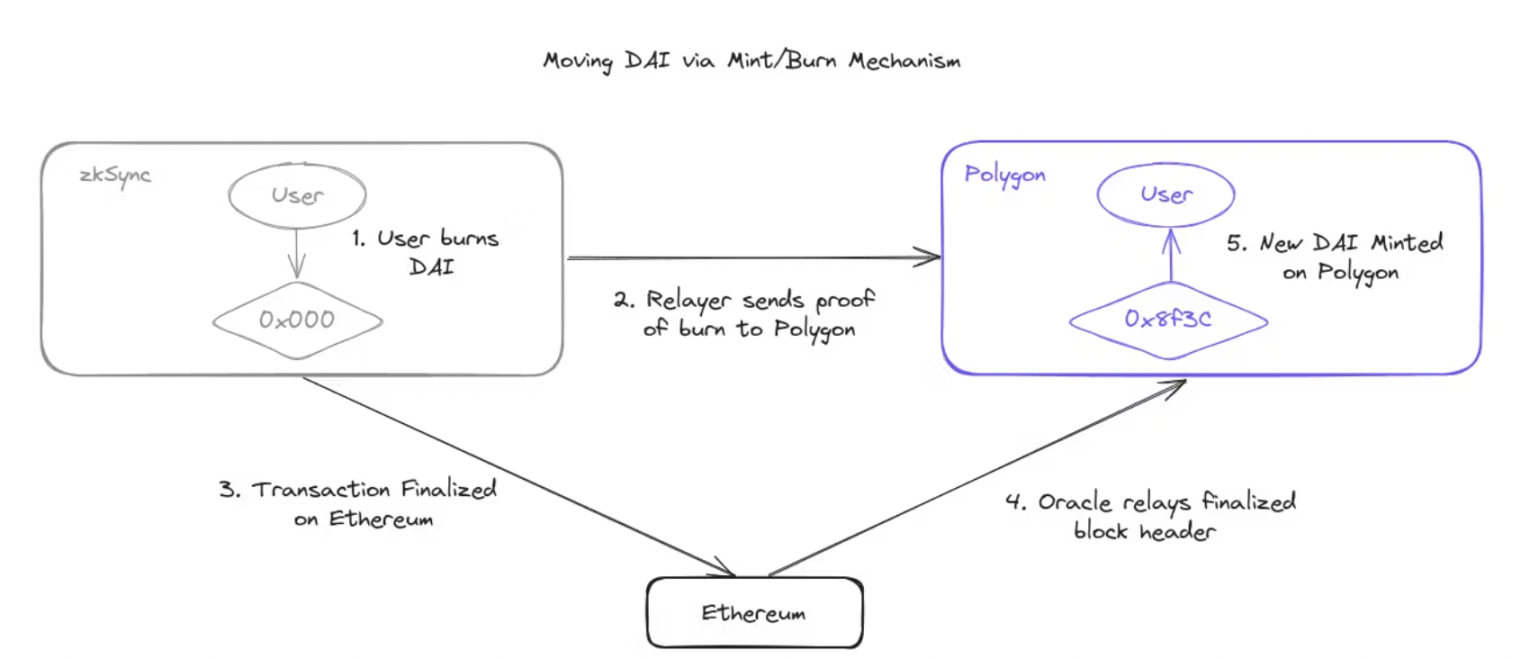

การย้าย DAI จาก zkSync ไปยัง Polygon โดยไม่ต้องใช้ Ethereum mainnet

ข้อความมิ้นต์/ทำลายเหล่านี้สามารถส่งผ่านมิดเดิลแวร์ เช่น Layer Zero หรือ Chainlink CCIP Layer Zero กำลังพัฒนาโปรเจ็กต์ที่เรียกว่า Omnichain ที่จะอนุญาตให้โทเค็นใช้ฟังก์ชันนี้

เหรียญบางเหรียญได้ดำเนินการนี้แล้ว Circle เพิ่งเปิดตัว Cross-Chain Transfer Protocol (CCTP) และนำไปใช้กับ 8 เครือข่ายที่แตกต่างกัน

เนื่องจาก USDC มีสภาพคล่องสูงในหลายเครือข่าย และไม่มีข้อจำกัดด้านสภาพคล่องที่มีอยู่ จึงอาจเป็นตัวกลางที่สมบูรณ์แบบสำหรับการโอนสินทรัพย์ระหว่างเครือข่าย กระเป๋าเงินสามารถแลกเปลี่ยนโทเค็นที่คุณต้องการข้ามสายโซ่เป็น USDC ใช้ CCTP เพื่อข้ามสายโซ่ USDC จากนั้นแลกเปลี่ยนกลับไปยังโทเค็นที่คุณต้องการบนห่วงโซ่เป้าหมาย ซึ่งสามารถทำได้โดยเสียค่าธรรมเนียมหรือส่วนต่างของราคาเพียงเล็กน้อย และกระเป๋าสตางค์ของคุณจัดการโดยอัตโนมัติ

ข้อเสียของการรวมศูนย์สภาพคล่องไว้ในโทเค็นก็คือมันขึ้นอยู่กับโทเค็นแต่ละอันที่จะนำไปใช้ และกระเป๋าสตางค์และแอปพลิเคชันจะต้องรู้ว่าโทเค็นใดที่พวกเขาสามารถข้ามสายโซ่ได้โดยอัตโนมัติ และโทเค็นใดที่พวกเขาไม่สามารถทำได้

นอกจากนี้ยังต้องใช้โทเค็นเพื่อรอให้ห่วงโซ่เสร็จสมบูรณ์ก่อนที่จะส่งโทเค็น ซึ่งอาจใช้เวลาตั้งแต่นาทีไปจนถึงชั่วโมง ขึ้นอยู่กับความถี่ในการเขียนข้อมูลไปยัง Ethereum หากโทเค็นไม่รอการสรุปผล เป็นไปได้ที่จะใช้จ่ายเป็นสองเท่าโดยการสร้างเหรียญบนเชนปลายทาง จากนั้นจึงดำเนินการส่งต่อในการปรับโครงสร้างองค์กรบนเชนการส่งอีกครั้ง

ความเสี่ยงอีกประการหนึ่งที่ต้องพิจารณาก็คือการรักษาความปลอดภัยของโทเค็นนั้นขึ้นอยู่กับความปลอดภัยของระบบเชนและรีเลย์แต่ละระบบ หาก L2 ถูกโจมตี มันจะสามารถสร้างโทเค็นใหม่ได้โดยการส่งข้อความที่เป็นอันตรายไปยังเชนอื่น ๆ (เช่น บอกว่ามันเผาเหรียญทั้งที่จริงๆ แล้วไม่ได้เผา) สถานการณ์เดียวกันนี้อาจเกิดขึ้นได้หากผู้ส่งต่อโทเค็นหรือ oracle ถูกโจมตี นี่จะทำให้โทเค็นยุบบนเชนทั้งหมด

โทเค็นแบบ Cross-chain ถูกนำมาใช้ก่อนหน้านี้ในระบบนิเวศของ Cosmos ผ่านทาง ICS-20 มันแก้ปัญหา ห่วงโซ่เดียวที่ทำลายโทเค็นบนเชนทั้งหมด โดยปล่อยให้โทเค็นติดตามเส้นทางของพวกเขาไปยังเชนปัจจุบัน หากโทเค็น X ถูกส่งผ่านเชน A -> B -> C และโทเค็น X บางส่วนถูกส่งผ่าน A -> C ดังนั้นเชน B จะถูกโจมตีและโทเค็น X ชุดแรกยังคงมีค่าเนื่องจากไม่ได้ข้ามเชน B . สิ่งนี้สร้างปัญหาเพิ่มเติมเกี่ยวกับความสามารถในการใช้งานโทเค็นที่กระเป๋าเงินและแอปพลิเคชันต้องจัดการ

ข้อได้เปรียบ

Token สามารถโอนได้อย่างอิสระบน L2 chain ใดก็ได้

สามารถโอนโทเค็นจำนวนเท่าใดก็ได้โดยไม่มีการเลื่อนไหล

ข้อบกพร่อง

เชนจะต้องปลอดภัย เชนที่ถูกบุกรุกสามารถทำลายโทเค็นออนเชนทั้งหมดได้

กระเป๋าเงินจะต้องรู้ว่าแต่ละโทเค็นสามารถเชื่อมโยงข้ามสายโซ่ได้โดยอัตโนมัติเพื่อลดความซับซ้อนของประสบการณ์ผู้ใช้หรือไม่

โทเค็นต้องรอการสรุปก่อนที่จะโอน ซึ่งอาจใช้เวลาหลายนาทีหรือหลายชั่วโมง

สะพานข้ามสายโซ่พื้นเมืองที่ไว้วางใจซึ่งกันและกัน

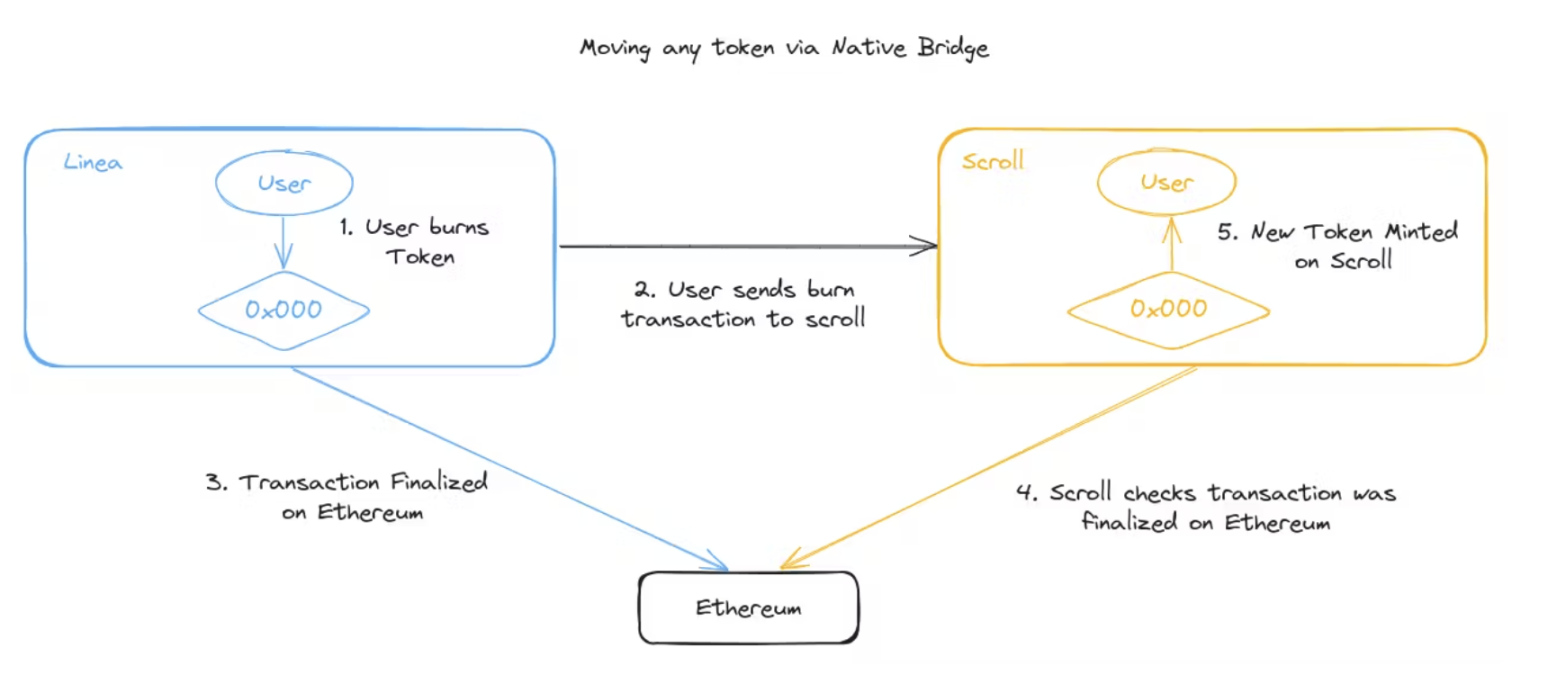

โซ่ L2 ที่มีสะพานข้ามโซ่ ZK ช่วยให้ถ่ายโอนโทเค็นได้อย่างรวดเร็วและฟรี โดยการเชื่อถือสะพานข้ามโซ่ดั้งเดิมของโซ่ L2 อื่นๆ สิ่งนี้สามารถทำได้โดยผู้ใช้เบิร์นโทเค็นบนเชนหนึ่ง จากนั้นสร้างโทเค็นนั้นบนบริดจ์ข้ามเชนดั้งเดิมของเชนอื่นโดยใช้การพิสูจน์การเบิร์น

ตัวอย่างเช่น หาก Scroll ตรวจสอบสะพาน Linea และคิดว่าปลอดภัย (และไม่สามารถอัปเกรดให้กลายเป็นไม่ปลอดภัยได้) พวกเขาสามารถตั้งค่าบริการเพื่อตรวจสอบสถานะราก L1 ของสะพาน Linea ได้ โดยอนุญาตให้ผู้ใช้ทุกคนบน Linea เผยแพร่หลักฐานการเบิร์นโทเค็นของตน บน Linea ธุรกรรมการเบิร์นนี้จะรวมอยู่ในรูทสถานะ L1 และโทเค็นที่เทียบเท่ากับมิ้นท์บน Scroll

โอนโทเค็นระหว่างสอง L2 โดยไม่ต้องใช้ Ethereum mainnet

ไวทาลิคบทความนี้กระบวนการที่เครือข่ายตรวจสอบสถานะของกันและกันมีการอธิบายไว้โดยละเอียด

สิ่งนี้คล้ายกับการ cross-chaining กลับไปที่ Ethereum แล้วจึง cross-chaining ไปยัง L2 อื่น แต่วิธีนี้จะช่วยประหยัดค่าธรรมเนียม L1 gas ได้สูง

ความเสี่ยงในขณะนี้คือจำนวนโทเค็นที่ถูกล็อคในสะพานข้ามสายโซ่ดั้งเดิมเหล่านี้จะไม่เท่ากันทุกประการกับจำนวนโทเค็นที่สร้างบน L2 ซึ่งเป็นคุณลักษณะหลักของ L2 และยังไม่ถูกทำลายจนถึงตอนนี้ ในตัวอย่างข้างต้น หากผู้ใช้โอน 1 ล้านดอลลาร์ใน DAI จาก Linea ไปยัง Scroll สะพานข้ามสายโซ่ของ Scroll จะหายไป 1 ล้านดอลลาร์ใน DAI และหากผู้ใช้ต้องการถอนโทเค็นจำนวนมากจาก Cross Cross ดั้งเดิมของ Scroll -สะพานโซ่ จะมีโทเค็นไม่เพียงพอ สะพานข้ามสายโซ่สามารถกระทบยอดความแตกต่างเหล่านี้ได้โดยการโอนโทเค็น L1 ระหว่างกันเป็นชุด หรือโดยการรักษาความไว้วางใจแบบสองทางระหว่างกันอยู่เสมอ เพื่อให้นักลงทุนรายใหญ่สามารถถอนเงินผ่านสะพานข้ามสายโซ่ของ Linea แม้ว่าสะพานข้ามสายโซ่ของ Scroll จะปิดแล้วก็ตาม ทำให้ว่างเปล่า.

ข้อได้เปรียบ

โทเค็นสามารถถ่ายโอนระหว่างเครือข่ายที่เชื่อถือได้ได้อย่างอิสระ

สามารถโอนโทเค็นจำนวนเท่าใดก็ได้โดยไม่มีการเลื่อนไหล

ข้อบกพร่อง

หากสะพานข้ามสายโซ่ตัวใดตัวหนึ่งเสียหาย อาจส่งผลกระทบต่อสะพานข้ามสายโซ่ทั้งหมดที่เชื่อถือ

สะพานข้ามสายโซ่จะล็อคและสร้างโทเค็นจำนวนต่างกันบนเครือข่าย ซึ่งอาจทำให้เกิดปัญหาในการถอนออก

ชั้นสรุปที่รวดเร็วเพื่อความมั่นคงทางการเงิน

วิธีการทั้งสามนี้นำเสนอความสามารถในการปรับขนาดและความปลอดภัยที่ยอดเยี่ยม แต่มีข้อบกพร่องประการหนึ่งที่ทำให้การถ่ายโอนช้าลงอย่างมาก นั่นก็คือ กำลังรอการสรุปผล การสร้างบล็อกให้เสร็จสิ้นนั้น เครือข่ายการส่งต้องเขียนข้อมูลลงใน Ethereum ซึ่งอาจใช้เวลาถึงหนึ่งชั่วโมงก่อนที่ Ethereum mainnet จะเสร็จสมบูรณ์ ซึ่งอาจใช้เวลาอีก 15 นาที

ด้วยสิ่งจูงใจทางการเงิน เราสามารถสร้าง ขั้นสุดท้ายแบบนุ่มนวล ซึ่งมูลค่าทางเศรษฐกิจของธุรกรรมสูงกว่ามูลค่าที่แท้จริง สิ่งนี้สามารถทำได้โดยโหนดที่ให้บริการต่างๆ เช่น Eigenlayer ซึ่งสามารถลดสัดส่วนการเดิมพันและพิสูจน์ได้ว่าธุรกรรมเสร็จสมบูรณ์แล้ว หากธุรกรรมได้รับการกู้คืนด้วยวิธีใดวิธีหนึ่ง โหนดจะถูกเฉือน และอาจใช้การเฉือนเพื่อเติมเต็มรูที่สร้างขึ้นโดยการย้อนกลับ

ข้อดีก็คือ ธุรกรรมสามารถยืนยันแบบ soft-confirm ได้ภายในไม่กี่วินาที ซึ่งจะช่วยเร่งการถ่ายโอนโทเค็นข้ามสายโซ่ทั้งหมดได้อย่างมาก

นี่คือสิ่งที่ Near กำลังพิจารณาอยู่ หลักฐานที่ส่ง/ทำลายไม่จำเป็นต้องเขียนลงใน Ethereum L1 และทำการสรุปผล แต่หลักฐานจะถูกเขียนไปยังห่วงโซ่การสรุปผลที่รวดเร็ว ซึ่งรับประกันขั้นสุดท้ายโดยผู้เดิมพัน Eigenlayer ซึ่งจะถูกเฉือนหากมีการย้อนกลับหรือการกู้คืน อันนี้ทวีตวิธีการทำงานจะมีการอธิบายโดยละเอียดเพิ่มเติม

มาดูกันว่าเลเยอร์การสรุปที่รวดเร็วนี้ช่วยปรับปรุงวิธีการถ่ายโอนโทเค็นทั้ง 3 วิธีได้อย่างไร:

เลเยอร์การทำงานร่วมกันเป็นเลเยอร์สุดท้ายที่รวดเร็วอยู่แล้ว ซึ่งจัดการโดยทีมระบบนิเวศ (Polygon, zkSync ฯลฯ) ช่วยให้การถ่ายโอนภายในระบบนิเวศใช้เวลาเพียงไม่กี่วินาที

เมื่อโทเค็นถูกสร้าง/เผาข้ามเชน ชั้นการสรุปที่รวดเร็วสามารถพิสูจน์ได้ว่าธุรกรรมเสร็จสมบูรณ์และไม่สามารถย้อนกลับได้ แทนที่จะรอให้ธุรกรรมเสร็จสมบูรณ์บน Ethereum (ซึ่งอาจใช้เวลานานถึง 20 นาที) ห่วงโซ่เป้าหมายสามารถเชื่อถือเลเยอร์นี้และทำเหรียญได้ทันทีที่มีการตรวจสอบธุรกรรม

ในทำนองเดียวกัน เมื่อ L2 เชื่อถือสะพานข้ามสายโซ่ร่วมกัน พวกเขาสามารถชำระการโอนโทเค็นผ่านเลเยอร์สุดท้ายที่รวดเร็วนี้ แทนที่จะรอ Ethereum

ข้อได้เปรียบ

การโอนโทเค็นสามารถทำได้ภายในไม่กี่วินาที

ข้อบกพร่อง

ยังไม่ชัดเจนว่ากลไกการเฉือนสามารถใช้เพื่อแก้ไขช่องโหว่ที่อาจเกิดการใช้จ่ายซ้ำซ้อนได้อย่างไร

พึ่งพาเครือข่ายระดับที่ไม่ใช่ Ethereum อื่น ๆ เพื่อรับรองความปลอดภัย

ประสบการณ์กระเป๋าสตางค์แห่งอนาคต

หลังจากใช้การปรับปรุงสภาพคล่องแบบครบวงจรใหม่เหล่านี้แล้ว ต้องมีขั้นตอนเพิ่มเติมอะไรบ้างเพื่อทำให้กระเป๋าเงิน cross-L2 รู้สึกเหมือนกำลังใช้ห่วงโซ่เดียว ปัญหาใหญ่ที่สุดสองประการที่เหลืออยู่คือก๊าซแบบ cross-chain และการรวมแอปพลิเคชันเข้ากับระบบ

การแบ่งปันแก๊สระหว่างโซ่

หากผู้ใช้ข้ามเครือข่ายหลาย ๆ เครือข่ายอย่างต่อเนื่อง พวกเขาจะได้รับน้ำมันจากเครือข่ายทั้งหมดเพื่อชำระค่าโอนได้อย่างไร

ปัญหานี้ได้รับการแก้ไขแล้วผ่านนามธรรมบัญชี AKA EIP-4337 และผู้ชำระเงิน ผู้ชำระเงินคือที่อยู่ที่คุณสามารถขอค่าธรรมเนียมการทำธุรกรรมเพื่อชำระให้กับคุณได้ กระเป๋าเงินบางใบ (เช่น Avocado และ Ambire) อนุญาตให้คุณโหลดยอดคงเหลือของ Gas ล่วงหน้า จากนั้นใช้ Gas นั้นกับเครือข่ายใดก็ได้ คล้ายกับบัตรเดบิตแบบเติมเงิน

วิธีแก้ปัญหาง่ายๆ อีกวิธีหนึ่งคือ Bungee Exchange Refuel ซึ่งใช้แก๊สบนโซ่หนึ่งและจ่ายแก๊สให้คุณเล็กน้อยบนอีกโซ่หนึ่ง นี่เป็นประสบการณ์ผู้ใช้ที่แย่กว่า paymaster และจะทำให้ผู้ใช้ต้องเสียเวลาเล็กน้อยกับเครือข่ายหลายแห่ง แต่ใช้งานได้กับบัญชี EOA (บัญชีสัญญาที่ไม่ใช่สมาร์ทมาตรฐาน)

แอพไร้แก๊ส

ผู้ชำระเงินยังปลดล็อกความสามารถของแอปพลิเคชันในการเรียกใช้ผู้ชำระเงินและชำระค่าธรรมเนียมการทำธุรกรรมของผู้ใช้ทั้งหมด ซึ่งจะช่วยให้ทุกคนสามารถใช้แอปพลิเคชันบนเครือข่ายของตนเองได้โดยไม่ต้องข้ามสะพานด้านหน้า แอปสามารถสร้างรายได้จากวิธีอื่นๆ เช่น การขายสินค้า หรือเสนอโหมดสาธิตฟรี แต่คุณต้องจ่ายเงินสำหรับประสบการณ์เต็มรูปแบบ

ทำให้ง่ายสำหรับแอปพลิเคชันในการใช้ประโยชน์จากสภาพคล่องแบบครบวงจร

แอปพลิเคชันจำนวนมากโหลดยอดโทเค็นผู้ใช้โดยการเรียก balanceOf ซึ่งเป็นกระบวนการที่ช้าและไม่สามารถทำงานข้ามเครือข่ายได้ พวกเขามักไม่มีความคิดเกี่ยวกับโทเค็นที่อาจเชื่อมโยงข้ามจากเครือข่ายอื่น

ปัญหานี้ควรได้รับการแก้ไขในระดับกระเป๋าเงิน เพื่อให้ทุกแอปพลิเคชันไม่จำเป็นต้องสร้างวงล้อใหม่เพื่อรองรับอนาคตแบบหลายห่วงโซ่ EIP-2256 นำเสนอฟังก์ชันมาตรฐานที่กระเป๋าเงินสามารถใช้ได้ ช่วยให้สามารถโหลดยอดคงเหลือโทเค็นทั้งหมดได้ในคราวเดียว แม้ว่าปัจจุบันจะเป็นเพียงห่วงโซ่เดียวก็ตาม

หากกระเป๋าสตางค์รับรู้ถึงหลายสายโซ่และรู้วิธีย้ายโทเค็นจากสายโซ่หนึ่งไปยังอีกสายหนึ่ง ก็จะสามารถบอกแอปพลิเคชันได้ว่าโทเค็นที่รองรับสายโซ่ข้ามเหล่านี้จะพร้อมใช้งานสำหรับผู้ใช้ทันที และเมื่อผู้ใช้โต้ตอบกับแอปพลิเคชัน กระเป๋าเงิน Cross-chain ทันทีก่อนดำเนินการ

สรุปแล้ว

หวังว่าตอนนี้คุณคงจะเข้าใจดีขึ้นแล้วว่าสภาพคล่องระหว่าง L2 จะไหลลื่นได้อย่างไรในอนาคต และวิธีที่กระเป๋าเงินจะใช้เทคโนโลยีใหม่เหล่านี้เพื่อสรุปบล็อกเชนได้อย่างสมบูรณ์ เพื่อทำให้การใช้ Ethereum เป็นเรื่องง่ายเหมือนในปี 2020 โดยไม่ต้องยุ่งยาก ค่าธรรมเนียมสูง

ขอขอบคุณ Chad Fowler, Alejo Salles, Mike B, Montana Wong และ Centauri.eth สำหรับคำติชมเกี่ยวกับบทความนี้