融资千万美元,Dinari能成为美股交易便捷渠道吗?

Original - Odaily

Author - Nan Zhi

Blockchain securities investment platform Dinari on the X platformAnnounce, which completed a US$10 million seed round of financing in the fourth quarter of 2023, with participation from 500 Global, former Coinbase CTO Balaji Srinivasan, Alchemy, Version One Ventures, Sancus Ventures, etc.

It is reported that Dinari launched 1:1 asset-backed RWA products for US stocks and bonds on Arbitrum One, and added more than 10 new products today.

Business introduction

Dinari is a Web3-oriented securities asset trading platform that allows users to trade traditional securities assets such as stocks, bonds, and ETFs on the blockchain. Dinari uses smart contracts to tokenize securities called dShares and performs this automatically through programs, allowing users to trade seamlessly.

Currently, Dinari only runs on Arbitrum, supports the use of USDC, USDC.e and USDT, and uses stablecoins to pay for transaction gas, without the need to prepare native tokens such as ETH.

As of January 24, 2024, Dinari has launched 33 dShare, including traditional blue-chip stocks such as Apple, Amazon, Microsoft, and NVDIA, recently approved Bitcoin spot ETFs such as IBIT, BITB, HODL, etc., as well as Coinbase, WisdomTree floating Interest rate Treasury bond funds and a few other products.

According to Dinari’s official website, Dinari holds a total of 19 reserve assets, totaling US$234,000, of which Coinbase stock COIN accounts for 56%, which is US$131,000.

Regional restrictions

Dinari requires all users to undergo KYC verification before trading on the chain. According to the requirements of the US SEC and the Office of Foreign Assets Control (OFAC), includingChinese mainland, the United States, Canada, North Korea, etc. are not supported.

According to Dinari, Dinari, Inc., which is responsible for purchasing securities assets, is a transfer agent registered with the U.S. SEC and will update this list based on specific requirements.

Business details

Basic process: UserMarket orders can only be placed during US market trading hours, after the user places an order, Dinari will make a 1:1 purchase on the corresponding market. After the corresponding securities are settled, the tokens will be minted and issued to the user. Dinari said that the platform takes 1-2 days to execute large transactions. According to the official website,The current large transaction amount is $5,000.

Support dividend issuance: Dinari supports dividend issuance. According to the snapshot at 4 a.m. Eastern Time on the ex-dividend date of the actual stock or ETF, after the project treasury receives the legal currency, it will be converted into USDC and distributed to the user wallet. dShares purchased through other platforms will also receive corresponding dividends after registering a Dinari account within the 90-day time limit.

Support for stock splits: Dinari has built a migration program that will adjust user assets accordingly based on actual stock splits to correctly represent user assets.

No shareholder rights: All actual securities assets will be held by Dinari, and users do not have shareholder rights.

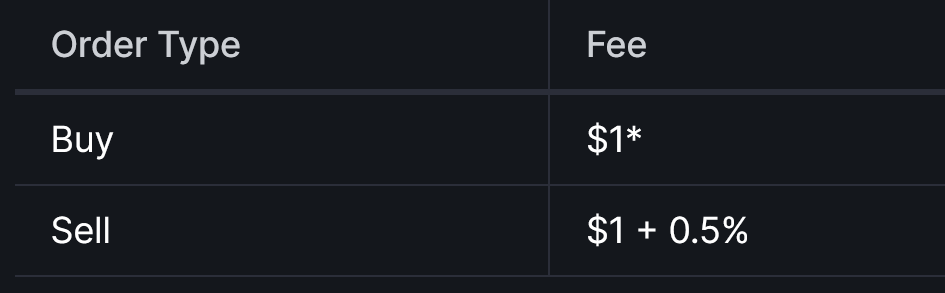

Transaction fees: a fixed $1 fee to buy and a fixed $1 + 0.5% floating fee to sell.

in conclusion

Mirror, Terras ecological synthetic securities asset trading platform, once set a TVL record of US$2 billion. Last years securities synthetic asset Telegram Bot AXE CAP also reached a market value of approximately US$14 million. Dinari still has a lot of room for growth (US$200,000). . For users, although Dinari supports use in most areas, it has problems such as high rates and limited amounts, and is more suitable for small asset allocation.