每周编辑精选 Weekly Editor's Picks(0120-0126)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

TrendX Research Institute: Selection of must-win point airdrop projects in 2024

KiloEx、Blur、Blast、Kinza Finance、TrendX、Rainbow、BEVM。

Bankless: A disruptive changemaker, how valuable is the EigenLayer airdrop?

Celestia could serve as a close enough competitor to speculate on EigenLayers valuation:

Celestias sole purpose may be as a data availability layer, but the networks TIA token currently has a fully diluted valuation (FDV) of $15 billion, just below last weeks brief peak of $20 billion. EigenLayers advantage over Celestia is the variety of additional services it offers, and there are multiple revenue drivers beyond data availability, meaning the market may view EigenLayer as a more attractive investment opportunity than Celestia.

Unfortunately, EigenLayers valuation is affected by the fact that it is not a blockchain network, which means that the EIGEN token cannot accumulate the L1 premium as expected.

In practical terms, this means that EIGEN will have less utility than TIA because it will not be an asset for staking AVS, a factor that will reduce demand for the token, potentially causing EigenLayer to trade at a lower valuation.

It seems reasonable to assume that EigenLayer will trade at an FDV similar to Celestia, possibly with a valuation of around $10 billion to $20 billion at initial launch.

It doesn’t seem outlandish to further assume that they will airdrop 10% of their token supply to early users, which would easily make the protocol a multi-billion dollar airdrop. Depositors can expect to receive $0.21 to $0.41 per point, representing a range of claim opportunities for Ethereum deposited each time EigenLayer raises its LST cap on February 5, ranging from $907 to $1,814.

Users should remember to deposit Ethereum on February 5th.

AI agent narrative is on the rise, which projects deserve early attention?

AI agents are a bit like smart contracts - given preset conditions, the results are automatically executed; there is also a difference - smart contracts have no initiative.

A classic and vivid metaphor: cryptocurrency is like cash, blockchain is like a cash register, Dapp is like a POS machine, and AI agents are like cashiers. They can think of ways to make the experience of using crypto products better (including but not limited to transactions) experience).

Projects related to the concept of AI agents are divided into two categories:

Encryption projects that directly engage in AI agency business: Autonolas (OLAS), Fetch.ai (FET), PAAL AI (PAAL);

Projects where AI agents complement existing businesses: Root Network (ROOT), Parallel (PRIME), Oraichain (ORAI).

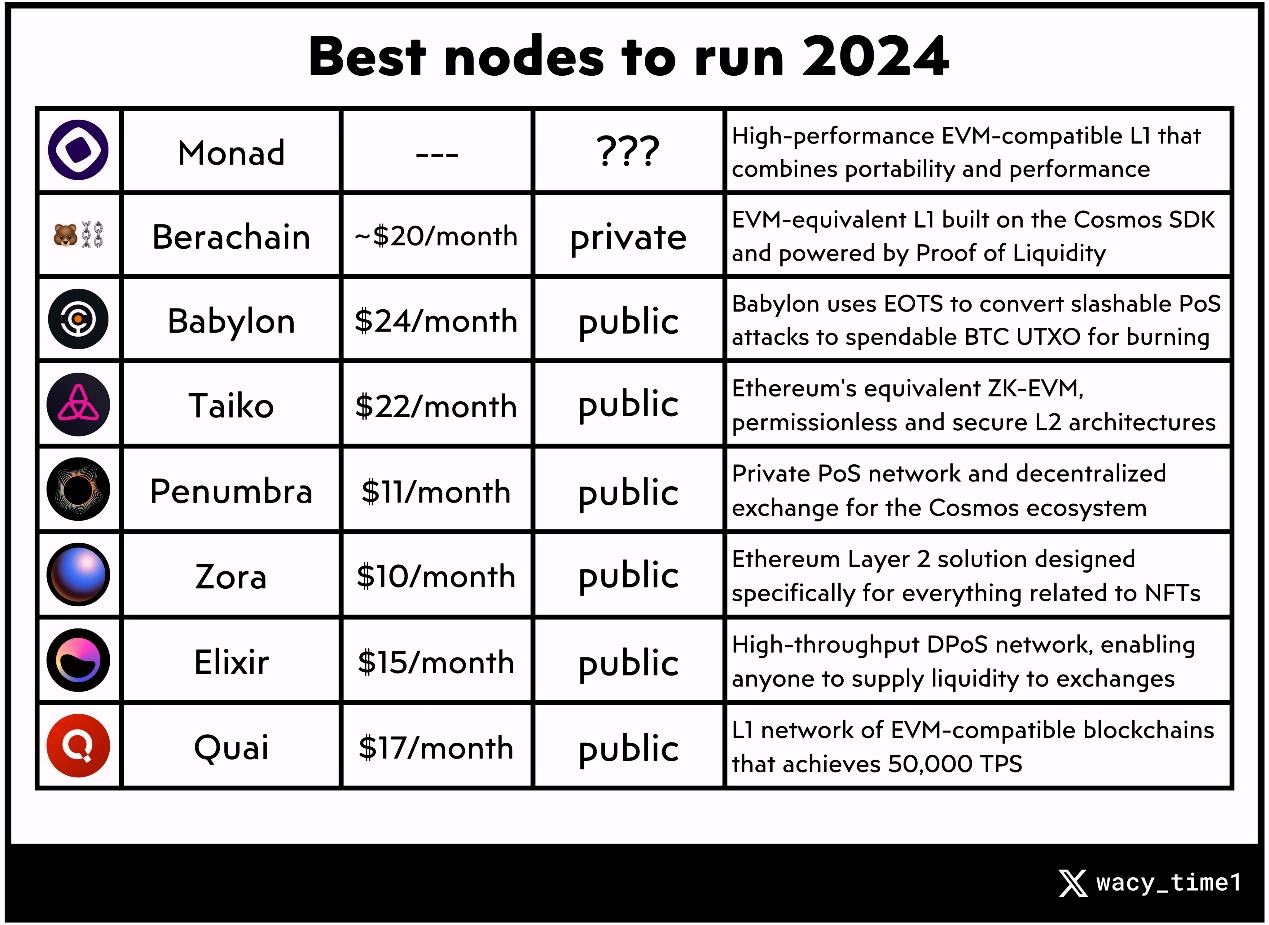

Layout guide: List of the 8 nodes with the most “money paths” in 2024

The cost to maintain a node (for launching a VPS server) ranges from $10 to $30 per month.

The following 8 nodes are the most profitable: they have the opportunity to reward users generously, and not many people are paying attention to them at present.

Outlier Ventures: How does the Web3 project design a token attribution scheme?

The vesting schedule is designed to correspond to each node of the protocol growth roadmap.

If there is no utility and basic demand, dont release the token to the market.

Web3 businesses go through three phases: build, scale, and saturate. Most coins should start distributing tokens during the scaling phase, not the building phase. Matching lock-up and vesting periods accordingly is key.

Delayed vesting through lock-ups and longer terms needs to be fully explained to early investors. Ultimately, they will benefit from a conservative vesting schedule as this provides breathing room for better product adoption and thus more counterparties for their profit realization.

A perfect vesting schedule does not exist, and more engineering resources should be allocated to advanced token vesting designs only if the Web3 business is capable. Therefore, it is important to find an appropriate compromise between the aspects discussed above.

Bitcoin Ecology

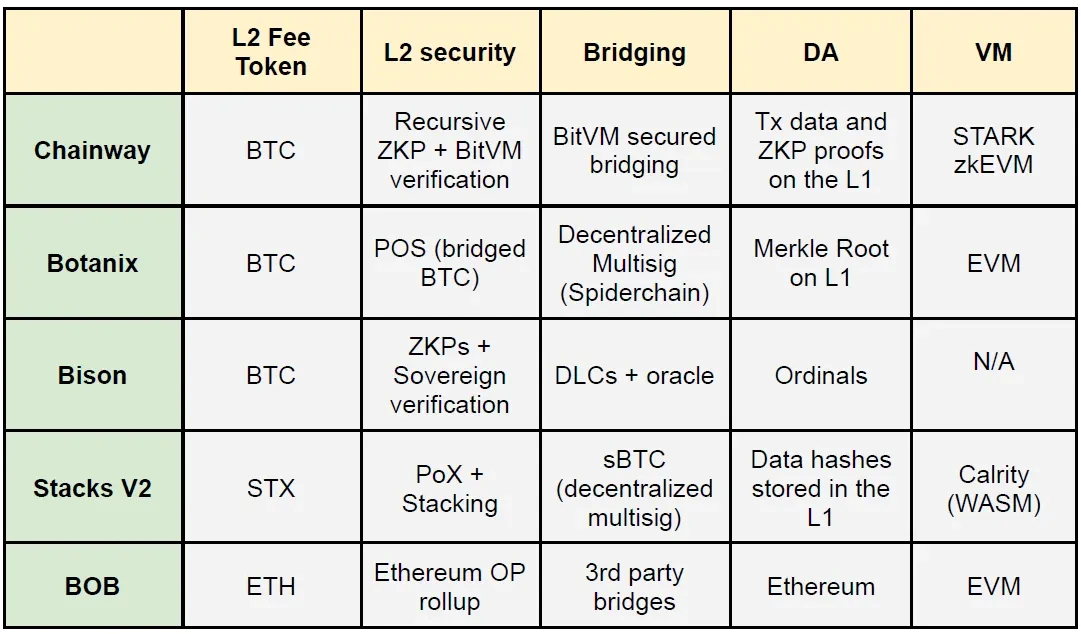

Defending Permissionless Bitcoin: Analysis of Bitcoin L2 Ecology and Prospects

Summary and comparison of Bitcoin L2 projects

Entrepreneurship opportunities in Bitcoin L2 also include DA layer, MEV extraction, and Bitcoin income tools.

Ethereum and Scaling

The amount of Ethereum pledges has surged. How will EIP-7514 deal with the pledge issue?

The deflationary trend and more attractive staking rewards make ETH holders confident in the long-term value of the Ethereum network and more inclined to earn passive income through staking. This trend also coincides with the growth in stability and maturity of the Ethereum ecosystem.

The major problem of over-collateralization in Ethereum stems from the pressure brought by the significant increase in validators on the Ethereum network, and the pressure on the consensus layer responsible for confirming transactions will also increase exponentially.

EIP-7514 proposes to mitigate the rapid surge in ETH staking by changing the growth rate of validators - converting it from the current exponential growth model to a controlled linear growth model by limiting the epoch churn limit. Effectively prevent the excessive growth of Ethereum pledge volume. EIP-7514 cannot immediately solve the technical and financial problems caused by the explosion of Ethereum staking, and is only a temporary response, but it will give the Ethereum development team enough time to explore long-term solutions to the staking problem.

The implementation methods of parallel EVM include scheduling-based concurrent processing, multi-threaded EVM instances, and system-level sharding, while facing technical challenges such as unreliable timestamps, blockchain determinism, and verifier revenue orientation. Key challenges in adopting parallelism include resolving data race and read-write conflict issues, ensuring technology compatibility with existing standards, adapting to new ecosystem interaction patterns, and managing increased system complexity, particularly in terms of security and resource allocation.

Monad significantly improves the scalability and transaction speed of the blockchain through unique technical features; Sei V2 aims to be the first fully parallelized EVM, providing backward compatibility with EVM smart contracts, optimistic parallelization, new SeiDB data structures and Interoperability of existing chains; Neon EVM on Solana aims to provide an efficient, secure, and decentralized environment for Ethereum dApps, allowing developers to easily deploy and run dApps while taking advantage of Solana’s high throughput and low cost advantages; L2 Lumio innovatively solves the scalability challenges of Ethereum by uniquely supporting EVM and Move VM used by Aptos; L2 Eclipse uses SVM to accelerate transaction processing, adopts a modular rollup architecture, and integrates Ethereum settlement, SVM smart contracts, and Celestia Data Availability and RISC Zero Fraud Proof…

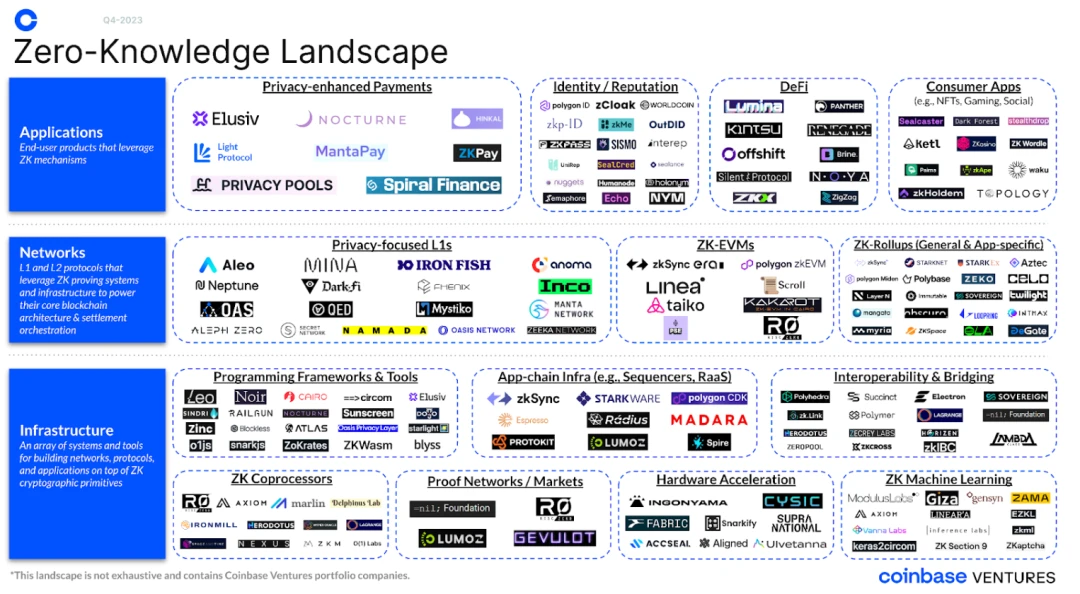

Coinbase: Detailed explanation of ZK ecology

Multiple ecology and cross-chain

OP Research: Layer 2 new battlefield, Blast ecological explosion

In less than two days since Blast announced Big Bang, more than 60 projects have announced cooperation with Blast and will be built on Blast.

The author selected 7 projects worth tracking from the early days: PumpX, Pyth Network, Quick Node, Thruster, The Graph, Ambient, RedStone.

New concept hyper-modularity: How is it different from classic modular blockchain?

Hyper-modularity not only achieves modularity at the software level, but also pays attention to the separation between modules at the network level. The software layer focuses on the functions and logic within the system, while the network layer focuses on the communication and connections between system nodes. Many modular chains share a limited number of operators, and the homogeneity between operators can lead to a high degree of coupling, making the system vulnerable to attacks and increasing the difficulty of maintenance. The ultra-modular design allows each component to run in an independent module, and the modules of different contracts can adopt different security mechanisms and protocols.

KIRA is divided into user layer, execution layer and verification layer. Communication between these three layers relies on the content access layer. The content access layer is the cornerstone of KIRAs design, acting as a middleware system between the client-hosted front-end application (static IPFS pages) and the back-end (the blockchain acting as the settlement layer).

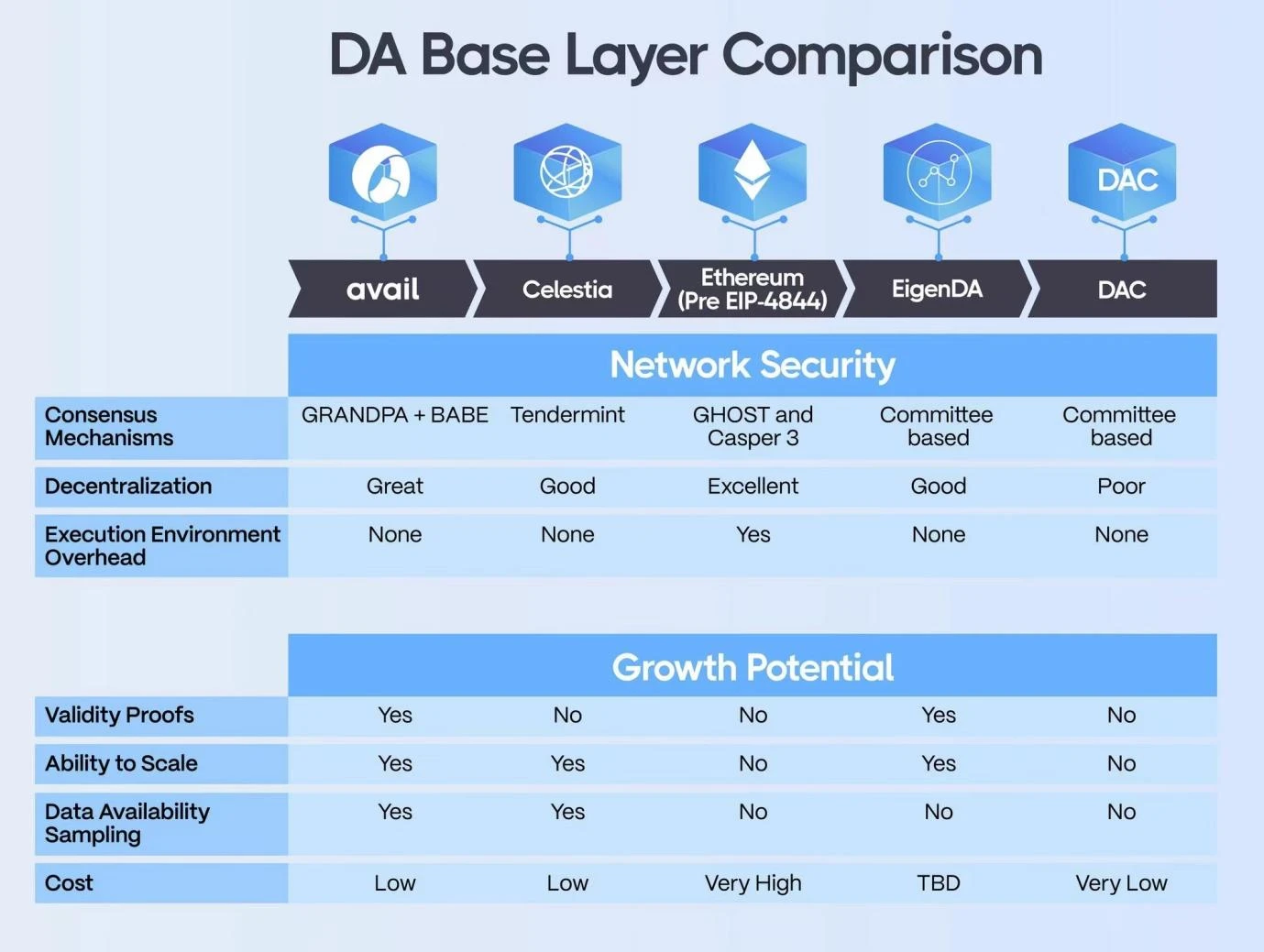

Celestia: Ethereum DA’s Biggest Competitor? Can EigenLayer come back?

DA base layer comparison

NFT

Royalties from NFTs in the Ethereum ecosystem have dropped significantly in the past two years. The average tax rate is now about 0.8%, down 84% from 5% two years ago.

Using 2021 tax rates as a basis, artists and creators will see about $37 million less in income in December 2023 alone.

OpenSea is still enforcing royalties for a handful of projects, but this will cease on February 29th. The overall royalties will then drop to around 0.5%.

Royalties for art are significantly higher than for other types of items, indicating collectors’ desire to build a positive ecosystem.

Hot Topics of the Week

In the past week,BTC drops below $40,000,ETH falls below $2,200,Altcoins plunge,Terraform Labs files for Chapter 11 bankruptcy protection with assets and liabilities between $100 million and $500 million,Mt.Gox trustees have contacted creditors to confirm account details or will initiate debt repayments;

In addition, in terms of policy and macro market,CBOE and Nasdaq file with SEC to conduct options trading on spot BTC ETF,Japanese lawmakers hope to formulate new Web3 policies and clarify DAO-related regulatory regulations;

In terms of opinions and voices, Morgan Stanley:The Fed is now expected to slow the pace of balance sheet reduction starting in June,Arthur Hayes:Bitcoin’s downward trend may indicate problems with U.S. dollar liquidity,Bitcoin prepares for dip after falling below $35,000, founder of CryptoQuant:GBTC continues its current reduction rate or will return to zero in mid-March, Fox Business reporter:People familiar with the matter said that the U.S. SEC currently holds a firm opposition position to the Ethereum spot ETF., USV Lianchuang:Mint means ownership, a business model native to both Web3 and AI, founder of DefiLlama:Many websites miscalculate BRC 20 token transaction volume as NFT transaction volume, resulting in inflated NFT data on the Bitcoin chain,Jupiter Lianchuang:Not caring about JUP’s opening price encourages airdrop users who don’t share Jupiter’s vision to sell immediately;

In terms of institutions, large companies and leading projects,Solana launches SPL token standard,EigenLayer delays re-staking window restart to February 5,ZetaChain announces token economics, 10% of total supply will be reserved for community rewards,AltLayer announces airdrop details, Dmail announced airdrop details:Domain name holders, 3D Crystal holders, full-time trading users, etc. can receive airdrops,Sleepless AI:Due to marketing, communication and other issues causing losses to Genesis NFT buyers, we will communicate one by one,Jupiter will test issue meme token WEN ahead of JUP...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~