ETH跌破2200美元,何时抄底?

原创 | Odaily星球日报

作者 | Asher

编辑 | 秦晓峰

近期,由于灰度持续砸盘导致 BTC 价格不断下行,连带着 ETH 也出现大幅度回调。

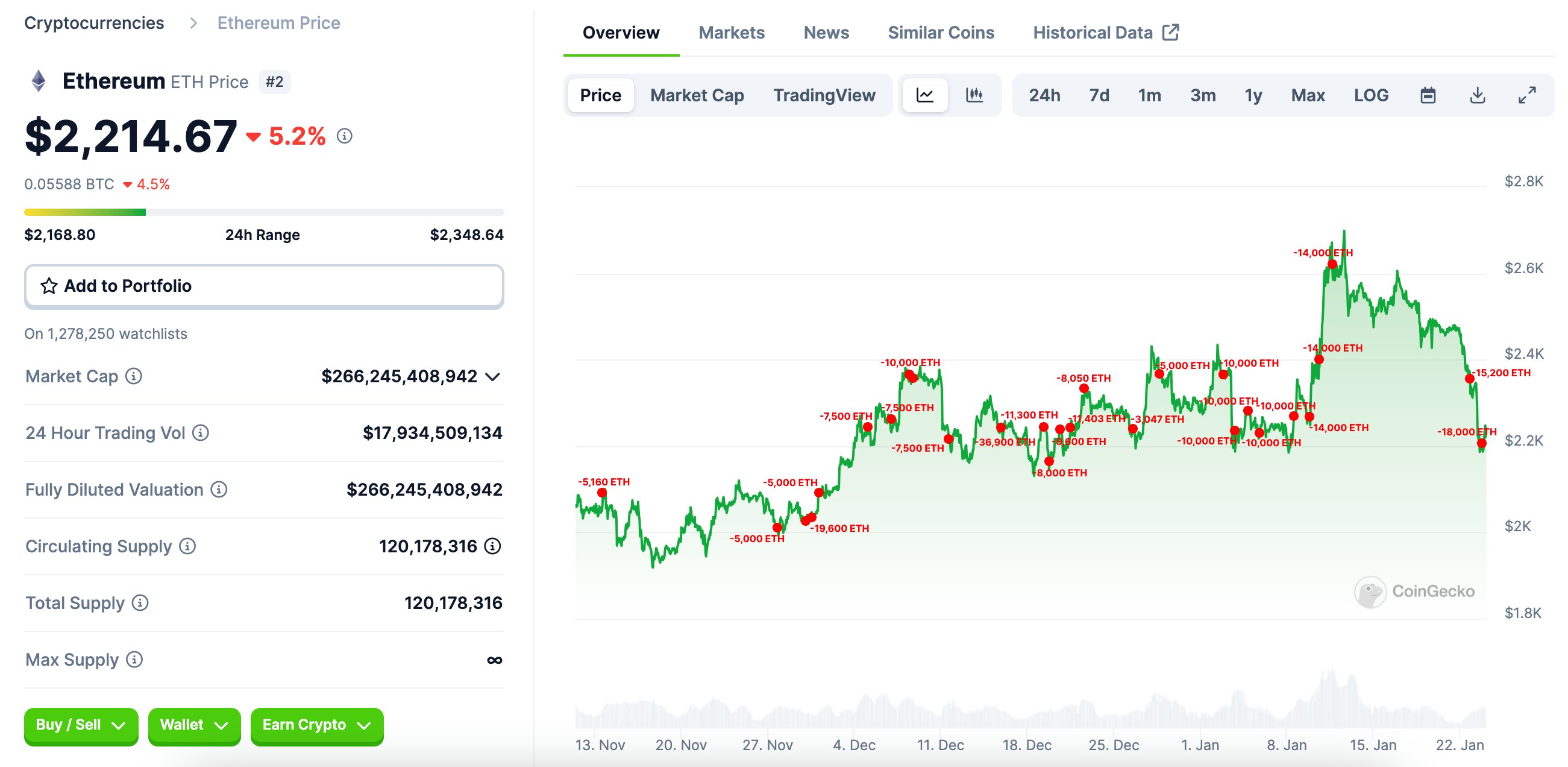

数据显示,ETH 从 1 月 12 日的高点 2712 USDT 不断下行直至昨日跌破 2200 USDT,最低跌至 2168 USDT,最大跌幅超过 20% ;截至发稿时,ETH 回升至 2250 USDT。

最近 ETH 的抛压来自哪里,目前存在多大程度的潜在抛压?潜在的买盘能否托住行情,甚至推动 ETH 价格再创新高?Odaily星球日报带大家从数据、信息层面进行解析。

数据维度:ETH 抛压与买盘

最大卖方 Celsius:已向 CEX 存入超 28 万枚 ETH

关于 ETH 的抛压,首先要提到的是 Celsius。从 2023 年 11 月 13 日起,Celsius 就开始持续向多家交易所存入 ETH。其中,2023 年末几笔较大数量的 ETH 转账如下:

2024 年 1 月 5 日,Celsius 在 X 平台发文表示,在准备资产分配的过程中,Celsius 已经开始了资产回收和再平衡的过程,以确保充足的流动性。因此,将解除质押现有的 ETH 持仓,以抵消整个重组过程中产生的某些成本。从那以后,Celsius 向交易所存入 ETH 的频率越来越高,几笔引市场关注的交易如下:

2024 年 1 月 10 日 Celsius 解除 1.4 万枚 ETH 质押(约合 3164 万美元),并存入 Coinbase;

2024 年 1 月 12 日 Celsius 解除 1.4 万枚 ETH 质押(约合 3653 万美元),并存入 Coinbase 和 FalconX;

2024 年 1 月 23 日 Celsius 向 Coinbase 和 FalconX 存入 1.52 万枚 ETH(约合 3599 万美元);

2024 年 1 月 24 日 Celsius 向 Coinbase 累计存入 1.8 万枚 ETH(约合 3934 万美元)。

下图为从 2023 年 11 月 13 日 起 Celsius 抛售 ETH 的情况。 截止到今日,Celsius 已经向 Coinbase、FalconX 和 OKX 存入 280, 760 枚 ETH(6.21 亿美元),目前仍持有 540, 029 枚 ETH(合 12 亿美元)。因此,Celsius 对 ETH 仍有很强的抛压。

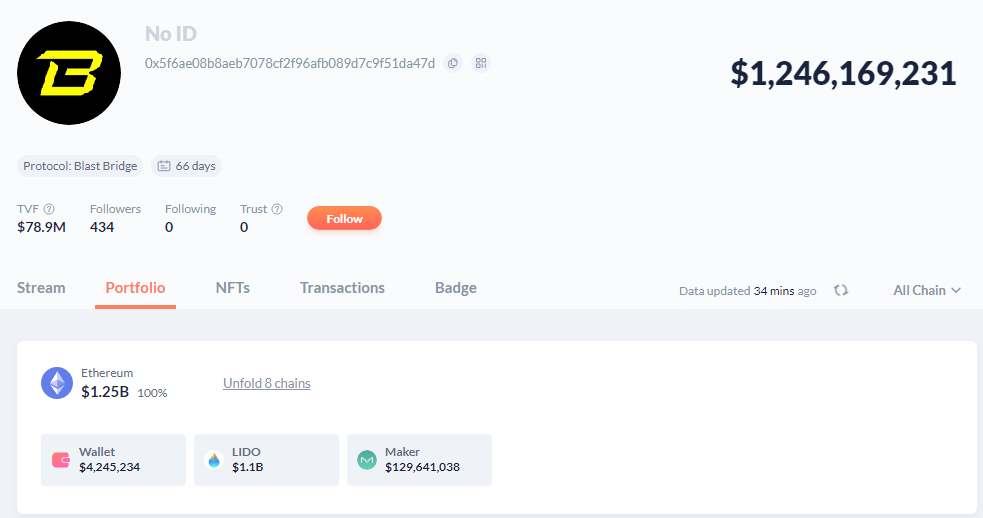

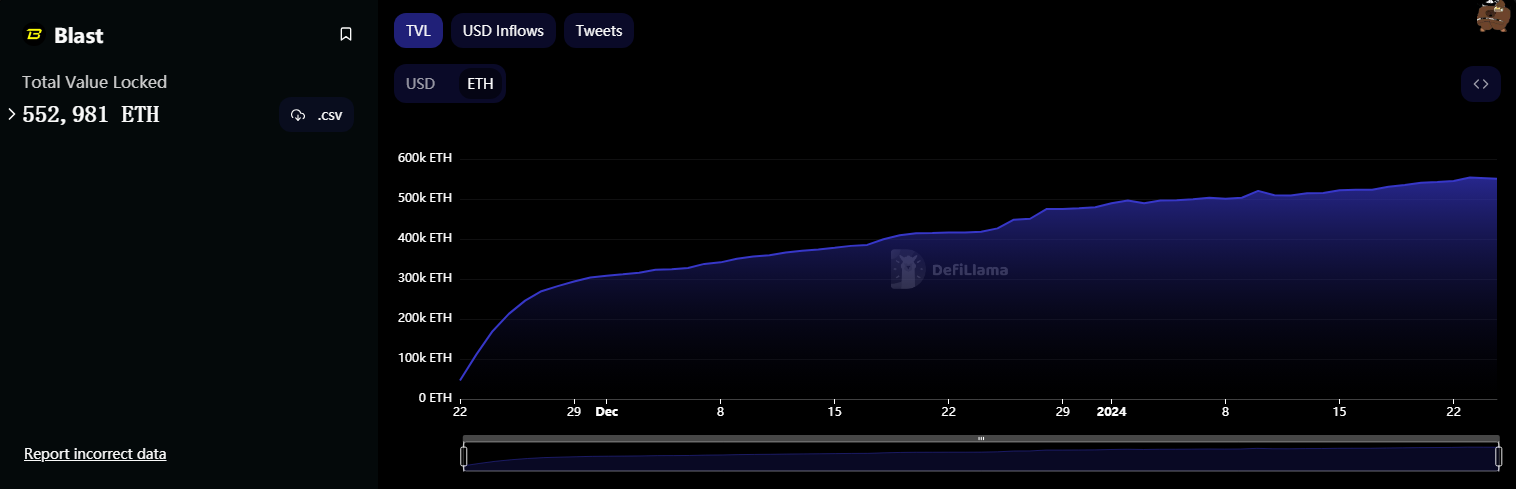

大量 ETH 存入 Blast

这段时间,用户持续购买 ETH 并进行质押的原因之一来自于 Blast。目前,虽然 Blast 主网并没有上线,但用户存入资产可以获得对应 ETH 的质押收益和稳定币生息。并且,Blast 空投中一半给在 Blast 上存入流动性的用户们。因此,其购买并质押 ETH 的热度异常之高。

DefiLlama 显示,Blast 上线第二天 TVL 就突破了 1 亿美元,34 天后 TVL 突破 10 亿美元,目前,Blast 的 TVL 超 12.39 亿美元,其中,近 50 万枚 ETH( 约合 11 亿美元)存入 Lido 协议。值得注意的是,质押的 50 万枚 ETH 预计将在今年 2 月末 Blast 上线主网的时解锁。

Celsius 是 2024 年 1 月 5 日宣布加速解锁 ETH 并持续转入交易所。因此,重点分析今年 1 月 5 日后 Blast 生态 ETH 的流入情况。通过 DeFiLlama 的数据可得,从 1 月 5 月到今日 Blast 共增加锁仓约 5.4 万枚 ETH。

图源:DeFiLlama

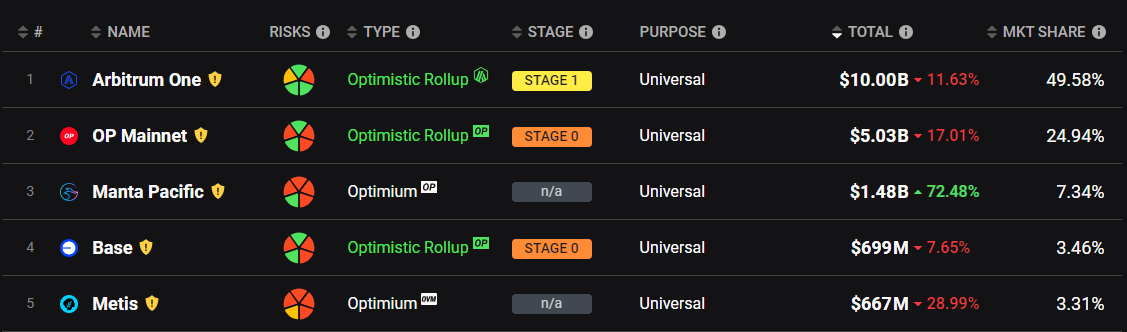

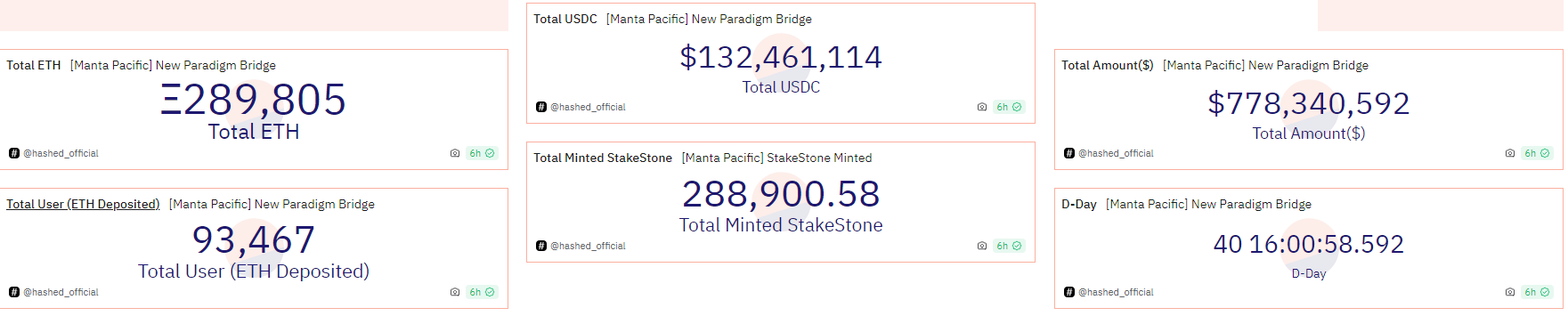

Manta Pacific:累计存入近 29 万枚 ETH

Manta Pacific 是另一个最近热度很高并且使用户持续购买并进行质押 ETH 的协议。截至今日, Manta Pacific TVL 近 15 亿美元, 7 日涨幅 72.48% ,占以太坊 Layer 2 市场 7.34% ,总排名第三,仅次于 Arbitrum、OP Mainnet。

图源:l2 beat

目前,根据 Dune 上的数据可得,通过跨链转入 Manta Pacific 的 ETH 数量为 28.9 万枚。其中,从 1 月 5 月到今日累计存入约 3.5 万枚 ETH。

图源:Dune

小结

根据对 Celsius 抛售 ETH、Blast 与 Manta Pacific 存入 ETH 的数据可得,若 Celsius 持续抛售仍持有的 540, 029 枚 ETH 的话,其抛压强度远远大于用户在 Blast 与 Manta Pacific 等热门项目购买 ETH 的强度。因此,若近期未能有更多吸引锁仓 ETH 的协议,ETH 很难稳住当前的价格。

信息维度:ETH 现货 ETF 与坎昆升级

ETH 现货 ETF 遥遥无期

伴随着比特币现货 ETF 的通过,市场对 ETH 现货 ETF 寄予厚望。Coinbase 表示:“以太坊可能迎来突破性的一年。比特币 ETF 的消息对以太坊来说是一个福音,以太坊一度飙升至 2700 美元以上,达到了自 2022 年 5 月以来的最高点。我们有理由对 ETH 的近期前景更加乐观。首先,比特币 ETF 背后的几家公司——包括贝莱德和 VanEck——也在策划基于以太坊的现货 ETF。”

不过,也有一些反对的声音认为,ETH 现货 ETF 可能不会问世。Fox Business 记者 Eleanor Terrett 称,美国 SEC 此时此刻的立场是“坚决反对”,目前对以太坊现货 ETF 的批准存在“一些内部阻力”。美国 SEC 专员 Hester Peirce 表示,该机构不想在以太坊 ETF 上重复同样的延迟错误,并称“我们需要对这些产品采用常规方式考虑,就像我们对类似产品采用的考虑一样”。Bankless 分析师 Jack Inabinet 指出,市场对以太坊现货 ETF 的批准存在一些怀疑,一些专家认为 SEC 可能需要在批准现货 ETF 之前明确其非证券的地位,但目前 Gensler 对以太坊的监管立场尚不明确。

摩根大通认为, 5 月前现货以太坊 ETF 获批的可能性不超过 50% 。“SEC 正在对加密货币交易所提起诉讼,这些交易所为包括以太坊在内的权益证明区块链(POS)提供质押服务,这使得现货以太坊现货 ETF 的批准更具挑战性,至少在这些诉讼得到解决之前是如此。”

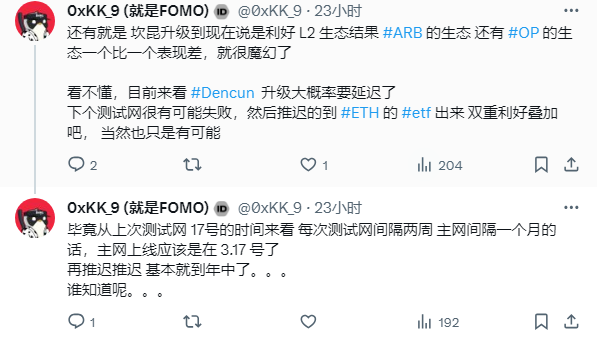

坎昆升级:上线时间或将推迟

今年以太坊另外一个值得期待的,便是坎昆升级。今年的 1 月 17 ,以太坊在 Goerli 测试网上进行了坎昆升级。但是,无论是 ETH 本身还是 L2 的 OP、ARB 的价格都没有因为该信息有一个不错的涨幅,而是随着 BTC 的价格持续下跌。

根据社交媒体信息,不少用户认为 ETH 主网的坎昆升级会进一步推迟(如下图)。甚至有用户称:“不应该叫坎昆升级,而是坎坷升级”。

图源:推特

目前,坎昆升级的时间尚未正式确定,按照以太坊一贯的调性,推迟的可能性很大。

综上所述,消息面上存在利好,但并没有真正兑现,仍然有待进一步发展。短期内,ETH 抛压较强,回撤幅度可能会继续超过 BTC,ETH/BTC 汇率可能进一步下行。