砖块与区块:RWA市场中的房地产项目研究

introduce

The concept of Real World Assets (RWA) is not newly introduced in the cryptocurrency market recently. It has existed at least in 2018. At that time, asset tokenization and Security Token Offerings (Security Token Offerings, referred to as STO) has many similarities with todays RWA concept. However, these early attempts did not develop into mature market sizes due to an immature regulatory framework and a lack of significant potential return advantages.

By 2022, as the U.S. continued to raise interest rates, U.S. Treasury yields significantly exceeded stablecoin lending rates in the crypto industry. Therefore, tokenizing U.S. Treasuries as the subject of RWA is becoming increasingly attractive to the crypto industry. Established DeFi projects like MakerDAO, Compound, and Aave, as well as traditional financial institutions like Goldman Sachs, JPMorgan Chase, Siemens, and even some governments, are starting to explore RWA.

Over the past two years, a handful of real estate RWA projects have emerged in the market. They aim to expand the real estate investment market in various ways, diversify real estate investment products, and lower the entry barrier for real estate investors. This study will conduct case studies of these projects to analyze the design advantages and disadvantages of real estate RWAs and their potential markets. As these projects are primarily targeted at the North American real estate sector, the relevant policies, regulations and market conditions discussed will primarily relate to the North American real estate market.

Ways to Tokenize the Real Estate Market

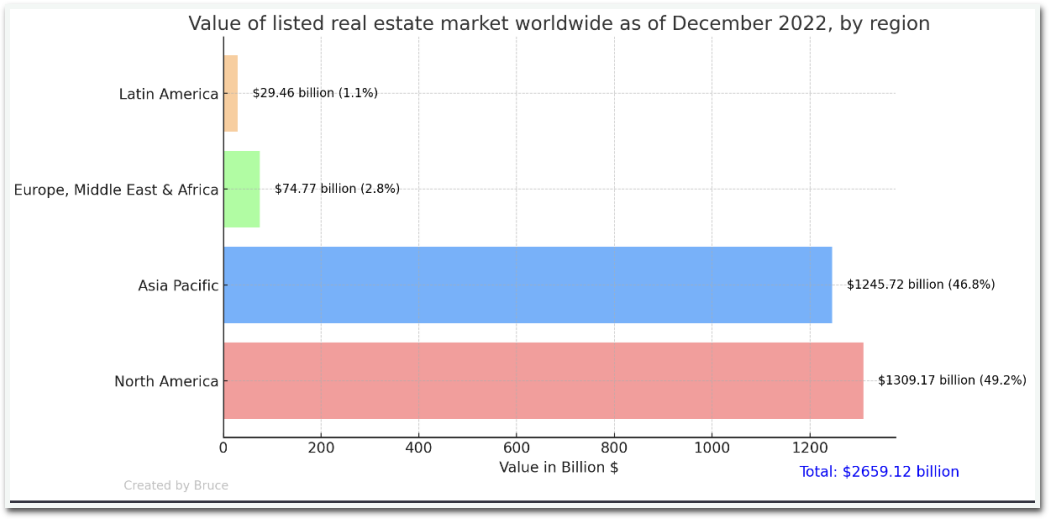

The real estate market is a vast area filled with investment opportunities. Statista research released in March 2023 revealed that the North American listed real estate market is worth a massive $1.3 trillion. That compares to $2.66 trillion in the global listed real estate market.

The core appeal of the tokenized real estate market is to achieve one or more of the following goals: create more diverse and flexible real estate investment products, attract a wider investor base, and increase the liquidity and value of real estate assets. These products usually come in three main forms:

1) Fragmented real estate ownership financing.

2) Real estate market index products in specific regions.

3) Real estate tokens for mortgage lending.

In addition, the tokenization of real estate on the chain also has the potential to enhance the transparency and democratic governance of real estate assets.

If youre familiar with a real estate investment trust (REIT), its a type of company that holds profitable real estate and manages or finances it. REITs provide mutual fund-like investment opportunities, giving ordinary investors access to dividend-like income and total returns on real estate investments and helping the regions real estate market grow. REITs and real estate RWAs have many similarities in providing fragmented real estate investment opportunities. They both effectively lower the investment threshold and enhance the liquidity of real estate assets. However, traditional REITs typically do not provide investors with management opportunities or ownership, maintaining a centralized operating model. Nonetheless, their review and operation of assets within a strict regulatory framework, as well as their investment structure, provide a framework for real estate RWA projects to refer to.

From observing the operations of real estate RWA projects over the past two years, we have gained some clarity on their strengths and weaknesses.

Typically, real estate RWA projects have the advantages and disadvantages mentioned above. However, when we delved into specific cases, we found that due to differences in management and product methods, the actual situations encountered during the operation of each project were different.

case analysis

In this chapter, I select three real estate RWA projects for analysis. Each project takes a different approach to tokenizing the real estate market and is representative of their respective fields. It should be noted that these projects are still in their early stages and their products have not yet undergone long-term and extensive market verification and testing.

RealT

Launched in 2019, RealT is one of the first real estate RWA projects focused on tokenizing U.S. residential real estate for retail investment via the Ethereum and Gnosis blockchains (primarily on Gnosis).

RealT purchases residential properties and tokenizes its holdings in compliance with U.S. regulations. The management, maintenance and rent collection responsibilities of these properties are delegated to a third party management agency. After fees, the rent generated by these properties is distributed to their token holders. While RealT is responsible for the tokenization process, they are legally separate from the companies holding the real estate assets. As stated on its website, token owners have the right to appoint another company to manage the holdings if the company defaults. However, it is worth noting that the agreement does not obligate RealT to participate in investing in the property tokens they bring to market. Users who hold property tokens can get a share of the rent of the house every month. The amount of the share needs to be subtracted from a maintenance reserve of about 2.5% and a management fee that is usually about 10%.

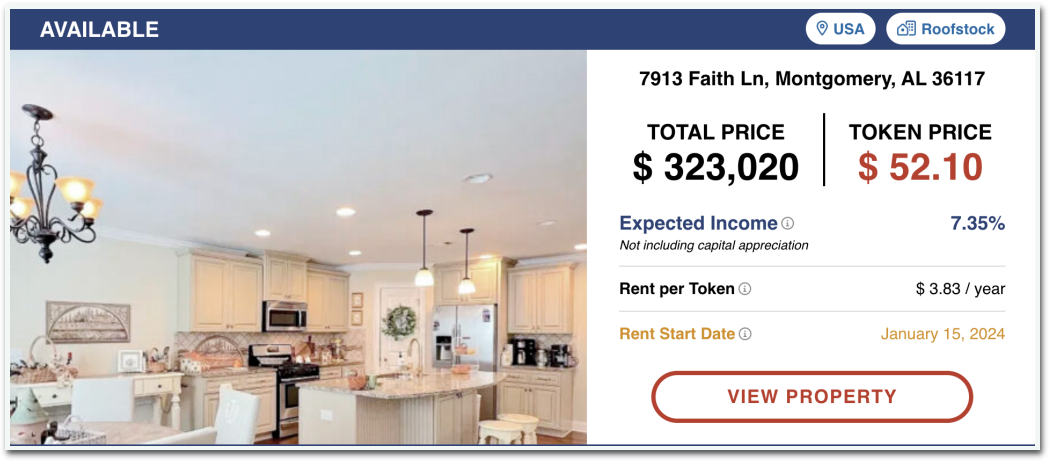

In the case of this property in Montgomery, the total value of real estate tokens is $323,020, each token is priced at $52.10, and a total of 6,200 tokens were issued. The property generates $2, 600 in monthly rental income. After deducting operating and administrative expenses totaling $622, monthly net profit was $1,978, for an annual total of $23,736. Therefore, each token receives an allocation of $3.83, resulting in an annual profit margin of 7.35%.

For this property, RealT is providing 100% of the tokens to the market, meaning RealT does not need to co-invest with clients and maintains a near-risk-free model to operate. The management agency takes 8% from the rent and the remainder from maintenance fees, and the investment platform only charges 2% for tokenizing the property, selecting the management agency and overseeing management. With this approach, the RealT team can save a lot of management time and focus on finding qualified properties and tokenizing them onto the market.

But while dispersed ownership helps spread risk among investors, it also introduces challenges. When an investors investment is too small, the companys management costs are too high and become unsustainable. Report by Laurens Swinkels explains the conflict of interest between real estate token holders and RealT. RealT selects management agencies to manage the properties it owns; if RealT has a substantial ownership stake in a property, they will try to reduce management costs; as poor management will have a greater negative impact on them. However, if RealTs shareholding ratio is too large, firstly it will reduce the liquidity of the tokens, and secondly, the small real estate shareholders will not fulfill their supervisory responsibilities. All token holders expect major shareholders to monitor whether the hired management agency is efficient and effective. On the other hand, if RealTs holdings are extremely small, RealT may lack sufficient incentives to diligently select managers and actively participate in supervision, and effective supervision of managers will become difficult for many retail investors.

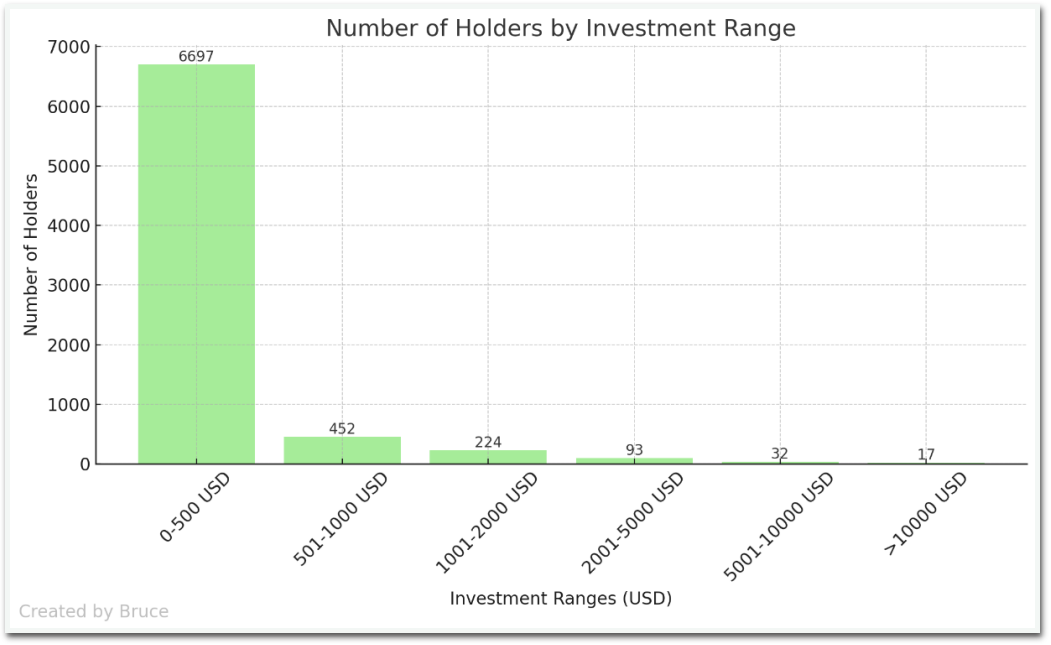

I looked at the ten most recently sold property tokens on the RealT market and used the associated blockchain explorer to find out how many holders each property had. As you can see in the chart, RealT diversifies the property into a varying number of tokens to ensure a price of around $50 per token. Most properties are located in Detroit and have approximately 500 token holders, with two properties having over 1,000 holders. Now, combine the number of tokens per holder to calculate the investment horizon for RealT investors.

About 90% of RealT investors invest less than $500, about 9% invest between $500 and $2,000, and 1% invest more than that amount. This shows that RealT has succeeded to some extent in creating a real estate investment market for retail investors and increasing liquidity in the housing market.

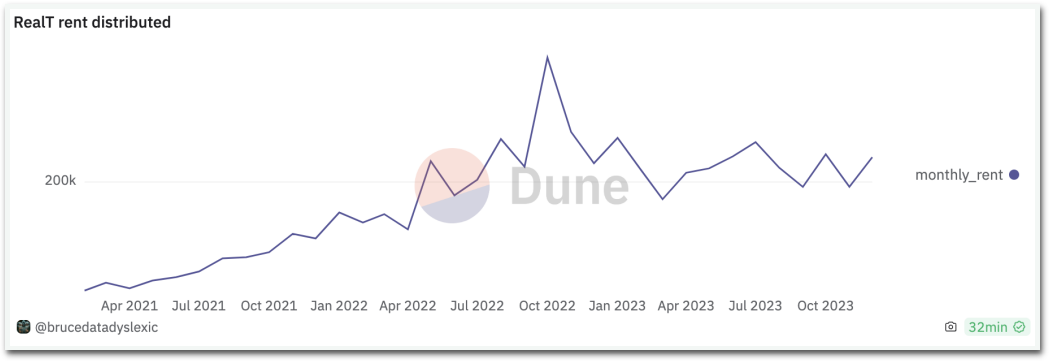

According to RealT querying transaction data on the wallet address of its main operating network Gnosis (wallet address: 0xE7D97868265078bd5022Bc2622C94dFc1Ef1D402), RealT distributed a total of approximately $6 million in rent. Platform fees fluctuate around 2.5% -3% of rent based on maintenance fees, insurance and taxes, which equates to approximately $150K to $180K in platform revenue over the past two years. However, since RealT is not required to participate in real estate investments and there are no specific limits or instructions on the extent of its involvement if it chooses to participate, the profits RealT derives from rental income are unknown.

From a corporate structure perspective, RealT established Real Token Inc. in Delaware as the core entity of the company. This entity does not own any real estate assets; it serves solely as the operating entity for the RealT project. Additionally, RealT formed Real Token LLC in Delaware as the parent company for a series of real estate companies. Like Real Token Inc., Real Token LLC (LLC: Limited Liability Company) does not own any real estate assets; its main purpose is to simplify the legal process and allow users to invest in all properties by signing up with just one company. Finally, RealT formed a corresponding series LLC for each investment property. As subsidiaries of Real Token LLC, each Series LLC owns specific properties and corresponding tokens. This structure is designed to ensure that financial or legal issues at one property do not impact other properties under RealT or the operations of the parent company.

Parcl

Parcl is a DeFi investment platform that allows users to trade price movements in global real estate markets. Parcl is used to bring real estate-related synthetic assets to market via an AMM architecture. Parcl has launched Parcl LabsPrice Feed to create area-specific real estate indices based on their sales history. The length of history can vary depending on how frequently a property is traded. After the index is created, investors have the opportunity to make speculative bets on the direction of property prices, establishing bullish or bearish positions on property prices in the area.

This method allows Parcl to avoid the legal issues involved in actual real estate operations because there is no actual real estate sale. You can also doubt whether it actually counts as a real estate RWA project since it does not meet the above-mentioned criteria. However, it is a relatively popular RWA project, with investments from Coinbase, Solana Ventures, DragonFly, and many other big names in the industry, and its uniqueness makes sense to include when discussing the product diversification of real estate RWAs of.

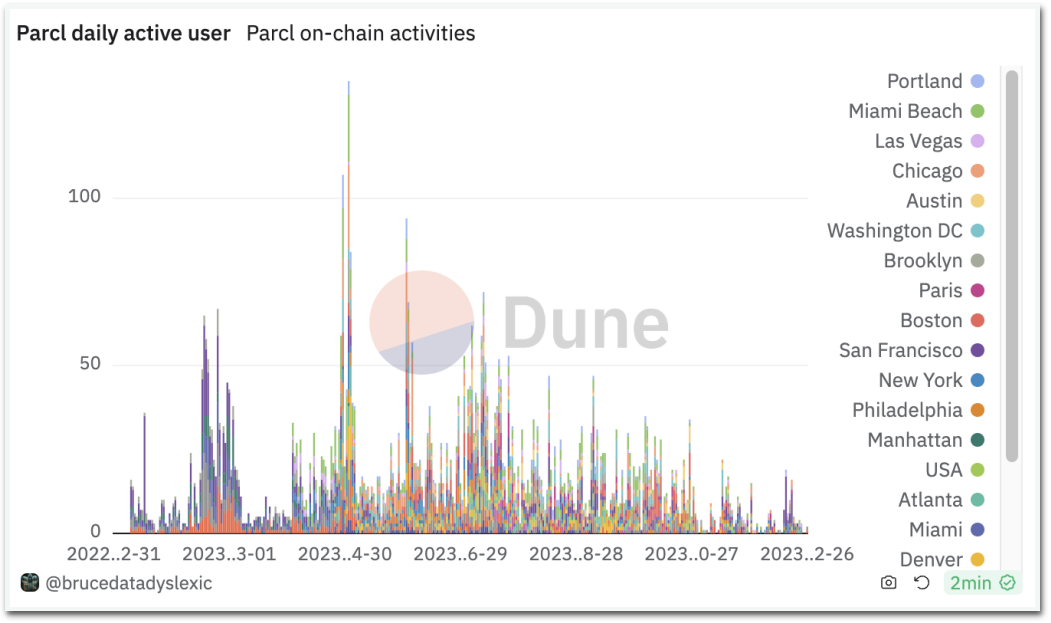

Parcl’s testnet launched on Solana in May 2022 and currently has $16 million in TVL. However, after more than a year of operation, Parcl does not seem to have attracted much attention, with daily transaction volume of less than $10,000 and less than 50 daily active users.

(The decrease in trading volume on October 26th is due to the Parcl V3 upgrade and changes to the pool address and the closure of many trading pairs, so the trading volume after that date is not included)

Parcls products are easy to use and quickly upgrade, and the Parcl Labs price provider and index market design are relatively mature. On the operational side, the Parcl team is actively rolling out Parcl Point, Real Estate Royale and other user acquisition initiatives. Despite these advantages and the support of many well-known investment institutions, Parcl still maintains relatively low market attention and market share, with a small user base and limited trading volume. Perhaps this proves to some extent that the cryptocurrency market is not ready for real estate index products.

Reinno

Large cryptocurrency companies like Ripple and MakerDAO are also exploring products in the real estate RWA direction. Ripple announced in July that their central bank digital currency team was experimenting with allowing users to tokenize properties and take out mortgages against them. MakerDAO has also partnered with Robinland to support property mortgage lending. RealT also offers the option of using tokenized real estate as collateral for loans, but this service is limited to the real estate tokens they issue. In essence, the service is more akin to a token lending product and does not materially enhance capital liquidity for individual real estate owners.

Reinno, an abandoned project that launched in 2020 and ceased operations in 2022, didn’t leave much of a mark on the market, but it introduced two real estate RWA-related products worth mentioning.

The first product is a loan service based on tokenized real estate. When property owners need financing, they can submit property documents to Reinno. Once approved, Reinno will create a special purpose vehicle, also known as an SPV, for it in Delaware, a subsidiary created by a parent company to insulate financial risks. Its legal status as an independent company makes it obligated It is safe even if the parent company goes bankrupt. In the United States, an SPV is usually the same as an LLC.) Reinno will then create a smart contract for the real estate token, and the owner can deposit the token as collateral for a loan and borrow up to the loan limit Will be based on token value.

RealT, Reinno, and many other projects choose to register in Delaware because:

1. Delaware has the most comprehensive, fastest updated, and most professional corporate legal system in the United States and even the world, providing more security and reliability than other states in the United States and other jurisdictions around the world;

2. Most U.S. technology startups, two-thirds of Fortune 500 companies, and 80% of U.S. IPO companies choose Delaware for company registration;

3. Any individual around the world can easily use online services to set up a Delaware company from home, starting with just a few hundred dollars. This registration service even provides access to all the tools and documents needed to run a company, including employer identification numbers (EINs) and tax IDs, and automatically generates articles of incorporation.

The second product is mortgage financing. After users purchase a property with a bank mortgage, they can tokenize the property ownership for financing. The funds obtained are used to repay the bank home loan, which the customer then repays into the agreement at a fixed interest rate.

Reinno still operates on a centralized and offline model, with customers typically required to visit an office and submit property documents. There are some obvious risks in taking an approach like Reinnos. First, if the borrower chooses to default and stop repaying the loan, Reinno, as a tokenization servicer rather than a lender, will have difficulty suing the borrower. Reinno does not actually own the property being mortgaged; the loans are essentially made by users who choose to provide funds on Reinno. Due to the lack of direct loan contracts between borrowers and lenders, especially in the context of fragmented real estate token financing, there is no sound legal framework to protect these lenders. Reinno did not provide detailed measures to mitigate this default risk. Secondly, if the property owner decides to sell the house after borrowing the money or stops repaying the mortgage loan to the bank after Reinno completes the mortgage financing, this behavior that leads to the transfer of the property rights cannot be effectively prevented by Reinno, resulting in the lender actually deducting the value of the property. The double flower. These obvious risks may be one of the reasons that cause projects to cease operations, and future real estate RWAs will require a more mature legal framework to address these issues.

There are some other real estate RWA projects not included for the following reasons: 1. Very similar to the projects mentioned and with smaller market share; 2. Still in the conceptual stage and lacking enough information for meaningful discussion; 3. is an RWA project and can support real estate operations, but its operations are currently focused on other RWAs, such as bonds or securities. Here is a list of these projects for those interested to check out for themselves.

in conclusion

Real estate RWA is a relatively new concept that has yet to establish a clear market size or produce leading projects. Projects currently operating in this field are relatively small in terms of market size and user base. This area requires strict operational compliance and a mature legal framework for regulation. Some projects have adopted risk-isolated corporate structures or selected real estate-related financial products as investment targets to reduce operational risks. However, to realize the full potential of real estate RWA – buying, selling properties and mortgages legislative advancement and operational compliance are indispensable.

On the legislative front, there is yet to be a clear and consistent framework to be followed regarding real estate RWAs. The U.S. Securities and Exchange Commission classifies most tokens as securities, the Commodity Futures Trading Commission considers some tokens to be commodities, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network classifies some tokens as currencies, and the Internal Revenue Service considers some tokens to be commodities. is taxable property. Furthermore, there is no international regulatory framework to refer to. Inconsistency among regulators on how to classify real estate tokens results in unclear rules and confusing processes, both of which threaten potential investors and jeopardize the long-term viability of property tokenization.

However, in such a chaotic regulatory state, there are still many well-known financial companies and cryptocurrency companies trying hard to try real estate RWA, and a small number of projects have limitedly proven the feasibility of the product in 1-2 years of operation. Real estate is a financial investment field. It is a medium-sized and large-scale sector. It is believed that with the establishment and improvement of the relevant legal framework, real estate RWA will lead to rapid and vigorous development.

About Coresky

Coresky is an asset-packaged NFT launchpad and trading platform. Coresky Launchpad converts primary market currency rights into asset-packaged NFTs. Coresky leverages Launchpads economic utility to drive user transactions while also solving primary and secondary market liquidity issues in the cryptocurrency equity and NFT trading markets.

learn more:

Official website:https://www.coresky.com/

Twitter:https://twitter.com/Coreskyofficial

TG Official:https://t.me/Coreskyofficial

TG Channel:https://t.me/CoreskyLaunchpadChannel

Discord:https://discord.gg/coresky