Weekly Editors Picks (0113-0119)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Multicoin: These 8 things we’re most excited about in 2024

Attention theory of value; social network for NFT collectors; stablecoin-driven transfers in emerging markets; cryptocurrency’s shift from being a product to driving a product; on-chain data; new forms of token distribution; UI layer composability property; client-side zero-knowledge proof (ZK).

OKX Ventures: The 7 most explosive tracks in 2024

BTCs expansion and application explosion, on-chain activity improve network security; Ethereum Cancun upgrade improves Layer 2 availability, leading the industry forward; represented by Solana, the Alt-layer 1 ecosystem will benefit from industry recovery; AI narrative and Web3 technology Close integration leads to the emergence of new applications; blockchain gaming breaks out into a new paradigm, with FOCG making a single breakthrough; DePIN continues to maintain high growth; the macro environment is improving and entering a new era of encryption.

As trading volume moved to the OTC, OTC trading volume increased by more than 400% in the second half of the year.

Payment concept assets (such as XRP) are the cryptocurrency category with the largest trading volume after BTC and ETH.

L1 and L2 transaction volume continues to grow, with ETH and MATIC leading the way.

DeFi remains strong, with slight market share gains and significant increases in nominal trading volume.

TradFi is back on the scene and moving into altcoin trading.

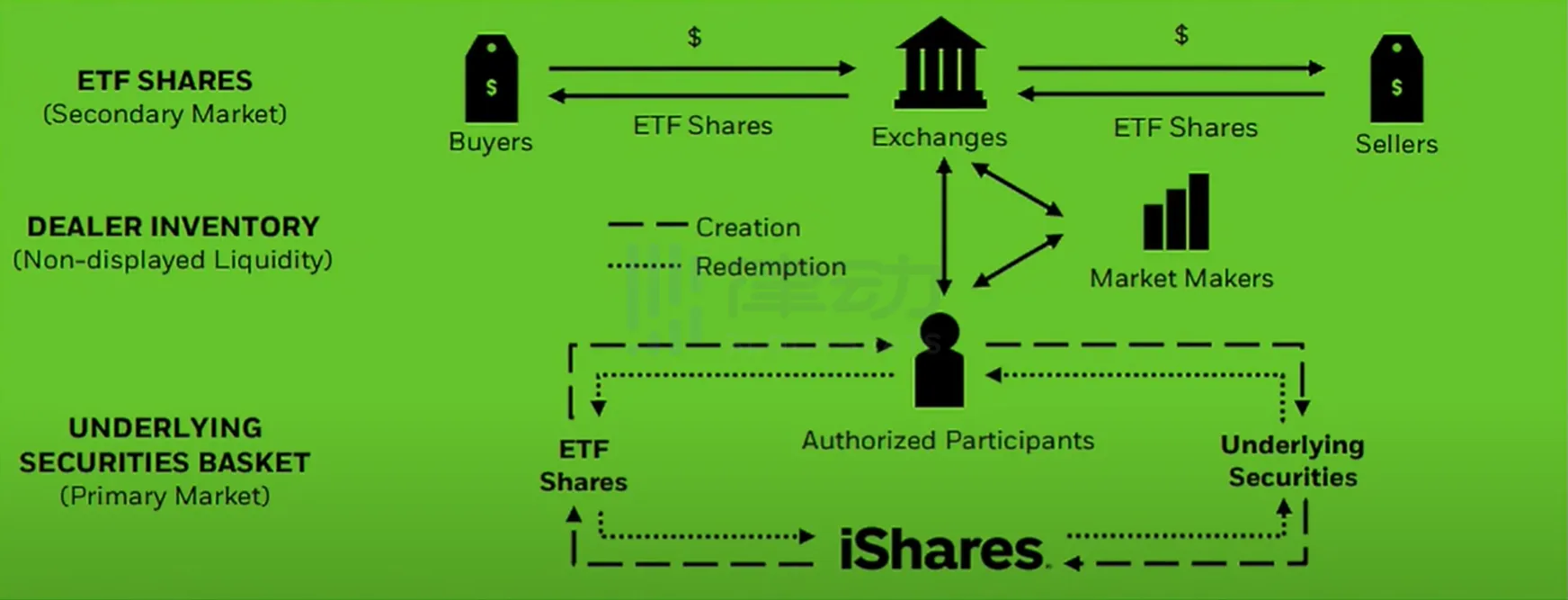

Understand the price determination mechanism of Bitcoin ETF in one article

ETF fees, as the management costs borne by investors, are directly related to the return on investment. Therefore, when choosing ETF products, investors tend to give priority to options with lower fees.

Through transactions between different participants in the primary and secondary markets, ETFs realize the determination mechanism of ETF prices, that is, through the arbitrage mechanism, the trading price of ETFs can relatively accurately track its NAV. Of course, there will be a premium or discount in the price of ETFs. In addition to the results of transactions, there are other factors, such as the transactions of assets in ETFs in different time zones.

Also recommended Taking the actual operation of 1,000 US dollars as an example to explain in detail the impact of spot ETF on the price of Bitcoin》。

NFT、GameFi

NFT fragmentation protocol Flooring Protocol hopes to revolutionize NFT trading by introducing the µToken/FLC trading pair in the Floor liquidity pool. µToken is a token that represents the fragmented value of NFT. Users deposit NFT into Flooring Protocol and obtain the µToken represented by the corresponding NFT. After the introduction of the µToken/FLC trading pair, users trading operations on FLC will directly affect the price of µToken. When trading on Flooring Protocol, the best exchange route on Uniswap will be ETH -> FLC -> µBAYC.

If FLC is included in the investment portfolio strategy, choosing FLC = optimistic about blue-chip NFT, this is undoubtedly attractive to users who intend to invest in the NFT market. But not long after, both the FLC and NFT markets collapsed.

Looking back, it is often difficult to provide liquidity solutions for the NFT market to protect itself; while attaching the value of NFT to FT tokens and introducing DeFi mechanisms to bring liquidity to the market, the cultural significance and Brand value and community loyalty are also diluted in favor of liquidity.

Overview of blockchain games: Looking back on 2023 and looking forward to 2024

Although the growth of the blockchain game market is relatively flat, it also ushered in a significant upward trend at the end of the year.

Only 6% of this year’s games have more than 1,000 active wallets, down from 10% last year.

AI is profoundly changing this industry.

Layer 2 blockchain is also developing rapidly, but established blockchains such as BNB chain still occupy the market.

In terms of user acquisition, it has become a trend to use social platforms such as Telegram and X (Twitter) to reach large user groups.

Web3

The Bitcoin and Solana ecosystems are rising strongly, and competitors are overtaking them in a corner. MetaMask is facing the most fierce market competition since its establishment. Being developer-oriented, it is difficult to create a new moat for MetaMask. ConsenSys does not want to sink the market. MetaMask wants to promote its products in a more secure and stable way. However, in the short term, such product logic will be difficult to establish an effective moat for MetaMask to face todays market competition.

Bitcoin Ecology

CoinShares Mining Report: The Bitcoin Cycle Code Hidden Behind the Halving

The average production cost of each BTC after the halving is $37,856.

Most miners will face the challenge of high SGA costs and must reduce costs to remain profitable. Even if the price of Bitcoin remains above $40,000, only a few mining companies are expected to be profitable.

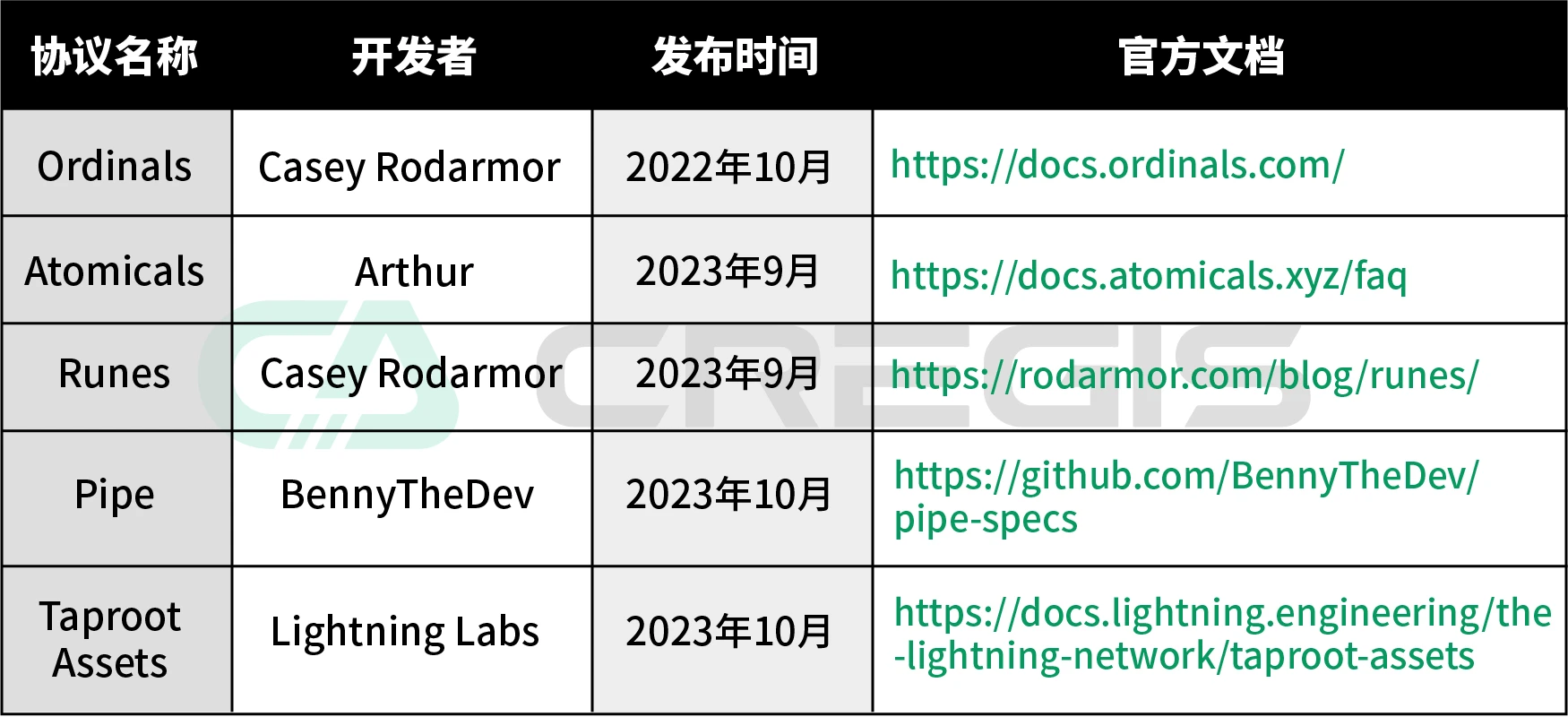

Cregis Research: 2023 Bitcoin Ecosystem Research Report

Bitcoin main chain extension protocol

Bitcoin second-layer solution

Bitcoin Turing Completeness Solution

Taking stock of 20 early Bitcoin Layer 2 projects worthy of attention

Rollup:B² Network、B L2、Chainway、Bison、Rollux、BOB、Hacash.com、Be L2;

Side chain: Libre;

DA:Nubit;

Combined with AI: x.TAI, AiPTP;

Others: BEVM, Dovi, ZeroSync, Map Protocol, Tectum, Bitfinity, BitBolt, DFS Network.

Ethereum and Scaling

Cancun is about to be upgraded. How to make an investment choice between L2 and L1?

Ethereum L2 solutions are gaining lasting importance. However, evaluating L2 solutions is far from simple. Unlike L1 networks such as Ethereum, which have clear revenue streams from transaction fees and clear fees from token issuance, L2 solutions pose unique valuation challenges.

EIP-4844 results in significant cost reductions, while revenue expectations may remain stable or increase as on-chain activity increases. EIP-4844 changes the way Rollup makes and spends money. With dynamic blob fees, one part of the fee market follows regular rules, while another part adjusts based on blob supply and demand. As blob demand grows, gas costs also rise.

As the number of specific application chains increases, the Rollups as a Service (RaaS) business model becomes increasingly important. RaaS makes developers lives simpler, faster, and more flexible. This gives them more time to prioritize and focus on the core logic and business model of the application.

Looking at Rollup governance tokens such as OP or ARB from an investment perspective, the situation becomes more complicated. There is no unique monetary premium for L2. While upside is limited in a bear market, the growth narrative in a bull market relies on network effects. Airdrops also affect user behavior. L2 will attract more users, benefiting ETH holders and validators, but picking winners in L2 becomes complicated. Ultimately, holding ETH is probably the safest bet.

Diverse ecosystems, specialized features, and diversification make other L1s still attractive for specific use cases and risk mitigation. A surviving L1 will bring unique value beyond EVM compatibility and lower gas charges.

The Celestia invasion war has begun, will Ethereum be the biggest winner?

The core of the Ethereum blockchain system is Data Avaliability and interoperability. DA corresponds to the verification capability of Ethereums Validators; interoperability corresponds to the communication and interaction capabilities of Ethereum and other chains.

As an L2 developer, what lies before you is nothing more than the tradeoff of DA legitimacy and the cost of issuing a chain. Third-party DAs like Celesitia are naturally a better choice. For developers who choose to take shortcuts to operate and maintain L2, cost will inevitably be the first consideration. The largest cost of L2 is the DA cost of Ethereum. Choosing a low-cost third-party DA to hedge the market revenue pressure of early operations may It is the preferred choice of most small developers at the tail end.

The development of L2 has left behind a lot of problems. Any problem that is raised and coupled with the Stack framework and Celestia DA may become a powerful development direction for the capitals narrative imagination space.

Compared with the loss of DA legitimacy and the rise of diverse and prosperous L2 and L3 markets, Ethereum will always be the biggest beneficiary.

Data availability solutions and project inventory

The data availability (DA) issue faced by L2 is mainly a trade-off between security and cost. Under the trade-off, on-chain and off-chain DA solutions are also produced.

The on-chain solution is represented by Proto-Danksharding, and the off-chain solution is divided into Validium, Data Availability Committee (DAC), Volition, and general DA solutions.

The more popular DA layer projects include StarkEx, zkPorter, EigenDA, Celestia, and Avail. Ethereum is only willing to separate the execution layer, and hopes to continue to maintain the functions of the DA layer, settlement layer and consensus layer. After the Cancun upgrade is officially completed, these off-chain DA layer projects (especially the DA public chain) may directly face business competition with Ethereum. By then, in addition to focusing on lower costs, how will they improve? What about your own competitiveness?

Celestia chose to issue coins at this time to incentivize developers and active addresses on the chain. It may also have strategic considerations to seize the opportunity and win over people. At the same time, for users, it is also worth looking forward to whether big-money projects like Optimism and Arbitrum will emerge in the competition at the DA level in the future.

Earn multiple points, check out EigenLayer’s 12 peripheral projects

Ether.Fi、Renzo、Mangata、Kelp DAO、AltLayer、PolyHedra、Hyperlane、Omni Network、Espresso Systems、EigenDA、Witness Chain。

Multiple ecology and cross-chain

Explore the Cosmos Ecosystem: An overview of potential protocols for unissued coins

Recently, in addition to ATOM, other chains in the Cosmos ecosystem are basically making efforts. The article introduces the protocols that will launch tokens in the Cosmos ecosystem: ZetaChain, Dymension, Saga, and BeraChain.

Cosmos: The leader and potential winner in modular blockchain

Modularity can be seen as the smart contract client of the Web3 world.

The original vision of Cosmos was to build a decentralized platform for trading, storing and protecting value, encouraging cooperation, innovation and competition. Therefore, Cosmos has chosen to be built using a modular software stack – the Cosmos SDK – and a network of interconnected blockchains. This allows centers and regions of the Cosmos ecosystem to launch modular blockchains with custom execution environments while leveraging IBC for cross-chain communication. This vision of modularity and autonomous growth rapidly increased the number of zones. As of now, 52 of the 56 regions are active.

In addition to Celestia, public chains built based on Cosmos modular tools also include the following hot projects worthy of attention: Dymension, Osmosis, Neutron, and Injective.

Take a look at 6 potential projects on Celestia

Ancient、HyperLane、Skip、Cartesi、Union、Alt Layer。

TVL continues to soar. What other potential airdrop projects are there in the Sui ecosystem?

The article takes stock of 7 potential protocols and interaction strategies on Sui: Haedal Protocol, Volo, Scallop, NAVI Protocol, BlueFin, KriyaDEX, and Bucket Protocol.

LD Capital: Sui, a new public chain based on accumulated experience

The MOVE language used by Sui has the advantages of high scalability, good programmability, fast speed and low cost. The ecosystem is booming and hot projects are emerging. The team has solid technical capabilities, good investment background, and a good fundamental foundation.

The tokens have not been unlocked in large amounts in the past three months. The first investor unlocked the tokens in May, and the new public chain data has advantages in comparison.

The token price has just returned to the level of the listing price in 2023, and the spot trading volume is active. It is currently in a trend of consolidation or further upward breakthrough.

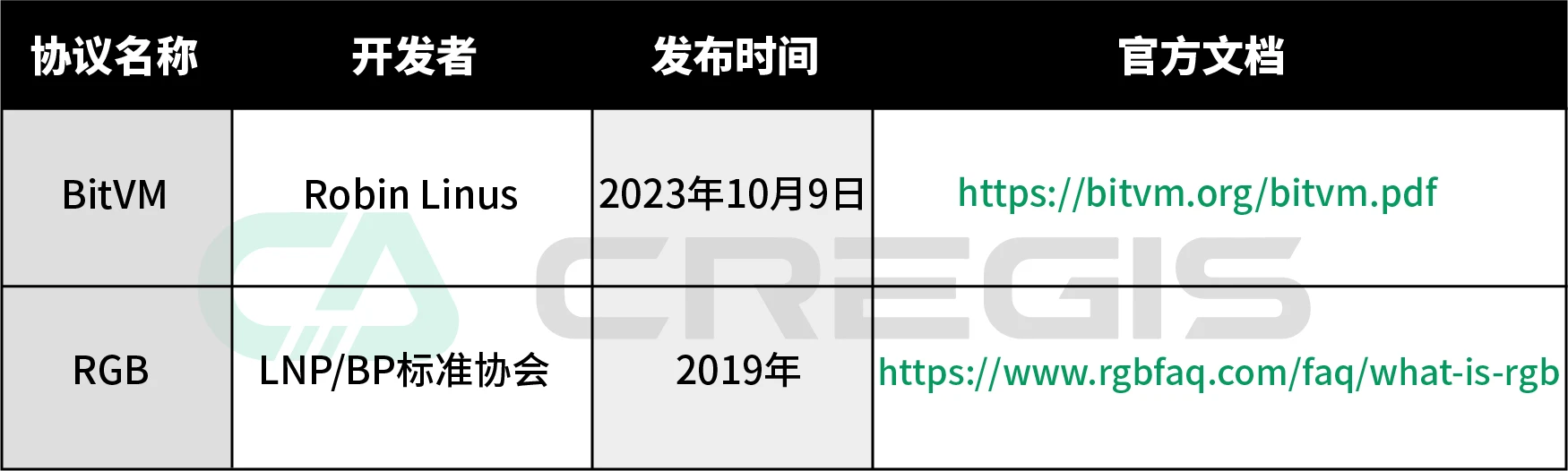

ZK

Coinbase: Panoramic interpretation of the zero-knowledge proof track

Zero-knowledge proof (ZKP) and its derivative technologies are a major breakthrough in cryptography and are largely regarded as the ultimate goal of the blockchain design concept.

Today, zero-knowledge proofs are increasingly emerging as a promising solution to unsolved problems in web3, including blockchain scalability, privacy-preserving applications, and trustless interoperability.

In 2023, more than $400 million will be invested in zero-knowledge technology, mainly focusing on the scalability, emerging infrastructure and developer tools of the Ethereum L1/L2 protocol layer. Although the zero-knowledge ecosystem is still in its infancy, its rapid development promises to usher in a new era of secure, private, and scalable blockchain solutions.

The zero-knowledge field can be divided into three levels:

1) Infrastructure, i.e. tools/hardware for building protocols/applications on top of zero-knowledge primitives;

2) Network, that is, L1/L2 protocol using zero-knowledge proof system;

3) Applications, i.e. end-user products that utilize zero-knowledge mechanisms.

policy

On December 22, 2023, the Hong Kong Securities and Futures Commission published the Circular on SFC-authorized funds investing in virtual assets, officially announcing its readiness to accept applications for spot virtual asset ETFs, and clearly stated that for virtual assets that are allowed to be traded on licensed trading platforms, For assets (such as Bitcoin, Ethereum), licensed institutions can issue and manage corresponding spot ETFs, and subscribe and redeem them in kind and in cash on licensed trading platforms or recognized financial institutions.

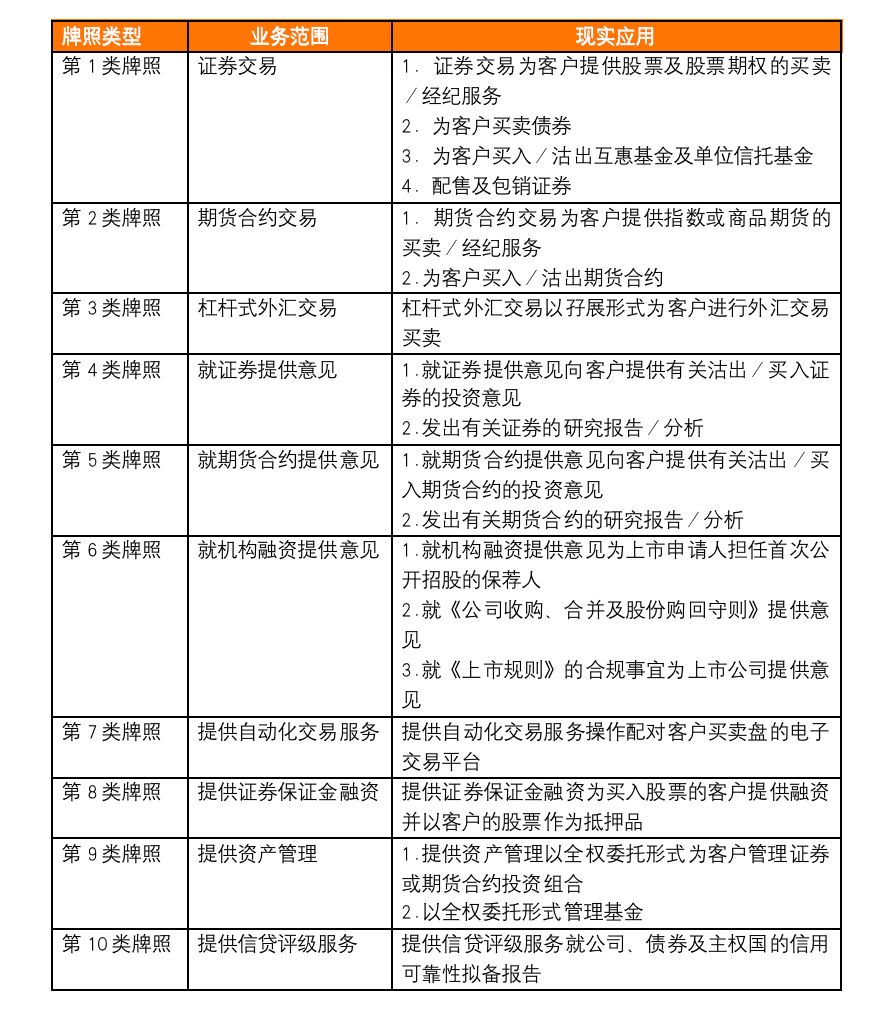

For institutions that want to issue spot virtual asset ETFs, they may need to pay more attention to the 149 license often referred to in the industry.

In terms of application time, for applications from new industry participants, the general waiting time is approximately: seven business days (applicable to applications for temporary licensed representatives); eight weeks (applicable to applications for ordinary licensed representatives); Ten weeks (for applications by responsible officers); or fifteen weeks (for applications by licensed corporations).

Hot Topics of the Week

In the past week,BTC fell as ETF benefits came to fruition and Grayscale “smashed the market”,Meme season is here again,The computing power of the entire Bitcoin network dropped by about 25% due to the cold wave power cuts in Texas, USA,Core Scientific reorganization plan approved by bankruptcy court, plans to re-list in January, TUSD unanchored (Cause Analysis);

In addition, in terms of policy and macro market,SECsueCoinbase hearinghold, Chairman of the U.S. SEC:Respecting the court’s ruling that Grayscale won the case, this case played a key role in the approval of the Bitcoin spot ETF, Monetary Authority of Singapore:Bitcoin spot ETF cannot be listed in Singapore,South Korean financial regulator approves overseas Bitcoin futures ETF trading, Thailand Securities and Exchange Commission:No plans to allow spot Bitcoin ETF locally,Thailand lifts personal investment restrictions on digital tokens;

In terms of opinions and voices, the founder of SkyBridge Capital:Bitcoin falls after spot ETF launch, partly due to GBTC selloff(analyze),Robinhood CBO:Most GBTC sellers put money into other Bitcoin spot ETFs,Arthur Hayes: Bitcoin ETF will create arbitrage opportunities, Grayscale CEO:Most of 11 spot Bitcoin ETFs won’t stick around long term,Franklin Templeton:Excited about Ethereum and its ecosystem; Bitcoin ecosystem Ordinals and L2 projects should not be ignored, investment bank TD Cowen:SEC won’t approve Ethereum ETF anytime soon,Vitalik:Only networks with stronger security properties than multi-signature can comply with the L2 standard,Pantera Capital:In the bull market, invest in Bitcoin first, then altcoins;

In terms of institutions, large companies and leading projects,ProShares Submits Application for Five Leveraged Bitcoin Spot ETFs,Tesla Supercharger stations to open soon, will accept DOGE payments,Solana Chapter 2 mobile phone pre-sale starts,Base releases testnet Sepolia migration schedule: Goerli infrastructure will be shut down on February 9,UniSat: Due to version issues, some platform transactions may result in the loss of inscriptions,Lido launches proposal to “select teams to develop wstETH bridge on BNB”,Blast testnet officially launched and launched the BIG BANG competition,DymensionAnnounce airdrop detailsandToken economic model,Conflux launches Bitcoin Layer 2, will be compatible with EVM and use BTC as gas token,Manta is attacked...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~