探索Cosmos生态:未发币的潜力协议一览

原文作者:雨中狂睡

在这段时间中,Cosmos 生态除了 $ATOM ,其他链基本都在发力搞事儿:

Neutron 在收编一些 Luna 时代的残党,大做 AEZ(ATOM 经济区)生态。其上的 Launchpad Eclipse 同样值得关注。

Osmosis 的主线是 LSD、抑制通胀和与 Umee(现 UX)合并。

Injective 虽然生态薄弱,奈何主力实力雄厚,币价表现非常好。

Kujira 表现同样优异,Kujira 质押收入不是通胀,而是真实收入。

Thorchain 走的是原生 BTC 的跨链叙事,还有两个同概念项目名叫 Maya Protocol 和 ChainFlip。

Stride 是 Cosmos 上的 LSD,市场份额占比超过了 90% 。

Sei 如今走上了并行 EVM 的叙事,前段时间受到了非常多市场的追捧。

Kava 在新的一年代币停止了通胀。

Axelar 最初大涨的原因是 Upbit List。如今它正在通过治理提案降低代币通胀,预计在未来也会受到 Wormhole 和 LayerZero 发布代币的影响。

Canto 选择离开 Cosmos,拥抱 Polygon 生态。它的主线叙事是 RWA 和全链稳定币。因此,它也会受到 LayerZero 代币发布的影响。

另外,最近市场在炒一些 LRT 的概念,因此 Cosmos 上的 LRT $PICA (最近在做扩展到 Solana 上的事情)也得到了广泛的关注,价格表现不错。

今天这篇内容呢,主要是想聊聊 Cosmos 生态中即将推出代币的协议,让我们一起潜进去。

ZetaChain

ZetaChain 是一条内置了跨链互操作性的 Layer 1 ,兼容 EVM,支持用户和开发者在任何链(包括 BTC 和 Doge 这类非智能合约链)之间实现全链、通用智能合约和消息传递。

开发者可以通过工具集,基于 ZetaChain 单点构建全链 DApp。

目前已经有超过 150 个 DApp 加入了 ZetaChain 生态,测试网用户已经超过 300 万。详情可点击该链接:https://www.zetachain.com/ecosystem

关注 ZetaChain 的理由在于:

LayerZero 即将发布 Token,全链叙事即将兴起(以及 Wormhole 同样发币在即);

ZetaChain 支持 BTC 链,暗合原生 BTC 叙事。未来 ZetaChain 上的 DApp 可能都将有能力支持原生 BTC 资产(Sushi 在 23 年 11 月宣布与 ZetaChain 合作,提供原生 BTC 支持,允许 Sushi 用户在 30 个网络之间交换原生 BTC)。

ZetaChain 这段时间官宣了很多合作,包括上面提及的 SushiSwap,还有 Curve、Bounce 等。

ZetaChain 的重要合作伙伴 WaaS(钱包即服务)供应商 Magic 在去年完成了一次 5200 万美元的融资,由 Paypal 领投。

ZetaChain 具体的主网上线时间目前还不清楚(不过在其 23 年回顾中,ZetaChain 团队提到,将会在未来几周内发布一系列重要更新,值得我们跟进一下)。

另外,由 Binance Labs 领投的 Ultiverse 子游戏 Meta Merge 已经加入了 ZetaChain 测试网进行构建,未来 Ultiverse 也将通过 ZetaChain 扩展其作为元宇宙平台的多链互操作性。这两个项目的合作进展同样值得关注。

现在,我们还可以通过 OKX Web3 Wallet 参与 ZetaChain 测试网的交互:

链接:https://www.okx.com/cn/web3/discover/cryptopedia/event/12

Dymension

Dymension 同样是模块化区块链的一员,它是一个模块化结算层。

Celestia 把 DA 层剥离了出来,单独作为一个模块化组件构建,为 Layer 2 们提供 DA 服务。而 Layer 2 们就只需要做好执行的工作,并在 Layer 1 上进行数据结算即可。而 Layer 2 们会选择 Celestia 作为 DA 层的原因,本质上可以归结为「更高的性价比」(这意味着更高的利润)。

而 Dymension 的推出,是为了解决 Layer 2 们之间的割裂感。之前 Layer 2 都是自定义部署,采用不同的多签桥接方式和不同的安全假设。Dymension 将通过 IBC 来对 Layer 2 们进行统一,制定标准化流程,最终实现由 RollApp 们构建 Web3 互联网的愿景。

简单来说,Dymension 做的事情就是利用 IBC 协议统一 Layer 2 标准和整合流动性,使用 Dymension Hub 来保护网络中的流动性,并于 DA 层(如 Celestia、Near,DA 层可由 RollApps 自主选择)来发布其交易数据。

Dymension 比较有意思的点是它在围绕 RollApps(一个新的加密原语)构建,在其上构建的开发者只需要打磨产品,提供更好的用户服务即可。

另外,再提两个同赛道项目:

Eclipse 是 Dymension 的竞品;

Fuel 是模块化执行层。

Saga

如果要简单理解 Saga,也可以将其理解为模块化生态的一部分。Saga 的主要服务形式就是帮其他开发者构建专用链。这些开发者可以根据自己的需求来做产品设计上的取舍。

Saga 团队认为,当前的 Web3 应用程序的竞争本质上是对区块空间的争夺。因此,Saga 的愿景是让开发人员能够以尽可能简单的方式构建他们的专用 Web3 应用链。

也就是,一键发链。

Saga 在 Cosmos 的基础上再一次降低门槛。

通过 Saga,开发人员可以在 10 分钟内启动一条属于自身的 EVM 链。Saga 将其称为 The Unblock 运动。

而 Saga 的倾向是,打造一个拥有互操作性的游戏(元宇宙)生态。

从我个人的角度来看,这个倾向和 Saga 所提供的服务很契合。基于 Saga,游戏开发者们可以专注于游戏设计,以及拥有更高的灵活性和互操作性。

BeraChain

BeraChain 是一个以 EVM 为架构的 Cosmos Layer 1 ,采用 PoL(流动性证明)共识机制。现在 BeraChain 已经上线公共测试网「Artio」,开发者和用户都可以通过水龙头领水来参与 Galxe 的交互任务。

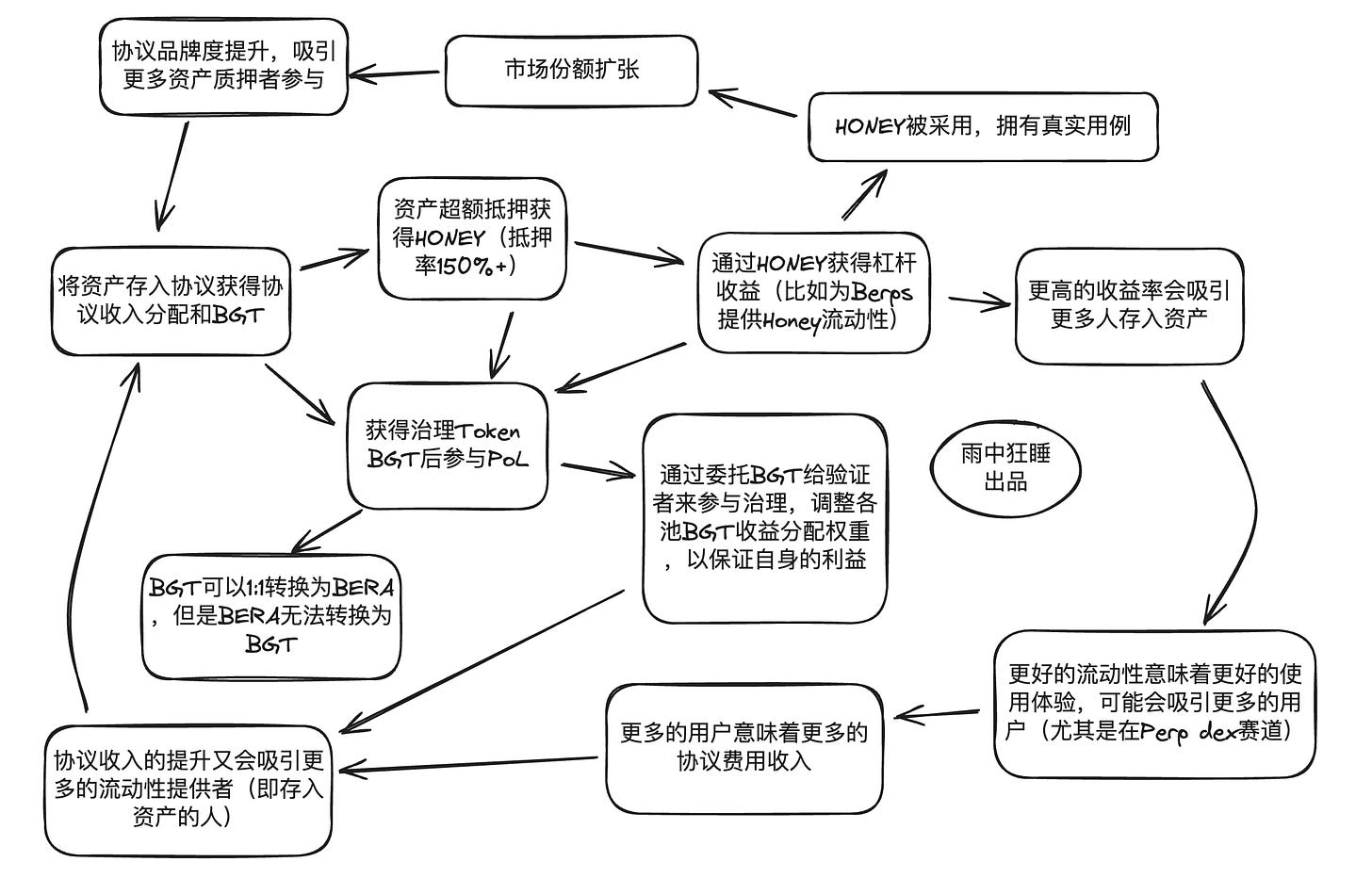

它在设计上,采用了三代币模式:

$BERA :Gas Token, 10% 的通胀;

$BGT :治理 Token,但不可转让,只能通过质押资产来获得;

$HONEY :超额抵押稳定币,协议收入分配媒介。

BeraChain 主网上线之后,允许用户质押 wBTC、wETH、wstETH 和 USDC、USDT、DAI 等资产,并获得 DeFi 活动的收益分配和 BERA ,各类资产的质押收益分配权重未来会由 BGT 治理完成。未来,BeraChain 生态大概率也会出现类似于 Stride 和 Convex 这样的流动性质押和聚合治理的产品。

至于空投细则,官方还没有公布。我个人猜测,除了 NFT Holder 外,BeraChain 可能还会向 TIA Staker 空投。

从我的视角来看,Berachain 构建了一个飞轮:

在最初启动的时候,Berachain 和 Canto 的模式很像,通过通胀的 Token 来推动 TVL 的抬升。但是随着用户量的增长,手续费收入的提升,Berachain 会走出一条和 Canto 不一样的路来。而且,Berachain 内置的治理博弈和稳定币又会进一步推动市场上对于其 Gas Token BERA 的需求。