LD Capital: Brief analysis of modular blockchain Celestia

Original author: Lisa, LD Capital

1. Project Introduction

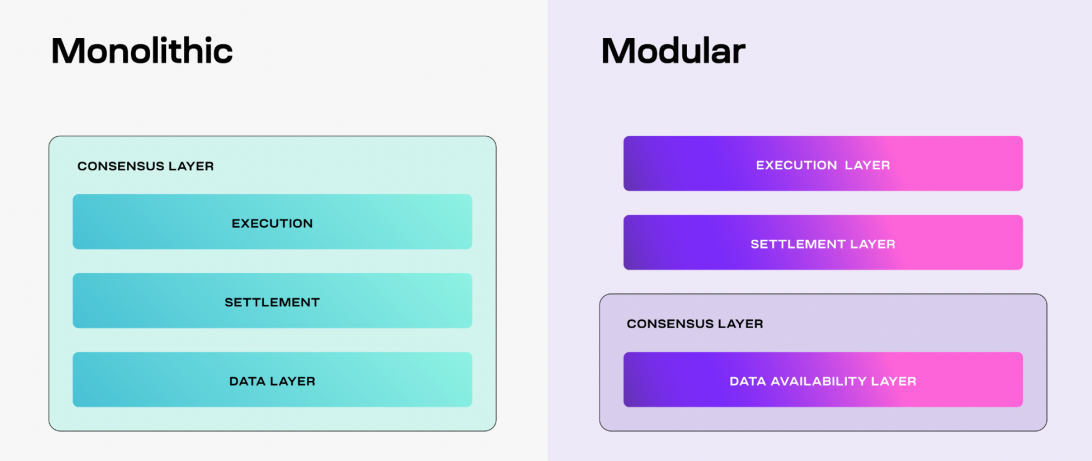

Celestia is a modular blockchain project focused on data availability. Compared to monolithic blockchains that independently perform execution, settlement, consensus, and data availability, modular blockchains decouple these functions among multiple dedicated layers as part of a modular stack, a Lego-like structure. Each module provides better flexibility and scalability. The basic layer of Celestia consists of consensus and data availability, that is, the consensus and data availability layer, which is referred to as the DA layer by the project party.

Celestia is a POS blockchain based on CometBFT and Cosmos SDK. The two key functions of its DA layer are data availability sampling (DAS) and namespace Merkle trees (NMT).

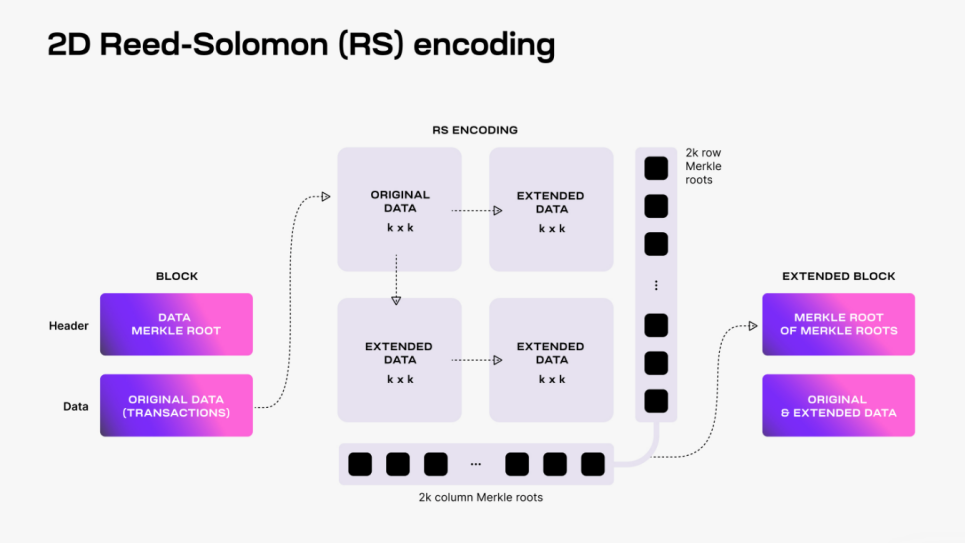

DAS enables light nodes to verify data availability without downloading the entire block. Light nodes cannot verify data availability because they only download the block header. Celestia uses the 2-dimensional Reed-Solomon encoding scheme to re-encode the block data to implement DAS for light nodes. Data Availability Sampling (DAS) works by having light nodes conduct multiple rounds of random sampling of small portions of block data. As light nodes complete more rounds of block data sampling, the confidence that the data is available increases. Data is considered available once a light node successfully reaches a predetermined confidence level (e.g., 99%).

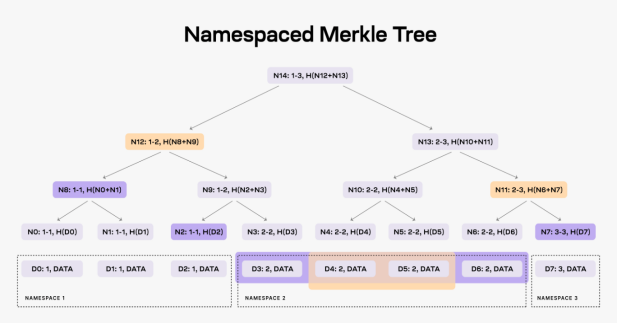

NMT enables the execution and settlement layers on Celestia to download only the transactions relevant to them. Celestia divides the data in the block into multiple namespaces. Each namespace corresponds to applications such as rollup built on Celestia. Each application only needs to download data related to itself to improve network efficiency.

2. Financing information

3. Economic Model

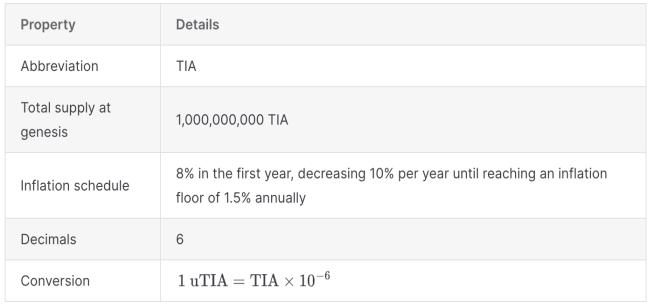

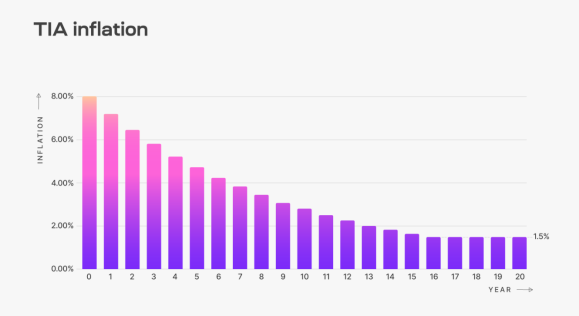

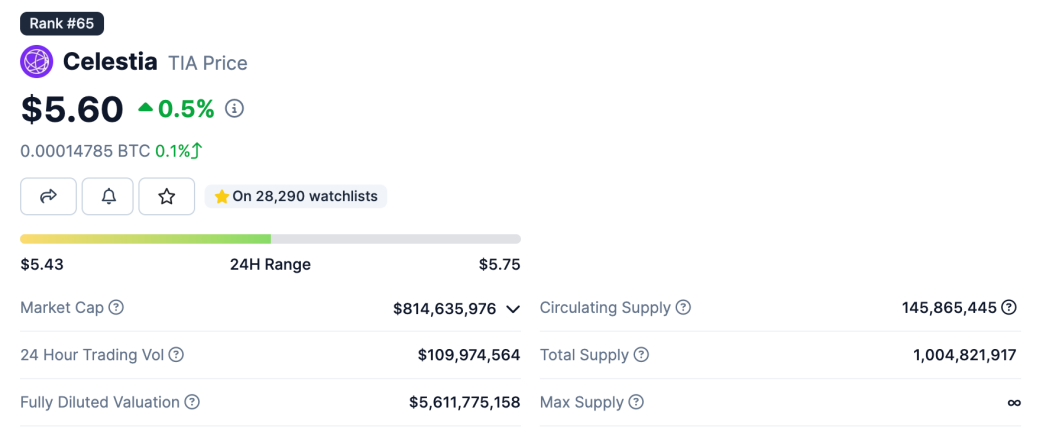

TIA is Celestias native token, with a total circulation of 1 billion. The inflation rate is 8% in the first year, and will decrease by 10% every year until the annual inflation rate drops to 1.5%.

(1) Use case

1. Rollup developers’ fees for using Celestia DA need to be paid in TIA;

2. Similar to Ethereum, Rollup built on Celestia will use TIA as GAS fee;

3. Pledge;

4. Governance.

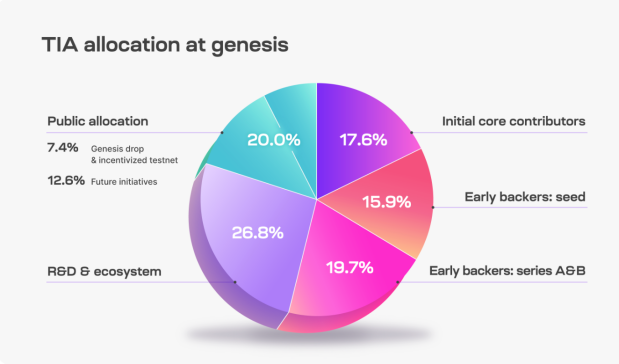

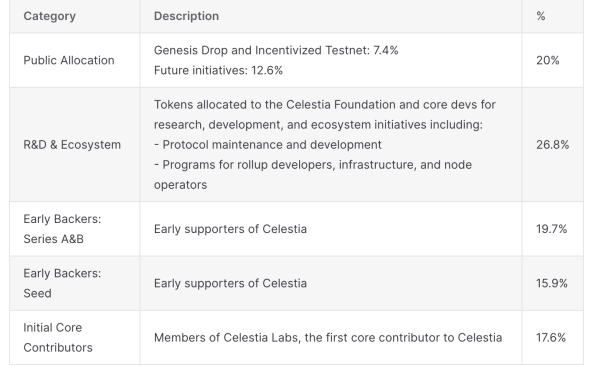

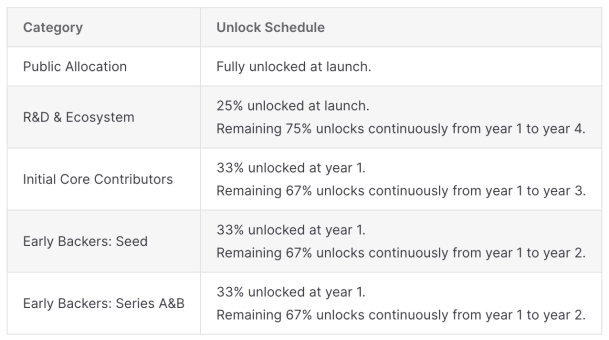

(2) Allocation and unlocking situation

On September 26, 2023, Celestia announced the launch of the Genesis Drop, and eligible participants can claim up to 60 million TIAs on October 17, 2023. 1/3 of the Genesis Drop, or 20 million TIAs, was allocated to 7,579 developers and researchers; the remaining 2/3 was allocated to 576,653 on-chain addresses, of which 20 million were awarded to the most active users of Ethereum Rollups , 20 million allocated to stakers and relayers of Cosmos Hub and Osmosis.

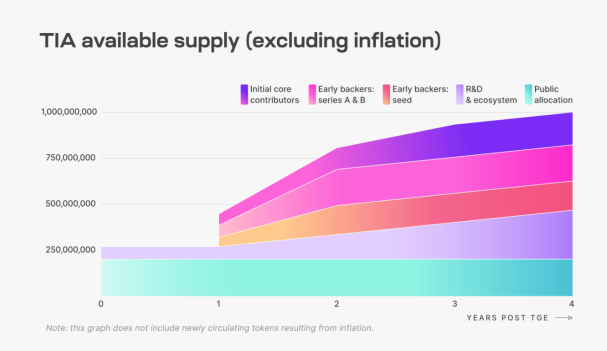

On October 31, 2023, Celestia completed the deployment of the mainnet beta version and issued airdrops, marking the launch of its modular network. The initial circulation of tokens includes 25% of the RD and ecosystem portion and 100% of the public distribution portion, totaling 26.7% (= 26.8% * 25% + 20%). However, since 12.6% of the public allocation is future inititives, the circulation ratio after excluding this part is 14.1% (= 26.7% -12.6%), corresponding to the circulating quantity of 141 million coins, plus the inflation part, and coincko shows TIA’s current The circulating supply is consistent with 145 million coins.

Although the unlocking of other parts such as TIA investors needs to wait until 1 year later, TIA has selling pressure from the inflation part. The annual inflation rate of 8% is based on the total amount of 1 billion tokens, which means that the inflation part will increase within 1 year. The number of tokens is 80 million, accounting for 56.7% of the initial circulation of 1.41 billion. If this part of the token is roughly averaged, it is likely to generate a selling pressure of US$1.227 million per day (priced at US$5.6). This is a part that is easily ignored.

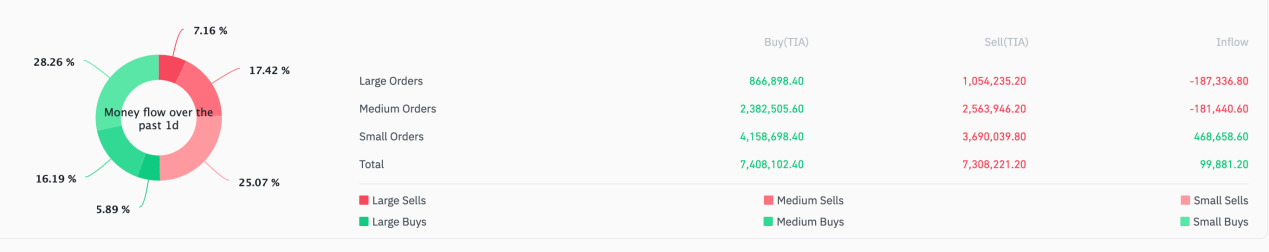

4. Spot data

TIA was listed on multiple exchanges such as Binance and OK as soon as the market opened. Within 10 days after being listed, it fluctuated slightly around 2.5. After a strong increase on November 11, it started to rise, reaching a maximum of $7.4. Chip prices are concentrated around $2.47, followed by around $5.9. The trading volume has dropped recently, returning to the level of the initial consolidation stage. The current price is at the Fibonacci retracement level of 0.618. On Binance, large investors sold a net 187,000 coins during the day, and retail investors bought a net 100,000 coins.

5. Contract data

OI/MC= 13.6%

Since the price began to fall from the high, CVD and open interest have declined simultaneously, and the ratio of long-short positions and the ratio of large accounts to long-short have both increased, reaching above 1. Active trading volume deviated slightly from the number of transactions.