SignalPlus Macro Research Report (20231122): The market firmly believes that the interest rate hike is over, and interest rates may be cut by 90 basis points next year.

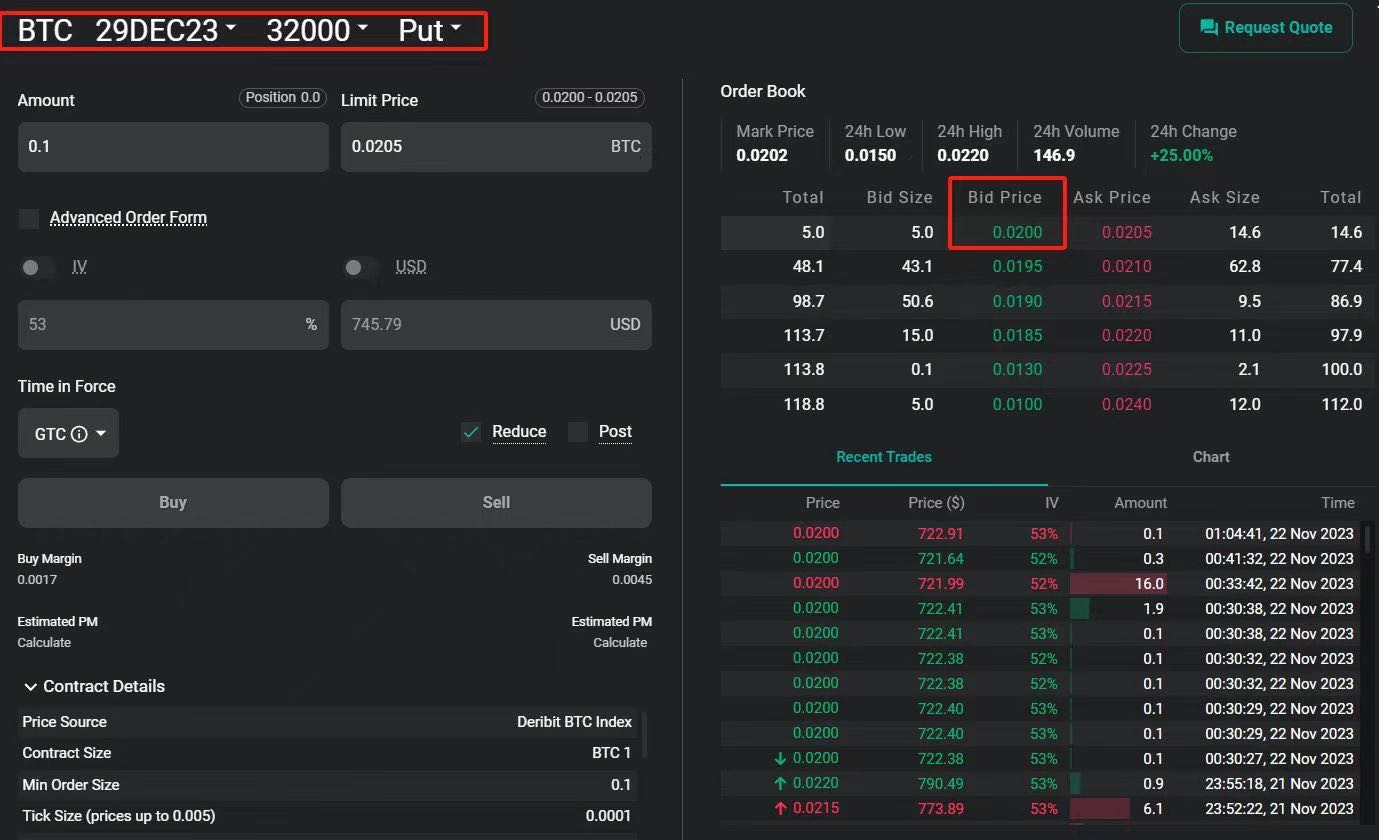

If you want to open a spot position at a low price: sell BTC at 32,000 bearish at the end of the year, the royalty income will be 2% (annualized 16%), and the price falls below 32,000 before the end of the year, you buy spot at the price of 32,000 (11% discount from the current price); if it does not fall below , you will earn 2% (without leverage), and as long as the price is >31300, it is a profitable transaction.

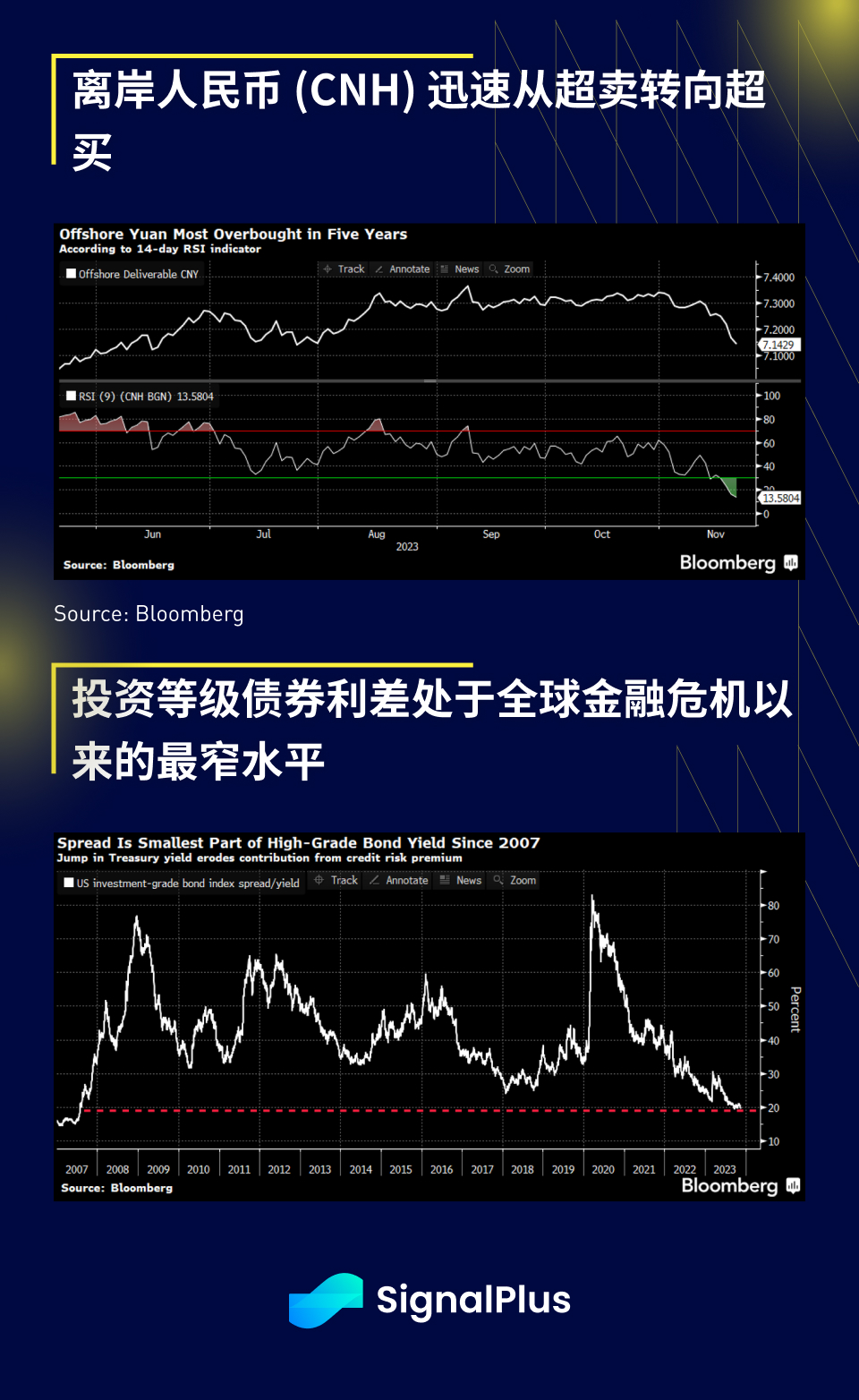

Markets took a breather yesterday, with stocks remaining stable, the U.S. interest rate curve overall moving down 1 basis point, the U.S. dollar weakening on a still-positive risk backdrop, and USD/CNY (as USD/EM The RSI (in CNH), which is a proxy for currencies, shows the greatest degree of overbought. On the credit side, investment grade bond spreads have tightened to their tightest levels since the global financial crisis (2007), partly due to higher underlying yields coupled with a return to high-yield chasing sentiment among asset managers.

Yesterdays economic data was not particularly important. Existing home sales were weak in October, the Chicago Fed activity index slowed, and the Philadelphia Fed services index improved slightly, but they had little impact on the market. The markets response to the FOMC meeting minutes at 2 p.m. was also muted. The Federal Reserve was basically on hold, repeating the argument of higher interest rates for longer. Some of Bloombergs news headlines are as follows:

Fed meeting minutes: All FOMC members agreed to proceed with caution on interest rates

All FOMC members believe rates will remain restrictive for some time

If insufficient progress is made on inflation, the Fed will further tighten policy

However, the market still firmly believes that the Federal Reserve has ended raising interest rates in this cycle. The pricing of federal funds futures in December 2024 shows that the market expects to cut interest rates by 90 basis points next year.

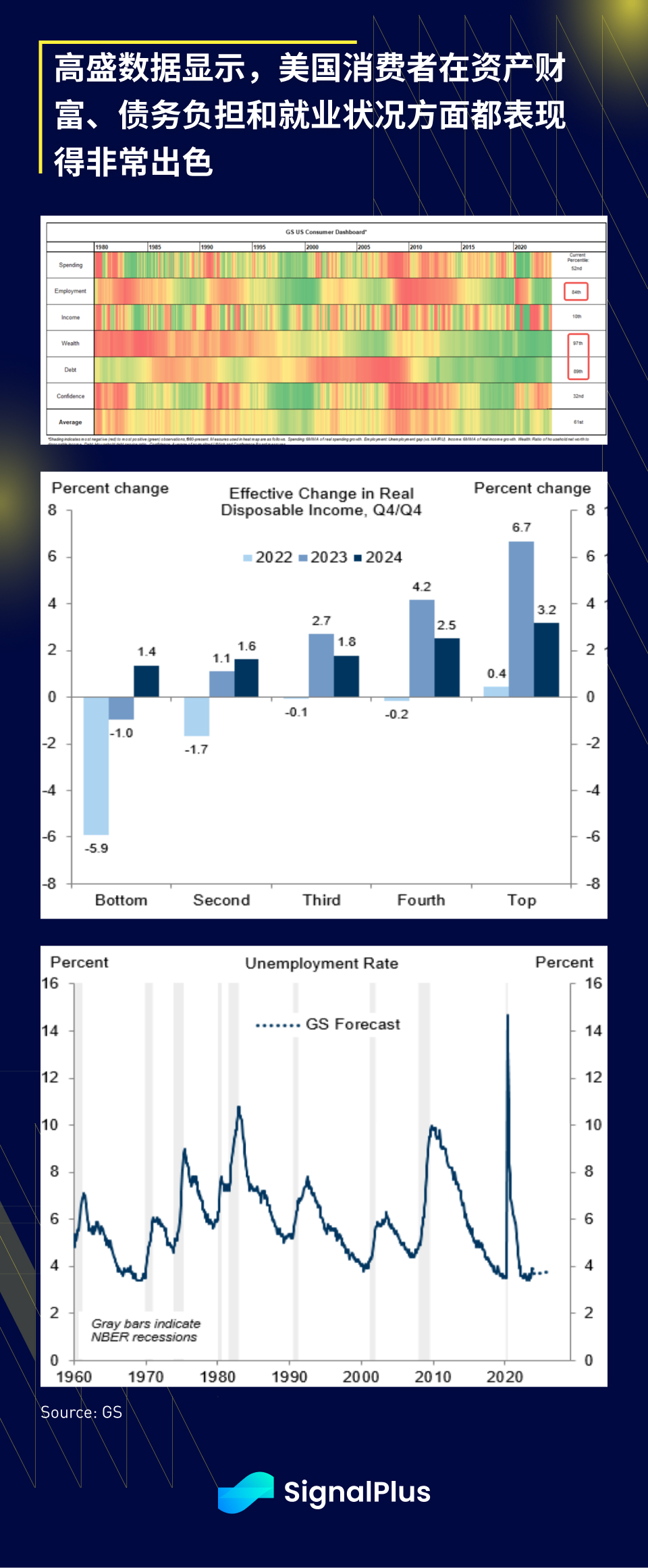

The Thanksgiving holiday is approaching, and the latest retail sales data continue to show the resilience of U.S. consumption. Goldman Sachs research shows that employment, wealth, and debt coverage ratios are at the 84th, 97th (!), and 89th percentiles respectively. In other words, With U.S. consumers at their wealthiest levels ever, debt burdens at all-time lows, the job market remaining strong over the long term, and companies remaining profitable, its hard to short stocks.

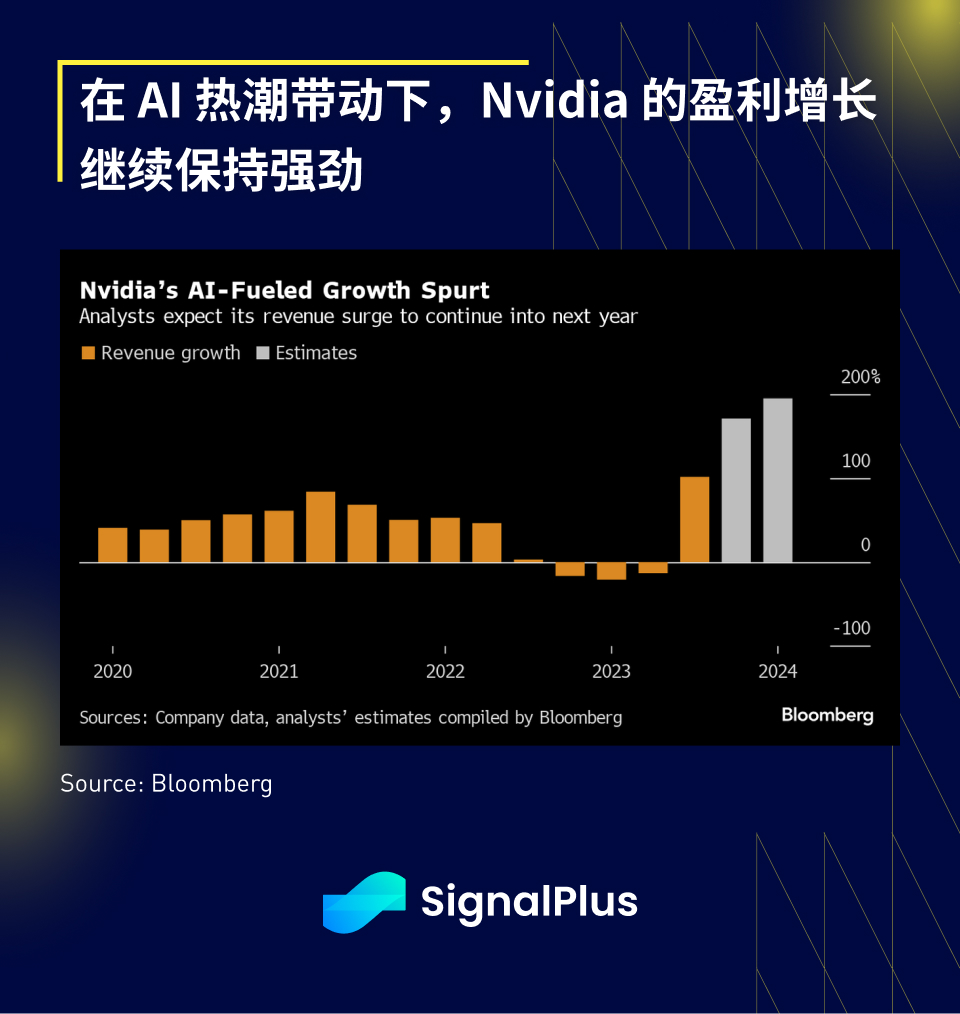

In terms of corporate profits, Nvidias profits significantly exceeded most analysts expectations. Quarterly revenue increased to US$18.1 billion (of which data centers accounted for 80%), and EPS was US$4.02, exceeding the expected US$3.36. 20 billion US dollars; this financial report result is absolutely outstanding, but due to the extremely high stock price multiples and the markets enthusiastic expectations for AI, investors set an incredibly high bar for Nvidia, and the stock price fell as much as 10% after the financial report. 6%, and finally recovered part of the decline, returning to 1.5%.

On the cryptocurrency front, the biggest news was the high-profile announcement by U.S. regulators of a settlement with Binance and CZ over various charges of money laundering and sanctions violations, with CZ agreeing to personally pay a $50 million fine, while Binance will be liable for $43 $100 million in fines (FinCEN, OFAC, CFTC), CZ’s sentencing will be deferred for 6 months, and if the right to appeal is waived, the sentence is expected to be no more than 18 months. The agreement prohibits CZ from operating business for the next 3 years, but in theory Only until 2026.

Overall, this is a very favorable outcome for CZ and Binance because:

1) The plea deal was reached quickly.

2) The fine was much smaller than the market feared ($10 billion+), and there were no further more serious charges, such as market manipulation or misappropriation of funds.

3) The sentencing is relatively light compared to other high-profile cases such as FTX and Bitmex.

This may also be seen as a positive outcome for the cryptocurrency market as a whole, with Binance likely to continue to dominate the CEX space while US regulators have fully cleaned up it, eliminating the bad effects of the previous cycle. behaviors and questionable entities, opening the door for further institutional involvement, although this comes with warnings that “institutions are about to enter” and the state of cryptocurrencies feels markedly different from the boom of the last cycle.

Cryptocurrency prices have corrected in the past 24 hours, with BNB down 10% at the time of writing, but still ranked in the top 5 by market capitalization. We expect cryptocurrency prices to remain largely stagnant, but given the recent gains and ETF approval delays, there may be a slight bearish bias and the market may remain in buy-on-the-dip mode, with implied volatility likely to head lower in the near term.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com