SignalPlus Macro Research Report Special Edition: Counter-Coup

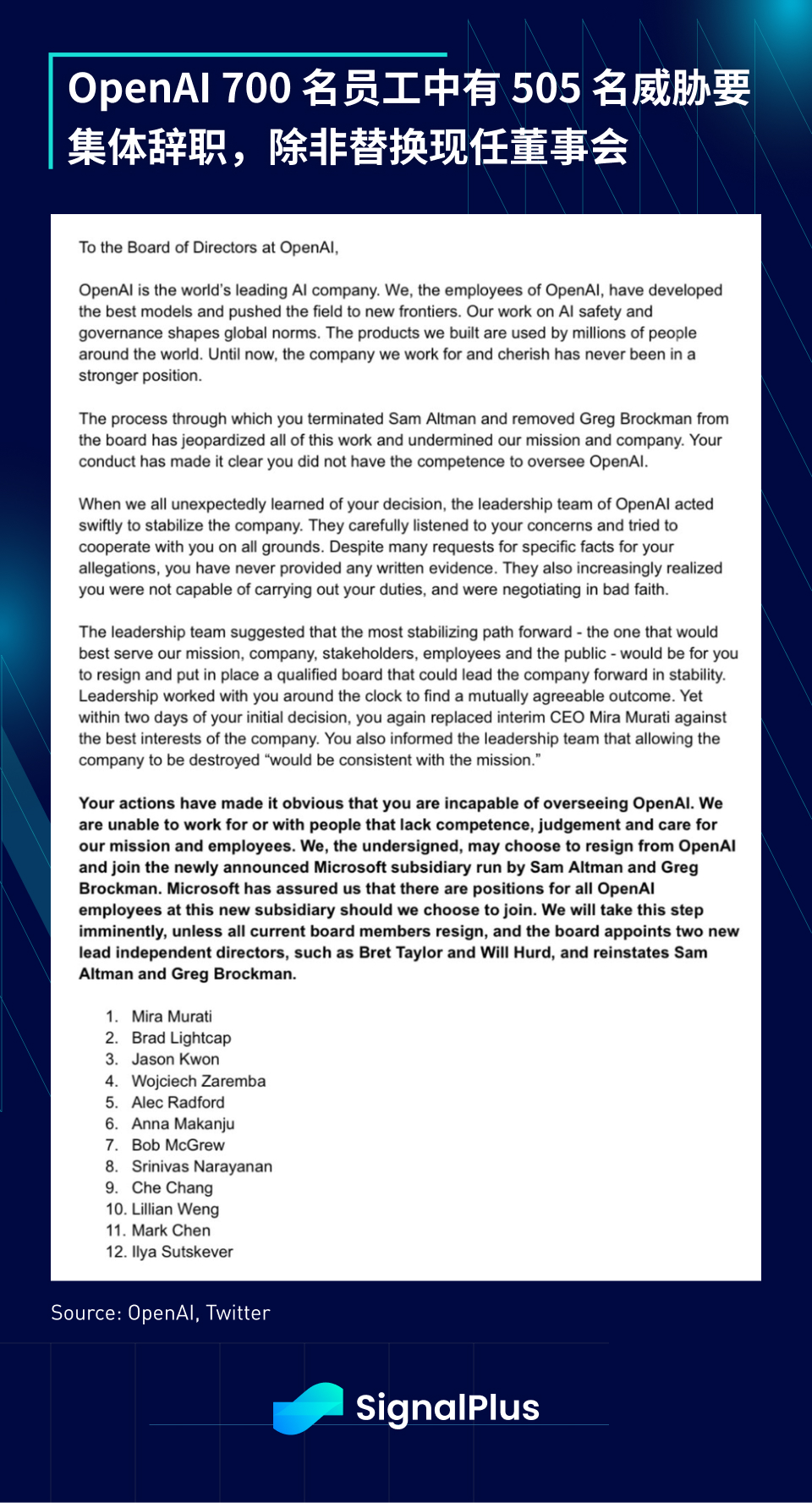

In the space of 72 hours, the market witnessed a shocking boardroom coup, followed by a counter-coup led by MSFT CEO Satya (more exciting than the best movie), and the AI landscape may never be the same; the clearest winner appears to be Its Microsoft, which has brought together the brightest minds in the AI race, is an entirely for-profit organization, and has given Altmans team more chip computing power than they had at OpenAI; the most obvious (so far) The losers appear to be OpenAIs investors (except MSFT), board of directors, and employees, although 505 of the 700 employees have threatened to resign en masse unless the current board of directors is replaced. Looks like another must-watch Netflix series.

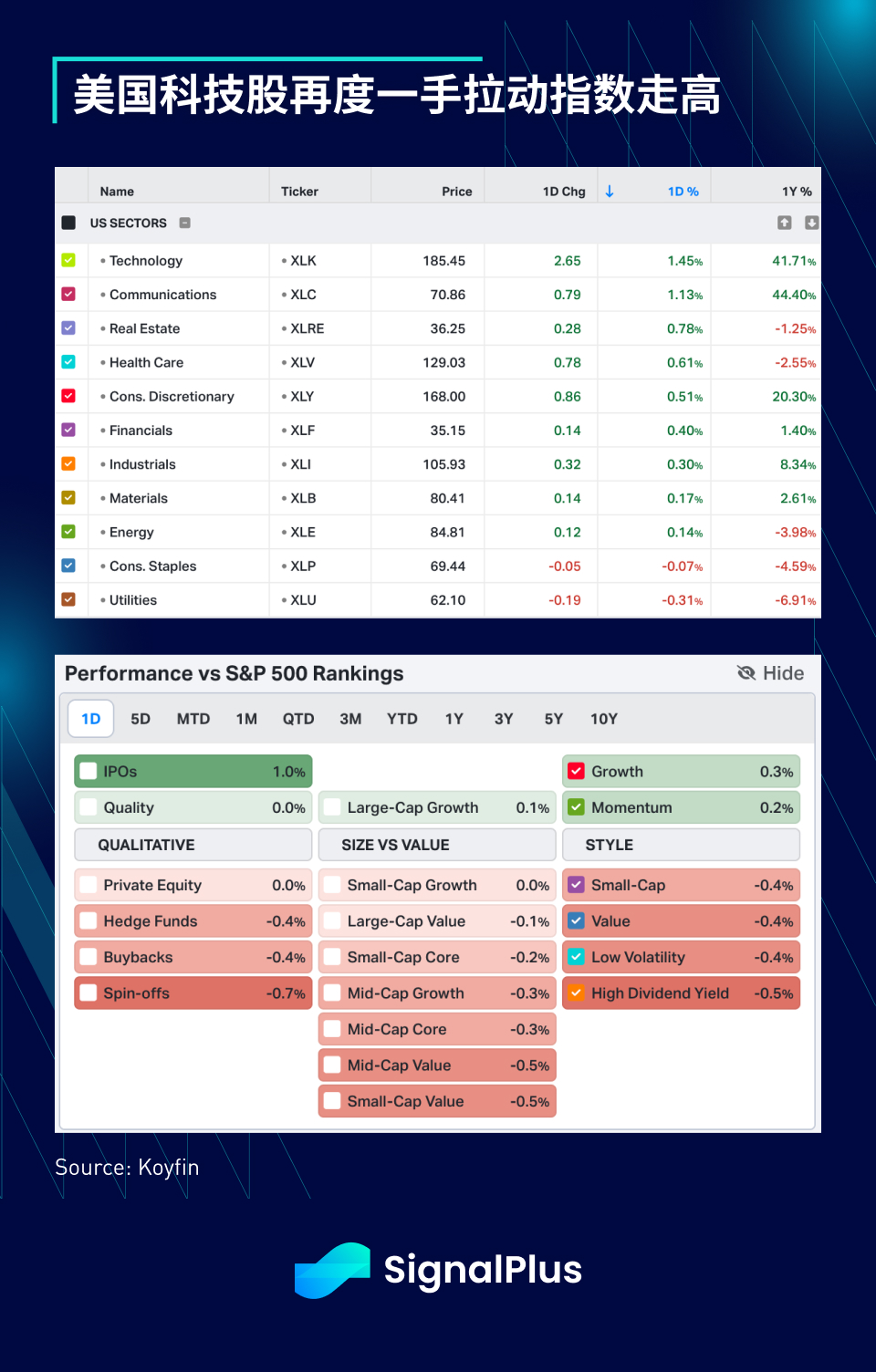

Although investors were initially worried that AI-related stocks would fall, Microsofts counterattack helped dispel all worries. Technology stocks eventually rose 1.5%, easily exceeding the SPXs 0.7% increase. The strong performance of large technology giants continued to exceed the indexs The rest of the constituents, among them small and mid-caps, value stocks and most other style factor stocks were actually down. However, don’t expect that to change anytime soon in the current “winner takes all” world. Common in almost every sector.

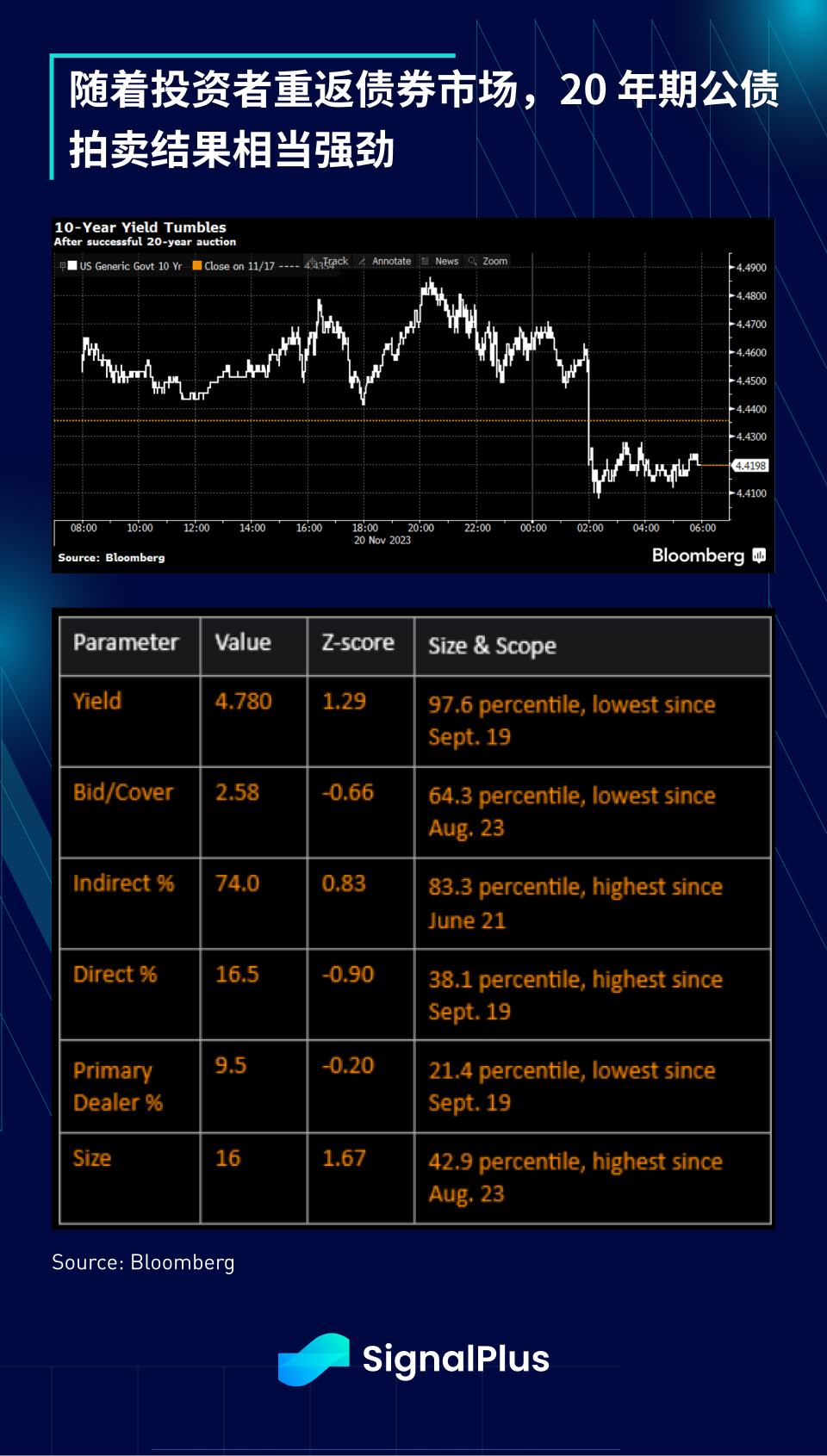

In fixed income, strong 20-year bond auction results once again confirmed the recent decline in yields, with auction statistics reaching the strongest level since September 2019, driving 10-year yields down 5 basis points intraday. Consistent with a significant narrowing in credit spreads, a decline in yield implied volatility, and a significant shift in bond futures positions, bond markets are already trading as if the Fed is about to embark on full-blown easing, gleefully ignoring all recent attempts by the Fed to negate Rhetoric (e.g., Richmond Fed: “The job is not done yet”), “Fight the Fed – Sequel” is expected to return to the market in the coming months.

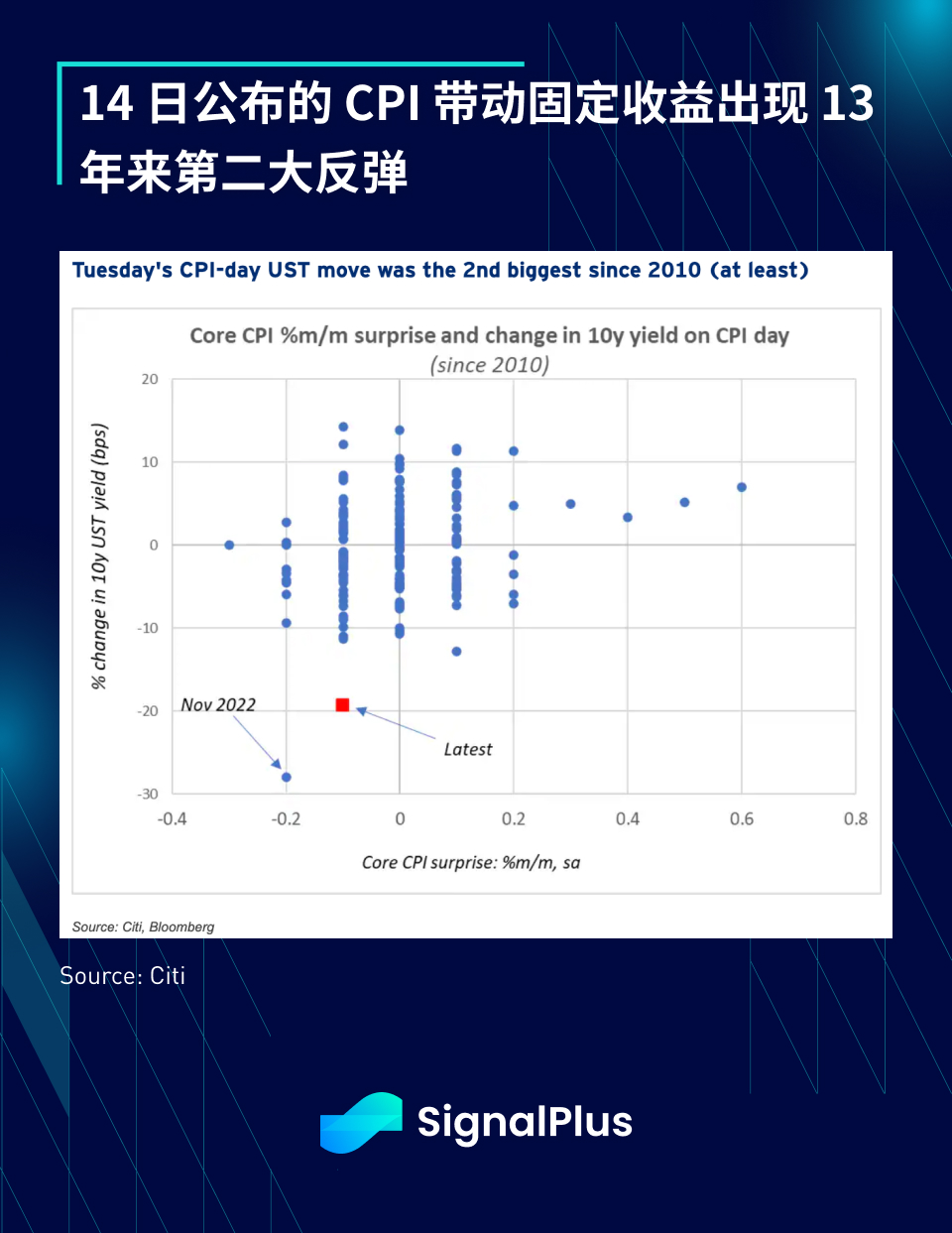

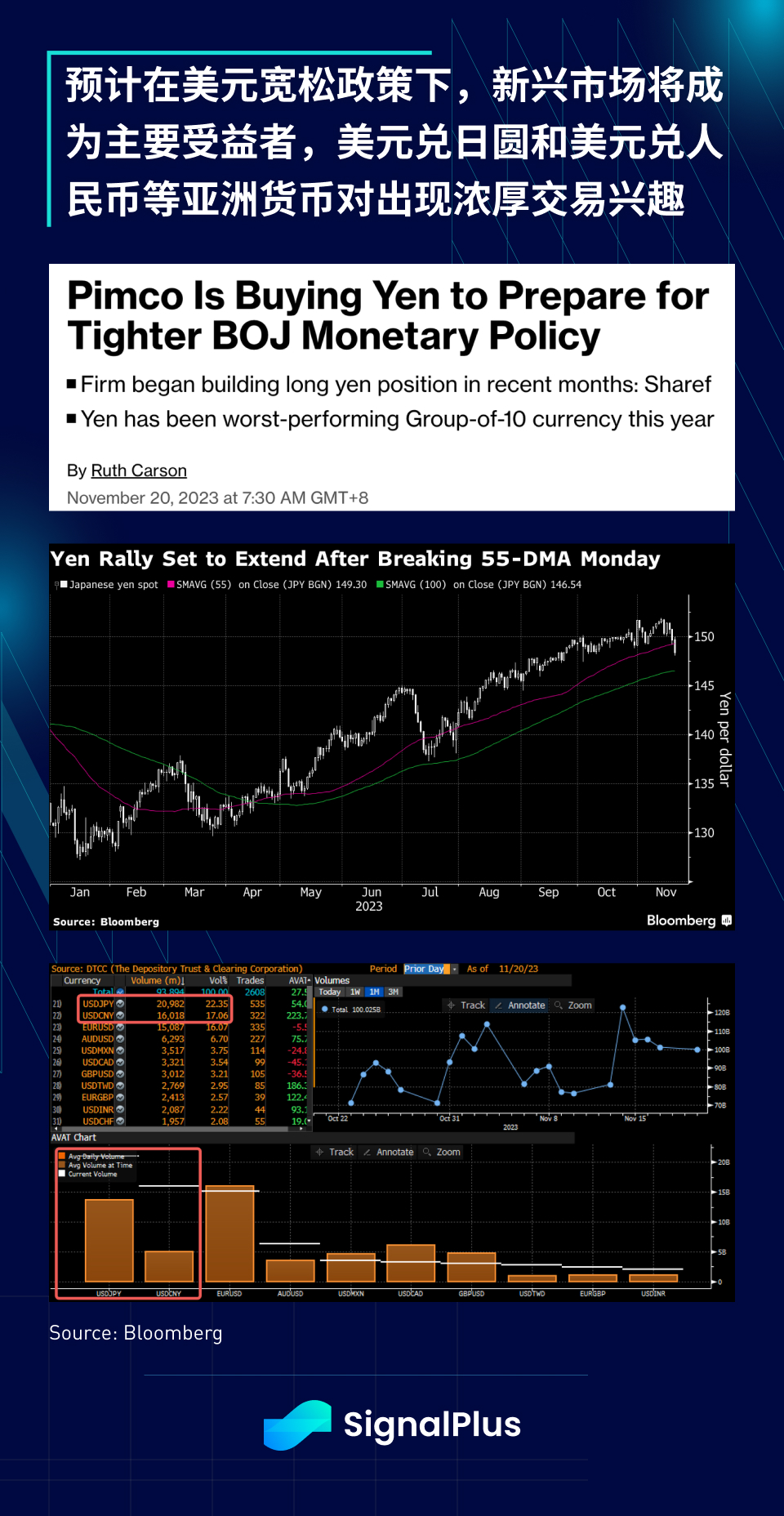

Looking back at the recent bond rally, the release of CPI a few weeks ago led to the second largest rebound in fixed income in 13 years(!), illustrating just how off-track bond investors were originally and explaining how the dovish turn has given all macro assets a boost The category brought momentum, and the U.S. dollar exchange rate also experienced a sharp reversal, especially the U.S. dollar against the yen (152 -> 147). Asset management company PIMCO also expressed a bullish view on the yen; as investors expect emerging markets to become the focus of the U.S. dollars turn One of the main beneficiaries has been an unusual surge in foreign exchange options trading volume for USD/CNY and USD/JPY, far outstripping the euro and other developed market currencies.

Today we have important Nvidia earnings reports (stocks are trading near all-time highs), followed by the OPEC meeting on November 26 and retail sales data for the Thanksgiving holiday. According to earlier customer surveys, this years Black Friday Consumer spending on Cyber Monday and Cyber Monday is expected to hit a new high. Online spending in October before the holiday has hit a record. Consumer spending grew 6% compared with the same period last year. Among them, electronic products and clothing sectors performed strongly, while major retailers (Amazon , Target, UPS)s recruitment plan also looks quite ideal, and the market generally expects holiday sales to increase by 13% year-on-year this year.

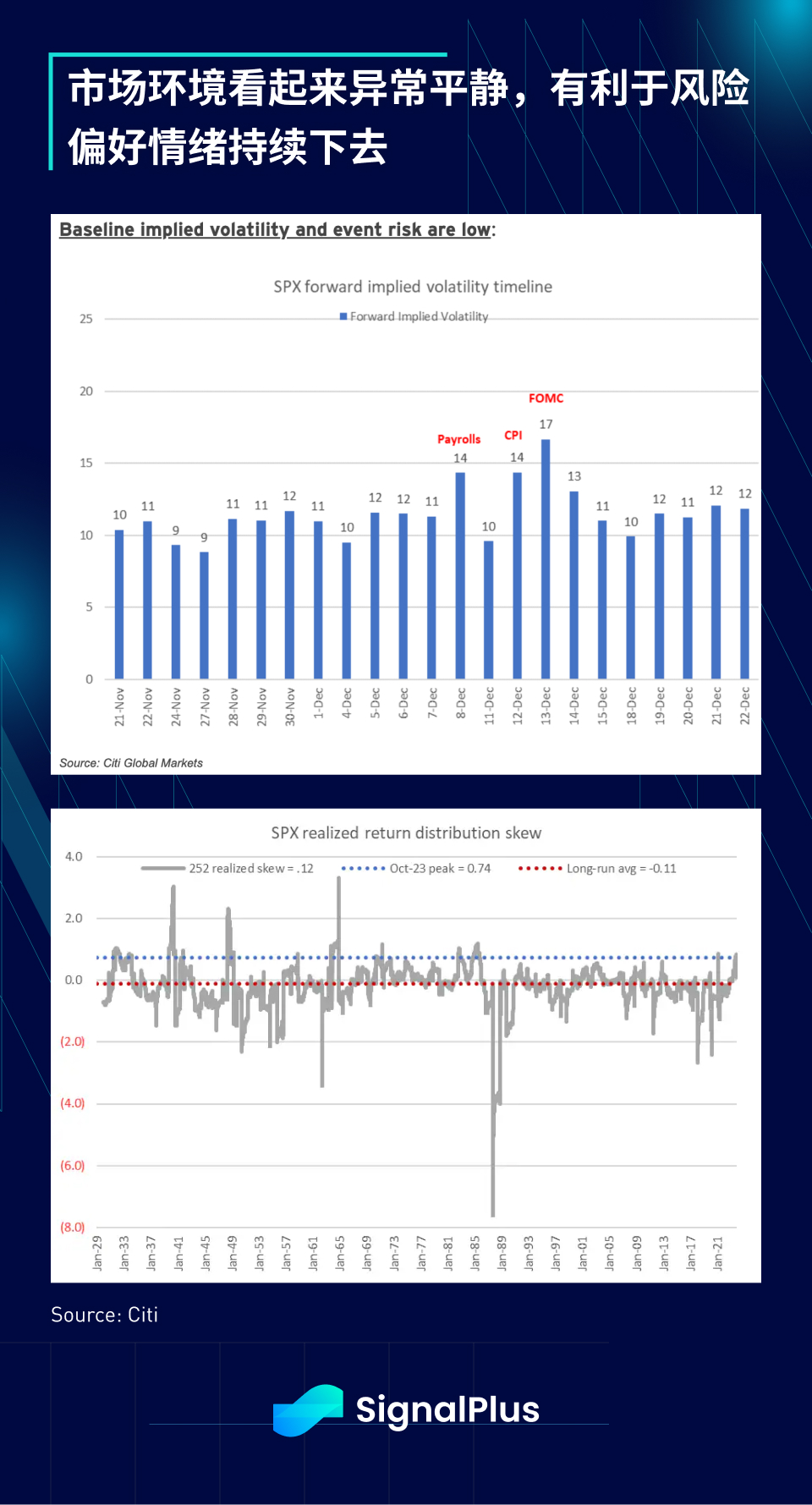

Beyond that, markets look set to be calmer into the year-end, with SPX daily implied volatility falling to cycle lows, but realized returns are still highly tilted to the upside (i.e. going long is profitable), although stocks It is indeed at an expensive level, but the only reasonable trade may be long or flat, and the bears will probably have to continue taking a vacation and wait for a return after the new year.

In terms of cryptocurrencies, although the SEC has officially postponed the approval of most BTC spot ETFs until January 2024, rising risk sentiment is still spilling over to major currencies. In addition, regulatory pressure is back. Reports indicate that in addition to seeking more than $4 billion in fines, the SEC intends to file lawsuits against Binance and CZ. The US exchange Kraken has also become the latest company to be accused by the SEC of operating an unregistered platform and mixing Exchange for client funds.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com