An overview of the current status of DeFi applications on Bitcoin: cross-chain, Layer 2, new protocols and native solutions

Original author: Jiang Haibo, PANews

With the launch of the Ordinals protocol and the creation of the BRC-20 token standard, the dynamics of the Bitcoin network have changed significantly. These innovations have led to persistently high levels of unconfirmed transactions in Bitcoin’s mempool, increasing demand for block space and thereby boosting miners’ income. With Bitcoin’s hashrate growing by more than 80% this year, these fundamental improvements may be the main reason why Bitcoin is outperforming relative to other cryptocurrencies before the spot ETF narrative kicks off.

Due to the rise of BRC-20 assets and the excellent performance of BTC prices, the Bitcoin ecosystem has received more attention. ORDI, RUNE, etc. have performed well in this round. Below, PANews will discuss DeFi projects in the Bitcoin ecosystem by category. The following data are as of November 14.

DeFi projects on cross-chain or Ethereum

As the most important crypto asset, Bitcoin accounts for about 50% of the market value. The safe introduction of Bitcoin into other chains (mainly Ethereum) has always been one of the research directions of DeFi projects. Currently, the main BTC-anchored currency is still WBTC, but the underlying BTC is centrally managed by BitGo. In the decentralized world, there are often cross-chain and synthetic asset ways to mint Bitcoin-pegged coins on Ethereum. Major decentralized BTC-anchored coins include tBTC issued by Threshold, renBTC issued by Ren Protocol, Synthetix’s sBTC, etc.

tBTC was introduced to Ethereum and other networks through Threshold’s decentralized cross-chain bridge. Threshold’s official website shows that the current circulation is 1662.9 tBTC, which is also the current main decentralized Bitcoin anchor currency. Curve is the main application site for tBTC, and the stablecoin crvUSD also supports the use of tBTC as collateral.

The Ren Protocol team was previously acquired by Alameda Research. Affected by the latters bankruptcy, Ren is now in the transition period from Ren 1.0 to Ren 2.0. There are currently 304.5 RenBTC issued on Ethereum.

Synthetixs sBTC was also one of the major decentralized Bitcoin anchor coins, but because the stable currency sUSD is a more important synthetic asset in the Synthetix ecosystem, the development of sBTC did not receive much attention. There are currently 391.5 sBTC issued on Ethereum, and there are also issuances on Optimism.

BadgerDAO, which focuses on bringing Bitcoin to DeFi, has also performed well recently. It provides automated staking services, allowing users to deposit WBTC and earn income. In addition, BadgerDAO has a decentralized stablecoin DIGG that is pegged to the price of Bitcoin. As Ethereum liquidity staking grows, BadgerDAO also plans to launch eBTC, a synthetic Bitcoin minted with stETH as collateral.

According to CoinGecko data, the native tokens of Threshold, Ren, Synthetix, and Badger in the above-mentioned projects have increased by 4.5%, -7.5%, 3.3%, and 34.9% respectively in the past seven days.

DeFi projects on Bitcoin sidechains or Layer 2

Bitcoin does not support full smart contract functionality, but only a limited scripting language, and does not have complex smart contract functionality like Ethereum. However, DeFi operations within the Bitcoin ecosystem can be implemented with the help of sidechains or Layer 2 solutions, including Lightning Network, Rootstock (RSK), Stacks, Liquid, MintLayer, RGB, etc. Projects like this take advantage of Bitcoin’s security while trying to increase transaction speeds and reduce costs.

Among these Layer 2 or sidechain projects, Stacks is the one that has launched a native token and has the highest market capitalization. According to DefiLlama, Stacks currently has a TVL of $19.14 million. Among the DeFi projects on Stacks, the decentralized exchange ALEX has the highest TVL at $13.33 million, which has increased by 69.85% in the past month.

RSK is a side chain of Bitcoin. It ensures network security by combining the proof-of-work (PoW) system of Bitcoin miners and RSK miners, achieving two-way anchoring between Bitcoin and RSK.

Sovryn is a Bitcoin DeFi platform on RSK that provides almost a full set of DeFi services, such as stablecoin DLLR, Sovryn AMM for trading, lending pools, and margin trading. DefiLlama shows Sovryn’s current TVL at $27.23 million. Money On Chain has RSK-based Bitcoin RBTC-collateralized stablecoin DoC, and a secondary investment token BPro that allows users to exchange RBTC for equivalent DOC. The current issuance of DoC is 3.69 million.

Bitcoin Lightning Network is a second-layer payment protocol built on the Bitcoin blockchain, designed to enable fast and cheap small-amount payments while significantly increasing the transaction throughput of the Bitcoin network. This is achieved by creating payment channels, and all transactions made by users within the channel do not need to be recorded on the Bitcoin blockchain immediately, but only when the channel is opened and closed. According to 1ML data, the current funds on Lightning Network are 194 million US dollars, which has remained unchanged in the past 30 days; the number of nodes is 14,615, a decrease of 1.98% in the past 30 days; the number of channels is 62,671, a decrease of 2.4% in the past 30 days.

10101 Finance is a derivatives protocol built on the Lightning Network that trades CFDs, options and other derivatives backed by Bitcoin, as well as a synthetic stablecoin. The team has previously developed multiple products based on Bitcoin, including atomic swaps between Bitcoin and Ethereum.

DeFi functionality based on specific protocols such as Ordinals

Ordinals embed data (such as images, text, etc.) directly into the witness portion of a Bitcoin transaction, thereby permanently storing non-monetary data on the Bitcoin blockchain. Based on Ordinasl, a token standard BRC-20 similar to Ethereums ERC-20 was born, which can create a unique identifier that represents a specific asset or token. Through the data embedded in Ordinals, complex financial transaction methods can be carried out on the blockchain without Bitcoin itself supporting smart contracts.

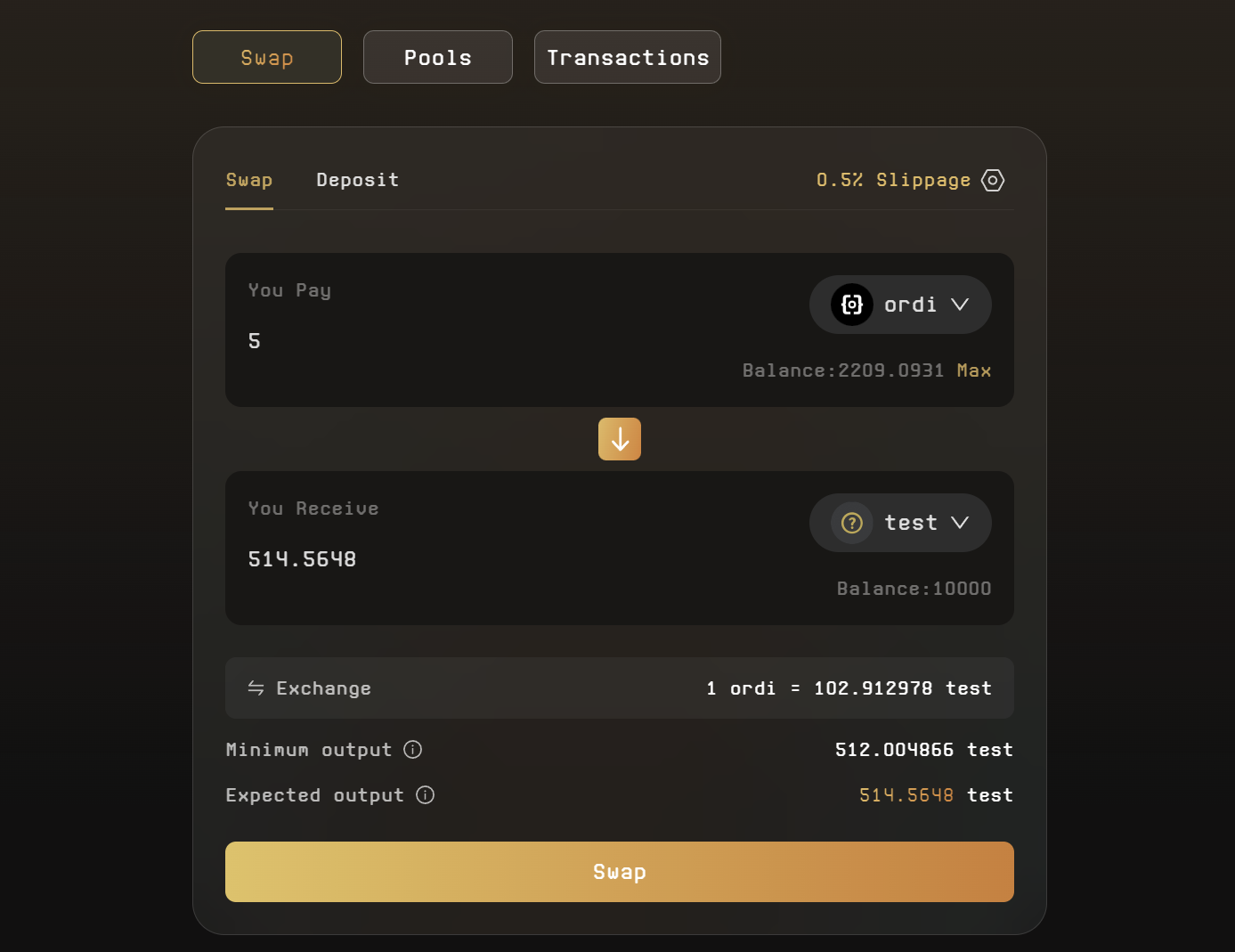

Based on the brc-20 protocol, Unisats has built a brc 20-swap that allows users to provide liquidity and transactions, and claims that this is the first native Ordinals trading module running on the Bitcoin mainnet and using the brc 20 protocol. brc 20-swap implements the function of an automatic market maker. It also conducts transactions according to the x * y = k formula adopted by Uniswap V2 and others. The handling fee is 0.3%. The liquidity provider receives 5/6 of the handling fee and the remaining 1/ 6 As a platform fee, the handling fee is charged in the form of brc-20 asset SATS.

However, OKX CEO and others are also questioning the decentralization of brc 20-swap, and it is difficult to achieve a completely decentralized DEX exchange. Although Unisats’ brc 20-swap inscription transaction is designed to support decentralized participation and deployment, since the Bitcoin network itself does not support smart contracts, its ability to achieve a fully decentralized exchange is still open to question.

In addition, similar to Ordinals, there are Atomics, Pipe, Runes, etc., which may also be able to achieve similar functions.

Other DeFi projects built on Bitcoin

In addition, there are some projects trying to implement basic DeFi functions on Bitcoin, which is an area with greater challenges but huge potential.

THORChain is the most important place for on-chain exchange of native Bitcoin. It is a decentralized liquidity network with interoperable blockchains that supports cross-chain token exchange. Its characteristic is that it does not anchor or wrap assets, but directly allows users to exchange tokens on different Layer 1 blockchains.

THORChain’s trading volume in the past seven days was $1.38 billion, ranking third among all DEXs. Currently, THORChain’s TVL is $250 million, rising 106.7% in the past month. Its native token RUNE is also one of the best-performing assets recently. The current price of RUNE is $4.84, up 39.3% in the past seven days.

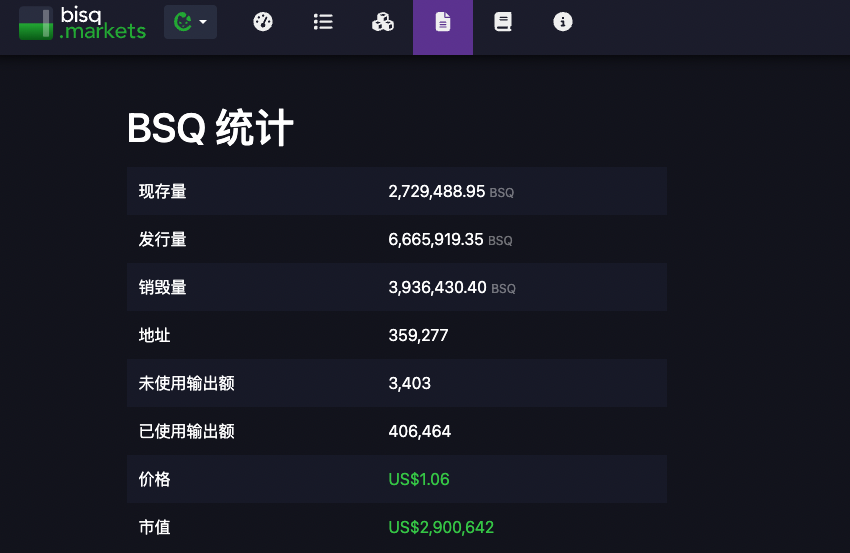

Bisq Network is a DEX that allows users to exchange Bitcoin for fiat or other cryptocurrencies. It operates in a trust-minimized manner and is operated by a DAO. Bisq issues BSQ as an incentive for contributors, and traders can also discount trading fees by holding BSQ. The current market value of BSQ is $2.9 million.

Atomic Finance combines Bitcoins basic technology and innovative contract mechanisms. It implements DeFi functions on Bitcoin through Bitcoins scripting language and discrete logarithm contracts (DLCs). Bitcoin holders are able to utilize their assets more efficiently to earn income while maintaining the security and decentralized nature of the asset. Currently, the app has been downloaded more than 1,000 times and the investment amount exceeds 75 BTC.

summary

As the largest crypto asset by market value, Bitcoin has never stopped developing applications on the Bitcoin network. The above summarizes four types of solutions for developing DeFi applications on Bitcoin, and lists representative projects among them.

Currently, protocols built on Bitcoin such as Ordinals account for a large number of transactions on the Bitcoin network. Other solutions, such as RGB and Taproot, are also technical routes that are favored by many people.