The Barbell Strategy for Crypto Markets: A Great Balance of Risk and Reward

The Barbell Strategy for Crypto Markets: An Excellent Balance of Risk and Reward

The high risk and high reward potential of the crypto market attracts more and more investors. However, this market is also accompanied by huge volatility and uncertainty, leaving investors facing risk management challenges. In this environment, the barbell strategy has become a much-discussed investment approach, aiming to balance risk and reward to achieve long-term growth.

This article explores the use of the barbell strategy in crypto markets to balance risk and reward. First, it introduces what the barbell strategy is and explains its origin and principle in the investment field. Then, it analyzes how to allocate crypto assets to maximize the advantages of the barbell strategy to achieve balanced risk and return. The focus is on how quantitative strategies in crypto markets can be configured into barbell portfolios, providing a practical way to reduce portfolio volatility and increase long-term growth opportunities. Finally, the configuration plan is summarized.

Part One: Principles of the Barbell Strategy

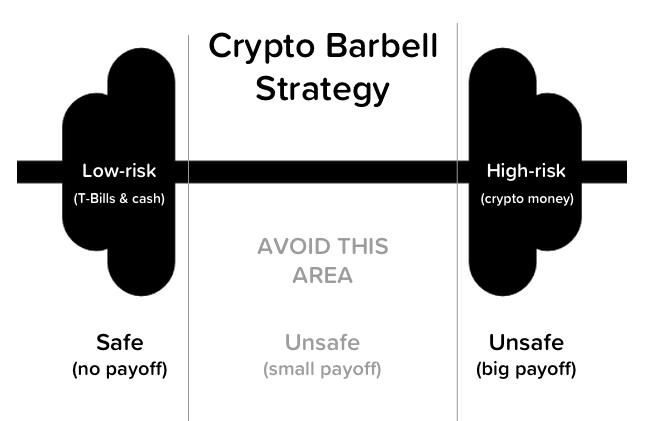

Left is low risk, right is high risk

The barbell strategy is an investment strategy originally proposed by Nassim Nicholas Taleb, a well-known risk analyst, author and investor. This strategy was inspired by the training methods of bodybuilding world record holder Franco Columbu, who focused his training on two ends, low and high weights, advocating that by using relatively lighter weights Perform high-intensity training to stimulate muscle growth, but also use very heavy weights for maximal strength improvements, ignoring moderate weights in between.

The middle zone of the barbell can be understood as being neither extreme nor conservative. In the investment field, investments that appear to be safe are made under market consensus. This is an investment method that looks safe but is actually dangerous. Investors with heavy positions who have experienced the financial crisis may have the best understanding.

The principle of the barbell strategy is to allocate the assets of the portfolio between two extremes, namely conservative assets and high-risk assets, to achieve a balance of risks. Conservative assets generally refer to relatively stable and low-risk investments such as bonds, cash and mortgages. High-risk assets refer to investments with higher potential returns but higher risks, such as innovative technology companies or cryptocurrencies.

The barbell strategy takes an extreme asset allocation in a portfolio and allocates the majority of funds to conservative assets to protect the portfolio from market fluctuations. At the same time, a small portion of funds are allocated to higher-risk assets in search of higher returns. The goal of this strategy is to reduce the overall volatility of the portfolio while providing some opportunity for growth.

The barbell strategy spreads risk by allocating assets between two extremes. Conservative assets provide stable income and capital protection against market declines and adverse economic conditions. Riskier assets offer the potential for growth and higher returns in response to rising markets and positive economic conditions. The purpose of this asset allocation is to reduce overall portfolio volatility and achieve balanced risk and return in different market environments.

It should be noted that the barbell strategy is not suitable for all investors and all market conditions. It requires investors to have better risk management capabilities and asset analysis capabilities. In addition, investors also need to adjust the specific configuration of the barbell strategy based on their own investment goals, time horizon and risk tolerance.

In the following sections, we will explore how to allocate assets in the crypto market to achieve the goals of a barbell strategy and balance risk with reward.

Part Two: Allocation of Crypto Assets to Maximize the Advantages of the Barbell Strategy

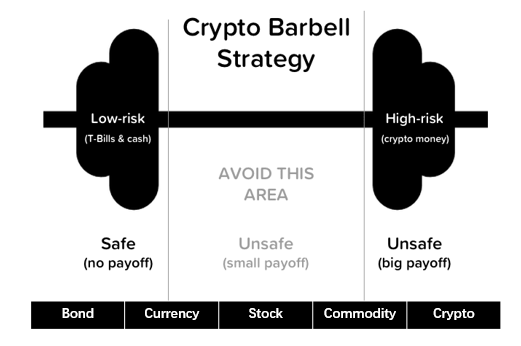

Allocation by asset class: bonds on the left, crypto on the right

Allocating a combination of U.S. bonds and cryptocurrencies can be a way to use a barbell strategy, and it is also a popular allocation plan currently under the conditions of considerable U.S. bond returns to achieve the goals of risk balance and growth opportunities. The following is a possible configuration scenario:

U.S. Treasuries (conservative assets):

U.S. government bonds are considered relatively low-risk investments and typically perform better during times of economic instability or market declines. Allocating a portion of your funds to invest in U.S. bonds can provide stable cash flow and capital protection. U.S. Treasuries offer relatively low returns but can serve as a defensive asset for a portfolio during times of market volatility.

Cryptocurrencies (High Risk Assets):

Cryptocurrencies are an emerging asset class with high volatility and potentially high returns. When allocating cryptocurrencies, you can choose cryptocurrencies that are widely recognized and liquid, such as Bitcoin and Ethereum. These cryptocurrencies have high market shares and strong ecosystem support, and are relatively stable. However, it should be noted that the cryptocurrency market is highly uncertain and risky, and investors need to conduct adequate research and risk management.

Asset allocation ratio:

The specific asset allocation ratio should be determined based on the investors risk tolerance, investment goals and time horizon. A common allocation is to allocate a large portion of funds to U.S. Treasuries, such as 80%, to protect the portfolio from market volatility. The remaining 20% can be allocated to cryptocurrencies in search of higher returns. Such an allocation can provide certain growth opportunities for the investment portfolio while maintaining relative stability.

Part 3: How to Configure Quantitative Strategies in Crypto Markets into a Barbell Portfolio

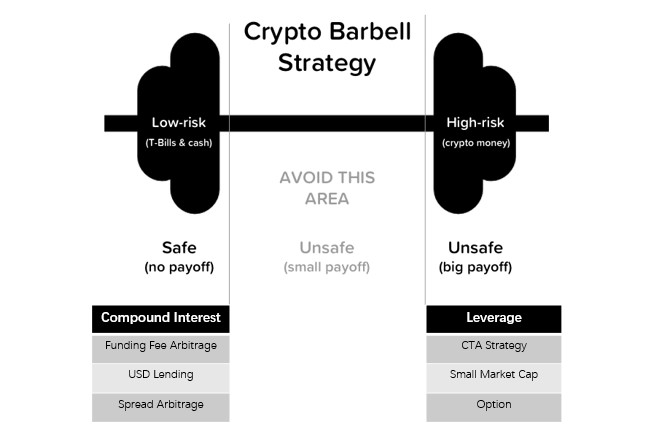

Configuration by strategy category: compound interest on the left, leverage on the right

The left side configures stable quantitative investment strategies, including funding rate arbitrage, US dollar quantitative lending, and on-chain spread arbitrage, etc., aiming to generate a compound interest effect. These strategies are based on rigorous data analysis and algorithmic models to achieve stable returns by taking advantage of price differences and interest rate differences in the market. Whether the market is rising, falling, or volatile, these quantitative strategies continue to work, providing investors with opportunities for continued growth. By configuring a stable quantitative investment strategy, investors can enjoy the long-term compound interest effect and steadily increase the value of their investment portfolio.

Anti-fragile strategies are configured on the right, including CTA trend strategies, holding small market capitalization coins and buying options, aiming to take advantage of market trends and volatility. These strategies seek high-risk, high-return opportunities by capturing short-term trends and fluctuations in the market. An excellent CTA trend strategy has a higher Kama ratio (annualized return/maximum retracement rate), but will experience continuous losses and retracements in periods of low volatility; holding small market capitalization coins in a bull market usually has greater growth Potential, but also comes with higher risks. Options trading can magnify investment returns through leverage and obtain greater profits when the market fluctuates. By configuring antifragile strategies, investors can obtain higher returns when the market rises or falls sharply, and use leverage to improve capital efficiency.

This configuration of compound interest on the left and leverage on the right can help investors balance risk and return. The stable quantitative investing strategy on the left provides stable growth and reduces overall portfolio volatility while protecting investors from wild swings in the market. The trend strategy on the right provides investors with the opportunity to pursue higher returns, especially when the market trend is obvious, they can quickly obtain larger profits. By combining left compound interest and right leverage strategies, investors can achieve the dual benefits of risk diversification and growth opportunities.

Part 4: Conclusion

All in all, traditional investors can moderately allocate cryptocurrencies by asset class or quantitative strategies for cryptocurrencies as a right-side attack, while crypto market believers can take advantage of quantitative investment strategies and configure a combination of left compound interest and right leverage to achieve long-term risk balance. and investment objectives for growth opportunities.

However, it should be noted that investors may have higher risk tolerance and analytical skills. Investors can invest through professional quantitative institutions, and should also conduct sufficient research and due diligence on quantitative institutions, and rationally allocate funds based on their own investment goals and risk preferences. It is also critical to regularly evaluate and adjust the performance of your strategy to keep your portfolio balanced and adapt to market changes.

refer to:

Nassim Nicholas Taleb Book Title: Antifragility

Twitter: @DerivativesCN

Website: https://dcbot.ai/