BTC Ecological Accelerator: Upgrading from Stacks’ Nakamoto to Talk about STX Investment Value

Original author:@JellyZhouishere, @GryphsisAcademy

TL;DR

The long-term value of Stacks depends on the growth of the Stacks ecosystem and the related demand for Clarity smart contracts. At present, the construction of the Stacks ecosystem is relatively sluggish, and the absolute number and growth of developers and actual users are slow;

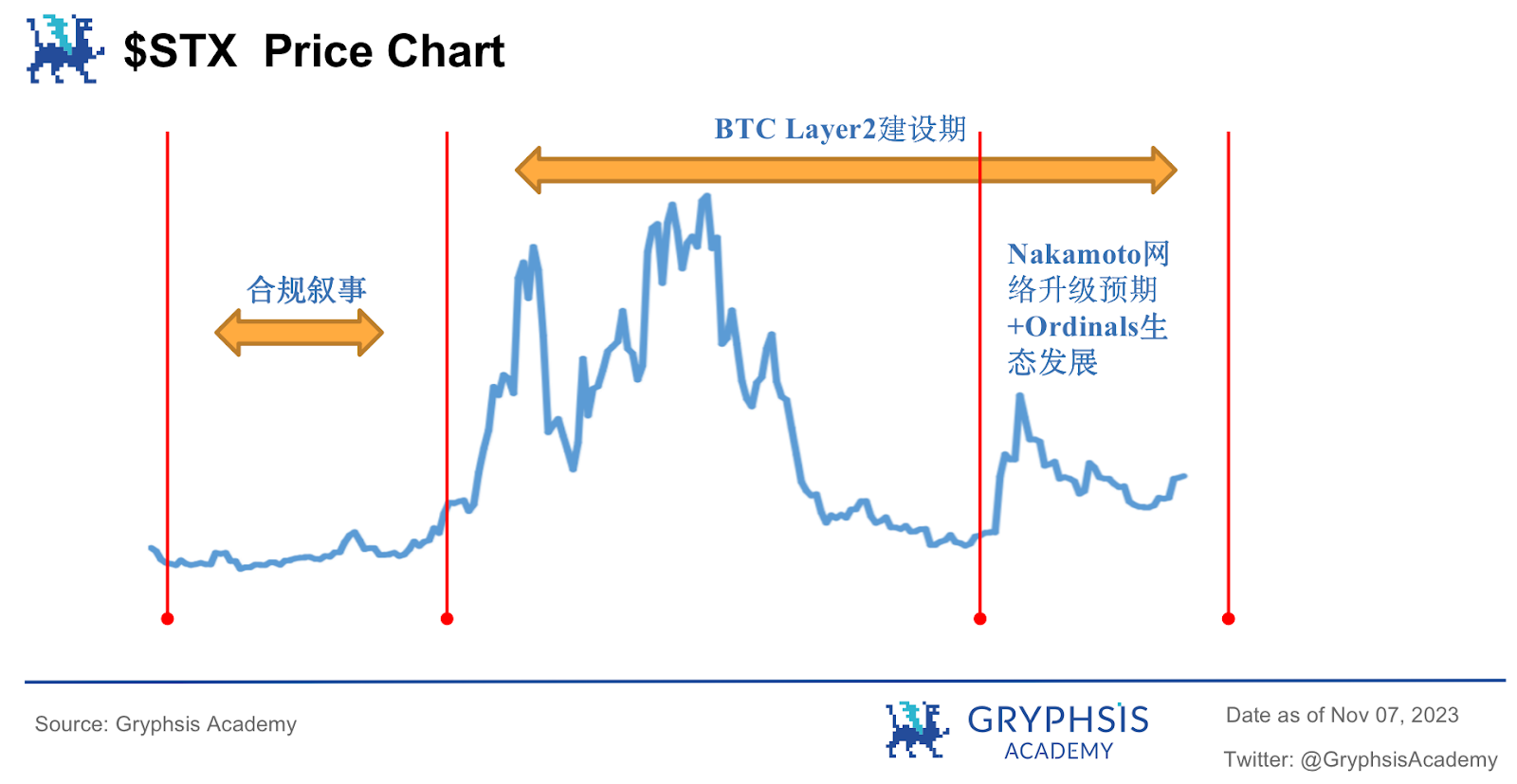

The price driving factors of Stacks mainly include: halving narrative, the only circulating Token project in the second layer of BTC, compliance narrative, upgrades, the emotional premium brought by the popularity of the Ordinals ecosystem, etc.;

The Nakamoto upgrade is the next major upgrade for Stacks, expected to be launched in the first quarter of 2024, and will be a potentially important catalyst driving $STX price movement. For Stacks, the Nakamoto upgrade means realizing shared network security with BTC, launching sBTC, supporting BTC atomic swaps, quickly producing blocks, supporting multiple development languages, etc.

Nakamotos upgraded Roadmap is divided into three stages. The second stage is currently underway. The Nakamoto Consensus is online on the test network; sBTC v 0.1 is online as a smart contract and further begins early testing in a real-time environment. Full rollout is expected in the first quarter of next year. If the progress goes well, it is expected that the hype for the upgrade event will start in advance.

In summary, this is a target that, as a chain, currently has technology, no commercialization capabilities, no market popularity, a Roadmap, no ecology, and no TVL, but at the same time it has many potential hype elements (upgrades, halving, compliance , one of the most famous and influential layer 2 in BTC), it is recommended to treat it as a BTC related meme/High leveraged beta.

Stacks Features

Stacks is a Bitcoin smart contract layer that aims to enable smart contracts to use Bitcoin as an asset and settle transactions trustlessly on the Bitcoin blockchain. Stacks have the following characteristics:

Stacks has its own chain, compiler, and programming language called Clarity. It runs in sync with Bitcoin. Essentially, a new chain is built outside the Bitcoin chain, with an independent governance structure and transaction model.

Instead of bridging assets through a cross-chain bridge, integration with the Bitcoin main chain is achieved by submitting anchor transactions on the Bitcoin main chain. These anchor transactions contain a summary of the block header information on the Stacks chain and some additional information. and is broadcast to the Bitcoin network to ensure it cannot be tampered with.

Allows applications and smart contracts to use BTC as their asset or currency and settle their transactions on the Bitcoin main chain.

Stacks uses the PoX (Proof of Transfer) consensus algorithm: miners and transaction verifiers are two roles in Stacks. Transaction verifiers need to pledge STX tokens (mining BTC), while miners need to pledge BTC (mining STX) on the Bitcoin main chain. .

STX: Project Value Analysis

The long-term value of Stacks depends on the growth of the Stacks ecosystem and the associated demand for Clarity smart contracts because:

Due to higher transaction fees, miners can see the value of mining increase, which provides an incentive for them to earn STX to participate in the consensus.

STX is designed for payment of transaction fees and smart contract execution, and STX Stackers will be able to benefit from the growth of the Stacks ecosystem

However, at present, the ecological construction of Stacks is relatively stagnant. There are almost no projects that can be launched. The absolute number and growth of developers and actual users are slow;

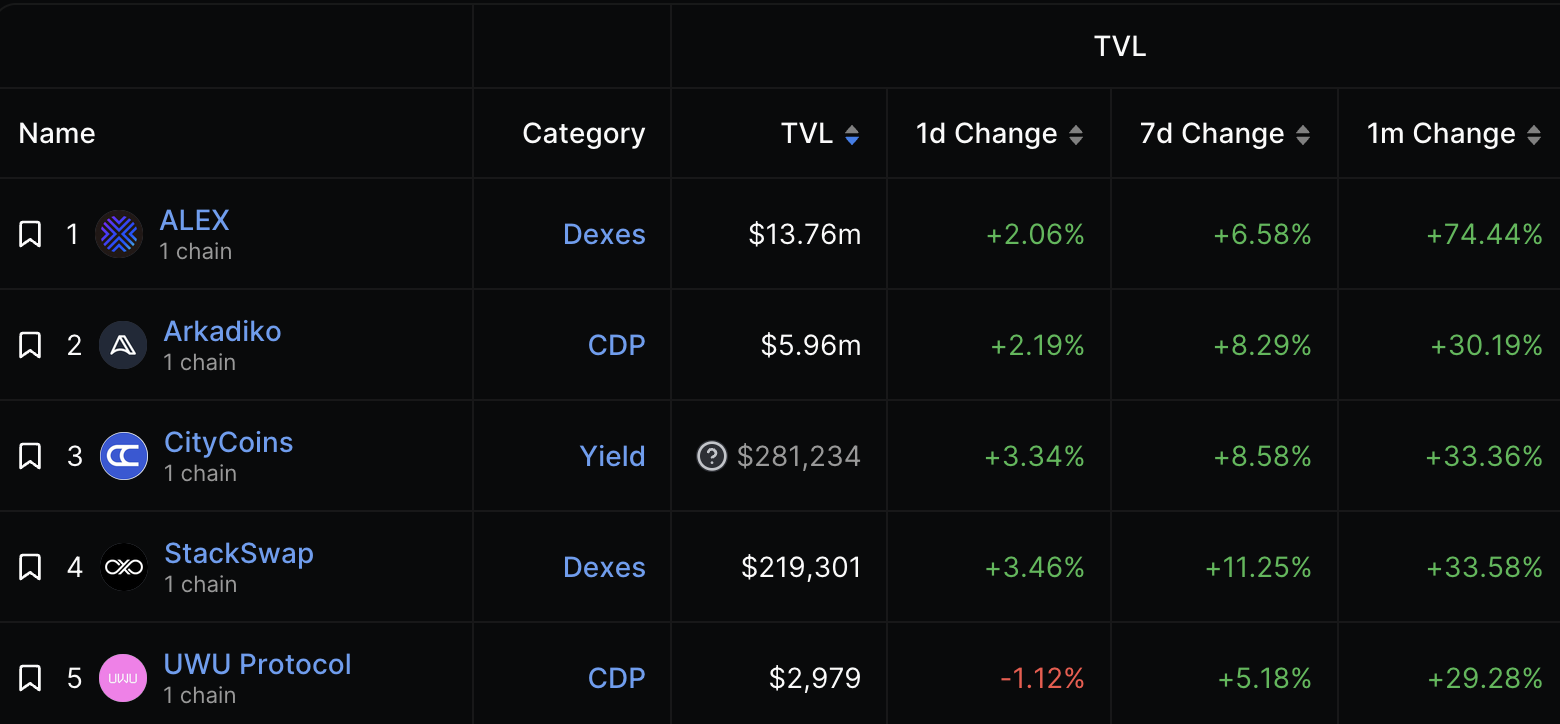

TVL: 19.13 M

The main reason: technology development is difficult and the market popularity is low

Source: Defillama (https://defillama.com/)

Source: https://defillama.com/chain/Stacks

Stacks development history and price drivers

To sort out the development history of Stacks, the key milestones are as follows:

The evolution of Stacks began in 2013.The project was created by founders Muneeb Ali and Ryan Shea. Stacks is the outgrowth of Muneeb Alis doctoral thesis, which detailed the framework for an internet that could be built around the Bitcoin blockchain. This framework is called Blockstack.

Participating in the Y Combinator batch in 2014 made initial research and development possible. Muneeb Ali and Ryan Shea raised early-stage funding from Union Square Ventures, Naval Ravikant, SV Angel, Winklevoss Capital and others.

Raised $47 million through token offering in 2017, and in 2019Passed SEC certificationraised $23 million in U.S. Reg A+ offerings and Reg S offerings. More than 4,500 Stacks holders participated in these offerings, including USV, Lux, DCG, Winklevoss Capital, Blockchain Capital, Foundation Capital, Hashkey, Fenbushi, and others.

2018 Q4 mainnet online

2018 Q4 Release official wallet Hiro Wallet

2019 Q2 Submitted $50 million to SEC to apply for compliance token issuance

2019 Q2 Stacks 2.0 white paper released

2019 Q2 Introducing Clarity contract development oracle

2019 Q3 BecomeThe first SEC-compliant public offering project

In 2020, Blockstacks was renamed to Stacks.

2020 Q1 Implementation of Proof of Mining Transfer (POX) consensus mechanism

2020 Q2 Stacks 2.0 testnet launched

2020 Q2 Submit development report to SEC

2020 Q4 After the launch of Stacks 2.0, STX will no longer be considered a securities regulated by U.S. law (the SEC has not publicly agreed with this view)

In January 2021, Stacks 2.0 mainnet was launched and is compatible with Clarity smart contracts.

2021 Q2 Release of Stacks Accelerator ecological development project

2021 Q2 Release Stacks expansion solution Hyperchain

2021 Q4 Audit of Clarity contract

2022 Q2 Release version 2.05.0.2.0

2023 Q1 Stacks 2.1 version released

Hiro developer platform will be launched in 2023 Q1

2023 Q4 major update, Nakamoto network release

2023 Q4 major update, sBTC released

Combined with the development history of Stacks, it is not difficult to find that the main price drivers of Stacks are as follows:

Combined with the development history of Stacks, it is not difficult to find that the main price drivers of Stacks are as follows:

Halving: The BTC halving will occur in about a year. The security after the halving will bring more attention to the second layer of BTC. At the same time, the market is also looking for trading opportunities with higher volatility related to the halving.

The only circulating Token project in the second layer of BTC: STX is currently the most complete second layer of BTC, and it is also the only circulating Token project in the second layer of BTC. Its market value is still very small compared to Ethereums L2.

As network usage efficiency improves and block space becomes more valuable, the BTC cost that miners need to pay will also increase accordingly, simultaneously increasing the rate of return for STX pledgers.

Compliance Narrative: SEC’s First Compliance Qualification Token Issuance

upgrade

The popularity of the Ordinals ecosystem brings capital and emotional premium to BTC layer 2

Nakamoto upgrade

The Nakamoto upgrade is the next major upgrade of Stacks and is expected to be launched in Q4 2023. It will be a potentially important catalyst driving $STX price changes. For Stacks, the main significance of Nakamoto’s upgrade is as follows:

(1) Shared network security with BTC: transactions are settled on the Bitcoin network. This feature makes Stacks transactions more secure and reliable, and becomes a true Layer 2 rather than a side chain with its own independent state.

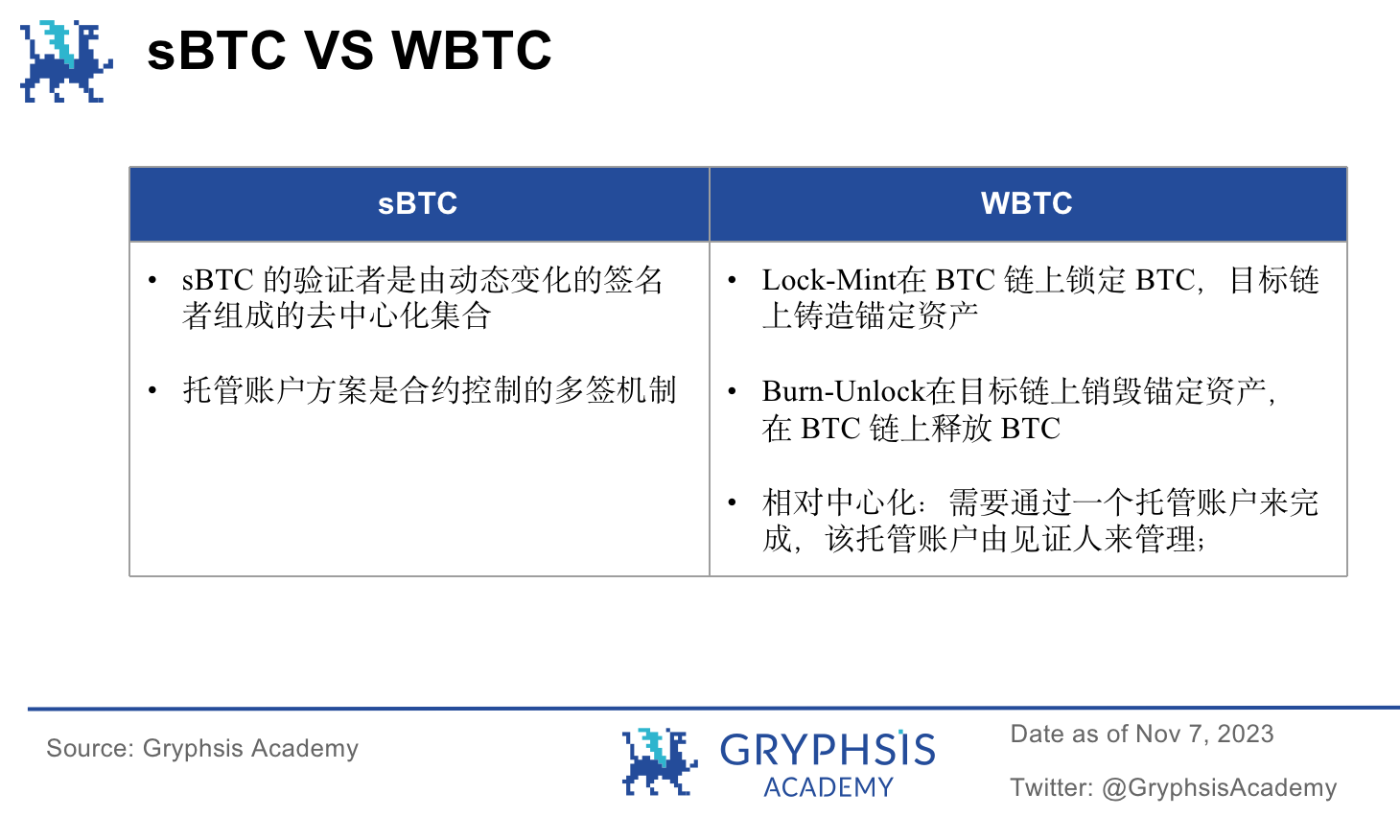

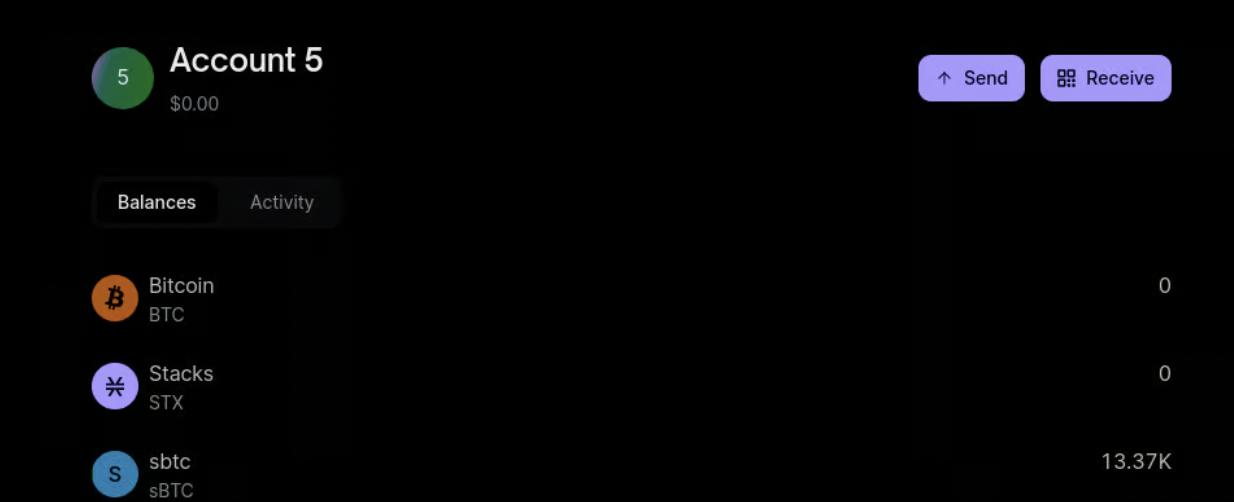

(2) Launch of sBTC: The introduction of the Bitcoin-linked asset sBTC enables smart contracts to run faster and cheaper, and can easily transfer BTC into or out of Stacks L2. Conducive to the development of the Bitcoin DeFi market.

When converting BTC to sBTC: Send BTC to a multi-signature address and initiate a transaction on the Stacks network, triggering a smart contract that will send BTC to the multi-signature address and create a corresponding number of sBTC assets on the Stacks network .

Convert sBTC back to BTC: Send a message to the smart contract and initiate another transaction on the Stacks network, triggering another smart contract that will destroy the corresponding amount of sBTC assets and send the corresponding amount of BTC to the user.

The comparison between sBTC and WBTC is as follows:

(3) Supporting BTC atomic swap, Bitcoin addresses can own and move assets defined on the Stacks layer, such as STX, stable coins and NFT, and transfer them through Bitcoin L1 transactions.

(3) Supporting BTC atomic swap, Bitcoin addresses can own and move assets defined on the Stacks layer, such as STX, stable coins and NFT, and transfer them through Bitcoin L1 transactions.

(4) Clarity language: The security of smart contracts on the chain can be greatly improved

(5) Bitcoin status reading: It can completely read the data of the Bitcoin chain, supports reading Bitcoin transactions and status changes, and executes smart contracts triggered by Bitcoin transactions. The Bitcoin reading function can synchronize Bitcoin L1 network data and L2 network data.

(6) Fast block generation: The current block generation time is 10 minutes. After the upgrade, it can reach a block generation speed of 4-5 seconds, breaking the 10-minute block generation limit of BTC. The transaction hash will be generated every time a Bitcoin block is generated. Writing to Bitcoin keeps the network secure.

(7) Customized subnets support multiple development languages: Scalability layers such as subnets can make different tradeoffs in performance and decentralization than the Stacks mainnet. The subnet can support other programming languages and execution environments (such as Ethereum’s Solidity and EVM), which allows all Ethereum smart contracts to use Bitcoin-anchored assets and be settled on the Bitcoin chain.

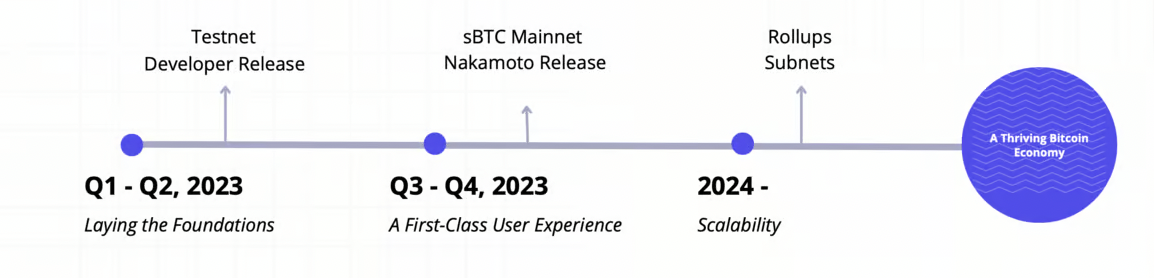

Nakamoto upgradedThe Roadmap is as follows:

sBTC, which will be launched in this upgrade, is divided into three phases, and the second phase is currently underway.

Source: https://www.stacks.co/explore/events

Test page:

Source: https://www.stacks.co/explore/events

The first phase is to lay the foundation for the upgrade, launch the MVP product of sBTC on the test network, and deploy the developer version to the main network and test network, which lasts for 6 months; the second phase implements the activation of the sBTC main network and the release of the Satoshi Nakamoto network, It is expected to last 6 months; in the third phase, the focus will shift to scalability, building a flywheel of the application ecosystem, and further expanding the Bitcoin economy, which is a relatively medium- to long-term task.

At present, sBTC has been launched and has begun early testing in a real-time environment. Full rollout is expected early next year. If the progress goes well, it is expected that the Stacks upgrade event will start to be hyped in advance.

in conclusion:

Let’s first discuss the project itself:

As an old project that can be traced back to 2013, Stacks is well-known and influential in the BTC core community and the Western currency circle;

Technology: There is a unique set of technology with its own chain, compiler and programming language that runs in parallel with Bitcoin. Essentially, a new chain is built outside the Bitcoin chain, with an independent governance structure and transaction model. The disadvantage is that technology development is relatively difficult;

Ecological construction: relatively lagging, the TVL of the entire chain is 19 M, and has not exceeded 10 M for most of the time since its establishment;

There is a lack of representative projects, and the absolute number and growth of developers and actual users are slow;

The commercial sensitivity is low, and the popularity of Ordinals and Brc 20 has not brought actual gains to the Stacks ecosystem; although Stacks clearly expressed its interest in Ordinals afterwards;

The development progress is slow, and the entire ecological construction pace is very slow;

Future construction focus: Bitcoin DeFi, BTC NFT, and other applications; infrastructure is still being slowly built at the moment;

Secondly, about $STX:

Keeping pace with BTC, it is the beta of the broader market most of the time; there was a small period of alpha at the beginning of this year to hype the Nakamoto upgrade expectations at the end of the year;

Hype points:

Halving: The BTC halving will occur in about a year. The security after the halving will bring more attention to the second layer of BTC. At the same time, the market is also looking for trading opportunities with higher volatility related to the halving;

Nakamoto network upgrade;

It is a rare currency issuance project in the second layer of BTC and is currently the most complete second layer of BTC;

As network usage efficiency improves and block space becomes more valuable, the BTC cost that miners need to pay will also increase accordingly, simultaneously increasing the rate of return for STX pledgers;

Compliance Narrative: SEC’s first compliance qualification Token was issued 21 years ago. There was a lot of compliance narrative hype: 2019 Q3 became the first SEC-compliant public offering project, and 2020 Q4 after Stacks 2.0 went online, STX was no longer considered a U.S. Legally regulated securities (the SEC has not publicly agreed with this view and tacitly agrees) are currently rarely mentioned in compliance narratives;

Finally, regarding the Nakamoto upgrade:

What to upgrade:

Improve Stacks performance and security;

Launch of Bitcoin-pegged asset sBTC

Support for multiple development languages: The subnet can support other programming languages and execution environments (such as Ethereum’s Solidity and EVM), which allows all Ethereum smart contracts to use Bitcoin-anchored assets and be settled on the Bitcoin chain .

Roadmap:

Nakamoto is currently online on the testnet, and its full launch is expected early next year. If the progress goes well, it is expected that the hype will start before the network upgrade is launched (need to continue to track and confirm the progress)

In summary, this is a target that, as a chain, currently has technology, no commercialization capabilities, no market popularity, a Roadmap, no ecology, and no TVL, but at the same time it has many potential hype elements (upgrades, halving, compliance , one of the most experienced, famous and influential layer 2 in BTC), it is recommended to treat it as a BTC related meme/High leveraged beta.

Reference:

https://www.stacks.co/explore/events

https://forum.stacks.org/t/sBTC-updates-weekly-megathread/14860/13

statement:

This report is by @GryphsisAcademy contributor@JellyZhouishereCompleted original work. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.